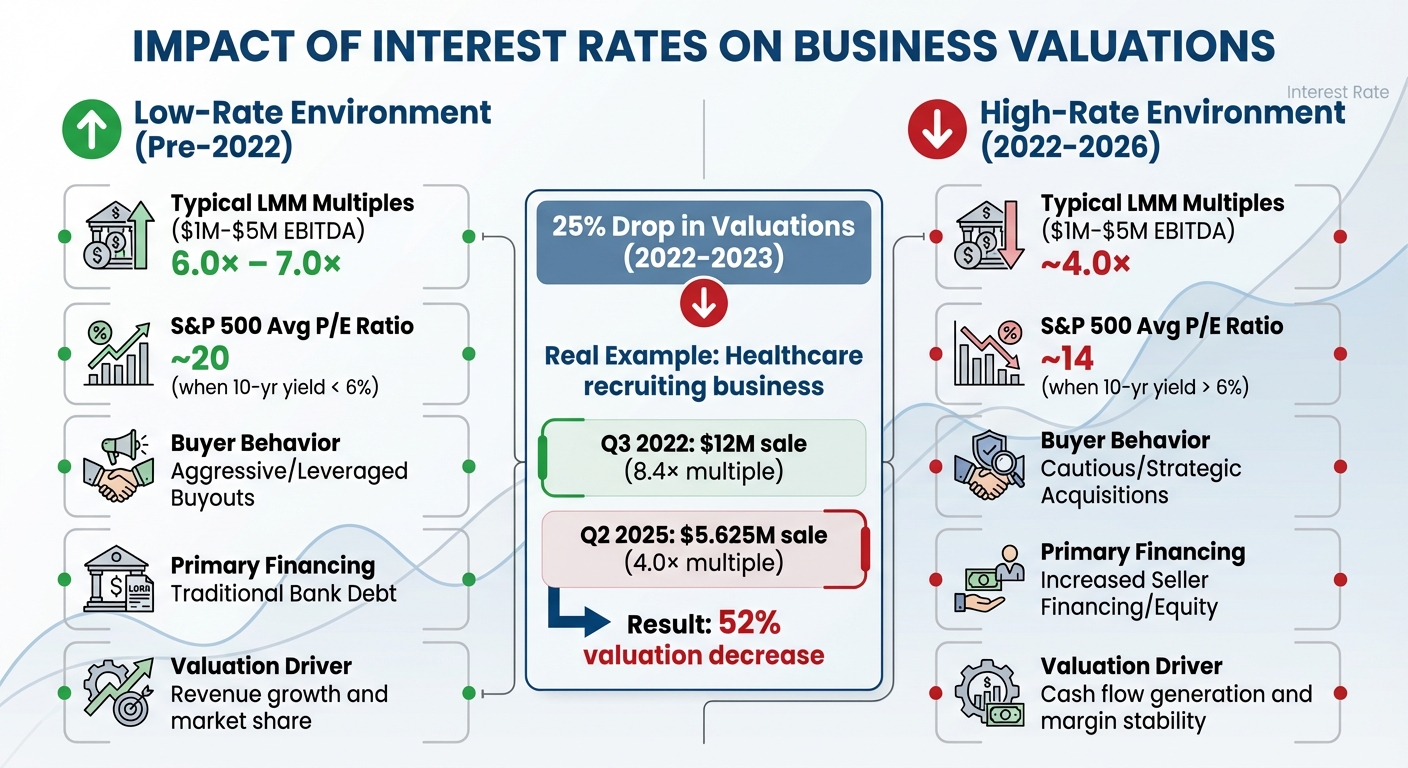

Interest rates directly influence business valuations, especially for smaller companies that rely on debt financing. When rates rise, borrowing costs increase, discount rates go up, and future cash flows lose value. From 2022 to 2023, higher rates caused valuations for small-to-medium businesses to drop by 25%, with EBITDA multiples falling from 6-7x to around 4x.

In 2026, the Federal Funds Rate has dropped to 3.50%-3.75%, easing from its 2024 highs. However, borrowing costs remain elevated, with the Bank Prime Loan Rate at 6.75%. This environment presents challenges for financing and valuation, particularly for businesses with floating-rate debt.

Key takeaways:

- Higher borrowing costs reduce valuations by increasing the cost of capital.

- Smaller businesses face tighter credit and higher interest expenses, impacting cash flow.

- Industries with narrow margins are more affected, while some sectors like finance and utilities remain resilient.

- Buyers are shifting to seller financing, earnouts, and deferred payments to close deals.

Understanding these dynamics is crucial for navigating today's market. Whether buying or selling, focusing on cash flow, efficient operations, and creative financing options can help bridge valuation gaps.

Current Interest Rate Environment in 2026

Key Interest Rate Benchmarks

As of January 20, 2026, the Federal Open Market Committee (FOMC) has set the target Fed Funds Range at 3.50%-3.75%, with an effective rate of 3.64%. This marks a significant drop from the 2024 range of 5.25%-5.50%, following three consecutive 0.25% rate cuts in late 2025.

The Bank Prime Loan Rate, a key benchmark for small business loans with variable rates, currently stands at 6.75%. Treasury yields, on the other hand, show a steepening curve: the 2-year Treasury yield is at 3.60%, the 10-year Treasury is at 4.30%, and the 30-year Treasury climbs to 4.91%. Greg Bone, a Partner at Corient, highlights the late 2025 rate adjustments:

"Rate cuts of 0.25% in September, October, and December brought the Fed Funds rate to the 3.50%–3.75% target range by year-end".

Looking ahead, forecasts suggest the 10-year Treasury yield may fall further, potentially reaching around 3.75% by mid-2026.

These benchmarks play a critical role in shaping the risk-free rate used in business valuation models. For example, the 10-year Treasury yield of 4.30% serves as the foundation for calculating the Cost of Equity under the Capital Asset Pricing Model (CAPM). Similarly, the Prime Rate directly influences the Cost of Debt for businesses that rely on bank loans. Together, these figures frame the broader economic landscape and its impact on business financing.

Economic Context and Business Impact

The Federal Reserve’s decision to lower rates reflects confidence in achieving a sustainable 2% inflation target. However, challenges remain. Persistent inflation and rising federal deficits continue to fuel economic uncertainty. As noted in Corient's 2026 Market Outlook:

"A weakening job market may allow for further Fed cuts in 2026. However, persistent inflation and rising federal deficits are reasons for caution".

For small and lower-middle-market businesses, the current environment presents a mix of opportunities and challenges. While interest rates have eased from their 2024 highs, borrowing costs are still higher than any time in the past 15 years. Banks remain cautious, maintaining tight credit standards for small business loans, with rates hovering near levels last seen in 2008. The overnight lending market reflects steady liquidity, with daily federal funds transactions averaging $83 billion.

Smaller businesses that rely on floating-rate debt face particular challenges. As rates adjust, their interest expenses rise quickly, putting pressure on cash flow. For borrowers in the lower-middle market with leveraged loans, interest coverage ratios remain near historic lows, making debt servicing increasingly difficult despite the recent rate cuts.

sbb-itb-a3ef7c1

Interest Rates and Stock Prices: More than meets the eye!

How Interest Rates Affect Business Valuations

Business Valuation Changes: Low vs High Interest Rate Environments

Cost of Capital and Discount Rates

Interest rates have a direct impact on business valuations by increasing both the cost of borrowing and the cost of equity. When the Federal Reserve raises benchmark rates, it becomes more expensive for businesses to take on debt. For instance, a one-percentage-point hike in the Federal Funds Rate typically raises corporate interest expenses by about 0.5 percentage points, although this effect unfolds gradually over roughly five quarters.

The cost of equity also rises in tandem. Higher interest rates elevate the risk-free rate, which is the baseline return investors expect from safe investments like Treasury bonds. According to the Capital Asset Pricing Model (CAPM), this higher risk-free rate prompts equity investors to demand greater returns compared to government securities. These combined increases push up the Weighted Average Cost of Capital (WACC), the rate used to discount future cash flows. As WACC rises, the present value of a business's future earnings declines.

Robert W. "Bob" Evans, Principal at Blue & Co., LLC, highlighted this real-world impact:

We have seen the 2022-2023 interest rate increases reduce values determined by the income approach by about 25 percent.

Additionally, higher borrowing costs limit the leverage buyers can use, leading to lower purchase price multiples. Matt Rice, Chief Investment Officer at First Business Bank, explained:

High interest rates directly impact business valuations by adjusting the cost of capital, affecting projected cash flows, and altering asset values.

The extent of this effect differs across industries, becoming more evident when comparing periods of low and high interest rates.

Valuation Impact by Industry Sector

While rising costs generally lower business valuations, the degree of impact varies significantly between industries. Businesses with slower growth tend to be more sensitive to rate changes, where even a small increase can cause noticeable shifts in enterprise value. Sectors with narrow profit margins face additional pressure as higher borrowing costs strain already tight cash flows. Many small businesses have responded by increasing retail prices - sometimes by 10% or more - to maintain profitability under the dual challenges of high rates and inflation.

Interestingly, some industries manage to thrive despite these challenges. Financial institutions, like banks and insurance companies, often benefit from higher rates as they can charge more for lending, boosting their earnings. Similarly, niche sectors like utilities serving data centers have remained resilient since surging electricity demand can offset the typical sensitivity to interest rates.

The landscape for buyers has also shifted. Higher borrowing costs have made leveraged buyouts less appealing, steering the market toward strategic acquisitions. In these cases, buyers focus on long-term synergies rather than short-term financial tactics. Businesses with strong intangible assets - such as loyal customers, proprietary technologies, or well-established brands - are better positioned to justify higher valuations even in this challenging environment.

Valuation Comparison: Low vs. High Rate Periods

The contrast between low-rate and high-rate periods illustrates the dramatic shift in financing and valuation dynamics. Before 2022, a low-rate environment made borrowing cheap, allowing buyers to pay higher multiples. With lower interest expenses, buyers could meet return targets even with elevated purchase prices.

A real-world example shows this shift clearly. In Q3 2022, a healthcare recruiting and staffing business with $1.424 million in EBITDA sold for $12 million, reflecting an 8.4× multiple. By Q2 2025, a nearly identical medical sales recruitment firm with $1.4 million in EBITDA sold for just $5.625 million, equating to a 4.0× multiple. This represents a 52% drop in valuation, driven by the changing financing environment.

Public markets reflect a similar trend. Over the past 50 years, the S&P 500's average price-to-earnings (P/E) ratio hovered around 20 when 10-year Treasury yields were below 6%. When yields exceeded that threshold, the average P/E ratio dropped to about 14.

| Metric | Low-Rate Period (Pre-2022) | High-Rate Period (2022-2026) |

|---|---|---|

| Typical LMM Multiples ($1M-$5M EBITDA) | 6.0× – 7.0× | ~4.0× |

| S&P 500 Avg P/E Ratio | ~20 (when 10-yr yield < 6%) | ~14 (when 10-yr yield > 6%) |

| Buyer Behavior | Aggressive/Leveraged Buyouts | Cautious/Strategic Acquisitions |

| Primary Financing | Traditional Bank Debt | Increased Seller Financing/Equity |

| Valuation Driver | Revenue growth and market share | Cash flow generation and margin stability |

This table underscores the shift in market priorities. Buyers now focus on cash flow generation and margin stability rather than purely chasing growth. With traditional bank debt remaining costly, seller financing has become more common, offering sellers an opportunity to earn interest income alongside the proceeds from the sale.

Strategies for Buyers and Sellers in a High-Rate Environment

Adjusting Deal Structures

When borrowing from banks becomes costly, creative deal-making can bridge the gap between what sellers want and what buyers can afford. One approach gaining traction is seller financing, where sellers provide direct loans to buyers through promissory notes. Matt Rice, Chief Investment Officer at First Business Bank, highlights its value:

In a high-interest rate environment, seller financing can be a key negotiating tactic for closing business sales. It not only opens the door for buyers who might be edged out by traditional lending barriers but also potentially offers a better return for the seller.

Other strategies like earnouts, deferred payments, and equity rollovers are also helping buyers manage upfront costs. For example, earnouts - where part of the purchase price depends on future performance metrics like EBITDA or revenue - grew by 4% between 2021 and 2022. Deferred payments allow buyers to spread costs over time, easing immediate financial strain. Meanwhile, equity rollovers let sellers retain a minority stake, reducing the buyer's initial capital needs while keeping the seller invested in the business's success.

Employee Stock Ownership Plans (ESOPs) offer another path, particularly when traditional loans aren’t appealing. These plans allow ownership to transfer gradually, providing tax benefits and maintaining business continuity. Buyers can also mix funding sources - known as a capital stack - to balance cost and risk.

Leveraging technology can further fine-tune these strategies, making transactions smoother and more efficient.

Using Clearly Acquired Tools

Clearly Acquired’s AI-powered tools are designed to help buyers and sellers navigate the challenges of high-interest rates. By adjusting for increased discount rates in real time, these tools offer precise business valuations. For buyers, the platform uses verified Debt Service Coverage Ratios (DSCR) based on tax returns, ensuring lenders see accurate financial data upfront. Buyers can also stress-test deals by simulating a 15–20% EBITDA drop, helping them evaluate whether a business can withstand financial pressure before committing to a Letter of Intent.

For sellers, Clearly Acquired simplifies the process of finding buyers. The platform uses confidential, technology-driven methods to market businesses to millions of qualified buyers while safeguarding sensitive information. Secure data rooms with permission controls streamline document sharing during due diligence, making the process faster and more compliant. Additionally, its debt brokerage tools match deals to the right lenders - whether SBA, traditional banks, or private credit - using real underwriting criteria instead of generic rate quotes. This integrated system replaces the need for fragmented advisors and tools, enhancing transparency and efficiency throughout the transaction process.

Financing Strategies to Manage Rate Risks

Beyond structuring deals, financing strategies can also help manage high borrowing costs. SBA 7(a) loans remain a strong option, offering up to 10-year terms that reduce monthly payments even if the interest rates are slightly higher. As of October 31, 2025, SBA 7(a) loans over $50,000 with terms of seven years or more have a maximum interest rate of 9.75% (Prime at 7.00% + 2.75% cap). These loans also allow buyers to roll closing costs - like legal fees and valuations - into the loan, preserving cash at closing.

For buyers, leveraging intangible assets like customer relationships or proprietary technology can make businesses more appealing for SBA financing, thanks to the program’s flexible collateral requirements. On the seller side, offering financing comes with risks, so it’s wise to secure loans with business assets as collateral and require a significant down payment to reduce default risks.

Buyers should also focus on ensuring their return on investment comfortably exceeds financing costs - a principle known as "positive leverage". Additionally, strategic acquisitions that emphasize synergies and long-term value are becoming more appealing than heavily leveraged buyouts. Buyers now prioritize businesses with strong cash flows, recurring revenue, and diverse customer bases to counterbalance higher financing costs.

Conclusion

Rising interest rates are reshaping business valuations, particularly for Main Street and Lower-Middle-Market sectors. With higher borrowing costs driving up discount rates in valuation models, future cash flows lose value in today’s terms. This effect isn't evenly distributed - capital-intensive industries and smaller companies with fewer financing options are feeling the pinch more than businesses with steady cash flows and diverse revenue sources.

Grasping these shifts is crucial for making smart decisions in today’s market. Sellers must recognize that buyer offers are likely to fall below past benchmarks due to increased financing costs. For example, interest rate hikes during 2022–2023 slashed income-based business values by roughly 25%. On the other hand, buyers face higher capital costs, which can add millions annually to financing mid-market deals. This growing gap between seller expectations and buyer affordability has made creative deal structures a necessity.

To bridge these valuation gaps, strategies like seller financing, earnouts, and deferred payments are becoming essential. Targeting businesses with strong cash flows, recurring revenue, and efficient operations can help offset the burden of higher borrowing costs. Additionally, strategic acquisitions that focus on long-term synergies are replacing highly leveraged buyouts as the go-to approach.

Clearly Acquired offers tools to navigate these challenges. Its AI-powered platform delivers real-time, data-driven valuations and stress tests, giving buyers the confidence they need. For sellers, the platform provides confidential access to millions of qualified buyers and integrated debt brokerage services, simplifying the process. By replacing fragmented advisory services with a unified solution, it brings much-needed transparency and efficiency to transactions that might otherwise falter.

The key to thriving in this high-rate environment lies in realistic expectations, adaptable deal structures, and precise valuation tools. Whether you're buying, selling, or financing, understanding the ripple effects of interest rates on valuations equips you to adjust your strategy and close better deals. Mastering these approaches is essential to achieving success in today’s ever-changing marketplace.

FAQs

How do rising interest rates influence the valuation of small businesses?

Rising interest rates can have a noticeable impact on small business valuations. They drive up borrowing costs and reduce the present value of future cash flows. As rates increase, buyers tend to use higher discount rates when evaluating a business, which often results in lower valuation multiples.

For business owners and investors, this shift means rethinking deal structures and financing strategies to align with the changing landscape. Grasping how interest rate trends affect the cost of capital is essential for making informed decisions and adapting effectively.

How can buyers manage higher borrowing costs when acquiring a business?

Buyers facing higher borrowing costs can consider creative deal structures like seller financing or earnouts. These options lower the need for upfront cash and reduce dependence on debt, making transactions more manageable. Another approach is using more cash or equity financing, which helps limit exposure to rising interest rates.

In a high-rate environment, adjusting leverage ratios to rely less on loans can also make deals more sustainable. On top of that, conducting thorough financial due diligence is crucial. This ensures the business has enough cash flow to comfortably support any necessary borrowing.

Which industries are best equipped to handle interest rate changes, and why?

Industries that can navigate interest rate changes effectively usually share a few key traits: steady cash flows, strong profitability, and minimal dependence on debt financing. For example, sectors like technology, healthcare, and consumer staples often show resilience. Their consistent demand shields them from the effects of rising borrowing costs.

Sectors providing essential goods or services, such as utilities and healthcare, also tend to weather these changes well. With their reliable revenue streams and significant barriers to entry, these industries can sustain their valuations even during economic turbulence. In contrast, industries like manufacturing and real estate, which rely heavily on borrowing and are closely tied to economic cycles, feel the impact of interest rate shifts more acutely.

Ultimately, an industry’s stability in the face of interest rate changes comes down to its ability to maintain cash flow and adapt to changing financial conditions. This makes some sectors far more prepared than others to handle economic fluctuations.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)