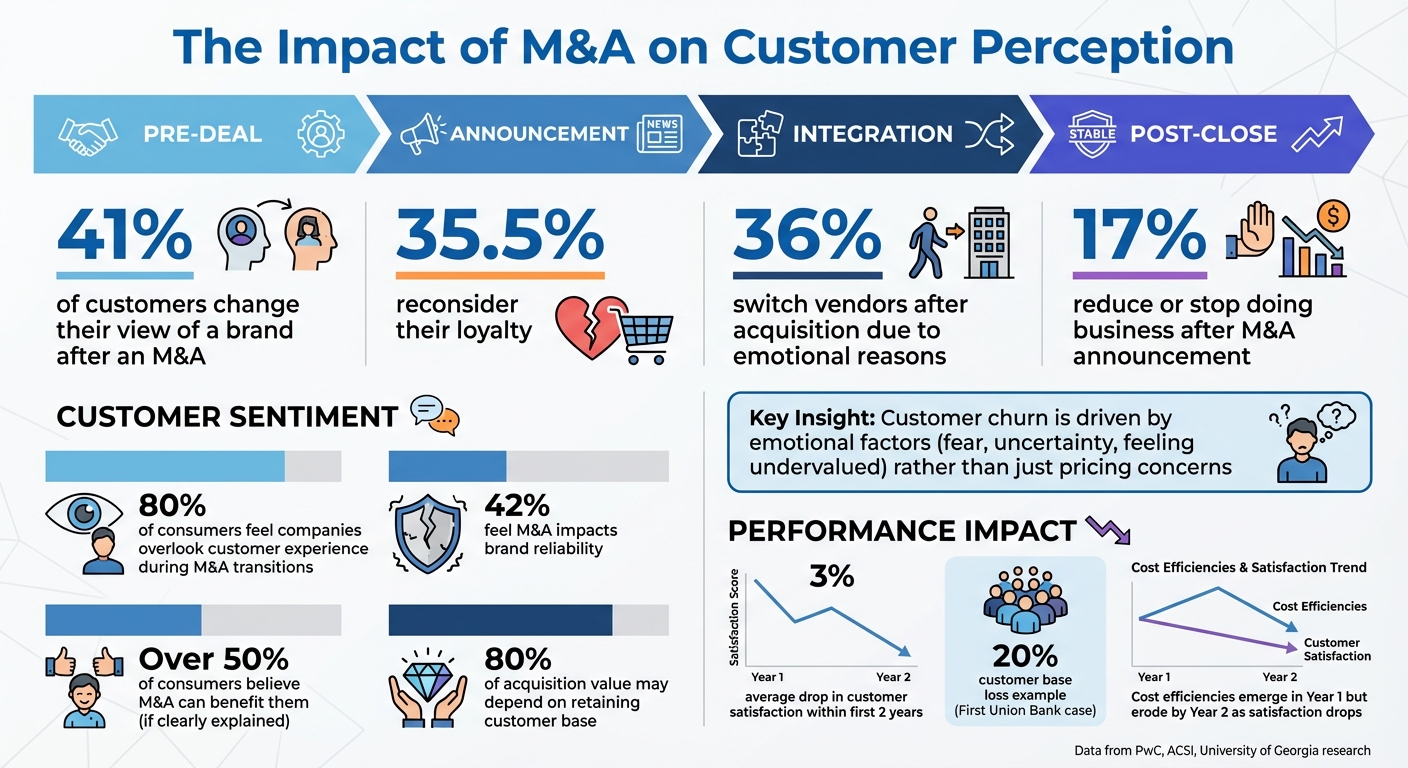

When companies merge or acquire others, customer perception can shift dramatically - and not always for the better. Studies show that 41% of customers change their view of a brand after an M&A, and 35.5% reconsider their loyalty. Why? Uncertainty about pricing, service quality, and product continuity often leads to frustration and churn.

The key to success? Managing customer trust at every stage of the M&A process. This means:

- Pre-Deal: Identify at-risk customers, conduct sentiment analysis, and create targeted communication strategies.

- Announcement Phase: Use consistent messaging, address concerns directly, and prioritize personal outreach for key accounts.

- Integration: Maintain service quality, offer retention incentives, and monitor customer feedback in real time.

- Post-Close: Track satisfaction metrics like NPS and churn, test rebranding carefully, and focus on long-term relationship-building.

Neglecting customer perception can erode the very value an acquisition aims to create. By prioritizing clear communication, proactive engagement, and consistent service, companies can retain customers, protect revenue, and build loyalty - even during uncertain transitions.

Customer Perception Statistics in M&A Transactions

Using Customer Insights to Guide M&A Add-On Strategies - A Micro-Session

Pre-Deal Preparation: Setting Up for Customer Retention

Before making a public announcement, it's essential to safeguard customer relationships by identifying customers who may be at risk and addressing their concerns early. Research highlights that 36% of customers switch vendors after an acquisition due to emotional reasons, such as uncertainty or feeling undervalued.

When companies focus only on financial synergies during pre-deal planning and neglect the customer experience, they risk jeopardizing long-term success. Data from the American Customer Satisfaction Index shows that while merged companies often achieve cost efficiencies in the first year, these benefits tend to erode by the second year as customer satisfaction drops and churn increases. The takeaway? Incorporating customer retention strategies into your M&A plan from the outset - alongside financial and operational priorities - can significantly reduce churn and revenue loss. Laying this groundwork also paves the way for effective sentiment analysis and customer segmentation.

Conducting Customer Sentiment Analysis

Gather insights into customer sentiment through surveys, Net Promoter Score (NPS) queries, focus groups, and behavioral data like churn rates, complaint trends, and support interactions.

For U.S. middle-market deals, it's a good idea to establish a baseline NPS and satisfaction score 60–90 days before the announcement and refresh these metrics every 30 days for at-risk segments. This helps gauge whether rumors or leaks are already impacting customer perceptions. Direct customer calls can be particularly effective for collecting NPS data and candid feedback before public announcements, which might introduce bias. Additionally, forming small advisory councils of key customers under NDA can provide early feedback on messaging and serve as an early warning system.

Pay close attention to red flags in your metrics. For example, a declining NPS - particularly if it falls below zero or drops more than 10 points in a quarter - indicates a vulnerable customer base. Similarly, a surge in complaints or negative feedback about reliability, pricing, or support suggests that your merger narrative and retention efforts need reinforcement. A cautionary tale: one U.S. bank saw its NPS plummet from +11.5 to zero after a merger because customer concerns were ignored during the planning phase.

Mapping Key Customer Segments

Segment your customer base into three tiers based on economic value, relationship strength, and strategic importance.

- Tier 1: These are your most valuable customers. They require personalized outreach and tailored transition plans.

- Tier 2: These accounts benefit from structured contact by account managers and carefully targeted messaging.

- Tier 3: These customers can be reached through scalable, automated communications.

In smaller transactions, like those handled by Clearly Acquired, segmentation may focus more on relationship depth - such as how closely customers are tied to the founder - or their influence in the local market, rather than formal NPS data. Regardless of the approach, the principle remains the same: prioritize the customers who drive the majority of your revenue and reputation. For smaller deals, pre-close introductions between the buyer and key customers, joint meetings led by the seller, and clear reassurances about continuity can often be more impactful than complex analytics.

Once you've identified your key segments, the next step is to develop a clear and targeted communication plan.

Creating a Customer Communication Plan

A solid communication plan outlines the key messages, timing, and communication channels, as well as who will deliver the messages. It should address:

- Target audiences

- Core messages (what’s changing and what’s staying the same)

- Channels for communication

- Timing for outreach

- Appropriate representatives (executives, account managers, or frontline staff)

- Feedback mechanisms to monitor customer responses

Ownership of the plan should be shared by a cross-functional team. Corporate communications and marketing teams can craft messages and manage mass communication channels. Sales and customer success teams can handle direct outreach, while operations and support teams can prepare service updates. Senior executives should take the lead in conversations with top-tier customers. Additionally, an escalation process for handling customer complaints should be in place before the deal closes, allowing any issues to be addressed promptly.

Your messaging should focus on "what’s in it for the customer" rather than internal goals like shareholder value or cost synergies. Translate internal objectives into customer benefits, such as a broader product range, extended support hours, increased locations, or stronger financial backing. Clearly communicate what will remain unchanged in the short term - such as contracts, pricing, and key contacts. Avoid making promises about upgrades or new capabilities unless your integration plan and budget fully support them. Finally, test your draft messages with a small group of customers to ensure they are credible and address the most pressing concerns.

Managing Customer Perception During the Announcement

The announcement of a merger or acquisition (M&A) is often when customer anxiety hits its peak. A study by PwC found that 80% of consumers feel companies overlook customer experience during M&A transitions. Even more concerning, 17% of customers may reduce or stop doing business with a company after such an announcement. How you handle this moment can make or break customer trust, influencing whether they stick with you or start exploring other options.

At the heart of customer churn are emotional triggers - fear, uncertainty, and feeling undervalued - rather than just concerns over pricing. Crafting a clear, unified announcement strategy is crucial to maintaining customer confidence and preventing unnecessary fallout.

Creating Consistent Messaging

Consistency in messaging is your strongest tool to combat misinformation and customer uncertainty. Whether it's a press release, a website update, an email, or a social media post, every channel must tell the same story. Mixed messages create confusion, and customers often fill in the blanks with their worst fears.

Focus your messaging on practical customer benefits: expanded product choices, longer support hours, or improved service reliability. Avoid drowning your audience in financial jargon. PwC research shows that over half of consumers believe M&A can benefit them - if companies clearly explain what’s in it for them. Address customer concerns head-on and back your promises with a solid integration plan to avoid sounding vague or unprepared.

Common fears, like losing access to existing contracts, warranties, or loyalty programs, should be addressed directly. Customers want to know that their rewards points, account statuses, and service-level agreements will remain intact.

Timing and Coordinating Announcements

Once your messaging is aligned, timing becomes the next critical step. A well-coordinated rollout ensures that customers hear the same message simultaneously across all platforms. Update your website and FAQ page the moment the announcement goes live, and make sure your language is consistent across social media, investor briefings, and analyst calls. Conflicting or delayed updates only fuel uncertainty.

For key accounts, take a more personal approach. Arrange same-day briefings with relationship managers or senior leaders so that high-value customers hear the news directly from someone they trust. This personal outreach not only reinforces the relationship but also gives customers a chance to ask questions and voice concerns right away.

Prepare for the operational demands that come with the announcement. Expect a surge in customer inquiries and ensure your support teams - whether in call centers, branches, or online - are fully staffed and briefed. Provide them with a centralized FAQ and designate specific spokespersons to quickly address any misinformation.

Using Internal Customer Advocates

In addition to consistent and well-timed announcements, rely on internal customer advocates to deliver your message. These are the employees who interact with customers daily and have already built trust with them. Their personal touch can provide the reassurance that mass communications often lack.

Identify these advocates early and involve them in shaping your messaging. Their insights into customer concerns can help you craft communications that address the most pressing issues. Research shows that companies with strong marketing and sales representation at the leadership level are better equipped to maintain customer satisfaction during M&A transitions.

Equip these advocates with the right tools: detailed outreach plans for key accounts, scripts for addressing common questions, and clear escalation protocols for handling serious concerns. Training them ahead of the announcement is essential. Take a page from the Sisense-Periscope merger, where leadership invested significant time preparing employees on topics like company culture, product roadmaps, and customer communication.

Finally, encourage two-way communication. Advocates should not only deliver information but also actively gather feedback and questions from customers. Sharing this feedback with your integration and communications teams in real time allows you to adjust your messaging quickly and address emerging concerns. When customers feel heard, they’re more likely to give the newly merged company a chance rather than looking for alternatives.

Integration Phase: Maintaining Customer Trust

After closing a deal, it's essential to maintain customer trust by ensuring service levels remain consistent. For the first 90–180 days, lock in core elements of the customer experience - such as response times, pricing, and service agreements - to minimize uncertainty and build confidence.

Assemble an integration team with members from sales, support, product, and operations. Their job? Map out every potential customer-facing change and identify risks. Adopt a "no-surprises" rule, requiring clear communication - like messaging and FAQs - whenever changes to billing, contracts, or support arise. Create an escalation playbook for handling at-risk accounts, including immediate actions like an executive callback within 24 hours. This proactive approach ensures your team can address concerns quickly, laying the groundwork for retention strategies, real-time feedback monitoring, and focused support.

Retention Programs and Customer Incentives

Once operations stabilize, retention programs are key to strengthening customer loyalty. These programs should deliver tangible value. For example, guarantee existing pricing and terms for 12–24 months, or provide at least 90 days' notice before introducing changes. This strategy helps prevent customers from adopting a "wait-and-see" mindset, which often leads to churn. Another effective move? Automatically match or upgrade loyalty tiers, like reassuring a customer, "Your gold status continues with enhanced benefits for the next year." This builds confidence, especially among frequent users.

You can also introduce retention bundles, such as offering a 10–20% discount on bundled services for 12 months. Pair these with service guarantees, like credits for downtime or promised response times. Present these initiatives as enhancements to the customer experience, not as reactive solutions. For customers showing early signs of disengagement, tailor specific offers - temporary discounts, premium support, or personalized onboarding assistance can make a big difference. Keep in mind that up to 80% of an acquisition's value may depend on retaining the customer base, so allocate budget accordingly.

Monitoring Customer Feedback in Real Time

Catching problems early is critical. Use multi-channel monitoring to track customer sentiment and feedback. Pay attention to U.S. social platforms, in-app surveys, and email surveys to gather quick NPS (Net Promoter Score) or CSAT (Customer Satisfaction) feedback, especially during sensitive periods like billing transitions or product migrations.

Leverage call center and ticket analytics to identify recurring issues, such as billing errors or login problems. Tools like topic tagging and sentiment analysis can pinpoint trends, while tracking repeat contacts highlights areas needing improvement. Set clear real-time triggers, such as sudden drops in NPS or CSAT scores, a spike in cancellation requests, or concerns raised by key accounts. For each trigger, assign an owner, define a rapid response timeline, and outline mitigation steps like 24-hour follow-ups, temporary credits, or expedited fixes.

Providing Dedicated Transition Support

Smooth transitions require a strong support system. Launch a Transition Support Desk that customers can reach by phone, email, or chat. Staff it with cross-trained agents who are familiar with both legacy and new systems, and ensure availability during U.S.-friendly hours and holidays.

For key accounts, assign dedicated managers to handle communications, escalations, and roadmap discussions. Meanwhile, technical teams should oversee data migration and system integration, with clear rollback plans in place. Create centralized knowledge bases and FAQ hubs to keep customers informed. Use plain language to explain what’s changing, what’s staying the same, and key dates - updating this information regularly.

Coordinate responsibilities across teams: let sales provide reassurance, customer success focus on adoption and value delivery, support handle incident resolution, and product or IT teams manage technical changes and timelines. All efforts should flow through your Integration Management Office to keep operations aligned and ensure a seamless experience for customers.

sbb-itb-a3ef7c1

Post-Close: Measuring and Improving Customer Perception

When the deal closes, the real work begins. The integration phase, typically spanning 6–24 months, is a critical period that determines whether customers stick around or start exploring other options. A study from the University of Georgia, which analyzed over 2,000 mergers, found that while cost efficiencies often emerge in the first year, those benefits tend to fade by year two as customer satisfaction declines. Companies that experienced sharp drops in customer satisfaction also saw significant long-term losses in profit and market value, often negating the initial gains. To avoid this, it’s essential to actively monitor and enhance how customers perceive the combined business. Below, we’ll cover how to track key metrics, test rebranding strategies, and build enduring customer relationships.

Tracking Key Performance Indicators

The first step is to establish a clear set of KPIs that reflect customer sentiment and behavior. Customer churn rate is a critical indicator - track the percentage of customers who cancel or reduce spending on a monthly or quarterly basis, and compare these figures to the 6–12 months before the merger. For example, First Union Bank lost 20% of its customer base in the year following its acquisition of CoreStates Financial due to poor customer experience and integration issues. Keeping a close eye on churn can help you avoid similar pitfalls.

In addition to churn, measure Net Promoter Score (NPS) and Customer Satisfaction (CSAT) at key intervals - 30, 90, and 180 days post-close. Conduct structured surveys to assess how likely customers are to recommend your business and their satisfaction with the transition, service, and new offerings. According to data from the American Customer Satisfaction Index (ACSI), acquiring companies often see a 3% drop in customer satisfaction within the first two years of a merger.

Also, monitor metrics like repeat purchase rate, contract renewals, and average revenue per account (ARPA) to gauge whether customer trust is holding steady or eroding. Pay close attention to complaint volume and resolution time, especially for issues related to billing, service access, and outages, which often spike during integration. Compare these metrics to pre-deal baselines, and segment the data by customer type - enterprise vs. SMB or legacy Brand A vs. Brand B - to pinpoint areas needing immediate attention.

Once these performance indicators are in place, you’ll be better equipped to refine your rebranding strategies.

Testing and Refining Rebranding Efforts

Rebranding after a merger can be a delicate process, and rushing it without testing can backfire. Before rolling out new logos, names, or messaging across your entire customer base, conduct A/B testing on high-traffic digital assets like your homepage, landing pages, and email headers. Experiment with variations in logo size, co-branding (e.g., "OldCo, now part of NewCo"), and color schemes. Measure click-through rates, time spent on the page, and conversion rates to identify what resonates most with customers.

It’s also important to test taglines and messaging. Compare versions that highlight customer benefits - like improved service, enhanced features, or greater stability - against more corporate-focused language such as "market leadership" or "shareholder value." Research shows that customers are more interested in how a merger benefits them personally rather than the company as a whole. Metrics like open rates, click-through rates, and unsubscribe rates can serve as proxies for how well your messaging is landing. A study on M&A and consumer behavior found that 41% of respondents said the merger influenced their perception of the brand, and 42% felt it impacted the brand’s reliability.

For legacy customers of Brand A and Brand B, consider running segment-specific tests. If one brand has significantly higher trust levels, forcing a rapid rebrand can lead to customer defection. A phased approach often works best: start with endorsement messaging like "Brand X, now part of Brand Y", then move to co-branding, and only transition fully to the new brand when metrics like NPS, churn, and CSAT show stability or improvement. In cases where a brand has strong emotional equity, it may be worth keeping it as a distinct sub-brand rather than merging it entirely.

Once your rebranding efforts are fine-tuned, you can shift focus to building lasting customer trust.

Building Long-Term Customer Relationships

To maintain strong relationships post-merger, prioritize proactive communication, added value, and continuity of care. For top accounts, schedule executive sponsor calls or visits to reassure customers about continuity and highlight improvements. Establish customer advisory boards (CABs) that include legacy customers from both companies. These boards can help co-create product roadmaps and service standards that reflect the strengths of each entity.

Adopt a "no surprises" approach when it comes to contract and pricing changes. Honor existing terms for a defined period, provide ample notice for adjustments, and position changes as value-driven rather than cost-focused. Offer value-added campaigns, such as bundled products at discounted rates or free upgrades, to showcase the benefits of the merger. For U.S. customers, maintain familiar service hours in local time zones and ensure accessible customer support channels, including phone, chat, and email.

Develop tailored communication plans for different customer segments. High-value enterprise clients might receive quarterly business reviews and monthly updates, while smaller accounts could get a quarterly newsletter. Focus every message on what matters to customers - service reliability, support contacts, product updates, and tangible benefits - rather than internal milestones. Create a centralized online hub or FAQ page for all merger-related updates to prevent confusion caused by inconsistent messaging. Encourage two-way communication by offering surveys, account manager access, or live webinars with Q&A sessions. This reinforces that customer feedback is valued and acted upon.

When changes are made based on customer input, close the loop by sharing what was updated and why. This transparency can turn initial skepticism into long-term loyalty, helping to solidify your customer base after the merger.

Common Mistakes in Customer Perception Management

Even the most carefully planned mergers can falter if companies mishandle customer relationships. Studies reveal that poor communication during mergers and acquisitions (M&A) often leads to significant shifts in customer behavior. The root of these issues typically lies in three mistakes: making lofty promises without evidence, allowing rumors to fill information gaps, and neglecting cultural differences in customer-facing teams. Let’s explore these common pitfalls and strategies to avoid them.

Overpromising Benefits Without Proof

Nothing erodes customer trust faster than making big promises - like lower prices, improved services, or cutting-edge innovations - without a clear plan to deliver. When companies focus on vague terms like "synergies" or "shareholder value" without outlining tangible benefits for customers, expectations skyrocket while service quality often takes a hit during the integration process.

To avoid this, only communicate benefits that are backed by concrete operational plans, budgets, and realistic timelines. Be specific. Instead of saying, "We’ll improve service", say something like, "Your current service levels will remain the same for 12 months", or "By Q4 2026, we’ll add 15 new service locations." Use customer feedback - through surveys, advisory panels, or interviews - to understand what truly matters to your audience before making commitments. Establish internal checks to ensure no executive or team promises changes that aren’t feasible. And when you do make commitments, tie them to measurable outcomes and provide regular updates on progress. Transparent, actionable communication builds trust, helping you retain customers during uncertain times.

Addressing Rumors and Misinformation

When companies fail to proactively communicate during a merger, customers often fill the silence with their own assumptions - and these are rarely positive. Rumors like "prices are going up", "contracts won’t be honored", or "support is moving overseas" can spread like wildfire through social media, review sites, and word-of-mouth, especially if frontline employees don’t have clear answers.

The best defense is a proactive communication strategy. Monitor social media, customer forums, and support tickets to identify and address recurring concerns as they emerge. Equip your teams with FAQ playbooks and escalation protocols so they can dispel misinformation quickly and escalate new issues to the integration team. Provide regular updates via email, in-app messages, website banners, or live webinars to clarify what’s changing, what remains the same, and what protections are in place (e.g., "All current contracts will be honored through their end dates"). Use named leaders, such as your Head of Customer Success, as spokespeople to add a personal touch and credibility to your messaging. When customers see consistent, clear communication from real people, rumors lose their grip.

Aligning Company Cultures in Customer Operations

Cultural differences between merging companies often create the most friction in customer-facing roles. For instance, one company might prioritize personalized service, while the other operates with a more rigid, transactional approach. This mismatch can lead to inconsistent service, conflicting policies, and a general sense of chaos - customers might get different answers from different agents or encounter unexpected hurdles in processes that once felt seamless. Over time, this unpredictability erodes trust, making customers feel undervalued.

To address this, conduct a culture and customer experience diagnostic before the merger is finalized. Look beyond corporate values and focus on how the two companies handle customer interactions, such as escalation practices, service tone, and response times. Define a unified customer experience for the combined organization and make it a key part of your integration plan. Train frontline teams early to ensure they understand and can deliver on the new standards. Align technology and processes - like CRM systems and ticketing platforms - to create a seamless experience for customers. Finally, tie leadership and manager incentives to customer metrics like Net Promoter Score (NPS), churn rates, and complaint resolution, ensuring cultural alignment becomes a measurable priority.

For smaller businesses, platforms like Clearly Acquired can help integrate customer experience into every stage of the M&A process. By avoiding empty promises, addressing misinformation head-on, and uniting teams around shared customer values, you can protect the trust and revenue streams that drive your business forward.

Conclusion

Handling customer perception during mergers and acquisitions can make or break a deal. Studies reveal that companies often experience long-term market value declines when customer dissatisfaction erodes initial efficiency gains. In fact, these gains typically vanish within two years if customer priorities are ignored. Overlooking customer experience during M&A leads to churn and declining satisfaction, which can ultimately undermine the entire value of the transaction.

To navigate this challenge, businesses should focus on three key strategies throughout the M&A lifecycle:

- Integrate customer experience into your M&A strategy from the start. Don’t treat it as an afterthought to financial and legal considerations. Use tools like sentiment analysis, customer segmentation, and communication planning during due diligence to identify customer priorities and concerns before making any public announcements.

- Communicate with clarity, consistency, and empathy. Customers need clear explanations about what will and won’t change - whether it’s pricing, contracts, service levels, or data security. Ensure your messaging is consistent across all channels to avoid confusion or conflicting information.

- Engage continuously with real-time feedback. Monitor metrics like retention rates, NPS, complaint volumes, and service-level adherence on a monthly basis. Use this data to adjust your integration plans when customer feedback signals trouble.

For smaller U.S. businesses without dedicated M&A or customer experience teams, platforms like Clearly Acquired offer tools to incorporate customer-focused strategies throughout the transaction process.

Managing customer perception isn’t just about damage control - it’s a measurable process that safeguards trust and revenue. By planning early, communicating effectively, and staying responsive to customer feedback, businesses can turn M&A challenges into opportunities for retention and growth. When done right, these efforts build loyalty and deliver results that customers notice and appreciate.

FAQs

How can companies maintain customer trust during a merger or acquisition?

Maintaining customer trust during a merger or acquisition hinges on open and consistent communication. It's crucial to be upfront about the changes, clearly outlining how the merger will benefit customers and addressing any potential concerns as soon as possible.

To ease customer worries, emphasize that the quality of service will remain steady and show a strong dedication to meeting their needs. Providing regular updates throughout the process and creating opportunities for customers to share feedback can go a long way in building confidence and strengthening loyalty during this period of change.

What are the most important metrics for tracking customer perception after a merger?

To keep a pulse on how customers perceive a merger, it's important to zero in on a few key metrics: customer satisfaction scores (CSAT), Net Promoter Score (NPS), and customer retention rates. Beyond the numbers, pay attention to customer feedback through reviews, analyze brand sentiment, and assess levels of customer engagement.

These tools give you a clear picture of customer sentiment toward the merged business and highlight where adjustments might be needed to preserve trust and loyalty.

How can companies effectively handle rumors and misinformation during M&A announcements?

When navigating rumors and misinformation during M&A announcements, companies need to focus on clear, timely communication. Use official channels to share accurate and transparent updates, addressing any concerns head-on to minimize speculation. It's also important to engage directly with key stakeholders - like employees, customers, and investors - to clear up misunderstandings and build trust. Acting swiftly and maintaining consistency in messaging can help preserve confidence and keep customer perceptions positive throughout the process.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)