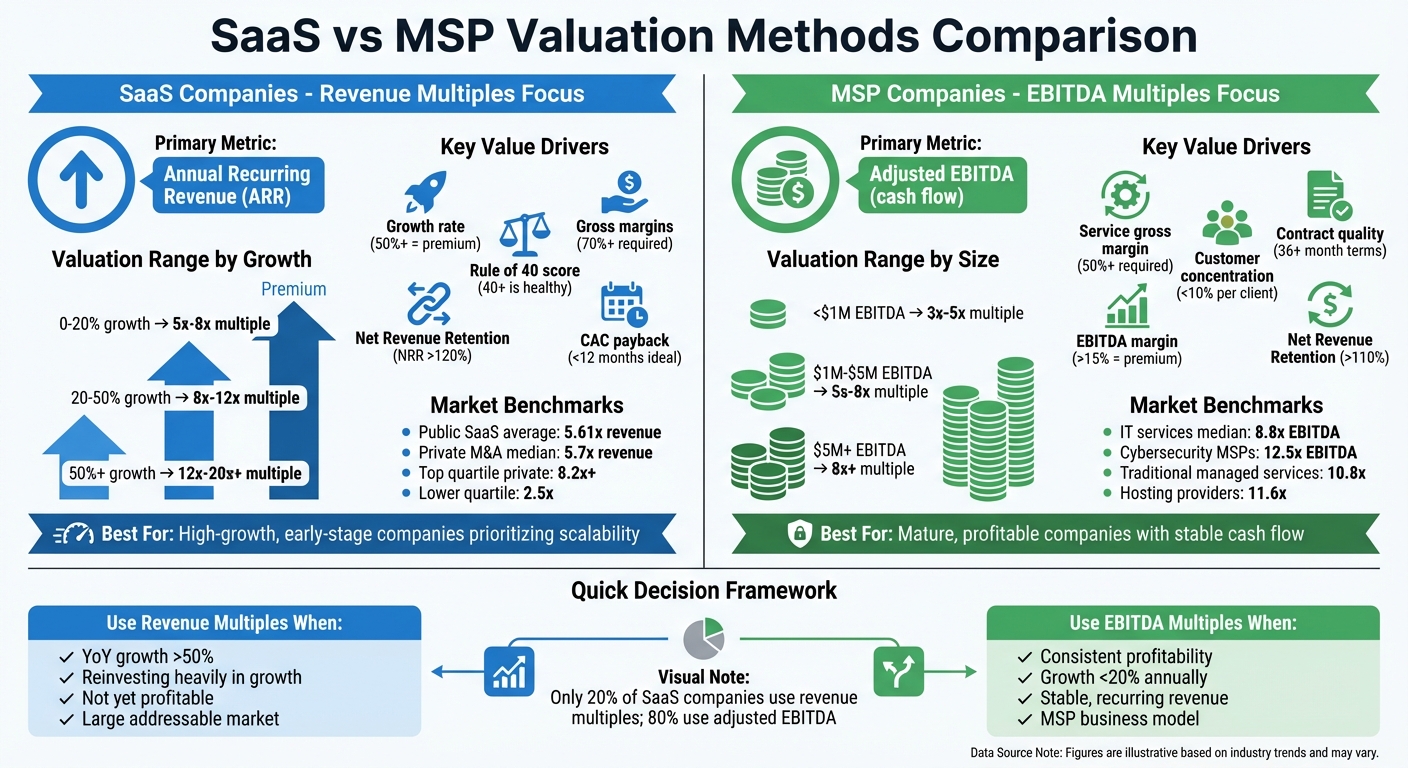

For SaaS and MSP businesses, valuation boils down to two main approaches: revenue multiples and EBITDA multiples. Each method reflects the unique nature of these business models:

- SaaS Companies: Valued using revenue multiples, focusing on Annual Recurring Revenue (ARR). High-growth SaaS firms prioritize scalability and recurring revenue, often trading at 3x–10x ARR or higher depending on growth rate, churn, and profitability metrics like the Rule of 40.

- MSP Companies: Valued using EBITDA multiples, emphasizing cash flow stability. Smaller MSPs with less than $1M EBITDA trade at 3x–5x, while larger MSPs with $5M+ EBITDA can achieve 8x or more. Factors like service gross margin, customer concentration, and contract quality heavily influence multiples.

Key Takeaways:

- SaaS Metrics: Growth rate, gross margins (70%+), and Net Revenue Retention (NRR) above 120% drive higher revenue multiples.

- MSP Metrics: Adjusted EBITDA, service gross margins (50%+), and diversified client bases are critical for valuation.

- Private vs. Public Valuations: Private SaaS firms trade at lower multiples than public ones, with private M&A deals averaging a 5.7x revenue multiple in 2025.

- Blended Approaches: Mature SaaS companies often shift to EBITDA-based valuations, while MSPs rarely rely on revenue multiples due to operational differences.

Understanding these valuation metrics ensures both buyers and sellers can negotiate fair deals based on accurate financial insights.

SaaS vs MSP Valuation Methods: Revenue Multiples vs EBITDA Multiples Comparison

Revenue Multiples for SaaS Companies

How Revenue Multiples Work

Revenue multiples, such as EV/Revenue or ARR multiples, are a way to measure a company's enterprise value in relation to its annual recurring revenue (ARR). To calculate this, divide the enterprise value by ARR. For instance, if a company has $2 million in ARR and operates at a 6x multiple, its valuation would be $12 million.

This method works well for SaaS companies because it focuses on recurring revenue, sidestepping the distortions caused by heavy reinvestment in growth.

"In the earlier stages, companies are typically focused on growth and reinvestment into the business, so they're not focused on EBITDA. They're just trying to grow the top line. Focusing on ARR and ARR multiples makes a lot of sense versus when a company is much larger." - Ben Murray, SaaS Expert

What Drives SaaS Revenue Multiples

Several factors influence whether a SaaS company can achieve a revenue multiple of 4x or push it to 15x or higher. At the top of the list is growth rate. Companies growing at a rate of 50% or more can command multiples ranging from 12x to 20x or higher. On the other hand, companies with growth below 20% typically see multiples in the 5x–8x range.

The Rule of 40 is another key metric, combining growth rate and EBITDA margin. A score of 40 or higher is considered a sign of health, and every additional 10 points in this score can increase the revenue multiple by about 2.2x. Net Revenue Retention (NRR) also plays a critical role, with an NRR above 120% signaling strong customer expansion, which can add 1x to 3x to a company’s multiple.

Other important drivers include:

- Gross margins: Companies with margins below 70% often fall short of standard SaaS multiples.

- CAC payback period: A payback period of less than 12 months is ideal.

- Churn rate: Lower churn rates indicate stronger customer retention.

Certain sectors, such as cybersecurity, AI, and vertical SaaS, tend to attract premium multiples.

SaaS Revenue Multiple Benchmarks

As of January 21, 2026, the average revenue multiple for 155 public SaaS companies is 5.61x, with a median of 3.64x. However, these averages hide significant differences based on company performance and market positioning.

For example, top-tier performers like Crowdstrike maintain revenue multiples as high as 20.8x, driven by 29% year-over-year growth and strong profitability metrics. Similarly, ServiceNow trades at 19.5x, supported by 22% growth and a Rule of 40 score of 37%. On the flip side, companies with declining revenue or negative margins, such as Upland Software at 0.4x, demonstrate how poor fundamentals can compress multiples.

Private SaaS companies generally trade at a discount compared to their public counterparts. By late 2025, private M&A deals closed at a median multiple of 5.7x EV/Revenue. Top-quartile private companies achieved multiples of 8.2x or higher, while lower-quartile firms settled around 2.5x. Bootstrapped SaaS firms averaged 4.8x, whereas equity-backed companies saw slightly higher multiples at 5.3x, reflecting their stronger growth trajectories.

| Growth Rate | Typical Revenue Multiple | Company Profile |

|---|---|---|

| 0–20% | 5x – 8x | Mature, stable growth with controlled burn |

| 20–50% | 8x – 12x | Strong expansion with moderate efficiency |

| 50%+ | 12x – 20x+ | High-growth with significant market impact |

Next, we’ll dive into how MSP companies use EBITDA multiples for their valuations.

sbb-itb-a3ef7c1

SaaS Valuation Explained: SDE vs. EBITDA vs. Revenue Multiples

EBITDA Multiples for MSP Companies

Unlike SaaS companies that focus heavily on recurring revenue, MSPs (Managed Service Providers) are primarily evaluated based on the stability and reliability of their cash flow.

How EBITDA Multiples Work

EBITDA multiples compare a company's enterprise value to its Adjusted EBITDA - earnings before interest, taxes, depreciation, and amortization. For MSPs, Adjusted EBITDA is calculated by normalizing earnings, which includes adding back one-time expenses and owner-related benefits. This adjustment reveals the business's sustainable earnings potential.

Here’s why this matters: if an MSP generates $1.5 million in Adjusted EBITDA and trades at a 6x multiple, its valuation would be $9 million. Unlike revenue multiples, EBITDA multiples strip away distortions tied to revenue figures, focusing instead on what buyers prioritize most - predictable cash flow.

"The anchoring metric for nearly every PE deal is Adjusted EBITDA... This measures profit before interest, taxes, depreciation, and amortization, adjusted for owner benefits and non-recurring expenses." - Alexej Pikovsky, CEO, Nuoptima

MSPs are a natural fit for EBITDA-based valuations because their income is stable and recurring, thanks to managed service contracts. Revenue multiples, on the other hand, can be misleading. For example, two MSPs might bring in the same revenue, but one could have a 60% service gross margin while the other operates at just 35% due to inefficiencies or heavy reliance on hardware resale. EBITDA multiples cut through this noise by focusing on actual profitability.

With the methodology in place, it’s important to look at the operational factors that influence these multiples.

What Drives MSP EBITDA Multiples

Several key factors determine whether an MSP earns a 4x or a 10x EBITDA multiple. Service gross margin is one of the most critical. A service gross margin of 50% or higher signals efficient delivery and scalability, which are essential for commanding higher multiples.

Customer concentration is another big factor. No single client should account for more than 10% of total revenue. Heavy reliance on one customer introduces risk - losing that client could significantly impact the business. Contract quality also plays a role. Long-term agreements (36+ months), automatic renewals, and defined SLAs (Service Level Agreements) demonstrate revenue stability, which buyers value.

EBITDA margin itself is a direct driver of valuation. MSPs with profit margins above 15% often see multiples around 7.02x, while those with margins below 7.5% tend to land closer to 6.2x. Other factors, like Net Revenue Retention (NRR) above 110%, can add 1x to 3x to the multiple. Similarly, an EBITDA margin that exceeds the industry average by 5% can increase the multiple by 0.5x to 1.0x. On the flip side, MSPs that rely heavily on low-margin hardware sales or project-based work often struggle to hit top-tier multiples. Buyers also favor MSPs with strong operational structures - documented processes and a solid management team reduce dependency on the founder, which can further boost valuations.

Together, these operational elements shape the EBITDA multiples seen in the market.

MSP EBITDA Multiple Benchmarks

MSP valuations show clear patterns based on company size. Smaller MSPs with less than $1 million in Adjusted EBITDA typically trade at multiples between 3x and 5x. These businesses often face challenges like key-person dependency and customer concentration risks.

Mid-sized MSPs, generating between $1 million and $5 million in Adjusted EBITDA, tend to see multiples ranging from 5x to 8x. These firms usually have more predictable operations and established infrastructures.

At the top of the spectrum are platform-scale MSPs, which generate over $5 million in Adjusted EBITDA. These companies command multiples of 8x or higher. Larger MSPs are highly sought after, especially by private equity firms pursuing roll-up strategies. As of Q2 2025, the median EV/EBITDA multiple for IT services transactions was 8.8x.

"Private equity groups are moving to consolidate this industry... PE firms want to buy MSPs and TSPs that each have $5 million to $10 million in profit." - Paul Dippell, CEO, Service Leadership

Within specific niches, cybersecurity-focused MSPs achieve the highest multiples. For example, cybersecurity MSPs in the $5 million to $10 million EBITDA range trade at 12.5x, compared to 10.8x for traditional managed services and 11.6x for hosting providers.

| MSP Size by Adjusted EBITDA | Typical EBITDA Multiple Range | Key Characteristics |

|---|---|---|

| Sub-$1M | 3x – 5x | High key-person dependency; concentration risk |

| $1M – $5M | 5x – 8x | Predictable MRR; established operations |

| $5M+ (Platform Scale) | 8x+ | Leadership depth; scalable growth infrastructure |

The composition of revenue also impacts valuation. For instance, managed services revenue typically multiplies at 1.333x per dollar, private cloud services at 1.368x, project services at 0.650x, and product resale at just 0.122x. This is why buyers closely examine revenue mix - not all income streams are valued equally.

Revenue Multiples vs. EBITDA Multiples

Deciding between revenue multiples and EBITDA multiples comes down to your company's performance and growth profile. The right choice depends on factors like your business model, growth stage, and what potential buyers prioritize.

Pros and Cons of Each Method

Revenue multiples focus on top-line growth, making them ideal for early-stage, high-growth SaaS companies that prioritize reinvestment in customer acquisition and product development. This approach highlights the value of recurring revenue and future earnings potential, even if current profitability is low. However, it assumes future profitability and overlooks operational efficiency. For example, two SaaS companies with the same revenue might have vastly different paths: one could be on track for profitability, while the other continues burning cash.

EBITDA multiples, on the other hand, emphasize cash flow and operational efficiency, offering a clearer picture of cash generation before debt and taxes. This method is often used for mature SaaS companies and MSPs, as it helps buyers assess their return on investment. The downside? EBITDA multiples may undervalue high-growth firms where heavy investments in scaling reduce current earnings.

"Revenue indicates growth, but profitability confirms value." - Dylan Gans, Baton Market

For MSPs, relying on revenue multiples can be risky. One MSP might generate $3 million in revenue with a 60% service gross margin, while another MSP with the same revenue might only achieve a 35% margin due to inefficiencies or reliance on low-margin hardware sales. EBITDA multiples, in contrast, focus on actual profitability, making them better suited for such comparisons.

| Feature | Revenue Multiples (SaaS Focus) | EBITDA Multiples (MSP/Mature SaaS Focus) |

|---|---|---|

| Primary Focus | Top-line growth and market share | Cash flow and operational efficiency |

| Best For | Early-stage, high-growth SaaS (>50% YoY) | Mature SaaS, MSPs, and stable SMBs |

| Profitability | Works for unprofitable firms | Requires consistent profitability |

| Risk Level | Higher (speculative future margins) | Lower (based on realized cash flow) |

| Key Metric | Annual Recurring Revenue (ARR) | Adjusted EBITDA / Seller's Discretionary Earnings |

Interestingly, only about 20% of SaaS companies are valued using revenue multiples; the majority rely on adjusted EBITDA.

When to Use Revenue vs. EBITDA Multiples

The choice between these valuation methods ultimately depends on your company's growth trajectory, profitability, and overall business model.

Revenue multiples are better suited for high-growth SaaS companies with year-over-year growth above 50%, large total addressable markets, and high gross margins (ideally 90% or more). Buyers using this method are betting on your future earnings potential rather than your current cash flow.

On the other hand, EBITDA multiples are the go-to for mature, stable, and consistently profitable businesses - or for MSPs. Even for SaaS companies, if growth slows below 20% annually or if operational efficiency becomes a priority, valuations often shift toward EBITDA multiples.

"The single biggest valuation trap for MSP owners is focusing on the top-line revenue multiple." - Alexej Pikovsky, CEO, Nuoptima

In practice, valuations frequently combine multiple approaches. For example, in 2025, the board of Semrush Holdings, Inc. used both Next Twelve Months (NTM) revenue multiples (median 2.5x) and adjusted EBITDA multiples (median 9.2x) to determine a valuation range for a proposed take-private transaction. This blended approach offers a more comprehensive view than relying on a single metric.

For sellers, choose the metric that best showcases your strengths. If you're scaling quickly but not yet profitable, emphasize a revenue multiple. If your margins are strong and cash flow is steady, focus on adjusted EBITDA to highlight operational efficiency. For buyers, revenue multiples can be a quick screening tool, but a deeper dive into service gross margins and EBITDA is critical to avoid overpaying for inflated revenue.

Lastly, accurate valuations depend on normalized financials. This means removing one-time expenses and adjusting owner compensation to reveal true earnings. Without normalization, comparisons can become misleading, like comparing apples to oranges.

How to Apply These Multiples in Real Deals

Using Clearly Acquired for Valuations

To effectively apply these multiples, you’ll need normalized financial data, accurate market comparables, and a reliable tool to turn raw numbers into a solid valuation. That’s where Clearly Acquired's AI-driven platform comes in.

This platform uses an AI-powered business valuation tool that integrates your financial data with industry benchmarks and current market trends. It analyzes key metrics like revenue, EBITDA, and growth rates to determine the most suitable valuation method. For instance, high-growth SaaS companies with over 50% year-over-year growth typically lean on revenue multiples, while EBITDA-based methods are more common for mature MSPs or stable SaaS businesses.

But the platform doesn’t stop at valuation. Its audit and growth insights help pinpoint critical value drivers and potential red flags, such as key-person dependency or customer concentration. Sellers can address these issues upfront, and buyers can ensure the asking price reflects a normalized EBITDA.

The platform also simplifies deal-making with features like secure data rooms, centralized pipeline management, due diligence support, and integrated financing tools. With options like a loan marketplace and Plaid pre-qualification, it helps users source, underwrite, finance, and close transactions more efficiently. This streamlined process paves the way for actionable advice for buyers and sellers alike.

Tips for Buyers and Sellers

For sellers:

Start by normalizing your EBITDA. Clearly document all add-backs, such as above-market owner salaries, one-time fees, or personal expenses, as buyers will scrutinize these closely. Transparency is key. If you’re running an MSP, aim to prove that your service gross margin is at least 50%, as anything below this threshold can negatively impact your valuation. For SaaS businesses, highlight monthly recurring revenue (MRR) rather than annual or lifetime plans, as MRR generally commands a higher valuation premium.

Address potential risks like key-person dependency by documenting processes and outsourcing critical roles. Ensure no single client accounts for more than 10% of your revenue to avoid concentration risks. For example, when Chad DeShon sold BromBone, buyers were reassured by the fact that development and customer support were already outsourced, which contributed to a higher valuation.

For buyers:

Buyers need to dig deeper than headline multiples to avoid overpaying. For MSPs, focus on service gross margins, as two companies with identical revenues can deliver vastly different EBITDA outcomes. For instance, an MSP with $3 million in revenue and a 60% margin will have a significantly stronger EBITDA than one operating at just 35%.

When evaluating SaaS businesses, verify the quality of MRR by checking for automatic renewals and long-term contracts (36 months or more). Translate deal structures - such as earnout-heavy versus cash-heavy offers - into risk-adjusted values to fully understand the financial implications.

Use forward estimates, like forward-12-month revenue or EBITDA, to validate multiples, and cross-check these with the Rule of 40 to ensure the numbers make sense. Additionally, assess the deal structure, whether it’s cash, rollover equity, or earnouts, to gauge the overall risk and return profile.

Conclusion

Main Points for SaaS and MSP Valuations

The valuation method you choose should align with your business's core financial dynamics. For high-growth SaaS companies - those expanding at rates above 20%–30% year-over-year - revenue multiples are often the go-to approach. These businesses are typically reinvesting profits into growth, so their value is tied more to future potential and scalability than current cash flow. On the other hand, EBITDA multiples are more suitable for mature, profitable companies, such as most MSPs and established SaaS firms generating over $5 million in ARR. These valuations emphasize operational efficiency and the ability to consistently produce cash flow.

For MSPs, multiples vary depending on size. Companies with annual EBITDA between $250,000 and $1 million generally see multiples of 4x–5x, while those with EBITDA in the $2 million–$5 million range can achieve multiples of 6x–8x. As growth slows and revenue expansion dips below the 20%–30% range, the focus shifts from scalability to margin control and cash flow stability. This is where the Rule of 40 comes into play - a combination of growth rate and EBITDA margin that should exceed 40%. Improving this metric by 10 points can increase your revenue multiple by approximately 1.1x to 2.2x.

Understanding and applying these benchmarks strategically is key to selecting the right valuation metric for your business.

Final Thoughts on Valuation Methods

Choosing the right valuation method is all about aligning it with your business fundamentals. As the CLFI Team insightfully states:

"Price Is a Data Point. Value Is a Decision"

For MSPs, relying solely on revenue multiples can be risky. Two companies with the same revenue can have vastly different EBITDA outcomes due to variations in margins - such as 35% versus 60% gross margins. To achieve a precise valuation, it’s essential to consider a combination of revenue multiples, EBITDA multiples, and forward-looking estimates.

Clearly Acquired’s AI-driven platform simplifies this process by integrating financial data with industry benchmarks. It helps identify the best valuation method for your specific situation, whether you’re preparing to sell or evaluating a potential acquisition. From normalized financial analysis to deal structure modeling, the platform goes beyond headline multiples to uncover the true value of a business. In the SMB acquisition world, getting the valuation right isn’t just about closing a deal - it’s about securing the best deal with confidence.

FAQs

Why are SaaS companies valued based on revenue multiples instead of EBITDA multiples?

SaaS companies are often evaluated using revenue multiples, and there’s a good reason for that. Their business models revolve around recurring revenue, scalability, and long-term growth. Because these companies tend to pour resources into expanding their reach, profitability often takes a backseat during the growth phase. This makes metrics like EBITDA, which focus on profitability, less relevant for gauging their true potential.

Revenue multiples, on the other hand, shine a light on what really matters for SaaS: predictable, subscription-based income streams. This method aligns perfectly with key industry metrics like Annual Recurring Revenue (ARR) and growth rates - two pillars of success in the SaaS world. By focusing on these metrics, revenue multiples offer a clearer snapshot of a company's health and future prospects.

What drives EBITDA multiples for MSP companies?

EBITDA multiples for Managed Service Provider (MSP) companies are shaped by several important factors, such as company size, profitability, growth potential, and overall risk profile. Larger MSPs often secure higher multiples thanks to their scale, steady recurring revenue streams, and appeal to private equity investors. Maintaining clean financial records - like well-adjusted EBITDA that removes owner benefits and one-time expenses - can also play a big role in increasing valuation.

Other key elements include customer retention rates, growth performance, and operational efficiency. MSPs with strong recurring revenue, high retention rates (for example, a Net Revenue Retention above 120%), and efficient growth (measured by meeting or exceeding the Rule of 40) usually achieve higher multiples. A low-risk profile, stable cash flow, and favorable market trends further enhance valuation. On the flip side, businesses with high volatility or capital-heavy operations often see reduced EBITDA multiples.

How do revenue multiples vary between private and public SaaS companies?

Revenue multiples for private SaaS companies tend to be lower and fluctuate more due to factors like company size, growth rate, and perceived risk. On the other hand, public SaaS companies typically enjoy higher and more stable multiples, as their valuations are shaped by real-time market data and overall investor sentiment.

Private companies often undergo more rigorous evaluation from potential buyers or investors, whereas public companies benefit from the transparency of financial disclosures and the availability of market comparisons, which can enhance their valuation metrics. For both private and public SaaS businesses, recurring revenue and growth potential remain critical factors in determining these multiples.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)