A search fund pitch deck is your main tool to attract investors for acquiring and running an established business. Unlike startup decks, this focuses on buying existing companies - typically with $2–$10 million in revenue. Investors expect a clear structure, including your investment thesis, financial projections, team credentials, market analysis, and value creation strategies. Key metrics include EBITDA ($1–$5 million), MOIC (3–5x), and IRR (25–40%). Deals often involve 50–60% debt financing (e.g., SBA 7(a) loans) and 40–50% equity.

Key Slides Include:

- Title and Executive Summary: Fund name, contact info, investment thesis, target profile, and key merits.

- Investment Thesis and Criteria: Targeted industries, financial benchmarks, and acquisition strategy.

- Team Background: Relevant experience, advisors, and roles.

- Market Analysis: Trends, TAM/SAM/SOM, and competitive landscape.

- Financials and Value Creation: Deal structure, ROI strategies (pricing, efficiencies, acquisitions), and exit plans.

Pro Tip: Keep it concise (10–15 slides), use clear visuals, and focus on showing how you'll deliver strong returns.

Crafting the Perfect Search Fund Pitch for Investors

Required Slides for Your Pitch Deck

When crafting your pitch deck, every slide matters. Investors typically spend no more than five minutes reviewing a deck, so it’s crucial to create a clear, concise, and engaging structure. The first few slides are especially important - they set the tone and determine whether investors will dig deeper or move on.

Title and Executive Summary

The title slide is your introduction. It should include your fund name, your full name and title (e.g., "Principal, Search Fund"), and your contact details (email and mobile number). Add your base location and the presentation date, all formatted in standard U.S. style. To grab attention, include a short tagline summarizing your search focus, such as: "Acquiring a $3–10M EBITDA B2B Services Company in the U.S." Don’t forget your fund logo and a brief confidentiality statement. Keep the design simple and professional, with a clean layout and legible fonts (24–32 pt) to make it easy to read at a glance.

The Executive Summary slide acts as a one-page memo with 4–6 key sections. Start with your investment thesis in one sentence, such as: "Acquire and grow a recurring-revenue, non-cyclical B2B services company with durable margins and low customer concentration in the U.S. Sunbelt." Follow this with a target profile snapshot, including revenue and EBITDA ranges (e.g., "$5–$30M revenue; $1–$5M EBITDA"), industry focus (e.g., "mission-critical B2B services"), and geographic preferences (e.g., "continental U.S., with a focus on the Southeast and Midwest").

Next, outline your search model and structure, specifying whether it’s self-funded or traditional, the expected search duration (e.g., 18–24 months), and how many targets you aim to review monthly. Include a returns overview with target IRR (e.g., 20–30%+), MOIC (e.g., 3–5x), and your typical holding period (5–7 years), clearly labeled as hypothetical. Wrap up with 3–5 key merits of your strategy, such as favorable demographics, seller succession trends, industry fragmentation, or your personal fit for the role.

From here, expand on your investment thesis and target criteria to solidify your case.

Investment Thesis and Target Criteria

The Investment Thesis slide should open with a strong statement about the kind of business you’re targeting, why it’s compelling, and how you plan to add value. For example: "Roll-up of owner-operated industrial maintenance firms in fragmented regional markets, leveraging seller succession and professionalizing operations." Highlight 2–4 key dynamics in the U.S. small-to-medium business (SMB) market that make this opportunity attractive. Include a section on your searcher edge, detailing specific advantages like prior operating experience, established lender relationships, or access to a robust sourcing network.

On the Target Acquisition Criteria slide, use a table or bullet points to present clear and focused parameters:

- Financial: Specify revenue ($5–$30 million), EBITDA ($1–$5 million), minimum EBITDA margin (15–25%+), and preference for strong free cash flow conversion.

- Business model: Highlight recurring revenue, low cyclicality, diversified customer base, low customer concentration (e.g., no single customer accounting for over 15% of revenue), and limited capital expenditure needs.

- Industry: List target sectors like B2B services, healthcare services, or facilities services, and state any exclusions (e.g., early-stage tech, heavily regulated clinical care, or commodity manufacturing).

- Geography: Focus on U.S.-based opportunities, with any regional preferences (e.g., Eastern U.S. or regions with time-zone compatibility).

- Deal characteristics: Emphasize majority control acquisitions (70–100% ownership), sellers willing to transition, stable or growing performance, and clean legal/compliance records.

Clear, bold labels and consistent formatting make it easy for investors to quickly assess your focus and discipline.

Finally, introduce your team to establish your ability to execute this strategy.

Team and Searcher Background

The searcher section should highlight your name, current role, and a brief positioning statement, such as: "Former operations leader in multi-unit services, focused on scaling U.S. SMBs." Include your education (e.g., "MBA, top-25 U.S. business school") in a standard resume format and list 3–5 relevant skills like P&L ownership, team leadership, sales, business development, process improvement, or M&A experience. If you’ve worked on acquisitions, integrations, or operational turnarounds in small or mid-sized businesses, make sure to emphasize that. Add a professional headshot and logos of key employers or schools. Organize the content into two columns - one for the photo and highlights, the other for your bio - so investors can scan it quickly.

Present your advisors, mentors, and operating partners in a compact grid. For each person, include their name, title, a one-line credential (e.g., "Former CEO of $100M industrial services roll-up; 3 successful exits"), and their role in your search (e.g., investment committee, industry advisor, or board candidate). Focus on 3–6 individuals with directly relevant experience, such as U.S. SMB acquisitions, search funds, SBA-backed deals, or expertise in your target industries. Adding recognizable company logos and specifying engagement levels (e.g., "Monthly check-ins and deal reviews") can reinforce their active involvement and credibility.

Market Analysis and Industry Focus

Show that your target market offers steady growth and dependable returns. This analysis will shape the key slides in your deck, focusing on industry trends and competitive positioning. Investors need to see that you grasp the market’s size, structure, and key dynamics - and that you’ve chosen a sector where a well-run business can thrive over time.

Market Overview and Industry Trends

Start your Market Overview slide with a clear statement of the Total Addressable Market (TAM) in U.S. dollars, backed by reliable sources like IBISWorld, the Bureau of Labor Statistics, or industry trade groups. For instance, you could write: "$4.5 billion U.S. specialty dental lab services market, growing at 5.2% CAGR from 2018 to 2028." Always use recent, well-sourced data - investors will quickly dismiss outdated or unsupported numbers. Narrow down to your Serviceable Available Market (SAM) by focusing on businesses within a specific revenue range, such as $1–$20 million. If you can, estimate your Serviceable Obtainable Market (SOM) to highlight realistic acquisition opportunities and reinforce your investment thesis.

Connect these figures to two to four long-term U.S. trends driving demand. Examples include an aging population boosting healthcare needs, regulatory complexity encouraging outsourcing, or reshoring creating new opportunities in manufacturing services. According to the Stanford Graduate School of Business 2022 Search Fund Study, successful acquisitions often focus on B2B services, niche manufacturing, healthcare services, and specialty distribution - industries known for stable demand and consistent revenue growth (typically mid-single to low double-digit percentages annually). Use a bar chart or line graph to show historical performance through at least one economic downturn, such as 2008–2009 or 2020, and label all figures in U.S. dollars with clear date ranges (e.g., 2019–2024).

Tie these trends back to your target company’s ability to sustain both revenue and margin growth. For instance, if you’re targeting mission-critical B2B services, emphasize how demand stems from essential regulatory or operational needs rather than passing market trends. Similarly, if your niche benefits from recurring contracts or subscription models, highlight this as a driver of steady growth.

These insights lay the groundwork for understanding the fragmented competitive landscape your target company operates within.

Competitive Landscape

Your Competitive Landscape slide should break down the industry structure and explain why a search-backed buyer can succeed. Start by quantifying fragmentation: How many firms operate in the U.S.? What percentage of market revenue is controlled by the top 5–10 players? For example, you might state: "Over 5,000 independent operators nationwide; top 10 players control less than 15% of U.S. market revenue." Search fund success often comes from targeting fragmented industries where top players hold less than 10% of the market share, leaving room for consolidation.

Identify two to six primary competitor types - such as local independents, regional chains, national players, or substitutes like software or DIY solutions - and use a positioning matrix (e.g., price vs. service level) to outline each type’s strengths and weaknesses. Highlight key factors like pricing power, customer relationships, specialized labor, proprietary processes, or high switching costs. If the industry has significant regulatory barriers (e.g., licensing or certifications), note how these create advantages for established players and challenges for new entrants.

Include typical EBITDA margin ranges for the industry and compare them to your target. For instance: "Sub-$5 million revenue operators typically run at 8–10% EBITDA, while scaled platforms achieve 18–20% through shared overhead and pricing discipline.". If your strategy includes a roll-up or professionalization approach, explain how fragmentation supports your plan. For example, you could describe acquiring a platform business and pursuing add-on acquisitions, centralizing back-office operations, implementing professionalized sales processes, or optimizing pricing to achieve economies of scale.

Finally, address competitive risks, such as the potential entry of a private equity-backed roll-up, and explain how your target’s niche focus, established local relationships, or operational density can help defend its position. Investors want to see a clear strategy to maintain and strengthen your competitive edge.

sbb-itb-a3ef7c1

Financials, Deal Economics, and Value Creation

Search Fund Deal Economics and Returns Overview

Investors need a clear picture of how your deal will generate returns. This section builds on earlier discussions about market opportunities, competitive positioning, and team strengths, diving into the financial mechanics and strategies that drive value creation in your acquisition.

Example Deal Economics

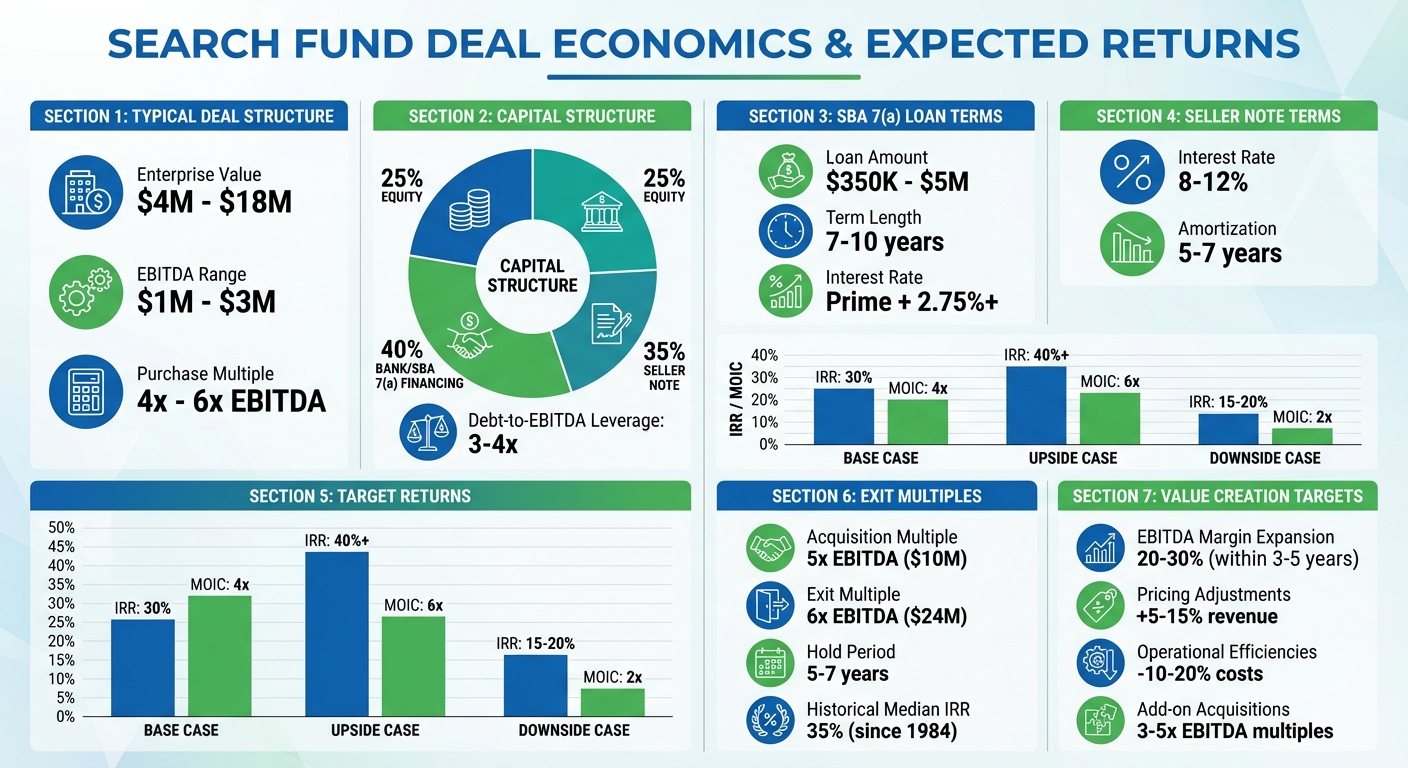

Begin with a Deal Economics slide that lays out the acquisition structure. Most search fund acquisitions focus on businesses with EBITDA between $1,000,000 and $3,000,000, typically purchased at 4x–6x EBITDA multiples. This translates to enterprise values ranging from $4,000,000 to $18,000,000.

A typical capital structure might include 25% equity, 40% bank/SBA 7(a) financing, and 35% seller note. SBA 7(a) loans generally range from $350,000 to $5,000,000, with 7–10 year terms at interest rates of prime plus 2.75% or more. Seller notes, on the other hand, often carry interest rates of 8–12% and amortization schedules of 5–7 years. This setup keeps debt-to-EBITDA leverage at a manageable 3–4x, reducing the equity burden for investors.

Your slide should also include a sources and uses table, breaking down how funds are allocated - covering the purchase price, working capital, fees, and initial improvements. Tools like Clearly Acquired can streamline this process by connecting you with lenders for SBA 7(a), SBA 504, and commercial loans. Their AI-driven loan brokerage services can also help verify deal flow and optimize your capital stack planning.

Value Creation Methods

Focus on 2–4 actionable strategies to grow EBITDA and enterprise value, aiming for 20–30% EBITDA margin expansion within 3–5 years.

- Pricing adjustments are often the quickest way to boost margins. If the target business hasn’t updated its pricing in years or lacks a dynamic pricing strategy, implementing these changes can lead to a 5–15% revenue increase without additional costs. For example, a 10% price hike on half of the offerings in an $8,000,000 revenue business with 20% gross margins could add $80,000 to EBITDA.

- Operational efficiencies can cut costs by 10–20%. This might include optimizing the supply chain, adopting new technology, or professionalizing management systems. For instance, reducing operating expenses by 12% on $1.8M EBITDA could add $216,000, significantly improving margins.

- Add-on acquisitions offer another growth path. In fragmented industries, acquiring smaller businesses at 3–5x EBITDA multiples - often lower than the initial acquisition multiple - can boost revenue and create economies of scale. For example, if your platform generates $2,400,000 in EBITDA after initial improvements, and you add two bolt-on acquisitions contributing $500,000 each, you could position the business for a higher exit multiple due to increased size and market presence.

Once these improvements are in place, you’ll be better positioned for a lucrative exit.

Exit Strategies and Investor Returns

Use your operational and acquisition strategies to present target metrics: 25–35% IRR and 3–5x MOIC (Multiple on Invested Capital) over a 5–7 year hold period. Include projections for different scenarios: a base case (30% IRR, 4x MOIC), an upside case (40%+ IRR, 6x MOIC with aggressive growth), and a downside case (15–20% IRR, 2x MOIC with conservative exits).

The most common exit route is a strategic sale to a corporate buyer, which accounts for 50–70% of search fund exits and typically achieves 5–7x EBITDA multiples. Corporate buyers often pay premiums for businesses that align with their expansion goals, add new capabilities, or open access to fresh customer segments. For instance, acquiring a business at $10,000,000 (5x $2,000,000 EBITDA) and growing EBITDA to $4,000,000 within five years could result in a 6x exit, yielding $24,000,000. This would deliver approximately 35% IRR and 3.2x MOIC for equity investors.

Alternative exit options include financial sponsor recapitalizations (selling to private equity firms pursuing roll-up strategies) or ESOP/management buyouts. Whatever the exit path, include a waterfall chart to illustrate how proceeds are distributed among debt holders, equity investors, and management. This transparency shows that your structure aligns incentives and offers competitive returns, matching the 32% net IRR historical average for search funds.

Tools and Resources for Search Funds

Running a successful search fund takes more than just a solid investment strategy and a skilled team. To stand out, you need the right tools and infrastructure to find deals, evaluate opportunities, and secure financing efficiently. Highlighting these resources in your pitch deck shows investors that you have a structured, scalable approach that aligns with their expectations.

Deal Sourcing and Verification

In the past, search funds often relied on personal networks and cold outreach to identify acquisition targets. Today, tools like Clearly Acquired have revolutionized this process. This AI-powered platform aggregates over 100,000 verified public listings from more than 100 marketplaces, 430 direct broker listings, and data on 200 million off-market businesses. By incorporating automated NDAs and AI-driven data rooms, you can manage sensitive information with ease, streamlining the process of screening, underwriting, and processing deals.

This tech-enabled approach not only saves time but also ensures you focus on opportunities that match your investment criteria. Additionally, building strong relationships with brokers remains essential. Brokers often favor buyers who present clear criteria, communicate promptly, and maintain consistency. By combining technology with strong broker connections, your sourcing strategy will reflect a disciplined and professional acquisition process.

Financing and Capital Solutions

After sourcing deals, securing the right financing becomes the next critical step. Clearly Acquired simplifies this by connecting searchers to a network of over 500 lenders, including banks, trusts, and private debt partners. This is particularly important in the U.S., where SBA 7(a) loans are a popular financing option thanks to their competitive terms. The platform also supports other financing options, such as SBA 504 loans, equipment financing, lines of credit, merchant cash advances, and equity injections.

With the help of expert advisors, you can prepare lender-ready packages before signing a Letter of Intent (LOI), ensuring you’re ready to secure the best terms quickly. Including this level of preparation in your pitch deck demonstrates a clear, actionable plan for closing deals efficiently and effectively.

Final Checklist

This checklist pulls together all the key elements discussed so far, helping you create a pitch deck that's clear, complete, and persuasive.

Key Takeaways

Your pitch deck needs to answer three critical questions: Why you? Why this deal? What returns? Investors want to see a clear investment thesis that highlights the market opportunity and your strategic vision, backed by strong financials with 3–5 year projections (covering revenue, EBITDA margins, and cash flow trends). Additionally, a well-defined target profile that outlines your industry focus and unique strengths is essential. Together, these components demonstrate a low-risk, high-reward opportunity. For context, search funds have delivered a median IRR of 35% for successful acquisitions since 1984.

Complete Pitch Deck Checklist

Make sure your pitch deck includes these essential sections:

-

Title and Executive Summary:

- Search fund name and a brief overview of the target company

- Key financial metrics (e.g., revenue, EBITDA, cash flow)

- Projected returns, including IRR and MOIC over five years

-

Investment Thesis and Target Criteria:

- Explanation of market trends and the opportunity they present

- Clear acquisition criteria and rationale behind the market focus

-

Team and Searcher Background:

- Relevant experience, qualifications, and bios for key team members

-

Market Analysis and Industry Focus:

- Market overview, including total market size (e.g., $500,000,000 TAM), growth potential, and segmentation

- Competitive landscape analysis with visuals like bar charts to illustrate market share and positioning

-

Financials, Deal Economics, and Value Creation:

- Details of deal economics, including your capitalization table and debt/equity structure

- Value creation strategies, such as operational improvements and new revenue streams

- Exit strategies with projected investor returns, supported by case studies

Keep your deck between 10–15 slides, with a clean and professional design. Use concise bullet points (ideally fewer than five per slide) and include visuals like charts and logos to make key metrics stand out. Test the flow to ensure your presentation builds investor confidence from start to finish.

FAQs

How is a search fund pitch deck different from a startup pitch deck?

A search fund pitch deck is crafted to win over investors by presenting a clear plan to purchase an established business. It typically covers essential aspects like market analysis, financial forecasts, the unique value of the target business, and the qualifications of the team leading the effort.

On the other hand, a startup pitch deck is all about securing funding to build a brand-new business. It emphasizes the product or service being developed, the market opportunity, any early signs of success, and the potential for future growth, alongside showcasing the team’s expertise.

The main difference between the two lies in their focus: one aims to acquire an existing business, while the other is centered on launching something entirely new.

What are the key slides to include in a search fund pitch deck to attract investors?

To craft a search fund pitch deck that grabs investors' attention, focus on including critical slides that clearly outline your strategy and value. These should address:

- Market Analysis: Present the size of the opportunity, key trends, and the competitive landscape.

- Financials: Share realistic projections, funding needs, and potential returns.

- Team Overview: Highlight your team’s expertise, relevant skills, and what sets you apart in achieving success.

Keep the deck straightforward, visually engaging, and backed by solid data. Show how you plan to identify top-notch deals and execute your strategy with precision. Investors prioritize clarity and preparation, so make sure your deck reflects a detailed plan, achievable financial targets, and a strong market opportunity.

What financial metrics and strategies should be included in a search fund pitch deck?

When putting together a search fund pitch deck, it's important to showcase critical financial metrics like revenue, EBITDA, net income, cash flow, and profit margins. These numbers paint a clear picture of the company's financial stability and growth potential.

You should also highlight scalable financial models, strategic growth plans, and cost management approaches. This shows your commitment to boosting profitability and building lasting value for investors.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)