NDA Breach Remedies in M&A Deals

When NDAs are breached during mergers and acquisitions (M&A), the consequences can be severe, threatening deals worth millions. Remedies focus on injunctive relief to stop further harm and monetary damages to compensate for losses. Unlike standard NDAs, M&A NDAs prioritize speed and enforceability, often including clauses for irreparable harm and standstill provisions. Key options include:

- Injunctive Relief: Courts may issue temporary, preliminary, or permanent injunctions to prevent further disclosure.

- Monetary Damages: Lost profits, diminished trade secret value, or increased costs can be recovered, though some clauses may limit compensation.

- Dispute Resolution: M&A NDAs often favor litigation or arbitration with specific carve-outs for urgent court action.

M&A NDAs are more aggressive and tailored for high-stakes deals, while standard NDAs focus on slower, monetary remedies. Choose the right approach based on the deal's urgency and risks.

M&A NDAs vs Standard Business NDAs: Key Differences in Remedies and Enforcement

1. Remedies in M&A Transactions

When a Non-Disclosure Agreement (NDA) is breached during a merger or acquisition (M&A) deal, the disclosing party has several legal options to address the situation. Unlike breaches in standard contracts, where the fallout might be limited to financial losses, an NDA breach in an M&A context can jeopardize the entire transaction. Let’s break down the key remedies available.

Injunctive Relief

Injunctive relief is one of the most powerful tools available when an NDA is breached in an M&A deal. Courts can issue different types of injunctions, including:

- Temporary Restraining Order (TRO): Quickly issued to prevent immediate harm until a preliminary hearing can be held.

- Preliminary Injunction: Maintains the status quo while litigation is ongoing.

- Permanent Injunction: Provides long-term protection after the case is fully resolved.

To secure an injunction, the disclosing party must demonstrate "irreparable harm", meaning harm that cannot be adequately addressed through financial compensation. Erik Lopez, Partner at Jasso Lopez PLLC, notes:

"Monetary damages are often extremely difficult for a plaintiff to prove as a result of a breach of a confidentiality agreement. Consequently, a discloser's best opportunity for recourse may be to seek injunctive or equitable relief."

Strengthening your NDA with specific language about irreparable harm and including a bond waiver can improve your chances of obtaining injunctive relief. A bond waiver eliminates the need for a financial guarantee when seeking emergency court orders . It’s also important to consider jurisdiction: for example, Delaware courts often uphold contractual stipulations of irreparable harm, while New York courts may require additional evidence.

Monetary Damages

While injunctions prevent further harm, monetary damages aim to compensate for losses that have already occurred. Courts typically calculate these damages by looking at factors such as the diminished value of a trade secret, lost profits due to the breach, or increased costs incurred by the disclosing party.

- Expectation Damages: These restore the financial benefits the disclosing party expected to gain from the deal.

- Consequential Damages: These cover indirect but foreseeable losses resulting from the breach.

Some NDAs include liquidated damages clauses, which specify a pre-agreed sum to be paid in the event of a breach. However, courts will reject these clauses if they appear punitive rather than a reasonable estimate of actual losses.

One potential pitfall to watch for is the inclusion of clauses that exclude "indirect, special, or consequential losses." These exclusions can be problematic, as lost profits - often the primary damage in NDA breaches - may fall under these categories. This could leave the disclosing party without adequate compensation.

Dispute Resolution

How disputes are resolved can be just as critical as the remedies themselves. Most M&A NDAs specify either court litigation or arbitration as the forum for resolving disputes.

- Litigation: Offers the ability to seek immediate court orders, such as a TRO, but may expose sensitive information unless filings are sealed.

- Arbitration: Ensures greater privacy but might require specific carve-outs to allow for urgent court intervention during the arbitration process .

Using clear and mandatory language in the NDA - such as stating that a party "is entitled to" relief rather than "may seek" relief - can strengthen enforceability. For deals involving public companies, including a standstill provision can provide additional security. Standstill provisions are often easier to enforce than proving misuse of confidential information, adding an extra layer of protection.

sbb-itb-a3ef7c1

2. Remedies in Standard Business Agreements

Standard business NDAs - used in partnerships, vendor arrangements, or joint ventures - serve to protect sensitive information without the high-stakes risks tied to M&A transactions. Here’s a closer look at the remedies typically outlined in these agreements.

Injunctive Relief

In standard business settings, injunctive relief is aimed at halting further disclosures, though courts often require a higher standard of proof. Burt Natkins of Sterlington PLLC explains:

"Injunctive relief is an extraordinary remedy... normally available to an aggrieved party when damages may not otherwise be recoverable by it."

Unlike M&A NDAs, which may use more forceful language, standard agreements often state that parties "may seek" an injunction. This softer phrasing reflects the stricter proof requirements in jurisdictions like New York compared to Delaware.

Monetary Damages

When breaches occur, courts award compensatory damages based on tangible losses, such as the reduced value of a trade secret, lost profits, or increased operational costs. However, negotiators need to steer clear of exclusion clauses that eliminate recovery for consequential damages. Tessa Brewis and Elnalene Cornelius from Cliffe Dekker Hofmeyr caution:

"If the parties expressly excluded liability for such special, indirect or consequential losses in the NDA, the start-up will have lost its trade secrets... and will have no remedy for loss of profits."

Careful negotiation is essential to ensure these exclusions don’t leave businesses unprotected.

Equitable Remedies

In addition to injunctions, courts may order specific actions, such as the return or destruction of confidential materials. While M&A agreements often push for aggressive remedies due to the stakes involved, standard NDAs rely on more balanced equitable measures. Although courts are generally reluctant to issue mandatory injunctions before a full trial, these remedies remain vital when financial compensation alone isn’t sufficient to address the harm.

Dispute Resolution

Dispute resolution clauses in standard NDAs further highlight their distinctions from M&A agreements. These NDAs typically designate New York or Delaware as the governing law and include jurisdiction clauses. Unlike M&A NDAs, which may include provisions like standstill or non-solicitation clauses, standard agreements focus exclusively on safeguarding confidential information. Many also include fee-shifting provisions, allowing for the recovery of legal expenses. Additionally, confidentiality obligations in standard NDAs often last between one to five years, contrasting with the indefinite durations sometimes sought in M&A agreements.

Pros and Cons

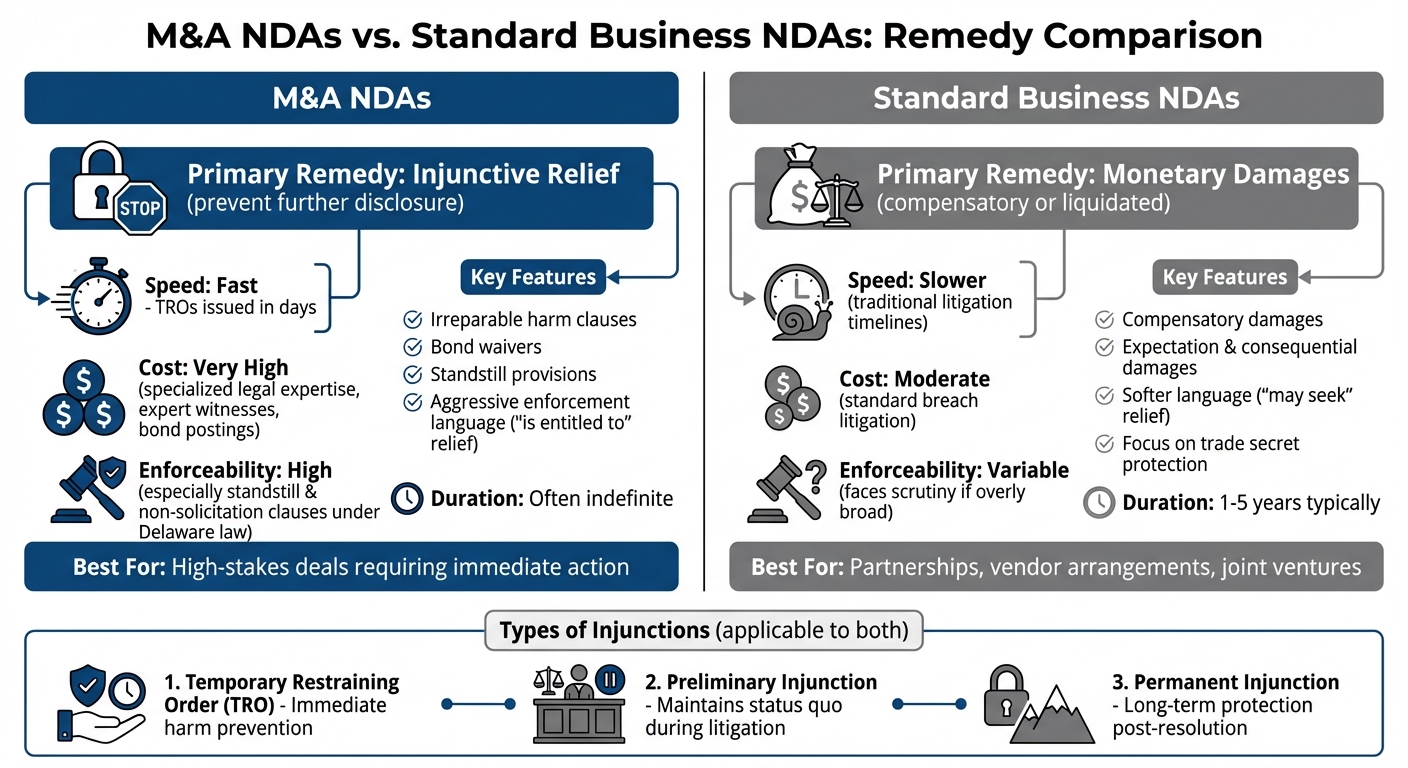

When deciding between M&A NDAs and standard business NDAs, the key factors boil down to speed, cost, and enforceability. In M&A transactions, NDAs are specifically designed to prioritize swift action through injunctive relief. For instance, Temporary Restraining Orders (TROs) can often be secured within just a few days to prevent disruptions to a deal. This speed, however, comes with higher expenses, making it a trade-off worth examining.

The urgency of M&A breach resolutions often requires specialized legal expertise, expert witnesses, and even bond postings, which significantly increases costs compared to standard NDAs. The emphasis on immediate legal action in these cases is what drives these higher expenses.

On the other hand, standard business NDAs primarily focus on monetary damages. While these remedies tend to have more predictable costs, they often lead to slower resolutions. This is largely because proving actual financial losses can be a complex and time-consuming process. Additionally, if consequential damages are excluded, standard NDAs might leave parties more vulnerable.

Here's a quick comparison of the two:

| Feature | M&A Deals | Standard Business Agreements |

|---|---|---|

| Enforceability | High, especially for clauses like standstills and non-solicits under Delaware law | Variable; often faces scrutiny if overly broad |

| Cost | Very high, due to specialized legal needs and potential bond postings | Moderate, handled through standard breach litigation |

| Resolution Speed | Fast, with TROs often issued in days | Slower, following traditional litigation timelines |

| Primary Remedy | Injunctive relief to stop disclosure and protect the deal | Monetary damages, either compensatory or liquidated |

In short, M&A NDAs are the go-to choice when deal certainty and immediate legal action are non-negotiable. On the flip side, standard NDAs work better in situations where a slower resolution is acceptable, and parties value the predictability of monetary remedies.

Conclusion

M&A NDAs focus heavily on securing immediate injunctive relief to protect high-stakes deals, while standard NDAs tend to rely on monetary damages and slower legal processes.

When drafting M&A NDAs, it’s crucial to include clear language stating that a breach “would” result in irreparable harm. This strengthens the case for injunctive relief. As Burt Natkins explains:

"Contracting parties cannot, therefore, contract for irreparable harm. In other words, it must be demonstrated beyond conclusory assertions, contract or otherwise".

Such precise wording ensures compliance with court standards and supports the swift legal actions discussed earlier.

Jurisdiction also plays a key role in enforceability. For instance, Delaware courts generally uphold irreparable harm clauses - especially when paired with a bond waiver. In contrast, New York courts require separate proof of harm.

Sellers should carefully outline "need to know" recipients and limit access to highly sensitive data until final due diligence using a secure deal room. Buyers, on the other hand, should secure carve-outs for necessary automated backups and regulatory copies. Both parties should also address key terms like standstill provisions, non-solicitation agreements (lasting 18–24 months), and representative liability .

A well-structured NDA not only protects the value of the deal but also facilitates smoother closings. By understanding these distinctions in remedies, parties can craft agreements that hold firm in the face of breaches, ensuring the security of both M&A transactions and everyday business arrangements.

FAQs

How do remedies for NDA breaches differ in M&A transactions compared to standard business agreements?

In mergers and acquisitions (M&A) transactions, the remedies outlined for breaches of non-disclosure agreements (NDAs) are often more precise and enforceable. This is because the information being protected is highly sensitive. These NDAs typically include provisions for injunctive relief, damages, and other legal measures to address breaches quickly, minimizing the risk of further misuse or disclosure. The stakes are particularly high in these situations, as a breach could derail the deal or severely impact the valuation of the business.

On the other hand, NDAs used in standard business contexts may not spell out remedies as clearly. While they still allow for compensatory damages and injunctive relief, the terms are generally less strict. This difference highlights the heightened importance of confidentiality in M&A deals, where a breach can directly threaten negotiations or the overall success of the transaction.

What steps can parties take to ensure an NDA includes strong injunctive relief provisions?

To make sure an NDA includes effective injunctive relief provisions, it's crucial to clearly state that any breach would result in irreparable harm. The agreement should also explicitly grant the disclosing party the right to seek injunctive relief. This helps stop any further misuse or disclosure of confidential information and underscores the importance of safeguarding sensitive details.

It's equally important to use clear and precise language to define what counts as a breach and to outline the scope of relief available. This level of detail not only reduces the chance of disputes but also strengthens the enforceability of the NDA in court, if necessary.

How does jurisdiction affect the enforceability of NDA remedies in M&A deals?

Jurisdiction is a key factor in determining how enforceable NDA remedies are in M&A transactions. Legal standards for remedies such as injunctive relief or damages can differ significantly depending on the jurisdiction. For example, an injunction granted in one state or country might not hold up elsewhere if the NDA doesn’t clearly define the governing law or jurisdiction.

To avoid potential legal headaches, it’s crucial to include explicit provisions in the NDA specifying the governing law and jurisdiction. This clarity helps ensure that remedies are enforceable and minimizes the chances of disputes, particularly when the parties involved are based in different states or countries. Moreover, the remedies outlined in the NDA should be consistent with the legal framework of the selected jurisdiction to enhance their enforceability and practical application.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)