The Excess Earnings Method (EEM) is a way to calculate the value of goodwill and other intangible assets in a business. It separates a company’s earnings into two parts: returns from physical assets and “excess earnings” from intangible factors like reputation or customer loyalty. This method is widely used in small-to-medium business (SMB) transactions, legal disputes, and tax valuations when market data is unavailable.

Here’s how it works:

- Step 1: Adjust financial statements to reflect true earnings (normalized earnings).

- Step 2: Calculate the expected return on tangible assets (e.g., equipment or inventory).

- Step 3: Subtract this return from normalized earnings to find excess earnings.

- Step 4: Use a capitalization rate to convert excess earnings into a goodwill value.

- Step 5: Compare results with other valuation methods to ensure accuracy.

While simple and easy to explain, the method’s reliability depends on accurate inputs and assumptions. It’s best used as a secondary approach or when no better valuation data is available.

For example, in a $500,000 business purchase where tangible assets are worth $300,000, the $200,000 difference could represent goodwill. Using EEM helps break down this value and justify the premium tied to intangible assets.

How the Excess Earnings Method Works

Key Inputs and Assumptions

The Excess Earnings Method relies on five main components:

- Net Tangible Assets (NTA): This represents the fair market value of physical assets (like working capital and fixed assets) after subtracting liabilities.

- Normalized Earnings: These are the company's adjusted earnings, stripped of one-time or unusual items, to reflect its true economic earning power.

- Fair Rate of Return on Tangible Assets: This is the expected return an investor would reasonably expect from the tangible assets alone.

- Excess Earnings: Calculated as normalized earnings minus the required return on tangible assets, this figure represents the earnings tied to intangible assets like goodwill.

- Capitalization Rate: Used to convert excess earnings into a present value for goodwill. This rate is typically higher than the return rate for tangible assets because of the increased risk associated with intangible assets.

This method assumes that tangible and intangible assets contribute to separate income streams. Overestimating the value of tangible assets can reduce excess earnings, potentially resulting in zero or even negative goodwill. It's also critical to use a consistent definition of earnings - whether that's EBITDA, pretax income, or net free cash flow - that aligns with the return and capitalization rates being applied. With these elements in place, the method provides a foundation for calculating intangible asset value.

When to Use the Excess Earnings Method

The Excess Earnings Method is particularly suited for small businesses and professional practices where intangible assets play a major role, but market-based valuation data is limited. It’s often applied to privately held companies that generate cash flows linked to intangible assets. This approach is also commonly used in litigation and divorce cases because its straightforward structure is easier for judges, attorneys, and business owners to grasp compared to more intricate models like discounted cash flow.

"The excess earnings method is relatively simple, it is not reliable. IRS Revenue Ruling 68-609 states that the method should not be used if there is better evidence available." - Kent Pummel, Shareholder, Clark, Schaefer, Hackett & Co.

The IRS views this method as a "last resort" and recommends using it only when better evidence - such as comparable market transactions - is unavailable to assess the value of intangible assets. Many valuation experts use it as a secondary check to validate results from other methods rather than as a primary tool. For example, in the Indiana divorce case Burnett v. Burnett, a valuation expert adapted this method to estimate a husband’s share in an anesthesiology practice. They used industry data to determine how his normalized earnings surpassed those of peers, then capitalized that excess to estimate enterprise goodwill. These scenarios illustrate the method’s utility in specific contexts.

Different Approaches to the Excess Earnings Method

Once the inputs are established, there are two main ways to apply the method:

- Capitalized Excess Earnings Method (CEEM): This traditional approach uses one year of normalized historical earnings to calculate a static goodwill value. It groups all intangible assets into a single "goodwill" figure, making it a straightforward option for small businesses, professional practices, and divorce valuations.

- Multi-Period Excess Earnings Method (MPEEM): This approach resembles a discounted cash flow model, projecting future cash flows over the useful life of a specific intangible asset. Instead of lumping all intangibles together, MPEEM focuses on a "primary" intangible asset - such as customer relationships or patents - and deducts "contributory asset charges" (CACs) for the use of other supporting assets. This is typically used in M&A transactions and ASC 805 purchase price allocations, where more detailed valuations are required.

Here’s a comparison of the two approaches:

| Feature | Capitalized Excess Earnings (CEEM) | Multi-Period Excess Earnings (MPEEM) |

|---|---|---|

| Time Horizon | Single period (historical) | Multiple periods (future projections) |

| Asset Treatment | Groups all intangibles as "Goodwill" | Isolates a "Primary Intangible Asset" |

| Complexity | Simple formula-based approach | More complex; includes CACs |

| Primary Use | Small businesses, professional practices, divorce | M&A, ASC 805 purchase price allocations, audits |

The choice between these approaches depends on the type of transaction and reporting requirements. CEEM is ideal for straightforward small business sales, while MPEEM is better suited for scenarios requiring detailed allocation of purchase prices across various intangible assets. These distinctions pave the way for a deeper dive into the calculation process.

sbb-itb-a3ef7c1

Excess Earnings Method - Business Valuation

Step-by-Step Process for Calculating Goodwill

5-Step Excess Earnings Method Process for Goodwill Valuation

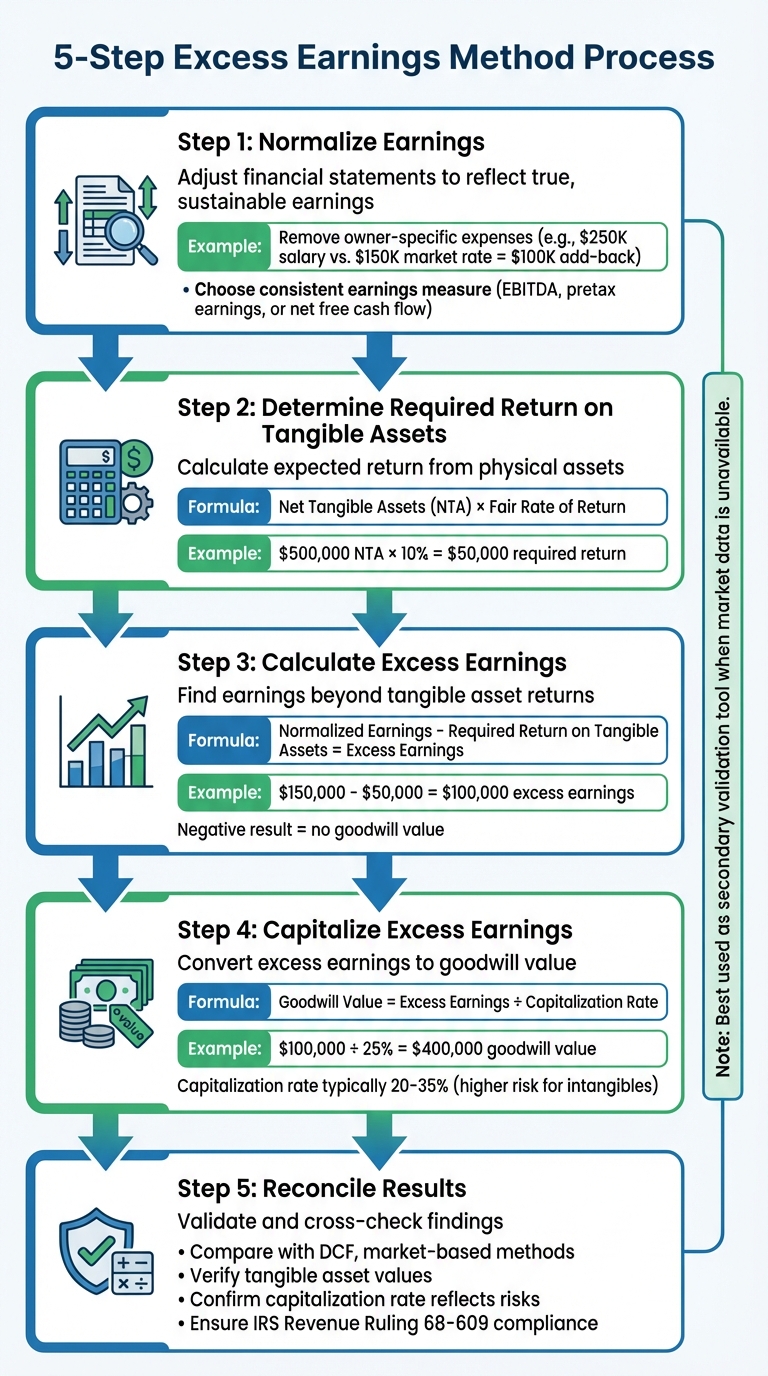

The Excess Earnings Method involves a detailed five-step process to evaluate goodwill, starting with financial adjustments and ending with a cross-check of results. Each step builds on the last, ensuring that every detail contributes to an accurate valuation.

Step 1: Normalize Earnings

The first step is to adjust the financial statements to reflect the business's true, sustainable earnings. This means removing distortions caused by tax strategies, one-time events, or owner-specific expenses that wouldn’t carry over to new ownership.

For instance, if the business owner takes a salary of $250,000 annually but a comparable professional would earn $150,000, the $100,000 difference should be added back to earnings. You’ll also need to choose a consistent earnings measure - like EBITDA, pretax earnings, or net free cash flow - and stick with it throughout the valuation.

Step 2: Determine Required Return on Tangible Assets

Next, calculate the return an investor would reasonably expect from the company’s physical assets. This starts with the net tangible assets (NTA), which is the fair market value of tangible assets minus current liabilities. It’s important to use fair market values rather than historical book values.

After determining the NTA, multiply it by a fair rate of return. For example, if a company has $500,000 in NTA and a 10% return rate is appropriate, the required return on tangible assets would be $50,000. This represents the earnings that the physical assets should generate before factoring in intangible contributions.

Step 3: Calculate Excess Earnings

Excess earnings are the portion of normalized earnings that surpass the return generated by tangible assets. To find this, subtract the required return on tangible assets from the total normalized earnings.

For example, if normalized earnings are $150,000 and the required return is $50,000, the excess earnings would be $100,000. This amount reflects the value created by intangible assets like customer loyalty, brand reputation, or specialized expertise. If the result is negative, it indicates the business isn’t generating enough returns to justify its tangible asset base.

Once calculated, the excess earnings figure is used to determine the goodwill value.

Step 4: Capitalize or Discount Excess Earnings

Now, convert the excess earnings into a goodwill value. Since intangible assets typically involve higher risk than tangible assets, you’ll apply a higher capitalization rate - usually between 20% and 35%.

The formula is straightforward:

Goodwill Value = Excess Earnings ÷ Capitalization Rate

For instance, if excess earnings total $100,000 and the capitalization rate is 25%, the goodwill value would be $400,000. Choosing the right capitalization rate depends on factors like customer retention, competitive advantages, and risks such as technological obsolescence.

Step 5: Reconcile Results

The final step is to validate the results. Compare the goodwill value derived from excess earnings with estimates from other valuation methods, such as Discounted Cash Flow (DCF), capitalized earnings, or market-based approaches. This serves as a reality check to ensure the valuation isn’t skewed.

Additionally, confirm that the tangible asset values are accurate and that the capitalization rate reflects the risks involved. Make sure the chosen earnings measure is consistent throughout the analysis. Lastly, ensure compliance with IRS Revenue Ruling 68-609, which requires using the Excess Earnings Method only when no better evidence is available for valuing intangible assets.

Applications, Advantages, and Limitations

Applications in SMB Transactions

This method finds frequent use in industries like medical, legal, and accounting practices, where much of a business's value lies in intangible assets. It provides a structured way to evaluate goodwill, which is especially useful in small and medium-sized business (SMB) transactions.

A common application is purchase price allocation. When a business is sold, the buyer must allocate the purchase price between tangible assets and intangible ones - like customer relationships or patents - for financial reporting under ASC 805. Additionally, the method plays a role in tax planning, particularly for estate and gift tax purposes, aligning with IRS guidelines under Revenue Ruling 68-609.

It’s particularly effective for owner-operated businesses where the owner's reputation, location, or brand generates income beyond what tangible assets and working capital alone could achieve. In cases where comparable data for specific intangible assets is unavailable, this method offers a clear formula to isolate goodwill.

Advantages of the Excess Earnings Method

The method brings several benefits to the table. One of its standout features is its ability to separate intangible value from physical assets. By dividing earnings into two categories - one tied to tangible assets and the other to intangibles - it provides a clear economic basis for identifying goodwill. If there are no excess earnings, then there’s no goodwill.

"The idea is that investors should expect to receive some reasonable returns given the business risk in order to justify the investment... If the actual business earnings exceed this required amount, the overage is deemed 'excess earnings.'" – ValuAdder

Another advantage is its simplicity. Unlike more complex models like Discounted Cash Flow, the Excess Earnings Method uses a straightforward formula, making it easier to explain and defend in legal or financial settings. It also works well as a validation tool, allowing users to compare results from other valuation methods and ensure the goodwill estimate aligns with the company’s tangible asset base.

Limitations and Risks

Despite its benefits, this method has notable limitations. Its reliance on subjective judgments and historical data can weaken its reliability. For example, determining fair rates of return for tangible assets or selecting the right capitalization rates for intangibles often involves assumptions that aren’t always backed by strong evidence. This leaves the method open to potential manipulation. Additionally, past performance may not always predict future results.

Another issue is the method’s assumption that tangible and intangible assets generate earnings independently. In reality, these assets often work together to produce income. The accuracy of the results also depends heavily on the quality of the data used. If historical financial records are flawed or if adjustments don’t accurately reflect future earnings, the valuation will likely be off.

The IRS considers this a "formula approach" to be used only when better evidence isn’t available. Moreover, some courts, such as those in Florida, have started discouraging its use in divorce cases because it can blur the line between personal goodwill and enterprise goodwill. These limitations highlight the importance of thorough analysis and caution when using this method in deal-making.

Using Excess Earnings Analysis in Dealmaking

Using Goodwill Valuations in Price Negotiations

The Excess Earnings Method breaks down a business's value into two parts: tangible assets and goodwill. This division gives both buyers and sellers a clear framework for negotiating purchase prices and allocating value in asset-based deals.

For buyers, this method highlights "superior earnings" - profits that exceed a reasonable return on invested capital. These earnings can justify paying a premium for intangible assets. On the other hand, if a business generates zero or negative excess earnings, it indicates the company isn’t producing enough returns to cover the associated risks, suggesting that goodwill has no value. Sellers, meanwhile, can use the return on tangible assets to set a baseline value while leveraging the capitalized excess earnings to argue for an intangible asset premium.

Both sides need to adjust financial statements to eliminate non-recurring expenses, as previously discussed. Buyers should also consider the Section 197 tax amortization benefit, which allows them to amortize the purchase price of intangible assets over a 15-year statutory period. This tax advantage can add to the deal's overall value.

This method is especially useful as a "sanity check" to validate findings from other valuation approaches, such as discounted cash flow or market multiples. It effectively bridges the gap between the measurable value of tangible assets and the often harder-to-define premium tied to intangible assets.

Lender Considerations for Goodwill-Heavy Deals

When lenders evaluate deals with significant goodwill, they focus on the distinct earnings streams from tangible and intangible assets. This approach allows for a more detailed risk assessment of the cash flows that will be used to service the debt. Strong excess earnings indicate the company generates returns above the required return on invested capital, which can support higher leverage ratios.

However, lenders must ensure the "required return" assigned to tangible assets is realistic. If asset values are overstated, goodwill calculations may appear artificially low. Conversely, undervaluing assets inflates goodwill figures. Negative excess earnings suggest the company isn’t generating enough profit to meet the expected return on its tangible assets, signaling a higher risk profile.

Lenders should also account for obsolescence risk by adjusting the capitalization rate based on the expected lifespan of intangible assets. For example, intellectual property with a three-year useful life might warrant a capitalization rate of about 33.3% to reflect only three years of earnings in the goodwill calculation. The IRS’s Revenue Ruling 68-609 advises using this method when better evidence, such as market comparables, isn’t available. These considerations help lenders refine valuations and manage risks in small and mid-sized business (SMB) transactions.

How Technology Streamlines Excess Earnings Analysis

Modern technology complements traditional analysis by improving the accuracy of excess earnings calculations. AI-driven tools can adjust historical earnings to exclude non-recurring expenses, reducing the risk of manual errors that could skew valuations. These tools can process 5–7 years of cash flows to determine whether a company generates superior earnings over the required return on invested capital.

Platforms like Clearly Acquired leverage AI to automate financial analysis, valuation modeling, and capital planning for Main Street and Lower-Middle-Market transactions. The platform manages complex calculations, including the Multi-Period Excess Earnings Method (MPEEM), by automating discounted cash flow models and factoring in adjustments like midyear conventions and tax amortization benefits. This automation minimizes errors in intricate calculations.

The platform’s AI-powered financial tools integrate seamlessly with deal management systems and secure data rooms. This allows buyers, sellers, and lenders to access normalized financials and goodwill valuations in real time. By combining excess earnings analysis with automated lender matching, Clearly Acquired helps align deals with underwriting criteria across SBA loans vs. other financing options, traditional banks, and private credit markets. This unified system replaces the need for fragmented advisors and disconnected spreadsheets, offering a streamlined solution for SMB acquisitions.

Key Takeaways and Practical Tips

Summary of the Excess Earnings Method

The Excess Earnings Method focuses on valuing intangible assets by breaking down a company's earnings into two parts: the returns from tangible assets and the "excess earnings" generated by goodwill and other intangibles. This method blends asset-based and income-based valuation techniques, making it especially handy for Main Street and Lower-Middle-Market transactions where finding market comparables can be challenging. To use this method effectively, you'll need normalized earnings, a fair rate of return on tangible assets, and a capitalization rate that reflects the risk and expected lifespan of intangible assets. Originally developed in 1920 to assess lost goodwill during Prohibition, it remains a useful sanity check when other valuation methods are applied.

"The method should not be used if there is better evidence available from which the value of intangibles can be determined." - IRS Revenue Ruling 68-609

The method's accuracy hinges on subjective inputs, such as the required return on invested capital and the capitalization rate for excess earnings. If excess earnings are negative, it signals that the business isn't generating enough profit to cover the return required on its tangible assets, meaning there's no economic goodwill. This foundation provides a starting point for actionable steps buyers and sellers can take.

Final Tips for Buyers and Sellers

To get the most out of the Excess Earnings Method, start by normalizing financial statements. Remove one-time expenses and non-market compensation to ensure a clearer picture of the business's earnings. Use the fair market value of tangible assets instead of relying on historical book values - this helps avoid major valuation errors. When determining a capitalization rate, factor in the lifespan of intangible assets. For instance, if intellectual property is likely to become obsolete in three years, a rate of approximately 33.3% would be appropriate.

While valuable, this method works best as a secondary check. Recent public filings and legal cases have affirmed its role as a complementary tool alongside other valuation techniques.

AI-powered tools can simplify this process further by automating financial normalization, accounting for contributory asset charges, and matching deals with lenders based on real underwriting criteria to help you find your next business opportunity. Platforms like Clearly Acquired integrate excess earnings analysis into deal management systems, offering secure data rooms and replacing clunky spreadsheets with a streamlined, unified solution. By adopting this approach, buyers and sellers can improve both the accuracy and efficiency of their valuations.

FAQs

What makes the Excess Earnings Method unique for valuing goodwill?

The Excess Earnings Method (EEM) stands out for its approach to valuing a business by combining the net tangible asset value with the capitalized value of earnings that go beyond a standard return on those assets. Here's how it works: first, the tangible assets are estimated, and a fair rate of return is applied to determine the expected earnings. Any earnings above this expected return are considered "excess" earnings. These excess earnings are then divided by a capitalization rate to calculate the value of goodwill or other intangible assets.

This method differs from others like the Discounted Cash Flow (DCF) approach, which projects future cash flows and discounts them using a risk-adjusted rate, or the market approach, which bases valuation on comparable transactions. EEM zeroes in on separating earnings tied to tangible assets from those tied to intangible ones. It's often favored for small, privately-owned businesses where goodwill plays a significant role in valuation. However, because it depends on subjective factors like the capitalization rate and assumptions about a fair return, its reliability diminishes when more detailed financial data is available.

What are the potential drawbacks of using the Excess Earnings Method for valuing goodwill?

The Excess Earnings Method (EEM) comes with a few challenges that can affect how accurately it measures goodwill. One major issue lies in splitting earnings between tangible and intangible assets. In reality, these assets often work together to generate income, so separating them can lead to skewed or unreliable results.

Another difficulty is the heavy reliance on subjective factors, like the assumed rate of return on tangible assets and the capitalization rate for excess earnings. Because there isn’t a standardized way to calculate these rates, the final valuation can swing widely based on the assumptions used.

The method’s simplicity also leaves room for manipulation. By tweaking the inputs, it’s possible to produce valuations that match a preferred outcome. On top of that, the IRS specifically states that EEM should only be used when no better evidence of intangible value is available, which underscores its limited usefulness in many situations.

When should the Excess Earnings Method be used for valuing a business?

The Excess Earnings Method is often used to determine the value of privately-owned businesses, especially small companies or professional practices. This approach is particularly useful when intangible assets, such as goodwill, contribute significantly to generating additional cash flow. It's a go-to method in situations like divorce settlements, legal disputes, or when there’s a lack of market data to evaluate intangible assets.

By distinguishing the earnings tied to tangible assets from the excess earnings driven by intangible factors, this method offers a clearer perspective on the value created by those intangible elements.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)