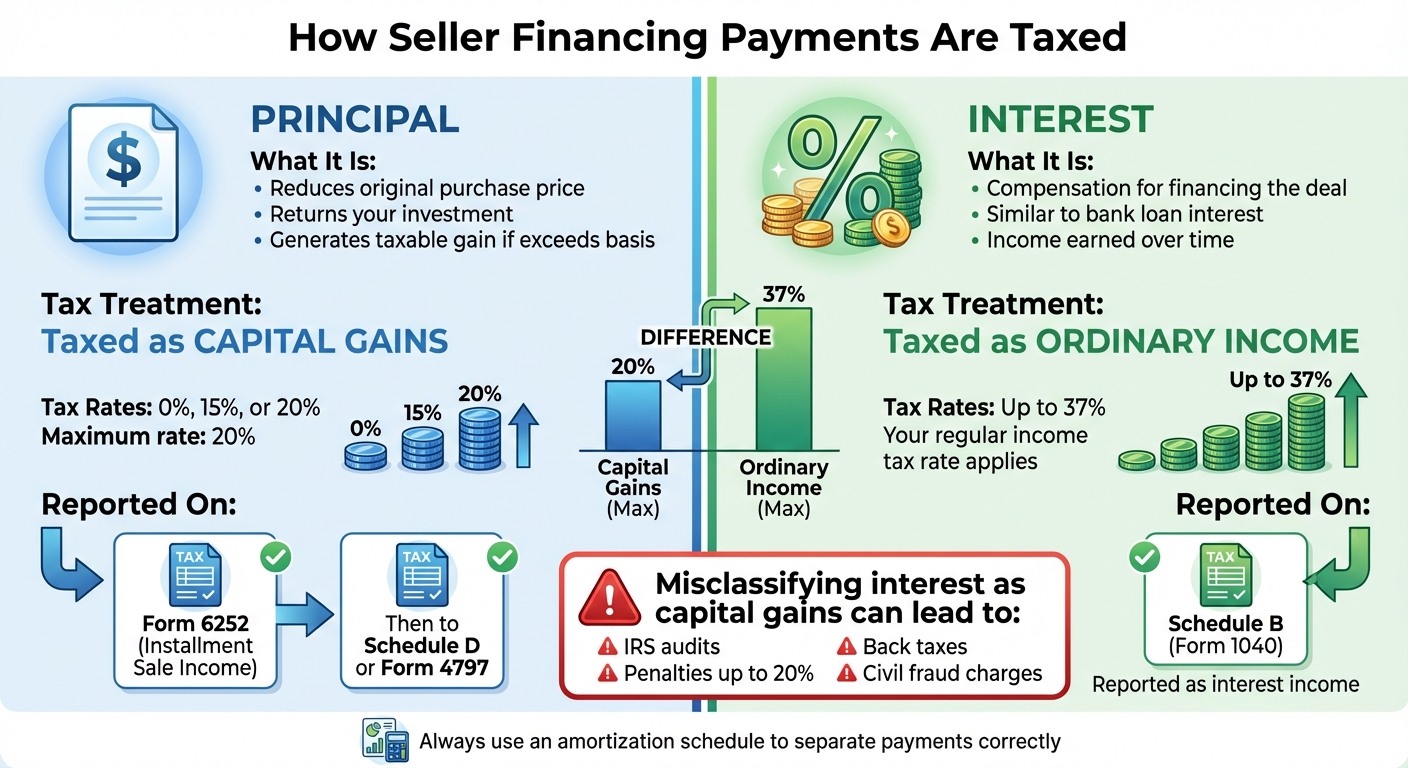

Seller financing allows you to act as a lender when selling a property or business, receiving payments over time that include principal and interest. For tax purposes:

- Principal: Taxed as capital gains (rates: 0%, 15%, or 20%).

- Interest: Taxed as ordinary income (rates up to 37%).

The IRS requires clear reporting of these components. Misclassifying interest as capital gains or setting interest rates below the IRS's Applicable Federal Rate (AFR) can lead to audits, penalties, and back taxes.

Key Points:

- Interest income is reported on Schedule B (Form 1040).

- Principal gains are reported on Form 6252 (Installment Sale Income).

- Below-market rates trigger imputed interest rules, taxing phantom income you didn’t actually receive.

- Maintain an amortization schedule to separate payments into interest and principal accurately.

Proper documentation and compliance with IRS rules are essential to avoid penalties and ensure correct taxation. Tools like amortization schedules and consulting a CPA can simplify the process.

Principal vs Interest Tax Treatment in Seller Financing

How the IRS Taxes Interest Income from Seller Financing

Principal vs. Interest: What's the Difference?

When a buyer makes a payment on a seller-financed deal, it’s split into two parts: principal and interest. The principal reduces the original purchase price, essentially returning your investment. If the principal amount exceeds your basis in the property, it generates a taxable gain. On the other hand, the interest is your compensation for financing the deal, much like a bank loan.

Here’s where it gets tricky: the IRS taxes these two components differently. Interest is treated as ordinary income, taxed at your regular rate, which can go as high as 37%. Meanwhile, any gain on the principal is taxed as a capital gain, with rates generally maxing out at 20% for most taxpayers. Misclassifying these amounts could lead to tax errors or penalties. To avoid this, an amortization schedule is crucial. This table breaks down each payment into its principal and interest portions, ensuring everything is properly categorized. Also, your promissory note should clearly outline the interest rate, payment schedule, and loan term to make sure the schedule is accurate.

IRS Reporting Requirements for Interest Income

When tax season rolls around, reporting seller-financed income requires extra attention. The IRS expects you to report interest and principal separately, and each goes on a different form.

- Interest income: Reported as ordinary income on Form 1040 and detailed on Schedule B.

- Principal income: The taxable gain portion is reported on Form 6252, Installment Sale Income, and then carried over to either Schedule D or Form 4797. The specific form depends on whether you sold a capital asset or business property.

Keeping these streams separate is critical because errors can raise red flags and potentially lead to audits. If you’re using tools like Clearly Acquired to structure your deal, ensure your documentation aligns with IRS requirements from the start. Proper paperwork and accurate reporting are key to staying compliant.

State Tax Rules

Federal rules might set the foundation, but state tax laws add another layer of complexity. Most states start with your federal taxable income and tax interest as ordinary income at their respective rates. However, some states apply unique rules to installment sales, including modifications or limitations that could affect how your income is taxed.

There’s more: some states have usury laws that cap the maximum interest rate you can charge. A few even require you to obtain a license if you finance multiple transactions in a single year. To avoid any complications, review the regulations for both your home state and the state where the property is located. Make sure your interest rate, paperwork, and reporting methods comply with all applicable rules. Staying informed can save you from unexpected issues down the road.

065. Tax Implications of Seller Financing

Common Tax Mistakes Sellers Make

Getting tax reporting right in seller financing is critical for staying compliant and avoiding unnecessary financial headaches. Even seasoned sellers can slip up, especially when it comes to reporting interest income. These mistakes can lead to tax underpayments and penalties. Let’s break down some common errors and how to sidestep them.

Treating Interest as Capital Gains

One common misstep is lumping together the principal and interest into a single "sale proceeds" figure and reporting it all as capital gains on Form 6252. The IRS, however, requires that interest income be reported as ordinary income in the year it’s received. Only the profit on the principal qualifies for capital gains treatment. This error often happens when sellers rely solely on the closing statement instead of using a detailed amortization schedule.

For example, misreporting $30,000 of interest as capital gains can lead to hefty penalties and even civil fraud charges. The IRS has tools to spot these errors, such as matching the buyer’s interest deductions or reviewing Form 1098. Once identified, the IRS can reclassify the misreported amounts, impose back taxes, and tack on accuracy-related penalties of up to 20%. To avoid this, ensure all interest income is properly reported as ordinary income.

In addition to misclassification, setting an interest rate that’s too low can bring its own tax complications.

Below-Market Interest Rates and Imputed Interest

If the interest rate on your note is too low - or even zero - the IRS may step in with imputed interest rules. When the stated interest rate is below the Applicable Federal Rate (AFR) for the note’s term and month, the IRS can treat part of the principal as taxable interest income. The AFR, which is updated monthly, applies to short-term (up to 3 years), mid-term (over 3 to 9 years), and long-term (over 9 years) notes.

For instance, imagine a $1,000,000 note with a 1% interest rate while the AFR for short-term notes is 3%. The IRS would require you to recognize an additional 2% as taxable interest - about $20,000 annually. This "phantom income" can push you into a higher tax bracket, reduce your eligibility for certain deductions or credits, and create timing mismatches between your taxable income and actual cash flow. Transactions between related parties, such as family members or closely held businesses, are especially scrutinized, as the IRS may suspect hidden gifts or income shifting.

Poor Record-Keeping for Interest and Principal

Keeping detailed records is a must. Without a clear amortization schedule, it’s easy to misreport payments by overstating capital gains or understating interest income. This can lead to inconsistent reporting and issues with basis adjustments, depreciation recapture, and gain calculations. Sellers who rely only on the original closing statement and fail to keep updated records often struggle to answer key questions from their tax preparer, like "How did you calculate the interest portion?" or "Where is your amortization schedule?"

Discrepancies between your records and the buyer’s statement of interest paid can also increase your audit risk. To stay compliant, maintain accurate, updated records that break down each payment into principal and interest. Keep copies of Form 6252, Schedule B, Form 1098, or any other relevant documents. This not only ensures proper reporting but also makes it easier to coordinate with buyers, tax advisors, and closing attorneys. Platforms like Clearly Acquired can also help structure and document deals for Main Street and lower mid-market transactions effectively.

sbb-itb-a3ef7c1

How to Report Interest Income Correctly

Now that you're familiar with the common mistakes, let's focus on how to accurately report your interest income. Proper documentation and using the correct IRS forms are key. Here's how to get it right.

Build an Amortization Schedule

An amortization schedule acts as your guide for dividing each payment into interest and principal. To create one, you'll need details from your promissory note, including the original loan amount, interest rate, term length, and payment frequency. For each payment, calculate the interest by multiplying the outstanding principal by the periodic interest rate (annual rate divided by the number of payments per year). The remaining portion of the payment reduces the principal. The schedule helps you track the balance over the loan's life.

You can use tools like Excel, Google Sheets, or online calculators to generate this schedule. Many accounting software programs can also create loan schedules that automatically separate annual totals of interest and principal. Be sure to include important details, such as payment dates, transaction references, and the buyer's name, to stay prepared for any audits.

If you’ve been receiving payments without a schedule, you’ll need to reconstruct one based on the original loan terms. Reallocate past payments between interest and principal, then compare your updated totals with what you’ve already reported. If there are major discrepancies, you may need to file amended returns (Form 1040-X) for the affected years. Going forward, keep your schedule updated - especially when the buyer makes extra payments, misses a payment, or if the loan terms change.

With a clear schedule, you can accurately separate principal from interest, which is crucial for using the installment sale method.

Use the Installment Sale Method

Once your amortization schedule is ready, you can apply the installment sale method to report your income. This method allows you to recognize the gain from the sale proportionally as you receive principal payments, instead of reporting the entire gain in the year of the sale. To calculate the taxable gain for each payment, multiply the principal received by your gross profit percentage (gross profit divided by the contract price). Report this amount on Form 6252 (Installment Sale Income), which flows to Schedule D or Form 4797, depending on the type of asset sold.

The interest portion of each payment is handled separately. It’s not included on Form 6252 but instead reported as ordinary interest income on Schedule B (Interest and Ordinary Dividends), similar to bank account interest. Use your amortization schedule to total the principal and interest received for the year, ensuring your records match your actual cash receipts.

Here’s an example: Imagine you sell a business for $500,000 with a $100,000 down payment and a $400,000 note at 6% interest, amortized over 10 years with monthly payments. In the first year, you receive $53,334 in total payments, of which $23,400 is interest and $29,934 is principal. If your gross profit on the sale is $300,000 (with a basis of $200,000), your gross profit percentage would be 60% ($300,000 ÷ $500,000). You’d report $77,960 as the installment gain on Form 6252 (60% of the down payment and principal received) and $23,400 as ordinary interest income on Schedule B.

Set Interest Rates at or Above the Applicable Federal Rate (AFR)

Setting the right interest rate from the beginning can save you from future problems. The IRS publishes the Applicable Federal Rate (AFR) each month, categorized by term lengths - short-term (up to 3 years), mid-term (over 3 to 9 years), and long-term (over 9 years). Make sure your note’s interest rate is at least equal to the AFR in effect during the month the financing arrangement is finalized.

Before signing your promissory note or purchase agreement, check the current AFR on IRS.gov. If your closing is delayed, double-check the updated rate, as AFRs change monthly. For example, if you’re finalizing a 5-year note in December 2025, confirm the mid-term AFR for that month to ensure your rate meets or exceeds it. This step helps you avoid the IRS treating your loan as below-market, which could lead to imputed interest rules and phantom taxable income.

Tools like Clearly Acquired can simplify AFR checks with ready-to-use templates. If your note meets or exceeds the AFR, you’ll report only the interest you actually receive, while the buyer deducts the interest they actually pay.

Complex Scenarios in Seller Financing

When it comes to seller financing, some situations demand extra care to ensure your reporting stays accurate and compliant. Scenarios like defaults, early payoffs, note modifications, and sales involving depreciable assets require more precise handling to meet IRS standards.

Defaults, Early Payoffs, and Note Modifications

Once you've set up clear methods for tracking routine payments, more complicated situations like defaults or early payoffs call for additional adjustments. For example, if a buyer defaults and you forgive part of the balance, the IRS requires you to recognize the deferred gain as ordinary income. In cases where you repossess the business or assets, it's essential that your seller financing agreement includes properly documented promissory notes, valid security interests (like UCC-1 filings), and clearly defined default and foreclosure terms.

An early payoff, on the other hand, means you’ll need to report all remaining deferred gain tied to the principal in the year the payoff occurs. This can result in a substantial one-time capital gains tax. The interest portion, based on your amortization schedule or payoff calculation, is considered ordinary income and must also be reported in the year received. Sellers with higher incomes often work with their tax advisors to time early payoffs strategically, helping them manage their tax brackets and estimated payments for that year.

When it comes to major note modifications - like changing the interest rate or payment terms - the IRS treats this as if you’ve exchanged the old note for a new one. This can trigger additional gain recognition on the original note, change how payments are allocated between interest and principal, and potentially invoke imputed interest rules if the new interest rate falls below the Applicable Federal Rate (AFR). Before finalizing any changes, recalculate your amortization schedule, confirm that the new rate meets or exceeds the AFR, and evaluate whether the tax consequences outweigh the benefits of the modification. Keeping detailed records and updating your schedules is critical when making these adjustments.

Transactions Involving Depreciable Assets

Sales that include depreciable assets - like equipment, furnishings, or certain real property improvements - require careful allocation to ensure compliance. In these cases, each payment must be broken down into interest, basis return, depreciation recapture, and capital gain. Interest is always considered ordinary income, while the portion of the sale price tied to depreciable assets may trigger depreciation recapture. This recapture is taxed at ordinary income rates, often up to 25% for certain real property components, and is recognized as you receive principal payments under the installment method. The remaining gain, after accounting for recapture, qualifies for long-term capital gains rates.

To stay compliant, start with a detailed asset allocation agreed upon by both parties. This is often documented on Form 8594, which breaks down the purchase price into categories like goodwill, real estate, and equipment. Each year, report interest income on Schedule B and gains (including recapture) on Form 6252. Consistent allocation in the purchase agreement and accurate reporting on Form 6252 are essential to avoid errors, such as underreporting recapture or misclassifying interest as capital gain.

Matching Interest Income with Buyer Deductions

Ensuring that your reported interest income matches the buyer’s deductions is crucial to maintain compliance with IRS standards. The IRS cross-references interest reported by sellers with the deductions claimed by buyers, and any mismatches can lead to audits. Common causes of discrepancies include misallocating payments, using inconsistent schedules, or failing to account for imputed interest.

To reduce risk, both parties should follow the same written amortization schedule, ensure the note's stated interest rate meets the AFR, and keep all closing documents, payment histories, and addenda aligned with the amounts reported on their respective tax returns. At closing, agree in writing on the interest rate, payment schedule, and allocation of the purchase price among assets. Make sure the amortization schedule clearly separates interest and principal for each payment. Each year, provide the buyer with a statement summarizing total payments, interest, and principal to ensure your filings align. If any changes occur, update the schedule and have both parties sign off on the revisions. For larger or multi-asset deals - common in Main Street and lower-middle-market transactions - working with platforms like Clearly Acquired and consulting a CPA experienced in installment sales can help maintain consistency and avoid costly disputes with the IRS.

Conclusion

Seller financing offers a flexible way to structure deals, but navigating the tax landscape requires careful attention. Interest earned is treated as ordinary income and must be reported annually on Schedule B and Form 1040, while principal payments are applied toward your basis and trigger capital gains. Using the installment sale method, gains are spread out over the life of the loan and reported using Form 6252. Misclassifying interest as capital gains can lead to penalties, so accuracy is essential.

Proper documentation is your best defense. Maintain an up-to-date amortization schedule to clearly separate interest from principal. Make sure your interest rate meets or exceeds the Applicable Federal Rate (AFR) to avoid imputed interest rules, which could require you to report income you haven’t actually received. If depreciable assets are part of the transaction, consult a CPA to allocate the purchase price correctly and prepare for depreciation recapture, which is taxed as ordinary income.

Common pitfalls - like setting rates below the AFR, poor record-keeping, or neglecting required filings - can result in audits or unexpected tax liabilities. To avoid these headaches, structure deals thoughtfully and work with a CPA or tax attorney who understands installment sales inside and out.

For those looking to streamline the process, Clearly Acquired offers digital tools that simplify seller financing. Features like integrated amortization schedules and capital structuring help transform seller financing into a tax-efficient strategy that aligns with IRS requirements while protecting your investment.

FAQs

What interest rate should I use for seller financing to comply with IRS rules?

To meet IRS requirements, the interest rate for seller financing must match or exceed the Applicable Federal Rate (AFR) - the minimum rate established by the IRS. If the rate falls below the AFR, it could trigger imputed interest, leading to extra tax obligations.

Always specify the interest rate clearly in the financing agreement and maintain detailed records of the terms to prove compliance. Since the AFR changes monthly, it’s important to stay updated to ensure your rate remains in line with the latest regulations.

How can I ensure my interest income from seller financing is classified correctly for taxes?

When dealing with interest income from seller financing, it's crucial to ensure it’s clearly identified as interest and not mistaken for principal repayment. Keep detailed records of payments, separating the interest portion from the principal, and report the interest as income on your tax return in line with IRS rules.

Working with a tax professional is a smart move to ensure everything is handled correctly and to minimize the risk of mistakes. Properly classifying this income not only keeps you compliant with tax laws but also helps you avoid unnecessary penalties.

How do state taxes affect interest income from seller financing?

State tax laws play a significant role in determining how interest income from seller financing is taxed. Generally, sellers need to report and pay taxes on the interest they earn, but the specifics can differ widely depending on the state. Some states may provide exemptions or apply unique tax treatments to this type of income.

To ensure compliance and steer clear of any surprise liabilities, it’s essential for sellers to understand the tax rules in their state. Consulting a tax professional is often a smart move, as they can provide guidance tailored to your situation. With careful planning, sellers can ensure accurate reporting and potentially minimize their tax obligations.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)