Valuing an e-commerce business today revolves around EBITDA multiples. Here's the key takeaway: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is the standard metric for assessing profitability, especially for businesses generating over $5–10 million in revenue. By multiplying EBITDA by market-specific multiples, you can estimate a business's value.

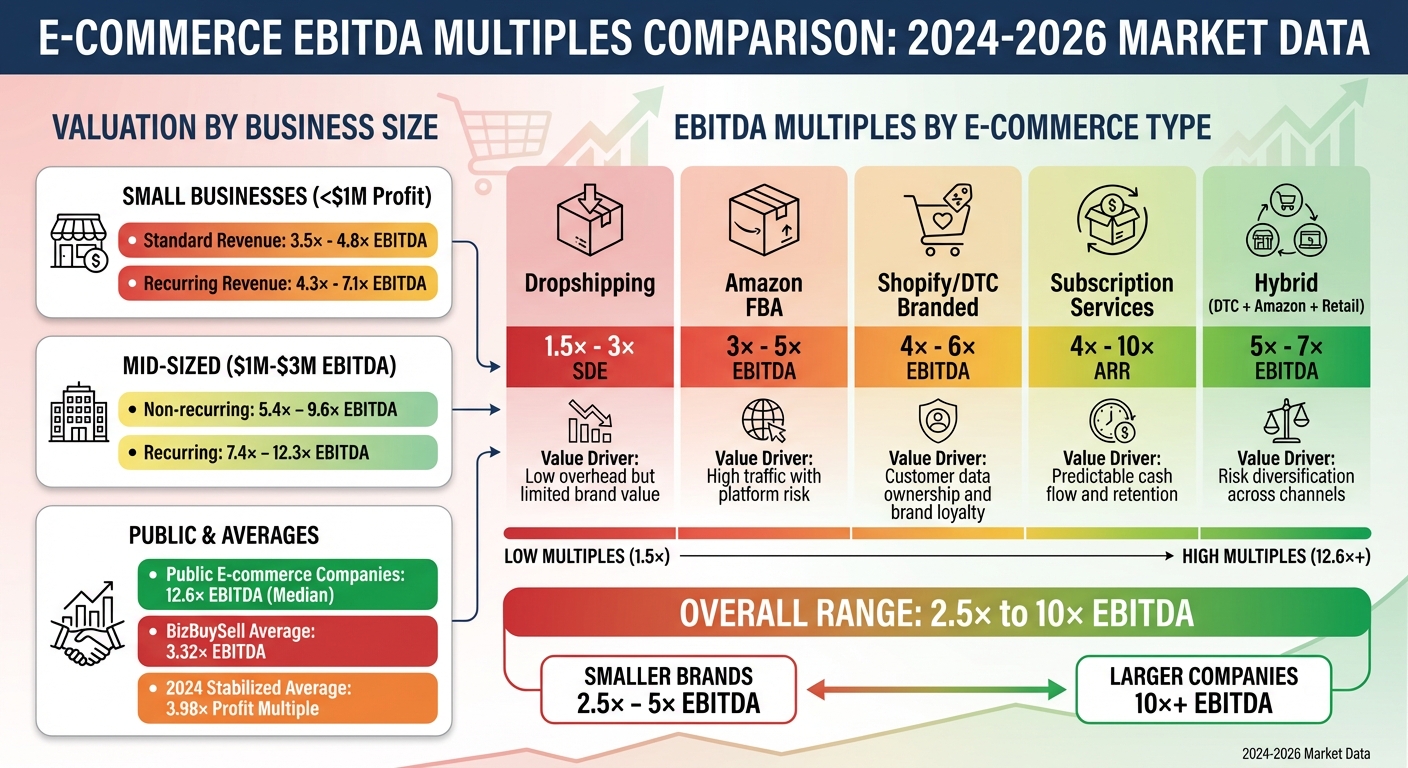

- Current Multiples (2024–2026): EBITDA multiples range from 2.5× to 10×, depending on size, profit, and business type.

- Smaller Brands: Typically sell for 2.5× to 5× EBITDA.

- Larger Companies: Can command 10× or more, with public companies averaging 12.6× EBITDA.

- Business Types: Dropshipping businesses have the lowest multiples (1.5×–3× SDE), while subscription services and hybrid models can achieve higher valuations (4×–10× ARR or EBITDA).

Why EBITDA over Revenue? Unlike revenue, EBITDA focuses on actual profitability, cutting through inflated top-line numbers. Normalized EBITDA, which excludes one-time costs and owner-specific expenses, provides a clearer picture of recurring earnings.

For buyers and sellers, understanding EBITDA multiples and normalization is essential for accurate valuations in today’s market.

H1 2025 eCommerce Valuation Webinar [April 2025] - The Fortia Group

sbb-itb-a3ef7c1

How to Normalize EBITDA for E-commerce Businesses

When it comes to valuing an e-commerce business, raw financial data often falls short because it includes nonrecurring items. To arrive at a more accurate valuation, you’ll need to normalize EBITDA. This process removes expenses that are unlikely to occur under new ownership, showcasing the business's true recurring earnings. In the e-commerce world, every valid add-back significantly impacts valuation. For example, a $50,000 add-back at a 4× multiple boosts the business's value by $200,000. Here's how to approach this critical step.

Collect Historical Financial Data

Start by gathering 2–3 years of financial records, including financial statements, bank statements, and tax returns. These documents help identify performance trends and flag anomalies, such as a one-time legal settlement or a temporary surge in advertising costs. Thorough records are essential for validating add-backs during due diligence.

Adjust for Owner Expenses and One-Time Costs

Next, pinpoint nonrecurring or owner-specific expenses. Owner-related costs might include personal travel charged to the business, inflated salaries for family members, home office expenses, or health insurance premiums. Similarly, adjust for nonrecurring costs like legal fees from specific disputes, rebranding efforts, or initial setup expenses for a new supply chain. Recently, some brands have also factored in "tariff-induced market volatility" by highlighting supply chain diversification to demonstrate stable margins to potential buyers. Properly documenting these adjustments is crucial for a smooth due diligence process.

EBITDA Calculation Formula

Once you’ve identified the necessary add-backs, use the standard EBITDA formula:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.

For smaller e-commerce businesses (typically those with revenue under $10 million), Seller's Discretionary Earnings (SDE) is a more common metric. SDE accounts for the owner’s salary and other discretionary expenses. The formula looks like this:

SDE = Net Income + Owner Salary + Discretionary Expenses + One-Time Costs (+ Depreciation, if applicable).

For example, let’s say a business has a net income of $300,000. Add-backs include $50,000 for the owner’s salary, $20,000 in discretionary expenses, and $10,000 in one-time legal fees. The normalized SDE becomes $380,000. At a 3× multiple, this translates to a valuation of $1.14 million, compared to $900,000 based solely on net income.

| Metric | Formula | Typical Use Case |

|---|---|---|

| EBITDA | Net Income + Interest + Taxes + Depreciation + Amortization | DTC businesses > $10M |

| SDE | Net Income + Owner Salary + Discretionary Expenses + One-Time Costs + Depreciation (if applicable) | FBA/Small brands < $10M |

Current EBITDA Multiples for Online Brands (2024-2026)

E-commerce Business Valuation Multiples by Type and Size 2024-2026

EBITDA multiples in e-commerce today range from 2.5× to 10×, with larger companies achieving higher multiples due to their stable earnings. By the first half of 2024, the median EBITDA multiple for e-commerce businesses hit 10×, reflecting a shift in focus toward steady earnings over short-term revenue spikes. Smaller to mid-sized online brands, however, typically sell for lower multiples - usually between 2.5× and 5× net profit. After adjusting EBITDA figures, these multiples become essential indicators for evaluating market value. They highlight how factors like business size, revenue model, and operational efficiency impact valuations.

EBITDA Multiples by Business Size and Profit

The size of an e-commerce business significantly influences its valuation. Smaller operations with under $1 million in profit generally see multiples between 3.5× and 4.8× EBITDA for standard revenue models, while businesses with recurring revenue models can achieve multiples of 4.3× to 7.1× EBITDA. For businesses earning $1 million to $3 million in EBITDA, the multiples increase to 5.4× to 9.6× for non-recurring revenue models and 7.4× to 12.3× for recurring revenue models.

Larger, public e-commerce companies command even higher valuations. In 2024, public e-commerce marketplaces reported a median multiple of 12.6× EBITDA, reflecting their market dominance and operational scale. On the other hand, the average multiple for e-commerce businesses sold on platforms like BizBuySell was approximately 3.32×, with profit multiples stabilizing at around 3.98× in the latter half of 2024. This stabilization indicates that the extraordinary growth seen between 2020 and 2022 is now viewed as an outlier.

EBITDA Multiples by E-commerce Type

The type of e-commerce business also plays a significant role in determining valuation. Dropshipping businesses typically have the lowest multiples - ranging from 1.5× to 3× SDE - due to their low margins and lack of brand differentiation. Amazon FBA brands fare better, with multiples of 3× to 5× EBITDA, benefiting from high traffic but facing risks tied to platform dependency.

Shopify and DTC (Direct-to-Consumer) brands command higher multiples, generally between 4× and 6× EBITDA, thanks to their control over customer data and stronger brand loyalty. Subscription box services, with their predictable revenue streams, achieve multiples of 4× to 10× ARR. The most sought-after model is the hybrid approach, which combines DTC, Amazon, and retail channels. These businesses typically achieve multiples of 5× to 7× EBITDA by spreading risk across multiple platforms.

| E-commerce Business Type | Typical Multiple Range | Primary Value Driver |

|---|---|---|

| Dropshipping | 1.5× – 3× SDE | Low overhead but limited brand value |

| Amazon FBA | 3× – 5× EBITDA | High traffic with platform risk |

| Shopify / DTC Branded | 4× – 6× EBITDA | Ownership of customer data and brand loyalty |

| Subscription Services | 4× – 10× ARR | Predictable cash flow and retention |

| Hybrid (DTC + Amazon + Retail) | 5× – 7× EBITDA | Risk diversification across channels |

What Affects EBITDA Multiples

Several factors influence EBITDA multiples, with growth trajectory being the most critical. Businesses demonstrating consistent growth tend to secure higher valuations, while those with flat or declining sales face discounts. Customer retention is another key metric; higher repeat purchase rates and strong Customer Lifetime Value signal long-term stability to potential buyers.

Traffic diversification is increasingly important in 2024-2026. Brands overly reliant on paid advertising often receive lower valuations, while those with a mix of acquisition channels - like organic search, email marketing, and social media - are seen as more resilient.

Other factors include gross margins (with margins above 50% commanding premium valuations) and platform dependency. Businesses that rely heavily on a single sales channel, such as Amazon, often face valuation penalties if over 70% of their revenue comes from that source. On the flip side, companies demonstrating operational independence - where the business can run with minimal owner involvement - earn higher multiples due to their scalability.

Finally, brands leveraging AI-driven automation for inventory management, personalized shopping, or content generation are increasingly attractive to buyers. This trend is expected to continue shaping valuations through 2026.

Using Clearly Acquired's Valuation Tools

Clearly Acquired's platform uses AI to streamline the valuation process by analyzing business metrics and standardizing financial data. It automatically adjusts for nonrecurring expenses before applying EBITDA multiples, reducing the chance of manual errors.

AI-Driven Financial Analysis

The platform doesn’t just stop at data normalization - it takes valuation accuracy to the next level by comparing your business metrics with live transaction data. This benchmarking process evaluates factors like unit economics and risk elements, including CAC-to-LTV ratios, customer concentration, owner dependency, and platform risks. These insights are then used to fine-tune EBITDA multiples. For smaller businesses (under $5 million), the tool employs the SDE method, while larger businesses benefit from standard EBITDA calculations to deliver precise valuations.

Simplified Valuation and Risk Screening

In addition to its valuation capabilities, the tool simplifies risk assessment by identifying critical indicators. It evaluates factors like owner dependency, ideal CAC-to-LTV ratios (typically between 1:3 and 1:5), and traffic diversification. If revenue concentration exceeds 70%, the platform flags it as a potential risk. Financial normalization further refines this process by adjusting for one-time costs and owner-related expenses, providing a clearer picture of profitability. By addressing risks upfront, buyers and sellers gain the clarity needed to make smarter decisions and structure deals that accurately reflect both value and potential risks. This integrated approach ensures that EBITDA-based valuations remain dependable for informed decision-making.

Conclusion

Valuing an e-commerce business boils down to normalized EBITDA and using the right multiples. By removing one-time expenses and owner-related costs, you get a clearer picture of the business's actual earning potential - the metric buyers care about most. This standardized process ensures consistent comparisons between similar businesses and highlights the realistic future earnings a buyer can anticipate. Without normalization, inflated or skewed numbers can lead to unrealistic expectations and derail potential deals.

Recent trends show a clear shift: buyers are now focusing on stable, normalized earnings rather than chasing revenue growth alone. This reflects a growing preference for businesses that demonstrate consistent profitability over those with impressive top-line numbers but shaky bottom lines.

In this changing market, data-driven valuations have become essential. Using accurate, market-aligned multiples not only saves time but also attracts buyers who understand a business’s true value. For buyers, comparing against industry benchmarks can uncover opportunities where a business exceeds expectations. Risk-adjusted methods also help investors avoid overpaying for businesses that look promising on paper but hide operational or market-based risks.

Clearly Acquired’s AI tools simplify this process by automating financial normalization, benchmarking metrics against live transaction data, and identifying risks like revenue concentration or dependency on the owner. Whether it’s calculating SDE for smaller businesses or applying EBITDA multiples for larger ones, the platform handles the complex calculations for you. This frees you to focus on strategic decisions rather than getting bogged down in spreadsheets. Whether you're buying, selling, or investing, having reliable valuations and thorough risk assessments ensures you’re making confident moves that align with true market value.

Understanding and applying these valuation techniques is key to navigating today’s competitive e-commerce market with clarity and confidence.

FAQs

How can I determine the right EBITDA multiple to value my e-commerce business?

To figure out the right EBITDA multiple for your e-commerce business, start by looking at market standards and then fine-tune based on what makes your business stand out. Typically, e-commerce brands are valued at 4× to 6× EBITDA. Smaller businesses or those with limited growth potential often fall on the lower end of the range, while high-growth, scalable brands can reach the higher end. If your business generates less than $1 million in annual profit, expect multiples between 3× and 4.5×. On the other hand, larger, fast-growing brands can sometimes reach multiples of 8× or more.

Here’s how to narrow down your multiple:

- Adjust your EBITDA by removing one-time expenses and non-essential costs to get a more accurate baseline.

- Compare your business to similar e-commerce brands in terms of size, growth rate, and profitability.

- Factor in elements like scalability, transferability, and sustainability. For instance, businesses with recurring revenue streams, low customer churn, and consistent growth often justify higher multiples. Conversely, businesses with declining sales or heavy dependence on a single traffic source may see lower valuations.

By blending market benchmarks with an honest assessment of your business’s strengths and risks, you can determine a valuation multiple that accurately reflects its worth.

What factors affect EBITDA multiples for e-commerce brands?

EBITDA multiples for e-commerce brands are shaped by several key elements that determine how appealing a business is to buyers and investors. Company size is a major factor - larger businesses with higher revenues and profits generally attract higher multiples. Similarly, profitability plays a big role, with brands that maintain strong and steady EBITDA margins often commanding premium valuations. Another important aspect is growth potential; opportunities like entering new markets or launching additional products can boost multiples by lowering perceived risks.

The industry or niche a brand operates in also carries weight. Certain sectors, such as beauty or electronics, often secure higher multiples compared to others. Beyond these measurable factors, qualitative elements like brand reputation, customer loyalty, and operational scalability can heavily influence valuation. For instance, brands with efficient operations or advanced automation are often seen as more reliable and attractive investments. On the flip side, smaller brands earning less than $100,000 in profits typically see lower multiples, whereas brands surpassing $250,000 annually tend to achieve higher valuations.

Ultimately, EBITDA multiples are shaped by a mix of tangible metrics - like size, margins, and growth - and intangible qualities, such as brand strength and scalability, that together define how much buyers are willing to pay for future earnings.

Why is it important to normalize EBITDA when valuing e-commerce businesses?

Normalizing EBITDA plays a key role in presenting a clear view of a business's recurring profitability. By adjusting for irregular expenses, one-time costs, and non-operating items, it allows buyers and investors to see the true financial performance of an e-commerce brand. This helps ensure that EBITDA multiples are applied consistently, resulting in a more accurate and fair market valuation.

When you focus on normalized EBITDA, you strip away the noise created by unusual financial events. This makes it much easier to compare businesses and evaluate their potential for long-term success.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)