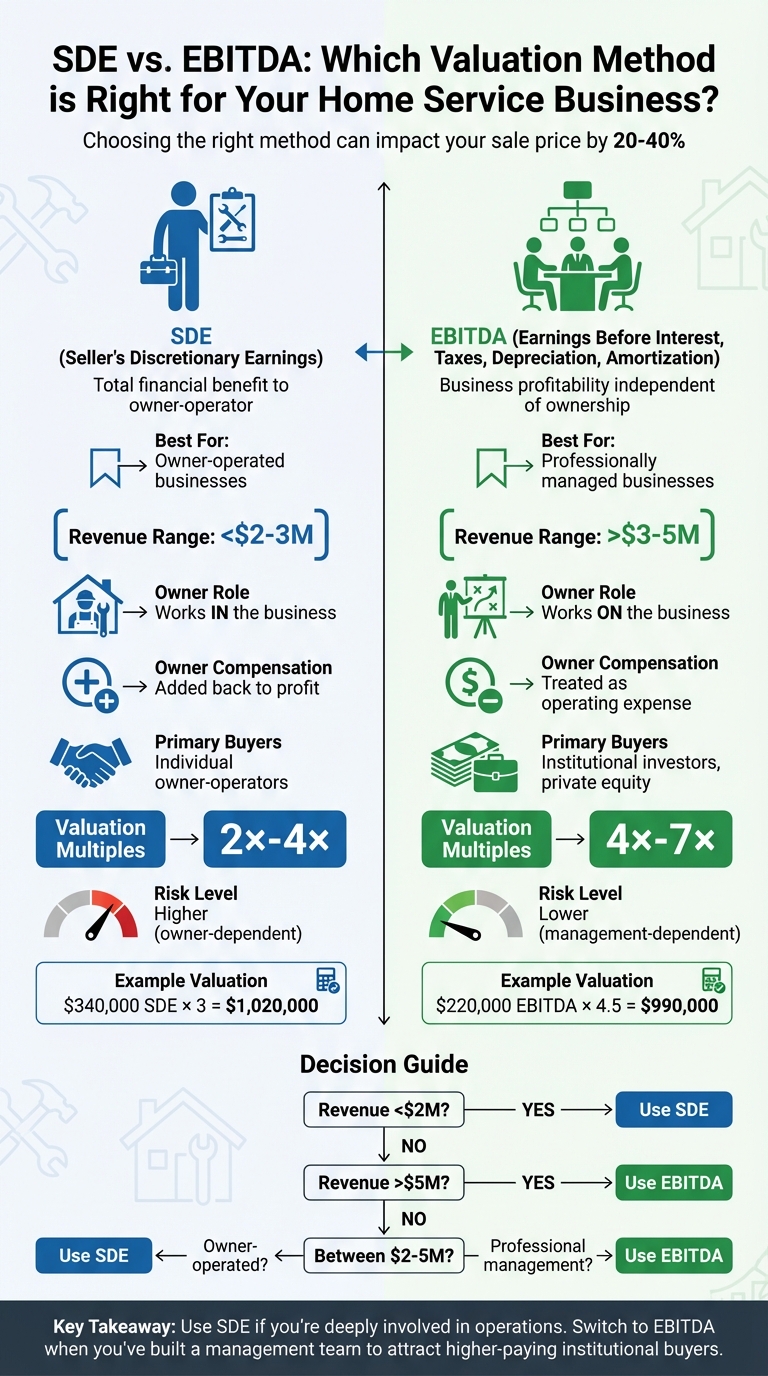

When valuing your home service business, the choice between EBITDA and SDE can significantly impact your sale price or financing prospects. Here's the key difference:

- SDE (Seller’s Discretionary Earnings): Best for small, owner-operated businesses. It reflects the total financial benefit an owner takes home, including salary, perks, and one-time expenses. Typically used for businesses under $2–$3 million in revenue and attracts individual buyers. Valuation multiples: 2×–4× SDE.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): Ideal for larger businesses with professional management. It measures profitability independent of ownership. Common for businesses over $3–$5 million in revenue, appealing to institutional buyers. Valuation multiples: 4×–7× EBITDA.

Quick Comparison

| Feature | SDE | EBITDA |

|---|---|---|

| Owner Compensation | Added back to profit | Treated as an operating expense |

| Typical Business Size | <$2–$3M revenue | >$3–$5M revenue |

| Primary Buyer | Individual owner-operator | Institutional investors, private equity |

| Valuation Multiples | 2×–4× | 4×–7× |

| Risk Perception | Higher (owner-dependent) | Lower (management-dependent) |

Key takeaway: Use SDE if you’re deeply involved in your business. Switch to EBITDA when you’ve built a management team and want to attract higher-paying, institutional buyers. Choose the method that aligns with your business structure and buyer expectations to maximize value.

SDE vs EBITDA Valuation Methods Comparison for Home Service Businesses

SDE vs EBITDA, when to use one vs the other. How to calculate it and chose the appropriate multiple

sbb-itb-a3ef7c1

What is Seller's Discretionary Earnings (SDE)?

Seller's Discretionary Earnings (SDE) represents the total financial benefit an owner-operator gains from their business. Jacob Orosz, President of Morgan & Westfield, puts it this way:

"Seller's discretionary earnings (SDE) is a measure of the earnings of a business and is the most common measure of cash flow used to value a small business."

This highlights SDE's focus on owner-specific earnings rather than general operational metrics.

SDE is especially relevant for small, owner-operated businesses - typically those generating less than $10 million in annual revenue. For home service companies like HVAC, plumbing, or landscaping businesses, this metric is particularly useful because the owner often wears multiple hats, acting as both manager and technician.

Unlike traditional accounting methods, SDE adjusts financials to reflect the true earning potential for a buyer. Essentially, it starts with net profit and adds back expenses tied to the current owner's unique situation - things like their full salary, personal vehicle costs charged to the business, and one-time expenses that wouldn’t carry over to new ownership.

How to Calculate SDE

Calculating SDE is straightforward:

SDE = Pre-Tax Net Income + Owner's Salary + Owner's Benefits + Interest + Depreciation + Amortization + Non-recurring Expenses

Here’s an example for a home service business:

| SDE Component | Amount | Notes |

|---|---|---|

| Pre-Tax Net Income | $150,000 | Starting point from your P&L |

| Owner's Salary | + $80,000 | Full compensation package |

| Health Insurance/Perks | + $10,000 | Personal benefits paid by the business |

| Interest Expense | + $5,000 | Interest on equipment loans |

| Depreciation | + $12,000 | Non-cash expense for service trucks |

| One-Time Legal Fees | + $3,000 | Non-recurring expense |

| Total SDE | $260,000 | Total benefit to a new owner-operator |

The "add-backs" fall into three main categories:

- Owner-related adjustments: This includes the owner's full salary, payroll taxes, health insurance, and retirement contributions. A new owner would set these based on their own needs.

- Discretionary expenses: Personal costs charged to the business, like vehicle leases, family phone plans, or charitable donations.

- Non-recurring expenses: One-time costs, such as legal settlements, major equipment repairs from rare events, or a website redesign.

To ensure buyers accept these adjustments during due diligence, document every expense thoroughly. Each discretionary cost should appear on your tax returns and income statements, supported by invoices. If you own the real estate where your business operates and pay yourself rent, adjust that rent to current market rates before calculating SDE.

Why Home Service Businesses Use SDE

Home service businesses are classic "Main Street" operations where the owner plays a central role. You’re not just the boss - you’re likely the lead technician, the person answering service calls, or the landscaper managing crews.

SDE reflects this hands-on reality. As Sheila Spangler, a Certified Mergers & Acquisitions Professional, explains:

"For smaller, owner-operator businesses, SDE generally is the most relevant earnings stream."

Since home service owners often mix personal and business finances, SDE provides a clear picture of the actual cash flow available to a buyer who plans to work in the business. This creates a fair comparison, even if one owner takes a higher salary or runs more personal expenses through the company.

For businesses earning under $1.5 million, SDE is the standard valuation method. Small businesses typically sell for 2× to 4× their SDE, meaning every dollar added back could increase the sale price by $2 to $4. This clarity in valuation paves the way to explore EBITDA, which is more relevant for larger operations.

What is EBITDA?

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It’s a way to measure your business’s core operating performance, independent of financing choices, tax strategies, or accounting methods . Unlike SDE (Seller’s Discretionary Earnings), which reflects what you, as the owner, take home, EBITDA focuses on what the business generates as a standalone entity - completely separate from ownership.

This distinction is important because EBITDA assumes the business operates with a professional management team rather than being owner-operated. It’s the go-to metric for institutional buyers, private equity firms, and experienced investors. For home service businesses generating $3 million to $5 million or more in revenue, EBITDA becomes the preferred valuation method . It’s specifically designed for businesses with established management structures and doesn’t account for owner-specific adjustments like personal expenses or discretionary perks.

Typically, businesses valued using SDE sell for 2× to 4× their earnings, while those using EBITDA can command multiples of 4× to 7× or even higher. Why the difference? Buyers are willing to pay more for a business that doesn’t rely heavily on a single individual, as this reduces operational risk.

How to Calculate EBITDA

Calculating EBITDA starts with your net income and adds back certain expenses:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

The key difference from SDE lies in how owner compensation is treated. With EBITDA, your salary is considered an operating expense at market rates, rather than being added back to profits . If you’re actively involved in the business, you’ll need to subtract the cost of hiring a professional manager to replace your role.

Here’s an example for a home service business:

| EBITDA Component | Amount | Notes |

|---|---|---|

| Net Income | $200,000 | After all expenses, including manager salary |

| Interest Expense | + $5,000 | Loan interest on equipment |

| Taxes | + $50,000 | Federal and state income taxes |

| Depreciation | + $12,000 | Service trucks and equipment |

| Amortization | + $3,000 | Software and intangible assets |

| Total EBITDA | $270,000 | Operating profit before financing decisions |

For instance, if you’re currently drawing $120,000 but a professional manager would cost $75,000, you need to adjust your net income accordingly before calculating EBITDA.

This method is particularly important when transitioning from an owner-operated model to one led by a management team.

When EBITDA Applies to Your Business

EBITDA is the right metric for your business when you’re no longer involved in daily operations. This shift typically happens once you’ve built a management team - such as an operations manager or general manager - who can handle the day-to-day decisions .

John C. Bucher provides a helpful perspective:

"Think of EBITDA as the business's cash flow if run by a hired management team."

Your business is ready for EBITDA-based valuation when it has multiple locations, standardized operating procedures, or an established management team . It’s also the preferred metric for banks and SBA lenders because it offers a clearer, less subjective view of cash flow available for debt repayment .

If you’re planning to sell to institutional buyers or private equity, it’s a good idea to start preparing your financials 2 to 3 years in advance. This includes removing personal expenses, hiring a general manager if needed, and documenting your operational systems. Shifting from "working in" your business to "working on" it can position you for the higher multiples that EBITDA-based valuations typically command.

SDE vs. EBITDA: Key Differences

The valuation method you choose plays a major role in shaping how buyers perceive your business and, ultimately, how much they’re willing to pay. Seller’s Discretionary Earnings (SDE) focuses on what you, as the owner, take home. It adds back your salary, personal perks, and discretionary expenses to reflect the total financial benefit available to a single owner-operator. On the other hand, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) measures what the business earns independently, treating an owner’s or manager’s salary as a normal operating expense.

This difference impacts everything from your asking price to the type of buyer your business attracts. SDE valuations typically appeal to individual owner-operators looking for a “job plus ownership.” Meanwhile, EBITDA valuations draw institutional investors, private equity firms, and strategic buyers.

Main Street businesses, which are often priced using SDE, usually sell for 2.0×–3.5× earnings. In contrast, mid-market companies valued with EBITDA tend to command multiples of 4×–7× or more. Misusing these metrics can significantly hurt your business’s value - sometimes by as much as 20%–40%. For example, inflating SDE figures with an EBITDA multiple creates unsustainable valuations that often fail during underwriting.

Side-by-Side Comparison: SDE vs. EBITDA

Here’s a quick breakdown of the key differences between the two valuation methods:

| Feature | Seller's Discretionary Earnings (SDE) | EBITDA |

|---|---|---|

| Owner Compensation | Added back to profit | Treated as an operating expense at market rates |

| Typical Business Size | Smaller businesses (under $2–$3M revenue) | Mid-market companies (over $3–$5M revenue) |

| Primary Buyer | Individual owner-operator | Institutional investors and strategic buyers |

| Operational Style | Owner works in the business | Owner works on the business |

| Valuation Multiples | 2.0× to 3.5× | 4× to 7× or higher |

| Risk Perception | Higher (business depends on owner’s involvement) | Lower (due to established systems and management) |

How the Wrong Method Affects Your Sale

Choosing the wrong valuation method can seriously derail your sale. For instance, using SDE for a larger, well-managed business undervalues it because it misses out on the higher multiples that institutional buyers are willing to pay for scalable operations. On the flip side, applying EBITDA to an owner-operated business overlooks the value of your personal contributions, which can lead to valuations that lenders reject.

Lenders, especially banks and SBA institutions, typically require a Debt Service Coverage Ratio (DSCR) of at least 1.25× to approve loans. This means the cash flow must comfortably cover debt payments after factoring in a market-rate manager’s salary. If your valuation doesn’t meet this standard, the deal might fall apart during underwriting.

Sheila Spangler, a business appraiser, emphasizes the importance of accurate data in valuations:

"The integrity of the data gathering used to demonstrate the multiples is extremely important... don't get too hung up on industry multiple reports."

To ensure a smooth sale, your valuation method must reflect your business’s structure and align with the type of buyer you’re targeting. Mixing metrics - like applying a 5× EBITDA multiple to an SDE cash flow - creates unrealistic figures that won’t hold up during due diligence. Proper alignment is key to accurate pricing and successful negotiations.

When to Use SDE for Your Home Service Business

Understanding when to use Seller’s Discretionary Earnings (SDE) instead of EBITDA is crucial for home service businesses, especially smaller, owner-operated ones. If your business generates annual revenue under $1 million and you’re deeply involved in its daily operations - whether that's taking service calls, scheduling jobs, or managing marketing - SDE is likely the better metric. This approach helps showcase the full cash flow potential for a prospective owner, offering a clear view of what they might realistically take home.

Chris Walton, CEO of Eton Venture Services, puts it simply:

"SDE is the go-to approach for showing a potential buyer how much they can realistically take home from the business."

This transparency not only ensures fair pricing during a sale but also strengthens your Small Business Administration (SBA) loan application. It’s a practical and straightforward choice in many owner-operated scenarios.

Best Use Cases for SDE

SDE is particularly useful when selling to an individual buyer looking to buy a business and run it themselves rather than hiring a management team. In these cases, the buyer isn’t just purchasing a company - they’re investing in a livelihood. They need confidence that the business can support their salary and lifestyle. SBA lenders also rely on SDE to verify that the business generates enough cash flow to cover debt payments, often requiring a Debt Service Coverage Ratio of at least 1.25×.

For many small home service businesses, personal and business finances are often intertwined. Expenses like personal vehicle leases, health insurance, travel, or even family payroll are sometimes run through the company. SDE accounts for these discretionary expenses by adding them back, revealing the business’s actual earning capacity for a new owner. However, it’s essential to document these add-backs thoroughly, as buyers and lenders will carefully examine them during due diligence.

To give some perspective, service businesses with annual revenues under $5 million typically sell for SDE multiples ranging from 1.5× to 3.0×. These multiples vary depending on the size and type of business. For instance, pest control businesses average 2.40×, landscaping services 2.24×, and cleaning businesses 2.14×. If you’re actively involved in running a small operation, SDE is likely the most relevant metric for evaluating your business.

When to Use EBITDA for Your Home Service Business

EBITDA becomes a practical choice for evaluating your home service business once it no longer depends on your direct involvement. If you've built a solid management team - whether that's a General Manager, COO, or department heads - EBITDA provides a clearer picture of your company's operational performance. This shift often occurs when your business reaches annual revenue between $3 million and $5 million or generates earnings in the range of $1 million to $2 million.

Unlike other metrics, EBITDA focuses on operational performance without factoring in the owner's day-to-day contributions. If you've stepped away from tasks like answering service calls or managing schedules, and the business continues to run efficiently, it's a signal that an EBITDA-based valuation might be appropriate. This operational independence not only boosts scalability but also enhances the valuation multiples when selling. Larger buyers, such as private equity firms or institutional investors, value this autonomy because it reduces risk and supports scalable operations, often leading to higher purchase prices.

For example, smaller, owner-operated businesses typically sell for multiples of 2x–3.5x Seller’s Discretionary Earnings (SDE). In contrast, mid-market companies evaluated using EBITDA often achieve multiples of 4x–7x or more. These higher multiples reflect the reduced risk and increased scalability that sophisticated buyers prioritize.

Best Use Cases for EBITDA

EBITDA is particularly useful when targeting institutional buyers rather than individual owner-operators. For instance, private equity firms seeking a "platform" acquisition in the home service industry or strategic buyers looking to expand their portfolios will likely evaluate your business using EBITDA.

Businesses with multiple locations or significant capital investments are also well-suited for EBITDA-based evaluations. If you manage several branches, each with its own leadership, EBITDA captures the overall efficiency of your operations. John Diaz from South Florida Business Sales explains:

"Larger HVAC companies, especially those with multiple locations or significant capital investments, might benefit more from EBITDA."

Additionally, banks and lenders favor EBITDA because it highlights operating profitability and cash flow available for servicing debt. Once you've hired key management, removed personal expenses from your financials, and documented Standard Operating Procedures, your business becomes a professional, turnkey operation. This level of preparation - typically achieved after 2–3 years - attracts both institutional financing and strategic acquirers.

Example: How SDE and EBITDA Change Your Business Value

Here's a real-world scenario shared by KMF Business Advisors (November 2025) that shows how business valuation can differ depending on whether you use SDE or EBITDA. The example involves an HVAC company.

The company brings in $1,000,000 in annual revenue and reports a net profit of $180,000. The owner takes a salary of $120,000, racks up $30,000 in personal perks (like vehicle expenses, health insurance, and travel), and had a one-time equipment repair expense of $10,000 during the year.

SDE Calculation

To calculate the Seller’s Discretionary Earnings (SDE), you add back the owner’s salary, personal perks, and the one-time expense to the net profit:

- $180,000 (net profit)

- $120,000 (owner salary)

- $30,000 (personal perks)

- $10,000 (one-time expense)

This gives a total SDE of $340,000. Using a typical 3× multiple for owner-operated HVAC businesses, the valuation comes out to $1,020,000.

EBITDA Calculation

For EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), you adjust the SDE by replacing the owner’s salary with the cost of a market-rate general manager, which is estimated at $120,000. This adjustment reduces the earnings figure:

- $340,000 (SDE)

- – $120,000 (owner salary replacement)

This results in $220,000 EBITDA. Applying a 4.5× multiple, which is typical for businesses with professional management, the valuation is approximately $990,000.

Key Takeaway

SDE gives a higher earnings figure but uses a lower multiple, while EBITDA results in a lower earnings figure but benefits from a higher multiple. As business broker John C. Bucher puts it:

"SDE = What the owner puts in their pocket. EBITDA = What the business earns regardless of who owns it."

The $30,000 difference in valuation highlights how buyer preferences vary. Individual buyers tend to value owner-specific benefits, while institutional investors prioritize earnings that are scalable and not tied to the current owner.

How to Choose Between SDE and EBITDA

Selecting the right valuation method is crucial for accurately representing your business's performance and meeting buyer expectations. A wrong choice could undervalue your business by as much as 20% to 40%.

The revenue level of your business plays a major role. For companies with earnings under $2 million, SDE is typically the better fit. On the other hand, businesses generating over $5 million often align better with EBITDA in the eyes of buyers. If your revenue falls between these benchmarks, the structure of your management team becomes the deciding factor.

Your operational role within the business is another key consideration. If you’re still involved in day-to-day tasks like service calls, estimates, or crew management, you’re likely an owner-operator, making SDE the more accurate choice. But if you’ve delegated daily operations to a general manager and focus more on strategy and growth, EBITDA might better represent the business’s performance.

The type of buyer you’re targeting also influences the decision. Individual buyers and local competitors often focus on SDE since they’re primarily interested in cash flow for themselves. In contrast, private equity firms and strategic buyers lean toward EBITDA because they’re evaluating the scalability and systems of the business rather than looking to step into an operational role. Business broker John C. Bucher sums it up well:

"SDE assumes the owner works in the business. EBITDA assumes the owner works on the business."

Considering these factors can help you make an informed choice. Here’s a breakdown to guide your decision.

Step-by-Step Decision Guide

- Revenue: Opt for SDE if your revenue is under $2 million. For businesses earning over $5 million, EBITDA is usually the better choice.

- Role in the Business: SDE is ideal for owner-operators, while EBITDA works better for businesses managed by professional teams.

- Buyer Profile: Individual buyers lean toward SDE, while private equity firms and strategic acquirers prefer EBITDA.

- Expense Documentation: If you’ve included personal perks in your expenses, SDE can help reflect the true earnings available to the owner.

Before finalizing your valuation, run a "Buyer’s Sanity Test." This involves assuming a 10%–20% down payment and a 10-year SBA loan. Make sure your chosen metric can comfortably cover debt payments while leaving room for a reasonable profit margin.

Conclusion

Deciding between SDE and EBITDA is all about aligning your valuation approach with what potential buyers expect. As business broker John C. Bucher explains:

"SDE = What the owner puts in their pocket. EBITDA = What the business earns regardless of who owns it."

Using the wrong metric can lead to a misaligned valuation, potentially hurting your chances of securing the right deal. That's why it's crucial to choose a method that fits your business model and appeals to your target buyer.

For smaller home service businesses - those typically generating less than $2–$3 million in revenue - where the owner is deeply involved in daily operations, SDE is often the better choice. On the other hand, if your business has scaled beyond $3–$5 million in revenue and includes a management team, EBITDA is more likely to attract institutional buyers who are prepared to pay higher multiples. Knowing which metric to use can make all the difference in achieving the best possible valuation.

Selecting the right valuation method not only helps your business meet financing requirements but also ensures you attract serious buyers and secure a fair deal. Matching your valuation approach to your business's structure and goals sets you up for a successful sale.

FAQs

How do I choose between SDE and EBITDA to value my home service business?

When determining the best way to value your home service business, the choice between SDE (Seller’s Discretionary Earnings) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) largely depends on how your business operates and its size.

If your business is owner-operated and relies heavily on your day-to-day involvement, SDE is the better option. It showcases the total financial benefits available to a single owner-operator, making it particularly useful for small businesses preparing for a sale.

For larger businesses with a professional management team, EBITDA is more appropriate. This metric focuses on operational performance without factoring in ownership, providing a clearer picture of the business’s profitability for prospective buyers or investors.

To decide which valuation method suits your business, think about its size, management structure, and who the valuation is intended for - whether it’s potential buyers or lenders.

What factors affect the valuation multiples for SDE and EBITDA in home service businesses?

Valuation multiples for Seller’s Discretionary Earnings (SDE) and EBITDA hinge on several factors that highlight a business's financial health and operational dynamics.

For SDE, which is often used for smaller, owner-operated businesses, key elements include the industry type, consistency of cash flow, and the owner’s role in daily operations. Companies with steady recurring revenue, minimal risk, and a strong foothold in their market typically secure higher SDE multiples.

On the other hand, EBITDA is more commonly associated with larger or professionally managed companies. Here, aspects like growth potential, profit margins, and competitive standing take center stage. Businesses with stable earnings, positive industry trends, and promising growth opportunities are more likely to command higher EBITDA multiples.

External influences also play a role. Industry growth rates, market conditions, and broader economic factors - such as interest rates and investor sentiment - can significantly sway these multiples. Larger companies, in particular, often benefit from higher multiples due to their economies of scale and the perception of lower risk.

Why do institutional buyers often prefer EBITDA over SDE for valuations?

Institutional buyers tend to prefer EBITDA because it offers a clear and consistent way to evaluate a business's financial health. By stripping out owner-specific costs and discretionary spending, EBITDA zeroes in on the company’s core operating profitability. This makes it much easier to compare businesses side by side.

This metric is especially appealing to buyers who intend to run the business independently of the current owner. It highlights the company’s earnings potential without being influenced by individual management styles or personal expenditures. For these reasons, EBITDA is often seen as a dependable tool for making long-term investment decisions.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)