Customer churn directly affects how much a business is worth. Here’s why:

- Churn measures customer loss: High churn means more customers leave, forcing businesses to spend heavily on replacements.

- It lowers revenue stability: Predictable income declines, making the business riskier for buyers.

- It hurts key metrics: Churn reduces Customer Lifetime Value (CLV) and disrupts the LTV:CAC ratio, which investors use to gauge efficiency.

- Low churn businesses are more attractive: They’re seen as stable, with loyal customers and higher future growth potential.

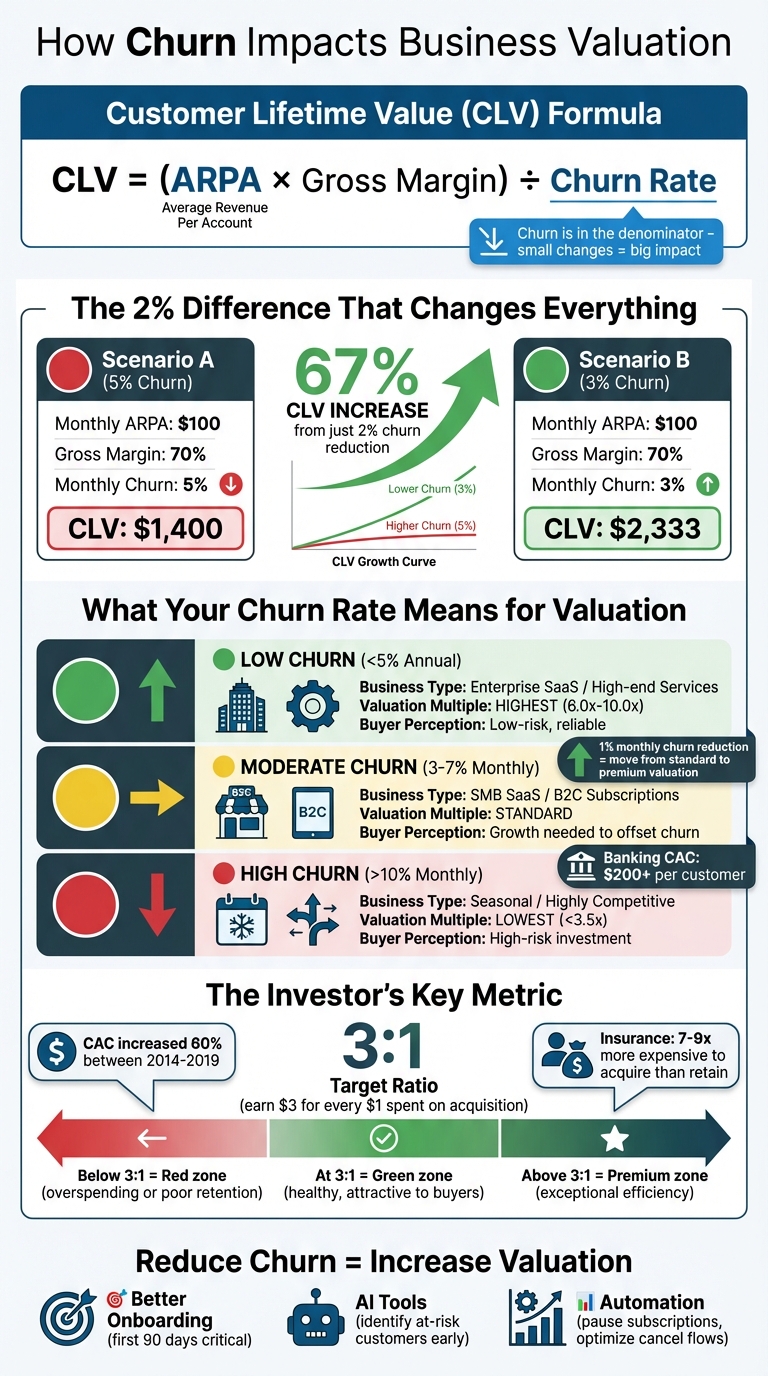

For example, reducing churn from 5% to 3% can increase CLV by 67%, boosting valuation. Buyers prioritize businesses with low churn because it signals reliable cash flow and scalability.

Focus on retention strategies like better onboarding, automation, and AI tools to lower churn and improve valuation before selling your business.

How Customer Churn Rate Impacts Business Valuation and CLV

How to Use Churn Rate to Calculate Customer Lifetime Value

How Churn Affects Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) represents the total revenue a business earns from a single customer over the course of their relationship. The churn rate - how quickly customers stop doing business with a company - plays a critical role in determining CLV. When churn increases, the length of the customer relationship decreases, which directly lowers CLV.

The CLV Formula and Churn Rate

The formula for CLV is typically written as:

CLV = (ARPA × Gross Margin) ÷ Churn Rate

Here, ARPA refers to the Average Revenue Per Account. Since churn is in the denominator, even minor changes can dramatically affect CLV. For example, imagine a subscription-based business with a $100 monthly ARPA and a 70% gross margin. If the monthly churn rate is 5%, the CLV is $1,400. However, by reducing churn to 3%, the CLV jumps to approximately $2,333 - a 67% increase from just a small improvement in retention. This relationship highlights why churn is a focal point during acquisition evaluations. Buyers understand that improving retention doesn’t just boost CLV - it also amplifies overall revenue over time.

The formula’s sensitivity to churn makes it a critical metric for assessing a company’s financial health and growth potential.

How CLV Impacts Valuation

Because CLV is so sensitive to churn, its influence on valuation is immense. A higher CLV directly correlates with stronger valuation multiples and more attractive acquisition offers. When buyers assess a company, they’re essentially investing in the future cash flows generated by both current and future customers. As Christian Steverson, Director of Acquisitions at Acquire.com, puts it:

"If your customer churn is low and lifetime value high, your product is sticky. A sticky product reduces acquisition risk for buyers and is a license for them to experiment with marketing, operations, or research and development in pursuit of returns."

This dynamic is especially evident in subscription-based businesses. A widely accepted benchmark for profitable growth is a 3:1 ratio between CLV and Customer Acquisition Cost (CAC). Businesses that meet or exceed this benchmark are often rewarded with premium valuations, as they demonstrate the ability to generate sustainable profits. For smaller companies, monthly churn rates typically range between 3% and 7%, while larger enterprises often enjoy much lower churn rates, which contribute to higher valuations.

Churn's Effect on Valuation Multiples

Churn plays a key role in how buyers assess valuation multiples because it reflects both risk and the predictability of cash flow. When deciding on an acquisition, buyers use churn rates to determine the valuation multiple - the factor applied to revenue or profit to establish a purchase price. Businesses with lower churn rates are seen as safer investments, leading to higher multiples thanks to steady and predictable cash flows. Let’s break down how benchmarks and industry-specific churn rates influence these multiples.

Churn Benchmarks and Multiples

The connection between churn and valuation multiples is simple: lower churn leads to higher multiples. Companies with annual churn rates below 5% tend to secure above-average revenue or profit multiples. Why? Because they showcase strong customer loyalty and a solid product-market fit.

On the flip side, businesses with annual churn rates above 10% often see their multiples drop. High churn indicates potential issues like intense competition or a weak market fit, making the investment riskier for buyers. Interestingly, even reducing monthly churn by just one percentage point can elevate a business from a typical market valuation to a premium tier.

Churn Rates by Business Type

Churn challenges vary across industries, which means valuation expectations differ too. For example, smaller SaaS companies catering to SMBs often face monthly churn rates between 3% and 7%, leading to notable annual customer losses. These businesses usually receive standard multiples and must rely on strong growth to counterbalance retention struggles.

Enterprise SaaS companies, however, often enjoy monthly churn rates below 1% to 2%. This is largely due to long-term contracts and the deep integration of their products into customers' workflows. Such stability makes these companies more attractive to buyers, earning them higher valuation multiples. Meanwhile, non-contractual businesses like e-commerce don’t track churn in the same way. Instead, their valuation depends on metrics like purchase frequency and average order value.

| Churn Rate Category | Typical Business Segment | Impact on Valuation Multiple |

|---|---|---|

| Low (<5% Annual) | Enterprise SaaS / High-end Services | Highest multiples; seen as reliable and low-risk |

| Moderate (3–7% Monthly) | SMB SaaS / B2C Subscriptions | Standard multiples; growth needed to offset churn |

| High (>10% Monthly) | Seasonal / Highly Competitive Markets | Lower multiples; often viewed as high-risk |

Churn rates act as a key indicator of valuation potential - lower churn generally commands stronger multiples, while higher churn can drag them down. Knowing where your business stands in these benchmarks can help you set realistic valuation goals and identify areas for improving customer retention before approaching buyers.

sbb-itb-a3ef7c1

The Connection Between Churn, CAC, and LTV:CAC Ratio

Let’s dive deeper into how churn affects customer acquisition costs (CAC) and disrupts the LTV:CAC ratio - a critical metric for gauging business efficiency and growth potential.

Churn doesn’t just shrink your customer base; it sets off a financial chain reaction. When customers leave before covering their acquisition costs, your business enters what Matt Goldman, CEO of Churn Buster, calls the "treadmill effect":

"If you're acquiring 10 new customers a month, but also have 10 customers a month cancel, your business is essentially at a stand still. You're running on a treadmill, not a track."

This cycle drains resources, making sustainable growth a steep uphill climb. As CAC rises and profit margins shrink, the LTV:CAC ratio - a key focus for investors - takes a hit.

How High Churn Drives Up CAC

When churn is high, acquisition budgets are constantly spent replacing lost customers rather than expanding the customer base. This repeated spending wastes the initial investment made to acquire those customers. Between 2014 and 2019, CAC increased by about 60% across various industries, underscoring the growing importance of customer retention.

Consider the insurance industry, where acquiring a new policyholder costs 7 to 9 times more than retaining an existing one. In banking, the average CAC exceeds $200 per customer, yet banks don’t break even until year two, given annual revenue of roughly $150 per customer. High churn also forces companies to spend on reactive measures like exit surveys and customer save strategies, diverting resources away from proactive growth efforts. All of this drives up CAC and disrupts the LTV:CAC ratio, making it harder to maintain profitability and attract investors.

LTV:CAC Ratio: Why It Matters to Investors

The LTV:CAC ratio is one of the most important metrics investors use to evaluate a company’s growth efficiency. The goal is to maintain a ratio of 3:1 - earning three dollars for every dollar spent on acquisition. High churn shortens the time customers remain profitable, which directly undermines this ratio. A low LTV:CAC ratio signals to investors that a business is either overspending on acquisition or struggling with retention, both of which increase perceived risk.

High churn also raises concerns about product-market fit or intense competition, which can make investors wary. For example, in the 2025 PropTech market, companies with annual gross revenue churn below 5% enjoy premium EV/Sales multiples of 6.0x to 10.0x, while those with churn above 15% often see multiples drop below 3.5x. As Thomas Lin, Director of Technology Practice at Objective IBV, puts it:

"Customer retention is the most powerful valuation catalyst in PropTech today."

Comparing Low and High Churn Scenarios

The financial impact of churn becomes crystal clear when comparing low and high churn environments. In a low churn scenario, acquisition spending drives real growth, the LTV:CAC ratio stays strong, and revenue forecasting is reliable. High churn, however, inflates CAC, erodes margins, and creates instability.

| Metric | Low Churn Environment | High Churn Environment |

|---|---|---|

| CAC Impact | Efficient; funds drive growth | Inflated; funds replace lost customers |

| LTV:CAC Ratio | High (3:1 or better) | Low; often below break-even |

| Profitability | Strong; acquisition costs are spread over time | Weak; margins shrink due to constant acquisition |

| Forecasting | Stable and predictable | Unstable and uncertain |

Reducing churn isn’t just about retaining customers - it’s a domino effect. Lower churn increases LTV, which improves cash flow and allows for more efficient marketing spend, ultimately reducing CAC over time. For potential buyers, a healthy LTV:CAC ratio supported by low churn signals a business that’s efficient, resilient, and less risky post-acquisition. This translates directly into higher valuation multiples.

How to Reduce Churn and Increase Valuation

Reducing churn does more than just steady the ship - it directly boosts business value. When retention rates improve, the effects ripple across key metrics: monthly recurring revenue (MRR) becomes more predictable, growth rates pick up speed, and profit margins widen. According to SaaS Capital, retention rates have a direct impact on MRR, growth trajectories, contribution margins, and even the total addressable market (TAM) - and these effects compound over time. For businesses gearing up for market entry, prioritizing retention is a smart, high-impact strategy that mitigates risks while paving the way for the tactical improvements outlined below.

Better Onboarding and Customer Retention

The first 90 days of a customer relationship are often the most critical. This is when early-stage churn typically peaks, making personalized engagement and a seamless onboarding process essential. For smaller businesses, monthly churn rates often fall between 3% and 7%.

Automation tools play a big role in extending customer lifetimes. Features like subscription pauses, trial extensions, and optimized cancel flows give customers the flexibility they need, offering second chances that can lead to longer relationships and higher customer lifetime value (CLV). For service-based businesses, having documented and standardized onboarding procedures ensures consistent quality, even during ownership transitions. This consistency can protect business value, especially during a sale.

But retention doesn’t stop at onboarding - technology can take it even further.

Using AI Tools to Identify Churn Risks

AI tools are reshaping how businesses tackle churn, often addressing problems before they escalate. For instance, Clearly Acquired’s AI solutions analyze 12-month profit and loss statements to detect anomalies and flag potential churn risks. This level of financial transparency is crucial during due diligence, as unexplained revenue fluctuations or uneven growth patterns can raise red flags for buyers.

Christian Steverson, Director of Acquisitions at Acquire.com, highlights the importance of retention:

"If your customer churn is low and lifetime value high, your product is sticky. A sticky product reduces acquisition risk for buyers and is a license for them to experiment with marketing, operations, or research and development in pursuit of returns."

AI tools also help founders prepare evidence that supports their valuation. Subscriber dashboards, quality of earnings reports, and financial recasts can showcase how reinvesting in growth impacts short-term profitability. These early insights not only help sellers demonstrate their business’s value but also pave the way for securing higher valuation multiples.

Case Study: Retention's Impact on Valuation

Take a SaaS company generating $1 million in annual recurring revenue with a 5% monthly churn rate. By implementing strategies like improved onboarding, automated cancel flows, and AI-driven churn monitoring, the company could significantly boost customer lifetime value. Even reducing churn by just 1% can improve the LTV:CAC ratio, stabilize revenue, and lead to higher valuation multiples. This demonstrates how retention efforts directly translate into enterprise value.

When retention is strong, buyers are willing to pay a premium for the stability and predictability of sticky revenue streams. Businesses with solid retention metrics are seen as less risky, highly scalable, and much more appealing to potential acquirers.

Conclusion

Customer churn has a direct impact on business value - it reduces customer lifetime value (CLV), lowers valuation multiples, and weakens the LTV:CAC ratio. A low churn rate signals stability and reliability, while a high churn rate raises red flags about product-market fit and competitive pressure.

Even small improvements in churn can make a big difference. For example, a 1% reduction in monthly churn can stabilize monthly recurring revenue (MRR), improve profit margins, and expand the total addressable market, boosting overall valuation. Similarly, achieving a 3:1 LTV:CAC ratio showcases a business with an efficient and scalable growth engine.

For business owners planning an exit, the takeaway is simple: focus on retention now. Strengthen onboarding processes, use automation to minimize involuntary churn, and leverage AI tools to identify and engage at-risk customers before they leave. These steps directly enhance enterprise value.

At Clearly Acquired, our AI platform provides the tools and insights to showcase strong retention. From 12-month profit and loss statements to subscriber dashboards, we help prepare the data buyers need. Our platform identifies anomalies, adjusts financials to highlight growth potential, and offers the transparency that takes deals from the Letter of Intent stage to closing. Whether you're reducing owner dependency, extending customer contracts, or creating robust retention systems, we’re here to support strategies that maximize your valuation.

Reducing churn isn’t just about today - it’s about building a business that buyers will compete to own tomorrow. Focus on retention now to secure long-term value.

FAQs

What steps can businesses take to reduce customer churn effectively?

Reducing customer churn starts with understanding why customers leave and tackling those problems directly. Early churn - often within the first 90 days - can be especially damaging and is often linked to poor onboarding or an unclear understanding of the product’s value. A well-designed onboarding process that highlights important features, sets clear expectations, and delivers quick wins can make a huge difference in keeping customers engaged.

Using data insights can help identify customers at risk of leaving before it’s too late. AI tools, for instance, can analyze customer behavior, sentiment, and support interactions to predict potential churn. This enables teams to step in proactively with personalized solutions. Regular check-ins, resolving issues quickly, and providing tailored support can transform potential losses into opportunities to retain customers - or even upsell them.

Building loyalty is also a critical piece of the puzzle. Consistently delivering value by improving product quality, listening to customer feedback, and offering perks like loyalty discounts or referral rewards can boost satisfaction and make switching less appealing. Lower churn doesn’t just mean happier customers - it also leads to better lifetime value, lower acquisition costs, and stronger profitability, all of which can elevate a company’s overall success.

How does customer churn affect the LTV:CAC ratio?

Customer churn has a direct effect on the LTV:CAC ratio by lowering the lifetime value (LTV) of your customers. When churn rates climb, customers leave sooner, which reduces the total revenue they contribute over their lifetime. This drop in LTV makes it more challenging to recover your customer acquisition cost (CAC) and reach profitability.

Keeping churn in check is essential for preserving a solid LTV:CAC ratio. Lower churn rates mean your customer acquisition efforts deliver better long-term returns. Plus, businesses with strong customer retention and steady revenue streams often attract higher valuations during acquisitions.

How does customer churn affect business valuation?

Customer churn plays a major role in shaping a business's valuation because it directly ties to revenue consistency and customer loyalty. When churn rates are low, it signals strong customer retention, which translates into steady recurring revenue, healthier profit margins, and less fluctuation in earnings. These qualities not only boost investor confidence but also justify higher valuation multiples.

Companies with lower churn rates are often perceived as more stable and predictable, making them especially appealing during acquisitions or when pursuing financing. By focusing on keeping customers and reducing churn, businesses can secure long-term value and set themselves up for stronger market performance.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)