The global waste management industry is projected to grow from $1.43 trillion in 2025 to $1.97 trillion by 2030, driven by a shift toward waste-to-energy and resource recovery models. Public companies like Waste Management trade at high multiples (14.6x EV/EBITDA), while small businesses typically sell for lower multiples (3.31x SDE). Key trends include automation, sustainability regulations, and consolidation through acquisitions. Small businesses with recurring revenue, modernized fleets, and specialized services like PFAS remediation are commanding higher valuations.

Key points:

- Market size: $1.56 trillion revenue forecast for 2026.

- Growth drivers: Sustainability rules, automation, and waste-to-energy.

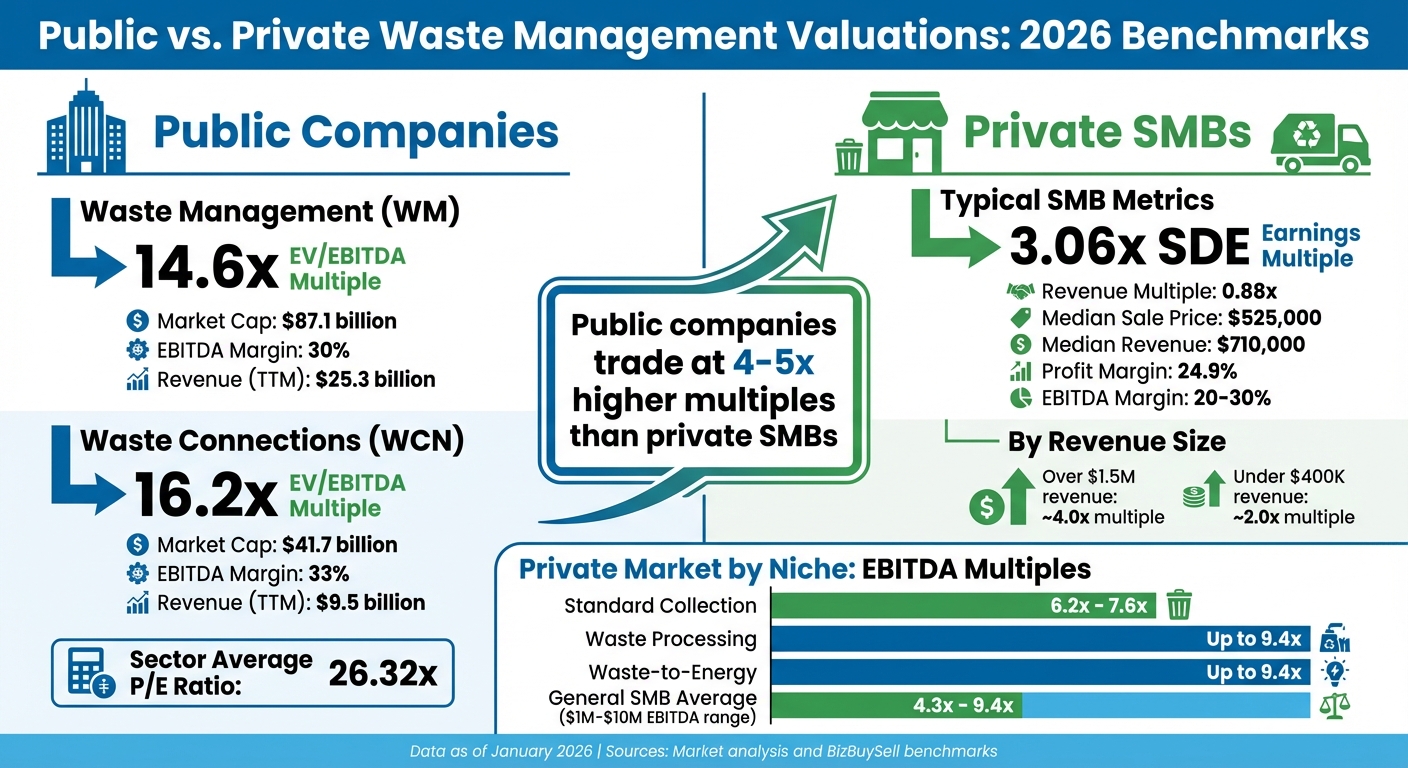

- Valuation multiples: Public firms (14.6x EBITDA) vs. SMBs (3.06x earnings).

- Segment growth: E-waste (7.3% CAGR) and C&D waste (7.89% CAGR) lead.

- SMB sale metrics: Median price $525,000; profit margins 24.9%.

For buyers, targeting businesses with advanced recycling or waste-to-energy capabilities is key. Sellers should focus on route density, recurring contracts, and regulatory compliance to maximize sale prices.

2026 Market Valuations and Projections

Market Size and Growth Factors

The global waste management market is expected to generate $1.56 trillion in revenue by 2026, growing at a compound annual growth rate (CAGR) of 5.5% through 2035. This growth reflects a shift toward resource recovery and energy generation models.

In the U.S., the solid waste management market is projected to hit $172.6 billion in 2026, with a CAGR of 5.3% from 2025 to 2033. Key drivers include compliance with the Resource Conservation and Recovery Act (RCRA), Environmental Protection Agency (EPA) policies targeting PFAS remediation, and Extended Producer Responsibility (EPR) initiatives. Additionally, a 155% surge in global ESG regulations over the past decade has pushed corporations to adopt more sustainable waste management strategies.

Technology also plays a critical role in this growth. Companies leveraging AI, IoT, and blockchain are achieving higher efficiency and stronger market valuations. For instance, Veolia expanded its hazardous waste treatment capacity by 530,000 tonnes annually in June 2025 through new facilities and acquisitions in the U.S., Japan, and Brazil.

Next, let’s explore how these trends influence valuations across different industry segments.

Valuations by Industry Segment

Industrial waste leads the market, contributing 51% of the global market share and a commanding 69.4% of U.S. market revenue in 2024. This dominance stems from the high waste output of sectors like manufacturing, construction, and energy. Municipal Solid Waste (MSW) is the second-largest segment, capturing between 32.3% and 41.34% of the market share, driven by urbanization and population growth.

Emerging as the fastest-growing categories are e-waste and Construction & Demolition (C&D) waste. E-waste is expected to grow at a CAGR of 7.3% between 2026 and 2035, fueled by rising consumer demand for electronics and the value of recoverable metals. Similarly, C&D waste is set to expand at a CAGR of 7.89%, supported by infrastructure projects and stricter landfill diversion policies.

From a service standpoint, waste collection dominated the U.S. market in 2024, accounting for 59.8% of revenue. Meanwhile, recycling and material recovery services are gaining traction, holding a 29.3% share of the municipal solid waste market. Disposal services, however, are expected to grow the fastest, with a projected CAGR of 5.7% in the U.S. through 2033.

These insights into segment-specific valuations provide a solid foundation for understanding broader trends shaping the market.

Trends Affecting 2026 Projections

The shift toward a circular economy is transforming market dynamics. Recycling and material recovery services are forecasted to grow at a CAGR of 9.52% through 2032, outpacing traditional landfill methods. This shift is driven by regulatory requirements and growing consumer demand for sustainable practices.

Waste-to-energy initiatives are also gaining traction, offering higher valuation multiples compared to traditional waste collection and transportation services. Companies converting non-recyclable waste into energy benefit from diversified revenue streams and favorable regulatory policies. For example, in April 2025, Waste Management launched two renewable natural gas (RNG) plants in Chicago and Philadelphia as part of a $3 billion sustainability investment plan running from 2022 to 2026.

Market consolidation continues to shape valuations as larger companies acquire smaller, regional operators to expand their reach and integrate new technologies. In July 2025, Casella Waste Systems acquired Mountain State Waste to strengthen its presence in the Eastern U.S.. Additionally, in February 2024, Clean Harbors acquired HEPACO for $400 million in cash, with HEPACO generating $36 million in EBITDA on $270 million in revenue the previous year. The deal was projected to deliver $20 million in cost synergies, resulting in a post-synergy acquisition multiple of 7.1x.

sbb-itb-a3ef7c1

Key Financial Metrics for Small and Mid-Sized Businesses

Median Revenue, Profit Margins, and Sale Prices

Small and mid-sized waste management businesses typically sell for a median price of $525,000, with a median asking price of $625,000, resulting in a sale-to-ask ratio of 0.91. These businesses report a median revenue of $710,000 and median owner earnings (SDE) of $176,635, translating to a 24.9% profit margin - a drop from 33.5% in 2021. On average, it takes about 207 days for these businesses to sell.

Profit margins vary significantly by route type. Residential routes generally yield margins between 15–25%, commercial routes deliver 30–35%, and industrial routes often exceed 40%, thanks to specialized handling and reduced competition.

Cash Flow and Earnings Metrics

In this sector, Seller’s Discretionary Earnings (SDE) plays a key role in determining valuations, as it reflects the cash flow available for financing and debt obligations. The average earnings multiple in the industry is 3.31x, while the revenue multiple is 0.95x. Larger businesses with annual revenues exceeding $1.5 million often achieve multiples closer to 4.0x, whereas smaller businesses under $400,000 tend to trade around 2.0x.

The waste management industry benefits from its essential service nature, offering recession-resistant and recurring revenue streams that attract both private equity and strategic buyers. Well-managed operations typically achieve EBITDA margins of 20–30%, with public companies like Waste Management (WM) setting benchmarks at 30% EBITDA margins. As of January 14, 2026, WM was trading at a 14.6x EV/EBITDA multiple. Factors such as long-term, auto-renewing contracts and high route density (measured by stops per mile) are critical for ensuring stable cash flow and enhancing valuations.

These metrics provide a solid foundation for understanding how small and mid-sized businesses in this sector are valued.

Case Study: SMB Sale Benchmarks in Practice

Real-world examples show how these metrics translate into higher valuations. For instance, in February 2024, Waste Connections acquired 30 energy waste treatment and disposal facilities from Secure Energy Services for CAD $1.075 billion. This portfolio included 18 treatment facilities, six landfills, and four disposal wells, bolstering their R360 environmental solutions brand. Commenting on the acquisition, CEO Ronald J. Mittelstaedt stated:

"This acquisition will contribute to the outsized margin expansion for which we are positioned in 2024, given the disposal-oriented profile of the facilities".

This example highlights how owning specialized facilities and disposal infrastructure can significantly boost valuations, often exceeding typical SMB multiples.

Buy & Build a Trash Business to a $4.4m Exit | Patrick Norris Interview

Valuation Multiples and Historical Comparisons

Waste Management Valuation Multiples: Public vs Private Companies 2026

Revenue and Earnings Multiples

Small and medium-sized businesses (SMBs) have traditionally averaged 3.31x seller's discretionary earnings (SDE) and 0.95x revenue. But by January 2026, these numbers shifted slightly, with typical transactions trading at 3.06x earnings and 0.88x revenue. This change highlights a growing emphasis on cash flow rather than top-line growth. For businesses earning over $1.5 million, multiples hover near 4.0x, while those earning less than $400,000 tend to average closer to 2.0x.

The disparity between public and private company valuations remains stark. For instance, Waste Management (WM) trades at 14.6x EV/EBITDA, while Waste Connections (WCN) commands 16.2x - multiples roughly four times higher than those seen in typical SMB transactions. These figures serve as a backdrop for exploring historical valuation trends and the factors driving volatility in SMB markets.

Historical Trends and 2026 Benchmarks

Looking back from 2021 to 2026, SMB valuations have shown notable swings. Median sale prices hit a high of $825,000 in 2021 before dropping to $327,500 in 2024, eventually stabilizing around $500,000 in 2025. This volatility reflects the varying mix of asset-heavy businesses, like those managing trucks and landfills, versus asset-light operations, such as junk removal services.

Earnings multiples peaked at 4.19x in 2024, driven by a few high-margin deals, but returned to 3.06x by 2025. Similarly, revenue multiples declined from 1.06x in 2021 to 0.88x in 2025, signaling a shift in buyer priorities toward profitability over revenue growth. Despite these fluctuations, the sale-to-ask ratio has held steady at approximately 0.91, indicating that sellers have largely maintained realistic pricing expectations.

Comparison Table: 2020–2026 Multiples

The table below provides a snapshot of valuation multiples and median sale prices over recent years. These figures offer a helpful context for understanding market dynamics and evaluating opportunities in the SMB acquisition space.

| Year | Avg. Earnings Multiple | Avg. Revenue Multiple | Median Sale Price |

|---|---|---|---|

| 2021 | 3.57x | 1.06x | $825,000 |

| 2022 | 3.05x | 1.07x | $600,000 |

| 2023 | 3.03x | 1.00x | $810,000 |

| 2024 | 4.19x | 0.80x | $327,500 |

| 2025 | 3.06x | 0.88x | $500,000 |

| 5-Year Avg | 3.31x | 0.95x | $612,500 |

Source: BizBuySell Valuation Benchmarks

Public Company Comparables and Sector Trends

Public Company Multiples and Performance

In the waste management sector, leading public companies operate with valuation multiples significantly higher than those of smaller businesses. As of January 14, 2026, Waste Management (WM) is trading at 14.6x EV/EBITDA, with a market capitalization of $87.1 billion. Similarly, Waste Connections (WCN) trades at 16.2x EV/EBITDA and holds a market cap of $41.7 billion. To put this in perspective, these multiples are about four to five times higher than the earnings multiples typically observed in small-to-medium business (SMB) transactions. These figures provide a useful benchmark for comparing revenue and margins across the sector.

Despite broader economic challenges, public companies in waste management continue to demonstrate strong revenue growth. For instance, Waste Management achieved a 14.90% year-over-year increase in quarterly revenue by late 2025, reaching $25.3 billion in trailing twelve-month revenue. Waste Connections reported $9.5 billion in revenue during the same period, with an EBITDA margin of 33%, surpassing WM’s 30% margin. The sector’s average price-to-earnings (P/E) ratio is 26.32x, with a weighted average by market capitalization of 30.00x. These performance metrics not only highlight the resilience of public companies but also set a baseline for evaluating trends that influence SMB valuations.

Additionally, recent high-profile acquisitions by public companies emphasize the significant gap in valuations between public firms and smaller private businesses.

What Public Company Data Means for SMB Valuations

The strong performance of public companies underscores key factors that influence private market valuations. While public firms trade at multiples of 14x–16x EV/EBITDA, private waste management businesses with EBITDA ranging from $1 million to $10 million typically trade within a much lower range of 4.3x to 9.4x, depending on their niche within the industry. This disparity reflects the "size premium" that public companies benefit from, thanks to their greater liquidity, scale, and access to capital markets.

Public company trends also provide insight into the future direction of SMB valuations. Investments by industry leaders in areas like renewable natural gas facilities, automated recycling technologies, and PFAS remediation are driving demand for smaller businesses with expertise in these fields. Notably, SMBs that operate waste processing facilities or waste-to-energy operations are commanding the highest private market multiples - up to 9.4x EV/EBITDA - due to their appeal as tuck-in acquisition targets for larger companies. This growing emphasis on sustainability and operational efficiency suggests that these capabilities will continue to add value for SMBs in the waste management sector.

Using Clearly Acquired's Tools for SMB Valuations

AI-Powered Valuation and Normalized Financials

When it comes to valuing waste management businesses, bridging the gap between small operator SDE (Seller's Discretionary Earnings) and institutional EBITDA is crucial. Smaller businesses typically report SDE, while larger buyers and lenders prioritize EBITDA. Clearly Acquired’s AI-driven valuation tools make this transition seamless by converting SDE into comparable EBITDA metrics. These tools apply industry benchmarks - like private businesses averaging 3.31x earnings multiples, compared to public companies such as Waste Management, which operate at 14.6x EBITDA - through automated analysis, ensuring accurate comparisons.

The platform also offers industry-specific benchmarks that reflect the diverse valuation ranges within the waste management sector. For instance, a standard collection business might trade at multiples between 6.2x and 7.6x EBITDA, while waste-to-energy operations can reach up to 9.4x EBITDA. By evaluating businesses against 2026 benchmarks, these tools highlight their market position and pinpoint factors that could increase valuations. This analysis sets the stage for crafting effective financing strategies.

Capital Stack Optimization for Waste Management Deals

Building on these benchmarks, Clearly Acquired simplifies deal financing for waste management acquisitions. Financing in this space often revolves around SDE, as lenders use it to determine the maximum debt a business can handle. The platform ensures financing aligns with SDE, helping businesses structure deals effectively. Companies generating over $1.5 million in annual revenue usually achieve earnings multiples nearing 4x, offering a stronger buffer for debt servicing.

Clearly Acquired connects buyers with tailored financing options, including SBA 7(a) loans vs. other financing options like conventional loans, equipment financing, and seller notes. For acquisitions involving specialized equipment or fleets, the platform identifies lenders familiar with asset-heavy operations and their unique cash flow needs.

Verified Deal Flow and Market Insights

In addition to valuation and financing tools, Clearly Acquired provides access to verified waste management opportunities. The platform’s deal flow includes businesses benchmarked against key sector trends, revealing which niches command higher valuations. For example, waste-to-energy companies with EBITDA in the $5 million–$10 million range achieved multiples of 9.4x in early 2025. Sellers can enhance their appeal by focusing on value drivers like route density, recurring contracts, and the condition of fleet assets.

The platform also tracks regulatory developments - such as PFAS remediation requirements and Extended Producer Responsibility mandates - helping investors identify companies positioned for future growth. These insights give buyers and sellers a competitive edge in navigating the waste management landscape.

Conclusion: Key Takeaways for 2026 Waste Management Valuations

Core Valuation Insights for Buyers and Sellers

In 2026, the waste management sector rewards businesses that excel in route density, asset control, and consistent recurring revenue streams. Public companies in this space are trading at much higher multiples - around 14.6x EBITDA - highlighting the valuation gap between public and private operators.

For sellers, showcasing strengths like long-term service agreements, modernized fleets, and low customer churn is crucial to achieving top-tier valuations. Specializing in niches such as medical waste, PFAS remediation, or hazardous waste management can also significantly boost buyer interest and drive up sale prices.

Buyers, on the other hand, are operating in a regulatory landscape that leans toward structural remedies like divestitures rather than outright deal rejections. This allows for smoother tuck-in acquisitions. As Timm Kuechle, Senior Director at Capstone Partners, puts it:

"In a sector where route density and asset control define competitive advantage, M&A proves to be a margin engine".

Incorporating antitrust remedies early in the deal process can help buyers more accurately value larger acquisitions and plan for potential asset divestitures.

Using Technology for Better Outcomes

Technology is playing a pivotal role in improving deal assessments and outcomes. Platforms like Clearly Acquired’s AI tools simplify complex processes by converting SDE to EBITDA, benchmarking performance across subsectors, and connecting buyers and sellers with tailored financing options. These include SBA 7(a) and 504 loan qualifications, equipment financing, and seller notes, making it easier to align financing with actual business cash flow.

Access to verified deal flow and real-time market data also helps identify emerging opportunities, such as waste-to-energy ventures or businesses poised to benefit from forthcoming EPA regulations on PFAS. Additionally, technology optimizes the capital stack, cutting down on time wasted with unqualified leads and ensuring financing aligns with the business’s needs. Whether you're acquiring your first route or scaling up through roll-ups, leveraging integrated tools designed for Main Street M&A can improve deal certainty and lead to better overall outcomes.

FAQs

What is driving the growth of the waste management and recycling industry by 2026?

The waste management and recycling industry is growing rapidly, driven by a mix of economic, environmental, and regulatory factors. For starters, as the global population grows and economies expand, waste production is increasing at an alarming rate. Municipal solid waste, for example, is projected to jump from about 1.3 billion tons in 2012 to over 2.2 billion tons by 2025. This surge is pushing the need for better systems to collect, process, and dispose of waste efficiently.

On top of that, stricter regulations and various sustainability initiatives at federal, state, and local levels are encouraging practices like recycling, composting, and waste-to-energy solutions. Public awareness around environmental issues is also on the rise, creating more demand for eco-conscious waste management options. Industrial sectors are playing a role too, especially when it comes to hazardous and specialty waste, as stricter compliance standards and the need for specialized treatments continue to grow.

Adding to the momentum, the industry's recurring revenue model and its steady, utility-like nature are drawing attention from private equity investors. This influx of capital is driving consolidation, technology upgrades, and capacity expansions, all of which are accelerating the industry's growth. These factors combined are shaping a dynamic and fast-evolving waste management market poised for major developments through 2026.

How do valuation multiples compare between public companies and small businesses in the waste management industry?

Valuation multiples in the waste management industry show a noticeable gap between large public companies and smaller, privately-owned businesses. Take Waste Management, Inc., for instance - this major player often operates with enterprise-value-to-revenue (EV/Revenue) multiples of around 5× and enterprise-value-to-EBITDA (EV/EBITDA) multiples close to 17×.

On the other hand, smaller private waste management companies typically see much lower multiples. EBITDA multiples can range from 4.3× for smaller operations, such as incineration services, to 9.4× for larger waste-to-energy businesses. Revenue multiples for these smaller businesses usually fall between 1.7× and 5.1×, influenced by factors like size and the type of service offered.

This disparity highlights the premium that public markets place on larger companies. Publicly traded firms benefit from scale, diversified services, and easier access to liquidity, which drives their higher valuation ratios. In contrast, smaller private businesses often rely on more modest multiples when pricing themselves for sale.

What trends are shaping waste management valuations and acquisitions in 2026?

The waste management and recycling industry is seeing some major shifts that are shaping valuations and driving acquisitions. Regulatory easing has opened up opportunities for companies to adopt roll-up strategies, which streamline operations and expand their service reach. Meanwhile, growing public awareness around sustainability, paired with government-supported initiatives, is fueling demand for services like recycling, composting, and waste-to-energy solutions. These areas, in particular, are catching the eye of investors.

Companies with long-term service contracts, well-maintained vehicle fleets, and dense operational routes are securing higher valuation multiples. Certain subsectors, such as waste-to-energy and liquid waste management, stand out because of their consistent revenue streams and niche expertise. On top of that, improving economic conditions are paving the way for a resurgence in mergers and acquisitions, with premium valuations especially in high-margin sectors like hazardous waste and waste-to-energy services.

In short, a mix of regulatory changes, sustainability-driven demand, operational improvements, and specialized growth opportunities are reshaping how the waste management industry is valued as we move closer to 2026.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)