Finding an SBA-approved lender is essential for securing financing backed by the U.S. Small Business Administration (SBA). These lenders, including banks and credit unions, provide loans with partial government guarantees, which reduce risk for lenders and offer better terms for borrowers. Here's a quick guide:

-

Use the SBA Lender Match Tool:

- A free online service connecting small business owners with over 800 SBA-approved lenders.

- Complete a short questionnaire to receive lender matches within two business days.

-

Search the SBA Lender Directory:

- A resource to identify lenders by location, loan type, and credentials, including Preferred Lender status.

-

Local vs. National Lenders:

- National banks: Faster processing with Preferred Lender status but stricter requirements.

- Community banks: More personalized service, flexible terms, and better for smaller, local projects.

-

Prepare Required Documents:

- Gather financial statements, tax returns, business plans, and other key paperwork to streamline the application process.

-

Compare Loan Offers:

- Evaluate interest rates, fees, repayment terms, prepayment penalties, and approval timelines to find the best fit.

For added convenience, platforms like Clearly Acquired simplify the process by matching borrowers with lenders, automating documentation, and offering additional acquisition support.

Quick Tip: Start with your existing bank or credit union, as they may prioritize applications from current customers.

How to Find the Right SBA 7a Lender for Your Loan Request

How to Find SBA-Approved Lenders

Connecting with the right SBA-approved lender doesn’t have to be complicated. The Small Business Administration (SBA) offers tools and resources designed to help you find lenders that align with your business needs. Here’s how you can locate qualified lenders.

Using the SBA Lender Match Tool

The SBA Lender Match tool is a free, online service that helps small business owners connect with SBA-approved lenders. With over 800 lenders participating nationwide, this tool is available across all 50 states and U.S. territories.

Here’s how it works: You’ll answer a few questions about your business, the loan amount you’re seeking, and how you plan to use the funds. The process takes about five minutes and requires basic details about your business and financing needs.

Within two business days, you’ll receive a list of potential lenders and their contact information. While this isn’t a formal loan application, it’s a great way to identify lenders who are specifically interested in your type of business and loan request.

To make the process smoother, have key documents like bank statements, tax returns, and financial statements ready. Once you’re matched, reach out to multiple lenders to compare their terms. Ask about interest rates, credit score requirements, cash flow criteria, prepayment penalties, and grace periods. However, note that the Lender Match tool doesn’t cover SBA Disaster Loans, which must be applied for directly through the SBA’s Disaster Assistance portal.

If you’d rather explore lenders on your own, the SBA Lender Directory is another excellent option.

Searching the SBA Lender Directory

The SBA Lender Directory is a comprehensive resource for finding approved lenders in your area. It’s particularly useful for verifying a lender’s credentials and understanding their loan offerings.

You can filter searches by location, lender type, and specific SBA loan programs. This allows you to find banks, credit unions, or non-bank lenders that participate in SBA programs. If you’ve received lender recommendations from other business owners, the directory can help you research those options further.

Pay special attention to whether a lender has Preferred Lender status. These lenders can approve loans without needing SBA review, which can shorten the funding timeline. The directory also indicates which SBA loan programs each lender supports, helping you narrow your search to those that meet your specific needs.

Local Banks vs. National Lenders

Choosing between a local community bank and a national lender depends on your business’s unique needs, qualifications, and timeline. Each type of lender offers distinct advantages.

National banks often have extensive experience with SBA loans and typically hold Preferred Lender status, which allows them to process loans faster. They also tend to offer competitive interest rates for highly qualified borrowers. However, their strict requirements for credit scores and business experience can make it harder for some applicants to qualify.

On the other hand, community banks tend to take a more personal approach. In 2021, 94% of small banks provided loans to small businesses, compared to 90% of large banks. These lenders may offer more flexibility with credit requirements and are often a better fit for borrowers without extensive industry experience. Community banks are more likely to consider the overall relationship with the borrower and tailor loan terms to meet individual needs.

Here’s a quick comparison of the two:

| Aspect | National Banks | Community Banks |

|---|---|---|

| Processing Speed | Faster with Preferred Lender status | Slower without Preferred Lender status |

| Interest Rates | Competitive due to high volume | Typically less competitive |

| Flexibility | Strict requirements, less personal | More flexible and relationship-focused |

| Ideal For | Larger loans, well-qualified borrowers | Smaller projects, personalized lending |

If you already have a banking relationship, start your search there. Many banks and credit unions prioritize loan applications from existing customers. Whether you choose a local or national lender, ensure they have a dedicated SBA specialist - not just a general loan officer.

Interestingly, smaller banks lend a higher percentage of their assets to small businesses compared to larger banks, according to the Federal Reserve Bank of St. Louis. While the process with community banks may take slightly longer, they’re often more motivated to support small business borrowers.

How to Choose the Right SBA Lender

Once you've pinpointed SBA-approved lenders, it's time to dive into the specifics of their loan terms. These terms directly impact your cash flow, monthly payments, and overall credit profile. Since loan terms can differ significantly depending on the lender and the type of loan, taking the time to understand these variations is crucial. After that, weigh the key factors of each lender to determine which one aligns best with your needs.

SBA Loan Application Process

Once you've chosen your lenders, it's time to gear up for the application process. Being well-prepared with the right documentation, applying strategically to multiple lenders, and carefully comparing offers can increase your chances of securing terms that suit your business goals.

Required Documents and Paperwork

SBA loan applications come with a long list of required documents, all aimed at proving your business's financial health and your ability to repay the loan. Here’s what you’ll need:

- Personal financial statements for any owner with 20% or more ownership.

- Three years of personal and business tax returns.

- Current profit and loss statements, balance sheets, and cash flow projections.

- A detailed business plan outlining your acquisition strategy, market analysis, and expected cash flows.

- The purchase agreement or letter of intent for the business you’re acquiring.

- Supporting documents like business licenses, articles of incorporation, and personal resumes that highlight relevant experience.

- Bank statements for both personal and business accounts.

If real estate is part of the acquisition, you’ll also need property appraisals and possibly environmental assessments.

One critical piece is your post-acquisition cash flow projections. These should clearly demonstrate how the combined business will generate enough cash to cover loan payments while keeping operations running smoothly.

Once you've gathered all your paperwork, you're ready to start submitting applications.

Applying to Multiple Lenders

Submitting your application to multiple lenders is a smart move. It not only increases your chances of approval but also gives you the opportunity to compare offers and find the best fit for your needs. Timing, however, is key to protecting your credit score.

To minimize the impact of multiple credit inquiries, submit all applications within a 14-day window. Credit scoring models like FICO treat multiple inquiries within 45 days as one, while VantageScore uses a 14-day period for the same purpose.

Before diving into formal applications, consider starting with pre-qualification. This step typically involves a soft credit check, which won’t affect your credit score. Pre-qualification allows you to preview potential offers and narrow down your list of lenders without any risk.

It’s also a good idea to review your credit report before applying. This helps you understand your creditworthiness and spot any issues that might hurt your chances of approval. Reducing your debt-to-income ratio, such as by paying off outstanding debts, can further strengthen your application.

Comparing Loan Offers

Once lenders start making offers, take the time to evaluate each one carefully. The goal is to find a loan that aligns with your business's financial situation and future plans.

Start by looking beyond just the interest rate. The total cost of borrowing includes fees like origination charges, guarantee fees, and ongoing servicing costs. For instance, a loan with a slightly higher interest rate but lower fees might end up being more affordable overall.

Pay close attention to repayment terms. While longer repayment periods can lower your monthly payments, they also increase the total interest paid over the life of the loan. Consider how these terms mesh with your projected cash flows from the acquired business.

Don’t overlook prepayment penalties. Some SBA loans allow early repayment without penalties after a certain period, while others impose fees for paying off the loan ahead of schedule. If you anticipate strong cash flows that might let you repay early, prioritize loans with lenient prepayment terms.

Another key factor is the personal guarantee requirement. Most SBA loans require personal guarantees from owners with at least 20% ownership, but the specifics can vary. Some lenders may ask for additional collateral or include stricter default clauses.

Finally, consider the lender’s approval timeline. Acquisition deals often come with tight closing deadlines, so a lender with faster processing times might be worth considering, even if their terms aren’t the most competitive.

To make the comparison process easier, create a chart listing the key terms of each offer side by side. Include details like interest rates, fees, repayment terms, guarantee requirements, and expected closing timelines. This visual breakdown can help you make an informed decision with confidence.

sbb-itb-a3ef7c1

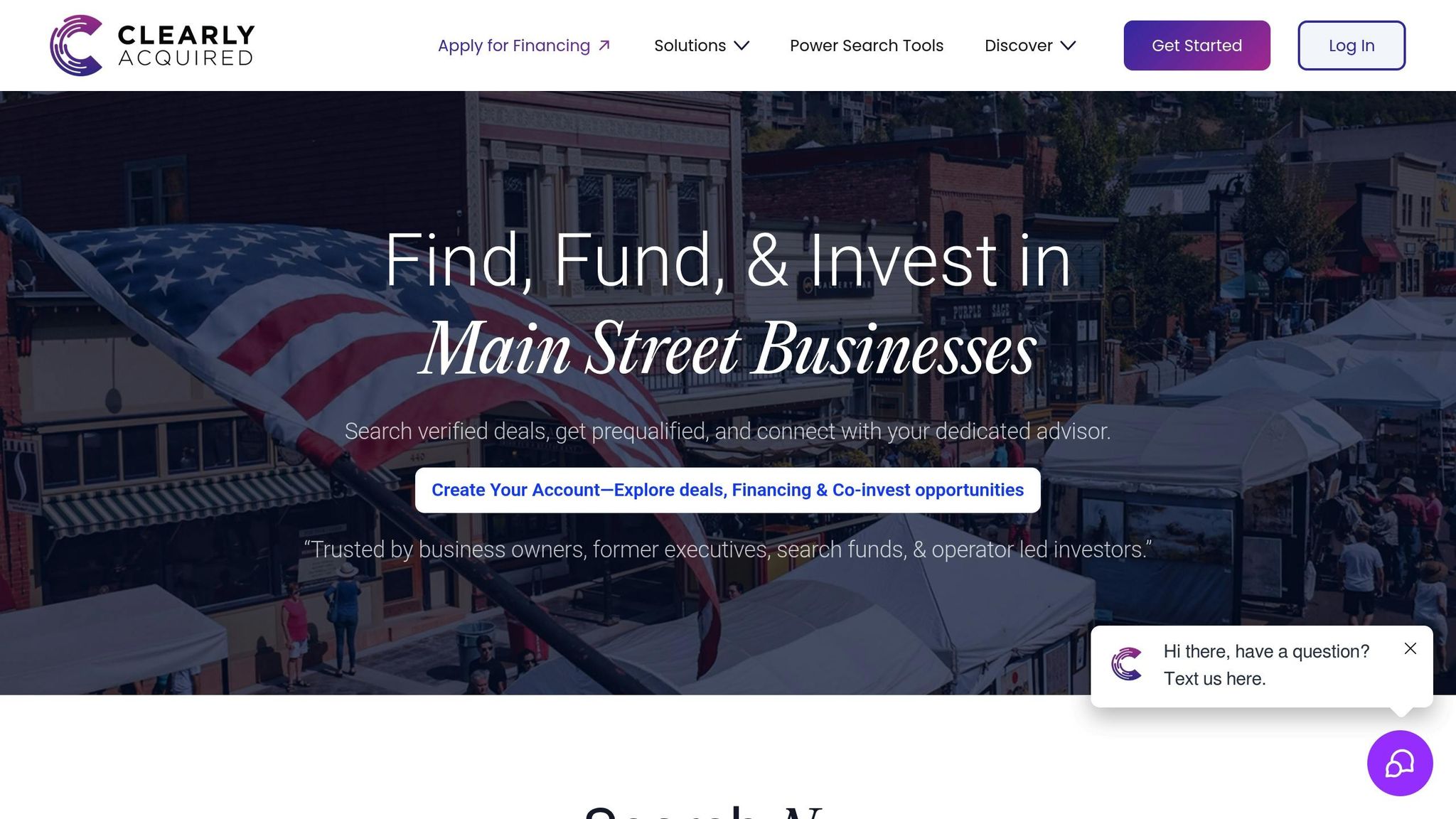

Using Clearly Acquired for SBA Loans

Navigating the SBA loan process can feel like a marathon, especially when you're trying to find and compare approved lenders. This is where Clearly Acquired steps in, simplifying the journey with its tech-driven platform. Acting as a Main Street investment bank, it brings together capital, advisory services, and specialized tools to guide you through every stage of a business acquisition - from sourcing the opportunity to closing the deal.

Lender Matching Services

Clearly Acquired's SBA loan marketplace is designed to connect buyers with pre-vetted lenders tailored to their unique business goals and acquisition needs. Instead of spending weeks researching, the platform's matching system quickly identifies lenders that align with your specific deal criteria.

Through its acquisition pre-qualification process, which integrates Plaid for financial verification, you can assess your borrowing capacity in no time. This automated step not only speeds up the initial screening but also helps lenders process your application more efficiently.

What makes this system stand out is its precision. Rather than casting a wide net and hoping for responses, Clearly Acquired matches you with lenders who specialize in your industry, deal size, and location. This targeted approach improves your chances of approval and eliminates wasted time on mismatched applications.

The platform supports both SBA 7(a) loans and SBA 504 loans, catering to a variety of acquisition types, including those involving real estate. This ensures you're paired with lenders who have expertise in the loan type you need.

Now, let’s dive into how Clearly Acquired simplifies the documentation process.

Automated Documentation and Verification

One of the most daunting aspects of applying for an SBA loan is handling the mountain of paperwork it requires. Clearly Acquired tackles this head-on with automated documentation and verification tools, making the process far more manageable.

The platform uses secure data rooms where you can organize and share financial documents with multiple lenders at once. Instead of preparing separate packages for each lender, you upload your materials a single time and control access as needed.

With AI-driven business valuation tools, the platform generates instant, data-backed valuations using market comparables. These valuations not only provide a clear starting point for discussions but also strengthen your loan application with objective data.

Communication with lenders is also streamlined. Automated updates ensure that everyone involved stays on the same page, preventing missed deadlines and keeping the process moving smoothly. Plus, Plaid integration verifies bank statements, cash flow, and other financial metrics automatically, further easing the underwriting process.

Beyond documentation, Clearly Acquired offers additional tools to support your acquisition journey.

Additional Acquisition Support

Clearly Acquired doesn’t just stop at matching you with lenders or organizing your documents - it also offers a range of services to support your acquisition from start to finish. Its deal management tools help coordinate everything from due diligence to the final closing, ensuring no detail is overlooked.

For situations where SBA loans alone aren’t enough, the platform provides creative financing options like seller notes, earnouts, and mezzanine capital. These solutions can bridge funding gaps or accommodate complex deal structures.

To help you better understand and grow your target business, Clearly Acquired offers business audits and growth insights. These tools highlight value drivers and areas for improvement, giving you an edge in loan applications and setting you up for post-acquisition success.

If additional capital is needed beyond the acquisition loan, the platform connects you with options like equipment financing and working capital lines of credit, ensuring your business has the resources it needs to thrive.

For larger acquisitions or when personal liquidity is limited, Clearly Acquired also offers investor and co-investor matching services, linking you with capital partners to supplement debt financing.

Finally, its pipeline and deal flow management tools centralize communication among buyers, sellers, brokers, and lenders. This streamlined approach is especially helpful when working under tight deadlines, which are common in acquisition deals.

Finding Your SBA Lender

Looking for the right SBA-approved lender to finance your business acquisition doesn’t have to feel daunting. By taking a structured approach, you can connect with qualified lenders while ensuring you're fully prepared for the application process. Here’s how to get started and evaluate potential lenders effectively.

Start with the SBA Lender Match tool. This free resource, discussed earlier, asks a few simple questions about your business needs and generates a tailored list of lenders interested in financing deals like yours.

Next, focus on getting financially prepared. Make sure you have a detailed business plan, know how much capital you need (SBA loans typically range from $500,000 to $5.5 million), and understand your credit score. Demonstrating your business’s financial health is crucial, so gather relevant documents and identify potential collateral early on to make lender discussions smoother.

When it’s time to evaluate lenders, ask the right questions. Find out about interest rates, credit score requirements, cash flow expectations, prepayment penalties, and grace periods. This will help you compare offers and avoid surprises later.

To keep things organized, structure your comparisons carefully and focus on finding the lender that best aligns with your acquisition goals.

For added convenience, platforms like Clearly Acquired can simplify the process. Their tools match you with pre-vetted lenders and provide automated documentation features, saving you time and effort.

FAQs

What’s the difference between SBA 7(a) and SBA 504 loans, and how do I choose the best option for buying a business?

SBA 7(a) loans offer a versatile funding option, with amounts up to $5 million. They can be used for a variety of needs, such as buying a business, covering working capital, or purchasing equipment. This flexibility makes them a great choice if you're looking to address multiple operational requirements.

SBA 504 loans, however, are designed with a specific purpose in mind: financing major fixed assets like real estate or equipment. These loans start at $500,000 and typically come with long-term, fixed-rate financing. They're particularly suited for projects aimed at expanding your business or creating jobs.

When deciding between the two, think about your primary objective. If you need funding for general operations or a mix of purposes, the 7(a) loan could be the better match. On the other hand, if your focus is on acquiring significant fixed assets or growing your business footprint, the 504 loan might be the more suitable option. Both are valuable tools to help you achieve your business goals.

What can I do to improve my chances of getting approved for an SBA loan if my credit score isn’t perfect?

If your credit score isn’t where you’d like it to be, there are steps you can take to boost your chances of getting approved for an SBA loan. Start by working on lowering your credit utilization rate - try to keep it under 30% - and focus on paying off any high-interest debts. If your credit report has negative marks, like late payments or defaults, be ready to explain them and share what actions you’ve taken to address those issues.

You can also strengthen your application by offering collateral or finding a co-signer with strong credit. Most lenders prefer to see a credit score of at least 650, so any improvements you can make before applying will go a long way. Lastly, providing detailed financial records and a well-thought-out business plan can show lenders that you’re capable of managing the loan and repaying it responsibly.

What are the most common mistakes to avoid when applying for an SBA loan?

Avoid These Common Mistakes When Applying for an SBA Loan

Getting an SBA loan can be a game-changer for your business, but the process requires careful attention to detail. Here are some pitfalls to steer clear of:

- Incomplete or messy paperwork: Missing documents or a lack of organization can slow down - or even stop - your application. Double-check that everything is complete and neatly arranged before submitting.

- Inaccurate financial records: Your financial details, like tax returns and profit and loss statements, must be accurate and current. Any discrepancies can raise red flags for lenders.

- Overlooking your credit score: A low credit score or unresolved credit issues can hurt your chances of approval. Make sure your credit profile is in good shape before applying.

- Weak business plan: Lenders want to see that you have a clear vision and strategy. A well-thought-out business plan shows you're prepared and serious about your goals.

- Not understanding loan terms: Each SBA loan has specific requirements. Take the time to fully understand the qualifications and terms for the loan you're pursuing.

By avoiding these mistakes, you’ll be better positioned to secure the funds your business needs to grow.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)