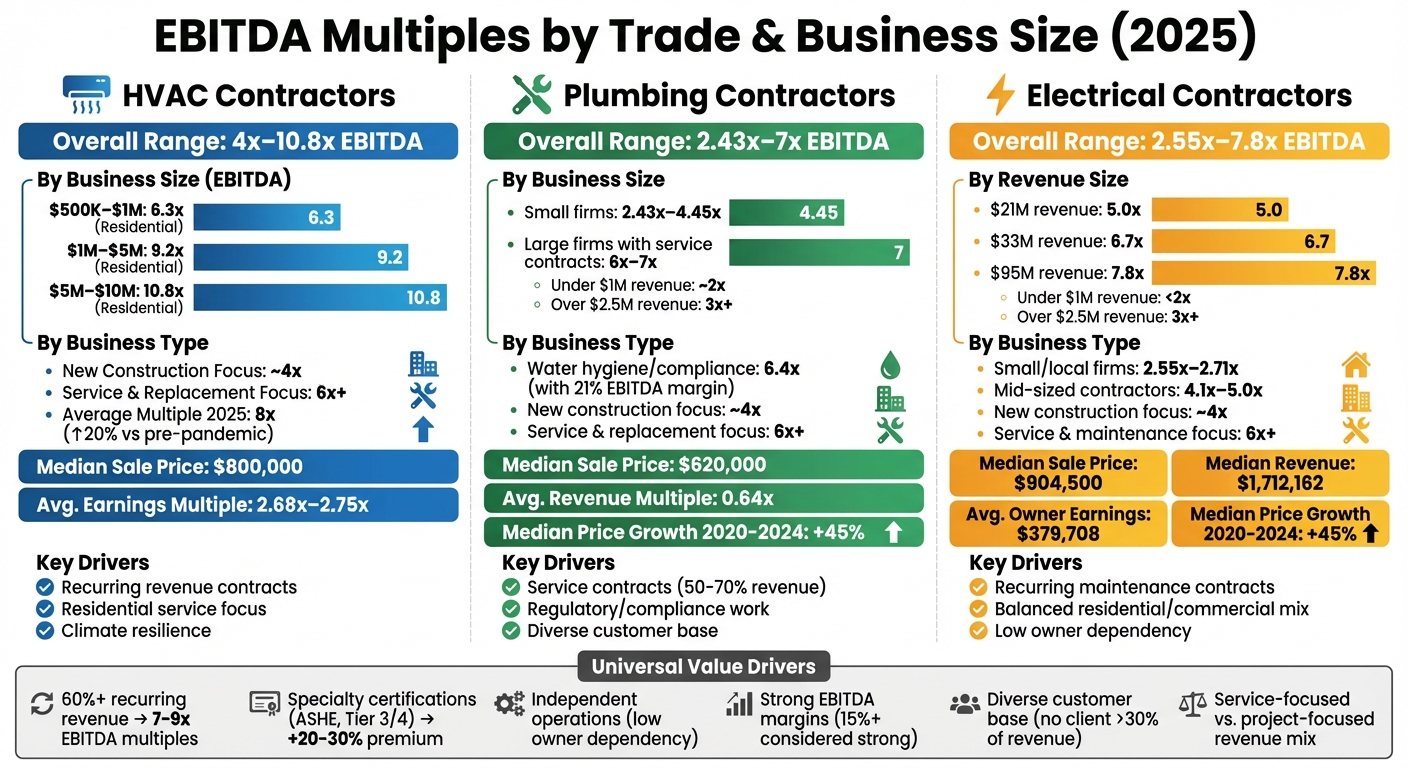

When buying or selling HVAC, plumbing, or electrical contracting businesses, EBITDA multiples are a key valuation tool. The formula is simple: Value = EBITDA × Multiple. Multiples vary by industry, business size, revenue mix, and location. Here are the main takeaways:

- HVAC Businesses: Multiples range from 4x–10.8x. Residential service-focused HVAC companies with recurring revenue command the highest valuations.

- Plumbing Businesses: Smaller firms average 2.43x–4.45x EBITDA, while larger firms with service contracts can achieve 6x–7x.

- Electrical Contractors: Multiples range from 2.55x–7.8x, depending on size and service focus. Larger firms with stable cash flow attract higher multiples.

Key drivers of higher multiples include recurring service contracts, diverse customer bases, and reduced owner dependency. Smaller businesses or those reliant on new construction projects typically sell for lower multiples.

| Sector | EBITDA Multiples (Range) | Key Valuation Drivers |

|---|---|---|

| HVAC | 4x–10.8x | Recurring revenue, residential focus |

| Plumbing | 2.43x–7x | Service contracts, regulatory work |

| Electrical | 2.55x–7.8x | Service mix, larger revenue size |

To secure higher valuations, focus on service-driven models, recurring contracts, and building a business that operates independently of the owner.

EBITDA Multiples Comparison for HVAC, Plumbing, and Electrical Contractors by Business Size

1. HVAC Contractors

EBITDA Multiples by Business Type

As of the first quarter of 2025, HVAC contractors are commanding higher valuations than ever before. The average EBITDA multiple has reached 8x, marking a 20% increase compared to pre-pandemic levels. Residential HVAC businesses continue to outperform their commercial counterparts. For example, residential all-purpose contractors with EBITDA between $5 million and $10 million are achieving multiples as high as 10.8x. In contrast, commercial all-purpose HVAC companies in the same EBITDA range typically see multiples closer to 9.2x.

Companies with service-focused models enjoy even better valuations. An HVAC business primarily engaged in new construction might sell for around 4x EBITDA, but those with a strong focus on service and replacement can command multiples of 6x EBITDA or more. This premium reflects the predictable, recurring revenue streams that buyers find attractive and less risky.

Now, let’s break down how revenue size influences these multiples.

Revenue Size Impact

The size of a business significantly affects its valuation. In Q1 2025, residential all-purpose HVAC companies with EBITDA between $500,000 and $1 million averaged 6.3x multiples. But for businesses generating $5 million to $10 million in EBITDA, multiples climbed to 10.8x. Smaller operators, often valued using Seller's Discretionary Earnings (SDE), typically see multiples ranging from 1.99x to 3.33x.

"Larger HVAC businesses that generate higher sales (and maintain reasonable profit margins) tend to sell for earnings multiples on the higher end." - BizBuySell

The median sale price for HVAC companies has also risen sharply - up 23% between 2021 and 2025. During this period, the median price increased from $650,000 to $800,000. Businesses with revenues over $2.5 million commonly achieve earnings multiples of 3.0x or higher, while smaller companies with less than $1 million in revenue often trade closer to 2.0x.

Geographic trends add another layer of complexity to these valuations.

Geographic and Market Factors

Location plays a big role in HVAC deal activity and valuation multiples. As of early 2026, the Middle Atlantic region leads the way with 31 active HVAC deals, followed by the South Atlantic with 27 deals, and the Mountain region with 23 deals. Regional differences can be dramatic. For instance, in September 2025, an HVAC contractor in the East South Central region with $9 million in revenue and $1.5 million in EBITDA sold for an impressive 10.93x multiple to a Family Office. Meanwhile, a similar-sized business in the Eastern Midwest with $22 million in revenue and $1.5 million in EBITDA sold for just 4.00x in January 2025.

Factors like climate variability and government programs, such as the Inflation Reduction Act, are driving up HVAC valuations. These initiatives are increasing demand for energy-efficient installations and HVAC services.

Service Mix and Contract Types

The type of revenue a business generates can make or break its valuation. Companies with a steady stream of income from recurring maintenance contracts are significantly more attractive to buyers than those relying solely on one-off installations. Predictable cash flow from long-term service agreements reduces risk for buyers and pushes multiples into the top tier.

Buyers also place a premium on businesses with well-trained technician teams and structured management that can operate independently of the owner. Skilled labor is a major differentiator - companies with experienced, specialized technicians generally achieve better results in mergers and acquisitions compared to those with less capable workforces.

| Company Type | $500K–$1M EBITDA | $1M–$5M EBITDA | $5M–$10M EBITDA |

|---|---|---|---|

| Residential (All-Purpose) | 6.3x | 9.2x | 10.8x |

| Commercial (All-Purpose) | 5.2x | 7.4x | 9.2x |

| Industrial (All-Purpose) | 5.6x | 8.0x | 9.3x |

sbb-itb-a3ef7c1

The 5 Boring Businesses that sell for millions

2. Plumbing Contractors

Plumbing business valuations, like HVAC, depend heavily on factors such as revenue mix, geographic reach, and service contracts. However, the unique characteristics of the plumbing industry add their own twist to these calculations.

EBITDA Multiples by Business Type

Smaller plumbing contractors typically see EBITDA multiples ranging from 2.43x to 4.45x, while larger, high-performing firms can achieve 4x to 7x EBITDA. The U.S. plumbing industry is highly fragmented, with nearly 122,350 businesses generating about $107 billion in revenue. No single company holds more than 5% market share. This fragmented market offers plenty of opportunities for consolidation, which keeps transaction activity high.

The type of work a plumbing business focuses on plays a major role in its valuation. Companies offering water hygiene and compliance services, like backflow testing and Legionella control, often trade at higher revenue multiples of 1.0x to 1.5x due to regulatory requirements. For instance, one niche water hygiene business, benefiting from a strong 21% EBITDA margin and regulatory-driven contracts, was acquired at approximately 6.4x EBITDA. On the other hand, plumbing firms that rely heavily on new construction projects tend to sell closer to 4x EBITDA, while those with a solid service and replacement revenue base can command 6x EBITDA or more.

Revenue Size Impact

The size of a plumbing business significantly affects its valuation. Smaller contractors with annual revenue under $1 million generally trade around 2x EBITDA, whereas those generating over $2.5 million in revenue tend to average 3x or higher.

"Larger businesses that generate higher sales (and maintain reasonable profit margins) tend to sell for earnings multiples on the higher end." - BizBuySell

Larger companies often attract institutional buyers, such as private equity firms, who are willing to pay premium multiples for businesses with scalability and platform potential. Between 2020 and 2024, the median sale price for plumbing contractors rose by over 45%, reflecting steady revenue growth and increasing market multiples.

Geographic and Market Factors

Location and market focus play a big part in determining plumbing business valuations. Contractors servicing critical facilities like hospitals or data centers often command higher multiples because plumbing failures in these settings can lead to serious regulatory or economic consequences. Buyers also value companies with multiple branches or the ability to serve multi-site customers, as regional scale enhances operational efficiency and resilience.

"Buyers pay more when plumbing failure means serious safety, regulatory or economic damage." - Eilla.ai

Regulatory and compliance-driven work, such as backflow testing, water hygiene control, and boiler safety inspections, is another key valuation driver. These services are considered non-discretionary, making businesses that specialize in them particularly attractive. In contrast, companies heavily reliant on new construction or renovation work are more cyclical and tend to trade at lower multiples due to their dependence on fluctuating demand.

Service Mix and Contract Types

The revenue mix of a plumbing business can significantly impact its value. Companies that generate 50–70% of their revenue from contracted service and maintenance typically outperform those with 70–90% of revenue tied to project or new build work. Buyers especially favor businesses that convert emergency calls into 1 to 3-year service agreements with automatic renewal and indexed pricing.

Maintenance-heavy portfolios in the building services sector generally trade at EBITDA multiples of 5.9x to 7.0x, while project-focused contractors tend to fall in the mid-single-digit range. Customer concentration also matters: businesses with a single client accounting for more than 30% of revenue often face valuation penalties, while those with a diverse customer base are seen as more stable and desirable. Similarly, EBITDA margins play a critical role - companies with margins under 5% are considered weak, whereas those with margins of 15% or higher command premium valuations.

| Business Profile | Lower-Value Version | Higher-Value Version |

|---|---|---|

| Revenue Mix | 70–90% project/new build | 50–70% contracted service/maintenance |

| Contract Structure | Informal/verbal agreements | Written 1–3 year contracts with indexation |

| Customer Base | High concentration (one client >30%) | Broad base of small/mid-sized customers |

| EBITDA Margin | Under 5% (Weak) | 15%+ (Strong) |

These valuation factors highlight the importance of service mix, customer diversity, and financial performance in determining the worth of a plumbing business. Together, they lay the groundwork for a deeper look at the advantages and challenges across the trades.

3. Electrical Contractors

Mid-sized electrical contractors typically trade at EBITDA multiples ranging from 4.1x to 5.0x, while smaller, locally owned electrical and mechanical service firms average between 2.55x and 2.71x EBITDA. Let’s dive into the factors that shape these valuations.

EBITDA Multiples by Business Type

The size of the business plays a major role in determining its valuation. For instance, companies generating $21 million in revenue trade at an average of 5.0x EBITDA, while those with revenues of $95 million see multiples as high as 7.8x. The range for these larger firms typically falls between 2.9x and 8.7x, depending on other variables.

"The data tells us only premium quality businesses are achieving extraordinary valuations in the construction industry." – BMI Mergers

Between 2020 and 2024, the median sale price for electrical and mechanical contractors climbed by over 45%, increasing from $595,000 to $875,000. On the smaller side of the market, electrical contractors with median revenues of $1,712,162 and owner earnings of $379,708 traded at an average earnings multiple of 2.55x.

Revenue Size Impact

A clear pattern emerges when looking at revenue size: smaller companies - those earning less than $1 million annually - sell for less than 2x EBITDA. Meanwhile, businesses with revenues exceeding $2.5 million tend to trade at multiples of 3x or higher. As revenue grows, so does the multiple. For example, companies with $33 million in revenue achieve an average EBITDA multiple of 6.7x.

| Electrical Contractor Revenue | Mean EBITDA Multiple |

|---|---|

| $21 Million | 5.0x |

| $33 Million | 6.7x |

| $95 Million | 7.8x |

This size premium stems from the increased cash flow stability and better debt coverage larger companies offer. Private equity firms and institutional buyers are particularly drawn to sizable electrical contractors with scalability and platform potential, further boosting valuations.

Geographic and Market Factors

Geographic location and local market conditions heavily influence electrical contractor valuations. Factors like market saturation, regional economic trends, and local competition can significantly impact multiples. Business brokers often rely on local comparable sales rather than national averages when pricing businesses, as these provide a more accurate reflection of regional market dynamics.

"Business brokers and valuation professionals will always turn to local comps when pricing businesses for sale or evaluating businesses for acquisition." – BizBuySell

In areas experiencing economic growth, companies with strong market penetration across both residential and commercial sectors tend to command higher valuations. Conversely, high competition in a saturated market can drive multiples down. Broader economic factors, such as interest rates, inflation, and consumer spending, also play a role in shaping business values.

Service Mix and Contract Types

The type of services offered can significantly impact an electrical contractor's valuation. Businesses focused on service and replacement work tend to achieve higher multiples than those primarily engaged in new construction projects. For example, a company centered on new construction might sell for 4x EBITDA, while one with a strong service and replacement component could fetch 6x EBITDA.

Recurring maintenance contracts are especially attractive to buyers because they provide stable revenue and reduce dependency on the owner. Businesses with a balanced mix of residential and commercial clients are often seen as more resilient during economic downturns compared to those reliant on commercial projects, which are more sensitive to market fluctuations.

| Business Profile | Lower-Value Version | Higher-Value Version |

|---|---|---|

| Revenue Focus | Predominantly new construction | Emphasis on service and maintenance |

| Market Sector | Commercial project-dependent | Balanced mix of residential and commercial |

| Contract Structure | One-time project work | Recurring maintenance agreements |

| Owner Involvement | High owner dependency | Operates with a self-sustaining management team |

To achieve higher valuations - multiples of 3.05x or above - electrical contractors should implement systems that allow the business to run without heavy owner involvement. Additionally, incorporating advanced technologies and energy-efficient solutions positions businesses as forward-thinking, making them more appealing to buyers seeking long-term growth opportunities.

Pros and Cons

Building on the detailed trade valuations above, let’s dive into the key trade-offs shaping market multiples. Each sector brings its own set of strengths and challenges that influence EBITDA multiples and deal structures. Below is a breakdown of the most notable advantages and drawbacks across trades.

HVAC contractors enjoy steady demand, even during economic downturns, particularly in the residential sector. Businesses generating $5 million to $10 million annually can see multiples as high as 10.8x EBITDA. However, these businesses often face high owner dependency and customer attrition, which can limit their scalability. Commercial HVAC companies, in particular, are more vulnerable to economic cycles since they heavily depend on new construction projects.

For Electrical contractors, revenue figures are solid, with the highest median revenues at $1,712,162 and average owner earnings of $379,708. Despite this, their market valuations tend to lag behind other trades, trading at lower multiples compared to their peers.

Plumbing contractors, on the other hand, command higher revenue multiples in the small business market, averaging 0.64x compared to 0.58x for electrical contractors. This reflects the emergency-driven nature of plumbing services, which creates consistent demand. However, plumbing businesses typically have lower sale prices compared to HVAC and electrical contractors.

Here’s a quick comparison of the three sectors:

| Sector | Primary Strength | Primary Weakness | Median Sale Price | Avg. Earnings Multiple |

|---|---|---|---|---|

| HVAC | Climate resilience & steady demand | High owner dependency, 52% fail-to-sell rate | $800,000 | 2.68x – 2.75x |

| Electrical | Highest median revenue & earnings | Trades at lower multiples | $904,500 | 2.55x – 2.71x |

| Plumbing | Strong revenue multiples | Lowest overall sale prices | $620,000 | 2.47x – 2.49x |

For all three sectors, the strategies discussed earlier - minimizing owner dependency and implementing recurring maintenance contracts - remain critical for achieving higher multiples. Businesses that can operate independently of their founders consistently attract better valuations, regardless of the trade they specialize in.

Conclusion

EBITDA multiples provide a structured and transparent way for buyers and sellers to navigate fair market negotiations. The trends are clear: businesses with over 60% recurring revenue often achieve EBITDA multiples in the 7–9x range, while those focused on new construction typically see lower multiples, around 3–4.5x.

"2025's valuation math rewards focus over generality, creating unprecedented gaps".

To maximize valuation, it's essential to reduce owner dependency by delegating daily operations to a skilled management team. Strengthen recurring revenue streams with preventive maintenance agreements and detailed operational playbooks. A voluntary financial review, conducted 9–12 months before the sale, can also instill buyer confidence. Additionally, hiring an M&A advisor has proven to increase sale prices by about 25% compared to owner-led processes. These steps lay the groundwork for achieving higher valuations.

Specialty certifications and local market data play a critical role in accurate valuations. Certifications like ASHE for healthcare or Tier 3/4 for data centers can add a 20–30% premium to the final valuation. Relying on local comparable sales data, rather than inflated listing prices - which can exceed actual transaction values by 10% or more - ensures realistic expectations. Furthermore, businesses that operate independently of their founders consistently command higher multiples, as founder dependency often leads to lower valuations. These factors highlight the market's preference for resilient, service-oriented business models.

Service-based models, particularly in residential HVAC, consistently outperform those focused on new construction. Residential HVAC businesses benefit from their recession-resistant and diversified customer base, making them more attractive to buyers. Companies generating over $2.5 million in annual sales often achieve multiples well above 3x, while smaller firms with sales under $1 million tend to trade closer to 2x. These benchmarks underscore the importance of strategic operational improvements in driving valuation.

Whether you're planning to sell or considering an acquisition, focusing on these key fundamentals is crucial for securing premium multiples.

FAQs

What drives higher EBITDA multiples for HVAC businesses?

Higher EBITDA multiples in the HVAC industry are shaped by several key factors, including company size, profitability, and growth potential. Larger HVAC businesses, particularly those generating EBITDA between $5 million and $10 million, often secure multiples as high as 10.8×. In contrast, smaller operators with EBITDA in the $500,000 to $1 million range typically see multiples around 5–6×. Companies that offer a mix of residential and commercial services often achieve higher valuations compared to those specializing solely in heating or cooling.

Strong EBITDA margins - generally 15% or higher - are especially attractive to buyers. These margins signal pricing power and efficient operations. Predictable revenue streams, such as maintenance contracts, along with a diverse customer base, also reduce risk and boost valuation multiples. Businesses in fast-growing regions with scalable operations, independent management teams, and clear growth opportunities (like upselling or acquisitions) are particularly appealing to investors. Furthermore, companies with low owner dependence and high barriers to entry tend to be more valuable and seamlessly integrate into larger platforms.

How does location affect the valuation of plumbing contractors?

Location heavily influences the valuation of a plumbing contractor. Businesses operating across multiple states or in rapidly expanding areas often secure higher EBITDA multiples. Why? They offer buyers a broader market reach, reduced exposure to local economic shifts, and better growth opportunities - qualities that make them stand out in the market.

In contrast, contractors confined to smaller or slower-growing regions typically see lower multiples. Their revenue streams are more susceptible to local competition and economic downturns. For instance, two contractors with identical EBITDA figures could have vastly different valuations if one serves a high-demand, multi-state market, while the other is limited to a single, less dynamic area.

Why do electrical contractors focused on service and maintenance achieve higher valuation multiples?

Electrical contractors who emphasize service and maintenance tend to achieve higher EBITDA multiples. Why? Their revenue streams are more stable and predictable, thanks to recurring, contract-based income. This steady flow of revenue lowers financial risk and provides consistent cash flow, making these businesses appealing to potential buyers.

On top of that, service and maintenance work typically delivers better profit margins than project-based work. This mix of reduced risk and increased profitability explains why valuations for these businesses often come with premium multiples.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)