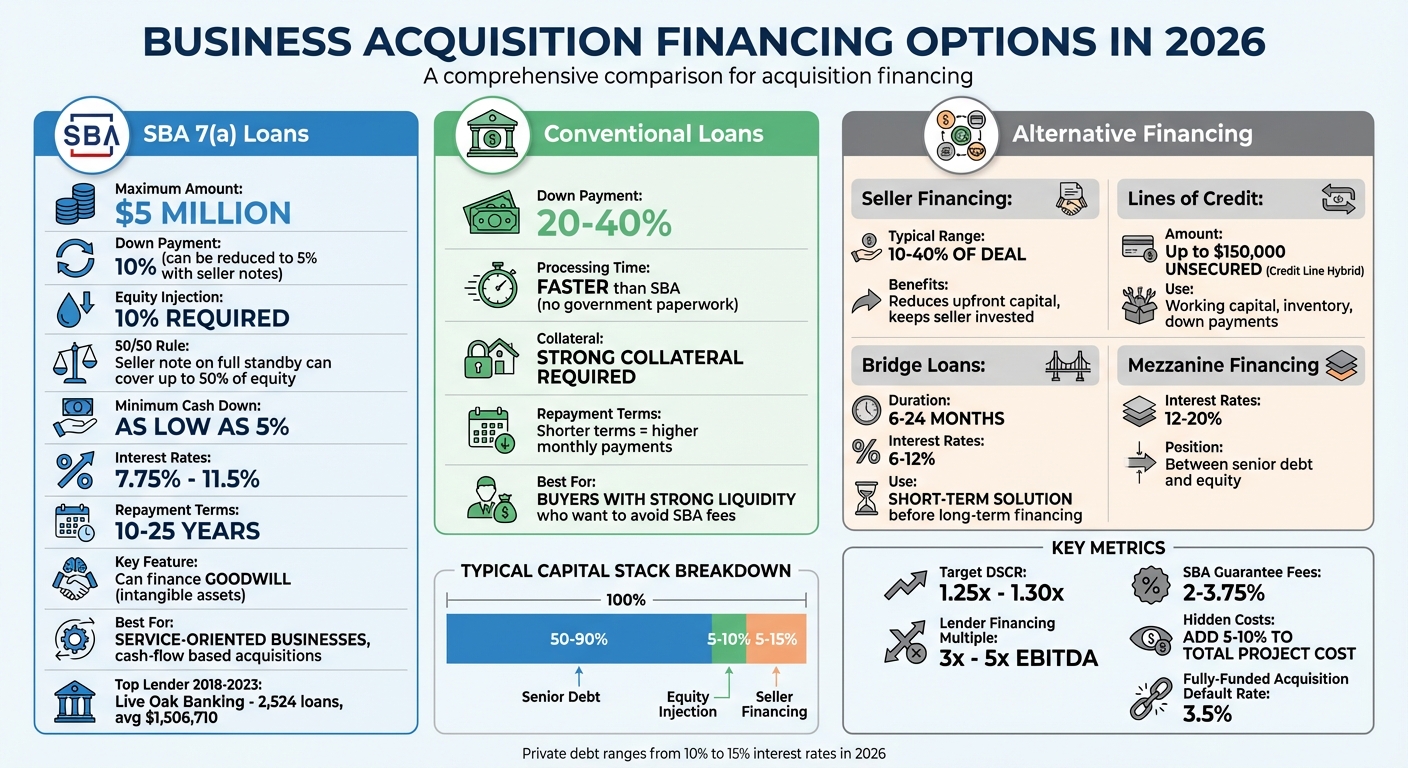

Business acquisition financing in 2026 offers a range of tools to help buyers purchase established businesses without depleting personal savings. With Baby Boomers retiring at a rate of 10,000 per day, the market is flooded with opportunities. SBA loans, seller financing, and hybrid funding models are leading options, while technology platforms like Clearly Acquired simplify the process. Key points to know:

- SBA 7(a) Loans: Up to $5 million, 10% down payment (can be reduced to 5% with seller notes), long repayment terms.

- Hybrid Models: Combine SBA loans, seller notes, and minimal buyer equity to lower upfront costs.

- Interest Rates in 2026: Stabilized between 7.75% and 11.5% for SBA loans; private debt ranges from 10% to 15%.

- Capital Stack: A mix of senior debt (50–90%), equity injection (5–10%), and seller financing (5–15%) ensures manageable debt service.

To succeed, buyers should plan for a DSCR of 1.25x–1.30x, maintain liquidity for post-acquisition needs, and leverage technology for faster lender matching and financial analysis. This guide outlines the options, trends, and strategies to navigate business acquisitions effectively in 2026.

The Ultimate Guide to SBA Acquisition Financing [Comprehensive 2025]

sbb-itb-a3ef7c1

Financing Options for Business Acquisitions

Business Acquisition Financing Options Comparison 2026

In 2026, buyers have access to a variety of financing tools tailored to different acquisition needs. These options reflect the evolving landscape of SMB acquisition financing. The right approach depends on factors like deal size, the buyer's financial situation, and the cash flow profile of the business being acquired. By understanding the pros and cons of each option, buyers can structure financing to minimize upfront costs while increasing the chances of a successful deal.

SBA 7(a) and SBA 504 Loans for Acquisitions

The SBA 7(a) loan remains a cornerstone for financing business acquisitions. One of its standout features is its ability to finance goodwill - the intangible value of a business that goes beyond physical assets. This makes it especially useful for service-oriented businesses, where much of the value lies in customer relationships, brand reputation, and operational systems. With a maximum loan amount of $5 million, the 7(a) program can cover the purchase price, working capital, equipment, and even refinance existing debt.

A key requirement for SBA 7(a) loans is a 10% equity injection, but there’s room for creativity here. For instance, a seller note on full standby - meaning no payments on principal or interest during the SBA loan's term - can count for up to 50% of the required equity. This setup allows some deals to close with as little as 5% cash down: 5% from the buyer and 5% from a seller note. This flexibility significantly reduces the upfront cash burden. Between 2018 and 2023, Live Oak Banking Company led the way in SBA lending for acquisitions, approving 2,524 loans with an average loan size of $1,506,710. In niche sectors like car washes, Metro City Bank approved 32 loans with an average loan size of $3,436,578.

"Seller debt may not be considered as part of the equity injection unless it is on full standby for the life of the SBA loan and it does not exceed half of the required equity injection." – Douglas Adams, VP of SBA Lending, Comerica Bank

The SBA 504 loan, while less common for acquisitions, works well for businesses with significant real estate or equipment. It offers long-term, fixed-rate financing for these assets, often with lower down payments compared to conventional loans. However, since it doesn’t cover goodwill, it’s not ideal for service-based businesses.

For buyers exploring options beyond SBA loans, conventional loans and credit lines provide additional flexibility.

Conventional Loans and Lines of Credit

Conventional loans from traditional banks are a faster alternative to SBA loans, as they skip the government paperwork. However, they come with steeper requirements, often needing 20–40% down and strong collateral. They also have shorter repayment terms, which can mean higher monthly payments.

Lines of credit are another flexible option, especially for post-acquisition needs like working capital, inventory, or even covering down payments on other financing. Some programs, like Credit Line Hybrid, offer up to $150,000 in unsecured financing. For businesses with fluctuating revenue, fintech providers offer revenue-based financing, where repayments are tied to daily sales, providing a more adaptable repayment structure.

Conventional loans are best suited for buyers with strong liquidity who want to avoid the fees and paperwork tied to SBA loans. On the other hand, lines of credit are ideal for managing cash flow gaps or meeting equity injection requirements for other financing options.

While these traditional tools address immediate funding needs, alternative financing methods can further reduce upfront costs and align seller interests.

Alternative Financing: Seller Notes, Earnouts, and Equipment Loans

Seller financing is a popular way to lower upfront capital requirements. Most sellers are open to financing 10–40% of a deal. This arrangement not only eases the buyer's cash burden but also keeps the seller financially invested in the business’s success post-closing, ensuring a smoother transition.

Earnouts are another option, tying part of the purchase price to future performance milestones. This is particularly helpful when buyers and sellers have differing views on the business’s valuation. However, earnouts are not allowed in SBA 7(a) transactions.

"Earnouts are not allowed in SBA 7(a) loan transactions. SBA requires that the full purchase price be determined and documented at closing, without future performance-based adjustments." – Pioneer Capital Advisory

For businesses with significant physical assets, equipment and inventory loans can be a practical choice. These loans use physical assets as collateral, making them easier to secure than financing tied to goodwill. However, they typically cover only a portion of the purchase price, requiring additional seller notes or personal collateral for intangible assets.

Bridge loans offer another short-term solution for buyers who need to close quickly before securing long-term financing. These loans usually last 6 to 24 months and come with interest rates between 6% and 12%. While more expensive, they’re useful in competitive situations where speed is critical.

How to Structure Your Capital Stack

A capital stack is essentially the mix of funding sources you use to cover the purchase price, closing costs, and working capital. It typically includes senior debt, buyer equity, and seller financing. Getting this combination right is essential - not just to close the deal, but also to set your business up for long-term success.

Matching Financing to Your Acquisition Needs

Each funding tool works best with specific types of assets. For example, SBA 7(a) loans are ideal for cash-flow-based intangibles, while asset-based lending (ABL) is better suited for physical assets.

"SBA 7(a) loans are fundamentally cash-flow loans - lenders focus more on DSCR and business performance than on fully collateralizing the entire loan amount." – Pioneer Capital Advisory

Here’s how the main components of a capital stack typically break down:

- Senior debt: This usually covers 50% to 90% of the purchase price. For small to medium-sized business (SMB) acquisitions, senior debt often comes in the form of an SBA 7(a) loan (up to $5 million) or a conventional bank loan.

- Equity injection: This is your cash down payment, which is generally around 10% for SBA deals. However, using a seller note on full standby can reduce the cash you need upfront.

- Seller financing: Often filling 5% to 15% of the deal, seller financing can help bridge valuation gaps and shows the seller’s confidence in the business.

If the combination of senior debt and equity doesn’t cover everything, mezzanine financing can step in. This type of financing sits between senior debt and equity, typically with interest rates ranging from 12% to 20%. It’s a useful tool when you want to avoid giving up more ownership. Lenders generally finance acquisitions at 3× to 5× EBITDA, depending on the stability of the business's cash flow.

Once you’ve matched the right financing tools to your needs, the next step is creating a clear funding strategy.

Steps to Build Your Funding Roadmap

After aligning your financing tools, it’s time to map out your funding roadmap. Start with a detailed breakdown of all costs: the purchase price, closing costs (like legal fees, due diligence, and broker fees), and working capital for the first 6 to 12 months. Make sure to keep some reserves for post-acquisition expenses instead of using all the funds at closing.

Next, take a close look at your debt service coverage ratio (DSCR). Aim for a DSCR between 1.25× and 1.30× by dividing your annual net operating income by total debt payments. If you’re falling short, consider increasing your equity injection or renegotiating loan terms.

It’s smart to engage with lenders early - even before you’ve identified a target business. This helps you establish a realistic budget and understand any industry-specific loan covenants. To make the process smoother, prepare a lender-ready package that includes your resume, the target’s historical financials, a quality-of-earnings report, and pro forma projections showing how the combined entity will perform. Comparing multiple term sheets can also help you evaluate rates, fees, and the likelihood of execution.

Finally, structure seller notes on full standby, meaning no principal or interest payments are due while the SBA loan is active. Also, plan for a working capital bridge or revolving credit line to handle operational expenses during your first year.

Using Technology and Clearly Acquired for Financing

In 2026, securing acquisition financing has become more efficient and less reliant on the mountains of paperwork and unpredictable bank approvals of the past. Thanks to modern technology, buyers can now connect with capital in ways that are faster and more precise. At the forefront of this shift is Clearly Acquired, a platform designed to simplify and streamline the financing process.

How Clearly Acquired Makes Financing Easier

Clearly Acquired uses AI to match buyers with lenders whose criteria align with the specifics of their deal - whether it’s the size, industry, or risk profile. This targeted approach eliminates the need for generic applications, saving time and improving the chances of approval. The platform also integrates with Plaid to offer real-time pre-qualification, allowing buyers to quickly assess their financial eligibility using up-to-date data.

Once matched with a lender, Clearly Acquired provides comprehensive support throughout the financing process. From structuring the capital stack to meeting closing requirements, the platform ensures buyers have access to various financing options, including SBA loans and other financing options, conventional credit, bridge loans, equipment loans, and lines of credit up to $5 million. Buyers can benefit from terms like up to 90% loan-to-value for qualified acquisitions, with some deals approved in as little as 45 days. For those needing faster solutions, bridge loans can be funded in just 7 days.

Additionally, the platform's "Get Verified" feature helps buyers establish credibility early on, making it easier to gain trust from both sellers and lenders. This seamless integration into the financing process reflects how acquisition financing has evolved by 2026.

Using AI Tools to Strengthen Deal Strategies

Clearly Acquired doesn’t stop at connecting buyers with lenders - it also provides tools to improve deal outcomes. The platform’s AI-driven valuation tools analyze historical financials, industry benchmarks, and market trends to deliver accurate, data-based valuations. This ensures buyers have a solid understanding of the deal's value.

Moreover, its financial analysis tools allow buyers to stress-test their financing structures. By simulating various deal scenarios, adjusting equity requirements, and refining seller terms, buyers can approach negotiations as well-prepared and competitive participants. These features not only enhance decision-making but also position buyers as serious contenders in the market.

Preparing for Risks and Challenges in 2026

When it comes to acquisitions in 2026, even the best financing structures can't shield you from every challenge. Addressing potential risks with diversified funding and early lender engagement is key to navigating the unexpected. A common stumbling block is financial overextension - some buyers fixate on the 10% down payment and forget about other essential costs like closing fees, working capital, and post-acquisition reserves. Deals with a Debt Service Coverage Ratio (DSCR) close to the 1.15x minimum are especially vulnerable; if cash flow dips, debt repayment becomes a serious issue. Lenders generally prefer a DSCR between 1.25x and 1.30x to provide a buffer. These risks underscore the importance of a well-rounded financing strategy.

Diversifying Your Funding Sources

Relying on just one financing source can leave you exposed. Instead, consider a hybrid capital stack that blends senior debt (like SBA or conventional loans), seller financing, equity, and other options. For example, customized seller financing and diversified funding can ease upfront cash demands. Performance-based earnouts are another tool, reducing the need for immediate financing while aligning the seller’s goals with your success after the acquisition. Bridge loans can also be useful for closing gaps while securing long-term SBA financing.

Building Lender Relationships Early

Engaging lenders early - ideally during your search phase or immediately after signing a Letter of Intent (LOI) - can save you time and expand your options. Waiting too long can lead to delays or limit your choices. Reach out to a mix of lenders, including banks, non-banks, and SBA-preferred institutions, to compare terms like interest rates, fees, and covenants. To streamline the process, prepare a lender package with your resume, business overview, financials from the last three years, tax returns, and pro forma projections. Early discussions help you gauge your actual purchasing power and set realistic expectations. Building strong lender relationships also complements maintaining liquidity, both of which are critical for managing risks post-acquisition.

Maintaining Cash Reserves and Flexibility

One of the biggest mistakes new owners make is depleting their cash reserves at closing, leaving them unprepared for integration costs or unexpected challenges. To avoid this, carefully model your cash needs, including working capital, closing costs, and a reserve to cover six to 12 months after the acquisition. Instead of exhausting all funds, keep a revolving credit line and adequate reserves to handle unforeseen expenses. Be mindful of restrictive covenants in traditional bank loans, which may require minimum cash balances or limit additional borrowing. Planning for these constraints ensures you have the financial flexibility to handle the critical transition period and beyond.

Conclusion: Key Takeaways for 2026 Acquisition Financing

Securing the right financing for a business acquisition in 2026 boils down to three main strategies: utilizing proven financing tools, crafting a balanced capital stack, and leveraging technology to streamline the process. SBA 7(a) loans remain a cornerstone for financing small and medium-sized business acquisitions, offering up to $5 million in funding with government guarantees. These loans allow for down payments as low as 10% and repayment terms ranging from 10 to 25 years. To minimize upfront cash requirements, the "50/50 rule" is a game-changer - by having a seller note on full standby, you can cover up to 50% of the required equity injection, reducing your out-of-pocket contribution to just 5%. This strategy helps preserve liquidity for working capital and reserves, which are critical during the transition period.

A well-structured capital stack typically includes 80–90% SBA financing, 5% buyer cash, and 5% seller notes on standby. This setup ensures manageable debt service while aligning the seller’s interests with the buyer’s success. Aim for a debt service coverage ratio (DSCR) of 1.25x–1.30x to comfortably handle loan payments. Don’t forget to account for hidden costs like SBA guarantee fees (2–3.75%), valuations ($1,500–$2,500), and legal expenses, which can add 5–10% to your total project cost. These considerations highlight the importance of a carefully planned capital stack in maintaining both liquidity and long-term financial stability.

On top of traditional financing structures, technology is reshaping how deals are executed. Tools like Clearly Acquired are revolutionizing the process by using AI for price discovery, Plaid for identity verification, and specialized lender networks to efficiently match buyers with financing options. Getting "Clearly Verified" early in the process can give you an edge with brokers and sellers. Additionally, automated financial analysis tools can quickly calculate SBA loan scenarios and flag potential issues in profit and loss statements.

"In 2026, business-acquisition underwriting increasingly considers digital infrastructure and sustainability risks." – Chad Otar, CEO of Lending Valley

Fully-funded small business acquisitions have a default rate of just 3.5%. With over 10,000 Baby Boomers retiring daily, the pool of established businesses available for purchase continues to expand. By combining SBA financing, seller notes, and cutting-edge technology, you can confidently navigate acquisitions in 2026. This modern approach - one that blends traditional financing methods with innovative tools and strategies - offers a clear path to closing deals with the ideal debt-to-equity balance.

FAQs

What are the main advantages of using an SBA 7(a) loan for buying a business in 2026?

SBA 7(a) loans bring several key benefits for business acquisitions in 2026. Backed by the U.S. Small Business Administration, these loans come with government guarantees that reduce the risk for lenders. This makes it easier for qualified buyers to secure funding with attractive terms, such as lower down payments - typically around 10% - and extended repayment periods. These features can help businesses maintain healthier cash flow.

Another advantage is the versatility of SBA 7(a) loans. Borrowers can use the funds for a variety of purposes, including purchasing real estate, acquiring equipment, or even refinancing existing debt. Plus, the competitive interest rates and longer repayment timelines can help reduce the overall cost of financing. This makes SBA 7(a) loans a practical option for small business acquisitions and building a foundation for future growth.

How does Clearly Acquired make business acquisition financing easier?

Clearly Acquired takes the hassle out of business acquisition financing by making the process smoother and more efficient. From securing loans to structuring deals, the platform provides tools that simplify every step. It’s particularly helpful when dealing with complex documentation, like SBA loan requirements, by offering features to help users organize and verify the necessary paperwork.

The platform connects buyers with a wide network of lenders, including traditional banks and alternative financing sources, giving users access to more options and quicker approvals. What sets Clearly Acquired apart is its use of AI-powered tools to automate underwriting and deal structuring. This reduces the need for manual work and helps avoid unnecessary delays. With these tools, users can handle compliance, lender negotiations, and funding decisions more easily, turning what’s often a stressful process into a more manageable and streamlined experience.

What are the best ways to lower upfront costs when financing a business acquisition?

Minimizing upfront costs when financing a business acquisition requires thoughtful planning and smart deal-making. One popular approach is seller financing, where the seller agrees to let you pay a portion of the purchase price over time. This arrangement can significantly reduce the amount of cash you need right away.

Another option to consider is using SBA 7(a) loans. These loans come with perks like smaller down payments and longer repayment periods, which can make managing the initial costs more feasible.

You might also look into deal structures that combine debt and equity. This approach spreads out financial responsibilities over time, easing reliance on large upfront payments. For even more flexibility, options like leveraged buyouts or mezzanine financing can help preserve cash for running the business after the purchase.

By tailoring these strategies to fit your financial position and the specific details of the deal, you can make the process of acquiring a business much more manageable from the start.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)