Preparing for due diligence can make or break your deal. For companies valued between $10 million and $100 million, the process is thorough, covering financials, legal records, and operational data. Buyers want clean, organized documentation to verify your business's value and identify risks. Here's what you need to know:

- Financial Prep: Provide 3–5 years of financial statements, tax returns, and detailed reports like QoE and adjusted EBITDA. Ensure consistency and transparency.

- Legal Records: Organize corporate documents, contracts, licenses, and any litigation history. Address gaps or liabilities early.

- Operational Data: Document supply chains, key personnel, and technology systems. Ensure processes are well-documented for a smooth transition.

- Common Risks: Tackle customer concentration, working capital, and contingent liabilities upfront to avoid price reductions or deal delays.

- Advisors: Engage accountants and legal experts early to prepare QoE reports and clean up records.

Preparation is key. Organize your data, address potential issues, and communicate clearly with buyers to ensure a smoother process.

Due Diligence in Mergers and Acquisitions (M&A) | Chuck Adams, Coeptis Consulting Group

sbb-itb-a3ef7c1

Preparing Financial Documentation

Your financial records are the cornerstone of due diligence. Buyers will comb through at least three to five years of income statements, balance sheets, and cash flow statements to confirm your company's performance and identify any risks. Beyond these historical documents, it's crucial to include monthly management reports, trailing 12-month statements, and the general ledger to showcase recent trends. This section outlines how to organize and present your financial data effectively.

"Without proper organization and complete records, deals stall, parties lose confidence and opportunities disappear." - Craig Hamm, Partner, BPM

Your financials should tell a clear and cohesive story. Buyers will want to review tax returns for the past three years (federal, state, and local), along with accounts receivable and accounts payable aging reports, inventory schedules, and bank statements. Additionally, breaking down revenue by customer, product line, and geography can help highlight risks like customer concentration and provide insight into your margin structure.

| Category | Essential Documents & Reports |

|---|---|

| Core Financials | 3-5 years of Income Statements, Balance Sheets, Cash Flow Statements; General Ledger; Trial Balance |

| Tax Records | 3 years of Federal, State, and Local Income Tax Returns; Sales Tax filings; Payroll Tax returns |

| Analysis Reports | Quality of Earnings (QoE) report; Adjusted EBITDA schedule; Net Working Capital (NWC) calculation |

| Operational | AR/AP Aging reports; Inventory schedules; Fixed asset register; 3 years of bank statements |

| Sales/Revenue | Revenue breakdown by customer/product; Sales pipeline/backlog; Customer concentration analysis |

| Forward-Looking | Annual budgets; 12-month financial projections; Capital expenditure (CapEx) plans |

Standardizing Financial Statements

Buyers value consistency over perfection. Even if your accounting practices haven't been flawless, maintaining uniformity in your historical records is more important than making changes midway. Ideally, aim to transition toward monthly GAAP reporting rather than relying solely on an annual cleanup.

"Consistent accounting is key. Even if your accounting hasn't been the greatest, it's better to be consistent than erratic or ever-changing. Predictability is much better during diligence." - Michael L. Vaccarella, Partner, Wipfli Advisory LLC

Start by reconciling all bank and credit card accounts. Unreconciled transactions can raise red flags. Next, review your chart of accounts, merging redundant categories (e.g., "software subscriptions" and "apps") and cleaning up "miscellaneous" or "uncategorized" expenses by assigning proper general ledger codes.

Prepare a Quality of Earnings (QoE) report to adjust your EBITDA by accounting for one-time expenses, non-core costs, and owner-related perks. Items like personal travel, club memberships, or family member salaries should be documented with supporting evidence to justify these adjustments. A pre-transaction QoE review can potentially increase your valuation by an additional 0.5x to 1.0x EBITDA multiple. Once your data is organized, consolidate it into a secure, easily accessible platform.

Building a Financial Data Room

Set up a secure digital repository, organized by category - Financial, Legal, HR, and Operations - before going to market. Use clear and consistent folder names, and group related documents into subfolders for easy navigation. For instance, create a "Tax Records" folder with subfolders for each year, further dividing them into federal, state, and payroll filings.

Assign a single point of contact, such as your CFO or COO, to handle document requests and maintain consistent communication. This person should regularly update files, remove outdated versions, and ensure the data room is well-managed. Implement security measures like encryption, two-factor authentication, and watermarking, and require buyers to sign a non-disclosure agreement before granting access.

Before uploading documents, audit your records for gaps, such as missing contracts or unresolved tax issues. Avoid providing incomplete responses to buyer inquiries, as this often leads to unnecessary follow-ups. Use metadata - like creation dates, authors, and keywords - to add context to your files. Once your documents are securely stored, provide detailed revenue and expense breakdowns to help buyers assess risks.

Documenting Revenue and Expenses

Break down your revenue into detailed categories such as customer, product line, service type, geography, and sales channel. This level of detail allows buyers to evaluate customer concentration risks and identify which revenue streams are driving your margins. For example, if your top three customers account for over 30% of total revenue, be ready to present documentation on contract terms, renewal history, and the strength of these relationships.

Calculate your Net Working Capital (NWC) using the formula:

Accounts Receivable + Inventory – Accounts Payable – Accrued Expenses.

"The buyer expects a normal working capital to be delivered at closing for the multiple they are paying on EBITDA." - Michael L. Vaccarella, Partner, Wipfli Advisory LLC

Prepare detailed accounts receivable and accounts payable aging reports to illustrate collection and payment patterns. These reports validate your working capital needs and demonstrate your operational health. For expenses, categorize each line item clearly and explain any significant year-over-year changes. If your business operates in multiple states, ensure proper state tax filings and employment returns to avoid liabilities that could impact the sale price.

Gathering Legal and Compliance Records

Legal records are essential to demonstrate compliance and ownership. Buyers will carefully examine these documents to uncover any hidden liabilities, confirm adherence to regulations, and ensure there are no obstacles to a smooth transfer of ownership. Missing or incomplete files can disrupt negotiations or lead to lower offers, so getting these records in order early is key.

"The due diligence process is generally the most time-consuming and burdensome part of the purchase process. To make it out on the other end, you'll need to know how to prepare yourself, what to expect, and how to protect your company."

– J. Gerard Legagneur, Attorney

Organize your records into three main categories: corporate and ownership documents, contracts and regulatory filings, and litigation or intellectual property files. Each category addresses specific buyer concerns and highlights that your business has a strong legal foundation. Before sharing any sensitive information, ensure buyers sign a Non-Disclosure Agreement (NDA) to safeguard proprietary data. This groundwork sets the stage for reviewing contracts and identifying any potential liabilities.

Corporate and Ownership Records

Corporate structure documents confirm your company’s legal status and ownership. Buyers will want to review key documents like your Articles of Incorporation (or Articles of Organization for LLCs), bylaws or operating agreements, and any amendments made since the company’s formation.

Maintain a minute book that includes resolutions and meeting minutes from board of directors and shareholder meetings. This shows that corporate formalities have been followed and that major decisions - such as issuing equity, real estate transactions, or changes to tax status - were properly authorized. Buyers will also need an organizational chart showing the structure of any subsidiaries or related entities, along with a detailed capitalization table (cap table) that lists all shareholders, the number of shares issued, issuance dates, and any stock options, warrants, or convertible securities.

Ensure you have updated Certificates of Good Standing from the Secretary of State for each jurisdiction where your company operates. Additionally, provide a list of all trade names or "Doing Business As" (DBA) registrations with their corresponding state filings. Address any gaps in ownership records with explanations before buyers uncover them during their review.

Contracts and Regulatory Documents

Buyers will need copies of all significant customer and supplier agreements, including distribution contracts, joint venture records, and any equipment or real estate leases. Review these contracts for change-of-control clauses or consent requirements that could complicate the sale. If a key agreement requires approval before ownership can transfer, resolve this early to avoid last-minute issues.

Compile all necessary governmental licenses and permits, such as building permits, zoning approvals, and land use authorizations. If your business operates in a regulated industry, include industry-specific certifications and correspondence with agencies like the EPA or OSHA.

Buyers may also conduct public searches for UCC-1 filings to identify creditors with security interests or liens on your assets. If your business owns real estate, prepare a title report to verify that the property is free of encumbrances. Having these documents ready in advance not only avoids delays but also reassures buyers that your business is compliant and unencumbered.

Litigation and Intellectual Property Files

Disclose any pending, threatened, or resolved litigation from the last three years, including lawsuits, government investigations, consent decrees, and unsatisfied judgments. Buyers need a clear understanding of your legal exposure, and withholding known claims can damage trust and jeopardize the deal.

"The results of the due diligence process can cause the buyer to react in a variety of ways, from demanding a reduction of the purchase price to terminating the transaction altogether."

– J. Gerard Legagneur, Attorney

For intellectual property (IP), provide documentation proving ownership of all patents (issued and pending), trademarks, trade names, copyrights, and domain names. Include copies of IP licensing agreements, assignment records, and "work for hire" contracts that confirm your company owns the rights to employee-created inventions or content. If your business relies on proprietary technology or branding, buyers will closely evaluate these files to ensure there are no restrictions on using these assets after the acquisition.

| Category | Key Documents Required |

|---|---|

| Corporate Structure | Articles of Incorporation, Bylaws, Operating Agreements, Minute Books, Organizational Charts |

| Ownership | Shareholder List (Cap Table), Stock Certificates, Option/Warrant Agreements, Voting Trusts |

| Regulatory | Business Licenses, Building Permits, Environmental Audits, EPA Correspondence, Industry Certifications |

| Intellectual Property | Patents, Trademarks, Copyrights, Domain Names, IP Licensing/Assignment Agreements |

| Legal/Litigation | Pending/Threatened Litigation Schedules, Settlement Agreements, Injunctions, UCC Filings |

| Material Contracts | Customer/Supplier Agreements, Joint Venture Documents, Loan/Credit Agreements, Real Estate Leases |

Organizing Operations and Personnel Data

Once your financial and legal records are in order, it’s time to turn your attention to operations and personnel data. This step is crucial for ensuring a seamless transition. Potential buyers want to understand how your business operates daily and whether it can continue to run smoothly after you step away. This operational overview builds on the groundwork laid by your financial and legal due diligence, offering buyers a complete picture. Well-organized operational and personnel records can highlight dependencies on key individuals, uncover supply chain vulnerabilities, and show whether critical processes are properly documented - or if they only exist in someone’s head. Missing or incomplete data in these areas can raise alarms and potentially derail negotiations.

"Operational excellence (OpEx) is the new king of the hill."

– James Thompson, Business Partner, Concentric Global

To simplify, organize your operational data into three main areas: vendor relationships and supply chain processes, staff structure and transition plans, and technology systems. This is no small task, but it’s worth noting that up to 70% of value creation in private equity stems from operational improvements after a deal closes, while integration challenges account for 47% of failed deals.

Operations and Vendor Relationships

Start by documenting your entire supply chain. Create a detailed list of your top 25 suppliers across manufacturing, logistics, and distribution. Include copies of key contracts and make sure to flag any change-of-control clauses that require vendor consent before ownership can transfer. A supply chain map is also essential - it should clearly show how products or services move from procurement to delivery. Include details about your procurement processes, leverage in vendor negotiations, and contingency plans for disruptions.

Don’t stop there. Buyers often want to see additional data, like top customer revenue figures, key contract terms, and strategies for replacing lost revenue. They may also request production capacity figures, process flow diagrams, throughput analysis, and asset utilization metrics to gauge operational efficiency. Once you’ve tackled vendor relationships, shift your focus to staff structure and transition planning.

Staff Structure and Transition Planning

A clear organizational chart is key. It should outline reporting lines and spans of control across all departments. Pair this with resumes of key personnel and detailed job descriptions for critical roles. Buyers need to assess whether the business relies too heavily on the owner or a small group of employees.

"The less you're personally involved in every critical element of the business, the more confident buyers will feel about a smooth transition."

– Ori Eldarov, Author

Provide a full employee roster that includes roles, compensation, bonus history, and tenure. Additionally, document all relevant employment agreements, such as non-compete and non-solicitation clauses, to protect proprietary information after the sale. If the business is highly dependent on you as the owner, demonstrate how your management team handles strategic decisions independently. Creating Standard Operating Procedures (SOPs) and work instructions can help capture undocumented processes that are critical to daily operations. Tools like competency trackers or passports can also be useful for mapping out key skills within your team. Conduct a bench strength analysis to identify potential gaps and implement succession plans to address them.

Technology and IT Systems

Buyers will expect a complete inventory of your technology stack - the software and systems that power your daily operations. Organize IT assets into categories like proprietary systems, supported platforms, and back-office tools. Include system architecture diagrams, IT maintenance records, and a list of hardware assets.

Cybersecurity is another major focus. Document your data protection policies and include penetration test reports or audit findings to demonstrate system security. If proprietary software is part of your business, be sure to include ownership documentation, intellectual property licenses, and work-for-hire agreements.

To make the transition smoother, prepare concise system guides and a contact list for vendors and IT support providers. This ensures the buyer can maintain these relationships from day one. For software or tech-enabled businesses, you’ll also need detailed revenue data for each product, development roadmaps for the next two years, and information on any open-source components used in your proprietary software. Comprehensive operational and IT documentation not only complements your financial and legal disclosures but also builds buyer confidence in the business’s long-term viability.

Managing Common Risk Areas in LMM Deals

Lower Middle Market businesses often face predictable risks that, if not tackled early, can derail potential deals. The three most common areas of concern are customer concentration, working capital levels, and contingent liabilities. Buyers tend to scrutinize these aspects thoroughly, so addressing them in advance can make a significant difference. Michael L. Vaccarella, Partner at Wipfli Advisory LLC, emphasizes:

"Matching your operational story of growth with your financial statements is crucial. If you are able to track your backlog and pipeline with accuracy and predictability, you can drive both value and speed of deal closing."

By organizing your financial, legal, and operational records and proactively managing these risks, you can instill greater confidence in potential buyers.

Customer Concentration and Revenue Patterns

Relying too heavily on a small number of customers is a red flag for buyers. Start by reviewing your sales data to see how much of your revenue comes from your top three to five clients. If a single customer accounts for a large portion of your revenue, expect buyers to dig deeper. They’ll want to examine retention rates, contract terms, and whether these relationships can be transferred post-sale.

To address these concerns, include a revenue bridge analysis that explains shifts in revenue due to changes in customer mix, pricing, or service offerings. Break down margins by customer, region, and product line to showcase your most profitable streams. Highlight long-term contracts or strong sales backlogs, as these can demonstrate stability and reduce buyer concerns. Conducting "voice-of-customer" research can also provide valuable feedback to showcase the strength of key relationships. If a critical contract is nearing expiration, outline your plan for renewal or diversification to mitigate risks.

Inventory and Receivables Documentation

Net working capital (NWC) is another key area buyers scrutinize. They expect current assets - like accounts receivable and inventory - to be at normal levels at the time of closing. Any shortfall here could lead to a dollar-for-dollar reduction in the purchase price. To prepare, calculate the 12-month average NWC to establish a baseline. Document your inventory valuation method (such as FIFO, LIFO, or weighted average) and include turnover rates to demonstrate that your inventory is current and saleable.

For accounts receivable, create an aging schedule that categorizes outstanding invoices by time periods (e.g., 30, 60, or 90+ days overdue). If more than 10% of accounts receivable are over 90 days past due, buyers may see this as a sign of collection issues or unresolved customer disputes, which could lead to contingent liabilities. Cross-check receivables with customer contracts and delivery confirmations, and be ready to share your collection policies and historical write-off rates.

Contingent Liabilities and Related-Party Deals

Undisclosed liabilities can jeopardize deals or lead to major price adjustments. Buyers will comb through your financial statements and tax returns (usually covering the past five years) to identify potential red flags like pending lawsuits, warranty obligations, government investigations, or unrecorded debts such as unpaid employee benefits. To stay ahead of this, create a detailed disclosure schedule that lists all potential claims, guarantees, or obligations - even those you think are unlikely to materialize.

Related-party transactions also require careful attention. Document all dealings involving the company and its owners, family members, or affiliated entities. This includes owner withdrawals, shareholder loans, real estate leases, and management fees. Since these transactions often appear as "addbacks" to EBITDA, buyers will verify them using payroll records, W-2s, and tax filings. Obtain tax transcripts directly from the IRS to ensure your reported liabilities align with your actual filings. If you have commercial leases tied to related parties, check for assignment clauses, as many require landlord approval to remain valid after a change in ownership.

| Risk Area | What Buyers Look For | Your Proactive Action |

|---|---|---|

| Customer Concentration | Revenue dependency on top 3–5 clients; contract transferability | Include a revenue bridge analysis and retention details |

| Working Capital | Normal NWC baseline; receivables aging; inventory turnover | Calculate a 12-month average NWC and document valuation methods |

| Contingent Liabilities | Pending claims, warranties, and unrecorded debts | Create a detailed disclosure schedule |

| Related-Party Deals | Owner withdrawals, affiliated leases, shareholder loans | Document all transactions with supporting tax records |

Working with Professional Advisors

Once you've organized your financial, legal, and operational records, it's time to involve professional advisors. These experts are crucial for ensuring a smooth transaction process. Bringing financial and legal advisors on board early allows you to address potential issues privately, rather than giving buyers leverage to lower your valuation or back out entirely. According to McLane Law Firm, conducting pre-transaction due diligence can boost your business valuation by an additional 0.5x to 1x EBITDA multiple. This step aligns seamlessly with your earlier internal preparations.

Financial and Legal Counsel

Start by hiring accountants to prepare a Quality of Earnings (QoE) report. This report validates your EBITDA calculations and confirms whether your earnings are sustainable. Your accountants should also adjust your financials to reflect actual profitability, removing any one-time expenses. These adjustments need to be well-documented and defensible.

While financial records form the backbone of your preparations, legal advisors play an equally critical role. Your attorney should focus on cleaning up your capitalization table, verifying corporate records, and ensuring that all major events - such as mergers, equity issuances, or ownership changes - are properly documented. If your business is structured as an S-Corporation or employs remote workers across state lines, tax specialists can confirm compliance with state and local tax filings. Overlooking these filings or income nexus issues could lead to unexpected liabilities that jeopardize the deal.

Third-Party Assessments

Buyers often request specialized reports to evaluate non-financial risks. Depending on your industry, these could include environmental studies, IT infrastructure audits, cybersecurity assessments, or equipment appraisals. For instance, if your business relies on proprietary software or patents, legal advisors should confirm that your intellectual property is free of third-party or open-source license risks. Similarly, if you handle sensitive customer data, a cybersecurity audit can assure buyers that your systems meet industry standards and mitigate concerns about potential data breaches.

These assessments reassure buyers that no hidden issues exist. With global sanctions increasing by 50% in 2023, regulatory and compliance due diligence has become more important than ever. Addressing these matters early demonstrates your commitment to transparency and helps avoid last-minute surprises.

Managing Communication with Buyers

Once your advisory team is in place, streamline communication with buyers. When questions arise, ensure your responses are organized and consistent. Designate a single point of contact - such as your CFO, General Counsel, or an external M&A advisor - to handle all communication with the buyer's team. This person should manage your Virtual Data Room (VDR), track document reviews, and ensure timely, accurate responses to buyer inquiries. Many professional M&A firms gather approximately 75–80% of the documents buyers will request before engaging with a specific buyer, significantly reducing the time between the Letter of Intent (LOI) and closing.

Set clear communication protocols from the start. Decide which discussions will take place in person versus virtually, who will schedule meetings, and where information will be stored. For highly sensitive data - such as detailed customer pricing or proprietary product details - consider using clean teams. These teams operate under strict protocols to prevent regulatory issues or competitive leaks while still providing buyers with the necessary information. As Steven Pappas, Partner and M&A Advisor at Touchstone Advisors, aptly notes:

"Only bad things happen between LOI and closing".

Your advisors' expertise is essential for minimizing risks and keeping the deal on track.

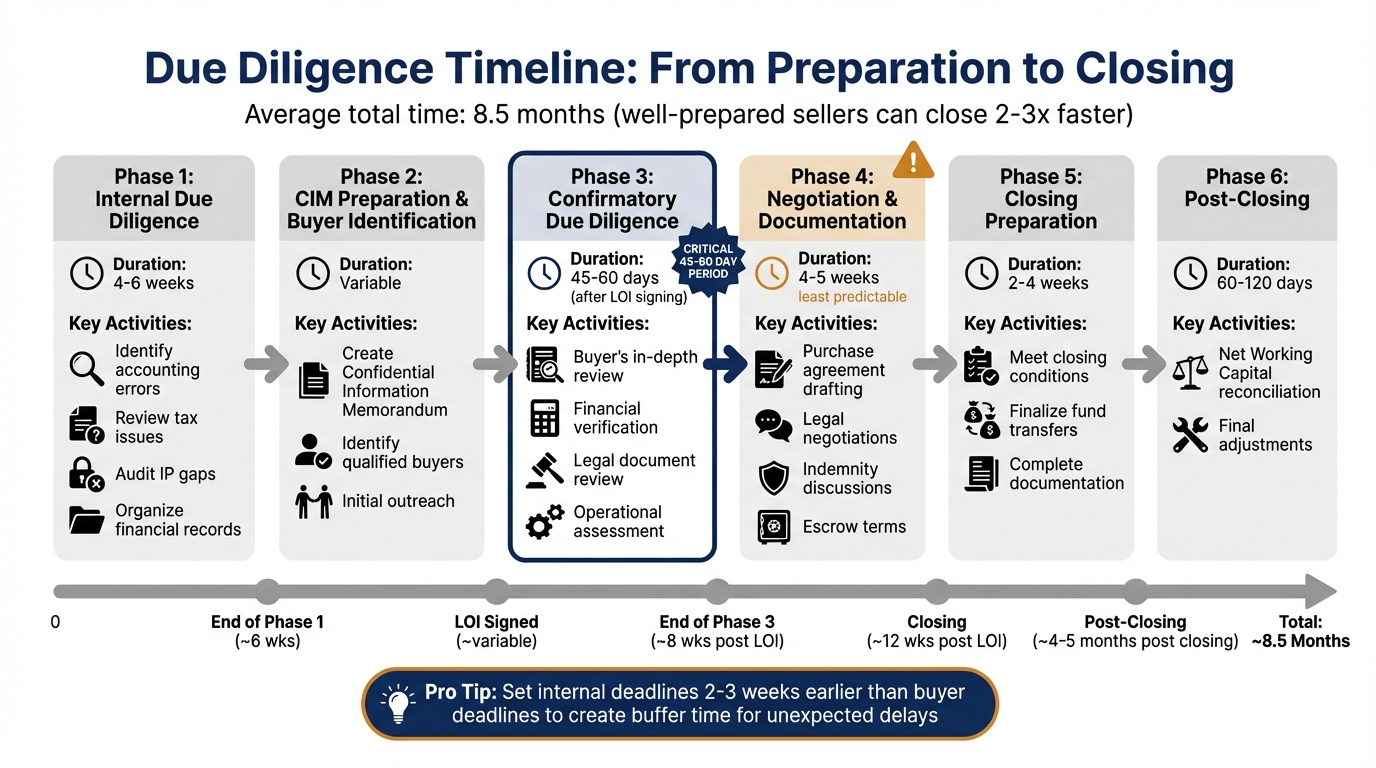

Creating a Due Diligence Timeline

Due Diligence Timeline for Lower Middle Market Companies

A well-structured timeline is essential for keeping your deal on track. On average, a lower middle market sale takes about 8.5 months to complete. However, sellers who are well-prepared can close the deal 2–3 times faster than those who scramble to organize documents at the last minute. Your timeline should outline every phase of the process - from initial preparation to final closing - while setting clear deadlines for each deliverable. This approach aligns seamlessly with your financial, legal, and operational planning.

Building a Master Schedule

Divide the process into distinct phases, each with its own timeframe. Internal due diligence typically takes 4–6 weeks and focuses on identifying accounting errors, tax issues, or gaps in intellectual property. Once your Confidential Information Memorandum (CIM) is ready and qualified buyers are identified, confirmatory due diligence begins after signing a Letter of Intent (LOI) with exclusivity. This phase involves buyers conducting in-depth reviews of your records.

Set clear milestones with specific deadlines. The negotiation and documentation phase usually lasts 4–5 weeks, but it can be unpredictable. As Ryan Kuhn, Founder of Kuhn Capital, explains:

"Stage 5's [Negotiation] length is the least predictable: Its progress relies on lawyers who are compensated for their time, not by closing."

Additionally, plan for a 2–4 week gap between signing the definitive sale agreement and the actual transfer of funds at closing. This time is needed to meet closing conditions and finalize fund transfers.

Assigning Tasks and Accountability

Once milestones are established, assigning clear responsibilities ensures the timeline stays on track. Use a Master Due Diligence (MDD) List - a centralized document that tracks all outstanding requests, questions, and their current status. This single source of truth eliminates confusion caused by duplicate versions and keeps everyone aligned. Kick off the process with a formal meeting involving key stakeholders, including internal staff, partners, and external advisors like lawyers and accountants. During this meeting, review the MDD list and data room procedures.

Assign tasks using a Role & Responsibility Matrix. Direct specific questions to the appropriate departments: HR for personnel data, Finance for profit and loss statements, and legal counsel for corporate records. For highly specialized areas, such as intellectual property or IT infrastructure, bring in external experts to provide quick, authoritative answers. As Morgan & Westfield emphasizes:

"It's absolutely essential that the parties understand how to use the MDD Checklist and that they use it on a regular basis to ensure the process is organized and that all outstanding requests are kept up to date."

Schedule weekly check-ins to monitor progress and maintain momentum. As documents become available, update their status on the MDD List.

Planning for Delays

Even the most carefully planned timelines can face unexpected hurdles. Identify critical tasks that might cause delays - like third-party audits, environmental studies, or regulatory filings - and implement a two-deadline strategy. Set internal deadlines 2–3 weeks earlier than those shared with the buyer, creating a buffer to stay ahead of schedule. As DealRoom notes:

"The best-laid due diligence plans go to waste but that doesn't mean you shouldn't make them."

If delays arise, pivot to other workstreams to keep the process moving. For instance, if financial documents are delayed, shift focus to operational site visits or IT infrastructure reviews. Build additional buffer time into the Purchase Agreement negotiation phase, as this stage often involves complex legal discussions, indemnity disputes, and escrow terms that can unexpectedly extend timelines.

After closing, prepare for a Net Working Capital reconciliation period of 60–120 days. This accounts for timing differences in receivables and inventory that couldn’t be finalized by the closing date. By addressing potential delays upfront, you can keep your deal on track and prevent minor setbacks from escalating into major issues.

Building Trust Through Disclosure

Being upfront is one of the most powerful tools you can use during negotiations. Buyers anticipate potential issues, but what they don’t expect is stumbling upon them at the last minute. Take the case of Kent Systems, acquired by Lex Corp. for $5 million in March 2023. The seller disclosed $200,000 in overdue taxes just one day before closing. This late revelation gave Lex Corp. significant leverage - they could demand a price cut of $200,000 or more, or even threaten to walk away from the deal entirely. To avoid situations like this, it’s better to disclose problems early. By doing so, you maintain control over the negotiation and lay the groundwork for a detailed disclosure schedule.

Creating a Disclosure Schedule

A well-prepared disclosure schedule builds on your organized records and demonstrates the transparency buyers need to trust you. This document should cover:

- Financial discrepancies: Highlight any deviations from Generally Accepted Accounting Principles (GAAP), unusual EBITDA adjustments, or one-off expenses.

- Tax issues: Include liabilities like State and Local Tax (SALT) exposure if you’ve operated in areas where you haven’t registered.

- Legal matters: List pending or resolved lawsuits, unsatisfied judgments, and any government investigations.

- Contracts: Identify material agreements with change-of-control clauses or major contracts nearing expiration.

- Intellectual property: Disclose liens, gaps in patent clearance, or missing “work for hire” agreements.

- HR concerns: Address labor disputes, union agreements, worker’s compensation claims, and any past wrongful termination or harassment cases.

- Environmental compliance: Detail hazardous substances, disposal methods, and any communication with regulators like the EPA.

For unresolved tax issues, consider entering a Voluntary Disclosure Agreement (VDA) with the relevant states to settle unpaid taxes while minimizing penalties. Work with your accountant to adjust financials, clearly explaining discretionary earnings and unusual add-backs to the buyer’s team.

As attorneys J. Gerard Legagneur and Amanda Hayes explain:

"Providing a complete and clear answer can minimize subsequent requests. It'll also reduce any leverage that the buyer would otherwise gain if a potential liability were to be revealed later in the negotiating process".

Explaining Financial or Operational Issues

When addressing financial or operational challenges, rely on documented reports and adjusted EBITDA to tell the full story. A sell-side Quality of Earnings (QoE) report can validate your earnings and explain one-time items. Michael L. Vaccarella, Partner at Wipfli Advisory LLC, emphasizes:

"A proper sell-side QOE report will properly vet and prepare your earnings presentation and speed up the buyer's diligence".

Use Adjusted EBITDA to normalize financial statements. Include documented add-backs for owner perks and one-time expenses to showcase the business’s true earning potential. Supplemental analysis in your QoE report can also help clarify non-recurring events or contextualize revenue shifts.

Operational weaknesses can be addressed by formalizing informal processes. Document operational knowledge through Standard Operating Procedures (SOPs) and work instructions before the sale. For inventory or receivables fluctuations, use a Net Working Capital true-up mechanism, which adjusts the purchase price based on actual assets delivered at closing. This ensures fairness and reduces uncertainty tied to timing differences.

Once all issues are clearly documented, streamline the communication process to keep things running smoothly.

Designating a Single Point of Contact

Assign a single point of contact (SPOC), such as your CFO, COO, or General Counsel, to oversee all communication with the buyer. This person will manage the flow of information between the buyer, your internal teams, and any external advisors. As Legagneur and Hayes point out:

"Designating a specific contact person will allow for the due diligence process to be better organized, more efficient, and less frustrating for all parties involved".

The SPOC should use a master tracking system to centralize buyer requests and avoid duplicate submissions. They can also negotiate unreasonable demands early on. For example, if the buyer asks for thousands of individual NDAs, the SPOC could offer a standard template or a representative sample instead. This structured approach helps prevent deal fatigue and keeps the transaction on track.

Conclusion

Due diligence doesn't have to derail your deal. Smart businesses get ahead by preparing early, staying organized, and fostering clear communication. Steps like aligning your financial statements with GAAP, creating a detailed digital data room, and completing a sell-side Quality of Earnings report before entering the market can make a big difference. These actions help position your company as a trustworthy, low-risk acquisition target, which can directly impact valuation - potentially increasing EBITDA multiples by 0.5x to 1x.

Beyond preparation, timing is everything. The typical due diligence phase for Lower Middle Market deals lasts 45 to 60 days, and dragging it out increases the risk of deal fatigue. Barbara Taylor, Co-founder of Allan Taylor & Co., emphasizes this point:

"The faster you can get through due diligence, the more likely it is that you'll get to the closing table".

Keeping the process moving smoothly requires both speed and consistency. Even if your accounting isn't flawless, predictable reporting builds far more trust with buyers than inconsistent numbers.

Transparency plays a key role in separating successful deals from those that fall apart due to last-minute price cuts or cancellations. Address potential trouble spots - like State and Local Tax compliance, cybersecurity risks, and Net Working Capital calculations - before buyers uncover them. Finally, streamline communication by designating a single point of contact to handle all inquiries efficiently.

FAQs

What financial documents are essential to prepare for due diligence?

To make the due diligence process as seamless as possible, it's crucial to have all your key financial documents in order. Start with detailed financial statements, including income statements, balance sheets, and cash flow statements, covering the past 3–5 years. Don't forget to include tax returns and bank statements for the same period.

You'll also want to gather and organize records for accounts receivable, accounts payable, and any out-of-the-ordinary or one-time expenses. Keeping these records well-organized and easily accessible not only simplifies the review process but also helps establish credibility with potential buyers.

How can I address customer concentration risks during due diligence?

Managing customer concentration risks during due diligence involves taking a close look at how much of the company’s revenue comes from its key customers. Relying too heavily on one or a handful of clients can be risky - if those relationships change, the business could face serious challenges. Start by examining historical revenue data to get a sense of how stable and diversified the customer base is. This can help pinpoint any areas of vulnerability.

Another critical step is reviewing contracts with major customers. Look for clauses like exclusivity agreements or long-term commitments that might limit flexibility. It’s also a good idea to talk with management and key team members to better understand the company’s dependency on certain clients and its ability to bring in new business if needed. Addressing these risks early allows you to negotiate protections, such as diversifying revenue streams or adding safeguards, to help secure the deal’s future stability.

What is the role of professional advisors in the due diligence process for lower middle market companies?

Professional advisors play a crucial role in the due diligence process, especially for lower middle market companies. They guide business owners in organizing and reviewing critical documents like financial records, legal agreements, and operational data. This ensures everything is accurate and prepared for buyer evaluation. Their expertise can also identify potential issues that might affect the company’s valuation, giving owners the chance to address them ahead of time.

Beyond identifying concerns, advisors help streamline the entire process. They manage due diligence efficiently and assist in creating essential materials, such as Confidential Information Memoranda (CIM). Their insights into financial, legal, and operational aspects not only minimize risks but also make the business more attractive to potential buyers. By working with professional advisors, business owners can navigate the complexities of due diligence with greater confidence, improving their chances of a successful transaction.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)