AI is transforming budget validation by automating repetitive tasks, analyzing vast datasets, and improving risk detection. It reduces errors, speeds up processes, and enhances forecasting accuracy. Here's how AI makes a difference:

- Faster Reviews: Cuts first-pass financial reviews by 27% (58 to 42 minutes) and mathematical checks by 52% (25 to 12 minutes).

- Higher Accuracy: Identifies risks with over 85% precision, far exceeding manual sampling.

- Predictive Insights: Delivers 20-40% more accurate forecasts and runs multiple budget scenarios instantly.

- Cost Efficiency: Recovers 20-30% of write-offs, boosting EBITDA by 0.3%-0.4%.

AI also strengthens fraud detection, compliance checks, and data organization, making it an essential tool for modern financial workflows. While AI handles data processing, human expertise and strategic consultation services ensure effective decision-making.

7 Ways AI CUT 99% of Financial Reporting Errors

sbb-itb-a3ef7c1

How AI Improves Budget Validation Accuracy

AI is reshaping how budgets are validated by automating tedious tasks, identifying inconsistencies across vast datasets, and running multiple forecast scenarios in record time. Let’s dive into how automation, anomaly detection, and predictive analysis come together to enhance the precision of budget validation.

Automated Data Extraction and Standardization

Thanks to Natural Language Processing, AI can extract financial data from contracts, press releases, and reports without requiring human input. It also uses machine learning to pull data from PDFs and standardize it automatically, reducing errors caused by manual entry.

The efficiency gains here are hard to ignore. For example, AI-powered tools can conduct over 450 automated checks per financial statement. Casting times drop from 25 minutes to 12 minutes, while first-pass reviews of statements shrink from 58 minutes to 42 minutes. Some audit teams even report efficiency gains of 40% to 50% on subsequent drafts through automation.

AI also addresses the chaos of unstructured data. It organizes, tags, and secures diligence archives and pricing benchmarks, turning scattered information into structured datasets ready for analysis. Even virtual data rooms benefit - AI organizes uploaded documents and suggests redactions for sensitive details automatically. As Jack Holloway, Commercial Director at Caseware, explains:

Clients often iterate through 10+ versions of statements with auditors. This creates inefficiencies and miscommunications.

By catching errors early, AI minimizes these repetitive back-and-forths.

Anomaly Detection for Finding Inconsistencies

AI’s pattern recognition capabilities are unmatched when it comes to analyzing large datasets. Machine learning algorithms can cross-check purchase prices in financial statements against tax declarations or notarial deeds, flagging discrepancies in seconds. They can also identify specific red flags like dividends paid without withholding tax, unusual indemnity clauses, or non-compliant board resolutions.

This technology boasts an 85% or higher accuracy rate in identifying risks, far surpassing human-only reviews that rely on limited sampling and subjective judgment. McKinsey highlighted this by using a dataset of over 1,600 enterprise transformations and 500,000+ initiatives to quickly pinpoint performance drivers and estimate outcomes.

AI doesn’t just find inconsistencies - it synthesizes vast amounts of public and proprietary data to uncover trends and propose hypotheses that analysts might miss. For instance, it can flag unrealistic revenue projections based on historical performance or detect understated expenses when compared to industry norms. Martin Baumgartner, a Partner at EY Switzerland, emphasizes:

A close collaboration between AI software and experienced humans will be vital to offer top-notch M&A due diligence services in the future.

With accurate anomaly detection as a foundation, AI takes things further with advanced forecasting.

Predictive Forecasting and Scenario Analysis

AI’s predictive forecasting takes the guesswork out of traditional manual analysis. By combining machine learning with driver-based models, it enables what BCG calls "dynamic steering" - forecasts that adjust in real time as new data becomes available. This method integrates both internal financial data and external market signals, like consumer spending trends, to create plans with less human bias and lower variance.

Companies that use AI for planning and forecasting report 30% faster planning cycles and forecasts that are 20% to 40% more accurate than traditional methods. Additionally, overall productivity in finance teams improves by 20% to 30% with AI-driven tools.

AI also runs multiple budget scenarios instantly, eliminating the delays of manual calculations. Teams can quickly test various assumptions - what if revenue grows 10% slower than expected? What if expenses rise by 15%? These real-time insights offer a clearer picture of potential outcomes.

| Capability | Traditional Approach | AI-Powered Approach |

|---|---|---|

| Planning Speed | Weeks to months | 30% faster cycles |

| Forecast Accuracy | Baseline | 20% to 40% improvement |

| Scenario Testing | Manual, time-intensive | Multiple scenarios instantly |

| Risk Detection | Subjective, limited sampling | 85%+ accuracy rate |

| Productivity Gain | Baseline | 20% to 30% increase |

AI-Powered Risk Assessment and Compliance Checks

AI isn't just about speeding up processes or improving accuracy - it actively seeks out risks that traditional methods might overlook. By scanning budgets for signs of fraud and comparing data against regulatory standards, AI shifts risk assessment from being a mere checklist to a proactive defense mechanism. This builds on AI's earlier roles in automating data analysis and spotting anomalies, further safeguarding the financial integrity of transactions.

Fraud Detection and Financial Integrity

AI systems are remarkably adept at analyzing financial statements and transaction records to uncover irregularities that could signal fraud. Using unsupervised learning, these systems can detect unusual patterns - sometimes referred to as "unknown unknowns." For instance, AI might flag recurring payments to unlisted entities in high-risk areas, which could point to potential bribery.

Machine learning models take this a step further by cross-checking budget data with external documents, highlighting issues like unpaid dividends, unsigned board resolutions, or significant off-balance-sheet items that could compromise financial integrity. Natural Language Processing (NLP) tools can sift through thousands of legal and financial documents to extract key clauses and flag any deviations from the norm. Meanwhile, computer vision technology can verify physical assets by analyzing satellite imagery, such as confirming inventory levels at storage facilities.

However, AI isn't perfect. The "black box" nature of some AI systems means their decision-making processes can be opaque, making human oversight essential. Professionals need to validate flagged risks and ensure findings are clear and justifiable to regulators, emphasizing the importance of explainable AI. These fraud detection tools lay the groundwork for AI's broader role in compliance verification.

Regulatory Compliance Verification

Building on its fraud detection capabilities, AI also helps firms ensure compliance with regulatory standards. By automating legal reviews, AI can scan massive databases to identify non-compliance with frameworks like GDPR or CCPA. Over time, machine learning algorithms refine their ability to detect anomalies and correlations as they process new datasets.

AI can pinpoint specific compliance gaps, such as missing documents like notarial deeds needed to verify financial integrity, or uncollected trade receivables from distressed parties. It also automates the redaction of sensitive employee details and intellectual property to maintain data privacy. For example, McKinsey used an anonymized dataset covering over 1,600 enterprise transformations and 500,000 initiatives to show how AI can summarize vast amounts of financial data in just hours - a task that would take human teams weeks.

AI's growing influence is even reshaping traditional legal concepts. For instance, what an "experienced business person" is expected to uncover during due diligence may now include findings aided by AI, potentially redefining what "fairly disclosed" means in transaction agreements.

To get the most out of AI tools, firms should develop a library of structured prompts for common validation tasks, ensuring consistent outputs from generative AI systems. Additionally, clear guidelines for data sharing and storage with AI vendors - such as encryption and access control protocols - are critical to maintaining security and compliance.

Adding AI to Financial Due Diligence Workflows

Incorporating AI into financial due diligence can streamline routine tasks using a secure deal room, freeing up teams to concentrate on strategic analysis. For instance, a McKinsey team recently leveraged an anonymized dataset to pinpoint performance drivers in just days instead of weeks. This transformation is reshaping roles, with analysts increasingly taking on the responsibility of managing and integrating AI tools. Below, we explore how to standardize data inputs and effectively combine AI insights with human expertise to refine due diligence processes.

Standardizing Data Input and Validation Processes

AI's ability to automate data validation is only as effective as the quality and structure of the input data. To maximize its potential, it's essential to standardize proprietary datasets. Start by identifying and tagging critical data sources, such as previous deal outcomes, synergy metrics, and pricing benchmarks, for AI analysis. Moving from unstructured search queries to structured prompts is equally important. Think of prompt engineering as akin to product management: clearly define roles, context, constraints, and data sources to ensure that AI outputs are both accurate and actionable. A shared prompt library with well-defined parameters can help your team maintain consistency across projects.

Instead of relying on generic AI tools, deploy specialized AI agents for targeted tasks like peer selection, market analysis, or revenue integrity checks. For example, in 2025, a SaaS company evaluating an acquisition used a generative AI model trained on proprietary customer and sales data. The AI identified users who were under-utilizing features and flagged those likely to upgrade, enabling the company to quantify revenue opportunities that might have been missed. To ensure smooth integration, consider designating an AI champion to act as a bridge between diligence, data, and risk management teams.

Combining AI Analysis with Human Judgment

While AI excels at processing and analyzing data, human expertise remains indispensable for interpreting results and steering decisions. AI can handle the "what" and "how", but humans are needed to answer the "so what" and "what next".

"A close collaboration between AI software and experienced humans will be vital to offer top-notch M&A due diligence services in the future."

- Martin Baumgartner, Partner, International Tax and Transaction Services, EY Switzerland

Establishing a governance framework is crucial to ensure accountability for AI-generated outputs and to address risks like algorithmic bias or AI hallucinations. A human-in-the-loop validation process is particularly important in sensitive areas such as fraud detection or regulatory compliance. Pilot programs, such as reviewing non-disclosure agreements or verifying specific budget items, can showcase the benefits of AI before scaling up its use. To further enhance accuracy, regularly assess AI performance, retrain models with updated data, and refine prompts as needed. These steps will help reduce errors and ensure that AI remains a reliable partner in financial due diligence.

Measuring AI's Impact on Budget Validation

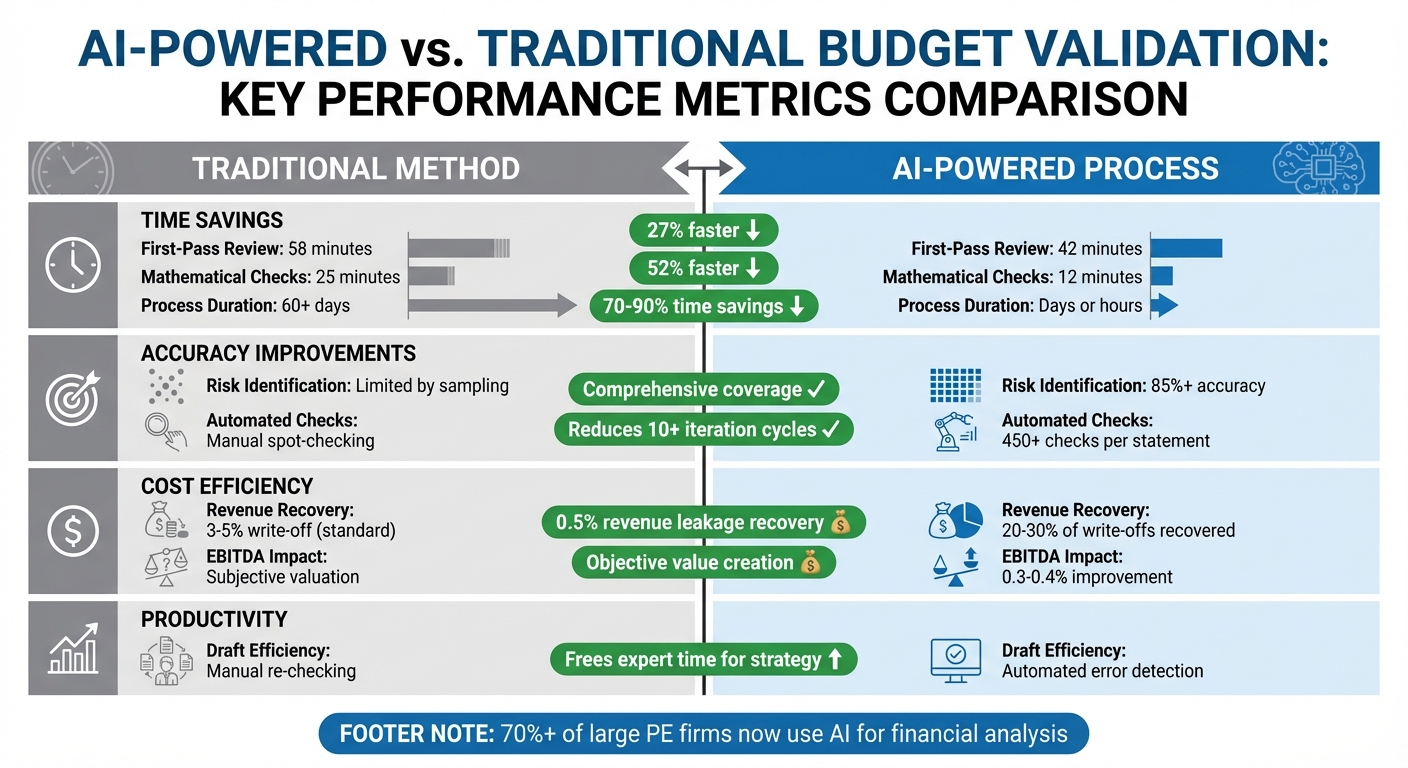

AI vs Traditional Budget Validation: Performance Metrics Comparison

Understanding the measurable impact of AI helps highlight its transformative role in budget validation. By examining key performance metrics, we can see how this technology is reshaping financial workflows, delivering improvements in speed, cost efficiency, and accuracy. Companies using AI-driven validation systems report major advancements, with some metrics showing over a 50% improvement.

Time savings stand out as one of the most visible benefits. Traditional first-pass reviews of financial statements take about 58 minutes, whereas AI-powered systems complete the same task in just 42 minutes - a 27% reduction. Similarly, mathematical checks drop from 25 minutes to 12 minutes, cutting the time by 52%. In one example, McKinsey analyzed a global oil and gas company in 2025 and applied AI to an anonymized dataset of 1,600 enterprise transformations and 500,000 initiatives. A process that once required weeks of manual effort was reduced to just days.

Cost savings are another significant advantage. AI can recover revenue that traditional methods often miss. For instance, businesses typically write off 3% to 5% of charges as bad debt. However, AI systems can recover 20% to 30% of these write-offs by pinpointing inefficiencies such as under-collection or coding mistakes. This translates to an EBITDA improvement of 0.3% to 0.4%. Additionally, AI streamlines processes, delivering operational efficiencies that further cut costs.

Accuracy improvements are driven by AI’s ability to analyze 100% of financial data instead of relying on manual sampling. AI-powered due diligence achieves risk identification accuracy rates of 85% or higher. Automated systems also conduct over 450 specific checks per financial statement, including cross-referencing and prior-year comparisons that human reviewers might overlook. Jack Holloway, Commercial Director at Caseware, explains:

Clients often iterate through 10+ versions of statements with auditors. This creates inefficiencies and miscommunications.

AI helps reduce these repeated iterations by identifying errors and inconsistencies during the initial review. These performance metrics clearly show how AI delivers tangible improvements over traditional methods.

Performance Metrics: Time, Cost, and Accuracy

The following table highlights how AI outperforms traditional methods across key performance indicators, showcasing its ability to improve efficiency, accuracy, and cost-effectiveness.

| Metric Category | Traditional Method | AI-Powered Process | Impact/Improvement |

|---|---|---|---|

| First-Pass Review | 58 minutes | 42 minutes | ~27% faster |

| Mathematical Checks | 25 minutes | 12 minutes | ~52% faster |

| Risk Identification | Limited by sampling | 85% or higher accuracy | Comprehensive coverage |

| Draft Efficiency | Manual re-checking | Reduces re-review iterations | Frees expert time |

| Revenue Recovery | 3-5% write-off (standard) | 20-30% of write-offs recovered | 0.5% revenue leakage recovery |

| EBITDA Impact | Subjective valuation | 0.3-0.4% improvement | Objective value creation |

| Process Duration | 60+ days | Days or hours | ~70-90% time savings |

With over 70% of large private equity firms now using AI for financial analysis, it’s clear that this technology offers a competitive edge. These metrics not only demonstrate AI’s efficiency but also pave the way for its broader adoption in financial workflows. By reducing manual workloads, financial teams can focus on evaluating more opportunities with greater confidence and precision.

Conclusion

AI is revolutionizing budget validation during due diligence by swiftly analyzing financial documents to uncover systemic risks and inconsistencies. With a risk identification accuracy exceeding 85%, this technology significantly cuts down the time required for manual work - from weeks to just a few days.

Raheel Khan and his team at Alvarez & Marsal highlight the broader impact of this shift:

"The real transformation lies not in automation itself, but in how AI fundamentally improves the quality of financial decisions, risk identification, and value creation strategies."

This balance between AI's precision and human expertise is essential for sound financial decision-making. While algorithms excel at processing large datasets and spotting patterns, human professionals provide the critical context, intuition, and strategic insight that machines simply can't replicate. Martin Baumgartner, Partner at EY Switzerland, underscores this point:

"A close collaboration between AI software and experienced humans will be vital to offer top-notch M&A due diligence services in the future."

FAQs

How does AI improve the accuracy of budget validation?

AI transforms budget validation by analyzing entire data sets and spotting anomalies in real time. This approach cuts reporting errors by about 40% compared to traditional methods, which often depend on limited sampling and manual checks.

With advanced algorithms at work, AI tools simplify the process, delivering quicker and more accurate financial evaluations. This enables businesses to make decisions with greater clarity and assurance.

How does AI enhance risk detection in financial statements?

AI has transformed the way risk is detected in financial statements by assessing transactions in real time to spot anomalies, unusual trends, or possible fraud. Unlike traditional manual sampling, which can miss critical details, AI tools can analyze entire datasets, ensuring a thorough review without anything slipping through the cracks.

By automating this process, AI not only improves precision but also saves valuable time. This allows businesses to shift their focus toward addressing risks head-on and making smarter, data-driven financial decisions.

How do AI tools speed up financial statement reviews?

AI tools are transforming financial statement reviews by automating tasks such as data extraction, cross-checking, and identifying anomalies. This automation speeds up the process, reducing reliance on repetitive manual calculations and generating audit trails instantly. The result? Faster, more accurate reviews.

In fact, these AI-driven solutions can reduce review times by an estimated 30% to 80%, freeing up professionals to concentrate on in-depth analysis and strategic decision-making instead of routine tasks.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)