EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a crucial metric for evaluating profitability in recurring revenue businesses like SaaS, subscription services, and IT-managed platforms. Here's what you need to know:

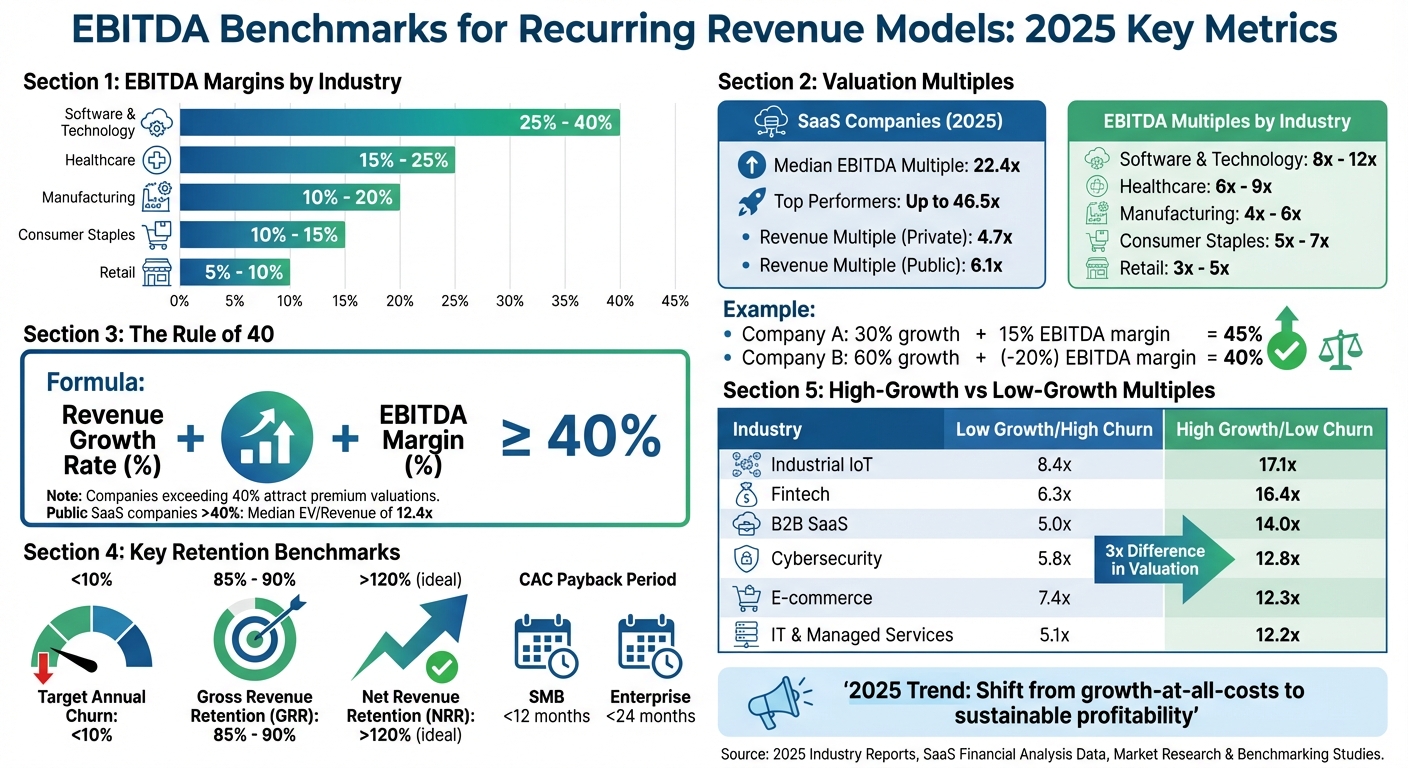

- EBITDA Margins: Mature SaaS companies typically deliver margins between 25% and 40%, while smaller businesses may prioritize growth over profitability.

- Valuation Multiples: In 2025, SaaS companies are valued at a median 22.4x EBITDA, with top performers reaching as high as 46.5x.

- Rule of 40: Combines revenue growth and EBITDA margin; businesses scoring 40% or higher are seen as efficient and attract premium valuations.

- Retention Impact: High churn (over 10%) erodes EBITDA, while metrics like Net Revenue Retention (NRR) above 120% indicate strong customer loyalty and expansion.

- Industry Multiples: SaaS companies lead with 8x–12x EBITDA multiples, followed by sectors like healthcare (6x–9x) and IT services (5.1x–12.2x).

Quick Overview of Key Metrics:

- ARR/MRR: Best for early-stage companies to measure predictable revenue.

- EBITDA: Focuses on cash generation for mature businesses.

- Customer Retention: Essential for stabilizing revenue; aim for churn below 10%.

- CAC Payback Period: Target under 12 months for SMBs, under 24 months for enterprise clients.

In 2025, the shift from "growth at any cost" to sustainable profitability is clear. Businesses that balance growth with strong EBITDA margins are rewarded with higher valuations.

EBITDA Benchmarks and Valuation Multiples for Recurring Revenue Businesses 2025

EBITDA Benchmarks for Recurring Revenue Businesses

What is EBITDA and How to Calculate It

EBITDA, short for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric that highlights the cash generated from a company’s primary operations. It leaves out financing decisions, tax obligations, and non-cash expenses like depreciation, offering a clearer picture of operational performance.

The formula is simple:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization.

Alternatively, you can calculate it from a revenue perspective:

EBITDA = Total Revenue – COGS – Operating Expenses (excluding depreciation and amortization).

By focusing solely on operational factors, EBITDA is particularly useful for evaluating the efficiency of recurring revenue businesses, which thrive on subscription-based income streams.

Now that we’ve covered the calculation, let’s dig into why EBITDA is so important for businesses with recurring revenue models.

Why EBITDA Matters for Recurring Revenue Models

EBITDA holds particular value for recurring revenue businesses because their income streams are both stable and predictable. These companies rely on subscription payments - whether monthly or annually - which creates a steady flow of renewable revenue. This reliability allows investors to gauge operational performance with greater confidence.

For more established recurring revenue companies, the focus often shifts from rapid growth to consistent cash flow. In this context, EBITDA becomes a key indicator of how well a company transforms its subscription income into operational profit, making it a cornerstone for valuation.

EBITDA in Recurring vs. Non-Recurring Business Models

Understanding EBITDA’s role becomes even more insightful when comparing recurring and non-recurring business models.

One major distinction lies in EBITDA multiples. For example, in the B2B SaaS sector, companies with $0–$1 million in EBITDA and a recurring revenue model can achieve multiples of 8.1x if they demonstrate high growth and low churn. In contrast, non-recurring models in the same sector typically cap out at 5.1x.

Why such a difference? Recurring models benefit from predictable income and scalability. A SaaS platform, for instance, can grow its customer base without needing to scale its workforce proportionally. On the other hand, traditional service businesses - like consulting - must expand their teams in line with revenue growth, which limits their ability to improve margins.

Early-stage recurring revenue businesses often report negative or breakeven EBITDA because they focus heavily on acquiring customers rather than immediate profitability. A great example is Zapier, which by March 2021 had surpassed $140 million in ARR while raising just $1.3 million in total funding. This showcases a high level of operational efficiency as the company matured. In contrast, traditional businesses rarely operate with negative EBITDA for long periods, as their valuation depends more on current cash flow than on future growth potential.

| Industry Sector | Typical EBITDA Margin | Typical EBITDA Multiple |

|---|---|---|

| Software & Technology | 25% – 40% | 8x – 12x |

| Healthcare | 15% – 25% | 6x – 9x |

| Manufacturing | 10% – 20% | 4x – 6x |

| Consumer Staples | 10% – 15% | 5x – 7x |

| Retail | 5% – 10% | 3x – 5x |

(Source: Raincatcher Industry Data [2])

Will Your SaaS Company Sell on a Revenue or EBITDA Multiple?

Key Metrics That Work with EBITDA for Valuation

EBITDA provides a solid foundation for understanding a company's profitability, but it doesn’t paint the full picture - especially for businesses with recurring revenue. To truly gauge a company's value, you need to pair EBITDA with metrics that highlight revenue stability, growth potential, and customer behavior. These additional insights help investors assess not just how profitable a business is today, but how well that profitability can hold up over time.

Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR)

ARR and MRR focus on renewable revenue streams, leaving out one-time fees, making them essential for evaluating a company's future operational value - even when EBITDA is still developing. Sophisticated valuation models often use a hybrid approach, balancing ARR or MRR with EBITDA depending on the company's stage. Early-stage companies tend to rely more on ARR multiples, while mature businesses lean toward EBITDA.

"Choosing between an ARR multiple and an EBITDA multiple can swing your valuation by millions of dollars." - Warfield Alexandre, Bookman Capital

The numbers speak volumes. As of 2025, private SaaS companies typically have a median valuation of 4.7x revenue, while public SaaS companies reach 6.1x. On the EBITDA side, SaaS businesses show a median multiple of 22.4x, with top performers hitting as high as 46.5x. For companies growing at 50% or more annually, ARR multiples can climb to 10x to 15x.

| Metric | Best For | What It Reveals |

|---|---|---|

| ARR/MRR | Early-stage (first 3-4 years); High growth (>50% annually) | Growth potential and predictable revenue streams |

| EBITDA | Mature businesses with established market presence | Actual cash generation and operational efficiency |

These metrics highlight the importance of predictable revenue, setting the stage for assessing the balance between growth and profitability using the Rule of 40.

The Rule of 40 for SaaS and Subscription Businesses

The Rule of 40 is a simple yet powerful formula that combines growth and profitability: Revenue Growth Rate (%) + EBITDA Margin (%) ≥ 40%. For example, a company growing at 30% with a 15% EBITDA margin scores 45%, comfortably surpassing the threshold. Even companies with negative EBITDA can meet the Rule of 40 if their growth rate is strong enough - a 60% growth rate with a -20% EBITDA margin still qualifies.

"A healthy SaaS business should aim for a combined score of 40 percent or higher." - Ryan Winemiller, Head of Marketing, Mosaic

This metric is particularly relevant for mature SaaS companies, typically those generating $1 million in MRR or $15 million to $50 million in ARR. Consistently achieving or exceeding the Rule of 40 demonstrates operational discipline and can justify higher valuation multiples. Public SaaS companies like Zoom, Twilio, and Datadog have historically exceeded this benchmark, aligning with their premium valuations.

However, it’s important not to prioritize Rule of 40 compliance too early. Pushing for profitability in the early stages can stifle growth, ultimately reducing long-term valuation potential. For businesses where subscription revenue makes up less than 80% of total revenue, it’s better to calculate the Rule of 40 using total revenue growth instead of relying solely on MRR or ARR growth.

How Customer Retention and Churn Affect EBITDA

Customer retention plays a critical role in stabilizing EBITDA. High churn rates can erode your revenue base, forcing you to spend more on acquiring new customers just to maintain your income level.

"Every percentage taken out of your retention is taken out of your growth rate." - Bessemer Venture Partners

Key metrics like Net Revenue Retention (NRR) and Gross Revenue Retention (GRR) provide valuable insights. NRR above 110% indicates strong expansion revenue, while GRR benchmarks typically fall between 85% and 90%. On average, companies with $10 million to $100 million in ARR achieve 120% net retention.

Another critical metric is the CAC Payback Period - the time it takes to recover the cost of acquiring a customer. Efficient companies aim for shorter payback periods, ideally under 12 months for SMB-focused accounts and under 24 months for enterprise accounts. These figures signal operational efficiency and support higher valuations.

Finally, SaaS companies should target an annual churn rate of under 10% to reflect a reliable service and stable revenue. Clean retention data across multiple customer cohorts strengthens your position during valuation discussions.

sbb-itb-a3ef7c1

EBITDA Multiples by Industry for Recurring Revenue Models

EBITDA multiples offer a valuable perspective on how recurring revenue businesses are valued in the market, building on operational benchmarks to highlight the factors driving these valuations.

EBITDA Multiples in SaaS and IT Services

SaaS businesses continue to lead the recurring revenue space with high EBITDA multiples, though the exact figures depend heavily on growth rates and operational efficiency. As of early 2025, SaaS revenue multiples hover around 6.1x, recovering from a three-year low of 5.5x. For top-performing SaaS companies, EBITDA multiples can climb as high as 6.13x.

Growth is the decisive factor here. B2B SaaS companies with $1 million to $3 million EBITDA, steady ~25% growth, and low customer churn can achieve multiples as high as 14.0x EBITDA. On the other hand, low-growth SaaS businesses with high churn in the same EBITDA range typically see multiples closer to 5.0x. That’s nearly a 3x difference, underscoring the importance of growth and operational stability.

Certain SaaS sub-sectors stand out even more. HR technology leads the pack, with EBITDA multiples for companies earning $5 million to $10 million reaching as high as 19.3x. Cybersecurity follows closely, with smaller firms commanding multiples of 12.9x and larger ones in the $5 million to $10 million EBITDA range reaching 15.8x. IT and Managed Services businesses, while slightly behind SaaS, still maintain strong valuations. Companies with $1 million to $3 million EBITDA can see multiples ranging from 5.1x for low-growth operations to 12.2x for high-growth providers. The growing reliance on outsourced IT infrastructure and cybersecurity services continues to fuel these valuations.

EBITDA Multiple Comparison Across Sectors

When comparing multiples across industries, some sectors consistently outperform others. Industrial IoT, for example, commands some of the highest private market multiples, with high-growth companies achieving up to 17.1x EBITDA. This reflects the critical role these systems play in manufacturing and logistics, where downtime is costly and switching providers poses significant risks.

Fintech also commands premium valuations, with high-growth businesses in the $1 million to $3 million EBITDA range reaching 16.4x EBITDA.

| Industry | Low Growth / High Turnover | High Growth / Low Turnover |

|---|---|---|

| Industrial IoT | 8.4x | 17.1x |

| Fintech | 6.3x | 16.4x |

| B2B SaaS | 5.0x | 14.0x |

| Cybersecurity | 5.8x | 12.8x |

| E-commerce | 7.4x | 12.3x |

| IT & Managed Services | 5.1x | 12.2x |

Source: Compiled from First Page Sage 2025 Meta-Analysis [11].

Even traditionally lower-valued sectors like e-commerce are seeing benefits when recurring revenue models are in play. Businesses using subscription models or membership programs stabilized at 3.98x profit by late 2024, reflecting a shift toward sustainable unit economics. While these multiples are lower than pure SaaS, they represent a 20% to 50% premium over traditional e-commerce businesses without recurring revenue.

What Drives EBITDA Multiples in 2025

In 2025, businesses that demonstrate both profitability and operational maturity are favored by the market. The era of prioritizing "growth-at-all-costs" has shifted to a focus on sustainable cash generation. Companies that balance profitability and growth, particularly those meeting or exceeding the Rule of 40, consistently achieve the highest multiples.

Size plays a significant role in valuations. Median profit multiples increase from 1.68x for businesses valued between $10,000 and $100,000 to 2.43x for those exceeding $1 million. Larger companies benefit from economies of scale, stronger management structures, and reduced key-person risk, all of which justify higher multiples. For small to midsized businesses with less than $250 million in revenue, EBITDA multiples generally fall between 4x and 8x adjusted EBITDA.

"The EBITDA multiple will depend on the size of the subject company, its profitability, its growth prospects, and the industry in which it works."

– Dan Gray, Equidam

AI adoption is another key driver of higher multiples in 2025. Businesses integrating advanced technologies like GPT-4 or proprietary machine learning systems are attracting increased investor interest, particularly in B2B SaaS and IT services. This reflects the operational efficiencies and competitive advantages these technologies provide.

Interest rates are also influencing valuations. High rates in 2023–2024 initially slowed private equity activity, but rate cuts in late 2024 and early 2025 have started to push valuations upward. With capital becoming more accessible, buyers are willing to pay higher prices, especially for businesses with strong recurring revenue and low churn.

"Multiples have steadily increased in the last year since the economic turbulence starting in '22 and have almost reached pre-pandemic numbers."

– First Page Sage

Operational efficiency remains a cornerstone of premium valuations. Businesses with documented processes, minimal reliance on owners (less than 15 hours per week), and diversified customer bases (no single customer exceeding 40% of revenue) can command 0.5x to 1.5x higher multiples than industry averages.

How to Improve EBITDA in Recurring Revenue Businesses

Boosting EBITDA in businesses with recurring revenue models relies on specific strategies tailored to their unique structure. Subscription-based companies, with their predictable revenue streams, see a significant impact from operational improvements. The key areas to focus on are customer retention, cost management, and revenue growth from existing customers.

Reduce Churn and Improve Customer Retention

Keeping customers around is one of the most effective ways to protect EBITDA margins. When customers leave, businesses often spend more on sales and marketing just to maintain their revenue. Every drop in retention directly affects growth.

"Retention is one of the most important measures of your cloud business' health, as it preserves the unit economics of historical customer acquisition." – Bessemer Venture Partners

Retention benchmarks for cloud companies tell a clear story: gross retention rates typically fall between 85% and 90%, while net retention averages about 140% for businesses with $1–10M in Annual Recurring Revenue (ARR). Monthly churn rates under 5% are ideal, while rates above 10% can signal trouble.

To improve retention, consider strategies that encourage organic growth, like bottoms-up sales models. These models work well for tools aimed at developers or team collaboration, where usage naturally expands over time. Another approach is to add complementary services to your core product. For example, Toast extended its point-of-sale platform by offering Payments and Capital services, which not only expanded its market but also offset slowing growth in its primary offering.

Once retention is optimized, the next step is tackling operational costs to further improve EBITDA.

Cut Operational Costs

Reducing operational expenses is a powerful way to strengthen EBITDA. As recurring revenue businesses scale, some costs naturally decrease as a percentage of revenue. This is especially true for Research & Development (R&D) and General & Administrative (G&A) expenses, which tend to level off over time.

In the early stages, R&D can eat up as much as 95% of revenue for companies with $1–10M ARR. By the time businesses surpass $100M ARR, top performers reduce this to around 35%. Similarly, G&A expenses drop from roughly 70% of revenue in the early days to about 20% at scale. A great example is PagerDuty, which lowered its R&D spending from nearly 60% at $12M ARR to about 35% by the time it went public - all while maintaining its market leadership.

Sales and Marketing (S&M) costs often remain the largest expense, sometimes exceeding 50% of revenue, even for mature businesses. To optimize these costs, align your Customer Acquisition Cost (CAC) payback period with your target customer segment. For instance, aim for under 12 months for small businesses, under 18 months for mid-market clients, and under 24 months for enterprise accounts. Increase acquisition spending only when your Customer Lifetime Value (CLTV)-to-CAC ratio is greater than 3x.

Automation is another valuable tool. Companies that rely on documented processes and automation to reduce owner involvement to fewer than 10 hours per week often see valuation multiples that are 0.5x to 1.5x higher than industry averages. Zapier, for example, reached over $140M ARR by March 2021 while raising just $1.3M in outside funding.

Grow Revenue Through Upselling and Service Expansion

Expanding revenue from your existing customer base is far more cost-effective than acquiring new customers. By building on existing relationships, you avoid the steep costs tied to new customer acquisition. A net retention rate above 100% shows that customers are spending more over time, which is a critical driver of EBITDA growth.

"Market leaders tend to accelerate their growth and expand their total addressable markets (TAM) by adding 'Second Act' products, so even if there is growth decay in the core product, there are constant second, third, and even fourth winds behind company growth as a whole." – Bessemer Venture Partners

Some effective strategies for expansion include:

- Introducing usage-based pricing tiers, allowing revenue to grow naturally as customer usage increases.

- Transitioning from single-product offerings to comprehensive multi-product platforms.

PagerDuty is a prime example. Between 2014 and 2018, the company scaled its ARR from $12M to over $100M by solidifying its market position and expanding its incident response product suite.

For B2B SaaS businesses with strong growth and low employee turnover, recurring revenue models often command EBITDA multiples around 8x - compared to just 5x for non-recurring revenue. This highlights the long-term value of focusing on expansion revenue.

Key Takeaways on EBITDA Benchmarks for Recurring Revenue Models

Market trends are shifting, emphasizing efficiency over unchecked growth. For businesses with recurring revenue models, EBITDA serves as a cornerstone for valuation. Margins typically range between 15% and 25%, with software and technology companies often achieving higher multiples, generally falling between 8x and 12x. In contrast, lower middle-market businesses are valued at 4x to 8x adjusted EBITDA, with SaaS companies occupying the higher end of that spectrum.

As of Q1 2025, profitability has taken center stage. The median EBITDA margin for tracked SaaS companies stood at approximately 6%, while top-performing companies aim for an efficiency score of 40% or more, with the best nearing 50%. Public SaaS companies that exceed a weighted Rule of 40 score of 40% are rewarded with a median EV/Revenue multiple of 12.4x.

Several factors drive higher EBITDA multiples, including low customer churn (gross retention rates of 85–90%), strong net revenue retention (above 120%), and healthy gross margins (typically 65–70%). For small B2B SaaS companies, high growth and low employee turnover can push EBITDA multiples as high as 8.0x, compared to just 2.8x for slower-growing counterparts. Additionally, running a competitive auction process with multiple bidders remains one of the most effective ways to maximize valuation multiples.

To help navigate these benchmarks, platforms like Clearly Acquired offer AI-powered valuation tools for both sellers and buyers. Sellers can optimize adjusted EBITDA by identifying one-time or owner-specific expenses to add back, while buyers benefit from AI-driven underwriting that evaluates deals against key benchmarks. This focus on operational precision ensures both parties are better positioned to secure premium valuations.

FAQs

What key factors determine EBITDA multiples for SaaS companies in 2025?

The EBITDA multiples for SaaS companies in 2025 will largely hinge on a few key factors: the quality and predictability of recurring revenue, profit margins, and growth rates. Beyond these, elements such as customer concentration, competitive positioning, and the strength of the management team will also significantly influence valuations.

Metrics unique to SaaS businesses - like Annual Recurring Revenue (ARR) growth, Net Revenue Retention (NRR), and Customer Acquisition Cost (CAC) efficiency - carry substantial weight as well. Companies excelling in these areas often attract higher multiples, thanks to their potential for scalability and profitability.

How does customer retention affect EBITDA in businesses with recurring revenue?

Customer retention is a major driver of EBITDA for businesses with recurring revenue models. When customers stick around - whether due to long-term contracts, high switching barriers, or subscription-based services - it creates a steady revenue stream. This not only stabilizes cash flow but also reduces the need for expensive sales and marketing efforts to replace lost customers. The result? Stronger EBITDA margins and improved overall profitability.

Retention also plays a big role in meeting benchmarks like the Rule of 40 - where the combined revenue growth rate and EBITDA margin total 40% or more. By keeping churn low, companies save on the costs of acquiring new customers to replace those who leave. Plus, they can spread fixed costs across a larger, more predictable revenue base, which further boosts EBITDA and valuation multiples. For both buyers and business owners, retention metrics offer critical insights into profitability and long-term value.

What is the Rule of 40, and why is it important for SaaS businesses?

The Rule of 40 is a popular metric used to gauge the financial health of SaaS companies. It combines two critical factors: a company’s revenue growth rate and its EBITDA margin. By blending these, the Rule of 40 offers a clear picture of how well a business is balancing growth with profitability.

When a SaaS company achieves or surpasses the Rule of 40, it’s often seen as a more appealing option for investors and potential buyers. Why? Because it shows the business is scaling efficiently without sacrificing its bottom line. For instance, if a company reports a 30% revenue growth rate paired with a 15% EBITDA margin, its Rule of 40 score would be 45 - a strong indicator of solid performance.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)