Looking to finance a business acquisition involving real estate or large equipment? The SBA 504 loan program offers long-term, fixed-rate financing with a low 10% down payment. With loan amounts up to $5.5 million, this program is ideal for businesses focused on purchasing fixed assets like owner-occupied real estate or equipment with a useful life of at least 10 years.

Key Highlights:

- Loan Structure: 50% private lender, 40% Certified Development Company (CDC), 10% borrower down payment.

- Repayment Terms: Choose from 10, 20, or 25 years.

- Eligibility: For-profit U.S. businesses with a net worth under $20M and average net income below $6.5M over the past 2 years.

- Job Creation Requirement: 1 job per $75,000 borrowed.

While SBA 7(a) loans are often used for general business acquisitions, the 504 loan is better suited for deals involving high-value real estate or equipment. Borrowers can also pair it with a 7(a) loan to cover working capital or goodwill. However, the process involves more coordination between lenders and strict asset eligibility rules.

This article explains how SBA 504 loans work, eligibility requirements, and how to structure financing for acquisitions.

Eligibility Requirements for SBA 504 Loans

Business Eligibility Criteria

To qualify for an SBA 504 loan, your business must operate as a for-profit entity based in the U.S., with a tangible net worth of less than $20 million and an average net income below $6.5 million over the past two years.

Certain businesses are excluded from eligibility. These include nonprofits, passive ventures (like rental real estate investments), companies involved in speculative activities, and financial institutions such as banks, finance companies, or life insurance providers.

Since SBA 504 loans are strictly for financing fixed assets, they’re ideal for businesses where much of the value is tied to real estate or heavy equipment, as opposed to goodwill or inventory. If you're purchasing machinery, it must have at least 10 years of useful life remaining.

Borrower Requirements

Meeting the business criteria is just one part of the equation - borrowers themselves must also meet specific qualifications. The SBA expects you to demonstrate strong character and proven management expertise to successfully run the business. This includes providing documented management experience and a clear, actionable acquisition plan.

Additionally, anyone owning 20% or more of the business must offer a personal guarantee. The business must be owned by U.S. citizens or legal permanent residents. Lenders will also evaluate whether the business’s historical cash flow is sufficient to cover operating costs, your salary, and the new loan payments.

sbb-itb-a3ef7c1

How Does the SBA 504 Loan Process Work in 2024?

The first step in this process is to find SBA-approved lenders that specialize in 504 loans for business acquisitions.

How to Structure the Capital Stack

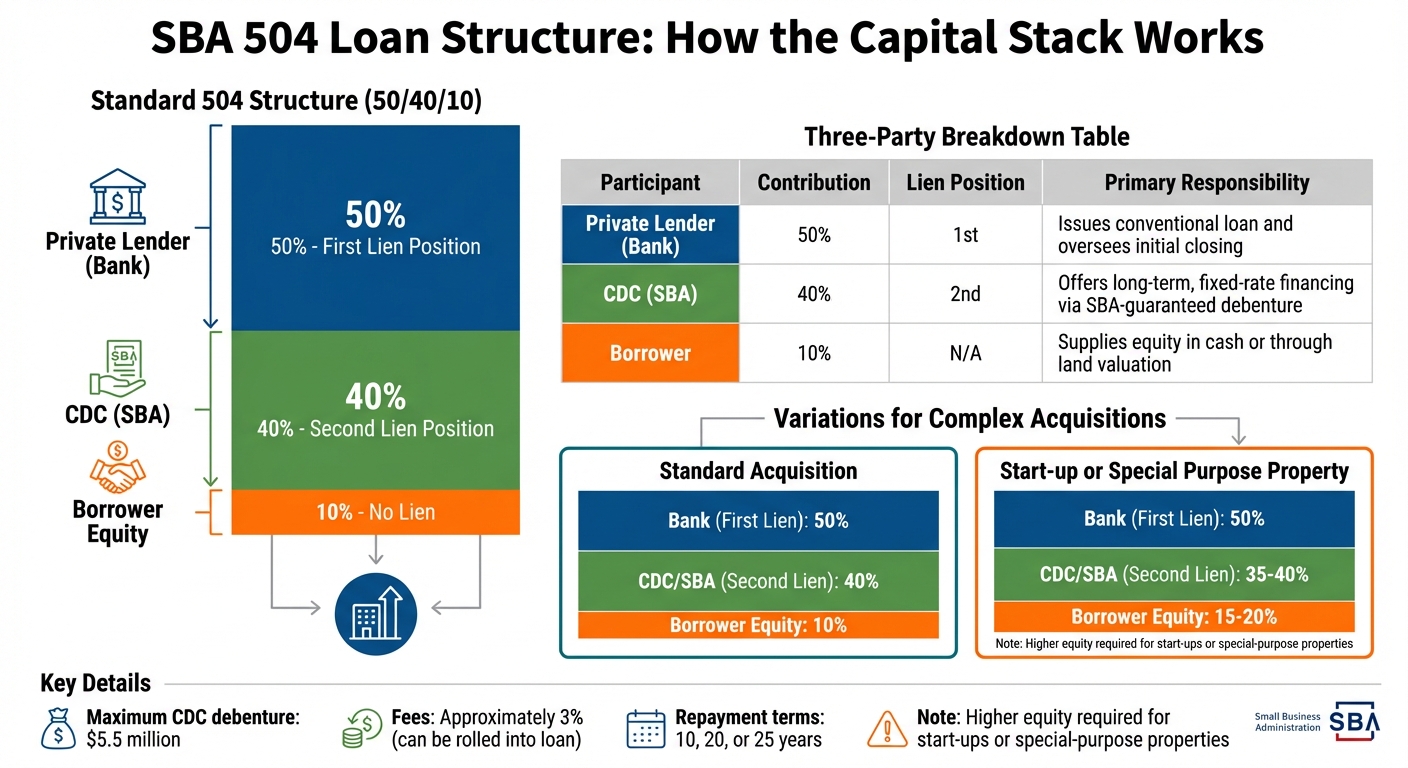

SBA 504 Loan Structure: Three-Party Financing Breakdown

Standard 504 Loan Structure

The SBA 504 loan is built on a three-party agreement involving a private lender (usually a bank), a Certified Development Company (CDC), and the borrower. This setup creates a financing structure that minimizes the borrower's upfront equity contribution.

Here’s how it breaks down:

- The bank provides 50% of the cost through a first mortgage and holds the first lien on the financed assets.

- The CDC covers 40% via an SBA-backed debenture, which takes a second lien position.

- The borrower contributes the remaining 10% in equity, either as cash or through land value.

| Participant | Contribution | Lien Position | Primary Responsibility |

|---|---|---|---|

| Private Lender (Bank) | 50% | 1st | Issues a conventional loan and oversees much of the initial closing. |

| CDC (SBA) | 40% | 2nd | Offers long-term, fixed-rate financing via an SBA-guaranteed debenture. |

| Borrower | 10% | N/A | Supplies the equity, either in cash or through land valuation. |

The CDC debenture has a cap of $5.5 million, with fees typically around 3% of the loan amount. These fees can often be rolled into the loan itself. Borrowers can choose from repayment terms of 10, 20, or 25 years.

If the acquisition includes both real estate and operational assets, the structure may need adjustments to account for these additional complexities.

Variations for Complex Acquisitions

While the standard 50/40/10 division works for most deals, some acquisitions require a more customized approach. For example, combining a 504 loan with an SBA 7(a) loan can offer added flexibility. The 504 loan typically covers fixed assets like real estate and equipment, while the 7(a) loan addresses goodwill, inventory, and working capital needs.

In February 2025, business ownership coach Beau Eckstein helped finance a dry cleaning and laundromat acquisition by pairing an SBA 504 loan for the real estate with an SBA 7(a) loan for operational costs. The deal also included seller financing to reduce the buyer’s down payment.

For higher-risk situations, lenders may require 15% to 20% borrower equity instead of the usual 10%. This is common for start-ups or special-purpose properties like gas stations or bowling alleys. Seller financing can help fill the gap when property type or limited operating history leads to stricter equity demands.

| Component | Standard Acquisition | Start-up or Special Purpose Property |

|---|---|---|

| Bank (First Lien) | 50% | 50% |

| CDC/SBA (Second Lien) | 40% | 35% - 40% |

| Borrower Equity | 10% | 15% - 20% |

Application Process and Required Documentation

Steps in the Application Process

The journey to securing an SBA 504 loan starts with finding a Certified Development Company (CDC). These nonprofit organizations, regulated by the SBA, act as the bridge to 504 financing. To simplify the search, you can use the SBA's "Find a CDC" tool to locate a qualified partner.

Once you've connected with a CDC, they’ll collaborate with a private lender - usually a bank - to assess your eligibility. This evaluation includes reviewing your business size, management skills, and the feasibility of your business plan. If you're applying for a loan above $350,000, be prepared for a deep dive into your credit history. The lender will also perform a detailed cash flow analysis to ensure your business can handle operational costs, your salary, and loan repayments.

After these initial steps, the focus shifts to gathering the necessary documentation to support your application.

Required Documentation

To move forward, you’ll need to assemble a comprehensive set of documents that showcase your financial health and the viability of your project.

Key financial records are a must. This includes business and personal tax returns, profit and loss statements, and balance sheets for the past two to three years. A well-structured business plan is also essential, detailing exactly how the loan will be used to acquire fixed assets.

You’ll also need to provide a debt schedule outlining all current obligations. If the loan involves real estate, submit the purchase agreement, a detailed asset list, and a property appraisal. These documents help the CDC and lender evaluate whether your project meets the criteria for the maximum loan amount, which is $5.5 million.

Keep in mind that SBA 504 loans are strictly for fixed asset investments. They cannot be used for working capital, inventory, or most types of debt consolidation. Ensuring your documentation aligns with these requirements is crucial for approval.

Pros and Cons of SBA 504 Loans for Acquisitions

Benefits of SBA 504 Loans

SBA 504 loans come with several appealing features, particularly for acquisitions. One standout benefit is the low 10% down payment, which is split into 50% from a bank and 40% from a Certified Development Company (CDC). This structure helps preserve cash, allowing businesses to invest in operations or other strategic areas.

Another advantage is the fixed interest rates. These rates are tied to a small margin above the 10-year U.S. Treasury rate, providing predictable monthly payments. This predictability is especially useful for long-term planning when purchasing a business. For those ready to buy a business, these terms offer significant leverage.

The program also offers extended repayment terms, with options up to 25 years for real estate. This reduces monthly payment amounts, easing financial strain. Additionally, the loans support job creation initiatives, aligning with the program's broader goals. Borrowers can access up to $5.5 million for qualifying projects like manufacturing or energy-efficient upgrades, and fees - roughly 3% - can be included in the loan amount for added convenience.

While these benefits make SBA 504 loans attractive, it’s equally important to weigh the challenges.

Drawbacks and Limitations

One major drawback is the restricted asset eligibility. SBA 504 loans are limited to financing long-term assets like real estate or machinery with a useful life of at least 10 years. They cannot be used for working capital, inventory, intellectual property, or consulting services, which limits their applicability for acquisitions focused on intangible or operational assets.

The program’s tri-party structure adds complexity, requiring coordination between the borrower, a bank, and a CDC. This can lead to longer processing times. Additionally, the job creation requirement - one job per $75,000 borrowed - may not align with every acquisition strategy, particularly if the goal is to streamline operations. Lastly, while the fees can be financed, the approximate 3% cost adds to the overall expense.

Comparison Table of Pros and Cons

| Pros | Cons |

|---|---|

| Low Down Payment: Only 10% equity required from the borrower | Limited Asset Scope: Cannot finance working capital, inventory, or intangible assets |

| Fixed Interest Rates: Protection against market fluctuations | Complex Structure: Requires coordination between bank, CDC, and SBA |

| Extended Terms: Up to 25 years for real estate reduce monthly payments | Job Creation Mandate: Must create 1 job per $75,000 borrowed |

| Higher Loan Limits: Up to $5.5 million for qualifying projects | Processing Time: Longer timeline due to the tri-party arrangement |

| Financeable Fees: Approximately 3% fees can be rolled into the loan | Equipment Restrictions: Machinery must have a useful life of 10+ years |

Special Considerations for Business Acquisitions

Refinancing Existing Acquisition Debt

If you're considering refinancing acquisition debt using an SBA 504 loan, the debt must meet the "qualified debt" criteria outlined in federal regulation 13 CFR 120.882, paragraphs (e) and (g). Essentially, this means the original loan must have been used to purchase assets eligible for 504 financing, such as owner-occupied real estate or long-term equipment that aligns with 504 requirements.

Keep in mind that this program doesn’t allow for general debt consolidation or refinancing of loans tied to ineligible assets, like inventory or working capital. To navigate these regulations, working with a Certified Development Company (CDC) - the only authorized entity for 504 loans - can be invaluable. They’ll help you determine if refinancing fits your acquisition financing options while ensuring compliance with the program’s requirements. This refinancing option aligns with the broader goal of the SBA 504 program: fostering local economic growth.

Job Creation and Retention Requirements

Another critical aspect of the SBA 504 program is its focus on employment outcomes. Specifically, borrowers must create or retain one job for every $75,000 of SBA loan proceeds. For instance, if you secure $5.5 million in 504 financing, you'll need to demonstrate the creation or retention of approximately 73 jobs.

To meet this requirement, it's important to develop a clear strategy early on. Outline how your acquisition will lead to new job opportunities or preserve existing roles. If the business you’re acquiring was at risk of closure or significant downsizing, retaining those positions counts toward the job requirement. The CDC will thoroughly evaluate your plan during the application process to ensure it aligns with the program’s economic development goals.

Conclusion

Key Takeaways

SBA 504 loans are designed to finance owner-occupied real estate and long-term equipment with fixed interest rates. These loans offer funding of up to $5.5 million and repayment terms that can extend up to 25 years. The financing follows a structured 50/40/10 plan, where a private lender, a Certified Development Company (CDC), and your down payment each contribute to the funding mix. This structure helps you conserve working capital while acquiring essential assets.

To succeed with an SBA 504 loan, planning is critical. Borrowers must show that the loan will create or retain one job for every $75,000 of SBA funding. This means your acquisition strategy should include a clear and actionable employment plan from the outset. Additionally, partnering with a Certified Development Company early in the process is vital. CDCs are the only entities authorized to facilitate 504 loans and can guide you through the complexities of eligible purchases and qualified debt.

For acquisitions that involve both real estate and business operations, combining a 504 loan for the property with a 7(a) loan for the business entity can be a smart strategy. This dual-loan approach can help you maximize leverage, secure better terms, and preserve liquidity for growth after the acquisition. While this requires careful coordination, it can significantly enhance your financing strategy.

How Clearly Acquired Can Help

Clearly Acquired simplifies the SBA 504 loan process, helping you tackle the challenges of financing with ease.

With AI-driven financial analysis, expert support, and integrated deal management, Clearly Acquired ensures that your SBA 504 loan journey is as smooth as possible. The platform evaluates your financial readiness, ensuring you meet essential benchmarks for debt service and cash flow. It also connects you with SBA 504 experts and streamlines capital arrangements across various financing options, including SBA 7(a), SBA 504, conventional loans, and structured equity.

From verified deal flow and secure data rooms to ongoing advisory support, Clearly Acquired provides the tools and insights you need to close deals confidently and effectively. Whether you're navigating SBA guidelines or planning for post-acquisition growth, their platform ensures your financing strategy aligns with your goals.

FAQs

Can an SBA 504 loan be used to buy an entire business?

Yes, you can use an SBA 504 loan to buy an entire business, especially if the purchase includes significant fixed assets like real estate or equipment. These loans are specifically structured to finance assets that are crucial for running and growing the business.

When should I combine an SBA 504 loan with an SBA 7(a) loan?

When financing a business acquisition, it can be smart to pair an SBA 504 loan with an SBA 7(a) loan. For instance, you could use the 504 loan to cover fixed assets like real estate, while the 7(a) loan handles working capital or day-to-day operational expenses. This combination allows you to align financing with specific needs, offering flexibility and efficiency for your business goals.

How do job creation rules work in an acquisition?

When using an SBA 504 loan to acquire a business, one of the main requirements is showing that the deal will lead to job creation or retention. The buyer needs to prove that the acquisition will help preserve existing jobs or generate new ones. This ties directly into the SBA's mission of encouraging economic development. Ownership changes are permitted under this program, as long as they meet the job-related benchmarks and other necessary criteria.

An SBA 504 loan can be used as part of a business acquisition, but only within clearly defined limits. The program is designed to finance eligible fixed assets—such as the building the company operates from, the land, or specialized equipment with a useful life of at least ten years. What it cannot finance are the intangible parts of a deal, including goodwill, inventory, accounts receivable, or equity/stock value beyond those hard assets. Because of this, a 504 loan by itself rarely covers the full purchase price unless the transaction is heavily weighted toward real estate and equipment.

In change-of-ownership situations, the SBA allows 504 financing provided certain conditions are met. The loan proceeds must be directed strictly toward the eligible fixed assets, while any excess value—like goodwill or stock—has to be funded separately, commonly with an SBA 7(a) loan or other capital sources. In addition, the buyer is generally expected to acquire 100% of the company, and the seller typically cannot retain an ownership stake or continue in a key management role. Practically speaking, most acquisitions that include owner-occupied property are structured with the 504 covering the real estate and equipment, and a 7(a) or companion financing covering goodwill, working capital, and the rest of the purchase price.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)