When selling a company valued between $5 million and $50 million, you’ll typically encounter two buyer types: strategic buyers and financial buyers. Each has unique goals, deal structures, and impacts on your business post-sale. Here’s a quick breakdown:

- Strategic Buyers: These are businesses looking to acquire for synergies - cost savings or revenue growth from combining operations. They often pay higher prices but may integrate your company into theirs, altering its identity and workforce. Expect cash-heavy deals and minimal seller involvement post-sale.

- Financial Buyers: These include private equity firms, family offices, and similar investors. They focus on growing your business as a standalone entity for future resale, often within 5–7 years. They may offer lower upfront cash but include rollover equity for potential future gains. They usually retain management and preserve operations.

Quick Comparison

| Factor | Strategic Buyers | Financial Buyers |

|---|---|---|

| Goal | Synergies, long-term integration | ROI, short-term growth (5–7 years) |

| Valuation Basis | Synergies post-acquisition | Standalone cash flow |

| Deal Structure | Cash-heavy, often 100% ownership | Cash + rollover equity (15–35%) |

| Leadership | Often replaced | Typically retained |

| Post-Sale Impact | Integration into buyer’s operations | Minimal changes, standalone focus |

Your choice depends on priorities: upfront cash vs. future growth, staying involved vs. exiting, or preserving vs. integrating your company. Strategic buyers suit those seeking a clean exit, while financial buyers are ideal for sellers wanting continued involvement and a stake in future success.

Strategic vs Financial Buyers: Key Differences for Lower Middle Market Companies

🎯 Strategic vs. Financial Buyers: The Valuation Game-Changer 🎬 From DDDM FM Podcast

sbb-itb-a3ef7c1

Strategic Buyers: Who They Are and What They Want

Strategic buyers are companies that actively acquire other businesses to enhance their competitive edge and achieve long-term growth by creating compounded value. This value stems from operational advantages that these buyers strive to secure through acquisitions.

Why Strategic Buyers Acquire Businesses

Strategic buyers often make acquisitions to quickly gain operational and competitive advantages. A key driver is achieving synergies - where combining operations leads to cost reductions or revenue growth that neither company could achieve independently. Take, for instance, T-Mobile's $26.5 billion merger with Sprint in April 2020. By merging their infrastructure, they improved network coverage and strengthened their position in the U.S. wireless market.

Other motivations include increasing market share by acquiring competitors, expanding into new geographic regions without starting from scratch, and gaining access to proprietary technology or skilled talent. Many companies also adopt a buy-versus-build approach, opting to acquire established businesses rather than investing time and resources into developing new capabilities internally. Strategic buyers also pursue vertical integration - acquiring suppliers (backward integration) or customers and distributors (forward integration) - to streamline costs and improve operational efficiency.

Types of Strategic Buyers

Strategic buyers come in various forms, including direct competitors aiming to consolidate market share, suppliers or customers pursuing vertical integration, and companies in adjacent markets seeking opportunities to cross-sell products or services.

For example, CVS Health's acquisition of Aetna in 2018 combined retail pharmacy locations with health insurance services, creating a new healthcare platform. Similarly, Google's 2019 acquisition of Fitbit was aimed at enhancing Wear OS and introducing wearable devices under the "Made by Google" brand. Regardless of their specific structure, strategic buyers share a common focus on long-term operational benefits, as outlined in their objectives.

What Strategic Buyers Aim to Achieve

Rather than seeking a quick financial return, strategic buyers prioritize long-term integration and operational efficiency. They assess acquisitions based on expected profitability driven by synergies over a three- to five-year period. Their goals often include eliminating redundant back-office functions, leveraging better supplier pricing through larger purchasing volumes, and consolidating facilities to lower overhead costs.

"Strategic buyers value your business based on what it becomes once integrated into their existing operations."

– Advisor Legacy

Because strategic buyers anticipate cost savings and revenue growth from integration, they are often willing to pay higher valuation multiples than financial buyers. This approach typically involves integrating the acquired company into their corporate structure, which may include replacing leadership and fully absorbing operations. Strategic buyers generally aim for complete ownership to ensure seamless integration and alignment with their overall corporate strategy.

Financial Buyers: Who They Are and What They Want

Financial buyers stand apart from strategic buyers by focusing entirely on return on investment rather than operational synergies. Their goal is to acquire businesses as investments, grow their value, and sell them for a profit within a set timeframe. Below, we’ll break down their motivations, methods, and what they look for in potential acquisitions.

Why Financial Buyers Acquire Businesses

Financial buyers typically aim for an Internal Rate of Return (IRR) of 20% to 30% annually. These investments usually last three to seven years, during which they work to grow the company’s EBITDA (earnings before interest, taxes, depreciation, and amortization) and exit at a higher valuation. Unlike strategic buyers, they assess a company’s value based on EBITDA multiples without factoring in synergies.

"Financial buyers analyze a company's cash flow on a stand-alone basis, without taking into account any synergistic benefits, with the objective of enhancing the capacity to increase earnings and the value of the business over the next three to seven years."

– Morgan & Westfield

One common strategy is multiple expansion - buying a company at a lower EBITDA multiple and selling it at a higher one. For instance, a buyer acquiring a business valued at 5.0x EBITDA with $2 million in earnings could see that valuation rise to 7.0x once EBITDA grows to $5 million. This increase translates to significant value creation for the buyer. To amplify returns, financial buyers often rely heavily on debt, sometimes financing up to 80% of the acquisition.

Types of Financial Buyers

The financial buyer landscape includes several key players, each with distinct approaches:

- Private Equity (PE) Firms: These firms raise capital from institutional investors to acquire, optimize, and eventually sell businesses. With around 8,000 professional private equity firms globally, they account for roughly 30% of the M&A market.

- Family Offices: Managing the wealth of high-net-worth families, these entities are increasingly bypassing PE funds to make direct acquisitions. Unlike PE firms, family offices often prioritize long-term investments and focus on preserving wealth over time.

- Independent Sponsors: Also called "fundless" sponsors, these buyers identify opportunities first and then secure funding for each deal. This approach allows for greater flexibility in structuring transactions.

"The financial buyer is open to investing in different kinds of businesses and industries rather than only those that align with his existing operations."

– Corporate Finance Institute

What Financial Buyers Aim to Achieve

Once they acquire a business, financial buyers employ a range of strategies to boost its value. Their primary goal is to achieve profitable exits, often targeting a return on invested capital (ROIC) of 2x to 3x their initial investment. To reach this goal, they rely on tools like professionalizing governance, upgrading operational systems, and making "add-on" acquisitions to consolidate fragmented industries.

Because financial buyers are investors rather than hands-on operators, they depend on strong management teams to stay in place after the acquisition. Additionally, sellers are often required to retain 15% to 35% in "rollover equity". This arrangement allows the seller to share in the profits when the buyer eventually resells the company, aligning both parties’ interests and maximizing value during the holding period.

These strategies and structures highlight the distinct investment approach financial buyers bring to the table, setting them apart from their strategic counterparts.

How Strategic and Financial Buyers Differ

Strategic and financial buyers may both target lower middle market companies, but their methods and priorities couldn’t be more different. Strategic buyers focus on achieving synergies through integration - whether that’s expanding horizontally, vertically, or consolidating to outpace competitors. On the other hand, financial buyers view acquisitions as standalone investments, aiming to grow the business and sell it within five to seven years.

For strategic buyers, the value lies in the synergies created after the acquisition, while financial buyers zero in on current cash flow and growth potential. This difference often influences pricing strategies. Historically, strategic buyers have been willing to pay higher premiums due to the added value of integration. However, with private equity firms becoming more competitive, financial buyers are now offering prices that rival - or even surpass - those of strategic buyers.

"Financial buyers are generally not absorbing their target company, but rather growing it as a standalone entity to realize a return on their investment."

– Axial

Another key difference is in deal structures. Strategic buyers usually aim for 100% ownership, often paying in cash or a cash-stock combination. Financial buyers, however, frequently include a rollover equity component, allowing the seller to retain partial ownership - typically between 15–35%. Leadership transitions also vary: strategic buyers tend to replace the existing management team with their own, while financial buyers prefer to keep the current leadership in place to ensure continuity.

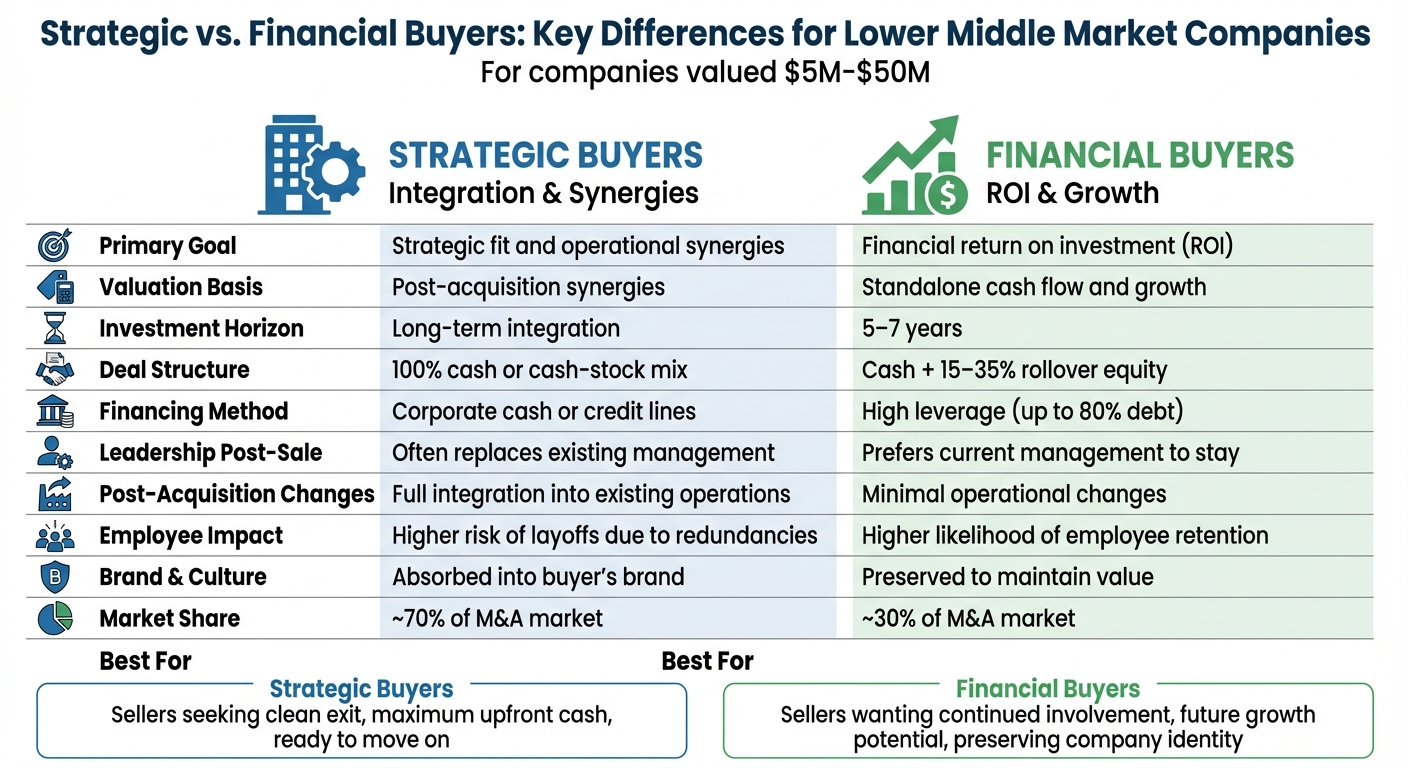

Here’s a quick comparison to break it down further:

Side-by-Side Comparison of Buyer Types

| Factor | Strategic Buyers | Financial Buyers |

|---|---|---|

| Primary Goal | Strategic fit and operational synergies | Financial return on investment (ROI) |

| Valuation Basis | Post-acquisition synergies | Standalone cash flow and growth |

| Investment Horizon | Long-term integration | 5–7 years |

| Deal Structure | 100% cash or cash-stock mix | Includes 15–35% rollover equity |

| Financing | Corporate cash or credit lines | High leverage (up to 80% debt) |

| Leadership | Often replaces existing management | Prefers current management to stay |

| Post-Acquisition | Full integration into existing operations | Minimal operational changes |

| Employee Impact | Higher risk of layoffs due to redundancies | Higher likelihood of employee retention |

| Brand & Culture | Absorbed into buyer’s brand | Preserved to maintain value |

These distinctions can help sellers decide which buyer aligns best with their goals. Whether a seller is looking for a clean break with maximum upfront cash or prefers to maintain some involvement and benefit from the company’s future growth, understanding these differences is key to making the right choice.

How Each Buyer Type Approaches Valuation and Deal Structure

When it comes to selling your business, the way buyers value and structure deals can significantly impact the cash you walk away with and your responsibilities after the sale. Strategic and financial buyers approach these aspects quite differently, shaped by their unique goals and methods.

How Strategic Buyers Value and Structure Deals

Strategic buyers look at both your current performance and the potential benefits they can gain by integrating your business into theirs. As Objective Investment Banking & Valuation explains:

"The purchase price strategic acquirers are willing to pay is significantly driven by their 'post-acquisition economics'. Simply put, this means how much money they project they are going to make in the next 3-5 years of owning the company".

This forward-looking approach often allows strategic buyers to justify paying more, thanks to expected synergies. These might include cutting overlapping costs, cross-selling products, or using their existing distribution networks to expand your business’s reach. Because of these potential benefits, strategic buyers are often willing to offer higher valuation multiples compared to financial buyers.

When it comes to structuring deals, strategic buyers usually prefer all-cash or cash-heavy transactions. Sometimes, they may include stock as part of the payment. Earnouts - payments tied to future performance milestones - are also common. If an earnout is part of your deal, ensure you negotiate clear post-closing rights to track integration efforts and confirm performance targets remain achievable.

How Financial Buyers Value and Structure Deals

Financial buyers, on the other hand, focus on a business’s standalone profitability. They care deeply about your company’s current cash flows, EBITDA multiples, and whether those numbers align with their targeted Internal Rate of Return (IRR). For businesses in the lower middle market, valuation multiples are currently averaging about 7.6x EBITDA.

Because financial buyers aim for a strong ROI and typically plan to sell the business within 5 to 7 years, they often get creative with deal structures. Seller notes and rollover equity are common tools to close valuation gaps.

"Rollover equity provides sellers with a 'second bite at the apple', participating in any future growth and value creation, and it ensures that the sellers and buyers maintain some alignment of interest going forward."

– Adrienne Penake, Keene Advisors

This setup can be appealing if you want to stay involved in the business and share in its future success. However, it also means your payout could be spread out over time and partially tied to the company’s ongoing performance.

Another hallmark of financial buyers is their rigorous due diligence process. As Steven Pappas of Touchstone Advisors puts it:

"The good news for sellers is financial buyers know what they are doing, the bad news is, financial buyers, know what they are doing. The due diligence is very thorough".

While thoroughness can feel overwhelming, it also ensures that financial buyers are well-prepared and serious about the deal.

Pros and Cons for Sellers

When selling your business, the type of buyer you choose impacts more than just the price - it shapes your role after the sale and the future of the company you’ve built. Strategic and financial buyers each bring distinct advantages and challenges, and understanding these can help you make the best decision.

Benefits and Drawbacks of Strategic Buyers

Strategic buyers often offer higher valuations because they aim to leverage integration synergies. These buyers dominate about 70% of the M&A market and can provide access to more capital and opportunities for market growth.

But this higher price comes with strings attached. Strategic buyers typically focus on full integration, which can lead to the elimination of overlapping roles, especially in departments like HR and accounting. Additionally, your company’s brand and culture may be absorbed into the parent organization. As Axial explains:

"Strategic buyers will eliminate any aspects of their newly acquired company - from existing operations to your customer relationships - that don't enhance or align with their own growth objectives".

If your priority is a clean exit with maximum cash at closing, a strategic buyer might be the right fit. However, if maintaining your company’s identity and protecting your team matter to you, be ready for significant operational changes.

Benefits and Drawbacks of Financial Buyers

Financial buyers, on the other hand, focus on continuity. They typically retain the existing management team and keep operations running as-is. This can be appealing if you want to stay involved in the business and potentially benefit from a "second bite at the apple" by rolling over 10% to 20% equity. This rollover can pay off when the financial buyer exits, usually within 3 to 7 years.

However, financial buyers often pay lower valuations since they don’t benefit from operational synergies. Their heavy reliance on debt - sometimes up to 80% - to fund the acquisition can strain the company’s cash flow. Additionally, the business is usually resold within a few years, creating uncertainty for employees and equity holders.

Here’s a quick comparison of the two buyer types:

| Feature | Strategic Buyer | Financial Buyer |

|---|---|---|

| Valuation | Higher (includes synergy premium) | Lower (based on cash flow/growth) |

| Cash at Close | Often 100% cash | Cash plus rollover equity common |

| Management Team | Often replaced or integrated | Usually retained to run operations |

| Company Culture | Likely absorbed into the parent | Generally preserved |

| Seller Involvement | Typically short-term or minimal | Often long-term with management retention |

| Exit Timeline | Buy and hold indefinitely | Exit in 3–7 years |

Choosing the right buyer depends on what matters most to you - whether it’s maximizing your payout, staying involved, or preserving your company’s legacy. Each option comes with trade-offs that should be carefully considered.

What Lower Middle Market Sellers Should Consider

Aligning Buyer Type with Your Goals

When deciding between a strategic or financial buyer, it’s essential to start by defining your primary objectives. The deal structure, your role after the sale, and the future of your team are all factors that will help determine which type of buyer aligns best with your priorities.

If your main goal is to secure as much cash as possible upfront and exit quickly, strategic buyers are often the better choice. They typically pay higher prices due to synergies they expect to achieve and usually require only a 6–12 month transition period. However, keep in mind that selling to a strategic buyer may lead to significant changes in your company’s operations and workforce. This makes them a strong option for sellers who are ready for a clean break.

On the other hand, if you’re interested in staying involved and benefiting from future growth, financial buyers - such as private equity firms - might be a better fit. These buyers often offer rollover equity, typically between 15% and 35%, allowing you to share in the company’s future success. While financial buyers may provide less cash at closing, they often allow you to retain operational involvement until they exit, usually within 5–7 years.

Employee retention is another critical factor to weigh. Financial buyers and family offices often aim to preserve the existing management team, while strategic buyers may restructure roles to achieve cost savings.

"Strategic buyers value your business based on what it becomes once integrated into their existing operations." – Anthony Whitbeck, CEO, Advisor Legacy

In contrast, financial buyers focus on your business as it stands today, emphasizing cash flow and growth potential.

To make the best decision, consider using a framework that evaluates potential buyers based on five key factors: certainty (the likelihood of closing the deal), risk (how much of your payout is contingent), control (your role post-sale), fit (the impact on your team and customers), and personal goals (whether you want to stay or exit). A helpful step is to ask serious buyers for their 100-day plan. This will give you insight into whether they plan to integrate aggressively, maintain your company’s independence, or strike a balance that aligns with your objectives.

How Clearly Acquired Helps You Find the Right Buyer

Once you’ve clarified your priorities, the next step is finding buyers who align with your vision - and that’s where Clearly Acquired comes in. Their approach isn’t just about getting offers; it’s about creating competition among buyers who are the right fit for your goals.

Clearly Acquired’s platform uses AI-driven tools to assess your business’s value from both strategic and financial perspectives. By analyzing your financials, identifying potential synergies, and evaluating key cash flow metrics, they position your business to attract the most suitable buyers.

From there, they market your business to a wide network of qualified buyers, including strategic acquirers, private equity firms, family offices, and individual investors. This process not only increases competition but also strengthens your negotiating position. The platform also ensures confidentiality with secure data rooms, automated NDAs, and thorough buyer verification, making due diligence more efficient.

Whether you’re weighing an all-cash offer from a strategic buyer or a rollover equity proposal from a private equity firm, Clearly Acquired helps you understand the trade-offs of each deal structure. They focus on matching buyer profiles to your specific goals. For instance, if you’re looking to retire immediately, they prioritize strategic buyers with strong integration experience. If you prefer to grow alongside a financial partner, they connect you with firms that align with your vision and timeline.

"The best buyer isn't always the one with the highest price - it's the highest price from the best buyer and how they will align with your goals and objectives." – Steven Pappas, Partner, Touchstone Advisors

Conclusion

Deciding between a strategic buyer and a financial buyer ultimately comes down to your priorities: do you value immediate liquidity or long-term growth potential? Strategic buyers often provide larger upfront cash payments and quicker exits, while financial buyers offer a mix of cash and rollover equity, giving you a chance to benefit from future growth opportunities. Understanding these differences is key to choosing the path that aligns with your financial goals and personal vision.

Your choice will depend on what matters most to you: cash now versus a stake in future profits, a clean break versus ongoing involvement, or integrated synergies versus maintaining operational independence. Each option comes with unique benefits and trade-offs that will impact your payout, your role after the sale, and the future of your business and team.

It’s important to remember that a higher upfront offer doesn’t always mean a better deal overall. While a strategic buyer's all-cash offer might seem appealing, a financial buyer's combination of cash and equity could result in a larger total payout if the business continues to grow post-sale.

To make an informed decision, take the time to define your priorities. Consider factors like deal certainty, risk tolerance, post-sale involvement, cultural fit, and your personal goals. Request detailed 100-day plans from potential buyers to ensure their intentions align with your vision.

Clearly Acquired simplifies this process with its AI-powered tools, helping you position your business to attract both strategic and financial buyers. Whether you’re leaning toward an all-cash offer or exploring the potential of a rollover equity deal, the platform equips you with the insights you need to evaluate each option and connect with buyers who share your long-term vision.

FAQs

How do deal structures differ between strategic and financial buyers in the lower middle market?

The key difference between strategic buyers and financial buyers comes down to their goals and how they approach acquisitions. Strategic buyers typically look to merge the acquired business into their existing operations. Their focus is on creating synergies, reducing costs, and driving long-term growth. To achieve this, they’re often willing to pay more for companies that align closely with their strategic plans. Their deal structures may include elements like earnouts or stock swaps to ensure the integration process goes smoothly.

Financial buyers, such as private equity firms, take a different approach. They’re primarily interested in the financial performance of the business as a standalone entity. Often using leveraged buyouts (LBOs) to fund acquisitions, they emphasize cash flow and profitability to deliver returns over a defined period, usually 5–7 years. Their deals often include performance-based incentives or earnouts to align the seller’s goals with their own.

In short, strategic buyers focus on operational alignment and synergies, while financial buyers center their efforts on maximizing financial returns and standalone value.

What impact do strategic buyers have on a company's workforce and culture after an acquisition?

Strategic buyers often bring significant shifts to a company's workforce and culture after completing an acquisition. Their primary aim is to integrate the new business into their existing operations, which frequently involves reorganizing areas like HR, accounting, or management. This process can result in layoffs, restructuring, or adjustments to roles to address redundancies and improve efficiency.

On the cultural side, strategic buyers often strive to align the acquired company with their own corporate values and practices. While this can help create a more cohesive organization, it may also disrupt the existing workplace culture, posing challenges for employees as they adapt to the new environment. The scope of these changes typically depends on the buyer’s overall integration plan and long-term objectives.

Why would a seller choose a financial buyer instead of a strategic buyer, even if the upfront cash offer is lower?

When selling a business, a seller might lean toward a financial buyer because these buyers usually prioritize the company’s ability to generate cash on its own, rather than merging it into their current operations. This approach often leads to a quicker, more straightforward sale, which can better align with the seller’s personal or financial objectives.

Financial buyers, like private equity firms, also bring another potential advantage: they may allow the seller to keep partial ownership or take part in the company’s future growth. This can open the door to long-term financial rewards that could surpass the initial payout.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)