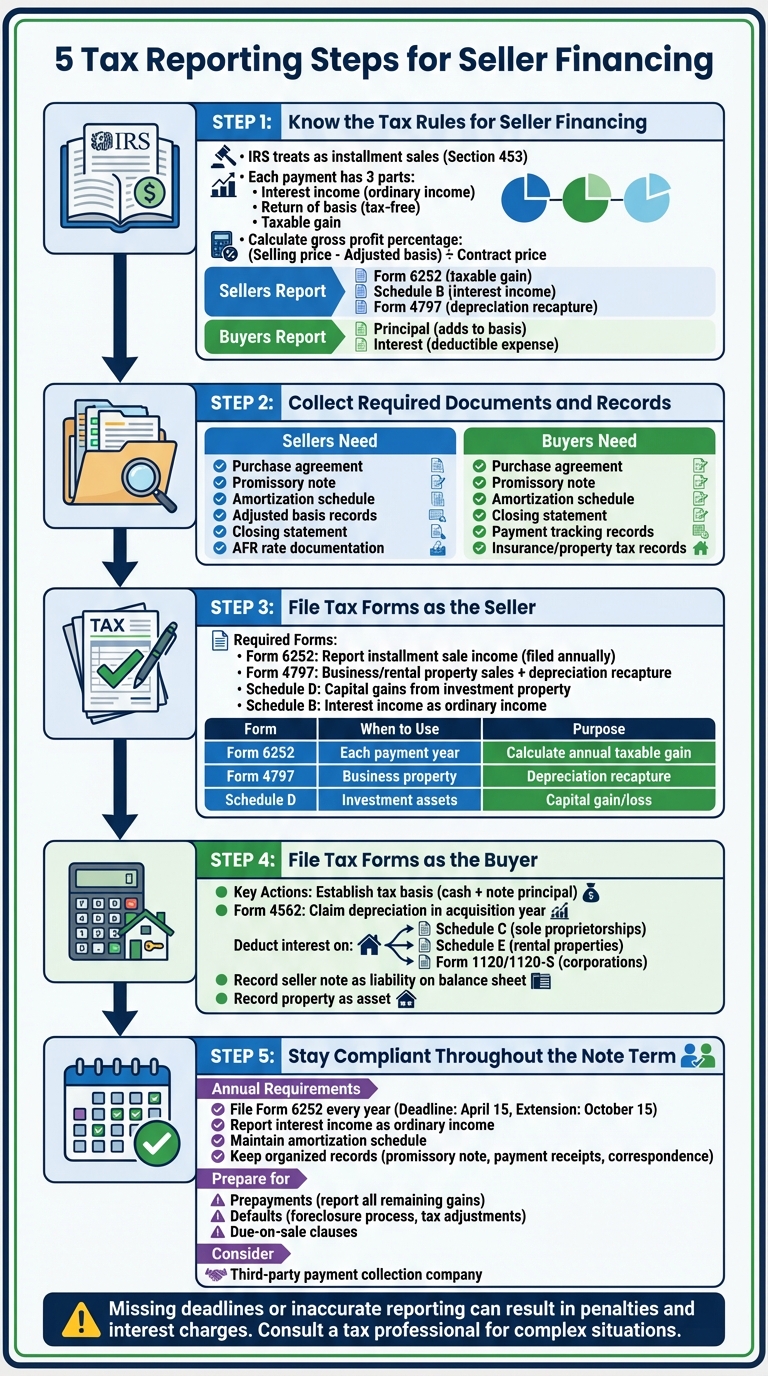

Seller financing, a method where the seller acts as the lender, can ease business sales but comes with tax complexities. The IRS treats these transactions as installment sales, meaning taxes are spread over time as payments are received. Each payment includes interest income (taxable as ordinary income), a return of the seller’s basis (non-taxable), and a taxable gain.

To avoid penalties, sellers and buyers must file the correct forms, track payments accurately, and comply with IRS rules. Key steps include understanding tax rules, organizing documents, filing required forms, and maintaining compliance throughout the loan term. Neglecting these responsibilities can lead to fines or legal issues.

Key Takeaways:

- Sellers report gains using Form 6252 and interest income on Schedule B. Depreciation recapture is reported on Form 4797.

- Buyers track basis, claim depreciation via Form 4562, and deduct interest on relevant schedules (e.g., Schedule C or E).

- Both parties need detailed records like purchase agreements, promissory notes, and amortization schedules.

- Annual filing and compliance are essential to avoid penalties.

Following these steps ensures accurate tax reporting and reduces risks associated with seller financing.

5 Tax Reporting Steps for Seller Financing: Complete Compliance Guide

065. Tax Implications of Seller Financing

Step 1: Know the Tax Rules for Seller Financing

When it comes to seller-financed business sales, the IRS typically treats these transactions as installment sales under Section 453. This approach allows sellers to defer capital gains taxes by spreading them out over time, with each payment divided into three parts: interest income (taxed as ordinary income), a return of the seller's adjusted basis (tax-free), and a taxable gain.

To figure out your tax liability, calculate your gross profit percentage. Start by subtracting your adjusted basis - which includes the original cost, improvements, selling expenses, and subtracts depreciation - from the selling price. Then, divide that result by the contract price. For example, if your gross profit percentage is 40%, you'll owe taxes on 40% of every principal payment you receive.

Keep in mind that depreciation recapture on depreciable assets is treated as ordinary income. This means any depreciation you’ve claimed will be fully recaptured and taxed in the year of the sale.

Now, let’s break down the reporting requirements for sellers.

What Sellers Must Report

Sellers have several key reporting obligations:

- Taxable Gain: Report your taxable gain using the gross profit percentage method.

- Interest Income: Declare all interest income as ordinary income, typically on Schedule B or Form 1040.

- Depreciation Recapture: Report any depreciation recapture as ordinary income on Form 4797 in the year of the sale.

Additionally, your financing agreement must include an interest rate that meets or exceeds the Applicable Federal Rate (AFR). If the stated rate is too low, the IRS could reclassify part of your principal payment as "unstated interest" or "original issue discount (OID)." This would increase your ordinary income and potentially alter your taxable gain.

Now let’s look at what buyers need to report.

What Buyers Must Report

For buyers, the installment sale method requires clear separation of principal and interest in each payment. Here’s how it works:

- Principal Payments: These are not deductible but contribute to your tax basis in the business. Your tax basis typically includes the total purchase price (down payment plus the seller-financed note), any assumed debt, and other liabilities like liens or back taxes.

- Interest Payments: These are generally deductible as a business expense if the property is used for income-generating purposes.

Your tax basis also determines depreciation (or amortization) on business assets, which can lead to additional deductions over the assets' useful life.

If your financing agreement includes little or no stated interest, the IRS might reclassify part of the principal as unstated interest. While this increases your interest deductions, it also reduces the depreciable basis. To avoid complications, both buyers and sellers should ensure the agreement complies with AFR requirements to prevent unintended tax issues.

Step 2: Collect Required Documents and Records

Accurate tax reporting for seller financing hinges on having well-organized documentation. This step ensures you avoid errors, missed deductions, or penalties. Proper records help both sellers and buyers separate principal from interest, establish tax basis, and comply with IRS requirements throughout the loan term.

Documents Sellers Need

Sellers need specific documents to correctly report income from an installment sale. Start with the purchase agreement, which outlines the selling price and date of sale - key details for completing Form 6252. The promissory note is equally important, as it records the loan amount and interest rate. An amortization schedule is also necessary to break down each payment into interest income and capital gain.

You’ll also need adjusted basis records, which reflect the property’s original cost, any improvements made, and depreciation claimed. These figures determine your taxable gain. Don’t forget the closing statement, which lists selling expenses like commissions and legal fees that reduce your taxable gain. If your financing agreement doesn’t include a fixed interest rate, check the IRS’s monthly Applicable Federal Rate (AFR) rulings to ensure compliance with unstated interest rules.

Documents Buyers Need

Buyers also need to maintain thorough records to support deductions and track their cost basis. The purchase agreement is essential, as it sets your initial cost basis for depreciation and for calculating future gains or losses. Keep the promissory note to document payment terms, and use an amortization schedule to separate deductible interest from principal payments.

Hold onto your closing statement, which details legal fees, closing costs, and other transaction expenses that add to your property’s cost basis. Unlike traditional mortgages, where banks issue an annual Form 1098 for interest paid, seller-financed arrangements require you to manually track and document interest payments to claim tax deductions. Additionally, keep copies of insurance and property tax records, especially if the seller manages these payments through an escrow account.

Step 3: File Tax Forms as the Seller

When selling property, you’ll need to file specific federal tax forms to report both the gain from the sale and any interest income received from buyer payments. The forms you use depend on the type of property sold and how the transaction is structured.

Form 6252: Installment Sale Income

Form 6252 is essential for reporting installment sales. You’ll need to file it in the year the sale takes place and every subsequent year that you receive payments. The form calculates the taxable portion of each payment using your gross profit percentage (gross profit divided by the contract price).

The form also tracks your total gain, which is determined by subtracting your adjusted basis from the selling price. The selling price includes cash, the value of any property received, buyer-paid expenses, and assumed debt. Only the taxable portion of the gain is reported each year as payments are received.

If you prefer to report the entire gain in the year of the sale instead of spreading it out over multiple years, you can elect out of the installment method. To do this, you’ll need to report the full gain on Form 4797 or Schedule D by the tax return filing deadline, including any extensions. Additional reporting may be required if the sale involves depreciable or investment property.

Form 4797 or Schedule D: Capital Gains Reporting

The type of property sold determines whether you’ll need Form 4797 or Schedule D. Here’s how they differ:

- Form 4797 is required if you sold business or rental property. It also handles depreciation recapture, which means any portion of the gain considered ordinary income under IRS sections 1245 or 1250 must be reported in full during the year of the sale, regardless of when payments are received.

- Schedule D is used for reporting capital gains from investment property or personal-use assets. The taxable gain calculated on Form 6252 typically flows into Schedule D. You might also need Form 8949 to provide detailed information about the sale of capital assets.

Here’s a quick reference table to clarify when to use each form:

| Form | When to Use | Key Purpose |

|---|---|---|

| Form 6252 | Filed each year a payment is received | Calculates the annual taxable gain using the gross profit percentage |

| Form 4797 | Sale of business or rental property | Reports depreciation recapture in the year of sale |

| Schedule D | Sale of capital or investment assets | Reports net capital gain or loss annually |

Reporting Interest Income

Interest income from installment sales must be reported separately from principal payments. Use Schedule B (Form 1040) to report interest income as ordinary income - it should not be combined with amounts reported on Form 6252.

If the interest rate on the sale is below the IRS’s Applicable Federal Rate (AFR), the IRS may reclassify part of the principal as unstated interest or Original Issue Discount (OID). This rule applies even if the sale results in a loss, meaning you may need to report interest income that wasn’t explicitly charged.

sbb-itb-a3ef7c1

Step 4: File Tax Forms as the Buyer

In a seller-financed property transaction, buyers have specific tax responsibilities to handle. These include establishing the property's basis, claiming depreciation, and deducting interest expenses. You'll need to start reporting in the year you acquire the property and continue doing so for the duration of the loan.

Reporting Asset Basis and Depreciation

Your tax basis includes the cash you paid at closing and the principal amount of the seller-financed note. To claim depreciation on eligible assets, use Form 4562 (Depreciation and Amortization) during the year of acquisition. This basis will determine the depreciation you can claim annually.

It's essential to ensure the interest rate in your contract is at least equal to the monthly published AFR (Applicable Federal Rate). If it’s lower, your initial basis calculation might need adjustments.

Deducting Interest Expenses

If the property generates income, the interest you pay to the seller can be deducted as a business expense. These deductions should be reported as follows:

- Schedule C for sole proprietorships

- Schedule E for rental properties

- Form 1120/1120-S for corporations

Keep thorough records to differentiate between the principal and interest portions of each payment, as seller-financed transactions are private. Dan Rafter, a Personal Finance Writer at Rocket Mortgage, explains:

The seller of the home spells out the terms of the buyer's payments, including how often the buyer makes payments, how much they are, and what interest rate is attached to them.

Finally, ensure your financial records accurately represent the details of the transaction.

Recording the Seller Note on Financial Statements

When preparing financial statements, the seller-financed note should be listed as a liability on the balance sheet. At the same time, the acquired property is recorded as an asset. The down payment will reduce your cash balance, reflecting the initial outflow of funds for the purchase.

Step 5: Stay Compliant Throughout the Note Term

Once you've set up your seller financing agreement, keeping up with compliance is critical to avoid penalties or legal issues. Seller financing comes with ongoing tax obligations for both the buyer and seller until the note is fully paid. Staying on top of these responsibilities means filing the necessary forms each year, keeping detailed records, and being prepared for unexpected changes.

Annual Tax Filing Deadlines

If you're the seller, you'll need to file Form 6252, Installment Sale Income, every year as you receive payments. This form breaks down each payment into three parts: return of basis, capital gain, and interest income.

Interest income, in particular, must be reported separately as ordinary income on your annual tax return. The filing deadline is April 15, though you can request an extension until October 15. Missing these deadlines can result in penalties and interest charges, so it's a good idea to set reminders or work with a tax professional.

Keeping Organized Records

Staying organized is half the battle when it comes to compliance. An amortization schedule is an essential tool - it helps you track how much of each payment goes toward the principal, interest, and remaining balance. Keeping this schedule updated makes tax reporting much easier. Additionally, create a dedicated file to store:

- The promissory note

- Mortgage deed or deed of trust

- Payment receipts

- Any correspondence with the buyer

To simplify things further, you might consider hiring a third-party payment collection company. These companies handle monthly billing, calculate interest, and even manage escrow accounts for property taxes and homeowners insurance. While there’s a small cost involved, their services can save you time and reduce the risk of errors or disputes.

Managing Prepayments, Defaults, and Changes

Compliance doesn’t stop at routine filings; you also need to be ready for unexpected changes. For example, if the buyer decides to prepay the note, you'll have to report all remaining gains in that tax year. This could push you into a higher tax bracket, so it’s important to plan for this possibility.

As Dan Rafter, a Personal Finance Writer at Rocket Mortgage, explains:

Sellers who need quick cash can sell the promissory note from a seller financing arrangement to an investor, though they might have to sell at a discounted price.

Selling the note creates a taxable event, and you'll need to report the difference between the note’s face value and the discounted price.

Defaults are another challenge to prepare for. If the buyer stops making payments, you may face a long and expensive foreclosure process to take back the property. Rafter also notes:

The seller faces financial risks if the borrower defaults. If the buyer defaults, the seller might have to navigate a lengthy and costly foreclosure to reclaim the home.

Once you reclaim the property, you'll need to account for the foreclosure on your taxes. This could involve reversing previously reported gains or recognizing a loss. To protect yourself, it’s wise to consult a real estate attorney when drafting the promissory note. They can include clauses that address prepayments, defaults, and modifications. Also, check for any "due-on-sale" clauses in your existing mortgage. If you're using a wraparound arrangement, these clauses could allow your original lender to demand immediate repayment.

Conclusion

Seller financing can provide tax benefits when you follow the rules and meet deadlines. By understanding the relevant tax regulations, gathering the right documents, filing the necessary forms, and staying on top of compliance throughout the term of the note, you can spread out your capital gains tax liability over time instead of paying it all at once. However, these advantages are only achievable if you maintain thorough records and adhere to every filing deadline. This guide outlines the steps to help you stay on track with tax compliance.

That said, seller financing comes with its share of administrative responsibilities. You'll need to manage billing, payment tracking, and tax reporting on your own. Even minor errors in tax reporting can lead to penalties or put the tax benefits you're aiming for at risk, which makes accuracy and attention to detail essential.

It's wise to seek professional advice to handle legal documentation and navigate more complex scenarios, such as prepayments or defaults. A tax expert can help ensure your filings are correct and guide you through tricky situations. Keep in mind that undocumented agreements may not hold up legally, further emphasizing the importance of proper documentation and accurate record-keeping.

For business acquisitions, tools like Clearly Acquired simplify the process by offering AI-driven financial analysis, secure data management, and integrated financing solutions. This kind of streamlined approach minimizes errors, keeps records organized, and helps both parties meet compliance requirements throughout the term of the note.

FAQs

What are the tax responsibilities for buyers and sellers in a seller-financed transaction?

In a seller-financed transaction, the IRS classifies the sale as an installment sale, which means the seller reports the capital gain gradually as payments come in. To handle this, the seller uses Form 6252 each year to declare the taxable portion of the payments. This form separates interest income (taxed as ordinary income) from the principal amount, which is only taxed when received. For the buyer, interest paid on the loan is typically deductible as ordinary interest, and the purchase price becomes the basis for depreciation or amortization of the acquired asset.

When real estate is part of the deal, the seller is required to issue Form 1099-S to report the gross proceeds from the sale. The buyer, on the other hand, reports the transaction using Form 8949 and Schedule D, which reconcile the sale price with the asset’s basis and any adjustments. Filing deadlines for these forms follow standard tax filing schedules, such as January 31 for issuing Form 1099-S and April 15 for individual tax returns.

Since seller-financed transactions involve intricate forms, detailed interest calculations, and strict deadlines, tools like Clearly Acquired can make compliance easier. These tools help organize documents, automate schedules, and send filing reminders - allowing both the buyer and seller to concentrate on the deal itself rather than the paperwork.

What steps should I take to comply with IRS rules for a seller-financed transaction?

When handling seller-financed transactions, it's essential to meet IRS requirements. Start by reporting the sale using Form 6252 for installment sales or Form 8949/Schedule D if you're dealing with capital assets. If the transaction involves real estate, make sure to issue Form 1099-S to report the proceeds. Additionally, if there are interest payments, you'll need to provide Form 1099-INT.

Accuracy is crucial - double-check that all forms are filled out correctly and submitted by the applicable deadlines. For detailed filing requirements and e-filing instructions, consult the most recent IRS guidelines. Staying on top of deadlines and maintaining proper records will help ensure you're fully compliant.

What tax forms do I need to report seller financing correctly?

To properly handle taxes for seller financing, you'll usually need to use several IRS forms:

- Form 6252: This form is for reporting income from installment sales when you receive seller-financed payments.

- Form 1099-S: Used to document proceeds from real estate transactions.

- Form 8949 (paired with Schedule D): Covers sales of capital assets.

- Form 4797: Specifically for reporting the sale of business property.

These forms are essential to meet IRS rules and accurately report your finances. Make sure to follow the instructions and meet the deadlines for each form to avoid mistakes or potential penalties.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)