EBITDA multiples are a common way to value construction companies by multiplying their EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) by an industry-specific factor. Here's what you need to know:

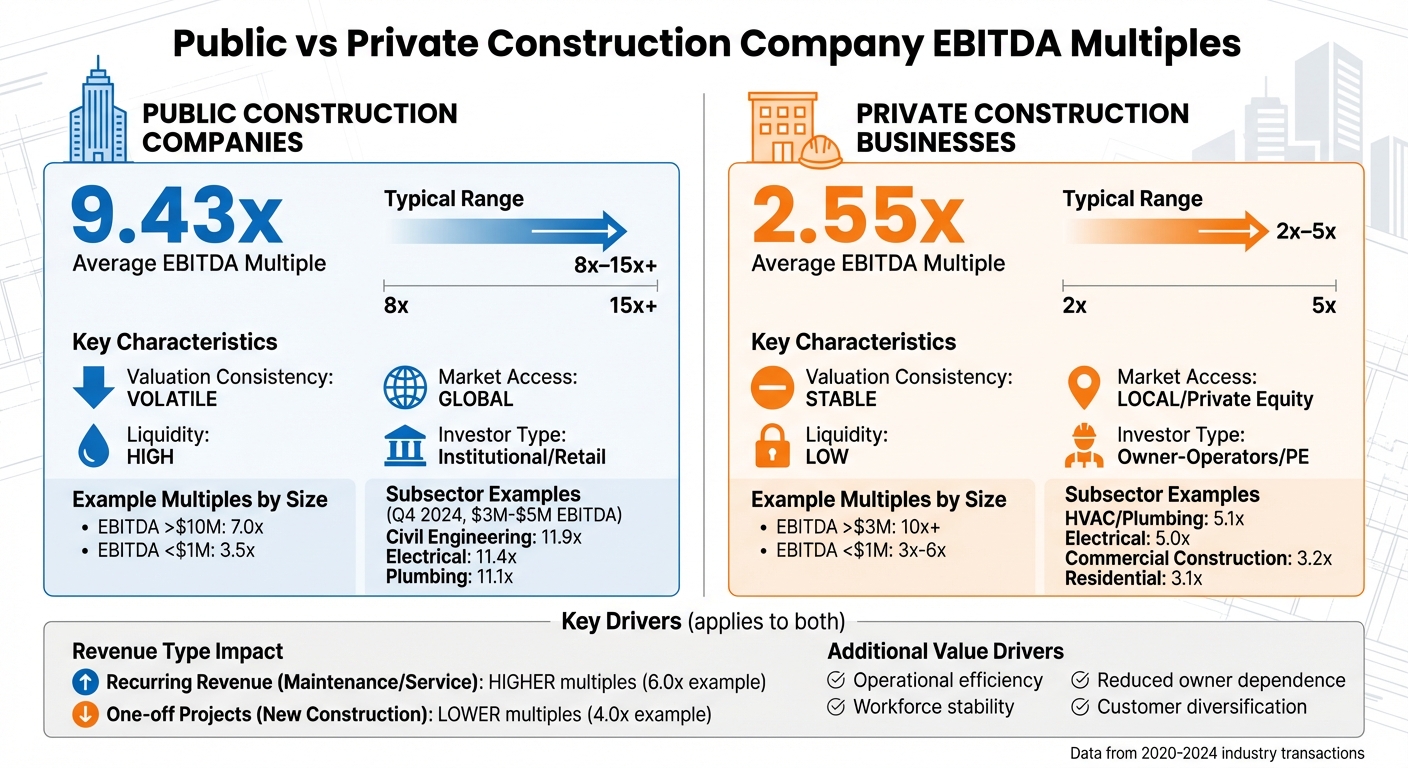

- Public vs. Private Multiples: Public construction firms have higher multiples (average 9.43x EBITDA) compared to private ones (2.55x EBITDA on average), due to their larger scale, greater liquidity, and transparency.

- Company Size: Larger firms command higher multiples. For example, a company with $95 million in revenue may see a 7.8x multiple, while one with $21 million in revenue averages 5.0x.

- Subsector Specialization: Specialized trades like electrical or HVAC often achieve higher multiples (e.g., 5.0x for private electrical contractors) versus general construction (3.2x).

- Revenue Type: Businesses with recurring revenue (e.g., maintenance contracts) tend to sell at higher multiples than those reliant on one-off projects.

Key drivers of valuation include operational efficiency, recurring revenue, workforce stability, and reduced owner dependence. Public firms benefit from global markets but face valuation volatility, while private firms trade more steadily, albeit at lower multiples.

Quick Comparison

| Feature | Public Construction Companies | Private Construction Businesses |

|---|---|---|

| EBITDA Multiples | 8x–15x+ | 2x–5x |

| Valuation Consistency | Volatile | Stable |

| Market Access | Global | Local/private equity |

| Revenue Type Impact | Higher for recurring revenue | Higher for recurring revenue |

| Buyer Type | Institutional/retail investors | Owner-operators/private equity |

Understanding these factors helps sellers optimize their exit strategies and buyers structure competitive offers.

Public vs Private Construction Company EBITDA Multiples Comparison

1. Public Construction Companies

Valuation Ranges

Public construction companies often command higher valuations thanks to their liquidity and transparency. But these valuations can differ significantly based on factors like company size and scale. For instance, firms with an EBITDA above $10 million generally trade at multiples around 7.0x, while smaller companies with EBITDA under $1 million tend to see multiples closer to 3.5x.

Recent transactions provide a snapshot of these valuation ranges. Take the June 2023 acquisition of CalAtlantic Group by Lennar, a major residential developer with $6.51 billion in revenue. This deal was valued at 8.42x EBITDA. Similarly, Comfort Systems acquired Ivey Mechanical, an HVAC firm generating $155 million in revenue, at a multiple of 8.01x EBITDA. These examples highlight how factors like scale and subsector positioning can push valuations into the higher range. Additionally, valuations differ across subsectors, influenced by the nature of specialized operations. This valuation gap is a critical consideration when developing a business exit strategy.

Subsector Influence

Specialized trades consistently achieve higher multiples compared to general construction firms. For example, during Q4 2024, companies in the $3 million to $5 million EBITDA range saw Civil Engineering firms commanding multiples as high as 11.9x, while Electrical contractors and Plumbing specialists reached 11.4x and 11.1x, respectively.

Recurring revenue models also play a crucial role in driving valuations. HVAC and mechanical firms with service contracts often trade at multiples around 6.0x EBITDA, compared to approximately 4.0x for companies focused on new construction projects.

Key Multiples Drivers

Several factors influence the valuation multiples of public construction companies, with operational efficiency and revenue quality standing out. High-performing firms leverage automation, modular construction techniques, and proprietary software to improve efficiency and command higher multiples. As FirstPageSage explains:

"EBITDA multiples in construction skew low due to non‐recurring revenue and high costs, but when automation (e.g. modular, prefab) and software play a larger role, multiples rise".

Revenue quality also heavily impacts valuations. Companies with recurring revenue streams - often supported by long-term service and maintenance contracts - attract premium multiples due to their predictable cash flows. Moreover, the surge in megaprojects in late 2024 has increased demand for large-scale contractors capable of managing complex, multi-year projects.

However, external challenges like a shortage of 500,000 workers and fluctuating material costs have put downward pressure on multiples.

sbb-itb-a3ef7c1

2. Private Construction Businesses

Valuation Ranges

Private construction firms typically sell at lower EBITDA multiples compared to other industries. From 2017 through late 2024, the median EBITDA multiple for private construction transactions was 3.8x. Most deals in this sector fall within 1x to 4.5x annual profit, with the majority clustering between 2x and 3x.

However, company size plays a major role in valuation. Smaller firms with EBITDA under $1 million often see multiples ranging from 3x to 6x, while larger private firms generating $3 million to $5 million in EBITDA can attract multiples exceeding 10x. For instance, private electrical contractors with $21 million in revenue average a 5.0x multiple, but those with $95 million in revenue can command a 7.8x multiple. These valuation figures also shift significantly depending on the industry specialization.

Subsector Influence

Specialized trades often achieve higher valuations than general construction firms. HVAC and plumbing businesses lead the pack with an average multiple of 5.1x, closely followed by electrical contractors at 5.0x. In comparison, commercial and heavy construction firms average just 3.2x, and residential home builders lag slightly behind at 3.1x.

The type of revenue a business generates is just as critical as its subsector. BMI Mergers & Acquisitions highlights this dynamic:

"An HVAC business primarily involved in new construction projects might sell at 4x EBITDA. In contrast, a company of similar size with a significant service and replacement component might sell for 6x EBITDA".

These differences underscore how revenue streams and specialization shape private market valuations.

Key Multiples Drivers

Certain factors can significantly influence EBITDA multiples for private construction firms. One major factor is owner dependence, which tends to lower valuations. Companies that document their procedures and build strong management teams are seen as less risky by buyers, leading to higher multiples. Evan Bailyn, Founder of FirstPageSage, explains:

"Construction companies that prioritize documentation and delegation are more likely to earn a higher multiple".

Other critical drivers include workforce stability, customer concentration, and acquisition financing options. For example, the industry faces a labor shortage of 500,000 unfilled positions, which can weigh on valuations unless firms demonstrate a strong talent pipeline. Similarly, complex accounting practices can deter buyers unless businesses show clear and reliable financial controls.

Private equity firms have increasingly targeted sub-$25 million construction companies, especially in fragmented niches like HVAC, plumbing, and electrical. These smaller contractors have seen average growth rates of 25%, creating opportunities for premium valuations among well-structured private firms.

How Professional Buyers Use EBITDA Multiples to Value My Business | Key Factors to Consider

Pros and Cons

Looking at the earlier valuation analysis, it's clear that public and private construction companies operate under very different valuation conditions, each with its own set of advantages and challenges. Recognizing these differences is crucial for business owners and investors aiming to set realistic expectations when assessing EBITDA multiples.

Public construction firms enjoy the benefits of immediate price discovery and access to global capital markets. However, their valuations are highly sensitive to daily market sentiment, interest rates, earnings reports, and overall economic conditions. For instance, as of July 2025, public Construction & Engineering firms trade at an average of 9.43x EBITDA, while Construction Materials companies reach 10.74x EBITDA. Mark Woodbury of Minerva Equity captures the contrasting reality for private businesses:

"Buying a small to mid-sized business means that you are responsible for the operation of the company... this added complexity... means that businesses sell for much lower profit multiples than their publicly traded peers".

On the other hand, private construction businesses typically trade at much lower multiples, with an average of 2.55x EBITDA from 2020 to 2024. Yet, these multiples tend to remain steady, even through periods of economic turbulence. According to BizBuySell, "valuation multiples across the broader building and construction space have remained remarkably consistent, with only modest fluctuations through the Covid-19 pandemic and ensuing economic volatility". This stability is largely due to the essential nature of construction services and the smaller pool of buyers who understand the operational demands of these businesses.

Here’s a quick comparison of how public and private construction firms differ in key valuation aspects:

| Feature | Public Construction Companies | Private Construction Businesses |

|---|---|---|

| Valuation Consistency | High volatility; influenced by daily market news | Stable; multiples show little change despite macroeconomic shifts |

| Market Access | Broad; global equity and bond markets | Limited; reliant on local banks, private equity, or seller financing |

| EBITDA Multiples | Generally 8x–15x+ depending on the sector | Typically 2x–5x for small to mid-sized firms |

| Investor Type | Passive (institutional and retail investors) | Active (owner-operators or private equity firms) |

| Economic Response | Highly reactive to interest rates and global trends | More resilient; valuations often withstand broader economic pressures |

These differences highlight the unique financial characteristics of public versus private construction firms. Private companies often face a 20%–30% discount due to illiquidity, making the decision between public and private benchmarks heavily dependent on factors like company size, operational complexity, and the type of buyer. These considerations play a critical role in shaping investment strategies within the construction sector. For those looking to execute these strategies, Entrepreneurship Through Acquisition (ETA) provides a structured path for operators to acquire and scale such firms.

Conclusion

EBITDA multiples in the construction industry highlight key differences between the public and private sectors. Public construction companies tend to command higher multiples due to their larger scale and greater liquidity, whereas private firms generally fall within the 2.0x to 4.5x range. These disparities stem from variations in liquidity, operational demands, and overall scale.

In the private sector, factors like sub-sector focus and company size play a major role in valuations. For instance, electrical and HVAC contractors typically see median multiples ranging from 4.1x to 4.6x, while general commercial construction averages closer to 3.2x. Larger firms also tend to achieve higher multiples; electrical contractors with $95 million in revenue average 7.8x EBITDA, compared to just 5.0x for those generating $21 million. Additionally, service-oriented businesses often outperform. An HVAC firm specializing in maintenance and replacement might sell for 6.0x EBITDA, while one focused solely on new construction could see a multiple closer to 4.0x. These details are critical for sellers aiming to optimize their exit and for buyers structuring competitive offers.

For sellers, improving valuation often comes down to reducing owner dependence and building recurring revenue streams. As Evan Bailyn of FirstPageSage explains:

"Construction companies that prioritize documentation and delegation are more likely to earn a higher multiple".

Buyers, on the other hand, should target asset-light businesses with strong management teams and a diversified customer base. Paying close attention to specialized contracts and subcontractor relationships during due diligence is also essential.

This valuation framework directly impacts transaction strategies. Clearly Acquired simplifies the process with its AI-powered platform, which supports valuation analysis, exit preparation, and deal management. The platform helps sellers by analyzing industry multiples, normalizing financials, and marketing to a wide network of qualified buyers. For buyers, it provides access to verified deal opportunities, AI-driven financial screening, and acquisition financing options, including SBA 7(a) loans, conventional loans, and structured equity. It also manages secure data rooms and optimizes capital stacks to ensure smooth deal closures.

FAQs

Why do public construction companies typically have higher EBITDA multiples than private ones?

Public construction companies tend to command higher EBITDA multiples for a few important reasons. For starters, their shares trade on liquid markets, making them easier for investors to buy and sell. This accessibility boosts their appeal. Additionally, public companies are held to strict regulatory and financial reporting standards, which help lower perceived risks by offering greater transparency.

On the other hand, private firms often deal with an illiquidity discount since their shares aren't as easily traded. They also face higher risk premiums due to less oversight and more limited access to capital markets. These factors create a noticeable valuation gap between public and private construction companies.

How does the size of a construction business affect its EBITDA multiple?

The valuation multiple of a construction business is closely tied to its size, often assessed through EBITDA or revenue. Larger companies tend to secure higher multiples because they offer steadier cash flows, a broader range of projects, and cost advantages from economies of scale - all factors that lower risk for potential buyers. For instance, companies with an EBITDA exceeding $3 million might achieve multiples in the 10–12× range, whereas smaller firms with EBITDA below $1 million typically land in the 4–6× range.

This gap highlights the difference in perceived risk and growth opportunities between larger and smaller businesses. For both buyers and sellers, recognizing how EBITDA growth impacts valuation is key. AI-driven tools can assist in modeling these variations and quantifying the added market value that comes with scale.

What factors increase EBITDA multiples for specialized construction businesses?

When it comes to specialized construction businesses, EBITDA multiples tend to be higher for companies that showcase strong fundamentals and distinct advantages. What drives these higher valuations? Factors like recurring service contracts, higher-than-average profit margins, and clear competitive edges in their respective markets play a big role. Additionally, businesses with experienced leadership, low employee turnover, and a loyal customer base are often more appealing to buyers, which pushes their valuations even higher.

Trades such as HVAC, plumbing, and electrical services often enjoy higher multiples. Why? These services are essential, consistently in demand, and show promising growth potential. Companies that can scale their operations or have room to expand become even more attractive to potential buyers, further enhancing their overall valuation.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)