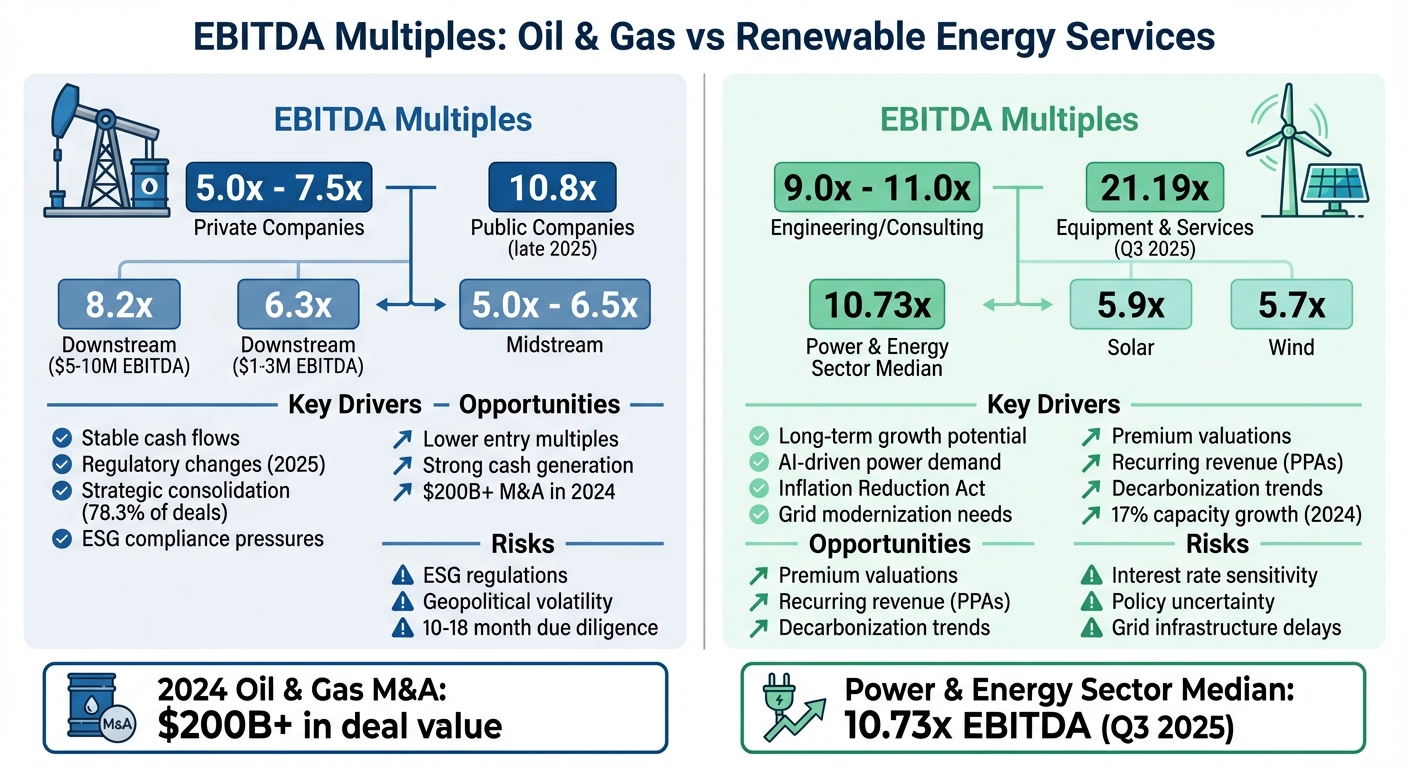

EBITDA multiples differ significantly between oil & gas services and renewable energy services due to industry trends, growth potential, and risk factors.

- Oil & Gas Services: Multiples range from 5.0x to 7.5x for private companies, with public companies averaging 10.8x by late 2025. Stable cash flows and recent regulatory changes have driven valuation growth, but ESG compliance and geopolitical risks remain challenges.

- Renewable Energy Services: Higher multiples, around 9.0x to 11.0x, reflect confidence in long-term growth from decarbonization and AI-driven power demand. However, interest rate sensitivity and policy uncertainties can impact valuations.

Key Findings:

- By Q3 2025, the Power & Energy sector median EBITDA multiple was 10.73x.

- Renewable energy equipment & services traded at a premium with 21.19x multiples, while oil-related services averaged 10.8x.

- 2024 oil & gas M&A surpassed $200 billion in deal value, with strategic buyers leading 78.3% of transactions.

- Renewable energy deals focused on grid modernization and assets with recurring revenue (e.g., long-term PPAs).

Investors must balance short-term cash flow opportunities in oil & gas with renewable energy’s growth potential while navigating risks like ESG compliance and interest rate volatility.

EBITDA Multiples Comparison: Oil & Gas vs Renewable Energy Services

1. Oil & Gas Services

The oil and gas services sector reflects unique valuation patterns, shaped by broader energy trends and specific market dynamics.

Current EBITDA Multiples

After recovering from pandemic lows, public companies in the oil and gas services sector are now trading at an average of 10.80x EBITDA as of late 2025. On the private side, engineering service firms focused on upstream operations typically trade between 5x and 7x EBITDA, highlighting the premium placed on the scale and liquidity of public markets.

Company size plays a significant role in valuation. Private downstream companies earning $5–10 million in EBITDA trade at approximately 8.2x, while smaller firms with $1–3 million in EBITDA are valued closer to 6.3x. Midstream operators tend to see lower multiples, ranging from 5.0x to 6.5x, depending on their size. Meanwhile, integrated players are valued slightly higher, at about 5.4x to 6.7x EBITDA. For context, the median multiple across the broader Power & Energy sector reached 10.73x by Q3 2025.

Key Factors Driving Multiples

Several factors are shaping valuations within the oil and gas services sector:

- Regulatory Changes: Adjustments in 2025, such as eased drilling restrictions and streamlined permitting processes under the new administration, have increased the appeal of conventional energy assets.

- Strategic Consolidation: Larger-scale deals now dominate, with 86% of M&A transactions over $1 billion focusing on acquisitions that help spread fixed costs and optimize supply chains.

- AI-Driven Power Demand: The rising power needs of data centers have encouraged providers to prioritize firm power generation and related infrastructure investments.

- ESG Compliance Pressures: The push for Environmental, Social, and Governance (ESG) compliance has fueled a wave of public-to-private transactions, as companies seek to avoid the stringent disclosure requirements tied to public markets.

These trends have created fertile ground for deal-making, with strategic buyers taking the lead.

Recent Transaction Examples

Recent transactions illustrate the sector's active deal environment:

- In Q3 2025, Schlumberger Limited acquired ChampionX Corporation for $8.63 billion, strengthening its position in chemistry solutions and lift technologies.

- In Q1 2025, Nabors Industries Ltd. purchased Parker Wellbore Company for $472.1 million, expanding its global drilling services and rental tool offerings.

- That same quarter, ONEOK, Inc. completed a $10.1 billion acquisition of EnLink Midstream, LLC, consolidating midstream infrastructure and services.

- Additional deals included Atlas Energy Solutions acquiring Moser Engine Service for $220.66 million, and Enersol RSC LTD purchasing Sun Energy Services for $223.0 million.

Strategic buyers accounted for roughly 78.3% of all transactions in the sector, underscoring their dominant role in shaping the industry landscape.

sbb-itb-a3ef7c1

2. Renewable Energy Services

The renewable energy sector continues to trade at higher multiples compared to oil and gas, signaling strong market confidence in the ongoing energy transition and the increasing demand for infrastructure to support it.

Current EBITDA Multiples

Renewable energy engineering and consulting services currently trade within a range of 9x to 11x EBITDA. Across the broader renewable energy space, valuations vary by subsector. In 2024, solar companies recorded a median EBITDA multiple of 5.9x, wind companies came in at 5.7x, alternative energy sources like biofuel and biomass reached 6.4x, and hydroelectric companies reported 5.6x. The overall sector median stood at 6.3x EBITDA, reflecting a dip from 2023 levels due to higher interest rates and rising operating costs. By Q3 2025, however, the Power & Energy sector showed signs of recovery, with median multiples climbing to 10.73x from 10.2x in Q1 2025. These numbers highlight the factors driving the premium valuations in this sector.

Key Factors Driving Multiples

The high valuation multiples in renewable energy are shaped by evolving technologies and regulatory developments. The rapid expansion of artificial intelligence and data centers is fueling demand for reliable, zero-carbon power sources, leading companies to prioritize service providers offering round-the-clock operations. Additionally, the Inflation Reduction Act is playing a pivotal role, boosting renewable energy deployment with tax incentives, and U.S. capacity is expected to grow 17% to reach 42 gigawatts in 2024. Buyers are increasingly drawn to assets with long-term Power Purchase Agreements and steady, regulated revenue streams.

Another key driver is the need for grid modernization, which is prompting a wave of mergers and acquisitions. Supply shortages for critical components, such as power transformers (projected to see a 30% deficit) and distribution transformers (facing a 10% shortfall) by 2025, are adding urgency to these efforts. Companies with recurring revenue models are particularly attractive, commanding the highest valuation premiums in the market.

Recent Transaction Examples

The momentum in the renewable energy sector is evident from several high-profile transactions in 2025. In July, TPG Global, LLC acquired Altus Power, Inc. for $2.51 billion. Around the same time, La Caisse completed a $7 billion cash acquisition of Innergex Renewable Energy, taking the company private at C$13.75 per share - a 58% premium over its pre-announcement price. Also in July, KKR & Co. Inc. and the Public Sector Pension Investment Board purchased transmission assets from AEP for $2.82 billion to address critical grid infrastructure needs.

In October 2025, Zeo Energy Corp. acquired Heliogen, Inc., a concentrated solar power technology company, for $12.38 million. Earlier in the year, Rio Tinto finalized a $6.7 billion acquisition of Arcadium Lithium plc to secure key supply chains for renewable energy storage and electric vehicles. These transactions underscore the focus of strategic buyers on acquiring essential infrastructure and technology assets to support the renewable energy transition.

Pros and Cons

Looking at the earlier analysis of these sectors, here’s a breakdown of the key advantages and challenges that shape valuation and investment decisions in each market.

The oil and gas services sector trades at low valuation multiples - roughly 4.5x for 2024 estimated EBITDA and 4.0x for 2025 projections - despite generating strong cash flows. For investors, this means a chance to acquire assets at relatively low entry points. However, the sector faces challenges like extended due diligence timelines (10–18 months) due to ESG compliance requirements and geopolitical risks, which can slow down deal-making and complicate structuring. Additionally, this market remains vulnerable to geopolitical conflicts and evolving environmental regulations, which can quickly shift valuation expectations.

On the other hand, renewable energy services command higher valuation multiples, partly driven by long-term policy support - such as the Inflation Reduction Act - and the broader push toward energy transition. Companies with recurring revenue streams, often backed by long-term power purchase agreements (PPAs), attract premium valuations because of their predictable cash flows. The sector also benefits from the rapid deployment and scalability of technologies like solar power, which offer strong growth potential. However, renewable energy valuations are highly sensitive to interest rate changes due to the significant upfront capital required. Policy uncertainty, including possible rollbacks of federal subsidies, adds volatility and can widen the gap between buyer and seller expectations.

| Factor | Oil & Gas Services | Renewable Energy Services |

|---|---|---|

| Valuation Level | Lower multiples (4.0x–8.2x); opportunities for value buys | Higher multiples (5.6x–6.4x); reflects recurring revenue and growth potential |

| Growth Trajectory | Mature sector with consolidation-driven growth; U.S. M&A exceeded $200B in 2024 | High growth fueled by decarbonization trends and AI/data center demand |

| Cash Flow Stability | Strong cash flows supported by rising capital expenditures | Predictable cash flows driven by long-term PPAs and recurring revenues |

| Primary Risks | ESG regulations, geopolitical risks, and prolonged due diligence (10–18 months) | Interest rate sensitivity, policy uncertainty, and grid delays |

| Market Sentiment | Shift toward public-to-private deals - 64% more in 2022 | Strong investor interest in decarbonization, but near-term uncertainties linger |

Investors must weigh short-term cash flow opportunities against long-term growth potential. Oil and gas services provide immediate value and strong cash generation but come with risks tied to regulatory changes and the global energy transition. Meanwhile, renewable energy aligns with long-term decarbonization goals but requires navigating financing challenges and policy uncertainties. In 2023, nearly 60% of upstream oil and gas deals involved companies generating less than $250 million in revenue, highlighting opportunities in the small-cap space. At the same time, strategic buyers drove 77.2% of Power & Energy transactions in early 2025, reflecting ongoing consolidation in the renewable energy sector. Ultimately, investors need to align their risk tolerance with the unique dynamics of each sector to make informed decisions in this evolving energy landscape.

Conclusion

Oil and gas services typically trade at EBITDA multiples of around 5.0x–7.5x, while renewable energy services command higher multiples, ranging from 9.0x–11.0x. This disparity is largely due to the steady revenue models and favorable policies that bolster the renewable sector. Public market trends further highlight this gap, with renewable energy equipment and services trading at approximately 21.19x EBITDA as of mid-2025. These valuation benchmarks are crucial for shaping strategies for both buyers and sellers.

For buyers and sellers, understanding what drives these valuation differences is key to setting realistic expectations. Oil and gas valuations are influenced by factors like commodity price fluctuations, opportunities for basin consolidation, and operational cash flows. On the other hand, renewable energy valuations benefit from stable, contracted revenue streams and long-term growth potential. Additionally, oil and gas due diligence now takes longer - spanning 10–18 months - due to ESG considerations and geopolitical complexities, making early preparation essential for sellers.

In this shifting landscape, strategic positioning has never been more important. Sellers can enhance their valuations by showcasing strengths in technology integration, automation, and ESG credentials during the due diligence process. Buyers, meanwhile, must account for a range of policy scenarios, including potential changes to clean energy subsidies or federal drilling regulations, to accurately gauge risks. Assets backed by long-term Power Purchase Agreements or regulated revenue streams are particularly attractive, as they offer dependable cash flows and help buffer against economic uncertainties.

Clearly Acquired provides detailed valuation insights, streamlined due diligence processes, and customized financing solutions. Whether you're considering a midstream infrastructure investment or a renewable energy project, having access to accurate data and efficient deal management tools is essential - especially when due diligence timelines can stretch beyond a year.

"M&A data is often kept frustratingly opaque, which makes it all the more difficult for business owners going through a process." - Evan Bailyn, Founder

As the energy services market continues to evolve, driven by rising electricity demand from AI, grid modernization efforts, and the ongoing energy transition, deal dynamics will shift further. Those who combine deep industry knowledge with the right tools and advisory support will be best equipped to seize opportunities and maximize value in this dynamic environment.

FAQs

Why do renewable energy services typically have higher EBITDA multiples compared to oil and gas services?

Renewable energy services tend to command higher EBITDA multiples, thanks to their strong growth outlook, supportive regulations, and the rising demand fueled by the global shift toward cleaner energy. These elements make renewable energy companies appealing to investors, often resulting in higher valuation standards.

Currently, EBITDA multiples for renewable energy services average around 11.1×, significantly outpacing those of oil and gas services, which typically fall between 5× and 8×. This disparity highlights the market's confidence in renewables as a more stable and forward-looking investment compared to the cyclical and regulation-sensitive oil and gas industry.

How do regulatory changes affect EBITDA multiples in the oil and gas industry?

Regulatory shifts play a major role in shaping EBITDA multiples in the oil and gas sector, as they can directly impact operating conditions and cost structures. For instance, stricter rules around emissions, carbon pricing initiatives, or more complex permitting processes can drive up compliance costs, squeezing profitability and potentially dragging down valuation multiples. On the flip side, regulatory changes that streamline permitting or offer tax incentives can boost investor confidence, leading to higher multiples.

The increasing emphasis on sustainability and the transition to cleaner energy sources also influences investor sentiment. Companies that proactively align with these changes and adopt cleaner technologies often gain favor with investors, while those lagging behind may see their valuation multiples dip. For buyers, sellers, and investors, keeping a close eye on these regulatory and market dynamics is essential in navigating this shifting landscape.

What are the key risks impacting valuations in the renewable energy sector?

Valuations in the renewable energy sector face a mix of challenges that can drive down EBITDA multiples. Economic pressures, like higher interest rates, make financing more expensive, especially for deals that rely heavily on debt. This added cost can make such investments less attractive. On top of that, global supply chain disruptions - impacting critical components such as turbines, solar panels, and batteries - can cause delays and push up costs, ultimately eating into expected returns.

Regulatory uncertainty adds another layer of complexity. Shifts in federal policies, tax incentives, or the rollout of legislation like the Inflation Reduction Act (IRA) can create a volatile environment. For instance, if tax credits become less accessible or harder to transfer, deal valuations could take a hit. On top of this, industry-specific hurdles like increasing competition, labor shortages, and rising costs for equipment and installation further weigh on valuations. These intertwined factors collectively influence the financial landscape for renewable energy projects and companies.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)