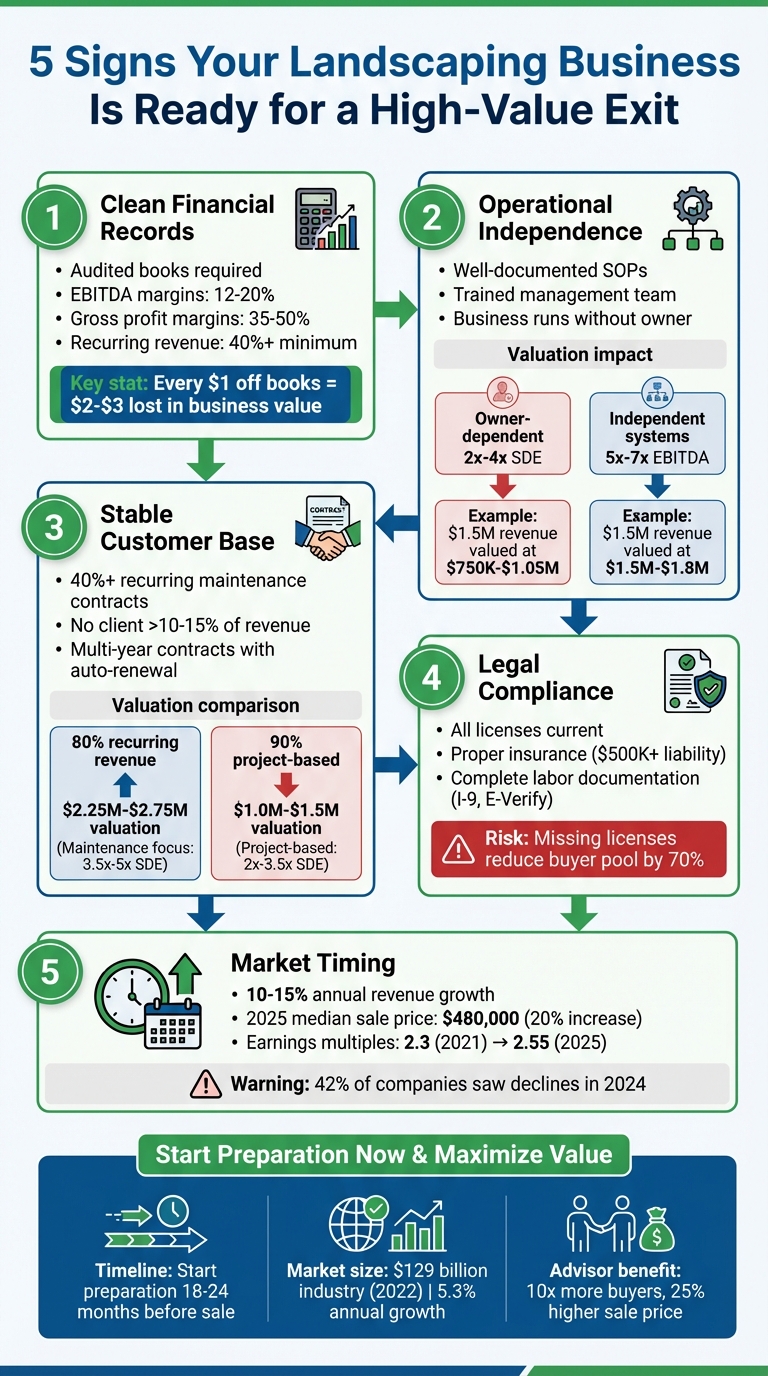

If you’re aiming to sell your landscaping business for top dollar, preparation is key. Buyers look for companies with strong financials, independent operations, predictable revenue, legal compliance, and favorable timing. Here’s what signals you’re ready for a high-value exit:

- Clean Financial Records: Audited books, strong EBITDA margins (12–20%), and at least 40% recurring revenue make your business attractive.

- Operational Independence: Well-documented systems and a trained team show the business can run without you.

- Stable Customer Base: Recurring maintenance contracts (40%+ of revenue) and diversified clients boost buyer confidence.

- Legal Compliance: Up-to-date licenses, labor records, and organized documentation prevent delays and build trust.

- Market Timing: Selling during growth phases and favorable market conditions can secure higher valuations.

Focus on these areas 18–24 months before listing your business to maximize value and attract serious buyers.

5 Signs Your Landscaping Business Is Ready for a High-Value Exit

The Truth About Selling a Lawn Care Business (Full Breakdown)

1. Consistent Financial Performance and Clean, Audited Books

If you're planning to sell your business, one thing is non-negotiable: audited financial records. For businesses generating over $1 million in revenue, buyers often evaluate performance using EBITDA. Smaller companies, on the other hand, are assessed based on Seller's Discretionary Earnings (SDE).

Strong financial margins are a cornerstone of trust. The best-performing businesses typically maintain EBITDA margins between 12% and 20%, with gross profit margins ranging from 35% to 50%. Missing or unverified financial details can significantly impact your sale price.

"For every $1 you take off the books, you're subtracting $2–$3 from your business value. Because businesses are sold on a multiple of earnings, you reduce your sale price exponentially with every dollar you can't prove you made." – Jeffery Baxter, MidStreet Brokerage

To ensure transparency, organize a data room that includes:

- Three years of profit-and-loss statements

- Current balance sheets

- 12 months of bank statements

- Two years of tax returns

Buyers will scrutinize these documents during the 90-day due diligence period after signing a Letter of Intent. It's also wise to switch to accrual-based accounting, as it provides a clearer view of long-term trends and seasonal fluctuations.

Another critical factor? Recurring revenue. Aim for at least 40% of your income to come from recurring maintenance contracts, as businesses with predictable revenue streams often secure higher valuations. However, be cautious of over-reliance on a single client - if one client accounts for more than 15–20% of your revenue, it could be seen as a risk.

2. Strong Operational Systems That Function Without Owner Dependency

Businesses that lean too heavily on their owners face significant risks. They can lose key client relationships, operational know-how, and even revenue streams if the owner steps away. That’s why having well-documented systems and a reliable team in place is essential if you want to achieve a premium sale price.

Buyers need to see that your business can run smoothly without you. Start by creating standard operating procedures (SOPs) for critical areas like field services, sales and estimating, HR, fleet management, and customer relationships. Want to make training easier and encourage independence? Use video documentation to capture these processes in action.

"The more your company can operate without your daily involvement, the more valuable it becomes to potential buyers." – Morgan Tate, Breakwater M&A

To prove operational independence, delegate key responsibilities (like project estimating, crew scheduling, or client management) at least 12–24 months before you plan to exit. This not only shows that the business can generate revenue without you but also reduces buyer concerns. Buyers often dig into labor documentation, and missing I-9 forms or E-Verify records can quickly lower your valuation. Delegating effectively doesn’t just make your business less dependent on you - it can significantly increase its value.

Here’s why this matters: owner-dependent businesses typically sell for 2x–4x Seller's Discretionary Earnings (SDE). In contrast, companies with strong systems and established management teams can command 5x–7x EBITDA. For example, imagine two businesses, each earning $1.5 million in revenue with identical profits. The company with documented systems and a trained team might be valued at $1.5M–$1.8M, while the owner-dependent competitor could fetch just $750K–$1.05M. That’s a dramatic difference, all because of operational independence.

3. Established Customer Base with Demonstrated Retention and Competitive Market Position

A solid and varied customer base is a key driver of business value. Buyers prioritize predictable revenue streams over one-time projects that vanish after completion. Businesses generating over 40% of their income from recurring maintenance contracts often achieve higher valuation multiples. In fact, recurring maintenance revenue is valued 2–3 times more than one-off installation revenue because it offers stability and predictability. This steady income flow also helps mitigate risk by diversifying revenue sources.

To strengthen your position, focus on building a well-balanced customer base while maintaining strong financial systems. A good rule of thumb is to ensure no single client accounts for more than 10–15% of your total revenue. Ideally, your customer mix should include mid-sized commercial or HOA clients for long-term reliability, paired with high-quality residential maintenance accounts for better profit margins. Written, multi-year contracts with auto-renewal clauses are far more valuable than informal agreements. If you're planning an exit, formalize these contracts 12–24 months in advance.

"Recurring commercial or HOA maintenance contracts are one of the biggest value drivers. They reduce seasonality, stabilize cash flow, and give buyers confidence they are buying a durable income stream." – Morgan Tate, Breakwater M&A

Here’s a striking comparison: two companies with $500,000 in profit were valued very differently. One, with 80% of its revenue from recurring contracts, was valued at $2.25M–$2.75M. The other, relying on 90% project-based work, was only worth $1.0M–$1.5M. The key difference? Buyers trust predictable, contracted revenue streams.

Companies with a heavy focus on maintenance contracts often achieve valuation multiples of 3.5x to 5x SDE, whereas project-based businesses typically range between 2x and 3.5x SDE. To maximize your business's value, transition to recurring contracts, keep an eye on retention over a few years, and diversify your client portfolio.

sbb-itb-a3ef7c1

4. Legal Compliance, Clean Title, and Organized Documentation

When selling your business, having all your paperwork in order and meeting legal requirements is non-negotiable. Missing licenses, incomplete labor records, or unresolved environmental issues can delay or even derail a sale, regardless of how impressive your financials might be. Experienced buyers are quick to spot these gaps, often resulting in reduced offers - or no deal at all.

To avoid these pitfalls, ensure you have all the necessary state-specific contractor licenses, EPA pesticide applicator certifications, and proper bonding in place. For instance, in Oregon, landscape contractors must maintain a minimum $10,000 bond for projects like walkways, driveways, or retaining walls. Additionally, general liability insurance - typically requiring at least $500,000 in coverage - and workers' compensation insurance are critical. Failing to meet these licensing requirements can shrink your pool of potential buyers by up to 70%. These compliance measures not only satisfy legal obligations but also reinforce the operational credibility discussed earlier.

"I've seen deals stall because a company lacked the proper pesticide application licenses or had unresolved environmental violations." – Frank C. Vito, President, Vito's Lawn Care & Landscaping

Labor documentation is another area buyers will scrutinize closely. This includes I-9 forms, E-Verify records, and proper worker classification (such as seasonal vs. permanent employees or employees vs. independent contractors). Any gaps here could signal potential fines or operational risks. Beyond labor records, you should have a well-organized digital data room containing crucial documents such as business formation records, active licenses, insurance policies, customer contracts, and environmental compliance certifications. Be sure to address "anti-assignment" clauses and formalize any informal agreements into written contracts.

Keeping your documentation organized and accessible not only simplifies due diligence but also builds buyer confidence. The easier it is for buyers to verify that your business is compliant, the smoother and faster the sale process will be.

5. Aligned Timing Between Business Performance and Market Conditions

Selling your business when it's performing strongly and market conditions are favorable creates the ideal scenario for a high-value exit. When your internal metrics are solid and align with positive market trends, your business becomes significantly more attractive to buyers. This combination often leads to better financial outcomes.

The numbers back this up. For example, businesses showing 10–15% annual revenue growth while the industry sees consolidation activity - especially from Private Equity firms - are in a prime position to secure premium multiples. A case in point: in 2025, the median sale price for landscaping businesses hit $480,000, marking a 20% increase from the previous year. During the same period, average earnings multiples rose from 2.3 in 2021 to 2.55. Buyers are drawn to businesses with strong momentum and a favorable market outlook.

"The most important year to [a buyer] is NEXT year and the year after that. The past is only important in helping predict the future." – Principium Group

Timing is crucial because buyers prioritize future cash flows over past performance. Selling during a growth phase often results in better returns than waiting until after your business peaks. For instance, 42% of landscaping companies reported revenue declines in 2024. Those businesses saw reduced valuations and fewer premium offers because of poor timing. On the other hand, companies with 40% or more recurring maintenance revenue in favorable markets frequently achieve multiples of 5x EBITDA or higher, compared to a baseline of 3x. This underscores the importance of timing your sale when your business is on an upward trajectory.

External factors also influence your business's value. Interest rates impact buyers' ability to secure financing, housing market activity drives demand for landscaping services, and Private Equity consolidation trends can intensify buyer competition. Location matters, too: businesses in warm climates like Florida or Arizona often command higher multiples due to year-round operations. Meanwhile, companies in colder regions need to highlight winter revenue streams, such as snow removal, to maintain their appeal.

If your current valuation falls short of your financial goals, it’s worth focusing on improving EBITDA margins and increasing recurring revenue before you list your business. When your strong financial performance aligns with a competitive market, you'll be in the best position to achieve a high-value exit.

Conclusion

Getting your landscaping business ready for a high-value sale means focusing on five critical areas: keeping accurate financial records, maintaining organized documentation, building strong operational systems, nurturing a loyal customer base with recurring contracts, ensuring legal compliance, and timing your sale to align with market conditions and business performance.

Neglecting these areas can have a direct impact on your business’s valuation. For instance, every unreported dollar can cut your business value by $2–$3. In fact, 42% of companies that delayed their exit plans experienced sharp valuation declines. On the other hand, businesses that tackled these five areas before going to market were able to secure higher valuations and attract serious buyers who focused on future growth potential rather than just past performance.

"Selling your business might be a once-in-a-lifetime event – make it count." – Dean Burnette, Managing Business Broker, B3 Brokers

To prepare effectively, start 18 to 24 months in advance. This includes cleaning up your financial records, formalizing agreements, documenting standard operating procedures (SOPs), auditing labor compliance, and renewing critical contracts. Partnering with M&A advisors who specialize in the landscaping industry can significantly expand your pool of potential buyers - by as much as 10x - and boost your final sale price by up to 25% through skilled negotiation. Tools like Clearly Acquired streamline this process with AI-powered valuations, well-organized data rooms, and access to qualified buyers and lenders.

The landscaping market itself is thriving. With a valuation of $129 billion in 2022 and an annual growth rate of 5.3%, it’s an attractive space for buyers seeking stable, contract-driven businesses. If your company boasts strong EBITDA margins (12–20%), recurring revenue (with 40% or more from maintenance contracts), and professional management systems, you’re in a prime position to command top dollar. By addressing these five preparation areas, you ensure your business stands out, aligns with market trends, and attracts premium offers.

FAQs

How can I make my landscaping business run smoothly without relying on my daily involvement before selling?

To get your landscaping business ready for sale, the key is to make it run smoothly without needing your constant involvement. Start by creating detailed, step-by-step documentation for everyday tasks, customer service processes, and project management. This way, the business can operate seamlessly, even in your absence.

Next, focus on building a reliable management team. Delegate responsibilities to skilled employees who can confidently handle operations. At the same time, keep your financial records well-organized and accurate. It’s also important to avoid relying too heavily on a few key clients or suppliers. By spreading out your client base and supplier relationships, you reduce risks and make the business more attractive to buyers. These efforts show potential buyers that the business is stable and capable of thriving without you at the helm.

Why is recurring revenue important for the valuation of my landscaping business?

Recurring revenue plays a crucial role in gauging the value of your landscaping business. Why? Because it offers stability, predictability, and minimizes risk for potential buyers. Steady income from ongoing maintenance contracts - like lawn care, snow removal, or property upkeep - makes your business far more attractive than one that depends heavily on one-off projects or seasonal work.

Buyers tend to place a higher value on recurring revenue streams since they reduce fluctuations in income and make it easier to predict future earnings. Businesses with strong recurring revenue often secure higher valuation multiples, as this type of income signals a loyal customer base and reliable cash flow. To boost your business’s value, prioritize building lasting customer relationships and locking in maintenance contracts that provide consistent income over time.

Why does timing matter when selling my landscaping business?

Timing is everything when it comes to selling your landscaping business. It can heavily impact both the sale price and the overall success of the deal. For instance, the landscaping industry has grown to a massive $129 billion, and selling during periods of strong market demand or industry growth can help you secure a better valuation and attract more buyers.

Planning ahead is equally important. It gives you the opportunity to fine-tune critical aspects of your business - like boosting profitability, ensuring steady recurring revenue, and streamlining operations. On the flip side, rushing to sell during a market slump or without adequate preparation could result in a lower valuation or a drawn-out, challenging sale process. By choosing to exit when both the market and your business are performing at their best, you’ll greatly increase your chances of closing a high-value deal.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)