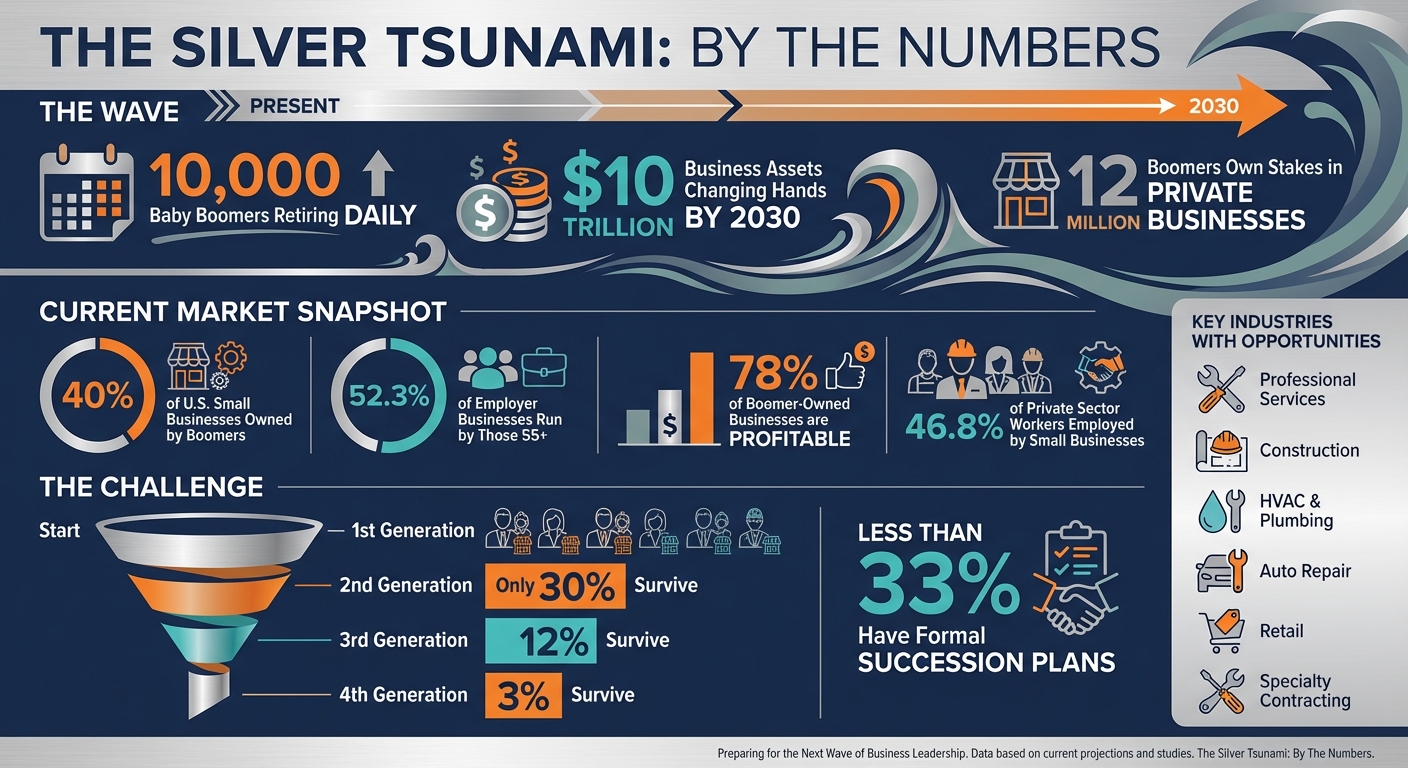

The Silver Tsunami refers to the wave of Baby Boomer business owners retiring, creating a massive transfer of ownership opportunities. By 2030, all Baby Boomers will be at least 65, with 10,000 retiring daily, leading to $10 trillion in business assets changing hands. Currently, Boomers own 40% of U.S. small businesses, many of which are profitable but lack succession plans. This presents a chance for buyers to acquire established companies across industries like construction, auto repair, and HVAC.

Key Points:

- 12 million Boomers own stakes in private businesses.

- 52.3% of employer businesses are run by those 55+.

- 78% of Boomer-owned businesses are profitable.

- Common challenges: lack of succession plans, valuation gaps, and competition from institutional buyers.

- Buyers can leverage tools like SBA loans, seller financing, and AI-driven platforms to seize opportunities.

This shift is not just a chance for buyers but also critical for economic stability, as small businesses employ nearly 46.8% of private sector workers. Acting now can help buyers acquire thriving businesses before competition intensifies.

Silver Tsunami Statistics: Baby Boomer Business Ownership and Transfer

Opportunity for investors with tsunami of baby boomers retiring

Challenges Buyers Face in This Market

The Silver Tsunami offers exciting opportunities, but it also comes with its fair share of challenges for those looking to purchase Baby Boomer-owned businesses. Understanding these hurdles is essential for refining your due diligence and structuring deals effectively. Let’s dive into some of the key obstacles and how to address them.

Missing Succession Plans

A surprising reality: fewer than one-third of small business owners have a formal succession plan. This lack of planning often leaves businesses overly reliant on their owners, with little in the way of documented systems for managing customer relationships, vendor agreements, pricing strategies, or daily operations. During due diligence, this can show up as missing standard operating procedures, unclear organizational structures, or a lack of strong middle management.

The statistics are striking - only 30% of family businesses make it to the second generation, 12% to the third, and a mere 3% to the fourth. For buyers, this means additional work post-acquisition. You’ll need to allocate time and resources to stabilize operations, formalize processes, and build a capable management team to ensure the business can thrive without the original owner.

Valuation Gaps Between Buyers and Sellers

Another common challenge is the disconnect between how sellers and buyers value a business. Sellers often base their asking price on legacy factors or personal retirement goals, while buyers focus on current market multiples and normalized cash flow. This gap is further widened by rising interest rates and tighter credit standards.

Bridging this divide requires creative deal structuring. Options like seller financing, earnouts, or contingent payments tied to future performance can help. For example, you might negotiate a lower upfront payment, with additional payouts over two to five years if certain revenue or EBITDA targets are achieved.

As Clearly Acquired notes, "Seller financing can be a powerful tool to bridge valuation gaps and get deals done, but it must be structured with strong legal guardrails."

Competition from Institutional Buyers

Institutional investors - such as private equity firms, family offices, and consolidators - are increasingly eyeing smaller businesses as part of their roll-up strategies and other investment approaches. With an estimated $10 trillion in business assets set to change hands as Boomers retire, these professional buyers bring significant advantages. They often have established lender relationships, in-house diligence teams, and the ability to waive financing contingencies.

While institutional buyers tend to dominate larger transactions, individual buyers can still find opportunities in smaller, owner-operated businesses or hyper-local service companies where personal relationships and continuity matter. To stay competitive, it’s smart to get pre-qualified with SBA lenders and secure financing ahead of time. Being prepared financially can give you a critical edge when going up against institutional players.

Buyer Opportunities in the Silver Tsunami

More Businesses Available to Buy

The market is currently flooded with businesses for sale, creating a favorable environment for buyers. This increase in supply shifts the balance of power, allowing buyers to carefully assess opportunities based on factors like size, industry, location, and risk. With more businesses available, prices may become more competitive, and listings could stay on the market longer. Platforms like Clearly Acquired simplify the process by offering access to verified listings and off-market opportunities. This abundance of options gives buyers a strong position to negotiate deals that suit their needs.

Motivated Sellers and Flexible Terms

The abundance of listings is paired with a growing number of motivated sellers eager to finalize their exits. Many retiring business owners are under pressure to sell due to personal circumstances, often prioritizing a timely sale over securing the highest price. A lack of succession plans among these owners adds to their urgency, creating opportunities for buyers to negotiate creative deal structures. These can include seller financing (typically covering 10–30% of the purchase price), earnouts, or transition support, all of which reduce the buyer's initial cash outlay while aligning with SBA lending requirements. This dynamic makes it easier for buyers to close deals on favorable terms.

Industries with the Most Opportunities

Some industries stand out for their high concentration of retirement-age business owners. Professional services, construction, and retail are key examples, along with trades like HVAC, plumbing, auto repair, flooring, and specialty contracting. In states like North Carolina, a significant percentage of businesses are owned by individuals over 55, with some counties reporting nearly 80% of local businesses falling into this category. These businesses often boast long-standing customer relationships, recurring revenue, and strong community reputations. However, many are underutilizing technology and digital marketing, presenting opportunities for new owners to modernize and unlock additional growth. Reports show that about 78% of businesses owned by Boomers are profitable, offering buyers a chance to acquire companies with proven cash flow. Using demographic filters on deal platforms or working with local advisors can help buyers identify regions with a high density of aging business owners, making it easier to find the right opportunity.

sbb-itb-a3ef7c1

How Clearly Acquired Helps Buyers Navigate This Market

Clearly Acquired offers a suite of tools designed to simplify every step of the business acquisition process, making it easier for buyers to seize opportunities in today’s market.

Finding Pre-Screened Business Listings

Clearly Acquired provides access to a massive database of over 100,000 verified public listings from marketplaces and brokerages. It also includes 430 direct broker listings from trusted partners and data on 200 million off-market businesses. This is especially useful during the "Silver Tsunami", as many Baby Boomer business owners have yet to formally list their companies or create succession plans. The platform’s advanced user verification, automated NDAs, and secure data rooms ensure sensitive financial information stays protected while buyers connect with sellers. With powerful filtering options, buyers can zero in on high-quality businesses in industries like professional services, construction, and trades. By offering pre-screened listings, Clearly Acquired helps bridge information gaps and uncover hidden opportunities that traditional platforms often miss.

Financing Options Through Clearly Acquired

Securing funding can be one of the biggest challenges in buying a small business. Clearly Acquired simplifies this hurdle by connecting buyers with a network of over 500 financial institutions, including banks, lenders, trusts, and private debt partners. The platform facilitates SBA 7(a) and SBA 504 loans, which are particularly well-suited for acquiring profitable Boomer-owned businesses - nearly 78% of which fall into this category. These loans offer benefits like low equity requirements, long repayment terms, and competitive rates, helping buyers preserve cash flow and reduce upfront costs. Beyond SBA loans, Clearly Acquired provides access to equipment financing, lines of credit, commercial loans, and merchant cash advances. Buyers also have access to buy-side advisors and debt brokers who ensure deals are matched with the right lenders. With Plaid-integrated financial verification, buyers can pre-qualify, speeding up lender matching and strengthening their negotiating position. These financing options address the common roadblocks buyers face, making the path to acquisition smoother.

AI Tools for Valuation and Due Diligence

Clearly Acquired’s AI-powered tools bring speed and precision to valuation and due diligence. The platform’s AI-driven valuation tools analyze financial data, market comparisons, and risk factors to deliver quick, data-supported valuations - critical when sellers and buyers often have differing expectations. These tools flag potential issues like fluctuating margins, revenue concentration, or retention risks, giving buyers a clearer picture of a business’s health. Additionally, the AI streamlines due diligence by summarizing key risks found in customer contracts, supplier agreements, legal documents, and HR files. This reduces review times from weeks to days, enabling individual buyers to compete with institutional investors. With an estimated 2.3 million Boomer-owned small businesses available, these tools give Main Street buyers the confidence and efficiency to close deals faster. By combining advanced technology with actionable insights, Clearly Acquired helps buyers move seamlessly from identifying opportunities to completing successful acquisitions.

Making Your Acquisition Successful After Closing

The first 90 days after closing an acquisition are critical. Studies reveal that 70–90% of acquisitions fail to achieve their expected synergies, often due to poor integration and employee-related challenges. The upside? Many of these issues can be avoided with careful planning and execution.

Managing Operations and Retaining Employees

Your top priority should be stabilizing the business and retaining key employees. Start by reviewing core operations and holding quick meetings with department heads and frontline staff to identify any immediate risks or operational bottlenecks.

Clear communication is essential during this period. Within the first week, organize an all-hands meeting to introduce yourself and reassure employees about job security. Collaborate with the outgoing owner to co-host the meeting, signaling their trust in your leadership. Follow this up with one-on-one discussions with key managers and top performers to understand their concerns, goals, and what they need to stay motivated. For critical team members, consider offering retention incentives like stay bonuses, performance-based rewards, or even phantom equity for senior leaders.

Don’t overlook customer relationships, as they’re just as important. Work with the seller to personally connect with the top 20–50 customers through meetings, calls, or joint emails. Send out a customer announcement letter to assure them that pricing, service quality, and account contacts will remain consistent for the foreseeable future. Track customer churn and complaints weekly for the first six months to quickly address any dissatisfaction or concerns.

Keep the seller involved during the transition. A structured plan - typically requiring 10–20 hours of their time per week for 60–90 days - can help you navigate operational questions and gain insights into customer relationships, vendor dependencies, and informal processes. To stay on top of things, establish weekly reports covering revenue, cash flow, and operational updates. You can also leverage Clearly Acquired’s advisory network to create a detailed 90-day playbook and KPI dashboard, helping you avoid critical oversights during this period.

Once you’ve stabilized operations and employee morale, you can turn your attention to driving growth.

Growing and Improving Business Operations

With the foundation secure, it’s time to focus on revenue and profit growth. Over the next 12–24 months, consider upgrades to your sales and marketing efforts, including modernizing your website, improving local SEO, integrating a CRM system, and re-engaging dormant customers. Evaluate your pricing strategy as well - many retiring business owners tend to undercharge, so adjusting prices to reflect market rates can be a straightforward way to boost margins. Shift your focus to higher-margin products or services while reducing emphasis on low-margin, high-complexity offerings.

Operational efficiency is another key area for improvement. Streamline processes like scheduling, inventory management, and vendor negotiations to cut down on waste. Invest in tools like cloud accounting software, field service platforms, or e-commerce capabilities to increase capacity without significantly raising costs. You might also consider hiring for strategic roles, such as a sales leader or operations manager, to free up your time and support scaling the business.

Clearly Acquired offers partnerships and advisory services to simplify post-close growth. Their Micro-Cap Private Equity partnerships allow buyers to co-invest equity into the business, strengthening the balance sheet for expansion, add-on acquisitions, or large capital projects. Additionally, their lending options - ranging from SBA 7(a) and SBA 504 loans to conventional term loans and equipment financing - are tailored to align with your business’s cash flow and seasonal needs.

Clearly Acquired also provides AI-driven tools to support ongoing success. These tools analyze historical financial data to uncover patterns in seasonality, margins, and costs, offering actionable insights for improvement. They also provide valuation and benchmarking data to ensure operational changes are translating into EBITDA growth, not just higher revenue. By combining debt and equity wisely, along with expert advisory support, you can transform a steady Main Street business into a scalable, growth-focused platform.

Key Takeaways

The "Silver Tsunami" marks one of the largest wealth transfers in U.S. history, with an estimated $10 trillion in private business assets set to change hands by 2030. For buyers, this presents a once-in-a-lifetime chance to acquire well-established, profitable businesses that boast loyal customers and consistent cash flow. Opportunities of this magnitude are unlikely to come around again.

However, success in this market goes beyond simply sourcing deals. Buyers face challenges like addressing the lack of succession plans, bridging valuation gaps between emotionally attached sellers and market expectations, and competing with institutional buyers who have the resources and speed to close deals quickly. To navigate these hurdles, buyers need access to pre-screened deal opportunities, accurate valuation tools, creative financing options (such as SBA 7(a) loans, seller financing, and equity partnerships), and expert advisory services to ensure swift and confident decision-making. An integrated platform can make all the difference in tackling these complexities.

Clearly Acquired steps in with a platform designed to meet these needs, offering buyers verified deal flow, built-in due diligence tools, and access to a network of lenders to create the best possible capital structures. Whether you're acquiring your first business or expanding a portfolio, the platform simplifies every stage of the process - from sourcing and underwriting to financing and post-acquisition growth - all in one streamlined system.

By 2030, the wave of Baby Boomer business exits will taper off, and the sheer volume of available businesses will stabilize. Buyers who act now by building pipelines, securing financing, and using technology to their advantage will be in the best position to acquire high-quality assets before competition heats up. Today’s tools, financing options, and advisory resources make it possible to turn this demographic shift into a defining career move. With the right support, buyers can transition smoothly from acquisition to profitable operations.

Securing a strong business is just the first step. Retaining key employees and maintaining customer trust are essential for long-term success. Clearly Acquired extends its support beyond the closing table, offering growth capital, advisory partnerships, and AI-driven performance analytics to help buyers transform stable Main Street businesses into scalable, thriving operations for the future.

FAQs

What challenges do buyers face when purchasing businesses from retiring Baby Boomers?

Buyers face a range of challenges when purchasing businesses from retiring Baby Boomers. One major issue is succession planning - figuring out how to smoothly transition ownership and operations. Another is determining the business's true value, which can be tricky without a clear understanding of its financial health and potential. On top of that, buyers need to consider the seller's motivations, which are often shaped by personal or financial goals.

Financing is another significant obstacle. Buyers must explore options like SBA loans, commercial financing, or equity investments to find a deal structure that supports their long-term growth plans. Tackling these challenges with a solid plan can make it easier to seize opportunities in this expanding market.

What strategies can buyers use to close valuation gaps with sellers?

Buyers can bridge valuation gaps by combining detailed due diligence with straightforward, open communication to align expectations. Showing a solid grasp of the business and its value can go a long way in establishing trust and credibility with the seller.

Flexible deal structures, like seller financing, earn-outs, or partial equity agreements, can also help address valuation differences. These options allow buyers to find common ground with sellers while minimizing upfront financial risks.

Using AI-driven tools and verified data platforms can ensure accurate valuations and simplify negotiations. This ensures both sides are working with reliable information to make well-informed decisions.

What are the best industries to explore for business acquisitions during the Silver Tsunami?

The term Silver Tsunami refers to the surge of Baby Boomer business owners heading into retirement, opening up a wealth of opportunities for potential buyers. Key sectors impacted by this trend include healthcare, senior care, manufacturing, construction, and professional services - all areas where retirements are particularly prevalent.

What makes these industries so appealing? Many of the businesses in these sectors are well-established, boasting loyal customer bases and solid growth potential. For buyers, this creates a rare opportunity to enter thriving markets and build on the solid foundations created by retiring owners. It’s a chance to benefit from years of experience and hard work - without starting from scratch.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)