Valuation multiples are key to estimating the value of consulting and professional service firms. They compare a firm's market value to financial metrics like revenue or EBITDA. Here's what you need to know:

-

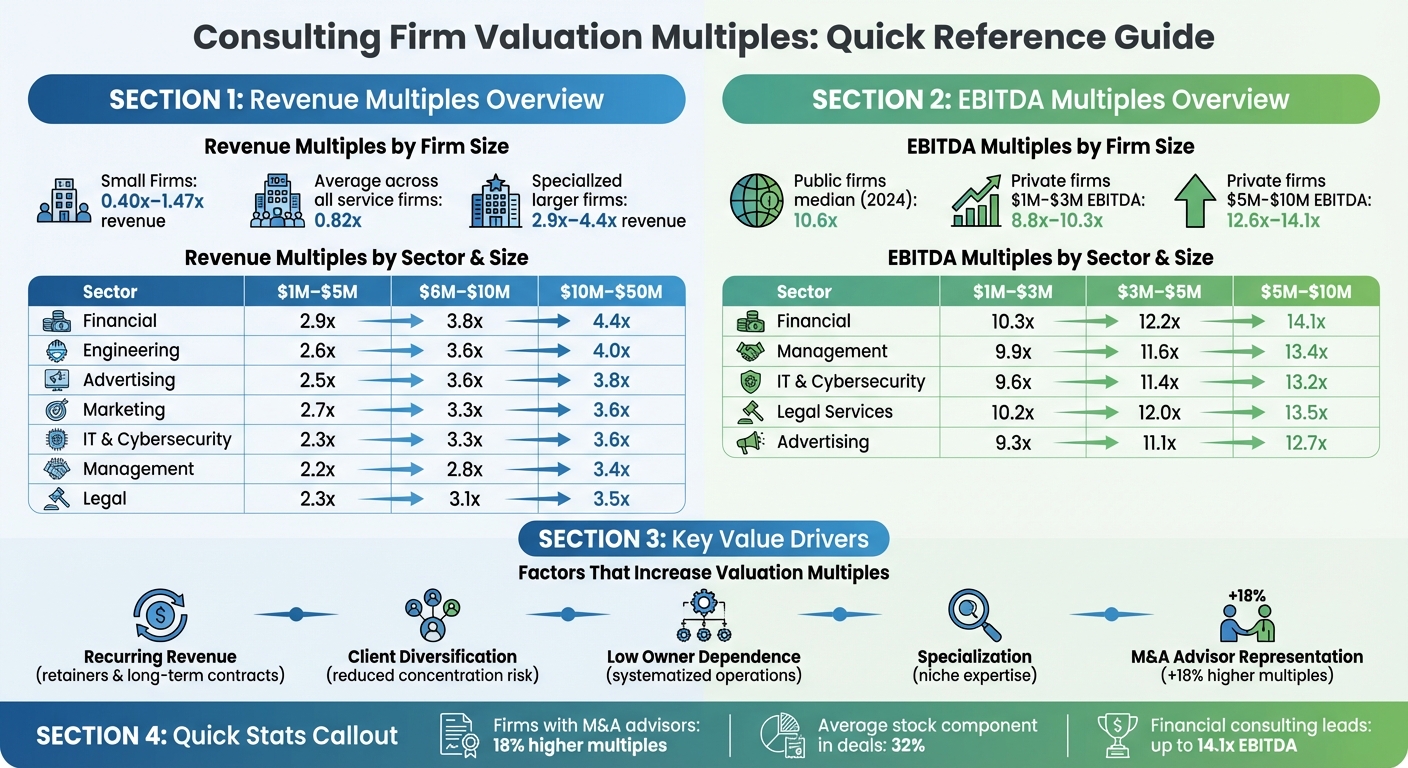

Revenue Multiples: Ideal for firms with fluctuating profit margins or prioritizing growth. Typical ranges:

- Small firms: 0.40x–1.47x revenue.

- Larger or specialized firms: Up to 4.4x revenue, depending on sector.

-

EBITDA Multiples: Focus on profitability and operational efficiency. Common ranges:

- $1M–$3M EBITDA: 8.8x–10.3x.

- $5M–$10M EBITDA: Up to 14.1x for financial consulting.

Factors influencing multiples:

- Recurring Revenue: Long-term contracts or retainers boost value.

- Client Diversification: Reduces risk and increases appeal.

- Owner Dependence: Firms less reliant on the owner command higher multiples.

- Specialization: Niche expertise often leads to higher valuations.

Recent trends show firms with M&A advisors achieve higher multiples (18% more), and sectors like IT, cybersecurity, and financial consulting lead in valuation growth.

Quick Comparison

| Metric | Revenue Multiples | EBITDA Multiples |

|---|---|---|

| Small Firms | 0.40x–1.47x | 8.8x–10.3x |

| Mid-Sized Firms | 2.9x–4.4x (specialized) | 12.6x–14.1x (financial) |

| Key Drivers | Recurring revenue, client diversification, reduced owner dependence |

Understanding these metrics helps buyers and sellers make informed decisions. Firms can improve their valuations by addressing risks, normalizing financials, and highlighting recurring revenue streams.

Consulting Firm Valuation Multiples by Size and Sector

How to Value a Consulting Firm | Peak Business Valuation

sbb-itb-a3ef7c1

Revenue Multiples for Consulting and Professional Service Firms

Revenue multiples provide a way to estimate a consulting firm's value by comparing its annual revenue to an industry-specific factor. This approach involves multiplying the firm’s total revenue by the designated multiple. While it doesn’t account for profitability like EBITDA multiples, it’s especially useful for firms with fluctuating profit margins or those prioritizing top-line growth over other metrics. Many experts use revenue multiples as a starting point or combine them with other methods to determine a fair market value range.

The appeal of revenue multiples lies in their straightforwardness, but this simplicity comes with limitations. Since they don't factor in a firm’s cost structure, assets, or liabilities, they tend to be less precise than EBITDA or SDE multiples. However, for certain industries - like accounting practices - revenue multiples remain the go-to valuation method, typically ranging between 1.0x and 2.5x depending on the size of the firm. They are particularly effective for evaluating firms with "sticky" revenue streams, such as recurring retainers or long-term contracts, which buyers often value more than one-off project fees.

Common Revenue Multiple Ranges

Revenue multiples can vary widely depending on the size and specialization of a firm. For smaller consulting firms, often referred to as "main street" businesses, multiples typically range between 0.40x and 1.47x revenue. Across all service-based businesses, the average multiple hovers around 0.82x. Larger firms with specialized expertise usually command higher multiples.

For private consulting firms generating annual revenues between $1 million and $50 million, recent data from 2025 highlights a clear scale premium. Financial consulting firms lead the pack, with multiples ranging from 2.9x for firms earning $1–5 million annually to 4.4x for those in the $10–50 million range. Engineering consultancies follow closely, with multiples between 2.6x and 4.0x in the same revenue bands, while general management consulting firms typically fall between 2.2x and 3.4x.

Here’s a summary of how multiples vary across sectors:

| Consulting Sector | $1M–$5M Revenue | $6M–$10M Revenue | $10M–$50M Revenue |

|---|---|---|---|

| Financial | 2.9x | 3.8x | 4.4x |

| Engineering | 2.6x | 3.6x | 4.0x |

| Advertising | 2.5x | 3.6x | 3.8x |

| Marketing | 2.7x | 3.3x | 3.6x |

| IT & Cybersecurity | 2.3x | 3.3x | 3.6x |

| Management | 2.2x | 2.8x | 3.4x |

| Legal | 2.3x | 3.1x | 3.5x |

Specialization plays a big role in driving up multiples. Firms offering expertise in areas like AI-driven solutions or cybersecurity often outperform general management consultancies. Additionally, firms that work with M&A advisors typically secure multiples about 18% higher than those selling without professional representation.

How to Calculate Revenue Multiples

To calculate a revenue multiple, simply multiply a firm’s annual revenue by the relevant industry multiple. For example, a firm generating $3.6 million in revenue at a 0.84x multiple would be valued at $3,024,000.

This method also scales for mid-market firms. For instance, a specialized legal consulting firm with $12 million in revenue applying a 3.1x multiple would be valued at $37.2 million. Similarly, an engineering consultancy earning $8 million annually at a 3.6x multiple would have an estimated value of $28.8 million.

Ultimately, a firm’s unique characteristics determine its appropriate multiple. Key factors like the percentage of recurring revenue, client diversification, and the degree of owner dependence can significantly influence where a firm falls within the range. For example, a financial consulting firm with 70% of its revenue coming from recurring retainers and minimal reliance on the owner might justify a multiple closer to the high end of the 2.9x–4.4x range. In contrast, a project-based firm with concentrated client relationships would likely fall toward the lower end. These factors are critical in assessing the specific multiple for any firm.

EBITDA Multiples in Professional Service Firm Valuation

EBITDA multiples offer a deeper look into a firm's value by focusing on profitability instead of just revenue. EBITDA - short for Earnings Before Interest, Taxes, Depreciation, and Amortization - serves as a measure of operating cash flow, giving buyers a way to assess return on investment. This method allows for consistent comparisons between firms by leveling out differences in tax policies, capital structures, and accounting practices. Since professional service firms usually don't need heavy capital investments, EBITDA and EBIT multiples often align closely, as depreciation and amortization costs are minimal.

EBITDA multiples are especially useful for evaluating a firm's operational efficiency and profitability over time. Unlike revenue multiples, which overlook cost structures, EBITDA multiples highlight how well a company turns sales into earnings. This makes them particularly relevant for comparing firms with varying cost profiles or growth plans. In 2024, the median EBITDA multiple for public professional service firms reached 10.6x, while private firms generally experience lower multiples depending on their size and unique characteristics. Below, we explore typical EBITDA multiple ranges and the factors that influence them.

Typical EBITDA Multiple Ranges

For private consulting firms, EBITDA multiples can vary widely based on factors like size, specialization, and overall maturity. Firms generating between $1 million and $3 million in EBITDA generally see multiples ranging from 8.8x to 10.3x, while those in the $5 million to $10 million range can command 12.6x to 14.1x. Among these, financial consulting firms tend to lead, reaching 14.1x at the higher end, whereas management consulting firms typically range between 9.9x and 13.4x for the same EBITDA levels.

Specialization also plays a big role. For example, IT and cybersecurity consultancies with EBITDA between $5 million and $10 million average 13.2x, while engineering firms in the same bracket typically see 12.9x.

| Consulting Sector | $1M–$3M EBITDA | $3M–$5M EBITDA | $5M–$10M EBITDA |

|---|---|---|---|

| Financial Consulting | 10.3x | 12.2x | 14.1x |

| Management Consulting | 9.9x | 11.6x | 13.4x |

| IT & Cybersecurity | 9.6x | 11.4x | 13.2x |

| Legal Services | 10.2x | 12.0x | 13.5x |

| Advertising | 9.3x | 11.1x | 12.7x |

Deal structure also influences valuations. In 2023, equity made up an average of 32% of consulting firm transactions, as buyers increasingly favored stock over cash to reduce upfront risk and retain key talent post-acquisition.

Adjusted EBITDA and Why It Matters

Adjusted EBITDA, also referred to as Normalized EBITDA, provides a clearer picture of a firm's earning potential by excluding one-time or non-recurring expenses, as well as owner-specific costs. This adjustment ensures buyers evaluate sustainable profitability without being misled by accounting anomalies.

A key adjustment involves replacing an owner's actual salary with a market-rate equivalent. For instance, if a founder pays themselves $400,000 annually but a comparable CEO would earn $200,000, the $200,000 difference is added back to EBITDA. Other adjustments include removing personal expenses like travel, club memberships, or non-business vehicle costs, as well as one-time legal or relocation expenses. These changes help reveal the business's true earnings, independent of the current owner's financial habits.

"Adjusted EBITDA... allows buyers to compare businesses on an apples-to-apples basis and ensures valuation reflects sustainable earnings, not discretionary accounting." - David Jacobs, Business Broker

Performing these adjustments before going to market reduces the risk of "retrade", where a buyer lowers their offer during due diligence after spotting financial inconsistencies. Preparing a detailed workbook to reconcile GAAP statements with normalized EBITDA six to nine months before a sale can help establish credibility and maintain the asking price during negotiations. These steps are particularly important when considering how firm size impacts EBITDA multiples.

How Firm Size Affects EBITDA Multiples

Larger firms often command higher multiples due to their scalability, established processes, and reduced reliance on owners. For instance, a consulting firm generating $8 million in EBITDA is likely to achieve a multiple 30% to 40% higher than one generating $2 million, even within the same industry. This premium reflects larger firms' ability to demonstrate growth, retain clients, and operate more efficiently. On the other hand, smaller firms may face lower multiples due to concerns about owner dependence and less developed infrastructure.

Take IT services firms as an example: those with $3 million to $5 million in EBITDA typically see multiples between 5x and 6x, while firms in the $10 million to $20 million range often achieve 7x to 8x. This roughly 40% increase is driven by their demonstrated ability to scale and operate with greater efficiency.

Factors That Influence Valuation Multiples

Expanding on the importance of revenue and EBITDA multiples, several other key factors determine whether a consulting firm can command a premium valuation or face a discounted one. Buyers carefully evaluate aspects like revenue stability, operational independence, and competitive positioning to assess risk. For sellers, understanding these elements can be a game-changer in preparing for an exit, while buyers can use them to spot firms with lasting value. Below, we explore factors like client diversity, growth potential, and owner dependence that directly shape valuation multiples.

Client Concentration and Recurring Revenue

A firm with a diversified client base offers buyers a sense of stability. When no single client represents a large share of revenue, the business is less exposed to risk if a key client relationship ends. In fact, customer relationships alone can account for up to 38% of a professional service firm's total value.

Recurring revenue models - like retainers, subscriptions, or long-term service contracts - are especially attractive. These models provide predictable cash flows, reducing buyer risk and often leading to higher valuation multiples compared to project-based work. Firms that shift from one-off projects to managed services or implementation contracts often see their valuations improve. However, the real key lies in ensuring client relationships are tied to the firm itself - not to individual consultants - making the business more transferable.

"The goal is to build relationships that belong to the firm, not just to an individual."

– Lindsay Sinclair, SMLS Advisors

These revenue patterns naturally feed into considerations of profitability and owner independence, which we’ll explore next.

Profitability and Growth Rate

Profit margins and growth rates are critical metrics for buyers calculating their potential return on investment. Firms operating in expanding fields - like AI-driven solutions, cybersecurity, or specialized financial consulting - tend to secure higher valuation multiples compared to those in stagnant industries. For instance, between 2024 and 2025, midsize financial consulting firms saw a 14% increase in valuation multiples, reaching ranges of 13x–15x EBITDA.

Firms that grow revenue while keeping costs in check - through standardized processes that deliver consistent service - achieve stronger margins and justify higher valuation multiples. Operational efficiency not only boosts current profitability but also strengthens the risk-adjusted valuation framework that buyers rely on. This connects closely to the impact of owner involvement on market perception.

Owner Dependence and Market Position

Consulting firms where the founder manages all major accounts often face valuation discounts because buyers see them as high-risk investments. Heavy reliance on the owner's personal network limits scalability and growth, which can drag down valuation multiples. Additionally, a lack of professional delegation and systematized operations exacerbates these risks.

To address this, firms should focus on reducing owner dependence by documenting client interactions, assigning team leaders to key accounts, and creating repeatable processes. Rebranding is another effective step - especially for firms named after the owner - to ensure the business's identity holds independent value before an exit. Competitive positioning also plays a significant role. Firms with niche expertise or proprietary tools that set them apart in the market often command higher multiples compared to generalist competitors.

"The irony of building a business you could sell is that you'll probably never want to. When your firm runs without you, work becomes a choice, not a necessity."

– Consulting Success

Recent Transaction Data and Market Trends

Revenue and EBITDA Multiple Benchmarks

Transaction data from 2024–2025 offers a clear picture of consulting firm valuations, emphasizing the importance of applying valuation multiples effectively in today’s fast-moving M&A market.

For private consulting firms, financial consulting firms lead the pack with the highest multiples. Firms in the $5–10M EBITDA range traded at 14.1x EBITDA and 4.4x revenue. Management consulting firms followed closely, with multiples of 13.4x EBITDA for firms of similar size, while IT and cybersecurity firms reached 13.2x EBITDA. Firms in the $1–3M EBITDA range generally traded at 10.3x EBITDA and 2.9x revenue within the financial consulting niche.

On the other hand, public consulting firms enjoy even higher valuations. By early 2025, Accenture’s $169 billion valuation translated to 2.4x revenue and 12.6x EBITDA. Experian achieved premium multiples of 5.7x revenue and 16.1x EBITDA, with an enterprise value of $47.1 billion. Huron Consulting Group, a smaller public firm valued at $3.8 billion, traded at 2.3x revenue and 16.0x EBITDA. Across the board, the median for public consulting firms in 2024 settled at 1.6x revenue and 13.2x EBITDA. Notably, the median P/E multiple climbed sharply to 27.5x, up from 18.7x in 2023.

| Private Consulting Firm Benchmarks (2025) | $1-3M EBITDA | $3-5M EBITDA | $5-10M EBITDA |

|---|---|---|---|

| Financial Consulting | 10.3x | 12.2x | 14.1x |

| Management Consulting | 9.9x | 11.6x | 13.4x |

| IT & Cybersecurity | 9.6x | 11.4x | 13.2x |

| Marketing Consulting | 10.1x | 11.7x | 13.5x |

| Engineering Consulting | 9.5x | 10.9x | 12.9x |

Engineering firms within the architecture and environmental sectors saw a median EBITDA multiple of 5.52x, with top-tier deals reaching 7.50x, thanks to the Infrastructure Investment and Jobs Act (IIJA). This $1.2 trillion federal infrastructure package provided greater transparency into future revenue streams, which justified higher valuations.

"It is apparent that since the passage of IIJA, acquirers have become more comfortable with higher multiples. This is likely due to better visibility into future revenue and higher expectations for growth."

– Peter McManus, Business Valuation Analyst, ROG+ Partners

These benchmarks provide a foundation for understanding how broader market trends influence deal structures and valuation expectations.

Current Trends in Consulting and Professional Services M&A

Building on these valuation benchmarks, recent M&A trends highlight how economic and technological shifts are reshaping buyer strategies. High interest rates throughout 2024 put pressure on dealmaking, reducing average middle-market valuations to 9.4x EV/EBITDA, down from 9.9x in 2022. Despite these challenges, highly specialized firms continued to attract strong interest, with many deals still closing at 10.0x EBITDA or higher.

To mitigate risks, buyers are increasingly structuring acquisitions with a stock component, averaging 32% stock in consulting firm deals. This approach allows buyers to conserve cash while ensuring that key employees and owners remain invested in the company’s post-acquisition success.

"Until the economy regains full momentum, buyers are likely to prefer deals with a greater proportion of stock compensation, which reduces the acquirer's risk and keeps owners and key employees in their positions."

– Evan Bailyn, Founder, First Page Sage

Digital transformation and AI capabilities have emerged as major drivers of valuation growth. Public firm revenue multiples increased from 1.1x to 1.6x as investors anticipated future earnings from generative AI and digital services. Firms embracing AI as an opportunity rather than a threat are commanding higher valuations, while those focused on routine analytical work face downward pressure.

The market has also seen a shift toward larger, more synergistic deals. The average enterprise value of middle-market targets rose from $112.5 million in 2023 to $166.8 million in 2024. Private equity continues to expand its influence, with roughly 20% of the top 250 design firms now under PE ownership.

Even large firms faced challenges. Deloitte reported its weakest growth since 2010, with global revenues increasing just 3.1% to $67.2 billion in 2024, reflecting softer demand in key markets.

Firms represented by M&A advisors or investment banks consistently achieved better deal outcomes, securing multiples 18% higher than their unrepresented counterparts. This reflects the value of professional deal management, competitive bidding, and structured negotiations in maximizing seller outcomes.

Using Clearly Acquired Tools for Valuation Analysis

AI-Powered Valuation Tools

Clearly Acquired's platform streamlines the valuation process by leveraging AI to compare your firm's financial metrics against a vast database of private consulting firm sales. This automated approach eliminates the need for manual research, matching your firm's data with thousands of comparable transactions to deliver fast, precise benchmarks.

One of the standout features is its ability to calculate Adjusted EBITDA by normalizing non-recurring expenses. This adjustment provides a sharper view of your firm's cash flow potential, which is a critical factor for buyers. For instance, consulting firms in the $1–3M EBITDA range often trade at multiples between 9.5x and 10.3x EBITDA.

The platform also acts as an early warning system for potential risks. Real-time dashboards monitor key metrics, flagging issues like high client concentration or heavy reliance on the owner. This allows firms to address vulnerabilities well before they impact valuation.

For firms aiming to position themselves as "AI-enhanced" rather than "AI-threatened", the platform highlights value drivers like automated diagnostic tools and scalable digital systems. These features can significantly boost valuations. In 2025, financial consulting firms with such capabilities are achieving multiples as high as 14.1x EBITDA in the $5–10M range.

Beyond assessing current valuations, these insights help businesses craft smarter acquisition and exit strategies.

Applying Multiples in Acquisition and Exit Planning

Building on its valuation benchmarks, Clearly Acquired's platform helps users apply these multiples to evaluate deal pricing and refine exit strategies. Buyers can analyze whether a target firm's asking price aligns with industry standards by comparing its financial performance against sector-specific multiples. For smaller, owner-operated firms, SDE multiples range from 1.29x to 3.30x, while larger consulting businesses typically see EBITDA multiples between 1.76x and 5.20x. This makes it easier to spot overpriced firms or uncover undervalued opportunities with growth potential.

For sellers preparing to exit, the platform builds a compelling, data-backed case for their firm's value. Factors like diversified revenue streams, reduced owner dependence through systematized operations, or proprietary methodologies can justify higher multiples.

Additionally, the platform assists in structuring optimal capital stacks for transactions. With buyers increasingly using approximately 32% stock compensation to manage risk and retain talent, Clearly Acquired evaluates whether a cash-heavy, stock-heavy, or blended approach aligns best with the firm's goals and risk profile. This ensures both buyers and sellers can approach deals with confidence and clarity.

Conclusion: Key Takeaways and Next Steps

Understanding valuation multiples is a must for anyone navigating the buying, selling, or investing landscape in consulting and professional service firms. Revenue multiples generally fall between 0.40x and 1.47x, while EBITDA multiples range from 1.76x to 5.20x for most firms. Specialized sectors, such as financial consulting, can see multiples climb as high as 14.1x in the $5–10M EBITDA range.

The most successful firms share a few common traits: they reduce reliance on founders, implement scalable systems, diversify their client base, and secure recurring revenue streams. Firms that fail to address these areas often see their valuations take a hit. Interestingly, professional guidance can increase valuation multiples by about 18%, underscoring the value of proper preparation and strategic positioning.

These insights pave the way for actionable strategies. Buyers can use valuation multiples to benchmark target firms, helping to spot overpriced deals or uncover undervalued firms with strong growth potential. On the other hand, sellers can focus on addressing weaknesses early, from normalizing financials to documenting proprietary processes and building a self-sufficient team. The difference between a lackluster exit and a standout valuation often boils down to preparation.

Clearly Acquired’s AI-powered platform takes these insights to the next level. By analyzing your firm’s metrics against thousands of comparable transactions, it calculates adjusted EBITDA and flags risks in real time. Whether you’re structuring a deal with the right blend of cash and stock (currently averaging 32% stock in consulting transactions) or assessing whether a target’s asking price aligns with market trends, these tools provide clear, actionable guidance.

Kick things off with a valuation analysis to identify key value drivers, address vulnerabilities, and structure deals that reflect true market value.

FAQs

How do recurring revenue and a diverse client base affect valuation multiples?

A broad and varied client base tends to drive up valuation multiples. Why? Because it spreads risk. When a business isn’t overly dependent on just a handful of clients, the chances of a major financial hit from losing one account are significantly reduced. On the flip side, if a large chunk of revenue is tied to just a few clients - known as high client concentration - it can drag down multiples. This setup signals a higher risk, as losing even one key client could have a major impact.

Another factor that can elevate valuation multiples is a recurring revenue model. This type of income stream is prized for its reliability and predictability. Investors and buyers often view recurring revenue as a hallmark of a robust and scalable business. It’s a standout feature when determining a company’s value.

Why do larger consulting firms tend to have higher EBITDA multiples?

Larger consulting firms tend to secure higher EBITDA multiples, and there's a good reason for it. Their size gives them distinct advantages that investors find appealing. For starters, they usually have a broader range of revenue sources, which means they’re less reliant on a single client or project. This diversification helps cushion them against potential downturns or client-specific risks.

On top of that, bigger firms often enjoy stronger market presence and reduced risks tied to client concentration. They’re also perceived as more stable and capable of scaling operations effectively, making them an attractive option for investors. This combination of stability, scalability, and market appeal, along with easier access to capital, often pushes their valuation multiples higher. In short, these factors position larger firms to secure premium valuations in the market.

How does reliance on the owner affect a consulting firm's valuation?

Owner dependence can significantly impact the valuation of a consulting or professional services firm. Buyers and investors generally prefer businesses that can run smoothly and maintain revenue without relying heavily on the owner. When the owner is deeply involved in client relationships, project execution, or key decision-making, it introduces a risk that revenue might drop after their departure, which can lead to a lower valuation.

Firms that have well-structured processes, a broad and varied client base, consistent revenue streams, and a capable management team that operates effectively with minimal owner input are more likely to secure higher valuation multiples. Minimizing owner dependence is one of the most effective strategies for increasing a firm's value and attracting serious buyers.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)