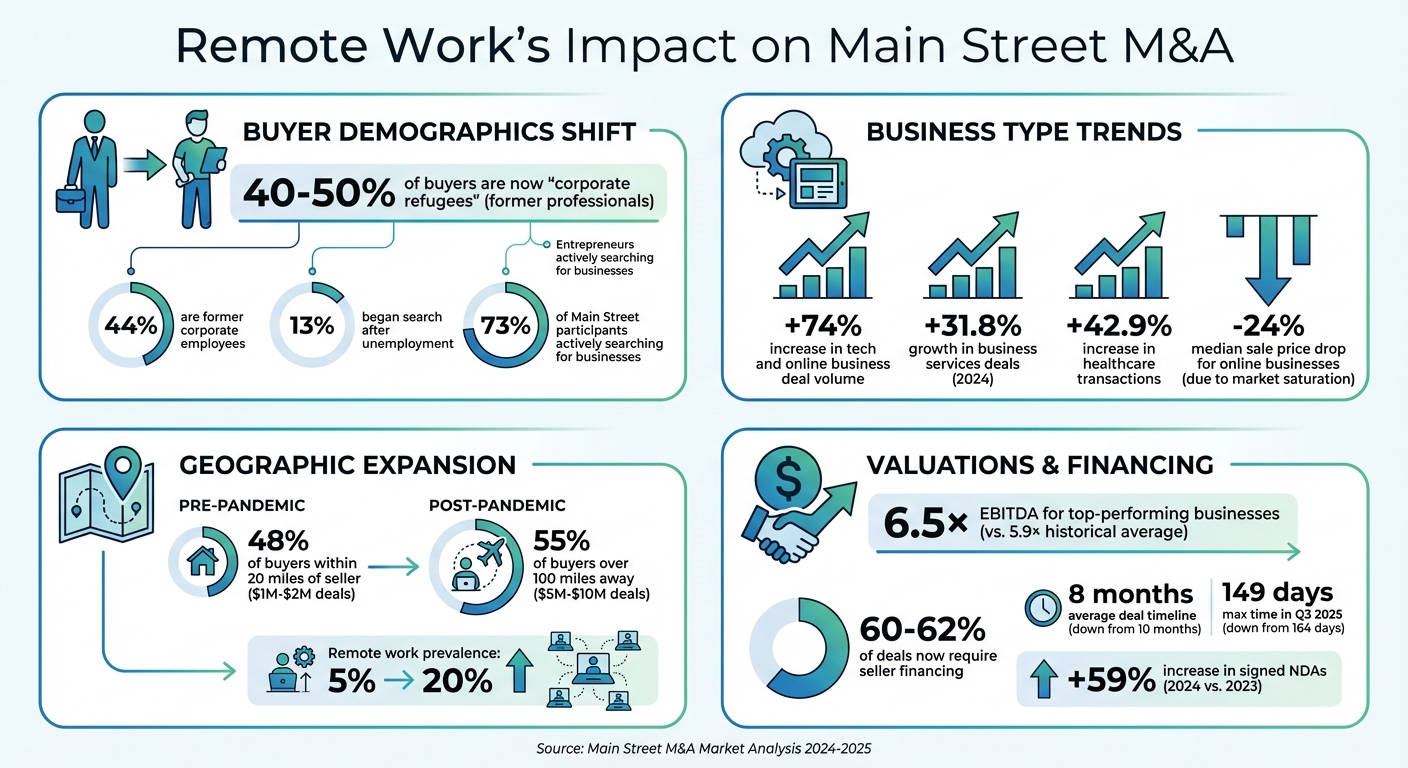

Remote work has reshaped Main Street M&A, driving changes in buyer demographics, business preferences, and deal structures. Here's what you need to know:

- Buyer Shift: "Corporate refugees" (former professionals leaving traditional jobs) now make up 40–50% of buyers, prioritizing remote-friendly businesses.

- Business Trends: Tech and online businesses saw a 74% increase in deal volume, while recurring revenue and low overhead are top priorities.

- Geographic Reach: Remote work enabled buyers to look beyond local areas, with 55% of $5M–$10M deals involving buyers over 100 miles away.

- Valuations & Financing: Seller financing is now critical in 60% of deals, while valuations remain strong, with top businesses fetching 6.5× EBITDA.

Remote work has not only expanded opportunities but also redefined how deals are made, creating a more dynamic M&A market.

Remote Work's Impact on Main Street M&A: Key Statistics and Trends

M&A in a Hybrid Work Environment | ShareVault Webinar

sbb-itb-a3ef7c1

Changes in Buyer Demographics and Behavior

The pandemic has reshaped the landscape of Main Street M&A, bringing significant changes to buyer demographics and behavior. Before COVID-19, this market was largely driven by local owner-operators who prioritized proximity to their acquisitions. Now, former corporate employees make up a substantial 44% of business buyers, with an additional 13% comprising individuals who began their search after becoming unemployed. These shifts highlight a growing trend: more people are seeking financial independence through business ownership, which is transforming how businesses operate and expand geographically.

The numbers tell a clear story. Among deals in the $1 million to $2 million range, half of the buyers are first-time business owners, and 43% are focused on securing a stable income rather than pursuing aggressive growth strategies. Max Friar of Calder Capital emphasizes that former corporate professionals now represent the majority of buyers, many of whom are embracing entrepreneurship for the first time. Additionally, 73% of active participants in the Main Street market are actively searching for businesses to buy. Many of these buyers use a business acquisition checklist to navigate the complexities of the process.

Remote work has further broken down traditional geographic limitations. Pre-pandemic, 48% of buyers in the $1 million to $2 million deal range lived within 20 miles of the seller. Today, for deals in the $5 million to $10 million range, 55% of buyers are located over 100 miles from the seller. This shift reflects a growing ability to manage operations remotely, allowing buyers to relocate to more cost-effective areas without sacrificing efficiency.

Beyond demographic and geographic changes, buyer engagement and deal timelines have also evolved. In 2024, 59% of intermediaries reported an increase in signed Non-Disclosure Agreements compared to 2023, signaling a surge in buyer interest. Deal timelines have shortened as well, dropping from an average of 10 months to just 8 months. Even the post–Letter of Intent due diligence phase has been streamlined, now averaging three months instead of four.

| Feature | Pre-Pandemic (Local) Buyers | Post-Pandemic (Remote-Capable) Buyers |

|---|---|---|

| Primary Profile | Local owner-operators | Former corporate employees (44%) and newly unemployed (13%) |

| Geographic Focus | 48% within 20 miles (in $1M–$2M deals) | Broader geographic reach enabled by remote work |

| Primary Motivation | Financial independence; secure income (43%) | Scalability, flexibility, and relocation opportunities |

| Deal Timeline | 10 months average | 8 months average |

| Digital Engagement | Lower NDA volume; slower process | 59% increase in signed NDAs |

Changes in Business Types and Operating Models

As buyer preferences shift, the kinds of businesses drawing acquisition interest are evolving too. The pandemic reshaped the Main Street M&A landscape, altering which businesses are changing hands. Before 2020, most deals revolved around brick-and-mortar establishments like restaurants, retail stores, and local service providers. Now, business services - spanning IT, marketing, and consulting - have surged, with deal activity growing by approximately 31.8% in 2024. Technology and online businesses have seen an even more dramatic rise, with deal volume on BizBuySell jumping 74%, though their median sale prices dipped by about 24%. Buyers are increasingly drawn to operations with recurring revenue streams and minimal physical overhead.

That said, location-dependent businesses haven’t vanished. Transactions in healthcare, for instance, which require a physical presence, climbed by 42.9%. Meanwhile, traditional businesses like car washes and laundromats are adapting by adopting subscription models and reducing labor reliance. Additionally, some Main Street locations are transforming into "zoom towns", where rural areas are attracting remote workers looking for digitally enabled lifestyles. These changes reflect a broader trend toward flexible, remote-friendly business models.

The way deals are financed mirrors this divide. Remote-friendly businesses often attract private equity or all-cash buyers, sidestepping traditional lending routes. In contrast, location-dependent businesses still lean heavily on SBA 7(a) loans for business purchases, which typically cover 60–70% of the deal structure. This has created a two-tier market: digital businesses with global appeal and local operations reliant on federal loans and regional buyers.

| Feature | Remote-Friendly / Digital Businesses | Location-Dependent / Brick-and-Mortar |

|---|---|---|

| Pros | Scalable, low overhead, recurring revenue, and access to a larger buyer pool | Resilient to economic downturns (e.g., healthcare), tangible assets, steady local demand, and reliable cash flow |

| Cons | Unpredictable valuations, intense competition, and potential management challenges | High labor costs, increasing rent/overhead, and sensitivity to local economic conditions |

| Typical Sectors | E-commerce (e.g., Amazon FBA), SaaS, IT services, and digital marketing | Car washes, laundromats, healthcare facilities, HVAC, and restaurants |

| Primary Financing | Private equity, all-cash deals, and conventional loans | SBA 7(a) and 504 loans (covering 60–70% of the deal structure) |

| Buyer Pool | National and global investors, including PE firms | Local and regional individual buyers |

Valuation trends further highlight this divide. Main Street businesses typically sell for 2–3× Seller's Discretionary Earnings if their revenue is under $2 million. Meanwhile, Lower Middle Market deals, such as those in manufacturing or larger service sectors, command higher multiples, around 5–6× EBITDA. Although online business transactions have increased, their valuations have softened due to a crowded market, creating opportunities for buyers who can act swiftly and structure deals creatively.

Geographic Reach, Valuations, and Financing Changes

The rise of remote work has expanded the boundaries of where buyers search for businesses, reshaping how acquisitions are evaluated. Before the pandemic, most Main Street business buyers focused on opportunities close to home, targeting businesses within their local or regional area. Today, geography has become a critical factor in assessing the health of Main Street businesses. In fact, the Federal Reserve now includes geographic splits in its "Main Street Metrics" to track trends like revenue growth and credit outcomes. This broader geographic scope is influencing how businesses are valued.

Before COVID-19, low interest rates fueled high valuations, often leading to aggressive pricing. However, by 2025–2026, a more balanced market emerged, with pricing reflecting realistic seller expectations. Robert Brauns, CEO and Founder of DealStream, explains:

"The data shows a market that's adapting rather than retreating. Buyers are staying active, sellers are realistic about pricing, and both sides are preparing for what could be a more favorable lending environment in 2026."

This shift is evident in the numbers: high-performing companies are fetching an average valuation of 6.5× EBITDA in early 2025, compared to the historical average of 5.9×.

Lenders, too, have adapted their approach, focusing on verified trailing twelve-month (TTM) performance and operational simplicity. For deals in the $5 million to $10 million range, due diligence now takes an average of 5.5 months. Garrett Monroe, Sell-Side Director at Calder Capital, highlights the importance of these factors:

"Verified TTM performance and operational simplicity are the clearest paths to deal success."

Quality of earnings reports has become a key driver for deal approvals, reflecting a broader shift in financing structures.

With lending standards tightening, seller financing has become an essential tool to close gaps in deals. A striking 62% of brokers now consider seller financing critical for closing transactions. It’s also a major component of successful offers, with 60% of winning Letters of Intent for deals in the $10 million to $25 million range including seller financing. Max Friar, Managing Partner at Calder Capital, aptly notes:

"Seller financing is uncertainty's friend, and we live in uncertain times."

Similarly, Ken Bohenek of Murphy Business Sales adds:

"If the business has a good return on the investment and ability to service debt, it's likely a good time to buy, regardless of rates."

Here’s a snapshot of how key trends have evolved over time:

| Trend/Metric | Pre-Pandemic | Pandemic Period (2022–2023) | Post-Pandemic (2025–2026) |

|---|---|---|---|

| Remote Work Prevalence | 5% pre-pandemic | Rapid shift to work-from-home (WFH) | 20% WFH prevalence post-pandemic |

| Buyer Geography | Primarily local/regional | Shift to remote counties | 55% of buyers >100 miles from target ($5M+ deals) |

| Valuation Environment | Aggressive valuations due to low rates | Market cooled by rising interest rates | Moderating valuations; high performers at 6.5× EBITDA vs. 5.9× historical |

| Deal Volume | Baseline stability | Volatile; Q1 2023 saw 10% drop | Flat volume, but 80% expect an increase by 2026 |

| Aggregate Value (Small Businesses) | Standard cycles | $6.3B–$6.5B | Total U.S. M&A reached $598B in Q3 2025 |

| Financing Structure | Traditional senior debt dominant | Stimulus and low rates | Seller financing critical (60–62%) |

| Lender Focus | Standard cash flow/asset-based lending | High uncertainty; paused deals | Tightened standards; focus on QofE and TTM; 5.5-month due diligence |

This evolving landscape underscores the need for adaptability in both valuation and financing strategies as the market continues to stabilize.

Pros and Cons

The shifts brought about by remote work have reshaped the landscape of Main Street M&A, introducing both opportunities and challenges. These changes have altered buyer demographics, operational timelines, and financing structures, creating a new playing field for buyers and sellers. Understanding these dynamics is key to navigating the current market effectively.

Buyer Diversity has seen a dramatic shift. Before the pandemic, there was a noticeable "entrepreneurial generational gap", with younger individuals favoring corporate or government roles over business ownership. Now, a growing number of MBA graduates are choosing to become "CEOs on Main Street" by acquiring businesses. Over the last five years, search funds have grown by an impressive 428%. Heather Endresen, Senior Loan Officer at Live Oak Bank, highlights this trend:

"Many of these young MBA graduates are opting to be CEOs on Main Street instead of Wall Street by acquiring their own businesses."

Additionally, professionals from private equity and investment banking - often referred to as expats - are entering the market, increasing competition for high-quality deals. These demographic changes contribute to the evolving challenges and opportunities in the market.

Business Resilience paints a mixed picture. On the one hand, optimism prevails, with 90% of private equity respondents and 80% of corporate respondents anticipating an increase in deal volume by 2026. On the other hand, retirement-driven exits have risen from 48% to 56%, adding pressure on both buyers and sellers.

Financing has also undergone significant changes. Acquisition financing strategies have shifted considerably, with seller financing becoming a critical component of deal-making. Today, 62% of brokers consider seller financing "very important", as rising interest rates make it a necessity for closing deals. Max Friar, Managing Partner at Calder Capital, emphasizes:

"Seller financing is uncertainty's friend, and we live in uncertain times."

Lenders now require verified trailing twelve-month (TTM) performance and operational simplicity, extending due diligence periods to an average of 5.5 months for deals over $5 million. Meanwhile, the Main Street Lending Program (MSLP) from the pandemic era poses its own challenges, with 70% of the loan principal due as a balloon payment by late 2025.

The table below highlights how these factors compare between the pre-pandemic and post-pandemic eras:

| Factor | Pre-Pandemic | Post-Pandemic |

|---|---|---|

| Buyer Diversity | Local buyers with a generational gap | 428% rise in search funds among younger MBA buyers; more PE/IB expats |

| Business Resilience | Deal processes averaging 10 months; 48% exits due to retirement | Higher retirement-driven exits (56%); strong buyer optimism |

| Financing Options | Lower interest rates (below 4%); seller financing rare | Seller financing in ~60% of winning LOIs; higher rates (7.5%–8%), longer due diligence, and looming MSLP balloon payments |

Conclusion

Remote work has reshaped the landscape of Main Street M&A, altering who the buyers are and how deals are executed. A growing number of buyers, dubbed "corporate refugees", now come from white-collar and high-tech backgrounds - accounting for 40% of current buyers. Many of these individuals are seeking new opportunities after layoffs or as an alternative to traditional career paths. This shift is speeding up deal cycles, with the median market time dropping to 149 days in Q3 2025, compared to 164 days the year before.

Digital tools have made it easier than ever for buyers and sellers to connect, regardless of physical location. In fact, 90% of private equity respondents and 80% of corporate dealmakers anticipate deal volumes to grow in 2026. On the seller side, there’s a noticeable trend toward more realistic valuations, driven by high interest rates and inflation. Sellers are also positioning themselves for a potentially better lending environment. Meanwhile, buyers face stiff competition for quality businesses, and sellers need solid financial records - at least three years of consistent data - to justify their asking prices.

Platforms like Clearly Acquired are stepping in to streamline this evolving market. Their technology-driven solutions help buyers and sellers navigate the complexities of modern deal-making. Buyers can leverage AI-powered tools for deal sourcing, using smart matching algorithms that consider industry, location, and deal size. Sellers benefit from features like AI-driven business valuations and secure data rooms, which simplify remote due diligence. Additionally, the platform’s debt sizing and lender matching tools connect buyers with SBA and conventional lenders, ensuring deals are finance-ready with thorough underwriting.

As remote work continues to shape Main Street M&A, staying ahead requires the right technology to bridge geographic gaps, meet the demands of a changing buyer pool, and structure deals that can thrive in today’s high-interest-rate environment. Adapting to these changes is no longer optional - it's the key to success in this new era.

FAQs

How has remote work impacted the types of buyers in Main Street M&A?

Remote work has reshaped the buyer landscape in Main Street M&A, bringing in a new wave of investors. Since the pandemic, many first-time buyers - often tech-savvy former white-collar professionals - have stepped into the market. These individuals, familiar with remote work setups, are particularly interested in businesses that are scalable, location-independent, and incorporate AI, automation, and remote-work tools.

This change has broadened the pool of potential buyers. It's no longer just local operators; now, remote-friendly entrepreneurs and investors are seeking ownership opportunities that offer flexibility. The ability to run businesses from virtually anywhere has made Main Street acquisitions more attractive to a diverse range of buyers.

What types of businesses are attracting buyers in the Main Street M&A market?

Buyers in the Main Street M&A market are showing a growing interest in consumer-focused and technology-driven businesses. There's been a noticeable increase in retail-related deals, while transactions in traditional manufacturing sectors are tapering off. Businesses in franchises, health and wellness, digital commerce, and SaaS-based models are drawing attention for their scalability and ability to function remotely.

The shift toward remote work has played a big role in shaping buyer preferences. Many are leaning toward location-independent businesses like e-commerce platforms, business process outsourcing, and subscription-based services. These types of businesses typically come with lower overhead costs, steady recurring revenue, and a strong ability to weather supply chain challenges. Additionally, buyers are using AI tools to simplify financial analysis and due diligence, making these flexible and digitally-focused models even more appealing.

Why is seller financing becoming more important in Main Street M&A transactions?

Seller financing is becoming increasingly important in Main Street mergers and acquisitions (M&A). With tighter credit conditions and less cash available at closing, funding gaps are more common. By offering seller financing, business owners can help close these gaps, allowing deals to proceed and improving the chances of a successful transaction.

This method offers advantages for both sides. Buyers benefit from more flexible financing options, while sellers often achieve a higher total deal value and show confidence in the business's future potential. In today’s market, seller financing has emerged as a key strategy for keeping deals on track.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)