A "multiple" is a key tool used to estimate the value of an HVAC or plumbing business. It works by multiplying a financial metric, like earnings or revenue, by a specific factor. For example, if your business has $300,000 in annual earnings and the market multiple is 3x, your business is valued at $900,000.

Key points:

- Smaller businesses (under $3M revenue) are valued using SDE (Seller’s Discretionary Earnings) multiples, typically 2x–4x.

- Larger businesses (over $3M revenue) use EBITDA multiples, ranging from 3x–8x+.

- Factors like recurring revenue, owner dependency, profit margins, and financial clarity impact your multiple.

- HVAC businesses averaged a 2.75x SDE multiple in 2025, while plumbing businesses averaged 2.47x.

To improve your multiple:

- Reduce owner involvement.

- Add recurring revenue streams like maintenance contracts.

- Keep financial records clean and transparent.

For buyers, multiples help assess a business’s value and potential risks, ensuring fair deals and informed decisions.

EBITDA Multiples and Valuation Ranges: How Companies are Valued

sbb-itb-a3ef7c1

What is a Business Valuation Multiple?

A business valuation multiple is a financial ratio used to estimate a company’s value by comparing it to similar businesses that have recently sold. It’s a way to standardize comparisons across businesses of different sizes. The formula is simple: Financial Metric × Multiple = Business Value.

Here’s an example: If your plumbing business generates $250,000 in Seller’s Discretionary Earnings (SDE) and the market multiple is 2.5x, your business would be valued at $625,000.

For smaller, owner-operated HVAC and plumbing businesses (usually under $3 million in revenue), SDE is the go-to metric. SDE includes the owner’s compensation and certain add-backs to net profit. Larger companies, on the other hand, often rely on EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). EBITDA measures return on investment while accounting for variations in tax and capital structures.

"Multiples are shorthand valuation metrics used to standardize a company's value on a per-unit basis, because absolute values cannot be compared between different companies." - Wall Street Prep

While revenue multiples exist, they don’t account for profitability, making earnings-based multiples a more reliable measure. For instance, a business with $2 million in revenue but only $100,000 in profit is not comparable to one with the same revenue and $400,000 in profit. Earnings-based multiples focus on the actual cash flow a new owner can expect, making them the preferred choice for buyers and sellers alike. This foundational concept sets the stage for understanding how specific factors in the HVAC and plumbing industries influence these multiples.

How Multiples Work for HVAC and Plumbing Businesses

In HVAC and plumbing, multiples reflect the realities of how these businesses operate. From 2021 to 2025, HVAC companies sold at an average earnings multiple of 2.75x, with a range of 2.40x to 3.40x for SDE and 3.40x to 7.80x for EBITDA. Plumbing businesses during the same period averaged 2.47x in earnings multiples.

The multiple a business receives depends on how buyers perceive its risk and growth potential. Higher multiples are awarded to businesses with less owner dependency and stronger growth prospects. Smaller, owner-reliant companies typically receive lower multiples, while larger businesses with established management teams command higher ones.

Size is a major factor in determining multiples. HVAC businesses generating over $2.5 million in annual sales often see multiples above 3.0x, while those under $1 million tend to trade closer to 2.0x. This "size premium" exists because larger businesses are generally better equipped to handle debt and support professional management, making them more appealing to buyers who rely on financing.

The type of work a business does also plays a role. Companies with recurring revenue from maintenance contracts typically secure higher multiples than those relying solely on one-time installations. A well-balanced revenue mix across installation, service, and maintenance signals stability and reduces buyer risk, which translates into better multiples. As businesses grow, the distinction between SDE and EBITDA becomes more important - smaller operations rely on SDE, while larger firms shift to EBITDA-based valuations.

Why Multiples Matter to Buyers and Sellers

Understanding how multiples work is essential for fair negotiations. They provide an objective benchmark for determining a fair price.

For sellers, knowing how multiples are calculated helps identify areas for improvement - like reducing owner dependency or increasing operational efficiency - that can enhance business value. Between 2021 and 2025, the median sale price for HVAC businesses rose 23%, from $650,000 to $800,000, as owners improved their fundamentals and secured higher multiples.

"Most business buyers want to buy an income stream, not a job. A business managed largely by employees is much more valuable than one whose owner needs to work 60 hours a week." - BizBuySell

For buyers, multiples offer a quick way to determine if a deal makes sense financially. If comparable plumbing businesses in your area sell for around 2.5x SDE and you’re evaluating one priced at 4.0x, it’s critical to understand why. Perhaps the business has strong recurring revenue, minimal owner involvement, or unique systems in place. Multiples help you identify overpriced listings and spot opportunities where the asking price aligns with the business’s fundamentals.

Common Valuation Methods for HVAC and Plumbing Businesses

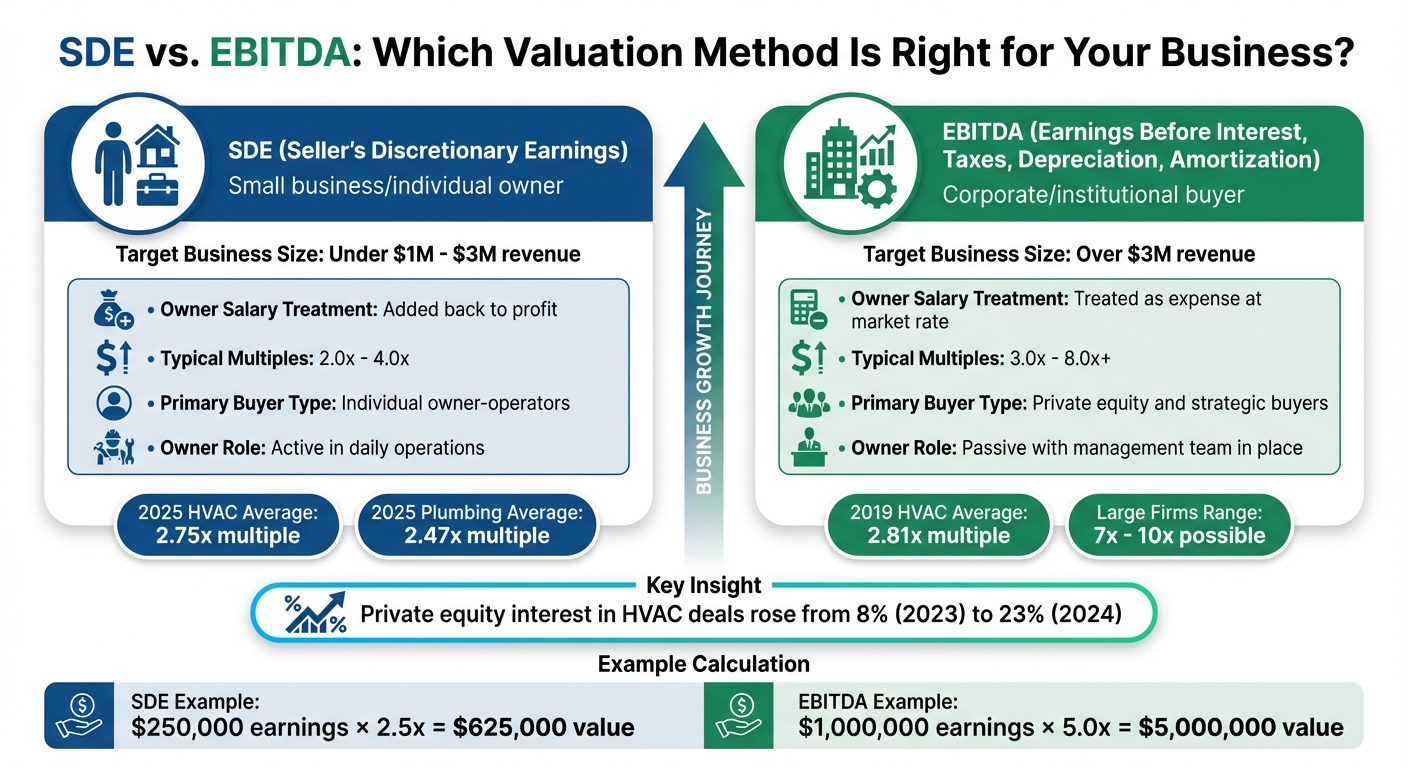

SDE vs EBITDA Valuation Methods for HVAC and Plumbing Businesses

When it comes to valuing HVAC and plumbing businesses, two main methods dominate the conversation: SDE (Seller's Discretionary Earnings) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). Each method aligns with specific business sizes, structures, and buyer preferences. Let’s break them down.

SDE Multiples: For Smaller, Owner-Operated Businesses

SDE is calculated by adding the owner’s salary, benefits, and one-time expenses (like legal fees) to the business’s net profit. This is the go-to valuation method for HVAC and plumbing businesses generating annual revenues between $1 million and $3 million. For smaller operations, especially those under $1 million in revenue, SDE multiples typically range from 2.75x to 3.25x for HVAC businesses in 2025, while plumbing companies often see multiples between 1.66x and 3.08x.

"Smaller HVAC companies usually get valued on SDE because the owner is the driving force... Larger companies (over $3M revenue) get valued on EBITDA because they have management teams in place."

– Ryan Shank

This method appeals to individual buyers because it highlights the business’s ability to generate personal income and cover debt payments. For example, if a plumbing business reports $300,000 in SDE and sells at a 2.5x multiple, the purchase price would be $750,000. The buyer essentially pays for a business that delivers $300,000 in yearly earnings.

However, as businesses grow, develop stronger management teams, and generate higher revenue, they transition to EBITDA as the preferred valuation metric.

EBITDA Multiples: For Larger, More Complex Transactions

EBITDA offers a clearer picture of a business’s operational profitability by excluding financing, taxes, and non-cash expenses. Unlike SDE, EBITDA assumes the owner’s salary is a market-rate expense, reflecting the cost of hiring a manager to replace the owner. This method is commonly used for larger HVAC and plumbing businesses - those generating over $3 million in revenue or achieving around $1 million in annual profits.

In 2019, HVAC companies sold at an average EBITDA multiple of 2.81x, but larger firms with strong recurring revenue streams can command multiples ranging from 7x to 10x. Median EBITDA multiples vary significantly, from 3.12x for businesses with under $1 million in EBITDA to 7.02x for those exceeding $5 million.

"SDE is the most commonly used metric when an individual is buying your business. EBITDA is most commonly used when a company is buying your business."

– Jacob Orosz, President, Morgan & Westfield

Private equity and strategic buyers favor EBITDA because they view the business as an investment opportunity, not merely a source of personal income. This shift is evident in the growing private equity interest in HVAC deals, which rose from 8% in 2023 to 23% in 2024.

SDE vs. EBITDA: Key Differences

Here’s a quick comparison of how these two valuation methods differ:

| Feature | SDE (Seller's Discretionary Earnings) | EBITDA (Earnings Before Interest, Taxes, etc.) |

|---|---|---|

| Target Business Size | Under $1M – $3M revenue | Over $3M revenue |

| Owner Salary | Added back to profit | Treated as an expense at market rate |

| Typical Multiples | 2.0x – 4.0x | 3.0x – 8.0x+ |

| Primary Buyer | Individual owner-operators | Private equity and strategic buyers |

| Owner Role | Active in daily operations | Passive with a management team in place |

The move from SDE to EBITDA often reflects a business’s maturity. If the owner is heavily involved in daily operations, the valuation will lean on SDE. But as the business shifts to a model where a management team handles operations, EBITDA becomes the standard - and can unlock higher valuation multiples.

What Affects Your Business Valuation Multiple

Knowing which valuation method to use is just part of the equation. The actual multiple your business attracts hinges on several key factors that buyers consider when assessing risk and future profitability. Let’s dive into the main elements that influence your valuation.

Recurring Revenue and Service Contracts

Predictable income is a huge draw for buyers. Long-term service contracts and recurring maintenance agreements provide stability, reducing buyer risk and often increasing valuation multiples by 0.5x to 1.0x compared to revenue from one-time installations.

"Companies with 40% or more revenue from service agreements often command 0.5x to 1.0x higher earnings multiples compared to businesses dependent on one-time installations"

– John Bartlett, Brentwood Growth

Why does this matter? Maintenance contracts not only indicate strong customer retention but also lower marketing costs per customer. This makes them far more appealing than relying solely on new installation jobs. Businesses centered around scheduled maintenance and repairs often achieve multiples between 4x to 6x SDE, while those leaning heavily on unpredictable installation work typically see lower multiples of 2x to 4x SDE. Maintenance-heavy models are also seen as more scalable and less vulnerable to economic downturns or competitive pricing battles.

Now, let’s look at how the mix of installation, service, and maintenance revenue further shapes buyer perceptions.

Revenue Mix: Installation vs. Service vs. Maintenance

Not all revenue streams are equal in the eyes of potential buyers. The balance between installation, service, and maintenance work plays a huge role in determining valuation, as each type of revenue carries different levels of predictability and risk.

Installation work is often cyclical and one-off - you complete the job, get paid, and then start searching for the next project. Service work offers more consistency, as customers reach out when something breaks, but it’s still not guaranteed. Maintenance work, however, stands out as the most reliable. With annual contracts, it provides built-in future cash flow.

| Revenue Stream | Predictability | Impact on Multiple | Buyer Risk Perception |

|---|---|---|---|

| Installation | Low (Cyclical/One-off) | Lowers Multiple | High (Economically sensitive) |

| Service | Medium (Repeatable) | Increases Multiple | Moderate |

| Maintenance | High (Recurring) | Highest Multiple | Low (Built-in cash flow) |

This revenue composition underscores the importance of stability and reduced risk. Businesses with strong maintenance memberships often secure premiums of 1 to 2 additional multiples compared to those reliant on installations. For instance, an HVAC company generating $1.2 million in revenue, with 50% coming from maintenance agreements, will typically command a higher multiple than one earning the same but deriving 70% of revenue from new installations.

The growing interest in recurring revenue models is evident, with private equity investments in HVAC acquisitions jumping from 8% in 2023 to 23% in 2024.

Profitability, Margins, and Financial Records

Beyond revenue streams, a business’s profitability and the clarity of its financial records are major factors in determining its valuation multiple. High profit margins and consistent earnings reduce buyer risk, directly supporting higher multiples. Healthy margins also provide a safety net for buyers, ensuring they can cover debt payments while still drawing a reasonable income.

In 2025, the median owner's discretionary earnings for HVAC businesses hit $315,225, representing a 24.8% margin of revenue. Businesses performing at or above this level often command multiples in the upper quartile, typically 3.33x SDE or higher. Strong margins signal efficient operations, effective cost management, and well-organized inventory systems - all key qualities that attract investors.

However, profitability alone isn’t enough. Transparent and organized financial records are critical during the due diligence process. Inaccurate or messy records create uncertainty, slow down negotiations, and can lead to lower offers - or deals falling apart entirely. Buyers need to trust your numbers, and clean records help build that trust.

Accurate financials also allow for add-backs, which normalize earnings by removing one-time expenses, potentially increasing the EBITDA or SDE base for valuation. For example, if you’ve expensed a personal vehicle or incurred one-time legal fees, these can be added back to showcase the true earning potential of your business.

It’s worth noting that roughly 52% of HVAC companies that go to market fail to sell, often due to high owner dependence or poor financial clarity. Partnering with an advisor can help you identify legitimate add-backs and ensure your financials are ready for scrutiny before listing your business. Clean records and strong margins not only enhance your overall value but also complement the advantages of recurring revenue and a balanced revenue mix.

How to Use Multiples to Value or Sell Your Business

Understanding how multiples work is crucial whether you're looking to sell your business or evaluate a potential acquisition. These numbers can significantly influence the final deal, so knowing how to use them effectively is key.

How to Increase Your Business's Multiple

If you're preparing to sell, your goal should be to move from a 2x–2.5x SDE multiple to a higher bracket, like 4x–5x. Achieving this takes strategic changes that make your business more appealing to buyers by reducing their perceived risks and increasing predictability.

Reduce owner dependency. A business that can operate without the owner is far more attractive to buyers. As one expert puts it, buyers prefer a "machine that prints money" over a "job with a price tag". To achieve this, consider hiring an operations manager or promoting an experienced team member to handle daily operations. Documenting processes like hiring, training, and sales can also make your business more self-sufficient.

Add recurring revenue streams. Shifting part of your revenue to maintenance agreements or service memberships can significantly improve your valuation. Even transitioning 20% of your revenue to recurring contracts can push your business into a higher multiple range. Ideally, aim for 30%–50% of your revenue to come from recurring services, as this creates predictable cash flow and reduces buyer concerns.

Organize your financials. Separate personal and discretionary expenses from your business accounts at least two years before selling. Clear financial records not only make your business more transparent but also help it sell faster - businesses with formal valuations close 15% faster and at 10% higher prices on average. Additionally, working with an M&A advisor can boost the sale price by 6% to 25%.

Stabilize your workforce. Frequent turnover among technicians can scare off buyers. To address this, invest in training programs, offer competitive benefits, and create a workplace culture that encourages employee retention. A stable team reduces operational risks and supports a higher valuation.

Invest in modern systems. Upgrading to tools like dispatch software, CRM platforms, and automated billing systems can streamline your operations and ensure clean financial records. For instance, Rainforest Plumbing & Air saw substantial growth after implementing automated dispatch and tracking KPIs, which also enhanced its valuation.

Diversify your customer base. Relying too heavily on a single client can be risky. If more than 20% of your revenue comes from one source, buyers may lower your multiple due to customer concentration risk. Expanding your customer base can help mitigate this issue.

These steps not only help sellers command higher multiples but also give buyers a checklist to evaluate the quality of a deal.

How Buyers Can Use Multiples to Evaluate Deals

For buyers, multiples provide a snapshot of a business's potential risks and rewards. A high multiple often signals lower risk and strong growth potential, while a low multiple might indicate challenges like owner dependency or inconsistent revenue.

Examine the revenue mix. Look at the balance of installation, service, and maintenance revenue. Higher multiples are justified only when maintenance and service revenue make up a significant portion of total income. A business claiming a 4x multiple should have strong recurring revenue rather than relying on one-off installation projects.

Evaluate leadership and systems. Check if the business has a capable management team in place. If the owner is still heavily involved in daily operations, the business likely falls on the lower end of the multiple scale (2x–3x). Look for documented standard operating procedures (SOPs) and automated systems that indicate the business can run independently.

Audit financials. Review profit and loss statements, tax returns, and add-backs. If personal expenses are mixed with business costs or add-backs are poorly documented, this could justify a lower multiple. Ensure that earnings are normalized, with add-backs clearly identified as non-recurring or personal.

Assess customer retention and concentration. A diversified customer base is a good sign. If one client accounts for more than 10% of revenue, negotiate a lower multiple. Additionally, a strong online reputation, like a 4–5 star Google rating, can indicate lower customer acquisition costs and justify a higher multiple.

Inspect assets. During due diligence, evaluate the condition of the fleet, tools, and equipment. Even if the multiple looks good on paper, immediate capital expenses for upgrades could reduce the business's actual value.

Use local market comparisons. Don't rely solely on national averages. Look at recent sales of similar businesses in your area, as local factors like climate, population trends, and competition can significantly affect valuations.

"If you don't know what your business is worth, how do you know if the deal is any good or not?"

– Brian Cohen, Business Strategist, SF&P Advisors

For instance, Core Mechanical Inc., a Chicago-based HVAC and plumbing business, successfully sold to Amalgam Capital in 2024. By installing a strong operational leader and reducing owner dependency, they attracted 375 potential buyers through the Axial network, ensuring a smooth and profitable exit.

Whether you're selling or buying, the key is preparation and due diligence. Sellers who reduce risks and build transferable value can command premium multiples, while buyers who carefully evaluate factors like revenue mix, financial clarity, and operational independence are better equipped to find high-quality opportunities. Multiples may be just numbers, but the work behind them is what truly determines their reliability.

Conclusion

As we've explored, understanding and strategically managing valuation multiples is crucial when selling or acquiring HVAC and plumbing businesses. These multiples act as a shorthand for determining value - whether it’s a smaller operation using a 2.5x SDE multiple or a business with strong recurring revenue aiming for a 5x multiple.

At its core, predictable cash flow is what drives value. For smaller businesses (typically under $3 million in sales), buyers and sellers focus on SDE, while larger transactions lean on EBITDA. In 2025, HVAC businesses sold at a median price of $800,000, with an average earnings multiple of 2.75x. Plumbing businesses, on the other hand, averaged $620,000 with a 2.47x multiple.

Boosting your multiple comes down to practical actions. For sellers, this means reducing reliance on the owner, building recurring revenue streams, and ensuring financial records are clean and organized. Buyers, meanwhile, should prioritize thorough due diligence - examining revenue sources, management capabilities, and any risks tied to customer concentration. And don’t underestimate the importance of online reputation; with 57% of consumers choosing home service businesses rated four stars or higher on Google, reviews can significantly influence valuation.

"The worth of a business is measured not by what has been put into it, but by what can be taken out of it."

– Benjamin Graham, Financial Analyst and Investor

Whether you're preparing to sell or considering an acquisition, valuation multiples provide a reliable framework for determining value. By focusing on building strong systems, developing a capable team, and nurturing long-term customer relationships, you naturally enhance your business's worth.

FAQs

How can I increase the valuation multiple of my HVAC or plumbing business?

To increase the valuation of your HVAC or plumbing business, focus on reducing reliance on the owner and building a stable, self-sufficient operation. Buyers are more inclined to invest in businesses that don’t hinge on the owner's day-to-day involvement and have a skilled, well-trained team in place. This makes the business appear more scalable and less risky. You can also make your business more appealing by expanding your services, exploring new markets, or growing recurring revenue streams.

Equally important is maintaining strong financial performance. Boosting profitability, keeping clean and accurate financial records, and showing consistent growth can have a big impact on your valuation. Businesses with a diverse customer base, scalable operations, and reliable cash flow tend to command higher valuation multiples - often ranging from 3x to 4x EBITDA, depending on market conditions. By refining your processes, investing in your team, and diversifying where your revenue comes from, you can position your business for a higher market value.

What factors have the biggest impact on the valuation multiple for small HVAC businesses?

The valuation multiple for small HVAC businesses hinges on several critical factors, including owner dependency, business size, and growth potential. If the owner is heavily involved in daily operations, the business typically fetches a lower multiple - around 2.5x EBITDA or revenue. On the flip side, businesses with a capable team, limited reliance on the owner, and clear pathways for growth often command higher multiples.

Other important considerations include the service mix (such as installation versus maintenance), recurring revenue streams, and whether the business caters to residential or commercial clients. HVAC companies with a diverse customer base and consistent, recurring income generally receive more favorable valuations. Ultimately, the multiple reflects how stable, scalable, and appealing the business is to potential buyers.

Why does recurring revenue increase the valuation multiple of an HVAC or plumbing business?

Recurring revenue plays a key role in increasing a business's valuation multiple. Why? Because it provides a steady, predictable income stream. This consistency lowers the risk for buyers and investors, making the business appear more stable and appealing.

In industries like HVAC and plumbing, recurring revenue typically comes from service contracts, maintenance agreements, or subscription-based plans. These models highlight strong, ongoing customer relationships and offer confidence in future earnings. As a result, businesses with these revenue streams often command higher valuation multiples during sales or acquisitions.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)