EBITDA multiples for SaaS and software companies are stabilizing in 2025-2026. Here's a quick breakdown:

- Private SaaS companies: Median multiple of 22.4x, with top performers exceeding 46x.

- Public software companies: Median multiples around 12.7x.

- Key drivers: High EBITDA margins, strong customer retention (Net Revenue Retention >120%), and efficient growth (Rule of 40 >40%).

- AI impact: Companies leveraging AI effectively see valuation boosts, especially in sectors like Data Infrastructure (24.4x) and DevOps (36.5x).

- Valuation trends: Larger companies and those with predictable cash flows secure higher multiples, while smaller, founder-dependent firms trade at lower levels.

The market is rewarding profitability, predictable revenue, and operational efficiency over aggressive growth. For buyers and sellers, clean financials, scalable operations, and a clear growth strategy are essential to achieving premium valuations.

SaaS Valuation Explained: SDE vs. EBITDA vs. Revenue Multiples

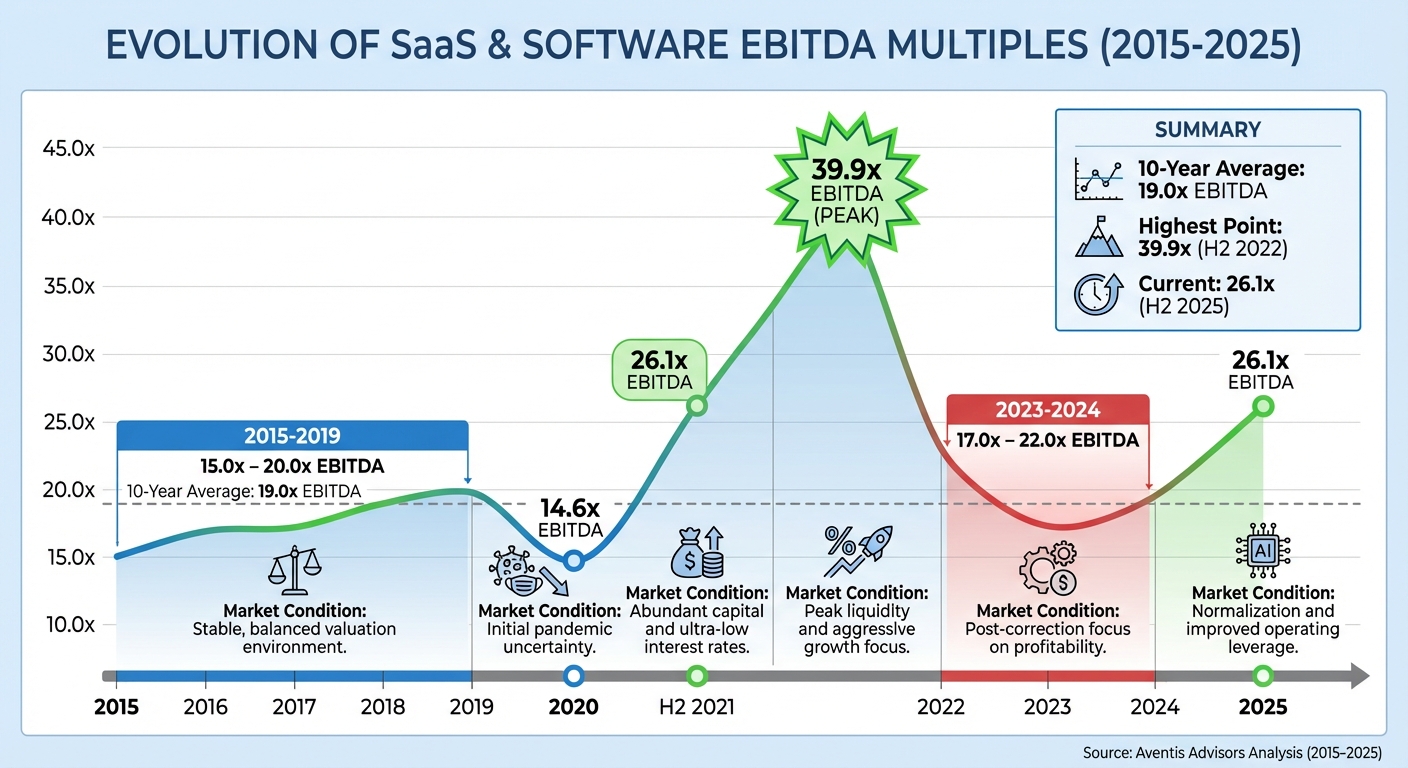

EBITDA Multiple Trends from 2015 to 2025

SaaS EBITDA Multiple Trends 2015-2025: From Stability to Peak and Normalization

Over the last decade, software valuation multiples have experienced periods of both steadiness and rapid growth, eventually settling into a more balanced state. From 2015 to 2019, EBITDA multiples were relatively stable, ranging between 15.0x and 20.0x. This reflected a market where investors carefully balanced growth potential with profitability. However, the onset of the pandemic in 2020 briefly disrupted this stability, causing the median multiple to dip to 14.6x as investor confidence wavered.

By late 2021, multiples skyrocketed to 26.1x, fueled by ultra-low interest rates and a surge of capital that encouraged a "growth at all costs" mindset. This frenzy reached its peak in the second half of 2022, with multiples hitting an extraordinary 39.9x EBITDA - the highest level seen in a decade. During this time, investor priorities shifted toward cash flow, margins, and operational efficiency. The Federal Reserve's interest rate hikes in 2022 triggered a sharp market correction, leading to a recalibration of these valuations.

| Period | Median EV/EBITDA Multiple | Market Condition |

|---|---|---|

| 2015–2019 | 15.0x – 20.0x | Stable, balanced valuation environment |

| 2020 | 14.6x | Initial pandemic uncertainty |

| H2 2021 | 26.1x | Abundant capital and ultra-low interest rates |

| H2 2022 | 39.9x | Peak liquidity and aggressive growth focus |

| 2023–2024 | 17.0x – 22.0x | Post-correction focus on profitability |

| H2 2025 | 26.1x | Normalization and improved operating leverage |

Source: Aventis Advisors Analysis (2015–2025) [8]

During 2023 and 2024, multiples retreated to a range of 17.0x to 22.0x as investors demanded clear evidence of sustainable profitability. By the second half of 2025, multiples rebounded to 26.1x, driven by stronger operating leverage and advancements in AI-driven efficiency. Over the span of this decade, the median multiple averaged 19.0x, serving as a benchmark for a more normalized valuation environment.

SaaS Valuation Changes Over Time

SaaS companies experienced notable shifts in valuation trends during this period. Between 2015 and 2020, SaaS firms enjoyed a 40% valuation premium over traditional software companies, reflecting the strong appeal of their recurring revenue models. However, this premium narrowed during the valuation boom of 2021, as all software segments saw significant increases. By 2024, the premium had stabilized at around 21%.

At the height of the growth-focused era in November 2021, Asana set a record with a valuation of 89.0x revenue. Following this peak, the Aventis SaaS Index dropped by more than 60% from its early 2021 high as the market reassessed risk. By Q3 2025, public SaaS companies reported a median EBITDA margin of 9.3%, a remarkable improvement from the net losses that were common between 2020 and 2022. Meanwhile, profitable private SaaS companies consistently traded above 20.0x EBITDA, with some reaching as high as 29.1x in 2022.

The "Rule of 40" - a widely used benchmark for SaaS valuation - gained increasing importance during this time. However, by late 2025, only 17% of publicly traded SaaS companies met the Rule of 40 threshold, down from about 30% in 2015.

Software Company Valuation Changes Over Time

Traditional software firms also adapted their valuation strategies as business models evolved. The adoption of hybrid cloud and subscription models helped narrow the valuation gap between these companies and pure-play SaaS firms. As a result, the distinction between "SaaS" and "software" became less pronounced, with investors focusing more on the overall economics of the business model rather than just the delivery method.

By October 2025, vertical software companies commanded a slight premium, trading at 3.3x revenue compared to horizontal SaaS companies at 3.0x revenue. This premium was attributed to deeper customer relationships and higher switching costs. Infrastructure software remained a standout, with Data Infrastructure businesses trading at 24.4x EBITDA and DevOps companies at 36.5x. In contrast, the broader SaaS median stood at 12.7x. U.S.-based software firms led the pack, trading at a median of 25.0x EBITDA, significantly higher than their counterparts in France (2.8x) and Canada (2.5x).

Company size also played a decisive role in valuations. Deals exceeding $500 million averaged 26.9x EBITDA, while smaller transactions under $5 million averaged 17.2x. This emphasized the premium placed on scale, established operations, and reduced risk perception.

Expected EBITDA Multiples for 2025-2026

The valuation landscape for SaaS and software companies in 2025-2026 reflects a shift toward fundamentals, prioritizing solid business metrics over speculative growth. By 2025, the median EBITDA multiple for SaaS businesses is around 22.4x, with top-performing companies reaching 46.5x EBITDA, driven by robust growth and operational efficiency. This marks a stabilization after the volatility seen from 2022-2024, with 75% of SaaS CEOs anticipating steady or rising valuations through 2025-2026.

Company size plays a major role in determining valuation. Larger companies typically secure higher multiples due to their lower risk profile, stronger management teams, and strategic appeal. Private equity firms value profitable SaaS businesses between 15x and 25x EBITDA, favoring predictable cash flows over high-burn models. As of July 2025, the average EBITDA multiple for the software sector was 10.59x, while IT Services & Consulting averaged 9.68x. This section explores how factors like growth rates, company size, and profitability shape these valuations.

How ARR Growth Rate Affects Multiples

Revenue growth rates play a crucial role in driving valuation premiums. Private SaaS companies with over 40% ARR growth can command 7x–10x ARR multiples, while those with slower growth below 20% typically see multiples between 3x–5x. These higher multiples reflect investor confidence in the company’s ability to scale and gain market share.

In Q3 2025, every 10-point improvement in the Rule of 40 score corresponded to a 1.1x increase in EV/Revenue multiples.

| ARR Growth Rate | Private SaaS ARR Multiple |

|---|---|

| High Growth (>40%) | 7x–10x |

| Moderate Growth (20–40%) | 5x–7x |

| Low Growth (<20%) | 3x–5x |

Source: Flippa 2025 Benchmarks [10]

How Company Size and Profitability Affect Multiples

In addition to growth rates, profitability and operational independence significantly influence valuation multiples. For smaller SaaS businesses, moving from owner-operated models to scalable enterprises is a critical milestone. Companies with ARR between $1 million and $5 million are often evaluated on their scalability rather than their reliance on the founder.

"Typically below ARR of $1M, the business is owner-operated. Another individual taking this on full-time will not pay a revenue multiple for an owner-operated business. They will pay a multiple on profit generated, typically anywhere from 2x–4x."

- Nick Carlucci, Broker, Flippa

Profitability also plays a key role. For B2B SaaS companies with $0–$1 million in EBITDA, those with low growth and high customer churn trade at 2.7x–3.1x, while high-growth, low-churn businesses can achieve multiples between 5.1x–8.1x. For companies generating $1 million–$3 million in EBITDA, low performers see multiples around 4.5x–5.0x, while high performers reach 8.3x–14.0x.

Recent sales illustrate these valuation dynamics:

- An Ads Generating SaaS business sold for $1.35 million with a 41% profit margin, achieving a 5.8x profit multiple and a 2.4x revenue multiple.

- Predictology, a sports data analytics SaaS platform, sold for $720,000 with an 84% profit margin, reflecting a 2.8x profit multiple and a 2.4x revenue multiple.

- A Call Tracking & Analytics SaaS business sold for $725,000 with a 74% profit margin, valued at a 4.0x profit multiple and a 2.9x revenue multiple.

Operational efficiency and structural maturity also play a big role in driving valuation multiples. For instance, industry specialization impacts valuations within the lower-middle market. Healthcare and MedTech SaaS companies with $1 million–$3 million in EBITDA trade at 11.6x, while those with $3 million–$5 million in EBITDA reach 13.5x. Human Resources SaaS commands even higher multiples, trading at 15.6x and 17.1x, respectively. In contrast, Real Estate and PropTech SaaS companies trade at 9.3x and 10.4x.

Reducing founder dependency can also boost EBITDA multiples by 15% to 30% for smaller businesses. This underscores the importance of documenting processes, building a capable management team, and creating systems that allow the business to function without heavy reliance on the founder.

What Drives EBITDA Multiples in 2025-2026

The valuation game for SaaS and software companies has changed. Investors now focus on efficiency and sustainable growth, leaving behind the "growth at any cost" mindset that once ruled the market. Today, companies that balance growth with operational discipline are the ones catching investors' eyes. Let’s break down the key metrics driving these valuation shifts.

Rule of 40 and Profitability Standards

The Rule of 40 - a formula that combines revenue growth rate with EBITDA margin - has become the go-to metric for evaluating SaaS companies in 2025-2026. Companies scoring above the 40% threshold prove they can grow without sacrificing profitability.

"Software companies that outperform the Rule of 40 have valuations double that of companies that fall 'below the line,' and they achieve returns as much as 15% higher than the S&P 500."

- Ben Murray, The SaaS CFO

For perspective, the median Rule of 40 score for healthy SaaS companies is around 42%. Some companies are far exceeding this benchmark. Take Palantir Technologies, for example, which reported a staggering Rule of 40 score of 114% and an impressive gross margin of 80.81% as of January 2026. While profitability remains a cornerstone, the role of technology - especially AI - is becoming equally critical, as discussed next.

AI Adoption and Operating Efficiency

In 2025-2026, AI readiness is a key differentiator for SaaS valuations. Investors are drawn to companies that clearly explain how AI enhances their operations, improves customer experience, and shapes their product strategies. The numbers back up this trend: SaaS M&A activity hit a record high of 746 transactions in Q3 2025, marking a 26% year-over-year increase, largely driven by AI adoption.

"CEOs who detail AI's impact on operations, customer experience, and product roadmap stand out in the market."

- Diamond Innabi, Software Equity Group

Certain sectors are leading the pack. For instance, Data Infrastructure software is trading at a median EBITDA multiple of 24.4x, while DevOps is commanding an even higher multiple at 36.5x as of October 2025. Companies that align their tech strategies with operating efficiency are reaping the rewards, as investors increasingly favor businesses that pair growth with disciplined, high-margin operations.

Net Revenue Retention and Gross Margins

Metrics like Net Revenue Retention (NRR) and gross margins are playing a huge role in determining valuation premiums. SaaS companies with NRR above 120% saw a median multiple of 11.7x in 2024 - more than double the industry median of 5.6x. A high NRR signals strong customer loyalty, revenue stability, and a solid product-market fit, all of which are highly valued by buyers.

Gross margins are equally important. Companies with margins exceeding 80% earned a median multiple of 7.6x, compared to just 5.5x for those below that mark. These figures highlight the importance of operational discipline and a clear path to profitability in today's market. Interestingly, about 28% of SaaS CEOs don’t track gross revenue retention, leaving them at a disadvantage in the competitive M&A landscape.

sbb-itb-a3ef7c1

SaaS vs. Software Company EBITDA Multiples

This section dives into the valuation differences between pure SaaS models and traditional software approaches, particularly in the 2025-2026 period. Pure SaaS companies generally enjoy higher valuation multiples compared to their traditional or hybrid software counterparts. Why? It all boils down to revenue predictability. SaaS businesses thrive on recurring subscription revenue, offering investors a stable and predictable cash flow. In contrast, traditional software companies often rely on project-based income or one-time license fees, which can lead to more erratic revenue streams.

Let’s look at the numbers. In the first half of 2025, pure SaaS companies with EBITDA between $5 million and $10 million achieved a median multiple of 12.4x, slightly higher than the 12.0x for broader Software Development companies in the same range. While this initial gap might seem small, retention metrics significantly amplify the difference. For instance, SaaS businesses with Net Revenue Retention above 120% saw multiples soar to 11.7x, more than double the industry median of 5.6x.

Here’s a closer look at EBITDA multiples across different business models:

| Business Type | EBITDA Multiple ($1-$3M) | EBITDA Multiple ($5-$10M) |

|---|---|---|

| Pure SaaS (Subscription) | 8.7x | 12.4x |

| B2B SaaS | 9.0x | 12.4x |

| Software Development (Hybrid) | 8.6x | 12.0x |

| Managed Services | 8.2x | 10.8x |

Source: FirstPageSage H1 2025 Report [5]

Digging deeper, vertical SaaS - known for fostering stronger customer relationships and higher switching costs - traded at 3.3x revenue as of October 2025, compared to 3.0x for horizontal SaaS. Vertical SaaS also accounted for 54% of all SaaS M&A activity in Q3 2025, a jump from 43% the previous year.

When it comes to commanding top-tier multiples, infrastructure software leads the pack. Data Infrastructure is trading at an impressive 24.4x EBITDA, while DevOps takes it even further at 36.5x, both far surpassing the median of 12.7x for all SaaS companies. These eye-popping numbers highlight the importance of robust data and development platforms in the AI-driven market. On the other end of the spectrum, industries like AdTech, which face higher platform risks and less predictable revenues, trade at a much lower 7.0x EBITDA.

Using Clearly Acquired Tools for SaaS Valuations

Technology is reshaping how SaaS companies are valued, and Clearly Acquired's AI-powered valuation platform is leading the charge. This platform revolutionizes the way buyers and sellers apply 2025–2026 EBITDA multiples by moving beyond outdated spreadsheets and static comparables. Instead, it offers real-time predictive insights that refine financial forecasts on the go. This shift transforms valuation from a reactive exercise into a proactive strategy, giving users a leg up in competitive markets. It also paves the way for deeper automation in financial normalization and benchmarking.

One of the platform’s standout features is its ability to handle financial normalization, a vital step in accurate SaaS valuations. It identifies areas for improvement, eliminates personal expenses that skew numbers, and ensures revenue recognition policies are clear. For instance, if a business owner has been running personal vehicle expenses through the company, the tool adjusts EBITDA upwards and applies a market-based salary for leadership. This tackles valuation inconsistencies that have been flagged in past market studies.

The platform’s benchmarking tools are another game-changer. It segments SaaS companies by sub-industry - Vertical, Horizontal, or Infrastructure SaaS - and organizes them by revenue and EBITDA ranges, reflecting different stages of market maturity. This allows users to compare a target company against precise industry benchmarks. Additionally, the platform calculates Rule of 40 scores (Growth % + Profit %), helping to highlight companies that command premium valuations by exceeding this threshold.

Clearly Acquired also simplifies due diligence with its secure data rooms. These spaces organize financial statements, customer contracts, and operational metrics in a permission-controlled environment. Buyers gain from AI-driven risk screenings, while sellers maintain confidentiality throughout the process. The platform’s pipeline management tools further streamline communication and data sharing, speeding up negotiations and reducing unnecessary friction. On top of that, it helps users explore SBA 7(a) loan terms vs. other financing options during the process.

Whether you’re a buyer evaluating multiple SaaS opportunities or a seller planning an exit, the platform matches deals with the right capital sources using real underwriting criteria - not generic quotes. Financing options include SBA 7(a) loans, conventional lending, and creative structures like seller notes or earnouts. By integrating valuation analysis, financial normalization, and capital stack planning into one seamless system, Clearly Acquired makes it easier to apply 2025–2026 EBITDA multiples to SaaS transactions effectively.

Conclusion

EBITDA multiples for SaaS and software companies have settled into a steady range for 2025-2026. Private SaaS companies are trading at a median of 22.4x, with top-performing companies reaching over 46x. Meanwhile, public market multiples hover around 12.7x.

Several factors now play a critical role in shaping valuations. These include strong performance under the Rule of 40 (balancing growth and profitability), net revenue retention surpassing 120%, gross margins exceeding 80%, and a well-defined AI strategy that capitalizes on emerging technologies.

The market has shifted its focus from prioritizing rapid growth at any cost to emphasizing efficient, sustainable growth. Buyers are now looking for businesses with predictable cash flow, strong customer retention, and disciplined operations. Vertical SaaS, which represented 54% of all transactions in Q3 2025, is especially appealing due to its deeper customer relationships and higher switching costs. At the same time, infrastructure categories like Data and DevOps are commanding higher multiples, driven by the ongoing AI data boom.

For sellers, maintaining clean financial records, tracking key metrics accurately, and presenting a clear AI roadmap are essential steps. On the buyer side, the focus should remain on companies with high margins, strong retention rates, and defensible market positions. It's equally important to ensure that acquisition targets are prepared to harness AI opportunities while mitigating risks associated with generative AI.

Advanced tools are playing a transformative role in this evolving market. Clearly Acquired's AI-powered platform streamlines the valuation process with real-time analysis, data normalization, benchmarking, and secure due diligence. Whether you're assessing acquisition opportunities, preparing for an exit, or structuring financing, the platform connects you with the right capital sources, offering precise underwriting criteria. It combines valuation, diligence, and capital planning into a single, integrated system designed for Main Street to Lower-Middle-Market SaaS transactions.

With SaaS M&A activity hitting record levels in 2025 and valuations stabilizing for high-quality companies, businesses with strong fundamentals are well-positioned to secure premium offers. By leveraging these insights and tools, you can strategically approach acquisitions, sales, or investments. These trends reaffirm that disciplined growth and operational excellence are the keys to achieving top-tier valuations in today’s SaaS and software markets.

FAQs

How is AI influencing EBITDA multiples for SaaS companies?

AI is driving a noticeable boost in EBITDA multiples for SaaS companies projected for 2025–2026. Investors are increasingly drawn to the sector, thanks to its rapid growth and enhanced operational efficiency. SaaS companies that successfully integrate AI into their product offerings are enjoying higher valuations, with some markets reporting premiums ranging from 15% to 24%. This is largely due to AI's ability to significantly enhance productivity and scalability.

AI-first SaaS companies are also setting new benchmarks by achieving much higher revenue per employee compared to traditional standards. This efficiency translates into stronger EBITDA margins. The combination of accelerated revenue growth and improved profitability is making these AI-powered companies particularly attractive to buyers and investors, who are willing to assign premium multiples to those effectively leveraging AI.

Why do larger SaaS companies typically have higher EBITDA multiples?

Larger SaaS companies tend to command higher EBITDA multiples, and it’s not hard to see why. Their size often brings steadier cash flows, stronger growth opportunities, and higher profitability - qualities that naturally appeal to buyers and investors by lowering perceived risks.

On top of that, bigger firms enjoy advantages like economies of scale, well-established customer bases, and competitive edges that set them apart. These strengths not only boost their market position but also significantly increase their valuation, as the mix of stability and growth makes them especially attractive in the eyes of potential investors.

What is the Rule of 40, and why is it important in SaaS company valuations?

The Rule of 40 is a straightforward metric that gauges the financial health of SaaS companies by balancing two critical factors: growth and profitability. It works like this - combine a company’s revenue growth rate with its EBITDA (or profit) margin. If the total hits 40% or more, the company is often seen as financially strong and balanced. Companies meeting or exceeding this benchmark tend to enjoy higher valuation multiples, while those falling short may struggle with lower valuations.

In today’s market, where sustainable growth outweighs sheer revenue expansion, the Rule of 40 has become a go-to measure. It helps buyers, sellers, and investors quickly determine if a SaaS company can scale effectively without draining its cash reserves. This makes it an essential tool for setting valuation expectations, comparing acquisition targets, and ensuring deal pricing aligns with market trends, particularly for transactions in 2025-2026.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)