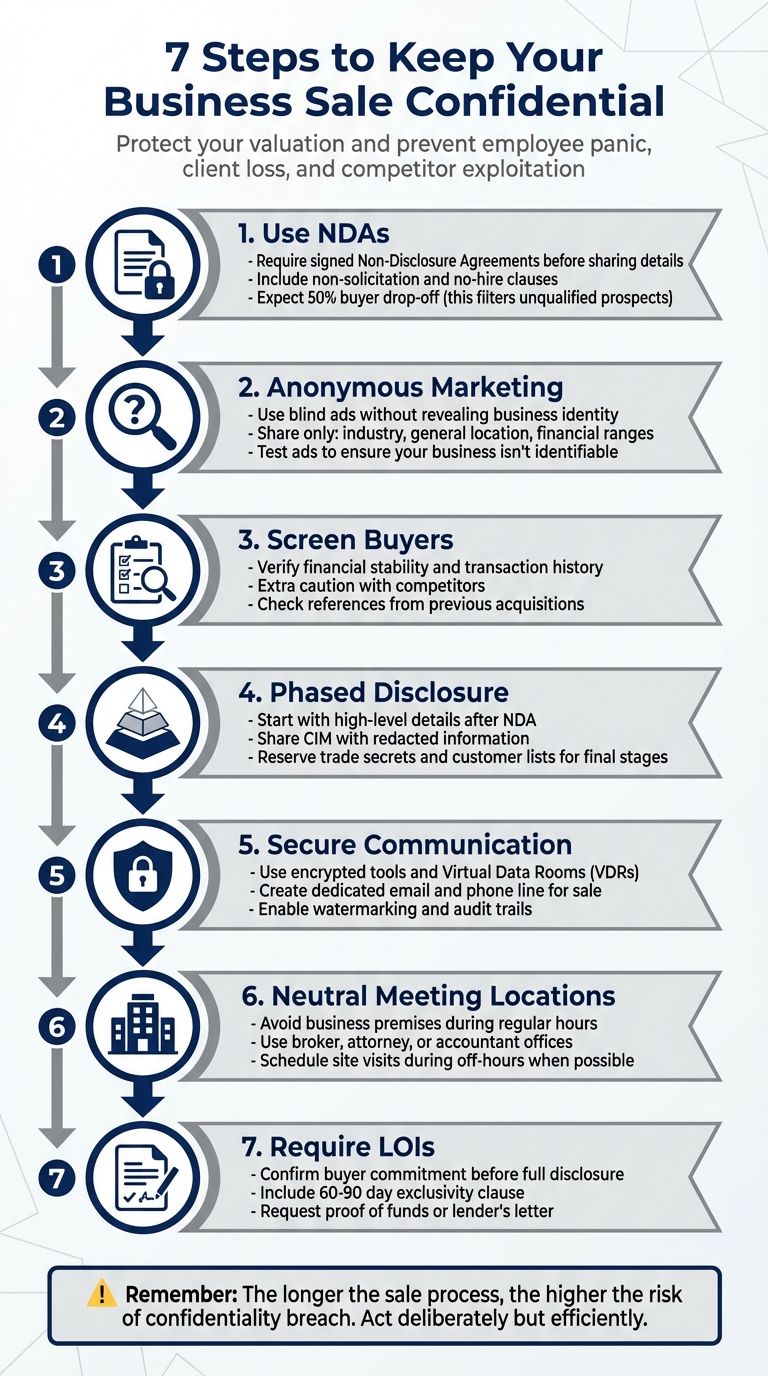

When selling your business, keeping the process confidential is critical. Leaks can lead to employee panic, loss of clients, and competitors exploiting the situation, which can harm your business's value and derail the deal. Here’s how to safeguard your sale:

- Use NDAs: Require potential buyers to sign well-drafted Non-Disclosure Agreements before sharing sensitive details. Include clauses to protect against breaches and employee poaching.

- Anonymous Marketing: Use blind ads to attract buyers without revealing your business identity. Share general information like industry, location, and financial metrics.

- Screen Buyers: Verify financial stability and intent before disclosing details. Be extra cautious with competitors to avoid misuse of information.

- Phased Disclosure: Share information gradually, starting with high-level details. Reserve sensitive data like trade secrets and customer lists for later stages.

- Secure Communication: Use encrypted tools, virtual data rooms, and separate contact methods to protect sensitive information.

- Neutral Meeting Locations: Avoid hosting meetings at your business premises during regular hours to prevent employee suspicion.

- Use LOIs: Require Letters of Intent to confirm buyer commitment before full disclosure.

Confidentiality is key to maintaining control, protecting your business valuation, and ensuring a smooth transaction. A single leak can jeopardize everything, so take deliberate steps to safeguard your sale.

7-Step Process to Keep Your Business Sale Confidential

Selling Your Business? Here’s Why Confidentiality Matters

sbb-itb-a3ef7c1

Using Non-Disclosure Agreements (NDAs)

NDAs are a cornerstone of protecting confidentiality during a business sale. Think of the NDA as your first line of defense - it’s the initial document a potential buyer signs after reviewing a teaser but before gaining access to sensitive details. This timing is crucial, as it sets the tone for the rest of the transaction.

"A properly prepared agreement signals to buyers that you're well-represented, and buyers will be less likely to use negotiating tactics they might try on unprepared, less sophisticated sellers." - Jacob Orosz, President, Morgan & Westfield

A well-drafted NDA not only establishes clear boundaries but also discourages opportunistic behavior. It creates legal obligations and underscores the consequences of breaches. Interestingly, requiring an NDA often results in a 50% drop-off rate among prospective buyers, which can actually be beneficial - it weeds out those who aren’t serious or qualified. This step is the foundation for maintaining confidentiality throughout the sale process.

What to Include in an NDA

For an NDA to offer meaningful protection, it needs to include specific, well-thought-out components. Start by clearly defining what counts as confidential information. This should cover everything from written documents and verbal communications to "derived information" created by buyers during their analysis.

Include non-solicitation and no-hire clauses to prevent buyers, particularly competitors, from poaching your employees or customers if the deal doesn’t go through. It’s also essential to specify who is allowed to access the information - such as the buyer’s CPA, attorney, or advisors - and ensure they’re bound by the same confidentiality obligations.

Additional must-haves include:

- Provisions requiring buyers to return or destroy documents if the deal falls through.

- Remedies for breaches, such as injunctions or liquidated damages.

- A clear statement that sharing information doesn’t obligate either party to complete the transaction.

Most NDAs in mergers and acquisitions (M&A) protect information for 1–5 years, though the exact duration depends on the nature of your industry and the sensitivity of the data.

| NDA Component | Purpose | Key Detail |

|---|---|---|

| Term/Duration | Limits how long info is protected | Typically 1–5 years; perpetual terms are often restricted in some areas |

| Permitted Use | Restricts how the information is used | Only for evaluating the specific transaction |

| Legal Disclosures | Handles legal requirements | Buyer must notify you before disclosing info under government or court orders |

| Jurisdiction | Defines where disputes are resolved | Specifies governing law and court location for enforcement |

How to Distribute and Enforce NDAs

Once the NDA is carefully drafted, it’s vital to ensure it’s properly executed. Screen potential buyers before sending them an NDA - this includes verifying their financial stability and transaction history to confirm their seriousness. Be meticulous with details, using the correct legal names of individuals or entities; errors here could render the agreement unenforceable.

When distributing your selling memorandum, assign a unique identifier to each copy. This allows you to trace the source of any leaks. If the buyer’s advisors will access the information, make sure they either sign the NDA directly or that the buyer is held fully accountable for any breaches by their representatives.

Most NDAs in M&A are unilateral, meaning they protect only the seller’s information. While private equity firms routinely sign NDAs, venture capitalists often avoid them due to the high volume of deals they review and the associated risks of trade secret claims. To simplify enforcement, use a consistent, seller-friendly NDA template for all potential buyers.

If you suspect a breach, act fast. Contact the party immediately to address the issue, then follow up with a written email to document the incident. Virtual data rooms can also play a key role in tracking who accesses what information and when. This provides concrete evidence if confidentiality is compromised, ensuring you have the tools to protect your business sale process effectively.

Marketing Your Business Anonymously

Once you've built a solid NDA framework, the next step is to attract qualified buyers - without giving away your business's identity. This is where anonymous marketing, often called "blind advertising", comes into play. The idea is to spark interest among serious buyers while keeping your company name, exact location, and other identifying details under wraps.

"A blind ad is the best way to create interest without risking confidentiality. It reveals enough to get buyers interested and request more information." – Erik Sullivan, MidStreet

The trick is to share just enough information to appeal to the right audience while keeping competitors and casual browsers at bay. Too vague, and you’ll struggle to generate interest; too detailed, and someone might connect the dots and uncover your business. Let’s dive into how to craft these ads and maintain secure communication.

Writing Blind Ads

A strong blind ad highlights your industry, a general geographic area, and key financial metrics - all without revealing your identity. Instead of naming your business, describe the type of operation. For example:

- "Premier Residential Roofing Contractor in North Carolina"

- "Specialty Manufacturing Business in the Southeast US"

Stick to broad regions and avoid pinpointing specific locations. Include high-level financial details, such as annual revenue ranges or Seller's Discretionary Earnings, to help buyers determine if they’re a good fit. However, steer clear of exact numbers from tax returns. Focus on your business model and potential for growth, rather than unique product lines or client names that could give away too much.

A good rule of thumb? Test your ad by searching for your business using various keyword combinations. If your company pops up in the results, it’s time to generalize or revise those details.

"The idea of a teaser is to provide enough data to get qualified buyers interested, but not so much that someone can read the teaser and know which business is for sale." – Blake Taylor, Synergy Business Brokers

Once you’ve crafted a compelling ad, the next step is to set up secure ways for interested buyers to reach you.

Setting Up Separate Contact Methods

To keep your identity safe, avoid using your business email or office phone number in your marketing materials. Instead, create a dedicated email address specifically for sale inquiries. This keeps sale-related messages separate from your daily operations and prevents employees from stumbling upon sensitive information.

For phone communication, use your personal cell phone or set up a virtual phone line. This keeps broker and buyer calls off your office caller ID system, avoiding any awkward questions from employees. It also prevents competitors from recognizing your business number in the ad. By maintaining this separation, you can ensure sale inquiries remain confidential and don’t interfere with your regular operations.

Managing Information Disclosure to Buyers

Once you've drawn interest through anonymous marketing, the next step is critical: deciding who actually qualifies to see sensitive information. Not every inquiry will come from a genuine buyer - some could be competitors fishing for insights. This is why careful screening and a phased approach to data sharing are essential. Treat your information like a prized asset and release it strategically.

Be prepared for a significant drop-off - around 50% - after your initial communication. This is normal as you weed out unqualified buyers. The goal is to identify those with both the financial resources and the professionalism required to close the deal before granting access to sensitive details. Let’s break down how to screen buyers effectively and manage the controlled release of your data.

Screening Potential Buyers

Before sharing anything beyond your initial blind advertisement, verify the buyer’s financial capability. This could mean reviewing credit reports, financial statements, or proof of funds. For individual buyers, dig deeper into the source of their funds, and if anything seems off, conduct a background check immediately.

Corporate and private equity buyers require a different approach. Verify their acquisition history by reaching out to references, such as CEOs of companies they’ve previously acquired. This can help confirm their professionalism and adherence to confidentiality agreements.

Competitors, in particular, warrant extra caution. They may have ulterior motives, so ask them to clearly outline their intentions and qualifications for the purchase. Pay attention to how they respond to your Non-Disclosure Agreement (NDA) and communication protocols - serious buyers will respect your process without hesitation.

Releasing Information in Stages

Once a buyer passes your initial screening, share information incrementally. Start by requiring them to sign an NDA before providing a Confidential Information Memorandum (CIM). The CIM includes detailed financials and an overview of your business model but keeps key identifiers - like customer and employee names - protected.

As the buyer progresses through the diligence process, release more sensitive data gradually. Early on, share redacted or aggregated information. Reserve trade secrets, proprietary pricing, and complete customer or employee lists for the later stages, only after a Letter of Intent has been signed. This step-by-step approach ensures that buyers demonstrate genuine commitment before accessing your most critical information.

For situations involving competitors, consider using "clean teams." These are neutral third-party advisors who review your sensitive data and provide summarized reports to the buyer. This method adds an extra layer of protection, allowing the buyer to evaluate the opportunity without direct access to your proprietary information. It’s a smart way to balance transparency with security.

Keeping Meetings and Communications Secure

How you handle meetings and communications plays a big role in protecting confidentiality, especially as technology changes how business transactions are managed. Even with NDAs signed and buyers carefully vetted, one careless email or poorly planned meeting can lead to leaks. A notable example from 2014 involved a high-value deal where unsecured communications revealed critical information to competitors, highlighting the importance of both physical and digital security measures.

Selecting Neutral Meeting Locations

Holding meetings at your business location during regular hours can raise eyebrows among employees, customers, or suppliers. This can lead to rumors that might jeopardize your sale. Instead, choose neutral, professional settings like your business broker's office, your attorney's firm, or your accountant's workspace. These locations provide a discreet and professional environment.

If a buyer needs to visit your premises - for instance, to inspect equipment - try to schedule the visit during off-hours, such as weekends or evenings, when staff are not present. If a daytime visit is unavoidable, introduce the visitor with a plausible explanation. For example, you could describe them as consultants reviewing operations, potential partners exploring collaboration, or advisors assessing your engineering systems. This approach helps maintain discretion while allowing the necessary inspection.

Using Encrypted Communication Tools

Standard email and phone systems can be risky when it comes to sensitive information. To minimize exposure, create a dedicated email address for the sale (e.g., project-alpha-sale@email.com) and use a separate phone line or cell phone exclusively for sale-related communications. This keeps critical information off your company’s servers and adds an extra layer of separation.

For document sharing, Virtual Data Rooms (VDRs) are an excellent choice. These secure platforms offer centralized storage with features like multi-factor authentication, granular access controls, and audit trails. Many VDRs also allow you to watermark documents with user-specific identifiers, making it easier to trace leaks if they occur. For highly sensitive materials, you can even disable downloading and printing entirely.

While tools like S/MIME in Outlook and Gmail’s Confidential Mode can enhance the security of routine email exchanges, they shouldn’t replace a dedicated data room for your most critical files. A VDR remains the gold standard for safeguarding sensitive documents during a sale.

Requiring Letters of Intent (LOIs) Before Full Disclosure

A Letter of Intent (LOI) acts as a checkpoint, confirming a buyer's intent and financial capability before you share sensitive business details. While an NDA helps protect your initial conversations, an LOI signals a deeper level of commitment, ensuring you’re not exposing trade secrets or critical operational data prematurely.

"Even with a signed confidentiality agreement, you shouldn't share proprietary information, client lists or trade secrets about your business. The buyer must demonstrate their purchasing capability and their intent to make an offer. This is done formally with a letter of intent (LOI)" - Brenda Krauss, Product Marketing Manager at BizBuySell.

This document outlines the framework for a structured and phased release of information.

An LOI typically includes essential deal terms such as the transaction type, price, and payment structure. It also incorporates binding clauses on confidentiality, non-solicitation, and exclusivity. For instance, a 60- to 90-day exclusivity clause ensures the buyer has time for due diligence without you engaging in parallel negotiations. This arrangement benefits both parties: the buyer gains your focused attention, while you gain confidence that your efforts won’t be wasted.

To further secure the process, request proof of funds or a lender’s letter before finalizing the LOI. This step weeds out unqualified buyers or those fishing for competitive insights. The LOI can also establish a phased disclosure plan for due diligence. Begin by sharing high-level financial data, gradually providing more detailed information as the buyer hits specific milestones. Reserve the most sensitive assets - like customer lists, trade secrets, and employee identities - for the final stages. If particularly sensitive data is involved, especially with potential competitors, consider using neutral third parties or "clean teams" to review the information and provide summaries instead of sharing raw data directly.

"A well-prepared LOI serves as a blueprint for transaction documents and flags deal-breakers early on" - Attorney Gianfranco Pietrafesa, Cooper Rose & English LLP.

Conclusion

Protecting confidentiality isn’t just about keeping secrets - it’s about safeguarding your company’s value and ensuring a smooth sale process. Curtis Kroeker, Group General Manager at BizBuySell.com, emphasizes this point:

"Keeping quiet about your impending business sale is imperative because news that a business is for sale can trigger negative reactions among creditors, customers, suppliers and employees".

To mitigate these risks, a layered approach to confidentiality is key. Start with a well-crafted NDA that clearly defines what’s confidential and includes non-solicitation clauses to prevent employee poaching. Gradually disclose information in stages - use blind ads initially and save full financial details for after a Letter of Intent (LOI) is signed. Tools like Virtual Data Rooms can help monitor document access, while meeting buyers at neutral locations (like your attorney’s office) ensures your business operations remain discreet.

Confidentiality isn’t just a formality - it directly affects your valuation and the success of your deal. A single leak can lead to employees seeking new jobs, customers losing trust, or competitors gaining an edge if the deal falls through. Even minor breaches can jeopardize transactions worth millions.

To stay ahead, use separate communication channels, redact sensitive details until later stages, and enforce a strict "need-to-know" policy. Jacob Orosz, President of Morgan & Westfield, underscores the importance of timing:

"The longer it takes to sell your business, the higher the probability of a confidentiality breach".

While speed is important, controlled and deliberate disclosure is non-negotiable. These strategies are designed to keep you in control, ensuring that when the sale is announced, it’s on your terms - not because of an untimely leak.

FAQs

How can I make sure potential buyers are serious before sharing sensitive business information?

When assessing potential buyers, it's crucial to verify both their interest and their ability to follow through with the purchase. Start by requesting a buyer profile that outlines their background and financial qualifications. This step ensures you're dealing with serious and capable prospects.

Before diving into specifics, make sure Non-Disclosure Agreements (NDAs) are signed. NDAs safeguard your confidential information and establish clear boundaries for how that information can be used. To streamline this process, you might want to involve a trusted intermediary, such as a business broker. They can handle initial communications and screen out buyers who aren't qualified or genuinely interested.

Another key strategy is to release information gradually. Begin with general, non-sensitive details and only disclose more critical data once the buyer has proven their commitment and capability. This phased approach helps protect your business's value and keeps sensitive information secure during the sales process.

How can I protect sensitive information during the sale of my business?

When selling your business, protecting sensitive information is crucial. Begin by having all involved parties sign Non-Disclosure Agreements (NDAs) before sharing any details. To minimize risks, share information in stages and only with individuals who genuinely need access. Make sure to use secure communication methods, like encrypted emails or virtual data rooms, to keep unauthorized eyes away.

It's also important to set up clear guidelines for managing confidential information and stay vigilant for any signs of unusual activity that might suggest a breach. These steps will help maintain your business's value and keep the sale process as private as possible.

How can I keep the sale of my business confidential from employees and competitors?

Maintaining confidentiality when selling your business takes thoughtful planning and secure communication practices. One of the first steps is to use non-disclosure agreements (NDAs). These legal documents ensure that everyone involved understands the importance of keeping sensitive details private. Share critical information only with trusted advisors or potential buyers who genuinely need access.

When communicating, stick to secure methods like encrypted email or specialized platforms designed for privacy. You might also use generic project names - like "Project Falcon" - to keep the sale under wraps and avoid drawing unwanted attention. Whenever possible, hold meetings off-site to reduce the risk of being overheard, and steer clear of public or informal settings for sensitive discussions.

Don’t overlook the impact of social media and casual communication channels. Even a small comment or vague hint can spark curiosity or unwanted attention. By combining legal safeguards, tightly controlled information sharing, and secure communication strategies, you can protect your confidentiality throughout the entire sale process.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)