SBA loans simplify buying a business by offering low down payments, long repayment terms, and flexible financing options. With government backing, these loans reduce lender risk, making approval easier for borrowers who might not qualify for conventional loans. Here’s why SBA loans are a popular choice for acquisitions:

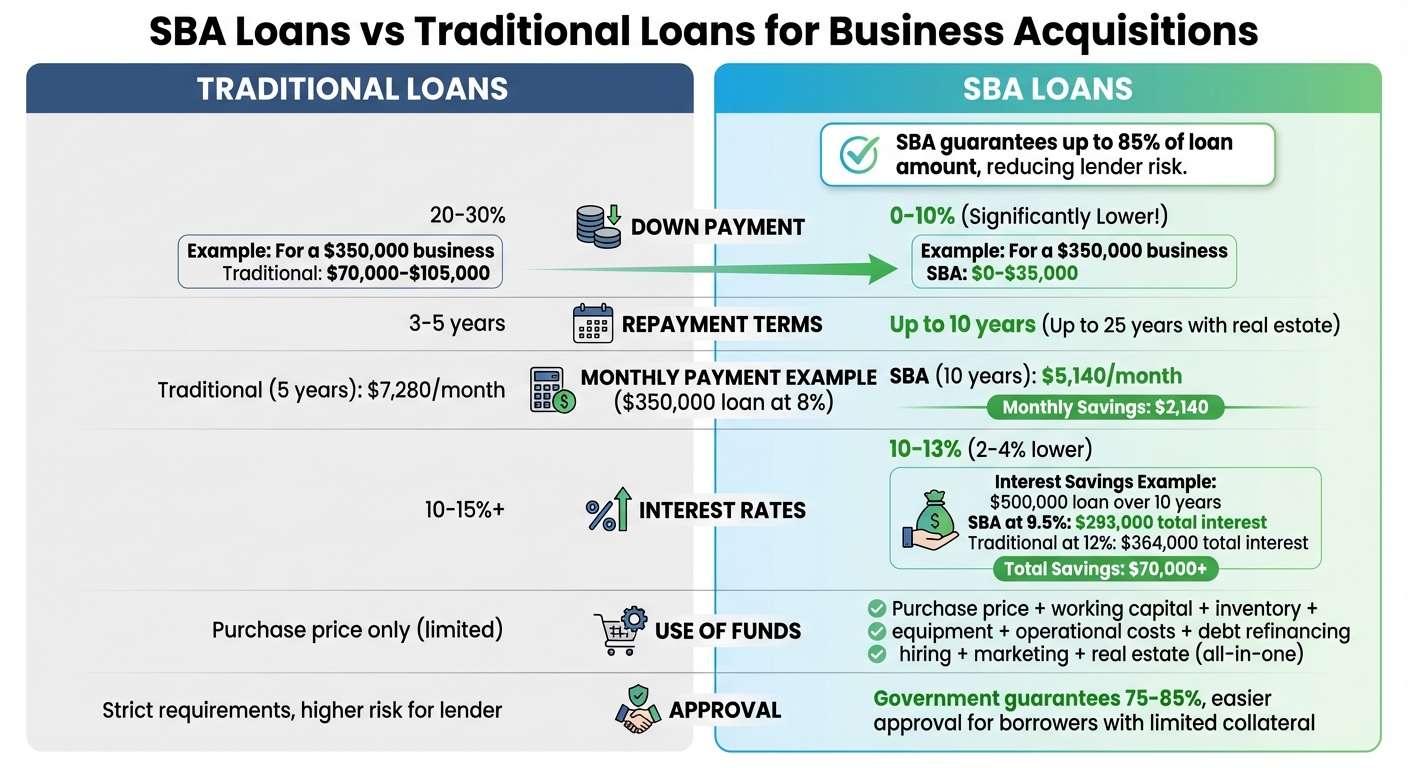

- Lower Down Payments: As low as 0–10%, compared to 20–30% for traditional loans.

- Longer Repayment Terms: Up to 10 years (or 25 years with real estate), easing monthly cash flow.

- Competitive Interest Rates: Often 2–4% lower than conventional loans, saving thousands in interest.

- Flexible Use of Funds: Covers purchase price, working capital, inventory, and more in one loan.

- Government Guarantee: Reduces lender risk, increasing approval chances for borrowers with limited collateral.

These features make SBA loans an accessible and practical solution for entrepreneurs looking to buy or expand a business. Keep reading to learn how these benefits work in detail.

SBA Loans vs Traditional Loans: Key Differences for Business Acquisitions

The Ultimate Guide to SBA Acquisition Financing [Comprehensive 2025]

1. Lower Down Payments

Coming up with the upfront cash is often one of the toughest hurdles when buying a business. Traditional lenders typically ask for a hefty down payment - around 20–30% of the purchase price. For a $350,000 business, this means you’d need to scrape together $70,000 to $105,000 just for the down payment, not to mention other costs like closing fees or working capital.

SBA 7(a) loans take a different approach. They generally require just 10% down, and in some cases - like purchasing a business in the same industry you’re already in or buying out a partner - you might qualify for 0% down. So, for that $350,000 business, you could need as little as $35,000 upfront - or even nothing - when seller financing or equity injections are part of the equation. That extra $35,000 to $70,000 you save can go toward payroll, marketing, or unexpected operational expenses.

What makes this possible? The SBA guarantees up to 85% of the loan amount, which reduces the lender’s risk and allows for financing up to 90% of the purchase price. This is especially helpful for service-based businesses, where much of the value comes from client relationships and goodwill rather than physical assets. Plus, the SBA is flexible about what counts as a down payment. Beyond cash, you can use seller financing, business assets, or even real estate to meet the equity injection requirement. For instance, if a seller agrees to hold a $35,000 note under the right terms, you might close the deal without putting any cash down, keeping your liquidity intact for other priorities.

This setup opens the door to business ownership for buyers who don’t have deep pockets. Instead of tying up your savings in a down payment, you can keep that cash available for running and growing the business - whether that means weathering a slow period, investing in expansion, or maintaining a safety net while you get up to speed. Platforms like Clearly Acquired can guide buyers through structuring these deals, connecting them with SBA-preferred lenders, and combining SBA 7(a) loans with seller financing to minimize upfront costs while staying within SBA guidelines. By preserving capital upfront, you’ll also benefit from other perks, like longer repayment terms, that support steady and sustainable growth.

2. Longer Repayment Terms

Longer repayment terms can significantly ease monthly cash flow, working hand-in-hand with the lower down payments mentioned earlier. Traditional business loans often come with repayment periods of 3–5 years. While this might seem manageable, it typically results in higher monthly payments, leaving less room for day-to-day operational flexibility. On the other hand, SBA 7(a) loans provide repayment terms of up to 10 years for most acquisitions, and even up to 25 years if real estate is part of the deal. This extended timeline allows businesses to allocate savings toward growth and maintaining operational stability.

Here’s an example: For a $350,000 loan at 8% interest over a 10-year term, monthly payments are about $5,140. Compare that to a conventional 5-year loan at the same interest rate, where monthly payments jump to approximately $7,280. That’s a monthly savings of $2,140. The difference becomes even more striking with larger loans. A $1 million acquisition at 8% interest would mean monthly payments of roughly $14,879 on a 10-year term versus about $30,708 on a 5-year term. For new business owners navigating transitional periods with fluctuating revenue or rising costs, these lower payments can make all the difference in keeping operations steady.

The SBA helps make these longer terms possible by guaranteeing a portion of the loan, reducing the lender’s risk. This guarantee enables repayment terms of up to 25 years when real estate is involved, significantly lowering monthly obligations and creating a smoother financial path during ownership transitions. Since 2020, lenders like Capital Bank have financed nearly $50 million in SBA acquisition loans, showcasing how these extended terms help safeguard cash flow and allow buyers to reinvest in growth rather than being bogged down by heavy debt payments.

This structure is especially advantageous in industries where much of the value lies in relationships and goodwill - think financial advisory firms, medical practices, or service-oriented businesses. It ensures business owners have the financial breathing room they need to focus on running their operations and expanding their ventures without being overwhelmed by cash flow constraints.

3. Competitive Interest Rates

SBA loans stand out for their appealing interest rates, largely due to the SBA guarantee that reduces lender risk. This benefit pairs well with the lower down payments and longer terms they offer. With the SBA backing up to 85% of the loan amount, lenders can provide rates that are typically 2–4% lower than those of conventional business loans.

As of late 2025, with the prime rate hovering around 8%, SBA 7(a) loans are priced between 10% and 13%. These rates are calculated by adding a markup - ranging from 2.25% to 4.75% - to the prime rate, depending on the loan's size and term. By comparison, conventional business loans for acquisitions often come with rates that range from 10% to 15% or even higher.

Let’s break it down with an example: A $500,000, 10-year SBA loan at a 9.5% rate results in monthly payments of about $6,600 and total interest close to $293,000. On the other hand, a 12% conventional loan for the same amount would require monthly payments of around $7,200 and total interest of roughly $364,000. That’s a savings of over $70,000 with the SBA loan.

The difference becomes even more striking with larger loans. For a $1 million loan over 10 years, a 9% SBA rate compared to a 12% conventional rate could save borrowers around $100,000 or more in interest.

SBA loans also give borrowers the flexibility to choose between fixed and variable rates. Fixed rates are often preferred since they offer predictable payments, making them an excellent choice for acquisition financing. These competitive rates, combined with favorable down payment and term options, make SBA loans a powerful tool for business acquisitions.

sbb-itb-a3ef7c1

4. Flexible Use of Funds Including Working Capital

One major perk of SBA loans is how versatile they are when it comes to using the funds. Unlike traditional loans that often limit you to specific uses like covering the purchase price, SBA 7(a) loans allow you to bundle multiple acquisition-related expenses into a single loan. This means you can use the loan to finance the business purchase, working capital, inventory, equipment, operational costs, debt refinancing, hiring employees, marketing expenses, and even real estate - all in one package. This flexibility can be a lifesaver during the often unpredictable post-acquisition transition phase.

Having working capital built into your SBA loan is a game-changer for managing cash flow while integrating operations. It gives you a cushion to handle unexpected costs without the hassle of seeking additional financing. For instance, if you're buying a business for $350,000, an SBA 7(a) loan can cover not only the purchase price but also working capital and closing costs, helping you preserve your personal cash for reinvestment opportunities.

By consolidating all these expenses into one loan, the process becomes much simpler. You only deal with one lender, one set of paperwork, and a single monthly payment, which helps reduce costs and keeps your cash flow intact.

With loan amounts available up to $5 million and repayment terms as long as 10 years (or 25 years if real estate is included), SBA loans offer the flexibility to structure payments in a way that keeps your monthly obligations manageable. This allows you to retain more cash for everyday operations.

This all-in-one funding approach is especially valuable for businesses that rely heavily on intangible assets, like financial advisory firms or insurance agencies, where traditional collateral options might be limited. By addressing working capital and growth needs upfront, SBA loans make it easier to upgrade equipment, replenish inventory, and ensure smooth operations without the need for additional financing.

5. Government Guarantee Enabling Easier Approval

The SBA guarantee makes it easier to secure financing compared to traditional loans. When you apply for an SBA 7(a) loan, the SBA covers a significant portion of the loan, reducing the lender's risk and simplifying the approval process.

Let’s break it down: Imagine you're borrowing $1,000,000 to purchase a business, and the SBA guarantees 75% of that loan. In this case, the lender's actual risk is only $250,000. Even if the collateral doesn’t fully cover the loan, the bank can recover up to $750,000 through the SBA. On the other hand, with a conventional loan, the bank could be on the hook for nearly the entire amount. This reduced risk not only protects lenders but also encourages them to be more flexible with their approval criteria.

Because the government shoulders most of the potential loss, lenders are more likely to approve borrowers who might not meet stricter conventional loan requirements. This is particularly helpful for first-time buyers moving from corporate jobs, operators with strong earnings but limited assets, or anyone purchasing a business where much of the value lies in cash flow and goodwill rather than physical assets.

The SBA guarantee also allows for higher leverage and more adaptable financing options. Lenders can cover up to 90% of the purchase price and even incorporate seller financing into the deal. Combined with lower down payments and longer repayment terms, this creates opportunities for partner buyouts, management buy-ins, and other acquisition scenarios where liquid capital might be tight.

It’s important to note that the SBA guarantee doesn’t eliminate the need for thorough underwriting. Lenders still evaluate cash flow, borrower experience, and whether the purchase price is reasonable. However, for many eligible buyers, this government-backed support can transform a likely rejection into an approval - making business ownership possible with far less upfront cash.

Conclusion

SBA loans make acquiring a business a realistic goal. With lower down payments, longer repayment terms, competitive interest rates, flexible use of funds, and government guarantees, they help reduce upfront costs, maintain cash flow, and provide opportunities for buyers who might not meet the requirements for traditional financing. Whether you're leaving the corporate world to buy your first business, expanding operations to a new location, or purchasing a business with strong cash flow but limited tangible assets, these loans make ownership more accessible while minimizing the need for significant personal capital.

What sets SBA loans apart is their flexibility. These terms not only ease the purchase process but also allow borrowers to include working capital, partner buyouts, and even closing costs within the loan. This creates a financing structure that supports not just the acquisition but also the transition and future growth of the business.

For buyers navigating the complexities of this process, having the right tools and guidance is essential. Clearly Acquired provides an AI-powered platform that connects buyers with SBA financing options through a vast network of lenders. This platform simplifies every step, from sourcing and underwriting to structuring and closing the deal.

With the right financing strategy in place, the road to business ownership becomes far more approachable. Whether you're pursuing your first acquisition or expanding your portfolio, SBA loans provide a reliable framework to turn your ambitions into reality. With the proper support, you can confidently move from evaluating opportunities to completing your deal.

FAQs

How does an SBA loan guarantee improve my chances of getting approved?

An SBA loan guarantee can greatly improve your chances of getting approved by minimizing the risk for lenders. Since the government promises to cover a portion of the loan if you default, lenders feel more secure in extending financing - even if you don’t check all the boxes for traditional loans.

This added security often translates into better terms for borrowers. You might be able to secure lower interest rates or longer repayment periods, making SBA loans a strong option for funding business acquisitions.

Can SBA loans cover working capital and daily operational expenses?

Yes, SBA loans are a reliable option for covering working capital and day-to-day operational expenses. Whether it's managing payroll, restocking inventory, or paying utility bills, these loans offer business owners the financial flexibility to handle ongoing costs.

With affordable financing and competitive terms, SBA loans make it easier for businesses to stay on track, ensuring smooth operations while keeping an eye on growth and future goals.

What makes SBA loan interest rates more competitive than conventional loans?

SBA loans often come with lower interest rates than conventional loans. Why? Because the U.S. government partially guarantees these loans, reducing the risk for lenders. With this safety net, lenders are able to offer better terms to borrowers.

This makes SBA loans a great choice for financing business acquisitions. They help buyers keep costs under control while accessing the funds needed to expand or pursue new ventures.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)