Seller financing offers flexibility for buyers and potential financial benefits for sellers, but it comes with risks. To protect your interests, focus on these key safeguards:

- Promissory Notes: Clearly define repayment terms, interest rates, and default conditions. Secure these notes with collateral to strengthen enforceability.

- UCC-1 Filings & Security Agreements: Publicly record liens on assets to protect your claim in case of buyer default.

- Default & Foreclosure Clauses: Specify default triggers and remedies, such as accelerating debt or repossessing assets.

- Dodd-Frank Compliance: Understand exemptions and ensure adherence to federal and state regulations, especially for residential properties.

- Disclosures: Provide transparent loan terms to avoid disputes and regulatory penalties.

- Credit Insurance: Mitigate financial loss by requiring policies that cover buyer defaults.

- Maintenance Clauses: Ensure the buyer maintains property or business assets to preserve collateral value.

How Is a Seller Protected In a Seller Finance Transaction

1. Promissory Notes

A well-crafted promissory note serves as the backbone of legal protection in seller financing arrangements.

Enforceability of Agreements

At its core, a promissory note is a binding legal document that lays out the repayment terms in detail. It specifies the principal amount, interest rate (fixed or variable), payment schedule, fees, prepayment options, and other key provisions. These clear terms ensure that the agreement can be legally enforced if the buyer stops making payments.

Every note should include:

- The principal amount in U.S. dollars.

- A clear method for calculating interest.

- A repayment structure, whether amortizing or interest-only, with defined due dates.

- A maturity date or balloon payment.

- Late fees and an acceleration clause.

- Explicit definitions of default, such as missed payments, bankruptcy, or covenant violations.

- Prepayment terms and dispute resolution details, including governing law and venue.

Protection of Collateral

Promissory notes are often secured by collateral to strengthen the seller’s position. In real estate, this involves pairing the note with a mortgage or deed of trust, granting foreclosure rights if the buyer defaults. For business acquisitions, the note is usually tied to a security agreement and UCC‑1 filing, covering assets like equipment, inventory, or accounts receivable.

To ensure consistency, the note must reference these collateral documents explicitly. Whether it's a mortgage for real estate or a UCC‑1 filing for business assets, this cross-referencing enhances recovery options and reinforces the seller's rights.

Mitigation of Default Risks

A detailed promissory note goes beyond just missed payments when defining default events. It might include lapses in insurance, unauthorized asset sales, or other material breaches. Remedies for these defaults can include accelerating the balance, imposing late fees, or recovering attorney fees. Without these provisions, the seller’s ability to enforce the agreement can be significantly weakened.

When combined with collateral protections, these measures help reduce the risk of default and protect the seller’s interests.

Regulatory and Legal Compliance

Promissory notes must adhere to state usury laws and applicable federal regulations. For owner-occupied residential properties, Dodd-Frank rules - such as loan originator and ability-to-repay requirements - may apply unless specific exemptions are met. Business and commercial transactions, on the other hand, are governed by state contract laws and usury limits. Failure to comply with these regulations can result in serious consequences, like rescission of the note or the refunding of interest and fees, ultimately diminishing its enforceability and value.

2. UCC-1 Filings and Security Agreements

Protection of Collateral

Combining a security agreement with a UCC-1 filing establishes a public lien on a buyer's assets. The security agreement itself is the contract between you and the buyer, granting you rights to specific collateral. This collateral might include equipment, inventory, accounts receivable, or even intellectual property. Meanwhile, the UCC-1 filing serves as public notice of your lien, informing other parties of your claim.

Why is this public notice so critical? Let’s say you sell a manufacturing company for $500,000, with $300,000 seller-financed. To secure the deal, you use shop equipment valued at hundreds of thousands of dollars as collateral. Filing a UCC-1 ensures that, if the buyer defaults, you can repossess those assets. Without it, you risk being treated as an unsecured creditor, which could leave you with little to no recourse.

Enforceability of Agreements

For a security agreement to hold up in court, it must be specific and thorough. Clearly describe the collateral - such as "all machinery and equipment located at the manufacturing plant's address." The agreement should also include the buyer's signature, a detailed definition of what constitutes a default, and a clear outline of remedies available in case of nonpayment.

Timing is also crucial. Filing the UCC-1 within 20 days of executing the security agreement ensures your lien takes precedence over any junior claims. Courts generally uphold these perfected liens in default cases, transforming your promissory note from an unsecured promise into a secured obligation. This gives you the legal right to enforce repayment through repossession or judicial foreclosure. To maintain this priority, follow UCC Article 9 and any applicable state regulations.

Regulatory and Legal Compliance

UCC Article 9 governs the process of perfecting and maintaining your security interest. UCC-1 filings are managed by each state’s Secretary of State, with filing fees typically ranging from $10 to $75. Some states, such as California, have additional rules, including a cap on late fees at 6% and licensing requirements if you finance eight or more properties annually.

If your collateral includes fixtures attached to real property, additional steps may be required. In such cases, filing with the county recorder’s office ensures your lien maintains priority across the country.

3. Default and Foreclosure Clauses

Enforceability of Agreements

A default clause spells out the events that constitute a default and the remedies available to the lender. This can include actions like accelerating the debt, imposing late fees, or initiating foreclosure or repossession of collateral. To ensure these provisions hold up in court or during non-judicial foreclosure, the language must be precise and unambiguous.

Your promissory note should outline several default triggers. These might include unauthorized business transfers, material misrepresentations by the buyer, bankruptcy or insolvency, or breaches of key financial covenants. Including a detailed list of these events minimizes confusion and strengthens your position if you need to enforce remedies. Additionally, by clearly defining your foreclosure rights, you can better protect your collateral.

Protection of Collateral

Your foreclosure rights should be clearly outlined in both the promissory note and the security agreement. In cases of seller financing for business assets, these rights often allow the lender to seize and sell collateral such as inventory, equipment, or intellectual property. The security agreement should also grant you the right to inspect the collateral, request financial statements, and, in states where it’s permitted, pursue self-help repossession. These measures enable swift action to safeguard your collateral before its value diminishes.

A no-assumption clause is another critical component. This clause prevents the buyer from transferring their financial obligations to another party if they sell the business. Without this protection, you could end up dealing with a successor who lacks the creditworthiness or experience to meet the payment terms. By clearly defining your foreclosure rights and including safeguards like the no-assumption clause, you create a solid framework for handling defaults.

Mitigation of Default Risks

Notice and cure provisions help strike a balance between protecting the seller and being fair to the buyer. For instance, you might allow a 10–15-day period for curing payment defaults and a 30-day window for addressing non-monetary breaches. Modest late fees and default interest charges can also be included, along with provisions for accelerating the debt if necessary. These elements ensure you can act quickly while giving the buyer a reasonable chance to resolve issues.

When setting late fees and default interest, it’s important to be clear, reasonable, and compliant with state laws on usury. For example, California limits late fees on owner-occupied residential seller-financed loans to the greater of 6% of the installment due or $5. A good approach might include a small late fee after a brief grace period, an increased interest rate upon default that stays within legal limits, and an acceleration clause that allows you to demand immediate payment of the remaining balance.

Regulatory and Legal Compliance

To protect your legal rights, it’s essential to align your default and foreclosure clauses with federal and state regulations. For owner-occupied residential transactions, this means adhering to federal laws like Dodd-Frank, TILA, and CFPB guidelines. For commercial transactions, compliance typically involves state UCC Article 9 provisions. Residential deals may also require adherence to mortgage-servicing standards and loss-mitigation rules.

In commercial or business-asset seller financing, you generally have more flexibility. These transactions are governed by state UCC Article 9, which applies to personal property collateral and doesn’t include consumer-specific protections. This allows for stricter default terms and faster enforcement, giving you more control over the process in business-sale agreements.

4. Dodd-Frank Act Compliance and Exceptions

Regulatory and Legal Compliance

The Dodd-Frank Act and related CFPB rules mainly apply to seller-financed transactions involving 1–4 unit residential properties where the buyer intends to live on the property. These rules generally do not affect typical seller-financed business asset deals that aren't tied to a consumer's primary residence. For business acquisitions, structuring the deal as a commercial or business-purpose loan helps avoid the Dodd-Frank residential provisions.

Under the Dodd-Frank Loan Originator Rule, anyone negotiating a residential mortgage is usually considered a loan originator and must be licensed unless they qualify for specific seller-financing exceptions. Two key exceptions include:

- One-property exception: This allows individuals, estates, or trusts to finance one property per 12-month period without being classified as a loan originator, as long as the loan avoids negative amortization.

- Three-property exception: This permits financing up to three properties annually, but the loans must have fully amortizing terms, no balloon payments, a fixed interest rate for at least five years, and a documented ability-to-repay (ATR) analysis.

These nuances highlight the importance of proactive risk management to ensure compliance with the law.

Mitigation of Default Risks

To navigate these regulations effectively, maintaining thorough documentation is essential. For those qualifying under these exceptions, it’s critical to track financed properties, document the seller's ownership status, and retain full amortization schedules. Legal professionals often incorporate these terms into promissory notes to strengthen enforceability. Even if the loan is technically exempt from ATR requirements, conducting a basic ability-to-repay review - using tax returns, bank statements, or credit checks - can help reduce default risks and demonstrate responsible underwriting practices.

Enforceability of Agreements

Failing to comply with Dodd-Frank can lead to serious consequences, including rescission or reformation of the loan, refunding borrower costs and interest, or even the return of the property itself. These outcomes can jeopardize your collateral position. For example, if a court rescinds or reforms a non-compliant loan, you could lose lien priority or face less favorable terms during foreclosure. Additionally, in a default situation, the buyer might challenge the loan's legality under Dodd-Frank, increasing litigation costs and uncertainty.

To avoid these risks, business sellers often structure buyers as LLCs or corporations and require a business-purpose affidavit confirming the loan is for business or investment purposes, not personal use. This approach keeps the transaction outside Dodd-Frank’s residential mortgage regulations while safeguarding enforceability and collateral. If the deal does fall under Dodd-Frank, working with a licensed mortgage loan originator or broker can ensure full compliance with the law.

sbb-itb-a3ef7c1

5. Disclosures and Regulatory Compliance

Regulatory and Legal Compliance

Federal disclosure laws play a crucial role in consumer seller-financed transactions, especially when financing is secured by a dwelling and certain volume thresholds are met. Key laws like the Truth in Lending Act (TILA), Regulation Z, RESPA, the Equal Credit Opportunity Act (ECOA), and the Fair Housing Act outline clear disclosure and fair-lending requirements for residential deals. Even sellers who may be exempt from Dodd-Frank must adhere to relevant state disclosure and lending regulations.

When it comes to seller financing for business assets, consumer credit laws generally don’t apply. However, state contract laws and commercial lending statutes still demand precise documentation of critical terms such as interest rates, payment schedules, default remedies, and collateral. The Consumer Financial Protection Bureau (CFPB) has clarified that installment land contracts and contracts-for-deed are subject to federal home-lending rules. This means sellers using these structures must comply with TILA, RESPA, and other consumer protection laws. These disclosures not only meet legal obligations but also help create agreements that are enforceable in court.

Enforceability of Agreements

Regulatory requirements emphasize the importance of clear, written agreements. For an agreement to be enforceable, courts typically require it to detail essential terms such as the interest rate, repayment schedule, default triggers, collateral, and remedies. Signed and standardized disclosures further protect against claims of fraud or misrepresentation. When the promissory note, security agreement, and purchase agreement align and are backed by proper disclosures, sellers are in a stronger position to enforce their rights - whether that’s collecting payments, accelerating debt, or initiating foreclosure. Clear documentation also helps reduce disputes stemming from misunderstandings or hidden costs.

Mitigation of Default Risks

Precise disclosures are critical to protecting seller-financed transactions, especially when dealing with collateral and default clauses. A comprehensive disclosure package should include key loan terms - such as principal, interest rate, APR, amortization schedule, balloon payments, maturity date, and payment frequency. It should also clearly outline fees, including late fees, default interest, prepayment penalties, and escrow or servicing charges, all within applicable state limits. Additionally, collateral and remedies should be explained in straightforward language to avoid confusion. This level of transparency reduces the likelihood that a buyer can later claim they were misled.

Failing to comply with disclosure and lending regulations can lead to severe consequences, such as contract rescission, reformation, refunds of borrower costs and interest, property return, restitution, disgorgement, or private damages. Regulatory agencies are increasingly scrutinizing nontraditional seller-financing structures like contracts-for-deed, particularly when disclosures are inadequate or default remedies are overly harsh. To mitigate these risks, it’s wise to work with experienced M&A or real estate attorneys familiar with federal and state disclosure laws. For residential transactions, consider involving licensed mortgage brokers to ensure compliance with Dodd-Frank, TILA, and RESPA requirements.

6. Credit Insurance Requirements

Protection of Collateral

Credit insurance acts as a safety net to protect your collateral. If a buyer defaults, the insurance policy steps in to cover the loss, ensuring your investment is secure. By including a credit insurance requirement in your financing agreement, you create an added layer of security for your collateral. This approach helps reduce the financial risk associated with buyer defaults.

Mitigation of Default Risks

Requiring credit insurance is an effective way to reduce the risk of nonpayment. If the buyer fails to meet their repayment obligations, the insurance policy provides financial coverage, minimizing potential losses. To ensure this protection is enforceable, include detailed credit insurance requirements in the promissory note and security agreement. These should outline the necessary coverage amount, policy terms, and proof of an active policy at the time of closing. Additionally, make sure the seller is named as the loss payee or beneficiary on the policy. These steps integrate credit insurance into your broader risk management strategy.

Regulatory and Legal Compliance

Credit insurance is subject to state-level regulations and, in cases involving consumer-purpose real estate loans, may also intersect with federal laws like the Truth in Lending Act (TILA), the Dodd-Frank Act, and Consumer Financial Protection Bureau (CFPB) rules. Sellers should avoid engaging in insurance production and be mindful of state limitations on mandating credit insurance for consumer mortgage transactions. Any financed premiums must be disclosed as part of the APR and finance charge under TILA guidelines. For residential mortgage transactions, ensure compliance with Dodd-Frank rules on ability-to-repay and anti-steering provisions. While business-asset seller financing typically faces fewer regulatory challenges, it’s wise to consult legal counsel to properly integrate credit insurance into your security arrangements.

7. Property Upkeep and Maintenance Clauses

Protection of Collateral

Property upkeep clauses play a crucial role in safeguarding your investment by outlining the buyer's responsibilities for repairs, routine maintenance, insurance, and property taxes once they take possession. These provisions ensure the value of your collateral - whether it's real estate or business assets - remains intact throughout the financing term. Without such clear obligations, there's a risk the buyer might neglect the property or assets, leading to deterioration and reducing the value of what secures your loan.

Your agreement should specify that the buyer must maintain the property or assets in compliance with building codes and zoning regulations. It should also require proper insurance coverage that names you as the loss payee, along with provisions for regular inspections and submission of proof for insurance and maintenance. For business assets, include requirements for servicing key equipment according to manufacturer guidelines and restrict the buyer from selling or removing significant assets outside normal business operations. By ensuring periodic inspections and updated records, you can verify that the collateral remains protected and retains its value during the loan term. These measures not only preserve the asset’s worth but also help reduce the likelihood of default.

Mitigation of Default Risks

Well-crafted maintenance clauses act as a safety net, reducing the chance that your collateral loses value before it can be recovered in the event of a default. Prohibit actions like removing fixtures, selling secured equipment, or ignoring structural issues that could diminish the collateral’s value. For operating businesses, include restrictions on owner withdrawals or capital distributions that might lead to neglect of critical assets.

Your contract should also give you the right to step in if the buyer fails to address essential repairs, pay overdue taxes, or maintain insurance. After providing notice and allowing the buyer an opportunity to resolve the issue, you can make the necessary payments or repairs yourself and add those costs - plus interest - to the debt balance. This way, neglected upkeep becomes a recoverable expense rather than a total loss. Additionally, tie these provisions to requirements for timely payment of property taxes, HOA dues, and utility liens to prevent situations like tax sales or lien foreclosures that could jeopardize your secured position.

Regulatory and Legal Compliance

While protecting your collateral and mitigating default risks are key, it’s equally important to ensure that upkeep clauses comply with relevant laws. In residential seller financing, federal regulations such as the Dodd-Frank Act and CFPB rules come into play when the property is a dwelling and the buyer is a consumer. These laws limit how upkeep clauses can be enforced, preventing practices that might violate consumer protections or be deemed unfair.

State laws also influence the scope of these clauses. For instance, some states closely examine provisions that allow sellers to take possession too easily or impose excessive fees under the guise of "maintenance" charges. For commercial or business-backed financing, state UCC rules, mortgage statutes, and case law around "waste" and "good repair" obligations dictate how far you can go with inspections, operational requirements, or mandatory repairs. To ensure compliance, work with a local attorney who can confirm that your upkeep provisions align with state and federal laws, as well as with other contractual documents. When combined with promissory notes, UCC filings, and default clauses, these provisions form a solid legal framework to manage risks in seller financing agreements.

Comparison of Key Legal Protections

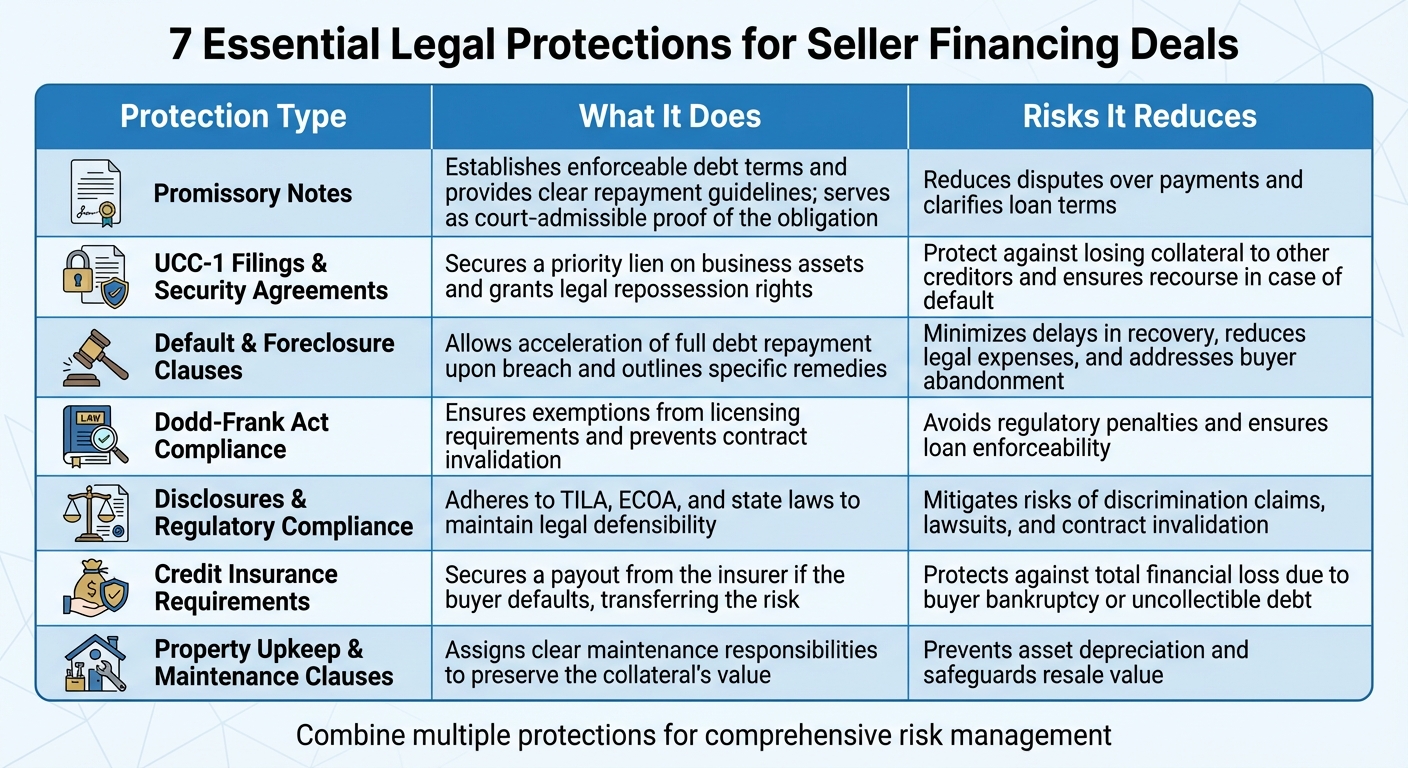

7 Essential Legal Protections for Seller Financing Deals

Every legal safeguard in a seller financing agreement serves a specific purpose, but together, they create a solid safety net for your investment. The table below explains how each protection functions and the risks it addresses. By layering these measures, you can build a more secure and reliable framework for protecting your financial interests.

| Protection Type | What It Does | Risks It Reduces |

|---|---|---|

| Promissory Notes | Establishes enforceable debt terms and provides clear repayment guidelines; serves as court-admissible proof of the obligation | Reduces disputes over payments and clarifies loan terms |

| UCC-1 Filings & Security Agreements | Secures a priority lien on business assets and grants legal repossession rights | Protects against losing collateral to other creditors and ensures recourse in case of default |

| Default & Foreclosure Clauses | Allows acceleration of full debt repayment upon breach and outlines specific remedies | Minimizes delays in recovery, reduces legal expenses, and addresses buyer abandonment |

| Dodd-Frank Act Compliance | Ensures exemptions from licensing requirements and prevents contract invalidation | Avoids regulatory penalties and ensures loan enforceability |

| Disclosures & Regulatory Compliance | Adheres to TILA, ECOA, and state laws to maintain legal defensibility | Mitigates risks of discrimination claims, lawsuits, and contract invalidation |

| Credit Insurance Requirements | Secures a payout from the insurer if the buyer defaults, transferring the risk | Protects against total financial loss due to buyer bankruptcy or uncollectible debt |

| Property Upkeep & Maintenance Clauses | Assigns clear maintenance responsibilities to preserve the collateral's value | Prevents asset depreciation and safeguards resale value |

By combining these protections, you create a layered defense against potential risks. For instance, pairing a promissory note with a UCC-1 filing ensures you have both enforceable debt terms and a priority claim on assets. Adding default clauses and credit insurance provides a clear recovery process and financial security if the buyer defaults. Including property upkeep requirements alongside foreclosure rights ensures the collateral remains valuable while offering an efficient remedy in case of non-compliance.

The best seller financing agreements incorporate all these elements, addressing risks from multiple angles. To customize these protections for your specific deal, consult with an experienced M&A attorney. This strategic approach turns seller financing into a structured and defensible investment opportunity.

Conclusion

Seller financing can open doors to deals that traditional lenders might decline, but it’s crucial to safeguard your interests right from the start. Overlooking key protections - like filing a UCC-1 or including strong default clauses - can leave you vulnerable to losing collateral or dealing with neglected assets. Each legal safeguard tackles a specific risk, and together, they form a robust defense against issues like payment disputes, asset deterioration, regulatory fines, or even complete financial loss. This multi-layered approach not only protects your collateral but also strengthens the enforceability of the entire agreement.

Skipping proper documentation can lead to unenforceable contracts, regulatory troubles, or losing your collateral if the buyer defaults. With stakes this high, professional expertise isn’t optional - it’s essential.

Partner with seasoned M&A attorneys to craft thorough, legally sound agreements. They’ll assess the buyer’s creditworthiness, structure promissory notes secured by collateral, ensure Dodd-Frank exceptions are applicable, and navigate state-specific regulations, such as caps on late fees.

For additional support, Clearly Acquired offers AI-driven tools and personalized advisory services to simplify compliance, due diligence, and financing structure management. By incorporating these legal protections, you turn your seller financing arrangement into a well-secured and strategic investment.

FAQs

What legal protections should sellers include in a financing deal?

When putting together a seller financing deal, it's important to include specific legal protections to safeguard your interests. One essential element is a promissory note - a written agreement where the buyer commits to repaying the loan. This document lays out critical details like the payment schedule and interest rates, ensuring everything is clearly defined.

Another key protection is filing a UCC (Uniform Commercial Code) statement. This filing helps establish your claim as a creditor by placing a lien on the assets being financed, giving you legal priority if issues arise. Lastly, including a default clause is vital. This clause spells out what happens if the buyer fails to meet their obligations, giving you a clear path to address non-payment or other breaches.

These measures not only clarify the terms of the agreement but also help reduce risks, making your financing arrangement more secure and enforceable.

How does the Dodd-Frank Act impact seller financing agreements?

The Dodd-Frank Act impacts seller financing agreements by introducing specific compliance requirements, especially for residential properties or larger financial transactions. Sellers are often required to meet federal standards, including borrower qualification criteria and detailed documentation processes, to remain compliant.

These regulations are designed to promote transparency and minimize financial risks, which can directly affect how seller financing terms are crafted. For sellers, understanding these rules and consulting with professionals is crucial to sidestep potential legal complications.

Why should maintenance clauses be included in seller financing agreements?

Including maintenance clauses in seller financing agreements is a smart way to safeguard the seller's interests. These clauses require the buyer to properly maintain the business and its assets, ensuring that the value of any collateral tied to the agreement remains intact. By clearly outlining who is responsible for repairs and upkeep, they also help minimize misunderstandings and reduce the chances of disputes or defaults.

For sellers, these provisions offer reassurance that their investment is protected and that the business will stay in good shape throughout the financing period.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)