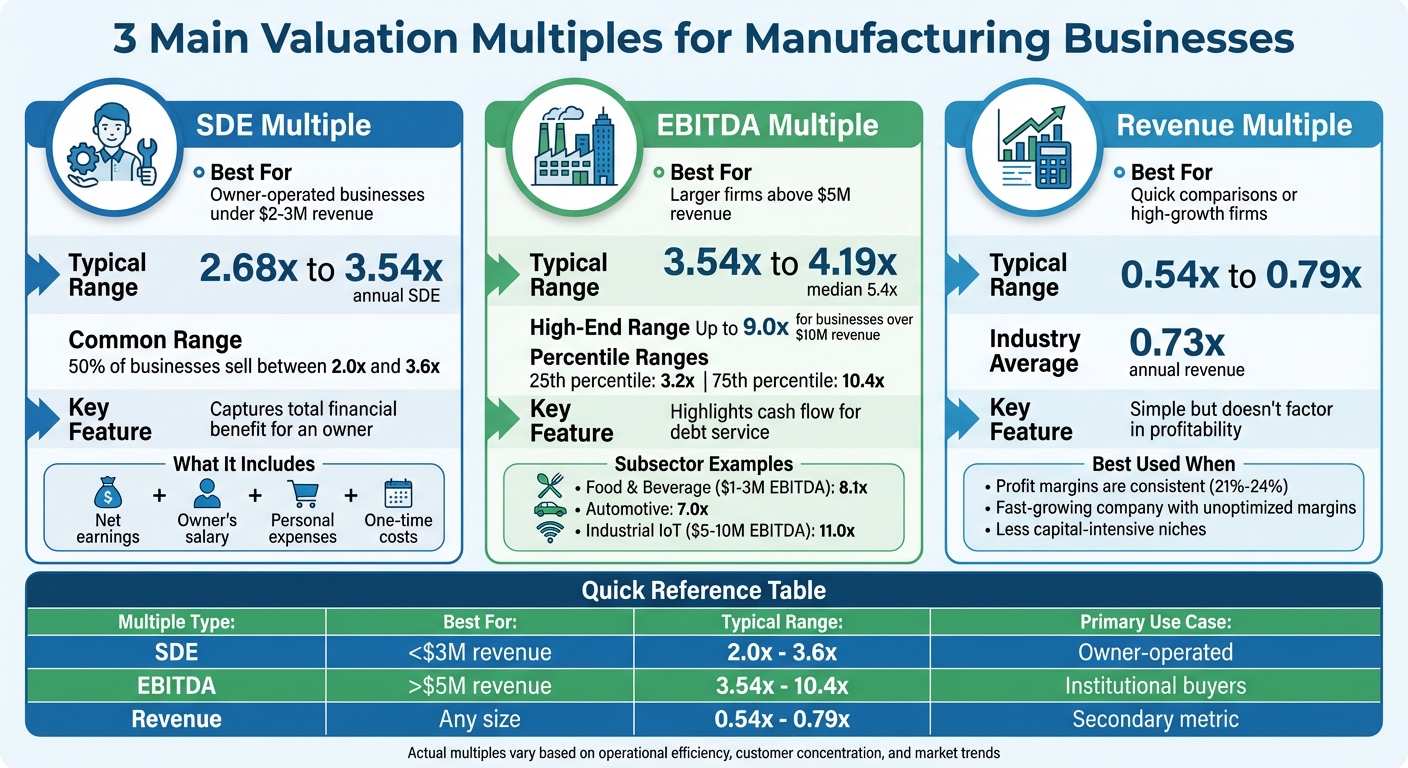

When determining the value of a manufacturing business, valuation multiples are key. These are ratios that compare a business's financial metrics (like earnings or revenue) to its market value. For sellers, they set pricing expectations, while for buyers, they guide financing decisions. Here’s a quick breakdown:

- SDE Multiples: Ideal for smaller, owner-operated businesses (revenue under $2–$3M). Typical range: 2.68x to 3.54x annual SDE.

- EBITDA Multiples: Used for larger businesses (revenue over $5M). Average range: 3.54x to 4.19x, with some reaching as high as 9.0x.

- Revenue Multiples: Applied when profit margins are inconsistent. Industry average: 0.73x annual revenue.

Factors affecting multiples include operational efficiency, customer concentration, market trends, and revenue stability. For example, businesses with diversified customers, strong cash flow, and automated processes often secure higher valuations. Tools like Clearly Acquired streamline this process by analyzing financial data and providing actionable insights for buyers and sellers.

Understanding Valuation Multiples by Industry

Understanding the 3 Main Valuation Multiples

Manufacturing Business Valuation Multiples Comparison Guide

Valuation multiples are essential tools for assessing a business's worth. Choosing the right one depends on factors like the size of the business, the owner's involvement, and what potential buyers prioritize.

SDE Multiples for Smaller Manufacturing Businesses

For smaller, owner-operated manufacturing businesses - those typically generating under $2 million to $3 million in revenue - Seller's Discretionary Earnings (SDE) is the go-to metric. SDE is calculated by adding back the owner's salary, personal expenses, and one-time costs (like legal fees or equipment repairs) to the net earnings.

In this segment, SDE multiples tend to follow well-established industry patterns. Around half of these businesses sell for a multiple between 2.0x and 3.6x their annual SDE.

SDE works particularly well for smaller operations because it reflects the total financial benefit available to a single owner-operator. It accounts for the hands-on nature of these businesses, where the owner often oversees everything from production to customer relationships.

However, as businesses grow and become less dependent on a single owner, valuation metrics typically shift to EBITDA.

EBITDA Multiples for Larger Manufacturing Companies

For manufacturing businesses earning more than $5 million in revenue, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) becomes the preferred valuation metric. EBITDA removes financing costs and certain accounting decisions, offering a clearer picture of the business's cash flow.

"EBITDA is a common measure of a company's cash flow that allows apples-to-apples comparisons between companies with different capital structures." - BMI Mergers & Acquisitions

Larger manufacturing firms - those with over $10 million in revenue - can sometimes achieve multiples as high as 9.0x. On average, the sector's median EBITDA multiple hovers around 5.4x, with a range from the 25th percentile at 3.2x to the 75th percentile at 10.4x.

Subsector variations also matter. For example:

- Food & Beverage manufacturers with $1 million to $3 million in EBITDA average around 8.1x.

- Automotive manufacturers typically see multiples closer to 7.0x.

- High-tech industries like Industrial IoT can reach multiples as high as 11.0x for companies with $5 million to $10 million in EBITDA.

Larger businesses often command higher multiples because they pose less risk. They typically have strong management teams, diversified customer bases, and more predictable cash flows. For buyers using institutional financing, EBITDA is particularly useful as it highlights the cash available for servicing debt and generating returns.

When profitability details are harder to pin down, revenue multiples can provide a simpler, alternative perspective.

Revenue Multiples: When and How to Use Them

Revenue multiples are straightforward and easy to calculate, making them a helpful secondary valuation tool. They are determined by multiplying total annual sales by a market factor, which usually ranges from 0.54x to 0.79x, with an industry average of about 0.73x.

These multiples are especially useful in three scenarios:

- When profit margins are consistent with industry norms (typically 21%–24%).

- When evaluating a fast-growing company that hasn’t yet optimized its margins.

- When valuing businesses in less capital-intensive niches, such as 3D printing or small-scale textile production.

However, revenue multiples don’t account for cost structures, so they are often used alongside SDE or EBITDA to provide a more balanced view.

| Multiple Type | Best For | Key Features |

|---|---|---|

| SDE Multiple | Owner-operated businesses (under ~$2–$3M revenue) | Captures total financial benefit for an owner |

| EBITDA Multiple | Larger firms (above ~$5M revenue) | Highlights cash flow for debt service |

| Revenue Multiple | Quick comparisons or high-growth firms | Simple but doesn’t factor in profitability |

What Affects Valuation Multiples in Manufacturing

Valuation multiples in manufacturing are shaped by several key factors that influence how buyers perceive a business's potential and profitability. While the type of multiple used is important, the underlying drivers - like operational efficiency, market trends, and revenue stability - play an even bigger role in determining value.

Operational Efficiency and Cost Control

Efficient operations are a major selling point for buyers. One standout indicator of this is automation, which signals streamlined processes and reduced reliance on labor. Automated systems often lead to higher margins and lower overhead, making businesses more scalable and attractive. For instance, "lights off" operations - where production runs with minimal human intervention - are particularly appealing because they cut labor costs and boost profitability.

Another critical measure of efficiency is inventory management. Private manufacturers typically aim for an inventory turnover ratio of 5:1 to 10:1. Faster inventory turnover reflects smoother operations and better cash flow, while slow-moving inventory can tie up resources and increase the risk of obsolescence.

Equipment maintenance is equally important. Efficient businesses spend 15% to 40% of their total expenses on maintenance. Buyers value well-maintained equipment because it reduces production downtime and avoids costly surprises. Detailed maintenance records further reassure buyers that machinery is reliable and ready for continued use.

Lastly, data accuracy plays a pivotal role. Buyers are willing to pay more for businesses that can provide clear, accurate operational data. Metrics like unit costs, labor productivity, and throughput rates not only demonstrate efficiency but also reduce perceived risks for potential buyers.

These operational strengths set a solid foundation, but market conditions also have a big impact on valuation.

Market Trends and Growth Opportunities

Market dynamics directly shape valuation multiples by influencing buyer expectations. For example, in 2025, the median EV/EBITDA multiple for industrial sector strategic buyers jumped to 14.7x from 8.0x in 2024. This increase was driven by demand in high-growth areas like electrification, automation, and grid infrastructure.

Tech-enabled manufacturing is particularly attractive. Businesses that integrate advanced technologies like IoT, robotics, and "digital twins" often achieve higher multiples than traditional manufacturers [10,18]. A notable example is Baker Hughes' acquisition of Chart Industries on July 29, 2025, for $13.6 billion. This deal, which valued Chart Industries at an EV/EBITDA multiple of around 14.8x, highlighted the premium placed on businesses expanding into high-demand sectors such as LNG and data-center cooling.

Another trend boosting valuations is reshoring and near-shoring. Geopolitical uncertainties and the push for shorter supply chains have made regional manufacturing hubs in North America and Europe more desirable. Facilities that can serve domestic markets with faster delivery times often command higher valuations.

Recurring revenue streams, like service and aftermarket revenue, are another growth lever. Businesses that generate steady income from maintenance contracts, spare parts, or consumables are typically valued higher than those relying solely on one-time equipment sales.

"Specific industries tend to have higher valuations, particularly those with unique technology or processes." – Tom Kerchner, Managing Director, BMI Mergers

Customer Concentration and Revenue Stability

Revenue distribution is a critical factor in how buyers assess risk. Customer concentration - the degree to which revenue depends on a small group of clients - can significantly impact valuation. A single customer accounting for more than 10% of total revenue raises concerns, while dependency on a single client for over 20% of revenue is considered high risk. Similarly, if the top five customers contribute more than 25% of total revenue, buyers may lower their offers.

High concentration not only increases the risk of revenue loss but also gives major clients leverage to negotiate less favorable terms, which can squeeze profit margins. Lenders also view high customer concentration as a risk, complicating financing and further affecting the sale price.

Long-term contracts can help offset these risks. Multi-year agreements with key customers provide predictable revenue and reduce the likelihood of client turnover [19,21]. Buyers are more confident in businesses with contracts that extend beyond the sale date, as these agreements ensure stability.

Diversification across industries and regions can further enhance revenue stability. A business with a broad customer base is more likely to achieve valuation multiples on the higher end of the 5–8x EBITDA range, while concentrated revenue often results in discounts [14,21].

| Concentration Level | Risk Category | Impact on Valuation Multiple |

|---|---|---|

| Single client < 10% | Healthy | Supports higher/premium multiples |

| Single client 10% - 20% | Caution / Elevated | Potential for slight multiple compression |

| Single client > 20% | High Risk | Likely significant discount or tighter deal terms |

| Top 5 clients > 25% | Red Flag | Increased scrutiny; likely lower EBITDA multiples |

sbb-itb-a3ef7c1

How to Apply Valuation Multiples with Clearly Acquired

Clearly Acquired takes the complexity of valuation multiples and turns it into actionable insights for real-world transactions. With advanced technology at its core, the platform combines AI-driven valuation tools and integrated financing options, making business evaluations and deal-making more precise and efficient.

AI-Powered Business Valuation Tools

Clearly Acquired’s valuation tools dive deep into financial data, applying multiples like EBITDA, SDE, or Revenue based on factors such as company size and capital intensity [1,9]. For smaller, owner-operated manufacturing businesses, the system uses SDE multiples. These adjust net earnings by factoring in owner compensation, benefits, and one-time expenses [1,5]. Meanwhile, larger manufacturing companies are evaluated with EBITDA multiples, which account for variations in capital structure and taxes [2,5].

The platform analyzes over 175 data points, capturing intangible elements like a company’s reputation, proprietary processes, and operational efficiency. It also segments the manufacturing sector into specific sub-industries - like Aerospace, Industrial IoT, Automotive, and Food & Beverage - since valuation multiples can vary significantly depending on operational and market differences within these sectors [9,12].

To refine valuations even further, the platform incorporates operational metrics such as Debt-to-EBITDA ratios, inventory turnover, and return on net assets. Companies that provide clean, well-organized data tend to secure higher multiples. In fact, businesses that handle M&A processes without professional advisory or advanced valuation tools typically earn 31% less than those using expert methods.

Accurate valuations not only determine a company’s worth but also lay the foundation for effective deal sourcing and financing strategies.

Deal Sourcing and Financing Integration

Once a valuation is established, buyers can confidently explore financing and deal opportunities. Clearly Acquired connects users to vetted deals through its marketplace, which includes public and private listings, as well as exclusive off-market opportunities accessed via proprietary search tools. Buyers can also centralize external opportunities using the platform’s Import Hub and deal-forwarding features.

Financing becomes simpler with Clearly Acquired’s tools. The platform calculates the Debt Service Coverage Ratio (DSCR) - a key metric for loan approval, typically requiring a ratio of 1.5x or higher. This allows buyers to quickly determine if a target business generates enough cash flow to cover debt obligations. Additionally, the loan marketplace matches deals with lenders offering SBA 7(a), SBA 504, conventional, and alternative financing options.

For strategic buyers, the focus shifts to synergy-adjusted valuations instead of just market multiples. Recent trends show that strategic buyers are willing to pay median EV/EBITDA multiples as high as 14.7x, driven by the value of potential synergies and the demand for tech integration.

Summary: Applying Valuation Multiples to Manufacturing Businesses

Valuation multiples are a powerful tool for buyers and sellers navigating manufacturing transactions. The process starts with choosing the right financial metric: SDE (Seller’s Discretionary Earnings) for smaller businesses, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for larger operations, or revenue multiples as a secondary reference. The calculation itself is simple - multiply your selected metric by the appropriate market-derived multiple to estimate the business's value.

But numbers alone don't tell the full story. Multiples can vary based on factors like operational efficiency and the stability of the customer base. For instance, a manufacturing business with well-maintained equipment, documented Standard Operating Procedures (SOPs), and no single customer accounting for more than 15% of revenue is likely to fetch a higher valuation. On the other hand, issues like heavy reliance on the owner or postponed capital investments tend to lower multiples. Businesses lacking professional valuation tools often end up selling for much less than they could achieve.

Normalization also plays a key role in refining valuations. This involves adjusting financials to account for one-time expenses, discretionary spending, and mixed personal and business costs. These adjustments can have a major impact, especially for smaller, Main Street businesses. Once normalized, the financial data becomes much easier to analyze and interpret.

Platforms like Clearly Acquired simplify this entire process. They analyze a wide range of data points, break manufacturing into specific sub-sectors, and apply industry-specific benchmarks automatically. The platform also calculates essential metrics like the Debt Service Coverage Ratio (DSCR) and aligns deals with suitable financing options. This ensures that buyers can transition smoothly from valuation to making an offer. The right multiple, when applied correctly, transforms raw data into actionable deal insights.

FAQs

How do operational efficiency and customer concentration affect valuation multiples for manufacturing businesses?

Operational efficiency is a major factor in determining valuation multiples because it has a direct effect on a company’s EBITDA margin - a key metric for potential buyers. Companies that run efficiently and generate more cash flow from each dollar of revenue tend to fetch higher multiples. For instance, manufacturers with strong profit margins often secure valuations at the higher end of their industry range, such as 10–11× EBITDA. On the other hand, less efficient competitors may see their valuations hover closer to 7×.

On the flip side, customer concentration can negatively impact valuation multiples by increasing risk. If a large portion of revenue depends on just a few customers, buyers might view the business as less stable. This perceived risk can lead to a discounted valuation, with multiples dropping by as much as 10–20% compared to similar companies with more diverse customer bases. A well-diversified revenue stream reassures buyers about the reliability of earnings, often resulting in stronger valuations.

When is it better to use revenue multiples instead of SDE or EBITDA multiples to value a business?

When a business hasn't yet reached profitability or its earnings fluctuate significantly, revenue multiples often come into play. This method is particularly common for high-growth companies or industries where revenue serves as a better gauge of value than earnings.

On the other hand, established businesses with consistent earnings typically rely on SDE (Seller’s Discretionary Earnings) or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples. These metrics offer a clearer insight into operational performance and cash flow. Ultimately, the choice between these approaches depends on the business's unique financial situation and characteristics.

How does Clearly Acquired make the valuation process easier for manufacturing and industrial businesses?

Clearly Acquired streamlines the valuation process by offering straightforward tools and insights specifically designed for manufacturing and industrial businesses. It breaks down essential valuation multiples, financial metrics, and industry benchmarks, helping users evaluate fair market value and craft competitive offers with ease.

By focusing on aspects such as operational efficiency, market trends, and growth opportunities, Clearly Acquired equips entrepreneurs, buyers, and investors with the knowledge they need to make informed and confident decisions during acquisitions or sales.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)