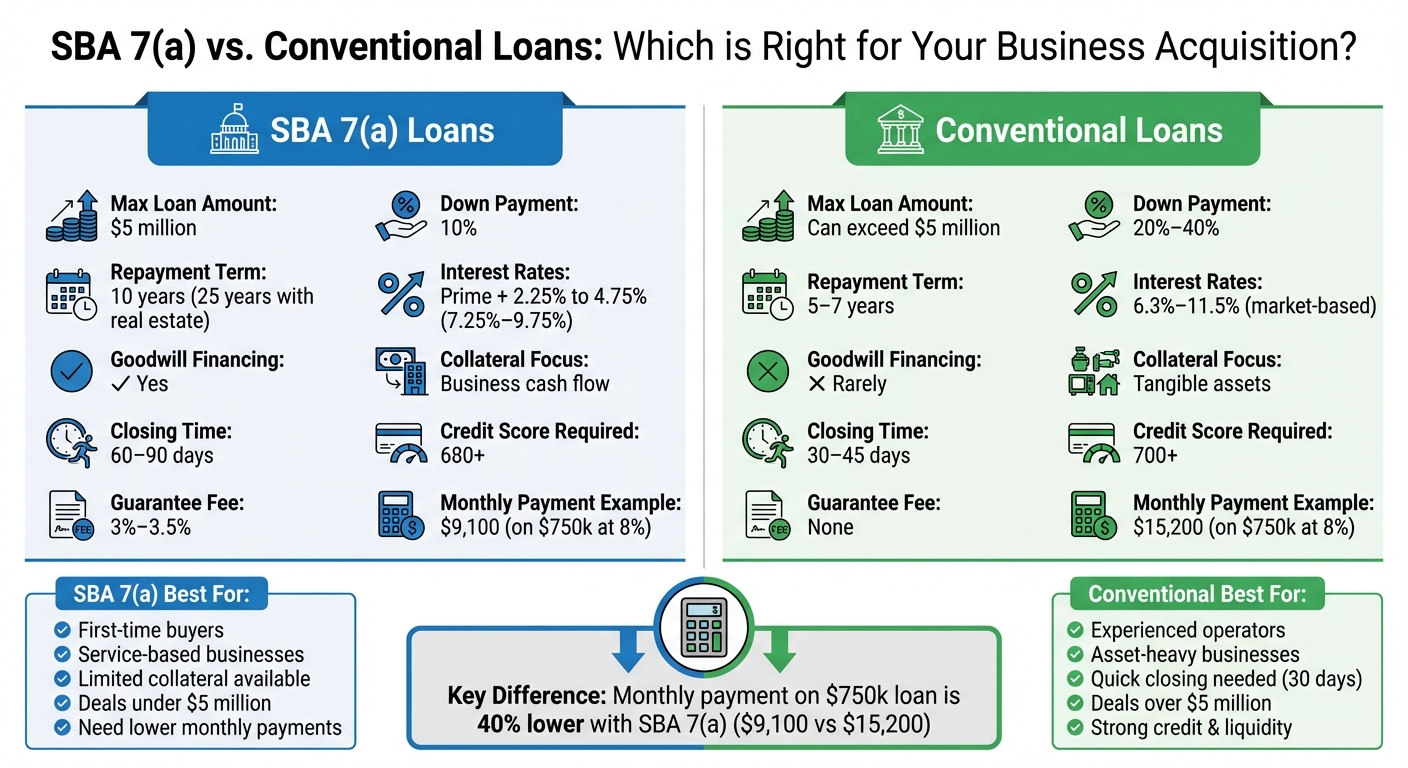

When buying a business, choosing the right loan can make or break your deal. The two main options are SBA 7(a) loan terms vs. other financing options like conventional loans. Here’s a quick breakdown to help you decide:

- SBA 7(a) Loans: Backed by the government, these loans are easier to qualify for and require a lower down payment (10%). They offer longer repayment terms (up to 10 years) and can finance goodwill (intangible assets). However, they take longer to close (60–90 days) and involve more paperwork.

- Conventional Loans: These are faster to close (30–45 days) and have no government fees, but they require a higher down payment (20%–40%) and shorter repayment terms (5–7 years). They’re better for asset-heavy businesses or deals over $5 million but rarely finance intangible assets like goodwill.

Quick Comparison

| Factor | SBA 7(a) Loan | Conventional Loan |

|---|---|---|

| Max Loan Amount | $5 million | Can exceed $5 million |

| Down Payment | 10% | 20%–40% |

| Repayment Term | 10 years (or 25 with real estate) | 5–7 years |

| Interest Rates | Prime + 2.25% to 4.75% (7.25%–9.75%) | 6.3%–11.5% (market-based) |

| Goodwill Financing | Yes | Rarely |

| Collateral Focus | Business cash flow | Tangible assets |

| Closing Time | 60–90 days | 30–45 days |

| Eligibility | Credit score 680+ | Credit score 700+ |

Bottom Line: SBA 7(a) loans are ideal for smaller, service-based businesses or buyers with limited assets. Conventional loans suit larger acquisitions or buyers with strong financial profiles. Your choice depends on your financial situation, timeline, and the nature of the business you’re buying.

SBA 7(a) vs Conventional Loans: Complete Comparison for Business Acquisition

The Ultimate Guide to SBA Acquisition Financing [Comprehensive 2025]

sbb-itb-a3ef7c1

Understanding SBA 7(a) Loans

The SBA 7(a) loan program is designed to help small businesses secure financing through private lenders by offering a government-backed guarantee - 85% for loans up to $150,000 and 75% for larger amounts. This guarantee significantly reduces the risk for lenders, making it easier for businesses to obtain funding. It’s especially helpful for first-time buyers and service-oriented businesses, where much of the value comes from intangible assets like customer relationships. These benefits make SBA 7(a) loans a standout choice for business acquisitions.

When it comes to acquisitions, SBA 7(a) loans are versatile. They can fund ownership changes, whether you're buying 100% of a business or just a partner’s share. These loans often cover the purchase price (including goodwill), working capital, equipment, and even closing costs.

Main Features of SBA 7(a) Loans

SBA 7(a) loans come with several features that make them appealing to business buyers. For starters, repayment terms are generous - 10 years for business acquisitions and up to 25 years if commercial real estate is part of the deal. Down payments are typically around 10%, and seller notes can account for up to 50% of the equity injection, which means buyers might only need to put down as little as 5% in cash.

Collateral requirements are also quite flexible. While lenders often prefer assets like real estate, equipment, or inventory as collateral, the SBA encourages them to focus on the business’s cash flow rather than requiring full collateral coverage. This makes SBA 7(a) loans more accessible to businesses with strong revenue potential but limited physical assets. Because of this, they are often referred to as "cash-flow loans", emphasizing the importance of a company’s ability to generate income over its tangible assets.

Another notable feature is the ability to finance goodwill. Goodwill represents the intangible value of a business - things like its brand reputation, customer loyalty, and established relationships. Conventional lenders typically won’t finance goodwill, but SBA 7(a) loans do, making them a great option for businesses where intangible assets carry significant value.

When to Use SBA 7(a) Loans for Acquisitions

SBA 7(a) loans are particularly useful in situations where buyers need flexibility. For first-time buyers, they offer lower down payments and easier approval, even if you don’t have an extensive credit history. Most lenders look for a personal credit score of 680 or higher, which is attainable for many buyers.

These loans are an excellent fit for businesses valued at $5 million or less. The 10-year repayment term ensures that monthly payments remain manageable, which is especially important during the early stages of ownership. They’re also a great choice for service-based companies or businesses where a large portion of the value comes from intangible assets like customer relationships and brand reputation. If you don’t have substantial collateral but have a strong business plan, industry experience, and projected cash flow, the SBA 7(a) program allows lenders to focus on these strengths rather than relying solely on asset-based collateral.

Understanding Conventional Loans

Conventional loans are provided by private lenders like banks, credit unions, or online platforms, and they operate without any government backing . Unlike SBA 7(a) loans, these loans don’t involve the Small Business Administration. Since the lender assumes all the risk, they have the freedom to establish their own rules and requirements, bypassing the strict guidelines and paperwork associated with SBA loans .

This independence allows lenders to tailor loan terms and rely heavily on tangible collateral. They can negotiate elements like personal liability and operational covenants without federal restrictions. Typically, conventional lenders focus on assets like real estate, equipment, or inventory that can be sold if the borrower defaults. However, they often avoid financing intangible assets, such as goodwill, or impose limits on it. This can be a major hurdle for service-oriented businesses where intangible assets make up a large part of the purchase price.

Main Features of Conventional Loans

One of the biggest advantages of conventional loans is speed. These loans usually close within 30 to 45 days, significantly faster than the 60 to 90 days it often takes to finalize an SBA 7(a) loan . This faster timeline is particularly helpful for deals that require quick action. Plus, borrowers avoid the SBA guarantee fee, which typically ranges from 3% to 3.5% of the loan amount.

Conventional loans are also suitable for larger acquisitions. While SBA 7(a) loans are capped at $5 million, conventional loans can exceed $10 million, making them a practical choice for buyers targeting high-value deals . But this flexibility comes with certain trade-offs. Borrowers usually need to make a down payment of 20% to 40% of the purchase price, compared to the 10% minimum required for SBA loans . Additionally, repayment terms are shorter - typically 5 to 7 years for business acquisitions - which results in higher monthly payments.

Interest rates for conventional loans are negotiated based on market conditions and the borrower’s financial profile. For those with excellent credit, rates can sometimes be lower than SBA loan rates, which are capped at Prime + 3% . You can estimate these costs using an SBA loan interest calculator. However, for most borrowers, conventional loan rates tend to be higher because they lack government support.

These features highlight the unique advantages and challenges of conventional loans, helping buyers determine when they might be the right fit.

When to Use Conventional Loans for Acquisitions

Conventional loans are best suited for borrowers with strong credit and significant liquid assets. Lenders typically require a credit score above 680 and place a heavy emphasis on the borrower’s personal financial history . Buyers with excellent credit, substantial assets, and relevant industry experience are more likely to secure favorable terms.

These loans work particularly well for asset-heavy acquisitions, such as manufacturing facilities, distribution companies, or businesses with valuable real estate. They are also ideal for deals where the purchase price exceeds $5 million, surpassing the SBA loan cap.

Another key advantage is speed. For deals with tight deadlines, the 30- to 45-day processing time of conventional loans can be a game-changer compared to the 2–3 months often required for SBA loans. Eligibility requirements typically include a strong business plan, proof of annual revenue, and at least one year of business operations.

SBA 7(a) vs. Conventional Loans: Side-by-Side Comparison

Loan Terms and Structure Comparison

Loan structure plays a huge role in determining monthly cash flow and the overall feasibility of a deal. Let’s say you’re financing a $750,000 acquisition at 8% interest. With an SBA 7(a) loan and a 10-year term, your monthly payment would be about $9,100. Compare that to a conventional loan with a standard 5-year term, where you’d be looking at roughly $15,200 per month. That’s more than a 40% difference in monthly payments, which can significantly impact your cash flow.

Here’s a breakdown of how SBA 7(a) loans and conventional loans measure up across key factors:

| Factor | SBA 7(a) Loan | Conventional Loan |

|---|---|---|

| Max Loan Amount | $5 million | Varies (can exceed $5 million) |

| Down Payment | 10% minimum | 20%–40% |

| Repayment Term | 10 years (25 years with real estate) | 5–7 years (typical) |

| Interest Rates | Prime + 2.25% to 4.75% (7.25%–9.75% as of Jan 2026) | 6.3%–11.5% (market-based) |

| Goodwill Financing | Yes (up to $5 million) | Rarely or limited |

| Collateral | All available business assets | Heavy emphasis on tangible assets |

| Closing Time | 60–90 days | 30–45 days |

| Guarantee Fee | 0%–3.5% of guaranteed portion | None |

One standout feature of SBA 7(a) loans is their ability to finance goodwill, which refers to the intangible value of a business - things like customer relationships and brand reputation. This is an area where conventional loans often fall short. According to DueDilio:

Conventional lenders typically refuse to finance goodwill. Consequently, this creates a fundamental mismatch in the market... SBA financing is often the only viable option.

For service-based businesses, where intangibles make up a large chunk of the purchase price, this flexibility can be a game-changer.

Eligibility Requirements and Credit Standards

The differences between SBA 7(a) loans and conventional loans go beyond loan terms - they also extend to eligibility and credit standards. SBA lenders generally look for a credit score in the 680–690 range, while conventional lenders prefer scores over 700 and a more established credit history.

Collateral requirements also set the two apart. SBA loans require a lien on business assets and may use personal assets as a backup. However, the SBA has rules that prevent lenders from denying a loan solely due to insufficient collateral, as long as other factors are strong. Conventional lenders, on the other hand, prioritize tangible assets like equipment or real estate that can be easily liquidated.

Another key difference lies in operational history. Conventional loans typically require two years of profitable operations and significant hard assets. In contrast, SBA 7(a) loans are more flexible - they’re available to startups (with a 3:1 debt-to-equity ratio) and established businesses alike. Most SBA lenders also look for a Debt Service Coverage Ratio (DSCR) of 1.15–1.25. Both loan types generally require personal guarantees from anyone owning 20% or more of the business.

These differences highlight how SBA 7(a) loans offer more flexibility, while conventional loans cater to borrowers with stronger financial profiles and established businesses.

Benefits and Drawbacks of SBA 7(a) Loans

Why Choose SBA 7(a) Loans

An SBA 7(a) loan offers some compelling advantages, especially when it comes to managing cash flow. With repayment terms stretching up to 10 years - compared to the typical 5-year term for conventional loans - monthly payments are about 40% lower. This lighter financial burden can make a big difference during the early stages of ownership, when cash flow is often tight.

Another appealing feature is the lower down payment requirement. Borrowers usually need to put down just 10%, whereas conventional loans often demand 20% to 40%. This leaves more capital available for other needs, like working capital or growing the business.

SBA 7(a) loans also stand out because they can cover goodwill - the intangible value tied to things like customer relationships and brand reputation. Conventional lenders rarely finance goodwill, making this a key advantage for businesses where intangible assets are a major part of their value.

These loans are also more accessible to first-time buyers or those with moderate credit scores. The SBA guarantees 75% to 85% of the loan, which reduces the lender’s risk and increases the chances of approval, even for deals that might not qualify under conventional terms. On top of that, closing costs and the SBA guarantee fee can often be included in the loan itself, easing the upfront financial burden.

While these benefits are significant, SBA 7(a) loans do come with some challenges that might complicate your acquisition timeline or negotiation process.

Challenges with SBA 7(a) Loans

Despite their advantages, SBA 7(a) loans have some hurdles that borrowers should be prepared for. One of the biggest drawbacks is the time it takes to close. While conventional loans can be finalized in 30 to 45 days, SBA 7(a) loans typically require 60 to 90 days. If you’re competing against cash buyers or need to act quickly, this longer timeline could put you at a disadvantage. Proper planning and clear communication with sellers are crucial to navigating this challenge.

The documentation requirements are also extensive. Borrowers and sellers must provide three years of tax returns, interim financial statements, personal financial statements for all guarantors, and a formal business valuation ordered by the bank. This thorough review can feel intrusive, and any inconsistencies or missing information could delay approval - or worse, jeopardize the entire deal.

SBA regulations impose additional restrictions that can complicate negotiations. For instance, earnouts - where part of the purchase price is tied to future business performance - are not allowed. The full purchase price must be determined and documented at closing. Sellers are also limited to consulting roles for no more than 12 months. If you’re using a seller note to meet the equity requirement, it must remain on full standby, meaning no payments can be made on it for the duration of the SBA loan.

Lastly, there’s the upfront cost to consider. Borrowers must pay a guarantee fee, typically 3% to 3.5% of the guaranteed portion of the loan. For a $750,000 loan with an 85% guarantee, this adds around $19,000 to $22,000 to closing costs. While these fees can be rolled into the loan, they’re still an added expense that conventional loans don’t require.

Benefits and Drawbacks of Conventional Loans

Why Choose Conventional Loans

One of the standout advantages of conventional loans is their speed. These loans often close within 30 to 45 days, and some lenders can fund them in as little as two to three business days. If you're in a competitive situation or dealing with a seller who needs to close quickly, this faster timeline can make all the difference.

Another perk is skipping the SBA guarantee fee. For comparison, SBA borrowers usually pay 3% to 3.5% of the guaranteed portion upfront. On a $750,000 loan, that adds up to an extra $20,000 to $25,000. Conventional loans not only avoid this fee but also come with less paperwork and fewer layers of government oversight.

Conventional loans also open the door to much higher borrowing limits. While SBA 7(a) loans max out at $5 million, some institutional lenders can fund up to $1 billion for large-scale acquisitions. If you're buying a business with significant tangible assets - like manufacturing equipment or real estate - conventional lenders are more likely to approve your loan when strong collateral is in play. These benefits, however, come with some notable hurdles.

Challenges with Conventional Loans

Despite their advantages, conventional loans have their share of challenges. For starters, they require a larger down payment - typically 20% to 30%, and sometimes as high as 40%. Compare that to SBA loans, which often require just 10% down. This higher upfront cost means you'll need more liquid capital, which could limit your ability to maintain working capital or fund other ventures.

Another drawback is shorter repayment terms, which lead to much higher monthly payments. For instance, on a $750,000 loan with an 8% interest rate, a 5-year term would mean a monthly payment of roughly $15,200. In contrast, a 10-year SBA loan would lower that payment to about $9,100 - a difference of $6,100 per month. These steeper payments can put a strain on cash flow, especially during the critical transition period after acquiring a business.

Perhaps the biggest challenge is that conventional lenders rarely finance goodwill - intangibles like customer relationships, brand reputation, or proprietary processes. Since goodwill can account for 60% to 80% of a business's purchase price, securing conventional financing can be tough without substantial hard assets. On top of that, conventional loans usually come with stricter credit requirements, demanding excellent personal and business credit scores.

Application Process and Timeline Differences

When it comes to SBA 7(a) loans, the approval process involves two layers: the lender and the federal government. In contrast, conventional loans are evaluated based solely on the lender's internal criteria.

If you're applying for an SBA 7(a) loan for a business acquisition, you'll need to submit several forms, including SBA Forms 1919, 912, and 413. Alongside these, you'll need three years of both personal and business tax returns, a detailed business plan with financial projections, and acquisition-specific documents such as a Letter of Intent, purchase agreement, and an independent business appraisal. Conventional loans, on the other hand, typically require less paperwork. Standard financial statements and collateral documentation are usually sufficient, with no need for the extensive forms or appraisals required for SBA loans.

Another key difference lies in the timeline. SBA 7(a) loans generally take 60 to 90 days from application to funding, while conventional loans often close within 30 to 45 days. However, working with an SBA Preferred Lender (PLP) can speed up the process by three to four weeks, as these lenders can approve loans without sending them to the SBA for additional review.

Given the longer timeline for SBA 7(a) loans, early preparation is crucial. Start gathering your documents - tax returns, business plan, and Letter of Intent - well in advance, as these are essential for completing the application. For conventional loans, the faster process means you'll need to have your financials ready quickly, but the reduced paperwork makes the process less time-consuming overall.

Choosing Between SBA 7(a) and Conventional Loans

What to Consider Before Deciding

If you have less than 20% of the purchase price available in cash, an SBA 7(a) loan might be your best option. Conventional loans often require a larger down payment - typically between 25% and 40% - which can strain the cash reserves you need to keep your business running smoothly.

Credit requirements also play a big role. SBA 7(a) lenders usually expect a personal credit score of at least 680, whereas conventional lenders often set the bar higher, requiring scores of 700 or more and a spotless business credit history. Additionally, if you have any outstanding federal debt, you could be disqualified from securing an SBA-backed loan.

Timing is another critical factor. If you need to close the deal within 30 days, a conventional loan is likely your only option. SBA 7(a) loans generally require more time, so ensure your purchase agreement allows for a closing period of 30 to 90 days. On the flip side, if you’re looking for longer repayment terms to ease cash flow pressures, SBA 7(a) loans are worth considering.

Keep in mind that SBA 7(a) loans have a $5 million cap. For acquisitions exceeding that amount, conventional loans are the way to go.

By weighing these factors, you can better determine which loan type aligns with your specific needs.

Best-Fit Scenarios for Each Loan Type

An SBA 7(a) loan is a solid choice if you’re a first-time buyer, lack significant collateral, or are purchasing a business with strong cash flow but limited tangible assets. As Pioneer Capital Advisory explains:

SBA 7(a) loans are fundamentally cash-flow loans - lenders focus more on DSCR and business performance than on fully collateralizing the entire loan amount.

For instance, if you’re buying a service business valued at $800,000 with strong cash flow but minimal equipment, an SBA 7(a) loan could be ideal. With a down payment of just $80,000, you can preserve your cash reserves. Plus, you could use a seller note on "full standby" (requiring no payments during the life of the SBA loan) to cover up to 50% of the required 10% equity injection, further reducing your upfront costs.

On the other hand, conventional loans are better suited for experienced operators with high liquidity, especially if the deal needs to close quickly - typically within 30 days - or if the acquisition price exceeds $5 million. Conventional loans are also ideal if you have ample collateral and want to avoid the paperwork and government approvals tied to SBA loans. For example, an established business owner acquiring a competitor for $3 million might put down $900,000 (30%) and finalize the deal within three weeks, gaining a competitive edge in markets where speed and certainty are crucial.

Final Thoughts

Choosing the right financing option depends on your acquisition goals and financial situation. SBA 7(a) loans are ideal for service-oriented businesses or deals focused on intangible assets. They offer benefits like a low 10% down payment and 10-year terms, helping you maintain healthier cash flow.

On the other hand, conventional loans are better suited for buyers who need faster closings or funding above $5 million. These loans typically close within 30–45 days, avoid SBA fees, and work well for buyers with strong liquidity or acquisitions involving significant tangible assets. However, they require higher down payments (20%–40%) and have shorter terms (5–7 years), making them a better fit for those with solid cash reserves.

FAQs

What are the benefits of using an SBA 7(a) loan to buy a business?

An SBA 7(a) loan can be a game-changer when it comes to financing a business acquisition. One of the standout perks? You can finance up to 90% of the purchase price, which means you only need to cover a small portion upfront. This makes it a practical choice for individuals or small businesses that might not have a lot of capital on hand.

Another big plus is the longer repayment terms - often stretching up to 10 years. This extended timeline can help keep monthly payments manageable, giving you more breathing room for other expenses and improving your cash flow. On top of that, these loans usually come with competitive interest rates and require a relatively low down payment, often around 10%. The government-backed guarantee behind these loans also makes them less risky for lenders, which works in your favor.

If you're looking for flexible and affordable financing to help make your business acquisition a reality, an SBA 7(a) loan is definitely worth considering.

What are the differences in down payment requirements between SBA 7(a) loans and conventional loans?

SBA 7(a) loans stand out for their lower down payment requirements, often set at about 10% of the total loan amount. This feature makes them a more approachable option for small business buyers who might not have a large amount of capital saved up for an initial investment.

On the other hand, conventional loans typically demand a higher down payment, often 20% or more. This reflects stricter lending standards and a heavier emphasis on collateral. For buyers with limited financial resources, this higher requirement can be a significant hurdle when trying to secure funding for a business purchase.

When is a conventional loan a better choice than an SBA 7(a) loan for buying a business?

If you have strong credit, robust financial stability, and sufficient collateral, a conventional loan might be a better option than an SBA 7(a) loan. These loans often come with lower interest rates, but lenders typically require a solid financial profile to qualify for these attractive terms.

Conventional loans can also be a good choice if you’re aiming for a quicker approval process or want to skip the extra paperwork and fees tied to SBA loans. They’re ideal for borrowers who don’t need the government backing offered by SBA programs and are in a position to negotiate favorable terms directly with their lender.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)