Buying a roofing business? SBA loans might be your best bet. Here's why:

- Lower Down Payments: SBA loans require as little as 10% down, compared to 20%-30% for conventional loans.

- Flexible Financing: They cover up to 90% of costs, including equipment, inventory, and working capital.

- Longer Terms: Repayment terms can stretch up to 25 years, reducing monthly payments.

- Seller Financing Options: Sellers can contribute 5% of the purchase price, easing your upfront costs.

- Smaller Default Rates: Fully-funded acquisitions have a low 3.5% default rate, compared to startups' 90% failure rate.

With retiring Baby Boomers selling profitable businesses, SBA loans make it easier to buy into a stable roofing company. Whether you're a first-time buyer or expanding your business, SBA loans provide the financial support to make it happen.

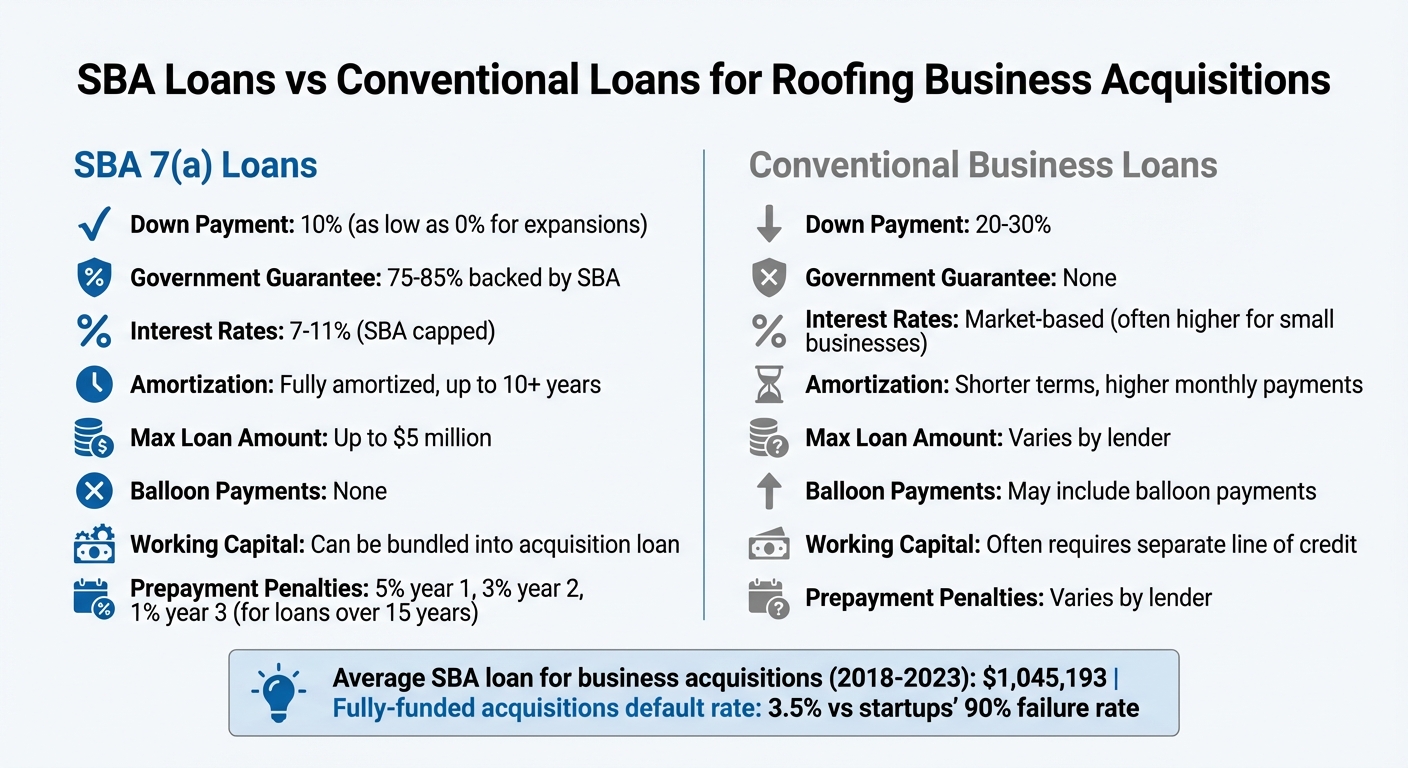

SBA Loans vs Conventional Loans for Roofing Business Acquisitions

Why SBA Loans Work Well for Roofing Business Buyers

Better Loan Terms for Small Business Buyers

SBA loans help qualified entrepreneurs overcome financial hurdles when acquiring roofing businesses. Unlike conventional lenders that typically require 20% to 30% down payments, SBA loans often need only a 0% to 10% equity injection for most ownership transitions.

With a federal guarantee of up to 85%, SBA loans reduce lender risk, making it easier for buyers to secure funding even if they don’t meet the strict criteria of traditional commercial loans. As First Business Bank explains:

"The SBA guarantee reduces some risk, but lenders still need to ensure the deal is sound".

SBA loans also stand out with longer amortization periods, which translate to smaller monthly payments. This flexibility is especially helpful in the roofing industry, where seasonal cash flow variations are common. Plus, SBA loans are fully amortized, meaning no balloon payments are due at the end of the term. Between 2018 and 2023, the average SBA loan for business acquisitions was $1,045,193. These terms make SBA loans a great fit for the cash flow needs of roofing businesses.

| Feature | SBA 7(a) Loan | Conventional Business Loan |

|---|---|---|

| Down Payment | 0% – 10% | 20% – 30% |

| Amortization | Longer periods, smaller payments | Shorter periods, higher payments |

| Government Guarantee | Up to 85% | None |

These features significantly reduce upfront costs and provide payment structures that align with the operational realities of roofing businesses.

How SBA Loans Support Roofing Business Needs

Beyond favorable terms, SBA loans address the specific funding needs of roofing businesses. These businesses often require capital for equipment, vehicles, inventory, and working capital to manage seasonal fluctuations. SBA loans can cover up to 90% of total project costs, including the purchase price, equipment, and funds needed for a smooth ownership transition. This ensures the business can continue running effectively during the handover.

For current roofing business owners looking to expand, the options are even better. If you’re acquiring another roofing company with the same 6-digit NAICS code within your area, you may qualify for 100% financing with $0 down. This allows experienced operators to grow their businesses without tapping into their cash reserves.

Another advantage is the SBA’s flexibility with seller financing, which can count toward the equity injection requirement. By structuring seller notes on full standby for the loan’s duration, buyers can preserve their working capital while meeting the equity requirements for the loan. This makes the transition smoother and keeps the business financially stable during the change in ownership.

sbb-itb-a3ef7c1

The TRUTH About SBA Loans & Business Acquisition #13

Types of SBA Loans for Roofing Business Acquisitions

When you're looking to buy a roofing business, two SBA loan programs stand out: the 7(a) loan and the 504 loan. Picking the right one can make a big difference in terms of both time and money.

Here's a closer look at each option.

SBA 7(a) Loans for Buying Roofing Businesses

The SBA 7(a) loan is a flexible choice that covers the entire acquisition process. This includes not just tangible assets like equipment and inventory but also intangible ones like goodwill, which might include customer relationships and brand reputation. Because of this versatility, it’s often the go-to option for many buyers.

Beyond covering the purchase price, 7(a) loans can also handle additional expenses like closing costs, SBA guaranty fees, and even franchise transfer fees. Loan terms depend on what you’re financing - up to 25 years for real estate and up to 10 years for business assets or equipment. Interest rates generally fall between 7% and 11%, and the SBA guarantees a significant portion of the loan: 85% for amounts up to $150,000 and 75% for loans above that threshold.

SBA 504 Loans for Real Estate and Equipment

The SBA 504 loan is specifically designed for long-term investments in fixed assets. It’s a great fit if your roofing business acquisition involves buying a warehouse, office space, or heavy-duty machinery like cranes or specialized vehicles. However, unlike the 7(a) loan, the 504 loan cannot be used for working capital or inventory.

For businesses with a heavy emphasis on physical assets, the 504 loan offers some clear benefits. It typically requires a down payment of 10%–20%, which helps conserve cash for other needs. The loan can go up to $5.5 million, with fixed interest rates that are often lower than those of the 7(a) loan. Additionally, it can be used to refinance existing high-interest debt tied to fixed assets.

One key requirement to keep in mind: if you’re using either loan to purchase real estate, your roofing business must occupy at least 51% of the property.

Here’s a quick comparison to help you decide which loan might be a better fit for your needs:

| Feature | SBA 7(a) Loan | SBA 504 Loan |

|---|---|---|

| Primary Use | Business acquisition and working capital | Fixed assets (real estate, heavy equipment) |

| Max Loan Amount | Up to $5 million | Up to $5.5 million |

| Term (Real Estate) | Up to 25 years | 10, 20, or 25 years |

| Term (Equipment) | Up to 10 years | 10 years |

| Interest Rate | Variable (7%–11%) | Fixed (usually lower) |

| Flexibility | High (can cover operational costs) | Low (restricted to fixed assets) |

SBA Loan Eligibility Requirements

Getting approved for an SBA loan comes down to meeting specific criteria that can make your application process smoother and more straightforward.

Basic Requirements for SBA Loan Approval

Lenders will carefully evaluate your credit score and industry experience - key indicators of your financial responsibility and your ability to run a roofing business. While there’s no official minimum credit score, having a score above 700 can help you secure better interest rates and streamline approval. On the other hand, scores below 600 might raise concerns about financial risk. If you’ve faced credit challenges in the past, be prepared to provide a detailed explanation of how you resolved those issues.

Experience in roofing or construction management is another critical factor. Lenders want confidence that you understand the business you’re acquiring. Beyond your personal qualifications, the financial health of the roofing company itself plays a major role. A Debt Service Coverage Ratio (DSCR) of at least 1.25x is often required. This means the business must generate enough income to cover loan payments with a 25% buffer. By focusing on these industry-specific metrics, SBA standards align closely with the operational realities of roofing businesses.

"At a minimum, SBA considers an equity injection of at least 10 percent of the total project costs... to be necessary for such transactions."

– Douglas Adams, VP of SBA Lending, Comerica Bank

Collateral is another non-negotiable requirement. The SBA mandates that lenders secure a first-position lien on all assets being acquired. If the collateral doesn’t fully cover the loan, lenders may require a lien on real estate owned by personal guarantors with at least 25% equity in the business. Additionally, you’ll need to submit SBA Form 413 (Personal Financial Statement) and three years of personal federal tax returns to demonstrate your overall financial stability.

A useful strategy is to work with a broker to identify "add-backs" as part of your SBA business acquisition journey when calculating the business’s cash flow. Add-backs include one-time expenses or excessive owner benefits that can be excluded from the cash flow analysis, giving a clearer picture of the business’s profitability.

These requirements highlight why SBA loans often stand out compared to traditional financing options.

SBA Loans vs. Conventional Loans

SBA 7(a) and 504 loans come with several advantages over conventional loans, especially when it comes to down payments and government backing. Here’s a quick comparison:

| Feature | SBA 7(a) Loans | Conventional Loans |

|---|---|---|

| Down Payment | As low as 10% | Typically 20% to 30% |

| Government Guarantee | 75% to 85% guaranteed by SBA | No government guarantee |

| Interest Rates | Capped by SBA (usually 7%–11%) | Market-based; often higher for small businesses |

| Prepayment Penalties | 5% in year one, 3% in year two, 1% in year three for loans over 15 years | Varies by lender |

The government guarantee is a major benefit of SBA loans, as it reduces the risk for lenders. This makes SBA loans accessible to buyers who might not qualify for traditional financing. Ishan Jetley, Owner of GoSBA Loans, explains:

"The government provides guarantees of up to 85% for loans up to $150,000 and 75% for larger loans, which encourages lenders to work with small business buyers who might not qualify for conventional financing."

To qualify, the roofing business must meet basic SBA standards. It must operate as a for-profit entity in the U.S. If real estate is part of the purchase, the business must occupy at least 51% of the property. Additionally, SBA loans cannot be used for speculative investments, gambling-related operations, or rare coin dealerships.

How to Apply for SBA Financing

Once you’ve confirmed you meet the eligibility requirements, it’s time to tackle the application process. Getting your documents in order early can save you time and prevent unnecessary delays.

Preparing Your Documents and Financials

Applying for an SBA loan involves pulling together a lot of paperwork - both from you and the seller. Here’s what you’ll need to provide:

- Your Records: Three years of personal tax returns, W-2s, SBA Form 413 (Personal Financial Statement), a resume highlighting your roofing or construction experience, and 3–12 months of bank statements showing the source of your down payment.

- Seller’s Records: Three years of business tax returns, interim profit and loss statements, balance sheets, and aging reports for receivables and payables. These documents are crucial for lenders to evaluate the roofing company’s cash flow, especially given the seasonal ups and downs typical in the industry.

- Acquisition Documents: An executed Letter of Intent (LOI), a current business valuation, the purchase agreement, and, if applicable, a copy of the business lease.

- SBA Forms: Standard forms like Form 1919 (Borrower Information Form) and Form 148 (Unconditional Guarantee) are required. Also, if a single customer accounts for more than 20% of the company’s revenue, be ready to submit a report explaining this revenue concentration, as it’s seen as a potential risk by lenders.

Here’s a quick breakdown of the required documents:

| Document Category | Specific Items Required |

|---|---|

| Buyer Records | Personal tax returns (3 years), resume, SBA Form 413, and bank statements for down payment source |

| Seller Records | Business tax returns (3 years), interim profit and loss statements, balance sheets, and aging reports |

| Acquisition Documents | Letter of Intent (LOI), business valuation, purchase agreement, and lease agreement (if applicable) |

| SBA Forms | Form 1919, Form 148, and Form 159 (Fee Disclosure) |

Once your documents are ready, the next step is finding the right SBA lender.

Choosing an SBA Lender

Picking the right lender can make or break the process, especially when buying a roofing business. Look for an SBA Preferred Lending Partner (PLP) with experience in roofing or similar industries. These lenders are familiar with the unique challenges of seasonal cash flow and can speed up the underwriting process.

Michelle Orr, Vice President of Small Business Lending at Live Oak Bank, emphasizes the benefits of working with a PLP:

"PLP lenders can underwrite, approve and close loans without SBA review. This results in a significantly expedited process."

Some lenders prioritize cash flow over hard assets, which is ideal for service-based businesses like roofing. Tools like the SBA’s "Lender Match" can help you connect with qualified lenders quickly. Alternatively, working with SBA loan brokers vs. direct lenders can help you decide which path streamlines the process further by matching you with specialized lenders and assisting with your application.

The Application and Approval Process

Once you’ve chosen a lender, submit your complete application package for review. The lender will evaluate the business’s cash flow history, your industry experience, and whether the business meets the SBA’s eligibility criteria. They’ll also ensure the business satisfies Debt Service Coverage Ratio (DSCR) requirements.

The overall timeline for approval and funding typically ranges from 30 to 90 days, though more complex transactions may take up to 120 days. During the underwriting phase, lenders often request a "Buyer’s Transition Plan." This plan outlines how you’ll manage the roofing team and retain customer contracts, giving lenders confidence that the business will continue running smoothly under your ownership.

If the deal involves seller financing, double-check that the seller note adheres to SBA equity rules. Once underwriting is complete and your loan is approved, the process moves to closing and funding.

SBA Loan Benefits and Terms for Roofing Businesses

Loan Terms for Roofing Business Acquisitions

SBA loans come with terms tailored to meet the needs of roofing businesses, offering competitive advantages like lower upfront costs and flexible financing options. For instance, the down payment requirement is only 10%. If you're acquiring a competitor within the same NAICS code, you might even qualify for 100% financing.

"The SBA 7(a) program provides many advantages for acquiring an established business, including its attractive terms, allowing a buyer to finance up to 90% of total project costs."

– Michelle Orr, Vice President of Small Business Lending at Live Oak Bank

Interest rates for SBA loans typically fall between 7% and 11%. However, as of late 2025, some rates have been reported to range from 9.75% to 13.25%. These loans also offer repayment terms of up to 10 years or more, with fully amortized schedules and no balloon payments. Plus, the SBA guarantees 75% to 85% of the loan, which makes lenders more willing to approve financing.

Another perk? You can use seller financing to cover half of the required 10% equity injection, provided the seller note remains on full standby for at least two years. For loans with terms over 15 years, prepayment penalties apply: 5% in year one, 3% in year two, and 1% in year three.

These borrower-friendly terms make SBA loans a standout option for roofing business acquisitions. To streamline your search, you can source businesses from 100+ marketplaces and manage your deal flow in one place.

Cost Comparison with Traditional Financing

When compared to traditional financing, SBA loans clearly come out ahead. They require less upfront capital, offer longer repayment terms, and even allow you to bundle working capital into the acquisition loan - something traditional lenders often don’t offer without a separate line of credit.

| Feature | SBA 7(a) Loan | Traditional Financing |

|---|---|---|

| Down Payment | 10% (as low as 0% for expansions) | 20% – 30%+ |

| Interest Rates | 7% – 11% (capped by SBA) | Market-based (often higher for small businesses) |

| Amortization | Fully amortized, up to 10+ years | Shorter terms, may include balloon payments |

| Working Capital | Can be bundled into the acquisition loan | Often requires a separate line of credit |

| Collateral | Assets being financed; personal real estate if under-collateralized | Strict requirements; often requires high coverage |

The SBA’s government-backed guarantee significantly reduces lender risk, which translates into better terms for borrowers. Lenders usually look for a debt service coverage ratio (DSCR) of at least 1.25x to ensure the business can comfortably handle loan payments. With longer repayment options and lower down payments, SBA loans help free up cash for day-to-day operations during the critical transition period. This flexibility ensures a smoother ownership transfer for roofing businesses.

How Clearly Acquired Helps with SBA Loans

AI Tools for Faster Loan Processing

Clearly Acquired streamlines the SBA loan process by blending advanced technology with expert guidance. The platform uses proprietary tools to analyze financials, evaluate creditworthiness, and connect buyers with lenders based on actual underwriting criteria - not just generic rate estimates. This targeted approach reduces the risk of delays caused by excessive paperwork.

One standout feature is the integrated financial verification via Plaid, which simplifies acquisition pre-qualification and speeds up initial approvals. By automating financial analysis and business valuation, Clearly Acquired ensures buyers are well-prepared for SBA financing before engaging with lenders. This reduces the usual back-and-forth of loan applications and increases the chances of securing approval on the first attempt. Alongside these automated tools, the platform's support team works to make each step of the acquisition process smooth and efficient.

Complete Support for Roofing Business Buyers

For those looking to buy roofing businesses, Clearly Acquired goes beyond automation by offering end-to-end support. The platform provides comprehensive buy-side representation, guiding buyers from the search phase to closing. This includes sourcing verified deals, underwriting roofing businesses, structuring the best financing options, and connecting buyers with lenders experienced in funding roofing business acquisitions. Whether you're pursuing an SBA 7(a) or 504 loan, Clearly Acquired ensures you’re matched with the right financing solution.

The advisory team also plays a critical role in ensuring success. They assist with accurate business valuations and detailed financial projections, ensuring buyers can confidently assess whether a target business is priced appropriately. To further streamline the process, the platform offers secure data rooms for documentation and automated NDAs. From due diligence to post-close execution, Clearly Acquired brings all the tools and resources under one roof, making the acquisition process as seamless as possible.

Conclusion

SBA loans offer a compelling advantage with down payments as low as 10% - a fraction of what bank loans typically requires - along with predictable terms that eliminate the stress of balloon payments. By structuring seller financing on full standby for at least two years, you can reduce your upfront cash requirement even further, needing just 5% out of pocket while the seller contributes an additional 5%. As Robert H. Bruno, Vice President and Senior SBA Lending Specialist at Huntington Bank, explains:

"SBA loans allow people who originally thought they could only lease equipment to consider purchasing instead".

Clearly Acquired simplifies the entire financing process, connecting you with lenders that align with your needs, automating financial analysis, and guiding you every step of the way - from sourcing deals to closing them. With AI-driven tools that match your acquisition to lenders based on real underwriting criteria, and secure features like data rooms and automated NDAs, your documentation stays both organized and confidential.

FAQs

What do I need to qualify for an SBA loan to buy a roofing business?

To secure an SBA loan for purchasing a roofing business, you’ll need to meet several important criteria. First, the business must qualify as a small business under SBA guidelines. For non-manufacturing businesses like roofing, this generally means annual revenue below $7.5 million. Additionally, the business must operate as a for-profit entity based in the U.S. and fall within an eligible industry - roofing services are fully allowed under these rules.

Lenders will also assess your creditworthiness and ability to repay the loan. This involves examining your credit score, financial records, and a solid business plan that shows how the acquisition will generate enough income. Be prepared to provide a down payment of 10–20% of the purchase price and offer collateral, such as business assets or real estate. The loan itself must be used for approved purposes, like purchasing the business, funding equipment, or covering operational expenses.

Navigating the SBA loan process can feel overwhelming, but platforms like Clearly Acquired can make things easier. They assist by verifying your eligibility, organizing financial documents, and connecting you with SBA-approved lenders to streamline the process.

How can seller financing work with SBA loans when buying a roofing business?

Seller financing can be a practical way to meet the equity requirements for SBA loans when buying a roofing business. With SBA 7(a) loans typically funding up to 90% of the purchase price, buyers are generally expected to contribute about 10% as equity. Instead of paying the entire 10% in cash, a seller note can help cover part of this equity injection. For instance, a deal might include a 5% cash down payment from the buyer, a 5% seller-financed note, and the remaining 90% covered by the SBA loan.

Lenders will often assess the seller note for credit risk and may require it to be placed on "full standby", meaning payments are deferred if the buyer defaults. Alternatively, it might be structured with repayment terms that are reasonable and acceptable to all parties. This setup not only reduces the buyer’s upfront cash burden but also provides sellers with ongoing payments. Ultimately, the loan structure will depend on several factors, including the buyer’s financial situation, the business’s performance, and the lender’s specific requirements.

What’s the difference between SBA 7(a) and SBA 504 loans when buying a roofing business?

SBA 7(a) loans offer flexibility, providing up to $5 million in funding for various purposes like business acquisitions, working capital, inventory, or equipment. Repayment terms can go up to 10 years for business-related purchases and extend to 25 years for real estate.

On the other hand, SBA 504 loans are tailored for financing owner-occupied real estate and long-term equipment. These loans can cover up to 90% of the purchase price, often exceeding $5 million. They feature fixed interest rates and repayment terms of up to 25 years for real estate and 10 years for equipment.

The best loan for you will depend on your specific goals - whether you need funding for real estate or require broader financial support for your business operations.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)