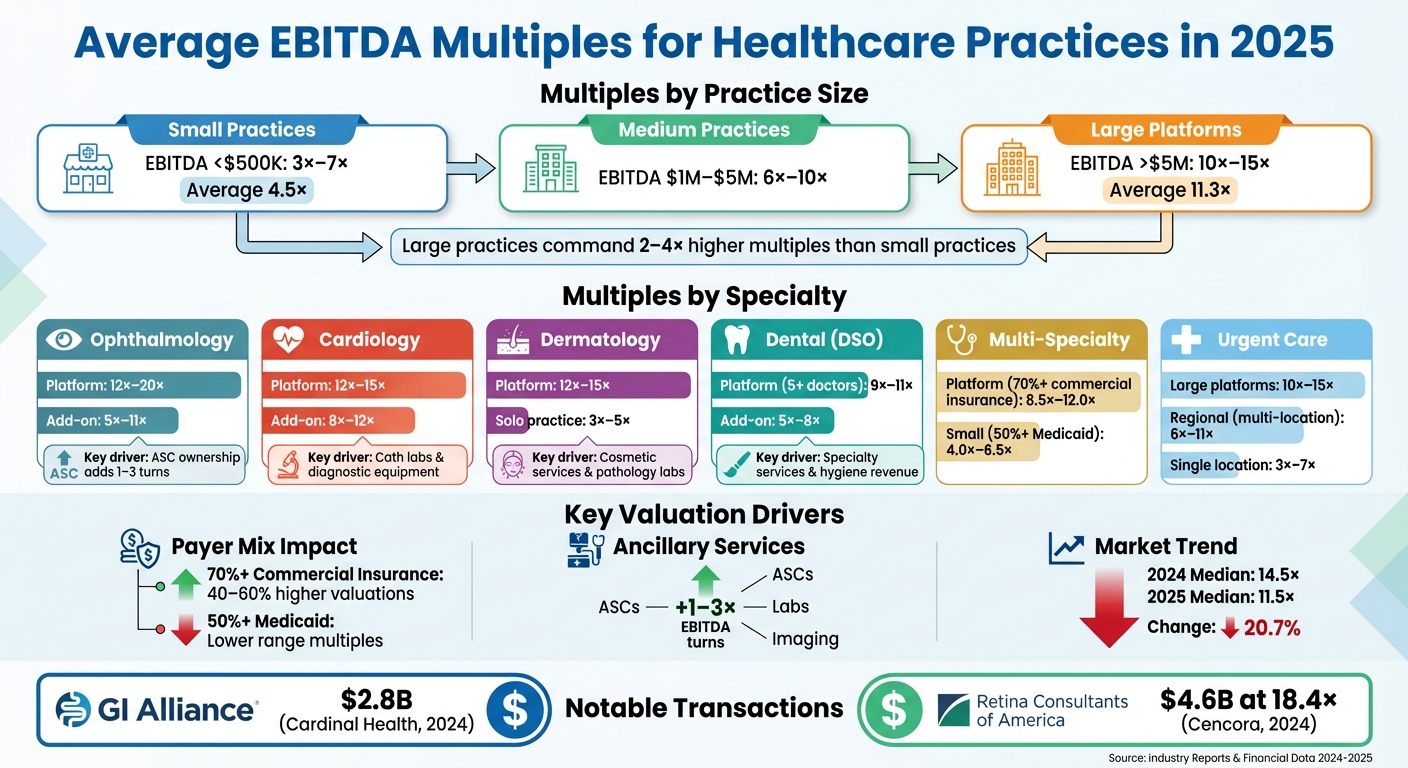

When valuing healthcare and medical practices, EBITDA multiples are a key measure used to calculate enterprise value. These multiples vary widely depending on factors like practice size, specialty, payer mix, and operational structure. Here's a quick overview:

- Practice Size: Larger practices with EBITDA over $5M often secure higher multiples (10×–15×), while smaller ones fall in the 3×–7× range.

- Specialties: Dermatology, cardiology, and ophthalmology practices command some of the highest multiples, reaching up to 20× for large platforms.

- Payer Mix: Practices with over 70% revenue from commercial insurance achieve 40–60% higher valuations than those reliant on government payers.

- Ancillary Services: Ownership of facilities like ASCs or diagnostic labs can increase multiples by 1–3×.

- Market Trends: Median healthcare services multiples were 11.5× in 2025, down from 14.5× in 2024.

Key takeaway: Factors like scale, revenue quality, and service diversification significantly influence valuations. Practices with strong commercial payer mixes and ancillary services typically achieve premium valuations.

Healthcare Practice EBITDA Multiples by Specialty and Size 2025

Medical Practice Valuation: How to Use EBITDA Multiples?

sbb-itb-a3ef7c1

1. Multi-Specialty Medical Practices

Multi-specialty medical practices are valued differently depending on their size and structure. Independent groups typically sell at mid-single-digit EBITDA multiples, while larger, multi-site platforms often achieve double-digit multiples. The key factor behind this disparity is what buyers refer to as the "Platform Premium." Practices generating over $5 million in EBITDA can attract multiples that are 2–4 times higher than smaller "add-on" practices. This premium grows as the practice's size and payer mix improve.

Size plays a crucial role in valuations. For example, practices with EBITDA below $500,000 average around 4.5×, while those exceeding $5 million jump to 11.3×. However, scale isn't the only factor influencing these numbers.

Payer mix is another critical element. Practices with more than 70% of their revenue coming from commercial insurance can achieve multiples between 8.5× and 12.0×, while those heavily reliant on Medicaid (over 50%) typically fall in the 4.0×–6.5× range. This difference reflects the stability and predictability of revenue streams. Commercial payers generally offer more reliable reimbursement rates and involve less administrative complexity compared to Medicaid.

Ancillary services also significantly boost valuations. Eric Yetter highlights the impact of these services, stating:

"a strong commercial or cash-pay mix and owned ancillaries like ASCs or cath labs can lift valuations by several turns".

In addition, a well-rounded team of providers and robust EHR systems reduce buyer risks, making these practices especially appealing to private equity firms, which account for more than 90% of transactions in this space.

Recent acquisitions underscore these valuation premiums. For instance, in 2024-2025, Cardinal Health acquired GI Alliance for $2.8 billion, leveraging supply chain synergies. Similarly, Cencora paid $4.6 billion to acquire Retina Consultants of America. These deals highlight how size, payer mix, and ancillary services can drive higher valuations in the multi-specialty medical practice market.

2. Dental Practices and DSOs

Dental practices and dental service organizations (DSOs) fall into distinct valuation categories. Larger platform-level transactions - typically involving 5 or more doctors across multiple locations - are valued higher, often commanding 9–11× EBITDA, while smaller add-ons tend to trade at 5–8× EBITDA. This difference reflects the premium buyers place on practices that are well-positioned to operate as independent platforms.

For dental practices, valuation also varies significantly by operational scale. Smaller practices with less than $1 million in EBITDA typically fall in the 5–7× range, whereas larger practices exceeding $5 million in EBITDA can achieve valuations of 11× or higher.

The mix of insurance accepted by a practice plays a key role in its valuation, much like in other areas of healthcare. Practices offering specialty services - such as orthodontics, oral surgery, pediatric dentistry, or endodontics - often secure higher valuations due to the elevated treatment values they generate. At the same time, steady hygiene revenue provides a predictable cash flow foundation. Buyers particularly value practices with strong patient recall systems and efficient hygiene-to-doctor production ratios, as these factors contribute to consistent and stable revenue streams.

Recent transactions highlight these valuation trends. For instance, in March 2025, Smile Doctors - supported by Thomas H. Lee Partners and Linden Capital Partners - acquired myOrthos, marking the first-ever acquisition of a scaled orthodontic services organization (OSO) by another OSO platform in the United States. Earlier, in December 2024, Branford Castle Partners purchased Eastern Dental from Staple Street Capital. This deal involved Lincoln International addressing specific challenges related to utilization rates and profitability across various payer types.

3. Dermatology Practices

When it comes to EBITDA multiples, dermatology practices stand out with some of the highest valuations in healthcare. Large, integrated dermatology platforms often command multiples of 12–15× EBITDA, thanks to strong private equity (PE) interest. Despite this, only about 10–15% of dermatology practices in the U.S. are currently backed by PE investors.

As with other healthcare specialties, scale plays a major role in determining valuations. Smaller, solo practices with less than $2 million in revenue typically trade at 3–5× EBITDA. Small group practices with 1–4 locations see slightly higher multiples, ranging from 4–7×. Regional platforms bringing in $15–$50 million in revenue are valued at 8–10× EBITDA, while larger platforms exceeding $50 million in revenue or $10 million in EBITDA achieve the top-tier multiples of 12–15×.

The mix of services offered by a practice also significantly influences its valuation. For example:

- Medical dermatology generates approximately $1.3 million per full-time physician with a 25% margin.

- Cosmetic dermatology outpaces this, bringing in $1.8 million per physician at a 27% margin.

- Internal services, such as pathology labs and Mohs surgery (with around 850,000 procedures performed annually in the U.S.), can add an extra 1–3 turns to EBITDA multiples.

Revenue sources are another key factor. Practices that earn 70% or more of their revenue from commercial or cash-pay services tend to receive higher valuations. On the other hand, practices reliant on Medicare face valuation discounts due to reimbursement cuts, such as the 2.83% reduction in the Medicare conversion factor. Geography also matters - practices located in Sunbelt states like Florida, Texas, Arizona, and Georgia benefit from stronger commercial payer mixes and higher buyer competition, driven by favorable demographics.

Eric Yetter highlights that practices with diversified service lines and recurring revenue models often achieve EBITDA multiples that are 1–2× higher. The growing emphasis on high-margin medspa and aesthetic services is helping practices offset declining reimbursements for routine care. These trends reflect the evolving dynamics of dermatology practice valuations.

4. Cardiology and Ophthalmology Practices

Cardiology and ophthalmology practices are among the most highly valued physician specialties in 2025, largely due to strong procedural margins and the dwindling number of independent groups. Platform-sized cardiology practices typically sell for 12–15× EBITDA, while ophthalmology platforms often command even higher multiples, ranging from 12–20× EBITDA. On the other hand, smaller practices joining existing platforms - referred to as add-on acquisitions - see lower valuations, with cardiology falling between 8–12× EBITDA and ophthalmology between 5–11× EBITDA. These valuation trends are shaped by several key performance factors.

Ancillary infrastructure drives higher valuations. Practices with ownership of an Ambulatory Surgery Center (ASC) enjoy a significant boost in value, adding 1–3 EBITDA turns compared to clinic-only models in ophthalmology. Andy Snyder, Managing Director at FOCUS Investment Banking, emphasizes:

"ASC ownership remains the single most impactful value driver in ophthalmology M&A".

Similarly, cardiology practices equipped with in-office diagnostic tools and outpatient catheterization labs attract premium valuations due to the enhanced economics of these procedures.

Scale matters. Larger practices, particularly those generating over $5 million in EBITDA, can secure multiples that are 2–4 turns higher than smaller practices earning less than $1 million. Retina-focused practices also command strong valuations. A standout example is Cencora’s 2024 acquisition of Retina Consultants of America for $4.6 billion, achieved at an 18.4× EBITDA multiple, showcasing the strategic value of injectable drug revenue.

Reimbursement mix plays a critical role. Practices with more than 70% of revenue coming from commercial payers can achieve 40–60% higher multiples compared to those heavily reliant on Medicare or Medicaid. This premium reflects better reimbursement rates, fewer claim denials, and more predictable cash flow. Strategic buyers, such as pharmaceutical distributors and health systems, often pay 20–40% more than private equity firms when vertical integration opportunities are present.

Consolidation is accelerating. Eric Yetter, Managing Director at FOCUS Investment Banking, highlights the growing interest in these specialties:

"Cardiology and ophthalmology remain the highest-valued specialties in 2025".

Despite this, only 8% of ophthalmologists were part of private equity-backed groups as of 2022, leaving ample room for further consolidation. This limited supply of independent, high-quality practices continues to drive valuations higher for sellers who are well-positioned in the market.

5. Urgent Care and Specialty Clinics

Urgent care centers, like other healthcare practices, have unique valuation metrics influenced by their scale and the variety of services they offer. These centers typically trade at 3.00× to 5.58× EBITDA, reflecting the fragmented nature of the industry. With over 7,400 centers nationwide and no single operator holding more than 5% of the $28 billion market, competition is intense. However, with the right operational strategies, valuations can climb significantly higher. Success in this space often hinges on strategic positioning and tailored operations.

Location and patient volume are key factors. Centers located in busy retail areas or densely populated regions with limited competition tend to attract more patients, which leads to higher valuations. Extended hours can also help drive patient traffic. Additionally, higher net revenue per visit strengthens profitability and operational stability - qualities that buyers find particularly appealing.

Staffing models make a difference. Many centers are turning to advanced practice providers like Physician Assistants and Nurse Practitioners, who earn 57% and 55% of a physician's hourly rate, respectively. This approach reduces staffing costs and bolsters EBITDA margins, which directly impacts the multiples buyers are willing to pay.

Service diversification and payer mix enhance appeal. Adding services such as occupational medicine, telehealth, diagnostic imaging, and lab work diversifies revenue streams, making these centers more attractive to potential buyers. Just as in other healthcare sectors, a payer mix dominated by commercial insurers can significantly boost valuations. Centers with more than 70% of their revenue coming from commercial insurance see valuations that are 40–60% higher than those relying heavily on Medicare or Medicaid, thanks to better reimbursement rates and more predictable cash flow.

Scale plays a major role in valuation gaps. Smaller, single-location centers with less than $10 million in revenue typically sell for 3× to 7× EBITDA. In contrast, regional operators with multiple locations generating $10–50 million in revenue command higher multiples, ranging from 6× to 11× EBITDA. Larger platforms with over $5 million in EBITDA can achieve multiples that are 2–4× higher than smaller counterparts. Providers leveraging technology and value-based care programs often reach even higher levels, with multiples ranging between 10× and 15×, showcasing how innovation and operational excellence can drive premium valuations.

6. Clearly Acquired

Figuring out the true value of a healthcare practice isn’t as simple as plugging numbers into a formula. Traditional valuation methods often rely on manual financial adjustments - like resetting owner compensation to fair-market levels, removing personal expenses, and verifying add-backs. These adjustments can have a major influence on the final sale price. However, these methods are prone to inaccuracies if add-backs aren't carefully vetted and require a high level of expertise to get right.

Clearly Acquired offers a fresh, tech-driven solution to these challenges. Their AI-powered valuation platform uses a market-based approach, comparing your practice to recent transactions involving similar businesses. The platform evaluates critical market factors, including business scale, platform status, payer mix quality, and normalized financial performance.

What sets this platform apart is its ability to automatically normalize financials. It adjusts owner compensation and eliminates non-recurring expenses using the same rigorous standards that sophisticated buyers rely on. This removes much of the guesswork, giving you a clear, data-backed picture of how your practice measures up against market benchmarks - whether you're running a single-location dental office or a multi-site urgent care network.

Beyond valuation, the platform streamlines the process for both buyers and sellers. It speeds up underwriting and connects valuation insights directly to financing options, including SBA loans, conventional funding, and creative deal structures. By aligning valuations with up-to-date market data and operational performance, Clearly Acquired integrates seamlessly with current trends. This approach also complements the EBITDA multiple benchmarks covered earlier, offering a comprehensive way to understand and act on your practice’s value.

Pros and Cons

EBITDA multiples are often used as benchmarks for valuing healthcare practices, but the unique characteristics of each specialty bring their own strengths and challenges. For example, elective specialties like plastic surgery and medical spas can achieve multiples as high as 11.3× in larger practices. However, these specialties are particularly vulnerable during economic downturns when discretionary spending decreases. During recent market instability, EBITDA multiples for non-essential specialties dropped by about 20%, compared to a smaller 7% decline for essential care providers like hospitals.

A practice's payer mix also plays a significant role in valuation. Practices with a high percentage of commercial insurance generally see EBITDA multiples 40–60% higher than those relying heavily on government payers. On the other hand, Medicare-heavy practices, such as some dermatology groups, face risks from policy changes. For instance, a recent 2.83% reduction in the Medicare conversion factor has impacted these practices.

Another key factor affecting valuations is asset ownership. Practices with owned facilities, such as ambulatory surgery centers (ASCs), often command higher multiples. For instance, cardiology platforms with owned ASCs trade at 12×–15×, while ophthalmology practices with similar assets can reach multiples of 10×–20×. These assets provide stable procedure margins, which help bolster EBITDA.

"As inflation persists and consumer discretionary spend tightens, buyers favor stable reimbursement models over elective procedures." - Andy Snyder, Managing Director, FOCUS Investment Banking

Size also matters significantly. Larger practices with EBITDA exceeding $5 million typically trade at multiples 2–4 turns higher than smaller, single-location practices. This is due to stronger operational infrastructures and lower execution risks. For example, a single-location dental practice might trade at 5×–7×, while larger dental service organizations (DSOs) can achieve multiples of 9×–11×.

The table below highlights the key advantages, risks, and typical multiple ranges for various specialties:

| Practice Type | Key Advantage | Primary Risk | Typical Multiple Range |

|---|---|---|---|

| Cardiology | High-margin cath labs; few independent groups | High capital expenditure; complex integration | 12×–15× |

| Dermatology | Cash-pay aesthetics; aging population demand | Medicare rate cuts; aging partners | 12×–15× |

| Dental (DSO) | Predictable hygiene revenue; consumer stability | Medicaid exposure; provider turnover | 9×–11× |

| Ophthalmology | ASC ownership; strong retina demand | Medicare sensitivity; succession risk | 10×–20× |

| Behavioral Health | High demand; scalable infrastructure | Staff churn; compliance risks | 9×–13×+ |

| Medspa/Aesthetics | Cash-pay model; membership revenue | Owner-dependency; recession sensitivity | 7×–12× |

Ancillary services can also significantly enhance valuation. Facilities like ambulatory surgery centers, pathology labs, and imaging centers can increase EBITDA multiples by 1–3 turns because these revenue streams are less affected by professional fee compression. For example, the GI Alliance acquisition by Cardinal Health, valued at $2.8 billion, was largely driven by its strong outpatient endoscopy capabilities and integrated supply chain. These factors play a critical role in shaping strategic decisions for both buyers and sellers in the ever-changing healthcare market.

Conclusion

The analysis above highlights how factors like practice size, revenue mix, and asset ownership play a crucial role in shaping valuation outcomes. These elements are deeply interconnected, collectively influencing the final sale price. Larger practices tend to fall into higher valuation tiers, often commanding significantly higher multiples compared to smaller ones. Additionally, thresholds clearly separate add-on acquisitions from platform investments.

Revenue quality is another key driver of valuation. Practices with a commercial or cash-pay revenue mix exceeding 70% typically achieve multiples between 8.5× and 12.0×, while those heavily reliant on Medicaid often face lower valuations, with multiples ranging between 4.0× and 6.5×. Ownership of assets such as ambulatory surgery centers or imaging centers further boosts valuations, providing noticeable premiums.

Market trends continue to shift. For example, by 2025, median healthcare services multiples are expected to settle around 11.5×, down from 14.5× in 2024. Strategic buyers remain willing to pay 20–40% more than financial buyers when clear synergies are evident, as seen in deals like Cencora's $4.6 billion acquisition of Retina Consultants of America.

"Multiples are sensitive to five forces you can influence: quality of earnings, scale, ancillaries, payer mix, and credible growth." - Eric Yetter, Managing Director and Healthcare Team Leader, FOCUS Investment Banking

Accurate valuations require careful attention to normalized earnings, removal of non-recurring expenses, and proper accounting for ancillary revenue streams. Clearly Acquired's AI-powered valuation tools integrate financial data, industry benchmarks, and real-time market trends to deliver precise assessments for healthcare practices. Whether you're planning to sell, considering an acquisition, or mapping out growth strategies, these tools provide the insights needed to make confident, data-driven decisions.

FAQs

What key factors impact EBITDA multiples for healthcare practices?

EBITDA multiples for healthcare practices hinge on several key factors. One major influence is earnings quality and stability. Practices with a well-balanced payer mix - spanning commercial insurers, government programs, and cash-paying patients - are often seen as less risky, which can lead to higher valuation multiples. On top of that, practices that own ancillary services or assets, such as imaging centers or surgery centers, tend to command better valuations thanks to the additional cash flow and opportunities for cross-selling.

Other important considerations include size, specialty, and growth potential. Larger practices with EBITDA exceeding $5 million or those operating in high-growth specialties, such as cardiology or gastroenterology, often attract stronger multiples. Location also plays a critical role; practices based in densely populated areas with high demand typically secure better valuations compared to those in less competitive or rural markets.

Lastly, the type of buyer and deal structure can make a big difference. Strategic buyers, who can leverage synergies, are generally willing to pay more than financial buyers. Similarly, platform transactions often achieve higher multiples compared to smaller add-on acquisitions. Together, these elements shape the valuation landscape for healthcare practices across the U.S.

How do ancillary services affect the valuation of healthcare practices?

Ancillary services - like ambulatory surgery centers, imaging suites, pathology labs, or cath labs - can play a major role in boosting the valuation of healthcare practices. These services create additional revenue streams, often with higher margins or cash-pay options, which not only enhance the practice’s EBITDA but also make earnings more stable and predictable.

In today’s competitive market, practices with strong ancillary income can secure higher EV/EBITDA multiples, often adding 1–3 points to the multiple itself. Buyers are particularly drawn to these services because they help diversify the payer mix, reduce dependence on fee-for-service reimbursements, and open doors for cost savings or cross-selling when integrated into larger healthcare networks or private equity platforms.

When assessing a practice’s value, analysts and buyers frequently adjust the baseline valuation upward to account for the scale and profitability of these ancillary services. This makes them a critical factor in determining the fair market value of a healthcare practice.

How does the payer mix impact the valuation of healthcare practices?

The payer mix is a key factor in evaluating the worth of a healthcare practice because it directly impacts revenue consistency and profitability. Practices with a diverse mix of payers, especially those with a strong share of commercial or in-network payers, often enjoy more predictable cash flow, higher-quality earnings, and steadier margins. These factors can significantly boost EBITDA multiples.

In contrast, practices heavily dependent on a single payer or those tied to low-reimbursement payers face greater financial uncertainty. This heightened risk makes such practices less appealing to potential buyers or investors, often leading to lower EBITDA multiples and a reduced overall valuation.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)