Valuing manufacturing businesses, especially those reliant on physical assets like machinery and facilities, revolves around financial metrics and industry-specific multiples. These businesses are typically assessed using earnings-based multiples such as SDE (Seller’s Discretionary Earnings) or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Here's what you need to know:

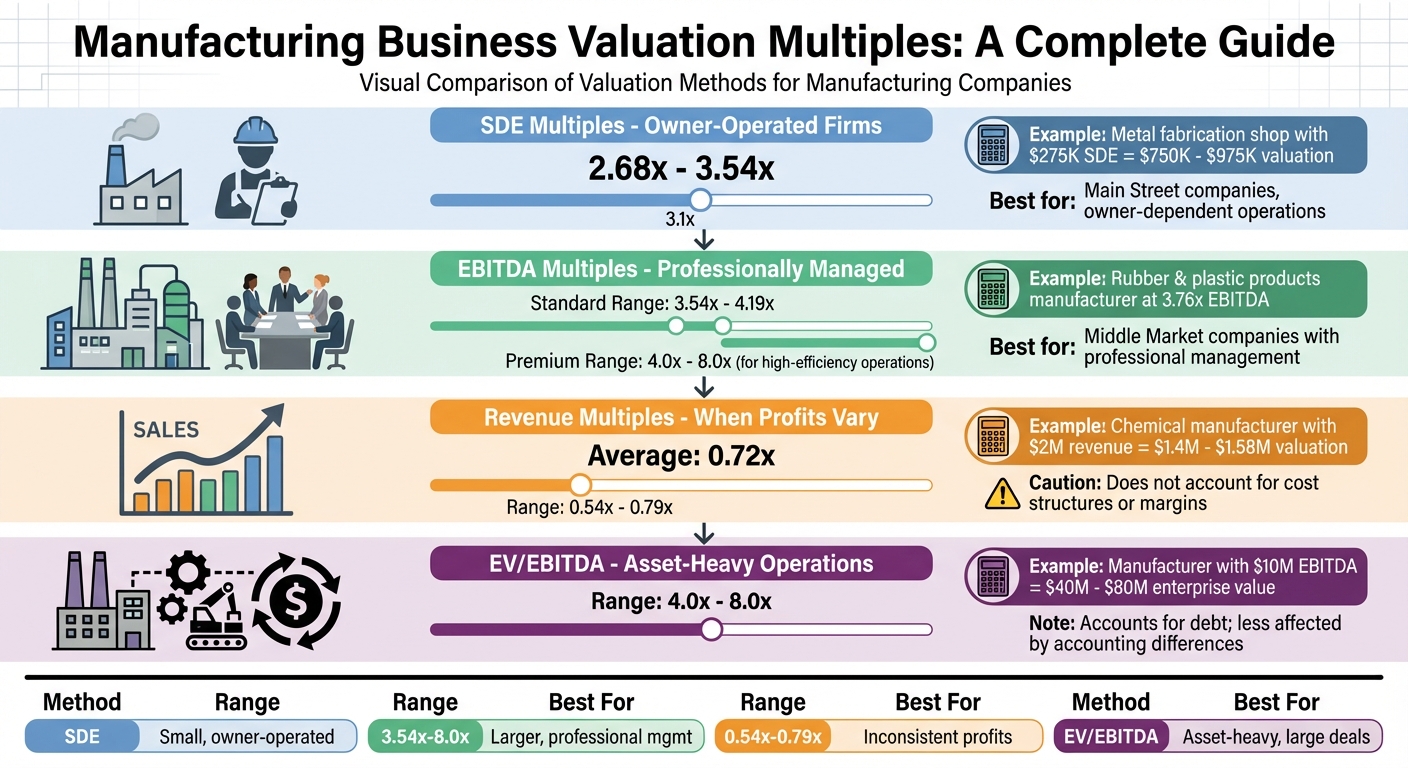

- SDE Multiples: Used for smaller, owner-operated firms. Average range: 2.68x–3.54x.

- EBITDA Multiples: Preferred for larger, professionally managed companies. Average range: 3.54x–4.19x, with some sectors reaching 7.0x–11.0x.

- Revenue Multiples: Often used when profitability is inconsistent. Average range: 0.54x–0.79x.

Key factors affecting valuation include the condition of physical assets, operational efficiency, customer concentration, and market position. Modern, well-maintained equipment and diversified customer bases typically lead to higher multiples, while outdated machinery or reliance on a few clients can lower valuations.

For accurate valuation, normalize financial statements, consider professional appraisals for assets, and select the right multiple based on business size, profitability, and sector. This ensures a fair and realistic assessment of a manufacturing company’s worth.

EBITDA Multiples and Valuation Ranges: How Companies are Valued

sbb-itb-a3ef7c1

Common Valuation Multiples in Manufacturing

Manufacturing Business Valuation Multiples by Type and Size

When it comes to valuing manufacturing businesses, financial performance plays a central role. These businesses often rely heavily on physical assets, and valuation multiples help assess their worth. The choice of multiple depends on factors like company size, profitability, and the owner's level of involvement. Here's a breakdown of the key valuation metrics used in different manufacturing scenarios.

SDE and EBITDA Multiples

For small to mid-sized, owner-operated manufacturing businesses, Seller's Discretionary Earnings (SDE) is the go-to metric. SDE is calculated by taking net income and adding back the owner's salary, benefits, discretionary expenses, and one-time costs. This approach provides a clear view of the cash flow available. From 2020 to 2024, SDE multiples typically ranged between 2.68x and 3.54x. For instance, a metal fabrication shop generating $275,000 in SDE could sell for anywhere between $750,000 and $975,000.

On the other hand, larger manufacturers with professional management teams are often evaluated using EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). EBITDA strips out non-cash charges like depreciation, offering a clearer picture of operational profitability. Overall, EBITDA multiples during the same period ranged from 3.54x to 4.19x, but larger companies with strong efficiency and growth potential could command multiples between 4.0x and 8.0x. For example, a rubber and plastic products manufacturer sold at an average EBITDA multiple of 3.76x. While SDE is better suited for smaller, owner-dependent businesses ("Main Street" companies), EBITDA is preferred for larger, professionally managed firms ("Middle Market" companies).

Revenue Multiples

Although earnings-based multiples are widely used, revenue multiples can provide an alternative perspective in specific cases. These are particularly helpful for businesses with inconsistent profits but significant revenue or when profit margins align with industry norms. Between 2020 and 2024, manufacturing businesses sold at an average revenue multiple of 0.72x, with a range of 0.54x to 0.79x. For example, a chemical manufacturer with $2 million in annual revenue might be valued between $1.4 million and $1.58 million using this method. However, revenue multiples come with a caveat - they don't factor in cost structures. This means businesses with high sales but thin margins could appear more valuable than they truly are.

Enterprise Value (EV) Multiples

For larger manufacturing deals, Enterprise Value (EV) multiples - such as EV/EBITDA and EV/Revenue - are commonly used. EV is calculated by adding a company's net debt to its equity value, offering a comprehensive view of its total worth, regardless of financing.

"EV multiples are typically less affected by accounting differences, since the denominator is computed higher up on the income statement."

The EV/EBITDA multiple is especially relevant for manufacturers with significant physical assets. By adding back depreciation, which is a non-cash expense tied to machinery, this metric provides a clearer picture of cash flow available to stakeholders. Manufacturing businesses have generally sold at EV/EBITDA multiples ranging from 4.0x to 8.0x. For example, a manufacturer with $10 million in EBITDA might have an enterprise value between $40 million and $80 million. In cases where businesses require ongoing investment in equipment, some analysts adjust the calculation to EV/(EBITDA−CapEx) to account for capital expenditures.

What Affects Valuation Multiples in Manufacturing

In manufacturing, valuation multiples are influenced by several key factors, with the condition of physical assets being a major component. These factors play a crucial role in helping buyers and sellers arrive at fair terms during negotiations.

Physical Assets and Equipment

The state of a manufacturer’s machinery and facilities has a direct impact on its valuation. Modern, efficient equipment not only cuts operating costs but also enhances productivity, which can lead to higher valuation multiples. On the other hand, outdated machinery often results in inefficiencies and higher maintenance costs, which can lower a company’s perceived value.

Lenders also prefer high-quality assets as collateral, which can strengthen the structure of a deal. For manufacturers with inconsistent profitability, these physical assets often establish a "valuation floor" - a baseline value that profit-focused methods might overlook.

"A turnkey business that doesn't require capital expenditures by the buyer will always sell for a higher multiple." - Frances Brunelle, Accelerated Manufacturing Brokers

Facilities with modular production lines that allow for scaling without significant capital investment are particularly appealing to investors. Additionally, owning the manufacturing space rather than leasing it signals stability and reduces risk, often resulting in a higher multiple. A clean, organized workspace reflects strong maintenance practices and operational discipline, which positively influences buyer perception.

| Key Asset Factor | Impact on Valuation Multiple |

|---|---|

| Modern, efficient equipment | Higher multiples due to reduced costs and better output |

| Outdated machinery | Lower multiples due to inefficiencies and repair needs |

| Facility ownership vs. leasing | Ownership indicates stability and commands higher multiples |

| Scalable production capacity | Drives higher multiples by enabling growth without major reinvestment |

| Well-maintained facilities | Signals operational excellence, boosting buyer confidence |

Operating Performance

A manufacturer’s profitability and efficiency are critical factors in determining valuation multiples. High gross and net margins demonstrate strong pricing power and cost management, while efficient resource usage - such as inventory, workforce, and production capacity - reduces waste and ensures steady cash flow. Metrics like inventory turnover ratios (typically 5:1 to 10:1) and maintenance expenses (15% to 40% of total costs) are key indicators of operational health. Generally, companies with gross margins exceeding 35% are more likely to achieve higher valuation multiples.

Strong management teams and clear Standard Operating Procedures (SOPs) also play a significant role in valuations. Companies with well-documented processes and a reduced dependency on the owner are seen as lower-risk investments, which can increase their multiples. Conversely, businesses where the owner’s technical expertise is critical often face discounts. A Debt Service Coverage Ratio (DSCR) above 1.5x is another strong indicator of financial health that buyers and lenders closely evaluate.

Market trends and customer relationships further influence valuation multiples, building on these operational fundamentals.

Market Position and Customer Base

Beyond physical assets and operational performance, a manufacturer’s position in the market significantly impacts its valuation. High customer concentration - where a single customer accounts for more than 15% of revenue or a single sector contributes over 25% - is considered a risk factor and often leads to downward adjustments in valuation multiples.

Long-term contracts and consistent renewals, however, provide revenue stability and justify higher multiples compared to businesses reliant on one-off sales. Companies with strong brand loyalty or "Tier 1" supplier status are better positioned to pass along rising input costs without losing business, which helps protect margins and supports higher valuations.

"If your firm has lower margins, weaker systems, or a concentrated customer base, we may adjust the multiple down. On the other hand, stronger retention, better operations, or more pricing power may support a higher one." - Chris Walton, CEO, Eton Venture Services

Manufacturers with proprietary processes, specialized certifications, or key contracts often command higher multiples. Additionally, businesses operating in growing sectors - like medical components or AI infrastructure - are particularly attractive, as buyers may value them based on future growth potential, rather than just historical earnings.

Valuation Multiples by Manufacturing Type

Industry-specific valuation multiples play a key role in setting benchmarks for buyers and sellers in the manufacturing sector. These benchmarks reflect how unique dynamics within each sector influence valuation.

Automotive and Industrial Equipment Manufacturing

In the automotive manufacturing sector, EBITDA multiples range from 7.0x to 10.2x. Smaller companies generating $1–3 million in EBITDA typically see multiples around 7.0x, while larger businesses with $5–10 million in EBITDA can reach up to 10.2x. For smaller, owner-operated automotive businesses, the median earnings multiple drops further to about 3.29x. As of January 2026, public auto parts manufacturers are trading at 9.11x EV/EBITDA.

Industrial equipment and machinery manufacturers, particularly those leveraging Industrial IoT technology, often command some of the highest multiples in manufacturing. EBITDA multiples for this group fall between 7.4x and 11.0x. Smaller operations in this sector average a median earnings multiple of 3.49x, while public machinery companies are trading at approximately 17.46x EV/EBITDA. Because these industries are capital-intensive, the debt-to-EBITDA ratio becomes a crucial metric for assessing financial health. Companies invested in advanced, automated production lines or proprietary technologies often hit the higher end of valuation ranges, making them attractive to buyers focused on operational efficiency.

Food and Beverage Manufacturing

The food and beverage manufacturing sector tends to show stable valuation multiples. Companies with $5–10 million in EBITDA trade at multiples of 8.1x to 9.4x, while smaller operations typically fall between 4.0x and 8.0x. Public food processors, as of January 2026, trade at an average of 9.63x EV/EBITDA.

Revenue multiples in this sector vary significantly. Standard producers see multiples ranging from 0.5x to 0.69x, while specialty producers - thanks to strong branding - achieve higher multiples of 1.0x to 1.5x. Certifications like FSMA and HACCP reduce operational risks and support higher valuations. However, factors such as high inventory reserves (10–20% of revenue) or a concentrated customer base (15–25% of revenue) can lead to valuation discounts. On the other hand, businesses with proprietary recipes, organic certifications, or patented processes often secure a premium of 10–15%, reflecting their competitive edge in negotiations.

General Manufacturing

General manufacturing businesses, which don't fall into more specialized categories, typically trade at lower valuation multiples. EBITDA multiples for these companies range from 3.54x to 4.19x, while smaller operations see SDE multiples between 2.68x and 3.54x. Revenue multiples average between 0.54x and 0.79x. These lower figures often reflect the commodity-like nature of many general manufacturing operations and the competitive pressures in this space.

Subsectors within general manufacturing show notable variations. For example:

- Machine shops and tool manufacturers average an earnings multiple of 3.34x, with median revenues around $1,152,880.

- Metal product manufacturers average 3.12x.

- Sign manufacturers trade closer to 2.45x, while furniture manufacturers average 2.72x.

- Electronic equipment manufacturers typically see multiples near 3.00x.

| Manufacturing Type | EBITDA Multiple Range | Revenue Multiple Range |

|---|---|---|

| Automotive | 7.0x – 10.2x | 0.68x |

| Industrial IoT | 7.4x – 11.0x | N/A |

| Food & Beverage | 8.1x – 9.4x | 0.5x – 1.5x |

| General Manufacturing | 3.54x – 4.19x | 0.54x – 0.79x |

| Machine Shops | ~3.34x | 0.85x |

The state of physical assets and a facility's readiness for operation heavily influence where a business falls within these valuation ranges. Companies requiring significant equipment upgrades or lacking detailed operating procedures usually trade on the lower end. Conversely, well-maintained facilities with minimal capital expenditure needs often command premium multiples. These benchmarks provide a solid foundation for accurately assessing the value of manufacturing businesses.

How to Calculate Manufacturing Business Value

Determining the value of an asset-heavy manufacturing business goes beyond applying a simple multiple. It requires a detailed adjustment of financials to reflect true profitability, selecting the right valuation metric, and carefully accounting for the physical assets that define these businesses. This step-by-step process ensures an accurate valuation.

Step 1: Normalize Financial Statements

To get a clear picture of the business’s earnings, start by normalizing the financial statements. This involves adjusting for factors like the owner’s personal expenses and any non-recurring costs. Begin with net income and then add back interest, taxes, depreciation, amortization, the owner’s salary, and personal expenses charged to the business. This calculation results in Seller’s Discretionary Earnings (SDE), which is especially relevant for smaller manufacturers.

Next, replace the owner’s salary with a market-based compensation for a professional manager. Review the balance sheet to ensure assets are valued at fair market rates. This includes writing down obsolete inventory, assessing accounts receivable for collectability, and accounting for any unrecorded liabilities like pending legal issues or environmental regulations. Manufacturing businesses often show median SDE margins just under 24%, so normalized margins far below this may raise red flags for buyers. Once your financials are normalized, you’re ready to choose the appropriate valuation multiple.

Step 2: Choose the Right Multiple

With normalized financials in hand, the next step is selecting a valuation multiple that aligns with your business’s size, subsector, and financial structure. For smaller manufacturers with revenue under $5 million, SDE multiples are common, averaging around 3.10x SDE or 0.72x revenue. Larger companies, typically run by professional management, often rely on EBITDA multiples. In asset-heavy industries, these multiples can vary by subsector - for instance, specialized areas like automotive or industrial IoT may see EBITDA multiples ranging from 7.0x to 11.0x.

For businesses with differing capital structures, Enterprise Value (EV) multiples offer consistency by accounting for debt. In operations requiring regular equipment reinvestment, an EV/(EBITDA − CapEx) multiple might better represent cash flow. If EBITDA is unstable or negative, revenue multiples could be used, though they don’t account for profit margins. Additionally, businesses with significant revenue concentration - like over 15% from one customer or 25% from one sector - may face lower multiples due to higher risk. A Debt Service Coverage Ratio (DSCR) of at least 1.5x is often needed to support higher multiples.

Step 3: Account for Physical Assets

For asset-heavy manufacturers, physical assets play a critical role in valuation. Obtain professional appraisals for specialized machinery and real estate. Certified third-party valuations can provide strong leverage during negotiations. Modern, well-maintained machinery typically supports higher multiples, while older equipment can reduce value.

"Fair market value is a hypothetical price that a willing buyer would agree upon with a willing seller... without any known outside influence." - CBIZ

In cases where profitability is low, the net asset value often sets a valuation floor, meaning the business is unlikely to sell for less than the liquidation value of its equipment and inventory. Review inventory for obsolescence and aim for turnover ratios between 5:1 and 10:1. Owned real estate should be valued separately from the operating business to avoid distorting the core valuation. Lastly, calculate net working capital by adjusting accounts receivable for uncollectibles and ensuring enough cash flow post-sale. Combine your normalized earnings (SDE or EBITDA) with the appropriate industry multiple and adjust for asset values to determine the business's total valuation.

Final Thoughts on Manufacturing Business Valuation

Valuing a manufacturing business isn’t as straightforward as plugging numbers into a formula. These businesses often come with a mix of physical assets - some of which may have depreciated on paper but still carry significant market value - and financial metrics like normalized earnings, which provide a clearer picture of profitability. Add to that qualitative factors, such as customer concentration and the strength of management, and it’s clear why these valuations require a more nuanced approach. Typically, manufacturing businesses sell for 2.0x to 3.6x their annual Seller's Discretionary Earnings (SDE). However, companies with proprietary technology or dominant market positions can fetch even higher multiples. This complexity highlights the importance of detailed analysis and experienced advisory support.

Skipping accurate financial analysis isn’t just risky - it can be costly. Deals often fall apart when lenders examine the Debt Service Coverage Ratio and find that cash flow won’t support financing. Frances Brunelle from Accelerated Manufacturing Brokers puts it plainly:

"Bad valuations have devastating impacts for your long-term plans. Selling your business for less than it's worth doesn't just leave money on the table, it shrinks your retirement resources."

Professional advisors can make a real difference. In 2024, the median sale price for manufacturing businesses hit $700,000, but skilled advisors often exceed market averages by tapping into niche buyer networks and leveraging forward-thinking valuation methods. For example, they can uncover hidden value in proprietary technology or long-term customer contracts that standard metrics might overlook. They also address asset misvaluations, such as updating machinery values from book value to fair market value, which can significantly boost the final sale price.

To handle these challenges effectively, focus on meticulous preparation and seek expert guidance. Start by organizing at least three years of clean financial records, getting professional appraisals for specialized equipment, and addressing any operational weaknesses before pursuing a valuation. A combination of thorough preparation and expert advice can help you secure a better deal.

FAQs

What’s the difference between SDE and EBITDA multiples when valuing manufacturing businesses?

The distinction between SDE (Seller’s Discretionary Earnings) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples primarily depends on the size and nature of the business being evaluated.

SDE multiples, which generally fall between 2.7x and 3.5x, are commonly used for smaller, owner-operated manufacturing businesses with annual revenues under $2–$3 million. These multiples factor in the owner's personal expenses and discretionary adjustments, making them particularly useful when the owner's role has a significant influence on the company’s profitability.

In contrast, EBITDA multiples, typically ranging from 3.5x to 9.0x, are suited for larger manufacturing companies with revenues exceeding $5 million. Unlike SDE, EBITDA excludes owner-specific expenses, offering a more accurate picture of operational cash flow. This makes it a preferred metric for institutional investors or buyers focused on larger, more structured businesses.

To sum it up, SDE works best for valuing smaller, owner-centric businesses, while EBITDA is the go-to for larger, investor-oriented companies.

How do physical assets impact the valuation of a manufacturing company?

Physical assets play a major role in determining the value of manufacturing companies, especially in industries that rely heavily on tangible resources. Items like machinery, equipment, inventory, and real estate often serve as the backbone of valuation methods, particularly the asset-based approach. To ensure an accurate reflection of a company’s worth, these assets are typically adjusted from their historical cost to their fair market value.

Machinery and equipment hold particular importance because they directly influence production capacity and efficiency. Their valuation depends on factors such as age, condition, and current market demand, all of which can significantly impact the overall business value. However, while physical assets are undeniably important, intangible assets also play a crucial role. Elements like intellectual property, customer relationships, and operational efficiencies drive long-term growth and competitive advantage. A thorough valuation considers both tangible and intangible factors, offering a more complete and balanced view of a company's true value.

Why would a manufacturing business use revenue multiples instead of earnings-based multiples for valuation?

Manufacturing businesses often lean toward using revenue multiples when their profitability is inconsistent or cash flow is unpredictable. By focusing on top-line revenue instead of volatile earnings, this method provides a steadier and more dependable way to determine value.

This approach is especially helpful in industries with high fixed costs or cyclical demand, where short-term profitability can vary significantly. It offers a broader perspective on the business's long-term potential.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)