Not sure whether to hire an industrial M&A advisor or a local business broker? Here’s the quick answer:

- Local Business Brokers: Best for small, owner-operated businesses with annual revenue under $2 million. They focus on simpler sales, often in consumer-facing industries like restaurants or retail, and connect sellers with local buyers. Fees are typically 8%-10% of the sale price, with no upfront costs.

- Industrial M&A Advisors: Ideal for larger, more complex businesses generating $2 million to $150 million+ in revenue. They manage intricate deals involving private equity, strategic buyers, or cross-border transactions, often requiring upfront retainers and charging 1%-12% based on deal size.

Key differences:

- Brokers handle smaller, local transactions with straightforward processes.

- M&A advisors specialize in high-value, multi-party deals requiring advanced financial tools and broader buyer networks.

Quick Tip: If your business is valued under $2 million, go with a broker. For deals above $5 million or involving complex terms, choose an M&A advisor. For businesses in the $1-$5 million range, assess the complexity of the sale.

What Industrial M&A Advisors Do

Definition and Role of Industrial M&A Advisors

Industrial M&A advisors help mid-to-large companies - typically those with annual revenues between $5 million and $150 million - navigate the complexities of mergers and acquisitions in industries like manufacturing, technology, healthcare, and construction.

These advisors act as the "quarterbacks" of the transaction process, managing teams of attorneys, accountants, and other professionals to ensure the deal runs smoothly. Their focus goes beyond current cash flow, emphasizing strategic positioning. They aim to connect sellers with buyers who can create value by expanding markets or integrating products. This strategic approach highlights the advanced expertise these advisors bring to the table.

Services Provided by Industrial M&A Advisors

M&A advisors use financial models such as EBITDA, discounted cash flow (DCF), and synergy assessments to determine a business's true value. Their valuation process looks at more than just past sales; it includes intellectual property, strategic opportunities, and future growth potential.

"The advisor will be quarterbacking accountants, attorney's, bankers, asset lenders, buyers, and most importantly, the seller." - Benjamin Engel, M&A Advisor

They structure deals using tools like earnouts, rollover equity, and seller financing. A key part of their role is running a structured sale process designed to create competition among multiple bidders. With access to extensive national and international buyer networks, they go beyond local markets to find the right fit, rigorously vetting buyers for both their financial strength and alignment with the seller’s goals.

Businesses That Benefit from Industrial M&A Advisors

Companies with complex operations - such as those managing multiple locations, large employee bases, or cross-border transactions - are prime candidates for M&A advisory services. Transactions typically range in value from $2 million to $200 million, making the specialized skills of an M&A advisor a worthwhile investment.

Legislation passed in 2022 (HR 2617) exempts many M&A advisors from FINRA licensing for deals involving companies with less than $250 million in revenue or $25 million in EBITDA. These guidelines help determine when hiring an M&A advisor is the right move. Business owners should seek advisors with professional certifications like the Merger & Acquisition Master Intermediary (M&AMI) or Certified Merger & Acquisition Advisor (CM&AA).

sbb-itb-a3ef7c1

What Local Business Brokers Do

Definition and Role of Local Business Brokers

Local business brokers focus on helping small, locally owned businesses - often called "Main Street businesses" - navigate the process of buying and selling. These businesses include everything from dry cleaners and hair salons to restaurants, auto repair shops, convenience stores, franchises, and small manufacturing or service operations.

Typically, these brokers handle businesses with annual revenues under $5 million, but their sweet spot is often those earning less than $1 million. Deals they manage usually fall below $2 million in value. Unlike larger transactions involving private equity firms or corporations, the buyers here are usually individuals looking to replace their income by running the business themselves, rather than treating it as a hands-off investment.

"Main Street businesses are many times referred to as 'mom and pops' and generally include businesses such as dry cleaners, hair salons, restaurants, auto and truck services centers, convenience stores, franchises, small manufacturing and service businesses..." – Worldwide Business Brokers

By understanding this niche, it becomes easier to see how brokers bring value to the table during the sale process.

Services Provided by Local Business Brokers

Local business brokers manage every step of the sales process for small business owners. Their work begins with a business valuation, where they assess factors like sales figures, location, and profitability. A key tool they use is Seller’s Discretionary Earnings (SDE), applying multiples of 2.0x to 3.0x SDE to determine a fair asking price.

To attract buyers, brokers often employ a "shotgun" marketing strategy, listing businesses on public platforms designed for business sales. This approach ensures maximum visibility, which is particularly effective for small businesses, where confidentiality concerns are less pressing than with larger companies.

"Business brokers guide the sale and purchase of small, Main Street businesses, offering expertise in legal, financial, and confidentiality aspects." – Investopedia

Beyond marketing, brokers screen potential buyers to weed out those who lack the funds or experience needed to run the business. They also simplify the documentation process, often relying on seller-provided tax returns or QuickBooks data rather than requiring audited financial statements.

Most brokers work on a commission-only basis, charging fees between 5% and 10% of the transaction value. This structure incentivizes them to close deals efficiently.

Businesses That Benefit from Local Business Brokers

If your business generates less than $5 million in annual revenue, especially if it’s consumer-facing - like a restaurant, retail store, or personal service business - a local business broker is likely your best option. This is particularly true for businesses where the owner plays a central role in daily operations and there’s no separate management team in place.

For smaller businesses valued under $1 million to $2 million, brokers are often the only practical choice, as larger M&A firms typically won’t handle these smaller deals. Brokers excel in situations where buyers are local individuals, entrepreneurs, or small-scale investors, rather than large institutional players.

When choosing a broker, it’s wise to look for certifications like Certified Business Intermediary (CBI). In states such as Florida and California, brokers are also required to hold real estate licenses. However, it’s worth noting that high-volume brokers may only sell 20% to 30% of their listings. Opting for a broker who prioritizes quality over quantity can make a big difference.

Business Broker vs Meger & Acquisition Advisor. Which one is right for you.

Industrial M&A Advisors vs. Local Business Brokers: Main Differences

Industrial M&A Advisors vs Local Business Brokers: Key Differences Comparison

Expertise, Services, and Network Differences

When it comes to selling businesses, the approach and expertise of local business brokers and industrial M&A advisors differ significantly. Business brokers typically focus on smaller, "Main Street" businesses, while M&A advisors handle transactions in the lower-middle to middle markets, with deal sizes ranging from $2 million to over $200 million.

The valuation methods they use also set them apart. Business brokers often rely on straightforward calculations based on current sales and profitability. On the other hand, M&A advisors use more advanced models that incorporate factors like growth potential, intellectual property, and synergies. As Andrew Rogerson, a Certified M&A Advisor, puts it:

"Business brokers tend to focus on Main Street businesses with annual revenue of less than $2M while an M&A Advisor will focus on selling a business with $2M and above".

The buyer networks are another key difference. Brokers generally connect with local buyers, such as individual entrepreneurs or owner-operators. M&A advisors, however, reach a much broader audience, leveraging national and even global networks that include private equity firms, strategic corporations, and high-net-worth individuals. Many M&A advisors also utilize proprietary databases containing hundreds of thousands of potential buyers.

Specialization is another hallmark of M&A advisors. They often develop expertise in niche industries, such as CNC manufacturing or industrial services, to handle complex valuations and regulatory challenges. Business brokers, by contrast, tend to serve a wider range of local businesses, from retail stores to small service providers. Jonah Pollone from MidStreet Mergers & Acquisitions highlights this distinction:

"As deals go up in size, expertise in the industry of the business being sold is important".

The structure of their operations also varies. M&A advisors work with specialized teams that include analysts, legal experts, and tax advisors, offering detailed guidance throughout the deal process and even post-sale support. Business brokers, often solo practitioners, manage a higher volume of transactions but tend to have lower closure rates.

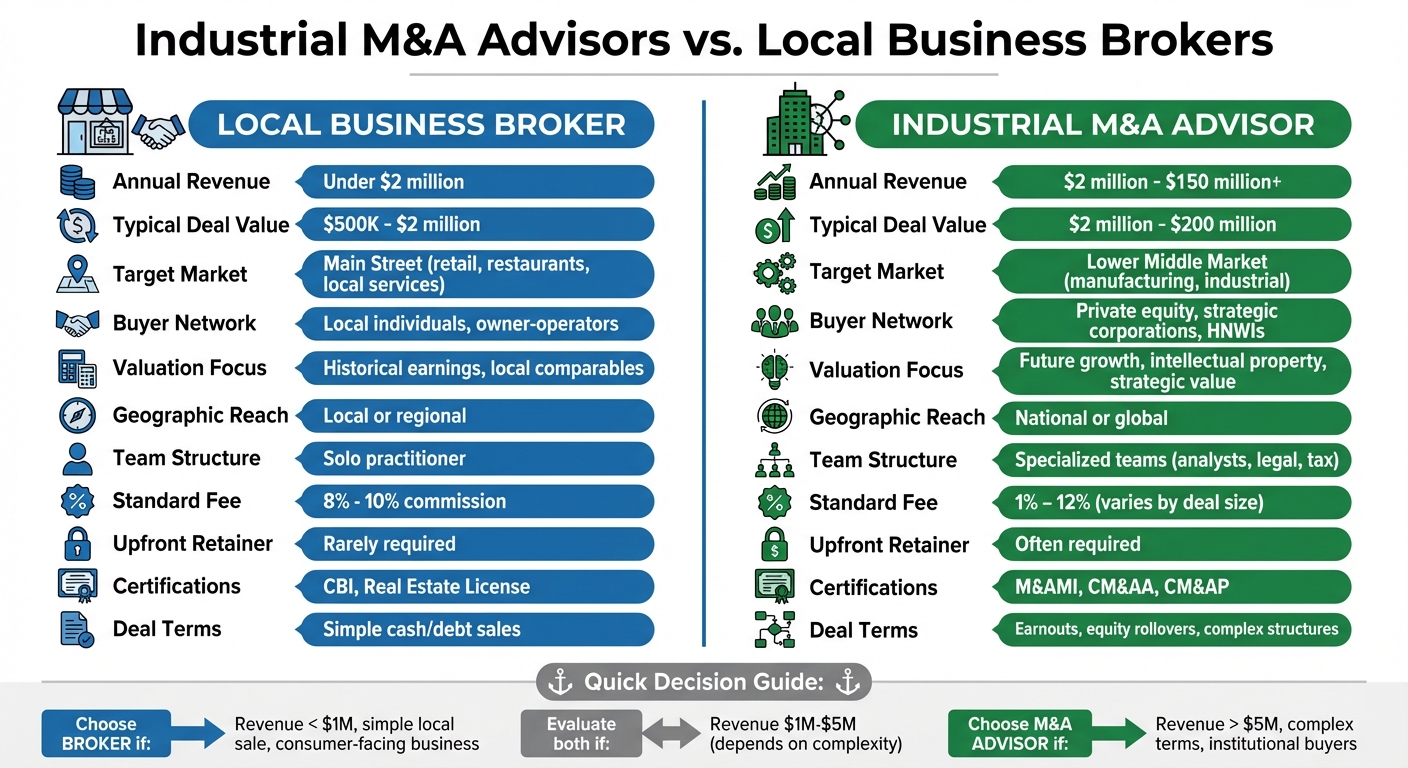

To sum it up, the table below highlights the main contrasts between local business brokers and industrial M&A advisors.

Side-by-Side Comparison Table

| Criteria | Local Business Broker | Industrial M&A Advisor |

|---|---|---|

| Annual Revenue | Under $2 million | $2 million – $150 million+ |

| Typical Deal Value | Under $1 million – $2 million | $2 million – $200 million |

| Target Market | Main Street (retail, local services) | Lower Middle Market (manufacturing, industrial) |

| Buyer Network | Local individuals, owner-operators | Private equity, strategic corporations, HNWIs |

| Valuation Focus | Historical earnings and local comparables | Future growth, intellectual property, strategic value |

| Geographic Reach | Local or regional | National or global |

| Team Structure | Often solo practitioner | Specialized teams (analysts, legal, tax) |

| Standard Fee | 8% – 10% commission | 1% – 12% (varies by deal size) |

| Upfront Retainer | Rarely required | Often required for marketing materials |

| Certifications | CBI, Real Estate License | M&AMI, CM&AA, CM&AP |

| Deal Terms | Simple cash/debt sales | Earnouts, equity rollovers, complex structures |

When to Hire an Industrial M&A Advisor

The size of your transaction plays a big role in deciding whether to hire an M&A advisor. Local business brokers often focus on smaller companies - those generating less than $1 million in annual revenue or with an enterprise value under $5 million. If your business surpasses these thresholds, especially in the lower-middle to middle market, bringing in an M&A advisor is a smart move.

Another key factor is the type of buyers your business attracts. If private equity firms, strategic acquirers, or family offices are showing interest - rather than individual owner-operators - an M&A advisor is essential. As Benjamin Engel points out, these advisors manage the coordination of professionals like attorneys, accountants, and bankers, ensuring that buyer due diligence is handled smoothly. This coordination becomes even more critical when dealing with institutional buyers who demand thorough and detailed reviews.

The complexity of the deal also matters. Transactions involving stock sales, earnouts, equity rollovers, or seller financing require advanced legal and tax planning, which often exceeds the capabilities of a traditional business broker. Additionally, if your business has operations across multiple locations or needs a national or international buyer search, an M&A advisor's extensive network can make all the difference.

Don’t overlook your internal capacity, either. If you lack the resources to manage the professionals involved in a sale, an M&A advisor can step in to handle this critical role. This support is especially important for businesses with significant intangible assets or those in the "MidStreet" range - companies with revenues between $1 million and $30 million. For these businesses, advisors with middle-market expertise offer valuable strategic guidance.

Finally, if your business holds intellectual property, has intricate operational structures, or offers strategic value that goes beyond its current earnings, an M&A advisor can help position these assets in the best possible light. Their tailored strategies often lead to stronger outcomes for complex and high-stakes transactions.

When to Hire a Local Business Broker

Local business brokers are usually the go-to professionals for selling smaller businesses. They typically work with owner-operated, consumer-focused companies generating less than $1 million in annual revenue, though some handle businesses with revenues up to $5 million. Their expertise lies in what’s often called "Main Street" transactions - businesses managed by their owners.

These brokers shine in consumer-facing industries such as restaurants, retail stores, HVAC repair, and carpentry. Ryan Kuhn highlights their specialization in local B2C enterprises.

One of their key advantages is affordability. Most local brokers operate on a commission-only basis, meaning you only pay when your business sells. The typical commission hovers around 10% of the sale price, and there are no upfront fees.

"Business brokers typically charge 10% of the sale price, but have no upfront fees, meaning you pay nothing until your business is sold." - Calhoun Companies

Local brokers also bring valuable regional expertise. They’re deeply connected within their communities and familiar with local market conditions. This allows them to introduce you to trusted professionals - like CPAs and attorneys - who understand state-specific regulations, such as California's bulk sale laws. This localized knowledge, combined with straightforward transaction processes, makes them an ideal choice for uncomplicated sales.

Unlike M&A advisors who handle intricate, multi-party deals, local brokers are best suited for simpler transactions that stay within the local market. If your sale doesn’t involve stock transfers, earnouts, or equity rollovers, and you’re looking for a quick, cost-effective deal with an individual buyer, a local broker offers the right mix of expertise and affordability. They typically handle transactions in the $500,000 to $2 million range.

How to Choose the Right Advisor for Your Business

Start by evaluating the size of your transaction. If your deal is under $1 million, a local broker is often the best choice. For transactions between $1 million and $5 million, your decision will depend on how complex the deal is. For deals over $5 million, working with an M&A advisor is generally the way to go.

Next, think about how complex your sale might be. If your transaction includes elements like stock transfers, earnouts, rollover equity, or third-party financing, an M&A advisor is better equipped to handle those nuances. On the other hand, simpler asset sales are usually well within the capabilities of a broker.

Your industry and the type of buyer you’re targeting also play a big role. For example, consumer-facing businesses - like restaurants or retail stores - are often a good match for brokers. However, B2B companies might require an M&A advisor with connections to private equity firms or strategic buyers. These considerations, alongside the earlier points, can help you zero in on the right advisor for your specific needs.

"A firm's title is far less important than its capabilities... Success in a business sale depends on aligning your company's attributes and goals with the expertise and approach of the advisor you choose." - BMI Mergers

Clearly Acquired offers support for Main Street and lower-middle-market transactions through a platform that connects you with qualified professionals. Whether your deal is $100,000 or tens of millions, you can choose between full-service representation or specific services like financial analysis, buyer screening, or acquisition financing, tailoring the support to fit your needs.

Conclusion

When it comes to selling a business, selecting the right advisor is critical. For simpler, low-value transactions - like businesses generating under $1 million in revenue - a local business broker is often the best choice. These brokers specialize in connecting sellers with local buyers efficiently. On the other hand, for high-value, intricate deals exceeding $5 million - especially those involving earnouts or private equity - a seasoned industrial M&A advisor is essential. Their expertise and extensive buyer networks are invaluable for navigating complex sales. For deals in the $1 million to $5 million range, the decision depends on the specific complexity of the transaction.

"A firm's title is far less important than its capabilities… Success in a business sale depends on aligning your company's attributes and goals with the expertise and approach of the advisor you choose." - BMI Mergers & Acquisitions

Clearly Acquired simplifies this process by connecting business owners with qualified professionals. Whether you need full-service representation or specific services like financial analysis, buyer screening, or assistance with acquisition financing, the platform offers flexible solutions tailored to your transaction's size and complexity. It caters to businesses across the Main Street and lower-middle-market spectrum.

"Choosing the right intermediary will give you the best chance at a successful outcome and, depending on the size of your business, save you hundreds of thousands of dollars." - Jonah Pollone, MidStreet

FAQs

How do I decide between an industrial M&A advisor and a local business broker?

Choosing between a business broker and an M&A advisor comes down to the size, complexity, and industry of your business. If your business is smaller - generally under $2 million in annual revenue - and operates in industries like retail or food service, a business broker might be the right fit. They’re experienced in handling straightforward transactions, often for local, Main Street businesses.

On the other hand, M&A advisors are equipped to manage larger, more intricate deals, typically involving businesses with revenues exceeding $10 million. These professionals work with specialized industries like technology or manufacturing and often handle transactions that involve complex structures, such as mergers or financing arrangements. They’re also adept at managing cross-border or institutional deals, making them a better option for businesses with more sophisticated needs.

The decision ultimately hinges on your business’s unique characteristics and transaction goals. Think about the level of expertise and the reach required to ensure the process is smooth and successful.

How do M&A advisors and business brokers value businesses differently?

M&A advisors often determine a business's value using multiples of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). This method emphasizes profitability and suits larger, more complex transactions typically involving institutional or strategic buyers. It's a common approach for deals in the lower-middle market and higher, where the focus is on a company’s operational performance rather than owner-specific factors.

In contrast, business brokers tend to use multiples of SDE (Seller’s Discretionary Earnings). This valuation method works well for smaller, owner-operated businesses because it factors in the owner's personal benefits and discretionary expenses. The choice of valuation metric reflects the nature of the transactions each professional specializes in - M&A advisors handle larger, more intricate deals, while business brokers concentrate on smaller, community-focused sales.

When should you pay an upfront retainer for an M&A advisor?

Paying an upfront retainer to an M&A advisor often makes sense for larger, more intricate transactions, especially when dealing with businesses valued at $5 million or more. These types of deals typically demand a high level of expertise, in-depth financial analysis, and strategic negotiation skills. All of this requires significant time and resources from a dedicated advisor.

The retainer helps fund critical services such as business valuation, market research, and managing the deal process. This ensures that the advisor remains fully focused on securing the best outcome for your transaction. On the other hand, for smaller or less complicated deals - usually those under $5 million - a success-based commission structure without an upfront fee might be enough. These transactions often involve less complexity and require fewer resources.

In the end, whether or not to pay a retainer depends on the size and complexity of your deal and how much personalized attention you need to achieve the best results.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)