Vendor financing, or seller financing, is when the seller helps finance part of a business purchase, typically covering 10–15% of the price, though it can go up to 30–60%. Buyers pay the seller in installments over 3–7 years, with interest rates between 5–10%. This approach is especially helpful when traditional loans don’t cover the full cost or when intangible assets like brand value are involved.

Key Points:

- For Buyers: Keeps more cash on hand during the transition, funds intangible assets, and provides flexibility for unexpected costs.

- For Sellers: Attracts more buyers, earns interest income, and may offer tax benefits.

- Typical Terms: Payments are often deferred or interest-only for the first year, with business assets serving as collateral.

Vendor financing benefits both parties by bridging financial gaps and aligning interests for a smoother business transition.

Seller Financing: The Ultimate Way to Buy a Business

sbb-itb-a3ef7c1

Benefits of Vendor Financing for Buyers and Sellers

Vendor Financing Benefits for Buyers vs Sellers Comparison

Benefits for Buyers

Vendor financing offers buyers the ability to manage their cash flow more effectively by deferring payments or making interest-only payments for 12–24 months. As Rima Bassi, Director of Growth and Transition Capital at BDC, points out:

The first 18 months following an ownership transition are the riskiest. Having more cash available during that period can make all the difference in your success.

This type of financing also opens the door for buyers to fund intangible assets - like brand reputation and intellectual property - that traditional bank loans often exclude. Additionally, if unexpected issues such as hidden liabilities or equipment failures come up after the deal is finalized, buyers may have the option to adjust or withhold vendor payments to address those costs. Since the seller’s repayment depends on the business's performance, they are often more inclined to offer valuable support, such as training, client introductions, and advisory guidance during the transition period.

By providing flexibility and reducing financial risk, vendor financing gives buyers a stronger foundation to succeed during the critical early stages of ownership.

Benefits for Sellers

For sellers, vendor financing widens the pool of potential buyers, which can help speed up the sale process and even increase the overall sale price. It also creates an additional income stream, as sellers earn interest - typically ranging from 6% to 10% - on the deferred portion of the purchase price, essentially transforming the sale into a steady cash flow. On top of that, spreading payments over time can lead to tax advantages, such as deferred capital gains.

Another key advantage is the message vendor financing sends to buyers and lenders. Offering this option demonstrates confidence in the business’s future, which can make it easier for buyers to compare SBA 7(a) loans vs. other financing options. As Rima Bassi explains:

Vendor financing usually indicates that the vendor believes in the business and its ongoing success.

These benefits make vendor financing a win-win solution, offering financial and strategic gains to both parties.

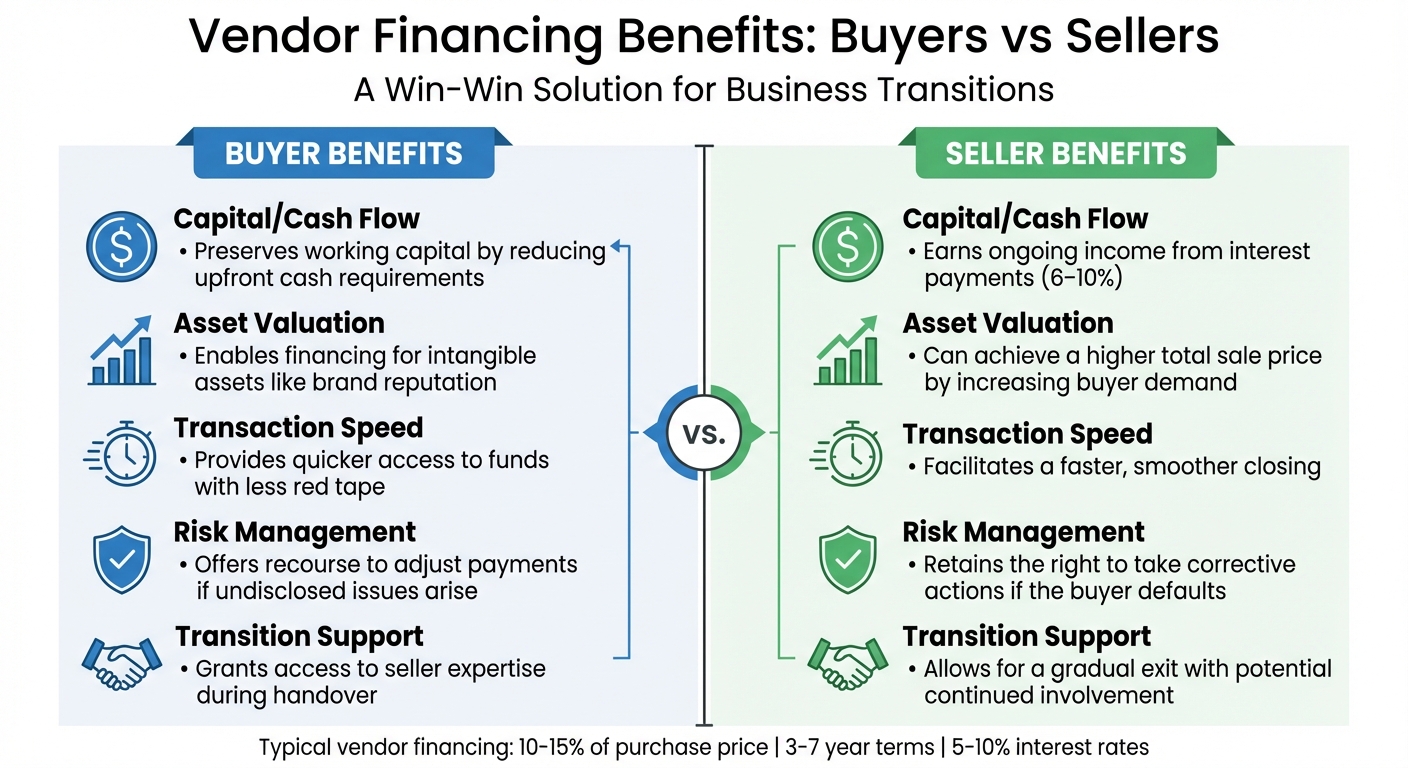

Side-by-Side Comparison of Buyer and Seller Benefits

The table below provides a clear overview of the advantages for buyers and sellers:

| Benefit Category | Buyers | Sellers |

|---|---|---|

| Capital/Cash Flow | Preserves working capital by reducing upfront cash requirements | Earns ongoing income from interest payments (6–10%) |

| Asset Valuation | Enables financing for intangible assets like brand reputation | Can achieve a higher total sale price by increasing buyer demand |

| Transaction Speed | Provides quicker access to funds with less red tape | Facilitates a faster, smoother closing |

| Risk Management | Offers recourse to adjust payments if undisclosed issues arise | Retains the right to take corrective actions if the buyer defaults |

| Transition Support | Grants access to seller expertise during handover | Allows for a gradual exit with potential continued involvement |

How Vendor Financing Works

The Vendor Financing Process

Vendor financing typically begins during the Letter of Intent (LOI) stage. At this point, the buyer introduces the idea to gauge the seller's openness to the arrangement. If both parties agree, they move on to negotiate the key terms: loan amount, interest rate, and repayment period.

While the buyer follows a business acquisition checklist to conduct due diligence, the seller also assesses the buyer's creditworthiness and the feasibility of their proposal. This mutual evaluation ensures that the deal is practical for both sides. Once terms are agreed upon, a lawyer drafts the formal agreement, which includes details like financial reporting obligations, actions to address undisclosed liabilities, and the seller's role after the sale. As one expert explains:

One of the reasons a lawyer is so important on your deal team is that they can draft up the terms of your vendor financing.

When the transaction closes, the buyer pays the purchase price minus the vendor-financed portion. The remaining balance becomes a debt that the buyer repays over time using the business's cash flow. If a bank is involved, the vendor financing is often structured as "junior debt," meaning the bank is repaid first, with the seller receiving payments afterward. Setting clear terms early on ensures that vendor financing benefits both parties. This foundation leads directly into defining repayment structures and standard terms.

Repayment Structures and Standard Terms

Once the core terms are settled, the repayment structure is outlined. Most vendor financing agreements span 3 to 5 years, with interest rates ranging from 5% to 10%. Buyers often negotiate for interest-only payments or a deferral of payments during the first 12 months to maintain cash flow during the crucial transition period. Afterward, monthly payments usually commence, though some agreements include a balloon payment at the end of the term.

These loans are typically secured by business assets, such as inventory or equipment, to provide the seller with recourse in case of default. For transactions involving SBA 7(a) and 504 loans, seller financing can only count toward the required 10% equity injection if it’s placed on "full standby" (no payments allowed) for the duration of the SBA loan and doesn’t exceed 50% of the required equity. Additionally, SBA guidelines allow a seller to stay on as a contracted consultant for up to 12 months after the sale.

| Term Component | Standard Range/Option |

|---|---|

| Loan Duration | 3–5 years |

| Interest Rate | 5%–10% |

| Initial Repayment | Deferred or interest-only for the first 12 months |

| Priority | Subordinated (Junior) to bank debt |

| Seller Involvement | Up to 12 months (SBA-specific) |

Key Terms to Negotiate in Vendor Financing

When it comes to vendor financing, ironing out the details of the agreement is crucial to ensure a smooth and mutually beneficial deal.

Loan Amount and Repayment Schedule

A vendor note typically fills the gap between what the buyer can contribute and what a bank is willing to lend. In many cases, vendor financing accounts for 10% to 15% of the total purchase price. For transactions involving SBA 7(a) loans, a common breakdown is 90% SBA loan, 5% buyer equity, and 5% seller note.

Repayment schedules need to match the business’s cash flow and revenue cycles. Structuring payments - whether through regular monthly installments or a single balloon payment - should be based on the business’s seasonal income patterns to prevent cash flow issues. For SBA-backed deals, repayment terms often stretch up to 10 years to align with the bank’s amortization schedule.

Once the loan amount and schedule are sorted, the next step is to focus on the cost of borrowing and timing of payments.

Interest Rates and Deferral Periods

Interest rates for vendor notes generally fall between 5% and 10%, reflecting the higher risk sellers take compared to banks. The exact rate depends on factors like the business’s financial health, the buyer's down payment size, and whether the debt is secured by tangible assets (like equipment financing) or intangibles (like brand value).

Buyers can often negotiate interest-only payments or defer payments entirely for 12 to 24 months to ease cash flow during the transition period. This breathing room can be critical when the business is at its most vulnerable. However, if the seller note is subject to SBA rules requiring "full standby", no payments can be made until the bank loan is fully repaid.

With payment terms in place, it’s also important to address the seller’s role after the sale.

Post-Sale Seller Involvement and Guarantees

Clearly defining the seller’s involvement post-sale is essential. According to SBA guidelines, sellers can stay on as consultants for up to 12 months. The agreement should outline specific responsibilities, such as training the buyer, introducing clients, or maintaining supplier relationships. It should also detail how often the buyer must provide financial updates to the seller.

Sellers often require personal guarantees from buyers to ensure repayment. Buyers, in turn, should negotiate clauses like the “right of offset,” allowing them to adjust payments if hidden liabilities - such as unpaid bills or legal issues - emerge after closing. Vendor loans are typically secured by business assets like inventory or equipment, though sellers might also accept intangible assets that banks usually won’t consider.

Advanced Vendor Financing Strategies

Once you’ve got a handle on the basics of vendor financing, it’s time to explore advanced strategies that can refine your approach to funding and managing risk. These techniques can help bridge funding gaps while aligning the interests of all parties involved.

Hybrid Financing Structures

A hybrid approach combines multiple funding sources to create a well-rounded capital stack. For example, many deals use an SBA 7(a) loan for up to 90% of the financing (these loans can go as high as $5 million). The remaining 10% is typically split between buyer equity and a seller note. Here’s how it works: banks require their loans to take priority, meaning they get repaid before any vendor financing. The seller note then serves as a bridge, covering gaps that equity and traditional loans can’t fill. When a seller agrees to this arrangement, it signals confidence in the business's future, which can reassure other lenders.

The rules around SBA loans have evolved. Under the updated 2023 guidelines, seller debt on "full standby" can count for up to half of the required 10% equity injection - essentially covering 5% of the total project cost.

Some buyers take a more creative route, structuring vendor financing as equity instead of debt. In this setup, the seller receives shares in the company rather than regular cash payments with interest. While this preserves cash flow, it does result in diluted ownership. Another inventive option is a "service swap", where two businesses exchange products or services of equal value rather than using cash or equity.

Next, let’s look at structures that tie payments directly to the business's performance.

Earn-Out Agreements and Performance-Based Payments

Earn-out agreements link repayments to the business’s post-closing performance, aligning the interests of both buyer and seller. For instance, if the business meets specific revenue or EBITDA targets, the seller receives the full payout. If it falls short, the payout is reduced. This approach offers flexibility, especially in cases where unexpected issues - like undisclosed liabilities or equipment problems - arise. Instead of locking in a fixed repayment, adjustments can be made based on actual performance.

To avoid disputes, it’s crucial to set clear performance metrics upfront. These might include gross revenue, EBITDA, or customer retention rates. If cash flow is tight, you can negotiate for the earn-out to be placed on "full standby." In this case, payments would only begin after the senior bank debt is repaid or the business reaches a certain liquidity level.

Now, let’s explore how modern technology simplifies these complex financing arrangements.

Using AI Tools for Structuring Vendor Financing

AI tools are transforming how financing packages are structured and managed. Automated underwriting platforms let you model various scenarios, showing how a vendor note fits alongside SBA loans and equity injections before you even approach a seller. Instead of manually juggling spreadsheets or guessing at key ratios (like maintaining a debt service coverage ratio of 1.25), these tools provide real-time insights.

For example, Clearly Acquired offers AI-powered solutions that assist with financial analysis and structuring capital stacks. Their platform helps buyers calculate the exact vendor financing needed to bridge gaps between equity and bank loans. Beyond that, buyers gain access to verified deal flow, secure data rooms, and automated verification tools - features that can help build trust with sellers, especially when proposing deferred payment terms.

These AI-driven tools also open doors to off-market opportunities, where sellers are often more receptive to creative financing arrangements. As of early 2026, there’s a growing trend of integrating funding tools directly into advisory services, making it easier for buyers to future-proof their acquisition strategies.

Common Pitfalls in Vendor Financing and How to Avoid Them

While vendor financing offers unique advantages, it's not without its challenges. If key risks aren’t addressed early, deals can unravel. The good news? Most of these issues can be avoided with solid preparation, clear communication, and thorough documentation.

Unclear Terms Leading to Disputes

Ambiguity in terms is a recipe for conflict. For instance, disputes often arise when payment structures aren’t clearly defined. Is the buyer expected to make interest-only payments, include principal, or handle a balloon payment at the end? Interest rates for vendor financing generally hover between 5% and 10% or more, depending on the level of risk. Clearly documenting these terms upfront can save both parties from headaches later.

Another common oversight is failing to address default scenarios. What happens if the buyer misses a payment? Will there be grace periods, late fees, or provisions allowing the seller to reclaim part of the business? These are critical questions to answer before signing any agreement. Additionally, your contract should outline what happens if undisclosed liabilities come to light, giving you options to adjust or withhold payments.

To avoid last-minute surprises, finalize key financial details - loan amounts, interest rates, and repayment timelines - in your Letter of Intent (LOI). Waiting until the closing phase to iron out these terms can derail the deal entirely. Assemble a team of professionals early, including a lawyer, accountant, and financial advisor, to ensure the agreement is precise and legally sound.

While clarity in contracts is essential, over-reliance on the seller can also create challenges.

Over-Reliance on Seller Involvement

Clearly defining the seller’s role during the transition period is vital. Whether they’re providing advisory support, training, or facilitating introductions, the agreement should specify their responsibilities and set a firm end date for their involvement. This ensures you can operate independently once the transition is complete while still gaining valuable insights, like maintaining relationships with key suppliers, staff, and industry contacts.

It’s also important to establish financial reporting expectations before closing. Decide which reports - such as profit and loss statements or balance sheets - you’ll share with the seller and how often. This keeps the seller informed without allowing them to overstep or interfere with your decision-making.

Beyond managing the seller’s role, structuring payments to protect your cash flow is equally critical.

Cash Flow Prioritization Challenges

Balancing multiple debt obligations can stretch your cash flow thin if not managed properly. Banks typically require their loans to take priority, meaning vendor notes are subordinated and repaid only after the bank loans are serviced. Make sure the seller understands this repayment hierarchy before finalizing the deal.

To ease the financial burden, negotiate deferred or interest-only payments during the initial transition period. For deals backed by the SBA, you may even structure the vendor note as "standby debt", delaying payments until the bank loan is fully repaid. This approach provides breathing room to stabilize the business before additional financial obligations kick in.

Maintaining cash reserves is equally important. Even if you can pay more upfront, holding onto extra funds gives you the flexibility to navigate the transition smoothly. After all, the seller’s incentive to support your success only works if you have the cash flow to keep the business running.

Conclusion

Key Takeaways for Buyers

Vendor financing can fill the gap when traditional bank loans or equity investments aren’t enough, all while helping you conserve cash during the critical first 18 months of ownership. Banks often see vendor financing as a sign of confidence in the business’s future. When a seller is willing to invest their own money in your success, lenders are more likely to approve additional financing. Plus, since the seller retains a financial interest in the business, they’re motivated to provide stronger support during the transition. This shared interest can be the difference between a seamless handover and a challenging start.

What sets vendor financing apart is its flexibility. Unlike rigid institutional loans, it allows for custom terms like interest-only periods, deferred payments, or performance-based repayment schedules that align with your cash flow needs. To avoid future disputes, it’s essential to formalize all terms in writing, including interest rates (usually between 5% and 10%), payment schedules, and conditions for default.

Final Thoughts on Structuring Successful Vendor Financing Deals

To make the most of vendor financing, start the conversation early. Mention it in your Letter of Intent (LOI) to gauge the seller’s willingness from the outset. Clearly outline the seller’s role after the sale - specify how long they’ll stay involved, what kind of financial updates they’ll provide, and when their active participation will end. This clarity ensures a smoother transition.

For a more streamlined process, platforms like Clearly Acquired can be invaluable. Their AI-driven tools connect you with suitable lenders and help you find verified business opportunities. With integrated advisory services and financing solutions in one place, you can move forward with confidence and close deals more efficiently. Whether you’re just starting or finalizing an acquisition, having the right tools and support in place can make all the difference. Vendor financing is a powerful option within the broader range of creative financing strategies for business acquisitions.

FAQs

What risks should buyers consider when using vendor financing to purchase a business?

Vendor financing can be a useful option when purchasing a business, but it’s not without its challenges. One major risk is that missing payments could allow the seller to reclaim the business. Unlike traditional lender foreclosures, this process can often happen much more quickly. Another potential issue is that sellers offering financing may remain involved in the business after the sale. If you’re someone who values having complete control, this could lead to complications.

That said, vendor financing often comes with more flexible terms. You might see lower interest rates or extended repayment periods, which can make the deal more appealing. However, these perks come with a catch: you’ll need to earn the seller’s trust. Expect them to review your credit history, financial records, and experience to ensure you’re a dependable borrower. Since the seller essentially becomes your lender, keeping a positive and professional relationship is crucial for the deal to go smoothly.

How does vendor financing affect a buyer's ability to secure additional bank loans?

Vendor financing can help buyers secure additional bank loans by lowering the amount of external funding required at the start. When the seller steps in to provide part of the financing, banks might see the transaction as less risky, particularly if the vendor financing offers favorable terms.

Another advantage is that vendor financing often features lower interest rates or more flexible repayment schedules compared to traditional loans. This can ease cash flow pressures for buyers, making them more appealing to lenders when they need extra funding.

What are the common repayment terms for vendor financing in business purchases?

Vendor financing often comes with repayment terms tailored to fit the buyer's needs better than traditional loans. These terms might include lower interest rates, extended repayment timelines, or schedules designed to align with the business's cash flow.

Typically, repayments are set over a pre-determined period and are sometimes linked to the revenue the business generates. This approach can be a smart choice for buyers looking to manage costs efficiently while focusing on growing their new acquisition.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)