If you're considering selling your medical practice or evaluating a partner buyout, understanding healthcare multiples is essential. These multiples are financial ratios that link your practice's value to key metrics like Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Here's why they matter:

- Higher multiples = higher valuation: A shift from a 6x to a 7x EBITDA multiple can mean millions in added value.

- Key factors influencing multiples: Specialty, practice size, payer mix, revenue sources, and growth potential.

- 2025 trends: Median healthcare services EBITDA multiples are projected to drop to 11.5x from 14.5x in 2024 due to tighter credit and rising costs.

To calculate your practice's value:

Adjusted EBITDA × Multiple = Value

For example, a practice with $1 million in EBITDA and a 7x multiple is worth $7 million. Larger practices or those in high-demand specialties like cardiology or oncology often command significantly higher multiples.

Quick Tips to Maximize Value:

- Diversify revenue streams (e.g., add ancillary services like ASCs or labs).

- Maintain a strong commercial insurance payer mix (70%+ preferred).

- Focus on retaining younger physicians under long-term contracts.

Accurate valuation requires up-to-date market data and careful adjustments to EBITDA. Even a small difference in multiples can greatly impact your transaction value.

Medical Practice Valuation & Current Trends in Physician Practice Transaction

sbb-itb-a3ef7c1

What Are Healthcare Multiples?

Healthcare multiples are financial ratios that help buyers and investors estimate the value of your medical practice. Essentially, they compare your practice's worth to a financial metric - like revenue or earnings - to turn financial performance into a dollar value.

These ratios are based on real market conditions. Experts use the market approach, analyzing recent sales of similar practices, to determine current multiples. This means your practice’s value is benchmarked against actual transactions in your specialty and region.

For a precise valuation, financials need to be normalized. This involves removing one-time expenses, excess owner compensation, and other non-recurring items. These adjustments reveal the true earning potential of your practice under typical operating conditions. Let’s explore how these multiples translate into straightforward valuation calculations.

How Valuation Multiples Work

Valuation multiples are straightforward ratios that link your practice’s value to a financial metric from your records. The formula looks like this:

Practice Value = Financial Metric × Multiple

For instance, if your adjusted EBITDA is $1 million and comparable practices in your specialty are selling at a 7x multiple, your estimated value would be $7 million.

Higher multiples usually reflect investor confidence in your practice’s stability, growth potential, and cash flow. On the other hand, lower multiples might indicate potential risks, such as reliance on the owner or irregular revenue. Nick Hernandez, Founder & CEO of ABISA, LLC, explains this shift in valuation methods:

"Practice values used to be referred to as a percentage of collections, but today's most common reference point is a multiple of earnings before interest, taxes, depreciation, and amortization (EBITDA)".

Common Multiple Types in Medical Practice Valuations

When valuing medical practices, three types of multiples are commonly used. The choice depends on the practice’s size and structure.

- Revenue multiples: These compare the practice's value to its total revenue. For medical practices, revenue multiples typically range from 0.69x to 0.93x of annual revenue. While this method provides a quick estimate, it doesn’t factor in profitability differences.

- Seller’s Discretionary Earnings (SDE) multiples: SDE reflects the total financial benefit an owner-operator receives, including net profit, salary, benefits, and personal expenses run through the business. For smaller practices, SDE multiples generally range from 1.65x to 2.52x. This approach works well for solo practitioners or small clinics where the owner is deeply involved in operations.

- EBITDA multiples: These are the go-to standard for most practice sales. EBITDA measures core operational profitability on a debt-free basis. Standard medical practices typically see EBITDA multiples between 2.61x and 3.61x, though larger practices or high-demand specialties often command higher multiples. Investors prefer EBITDA because it highlights cash-generating potential and allows consistent comparisons across different practice models.

Industry-wide, the median healthcare services EV/EBITDA multiple is expected to moderate to about 11.5x in 2025, down from 14.5x in 2024, due to tighter credit markets and rising physician compensation costs. However, these averages can vary significantly depending on factors like your specialty, practice size, payer mix, and growth outlook.

What Affects Medical Practice Valuation Multiples

Valuation multiples for medical practices vary depending on several key factors that buyers consider when determining a purchase price. By understanding these elements, you can better assess your practice's position and identify opportunities to boost its value.

Here’s how revenue sources, payer mix, and practice size influence valuation multiples.

Revenue Sources and Profit Margins

Revenue streams with higher profit margins, such as ambulatory surgery centers (ASCs), diagnostic imaging, pathology labs, and cardiac catheterization labs, indicate stable cash flow and diversified income. These high-margin ancillaries can increase EBITDA multiples by 1–3x.

The type of services offered also affects stability. For instance, oncology and primary care are considered recession-resistant due to consistent demand, even during economic downturns. On the other hand, specialties like plastic surgery and aesthetics, while highly profitable, are more volatile in tougher economic times. This volatility can compress multiples despite strong profitability. Practices with diverse service lines often command higher valuations by minimizing revenue concentration risks.

Payer Mix and Local Market Conditions

The payer mix has a direct impact on the quality of revenue. Practices with over 70% of their revenue coming from commercial insurance or meaningful cash-pay income can achieve valuation multiples that are 40–60% higher than those heavily reliant on government payers. Commercial insurance contracts typically offer better reimbursement rates, fewer claim denials, and more predictable collections.

For example, practices with over 50% Medicaid patients tend to trade at EBITDA multiples between 4.0x and 6.5x. In contrast, practices with a predominantly commercial insurance payer base can reach multiples between 8.5x and 12.0x. Eric Yetter, Managing Director at FOCUS Investment Banking, highlights the importance of a balanced payer mix:

"Payor mix = quality of earnings: Well-diversified, in-network payor strategies are preferred, with government pay appropriate for the service line".

Location also plays a role. Urban practices with high demand and limited competition often secure multiples that are 1–2x higher, thanks to stronger payer negotiation power and steady referral streams.

Practice Size, Specialty Type, and Growth Opportunities

Larger practices typically command significantly higher multiples. Those generating over $5 million in EBITDA can achieve multiples that are 80% higher than smaller practices earning under $1 million. Larger "platform" practices are particularly attractive because they offer professional management, lower operational risks, and established systems - earning 3–5x higher multiples compared to smaller "add-on" practices.

Specialty type also plays a big role. For example, in 2025, oncology and urology platform practices are expected to command multiples of 14x–19x, while primary care practices range from 8x–12x. Strategic buyers, such as McKesson (which acquired Core Oncology for $2.49 billion in 2024) and Cencora (which purchased Retina Consultants of America for $4.6 billion), often pay 20–40% more than financial buyers when vertical integration synergies are present.

Additionally, strong physician retention can elevate multiples. Practices with younger physicians under long-term contracts or a diverse provider team often secure a 1–2x premium, as they reduce dependency on any single key physician. A well-documented growth plan - outlining how the practice can expand to new locations or add services - further boosts buyer confidence and justifies higher valuations.

Healthcare Multiples by Specialty and Practice Size

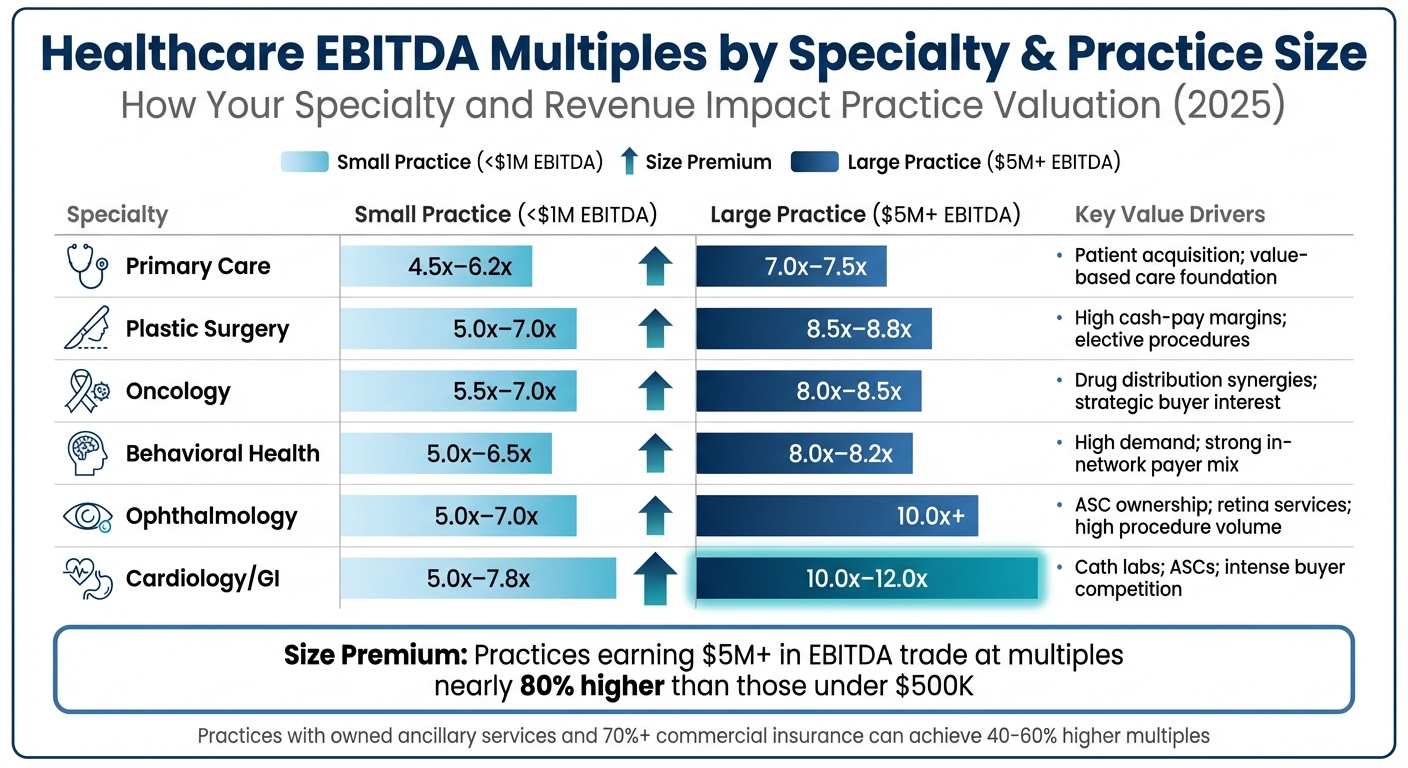

Medical Practice EBITDA Multiples by Specialty and Size

When it comes to healthcare valuations, multiples can vary significantly depending on both the specialty and the size of the practice.

Primary Care vs. Specialty Practice Valuations

Primary care practices generally trade at 7.0x–7.5x EBITDA for mid-sized operations. This valuation reflects their role as the "front door" of the healthcare system and their recession-resistant nature, even though they tend to have thinner profit margins.

On the other hand, specialty practices like cardiology, gastroenterology, and ophthalmology command much higher multiples, often in the range of 10.0x–12.0x EBITDA for larger platforms. These higher valuations are driven by their higher-margin procedures and the inclusion of ancillary services. For instance, cardiology practices with cardiac catheterization labs or GI practices with owned ambulatory surgery centers (ASCs) can see their multiples increase by 1–3 turns. Oncology practices also stand out, averaging 8.0x–8.5x EBITDA, as they attract interest from strategic buyers like McKesson, which acquired Core Oncology for $2.49 billion in 2024–2025. Such acquisitions highlight the appeal of vertical integration opportunities in oncology.

These differences in valuation are further influenced by the size of the practice.

How Practice Size Changes Multiples

The size of a practice plays a critical role in determining its valuation. Smaller practices generating under $500,000 in EBITDA typically trade at around 4.5x, while those earning $5 million or more in EBITDA can achieve multiples as high as 11.3x - a dramatic difference of nearly 80%.

According to Eric Yetter, Managing Director at FOCUS Investment Banking:

"Practices at ~$5M+ EBITDA often trade 2-4 multiple turns above smaller add-ons. Larger PE platforms can achieve multiples into the teens".

Larger practices are often seen as "platforms", capable of supporting professional management, regional growth, and corporate infrastructure. In contrast, smaller practices are typically viewed as "add-ons", which carry more execution risk and often depend heavily on a single owner-operator. Strategic buyers and private equity firms are willing to pay a premium for platform practices that serve as a foundation for scaling operations.

EBITDA Multiple Comparison Table

| Specialty | Small Practice (<$1M EBITDA) | Large Practice ($5M+ EBITDA) | Key Value Drivers |

|---|---|---|---|

| Primary Care | 4.5x–6.2x | 7.0x–7.5x | Patient acquisition; foundation for value-based care |

| Plastic Surgery | 5.0x–7.0x | 8.5x–8.8x | High cash-pay margins; elective procedures |

| Oncology | 5.5x–7.0x | 8.0x–8.5x | Drug distribution synergies; strategic buyer interest |

| Behavioral Health | 5.0x–6.5x | 8.0x–8.2x | High demand; strong in-network payer mix |

| Ophthalmology | 5.0x–7.0x | 10.0x+ | ASC ownership; retina services; high procedure volume |

| Cardiology/GI | 5.0x–7.8x | 10.0x–12.0x | Cath labs; ASCs; intense buyer competition |

Practices with owned ancillary services - such as imaging centers, pathology labs, or surgery centers - consistently achieve higher valuations. Additionally, practices with a strong commercial insurance payer mix (over 70%) can see their multiples increase by 40–60% compared to those relying primarily on government payers.

These distinctions underscore how specialty and size shape the valuation landscape for healthcare practices, making tailored strategies essential for maximizing value.

How to Calculate Your Medical Practice Value Using Multiples

Valuation Calculation Steps

Calculating the value of your medical practice using multiples comes down to a simple formula: Adjusted EBITDA x EBITDA Multiple = Transaction Value. But to get an accurate result, you need precise numbers before applying the multiple.

Start by calculating your Adjusted EBITDA. This begins with your net profit, to which you add back items like interest, taxes, depreciation, amortization, and any one-time expenses. Examples of such expenses might include legal settlements, COVID-19-related costs, or personal expenses like auto leases or non-business travel. Another critical step is adjusting for owner compensation. Add back what you and your partners currently pay yourselves, then subtract the fair market value of replacing your clinical services. Don’t forget to include pro-forma adjustments for near-term growth opportunities, like a new physician who hasn’t yet reached full productivity.

Once you’ve got your Adjusted EBITDA, the next step is choosing the right multiple. This depends on factors like your specialty, practice size, and stability indicators such as payer mix and the strength of your provider bench. For instance, a practice generating $1,350,000 in annual revenue with a 0.80x revenue multiple would have an estimated value of $1,080,000.

The importance of accuracy becomes clear when you consider the difference between a 7x and a 12x multiple on $1 million in EBITDA - that’s a $5 million swing in transaction value. After calculating your Adjusted EBITDA, the final step is to verify your multiple using up-to-date market data.

Using Market Data for Better Accuracy

Once you’ve determined your Adjusted EBITDA, it’s time to confirm your multiple using current market conditions. Multiples can vary significantly depending on recent comparable sales, investor sentiment, and broader market trends. As Eric Yetter notes:

"Multiples are heavily influenced by investor sentiment in the market including... interest rates on debt used to fund acquisitions."

For a more accurate valuation, update your multiple with fresh data. For example, the median multiple in 2025 is projected at 11.5x, reflecting factors like tighter credit and rising physician compensation costs. Relying on outdated numbers from 2023 could lead to overvaluing your practice by 20% or more.

To fine-tune your valuation, review recent transactions within your specialty and size category. For example, cardiology practices with $5 million in EBITDA may command multiples of 12x–15x, especially if they include additional revenue-generating opportunities. However, practices in other specialties might trade at lower multiples due to differences in market conditions or operational performance. Strategic buyers, such as health systems or distributors, often pay 20–40% more than private equity firms when vertical integration or supply chain synergies are involved. Be sure to use data from completed sales rather than asking prices, which are often inflated by at least 10% due to owner overvaluation.

Certain factors, like having over 70% commercial insurance and keeping Days in Accounts Receivable under 35, can justify achieving the higher end of your multiple range. By aligning your valuation with current market trends, you not only ensure accuracy but also position your practice to maximize its worth - topics explored further in later sections.

How Clearly Acquired Helps Maximize Practice Value

AI-Powered Valuation Tools

Clearly Acquired uses an advanced AI-driven valuation platform to provide an accurate assessment of your practice's value. The process begins with calculating normalized EBITDA by adjusting for one-time expenses, owner benefits, and nonrecurring costs. For instance, a $190,000 adjustment in normalized EBITDA could lead to a $1.3 million change in total practice value.

The platform doesn’t rely on outdated benchmarks. Instead, it applies specialty-specific multiples based on current market trends. It also evaluates critical quality-of-earnings factors, like your payer mix, to determine if your commercial insurance percentage - ideally over 70% - positions you for top-tier outcomes. Additionally, the tool flags potential risks, such as reliance on government payers or dependence on a single provider, which could negatively impact your valuation.

These insights are seamlessly integrated with Clearly Acquired's brokerage and financing services, creating a unified solution for practice valuation and transaction support.

Brokerage Services for Buyers and Sellers

Clearly Acquired provides comprehensive buy-side and sell-side brokerage services to ensure smooth transactions and maximize value. On the sell side, the platform manages financial preparations, screens potential buyers, and strategically positions your practice to attract the right acquirers. Practices involved in M&A-backed transactions often achieve 23% higher multiples compared to deals without such support.

The brokerage team prioritizes finding strategic buyers, such as healthcare distributors, systems, or payers, who may pay 20–40% more than financial buyers due to opportunities for vertical integration or supply chain efficiencies. For buyers, Clearly Acquired identifies both on-market and off-market opportunities, handles financial underwriting, and structures financing to improve deal certainty. By replacing the traditional fragmented advisor model, the platform delivers a streamlined, healthcare-focused M&A process.

This integrated system paves the way for financing strategies tailored to your acquisition goals.

Financing Options for Practice Acquisitions

Securing the right financing is essential for successful practice acquisitions. Clearly Acquired offers a variety of financing options, including SBA 7(a) loans, SBA 504 programs, conventional bank loans, partner buyouts, and growth capital. The platform matches deals to lenders using real underwriting criteria, ensuring an efficient and effective process.

Growth capital financing is especially beneficial for practices looking to expand through services like ambulatory surgery centers, imaging, or labs. These additions can boost EBITDA multiples by 1 to 3 turns. Buyers targeting larger practices with $5 million or more in EBITDA can also benefit from scale premiums, often trading 2 to 4 multiple turns higher than smaller acquisitions. By structuring the ideal mix of debt and equity, Clearly Acquired helps buyers and sellers maximize returns while ensuring transaction certainty.

Conclusion

Healthcare multiples serve as more than just a snapshot of current value - they’re a roadmap for enhancing future worth. As Eric Yetter, Managing Director at FOCUS Investment Banking, puts it:

"Even a single turn in multiple can translate into millions of dollars in transaction value".

Boosting these multiples involves strategies like normalizing EBITDA, diversifying revenue streams, and setting the stage for growth. Whether you're weighing an unsolicited offer, planning a partner buyout, or simply benchmarking your position in the market, multiples provide a clear financial lens to guide your decisions.

To make the most of these insights, a streamlined valuation approach is essential. Clearly Acquired’s platform simplifies the process by calculating normalized EBITDA, applying industry-specific multiples, and identifying quality-of-earnings factors for a precise valuation. It eliminates guesswork by building on proven methods. Additionally, their brokerage team connects you with buyers who align with your goals - whether that’s securing a premium offer or finding financial buyers focused on scalable opportunities. On top of that, their financing services ensure deal certainty with tailored debt and equity solutions.

These tools are especially critical in today’s market. With median multiples hovering around 11.5x and private equity firms involved in over 90% of transactions, having the right advisory resources is no longer optional. Clearly Acquired consolidates what used to require multiple advisors, outdated benchmarks, and fragmented processes into a single, efficient system designed specifically for healthcare M&A.

Ready to unlock your practice’s full potential? It’s time to aim for top-tier multiples.

FAQs

How can I determine the right valuation multiple for my medical practice?

Determining the right valuation multiple for your medical practice involves weighing several key factors. Start by looking at your practice’s size, specialty, and revenue streams. Larger practices or those offering a range of services with consistent profitability often command higher multiples. Another critical aspect is your payer mix - a diverse mix, especially one with a strong proportion of commercial or cash-pay patients, can significantly boost your practice’s valuation.

Broader market conditions also come into play. Economic factors, like credit availability and trends in the healthcare sector, can directly affect valuation multiples. On a more specific level, elements such as how efficiently your practice operates, physician productivity, and whether you’ve incorporated advanced technology or ancillary services can further shape the multiple.

To get an accurate and tailored valuation, it’s a good idea to consult with a professional who can evaluate these variables and align the multiple with your practice’s specific strengths and characteristics.

What factors can increase the value of my medical practice?

Several elements can play a key role in increasing the value of your medical practice. For starters, strong financial performance - steady revenue streams and consistent profitability - makes your practice more appealing to potential buyers. A diverse payer mix is also crucial. Having a balanced mix of commercial insurance, government programs, and cash-paying patients reduces risk and adds to the practice's overall appeal.

Offering ancillary services like imaging, pathology, or outpatient procedures can be another game-changer. These services not only boost revenue but also improve operational efficiency, especially in specialties with high demand. Practices that show growth potential, utilize advanced technology, or focus on a specialized niche are often viewed as scalable and less risky, which can elevate their valuation.

Finally, preparing your practice for sale is essential. This includes keeping thorough documentation, building a strong reputation, and ensuring compliance with all legal and regulatory requirements. These steps can position your practice to receive higher offers in today’s competitive healthcare landscape.

How does the payer mix affect the value of a medical practice?

The payer mix is a critical factor in assessing the value of a medical practice, as it highlights the stability and variety of its revenue streams. A well-rounded mix - blending commercial insurance, Medicare, Medicaid, and cash-paying patients - often leads to higher valuations. Why? Because a diverse payer mix helps spread financial risk and avoids over-reliance on a single source of income, especially when reimbursement rates fluctuate.

Take, for example, a practice that depends heavily on Medicare or Medicaid. These practices may see lower valuation multiples due to the consistent pressure on reimbursement rates. In contrast, practices with a significant portion of commercial insurance or cash-pay patients tend to achieve higher valuations. This is largely because these revenue sources offer steadier cash flow and less exposure to sudden financial shifts.

Striving for a balanced payer mix not only enhances profitability but also strengthens the practice’s market appeal. For buyers or investors, this diversity signals reduced financial risk and a more attractive opportunity.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)