When applying for an SBA loan, you must provide detailed personal financial information, especially if you own 20% or more of the business. Lenders use this data to assess your net worth, creditworthiness, and SBA loan eligibility. The key document is SBA Form 413, which captures your assets, liabilities, and income sources.

Key Steps:

- Complete SBA Form 413: Accurately list assets (cash, retirement accounts, real estate, etc.) and liabilities (loans, mortgages, unpaid taxes).

-

Gather Supporting Documents:

- Bank and retirement account statements

- Mortgage details and property deeds

- Vehicle valuations (e.g., Kelley Blue Book)

- Life insurance cash values

- Tax returns (last 3 years)

- Disclose Liens and Contingent Liabilities: Include liens, co-signed debts, or legal claims.

- Ensure Accuracy: Align figures with supporting documents and use the same "as of" date.

Proper preparation ensures a smoother review process and strengthens your loan application. Double-check all details to avoid delays.

How to Fill out the SBA Personal Financial Statement (Form 413)

sbb-itb-a3ef7c1

SBA Form 413: Personal Financial Statement

SBA Form 413 Assets vs Liabilities Categories

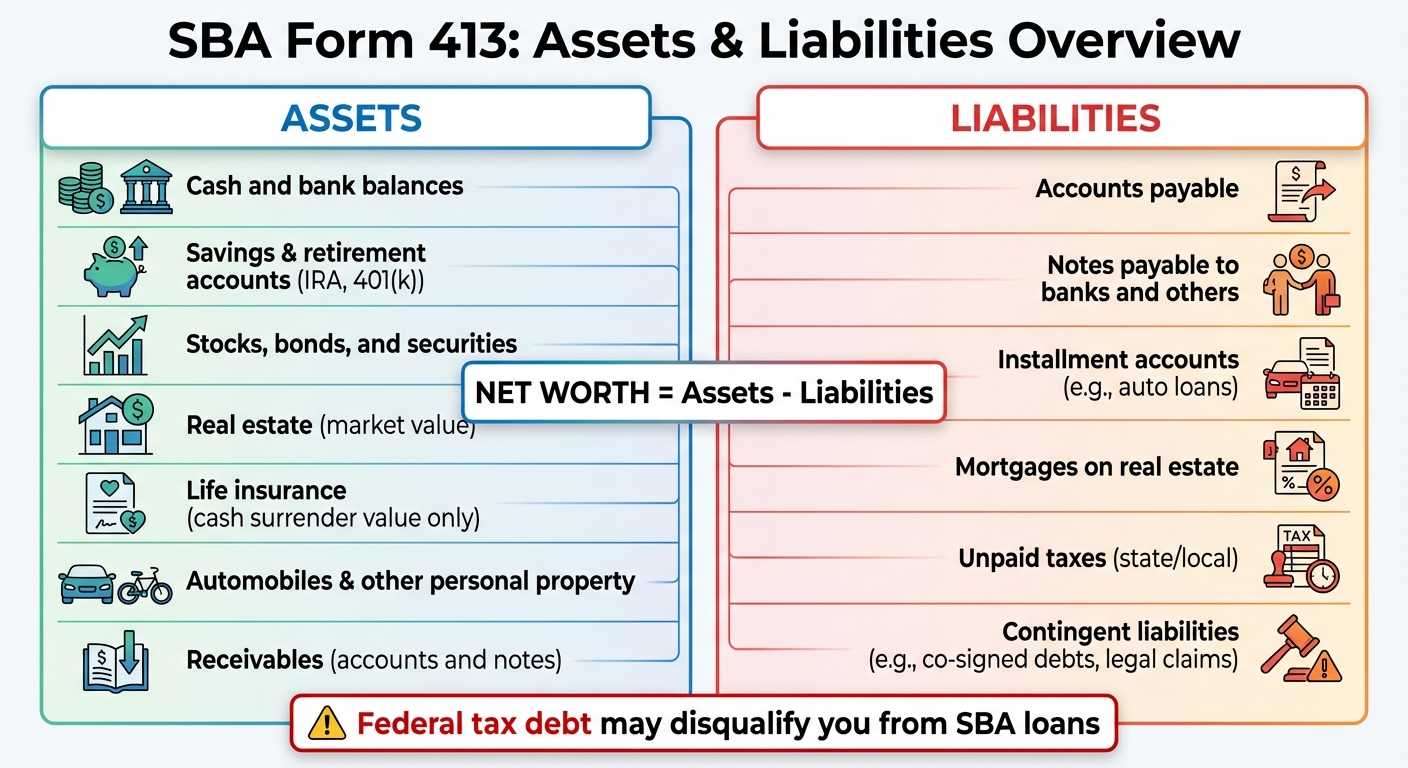

SBA Form 413 gives lenders a full picture of your personal financial situation. Essentially, it helps calculate your net worth by subtracting liabilities from assets. Lenders use this, along with your Debt Service Coverage Ratio, to assess your loan eligibility and the terms of the guarantee.

When completing the form, you’ll need to pick an "as of" date - usually the last day of the most recent month for which you have all supporting documents. Make sure this date matches across all your paperwork.

Information Required on SBA Form 413

The form is divided into two main sections: assets and liabilities.

Assets

You’ll need to list the following:

- Cash and bank balances: Include checking and savings accounts.

- Retirement accounts: Such as IRAs and 401(k)s.

- Investments: Stocks, bonds, and other securities.

- Real estate: List properties at their current market value.

- Personal property: Include items like cars and jewelry.

- Life insurance: Only report the cash surrender value of whole life policies (term life insurance doesn’t count).

Additionally, you must include income sources, such as your annual salary, net investment income, real estate income, and any other earnings like pensions. If you file taxes jointly with your spouse, their financial details must also be included, even if they’re not a loan guarantor.

Liabilities

On the liability side, you’ll need to document:

- Accounts payable: Regular credit purchases (not credit cards).

- Notes payable: Loans from banks or other parties.

- Installment accounts: For example, auto loans.

- Mortgages: Outstanding balances on real estate.

- Unpaid taxes: Include state and local taxes.

- Contingent liabilities: Debts you’ve co-signed or legal claims against you.

Keep in mind, unpaid federal taxes can disqualify you from getting an SBA loan until the debt is resolved.

| Asset Categories | Liability Categories |

|---|---|

| Cash and bank balances | Accounts payable |

| Savings & retirement accounts (IRA, 401(k)) | Notes payable to banks and others |

| Stocks, bonds, and securities | Installment accounts (e.g., auto loans) |

| Real estate (market value) | Mortgages on real estate |

| Life insurance (cash surrender value only) | Unpaid taxes (state/local) |

| Automobiles & other personal property | Contingent liabilities (e.g., co-signed debts, legal claims) |

| Receivables (accounts and notes) | - |

How to Complete the Form Accurately

Accuracy is key when filling out SBA Form 413. For example:

- Use Kelley Blue Book to estimate vehicle values.

- For stocks and bonds, include the name of each security, the number of shares, purchase cost, current value, and the date of the quote.

- When listing real estate, provide details like the property type, address, purchase date, original cost, current market value, and mortgage status (e.g., paid in full, current, or in foreclosure).

The form has limited space - only five rows for notes payable and three for real estate. If you need more room, use separate sheets labeled with the corresponding section number. Be sure to sign these sheets and confirm that all figures match your supporting documents.

Lenders will cross-check your Form 413 against your bank statements, tax returns, and investment records. Common errors include reporting the face value instead of the cash surrender value for life insurance, leaving out co-signed debts, and failing to include assets owned by your spouse or minor children if you own 20% or more of the business.

To make the process smoother, gather documents like bank statements, retirement account summaries, pay stubs, and loan statements ahead of time. Double-check all figures to ensure they align with your other financial documents.

Real Estate and Property Documentation

Required Real Estate Documents

When completing SBA Form 413, you'll need to provide supporting documents that verify property value and mortgage details.

Start by gathering recent mortgage statements for each property. These should include the lender's name and address, your account number, the current balance, payment amount, and payment frequency. If a mortgage has been paid off but still appears on your credit report, include proof that it’s "paid in full" to avoid confusion.

For properties worth over $250,000, lenders usually require a formal appraisal. For properties below that threshold, you can use property tax assessments or tools like the FHFA HPI Calculator for a preliminary valuation. However, you should be prepared to provide more detailed records during the due diligence process and review a checklist for SBA loan closing documents.

Additionally, you'll need property deeds or titles to confirm ownership. If you own more than three properties, include supplemental sheets labeled "Section 4 of Form 413", and make sure to sign them.

After establishing ownership and property valuation, disclose any liens or filings related to the property to complete your documentation.

Disclosing Existing Liens or UCC Filings

It's critical to disclose all existing liens or UCC filings associated with your properties. Failing to do so could jeopardize your application. Record any liens in the appropriate sections of Form 413. For standard mortgages, use Section 4 (Real Estate). For properties used as collateral for other loans, list them in Section 2 (Notes Payable to Banks and Others).

Tax liens require special attention. Federal tax liens typically disqualify you from SBA financing until they are resolved. On the other hand, state or local tax liens may be acceptable if disclosed properly. Include details such as the type of tax, the entity owed, the amount, and the property tied to the lien.

"If any of these valuables have been used as collateral in other loans, include information about the lien and lien holder." – sba7a.loans

For each lien, provide the lien holder's name and address, the original balance, the current balance, and the lien's current status. If there are liens from private agreements or pending lawsuits that don’t fit standard categories, explain them thoroughly in Section 7 of Form 413. Make sure all documentation aligns with the "as of" date, which is typically the last day of the previous month.

Financial Account and Investment Documentation

Financial Account Records Checklist

When applying for a loan, lenders will want a clear picture of your liquid assets and investments, so having the right documentation ready is key. Start by gathering current bank statements for all personal checking and savings accounts. These statements should align with the "as of" date listed on Form 413 and reflect the most recent balances.

For retirement accounts, you'll need up-to-date statements showing your current balances. If you hold investment accounts, obtain brokerage statements that detail the security name, number of shares, original cost, current market value, and the quotation date for each investment.

Keep in mind that Form 413 only has space for four securities. If you have more than four, prepare a separate, signed sheet labeled "Section 3 of Form 413" to list the additional holdings. Similarly, if you have more securities or notes payable than the form allows, include clearly marked, signed supplemental sheets. While these documents aren't required with your initial Form 413 submission, lenders often request them during their due diligence process. Having everything ready and well-organized can help move things along smoothly.

Finally, review your life insurance policies to confirm the cash surrender values are accurate.

Life Insurance Cash Values

Only whole life insurance policies are relevant here, as term life policies do not build cash value. The cash surrender value is the amount you'd receive if you canceled the policy today.

In Section 8 of Form 413, include the insurance company's name, the designated beneficiaries, the policy's face amount, and the current cash surrender value. If you've taken out a loan against the policy, make sure to disclose the outstanding balance in the liabilities section to avoid any discrepancies during underwriting.

Request current statements from your insurance provider that clearly show the cash surrender value as of your application's "as of" date. All financial documents should be no older than 90 days at the time of submission - or 30 days if you're applying for the SBA 8(a) program. If you file taxes jointly with your spouse, remember to include any life insurance assets they have, even if they aren't guaranteeing the loan. This ensures that your financial profile is complete and accurate.

Vehicles, Equipment, and Other Physical Assets

Vehicle and Equipment Documentation

When listing vehicles on SBA Form 413, use their current fair market value. The Kelley Blue Book (KBB) is the most widely accepted tool for determining vehicle values, so reference it to get accurate valuations as of the "as of" date. Be sure to include the year, make, and model for every vehicle listed.

If you have an auto loan, you'll need to provide your lender with the most recent loan statement during the due diligence process. This statement should outline the original loan balance, the current balance, monthly payments, and details about how the loan is secured. These records are essential for the lender’s review and complement the overall assessment of your personal assets.

For high-value assets like boats, collectibles, jewelry, antiques, or specialized equipment, list them in Section 5 of Form 413. Be thorough with descriptions - add details like serial numbers or model information when applicable. If there are liens on these items, include the lien holder's name and the outstanding balance.

Depreciation Schedules and Inventory Lists

Beyond vehicles and equipment, you’ll need to keep records for other personal physical assets. While depreciation schedules are generally used for business-owned equipment, they don’t apply to personal property listed on Form 413. For this form, report personal property at its current market value, not its depreciated value. If you’re buying an existing business, make sure to have a Bill of Sale that outlines the terms for equipment transfer. You may also want to consult with a professional through a business broker program to ensure all documentation is handled correctly.

For personal equipment or other physical assets, keep important documents like titles, registrations, appraisals, and inventory lists organized but separate. These aren’t required when you first submit your paperwork, but lenders will request them later to confirm the values you’ve reported. Always round amounts to the nearest dollar for consistency.

Additional Personal Financial Verification Documents

These documents help confirm the accuracy of the asset and liability details listed on Form 413.

Tax Returns and Debt Schedules

You'll need to provide signed personal federal income tax returns for the past three years. This applies to all business principals - typically anyone owning 20% or more of the business. Both the SBA and lenders use these returns to verify the annual salary and net investment income reported on Form 413.

"Include signed personal and business federal income tax returns of your business' principals for previous three years." – Commercial Loan Direct

Make sure the income figures on your tax returns align with what's reported on Form 413. Unsigned tax returns won’t be accepted, so double-check that everything is signed. Also, if you have any unresolved federal tax debt, address it before applying, as it can disqualify you from obtaining an SBA loan.

For your debt schedule, include a detailed breakdown of every liability listed on Form 413. This should cover the noteholder's name, original and current balances, payment amounts, and collateral descriptions. Be thorough - include credit card balances, installment loans, mortgages, and private agreements. Make sure that all documents, including tax returns and debt schedules, reflect the same "as of" date and are current, typically within the last 90 days before your application.

These documents are essential to support your financial statements. Next, you’ll need to address any additional income sources.

Written Explanations for Asset Sources

To complete your financial profile, provide explanations for any additional asset sources beyond the core data on Form 413. If your income includes gifts, inheritances, or significant deposits, note these directly on Form 413. If there’s not enough space, attach a signed sheet labeled with the relevant section number for clarity.

For high-value assets, include detailed descriptions along with any lien information. This ensures a comprehensive view of your financial standing.

Final Checklist and Document Review

Before you submit your SBA loan application, take some time to carefully review all your documents to ensure they’re complete, accurate, and up-to-date. Pay special attention to SBA Form 413 - its "as of" date should align with the closing date of all supporting statements, usually the last day of the most recent full month. Consistency matters because SBA-approved lenders and the SBA will verify every detail during their review.

To make the process smoother, organize your documents into clear categories. For example:

- Liquid assets: Bank statements

- Retirement accounts: IRA or 401(k) details

- Investments: Stocks and bonds

- Real estate: Mortgage statements

- Liabilities: Credit card and auto loan statements

- Income verification: Pay stubs

- Life insurance: Policy statements

If you own more than three properties or have over five notes payable, include separate signed sheets labeled with the relevant section number from Form 413. Make sure every figure in your application is backed by official documents for accuracy.

Also, confirm that your federal income tax returns for the last three years are signed and that the income figures match what’s reported on Form 413. Unsigned tax returns can cause delays. Double-check that all figures are supported by reliable valuations.

Don’t forget to disclose any contingent liabilities, such as legal claims, judgments, or instances where you’re a co-maker on a loan, along with specific amounts. If you have unresolved federal tax debt, address it before applying.

Plan to spend about 30 minutes completing Form 413 and set aside additional time to organize your supporting documents. A well-prepared and neatly organized application reflects financial responsibility, which can make the approval process much smoother.

FAQs

What is SBA Form 413, and why is it important for loan applications?

SBA Form 413 is a Personal Financial Statement that plays a key role in the loan application process. It gives lenders a clear picture of your financial situation by outlining your assets, liabilities, income, and net worth. This information helps lenders evaluate your ability to repay the loan and assess the level of risk involved.

This form is a required step for SBA loans, ensuring that your financial details are transparent. Providing accurate and complete information on this form can make a strong case for your loan application and improve your chances of approval.

How do I properly document my personal property and vehicles on SBA Form 413?

When filling out SBA Form 413, it's essential to provide a clear and thorough breakdown of your personal property and vehicles. This document serves as your personal financial statement, giving lenders a snapshot of your financial health as a guarantor for an SBA loan.

For personal property, include items like:

- Real estate holdings

- Savings accounts

- Investments

- Other valuable assets

When it comes to vehicles, make sure to provide specific details such as:

- The make and model

- Year of manufacture

- Current market value

- Any outstanding loan balances

Accuracy is key here. Lenders rely on this information to determine your eligibility and loan terms. Take the time to double-check every entry to ensure it reflects your financial situation as it stands today.

What personal and financial documents do I need for an SBA loan application?

To apply for an SBA loan, you'll need to prepare and organize several important documents that showcase your financial health and the potential of your business. Here's what you should have ready:

- Business financial statements: This includes balance sheets and income statements covering the last three years.

- Federal tax returns: You'll need both business and personal tax returns from the past three years.

- Bank statements: Collect statements from the last two years.

- Personal financial statement: Fill out SBA Form 413.

- Business debt schedule: Complete SBA Form 2202 to outline any existing debts.

Getting these documents in order ahead of time can simplify the application process and make it easier to move forward with confidence.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)