Mergers and acquisitions (M&A) in the lower-middle-market (LMM) are complex but offer significant opportunities for growth or exit. These businesses, with annual revenues between $5 million and $100 million, make up over 40% of all M&A deals. However, their unique traits - like owner-operated structures, unaudited financials, and regional focus - require careful planning and execution.

Key takeaways include:

- What Defines LMM Companies: Smaller teams, owner involvement, and limited internal controls make due diligence challenging.

- Why M&A Matters: It’s often a path for growth or an exit strategy, especially for retiring founders. Private equity firms and strategic buyers are major players.

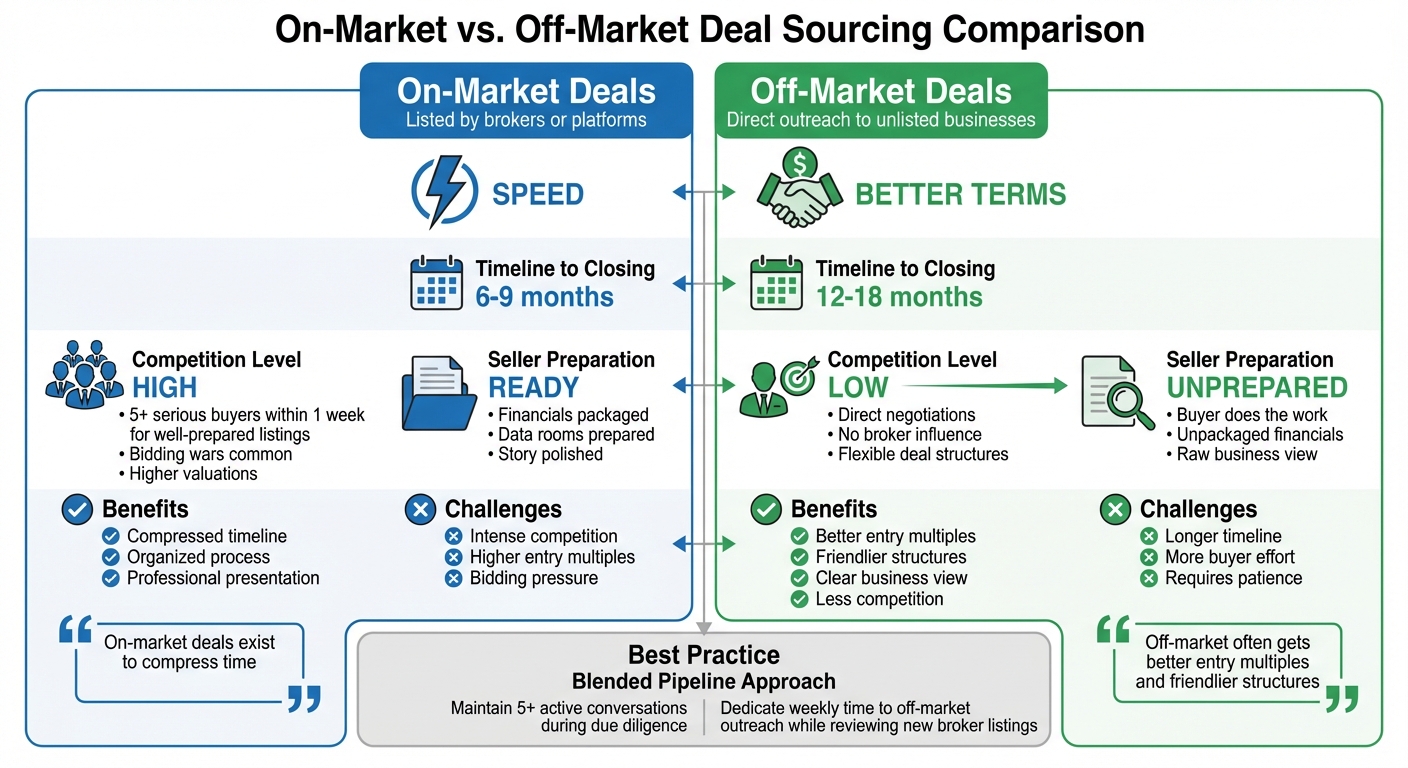

- Deal Sourcing: Balancing on-market listings for speed and off-market deals for better terms is critical.

- Valuation: EBITDA multiples vary by industry, with adjustments for risks like owner reliance or customer concentration.

- Due Diligence: Thorough financial, operational, and legal checks are essential to avoid surprises.

- Deal Structure: Asset purchases limit liability but add complexity; stock purchases simplify transfers but carry risks.

- Financing: SBA loans, seller financing, and private credit are common in LMM transactions.

- Post-Close Integration: Success depends on early planning, retaining key employees, and aligning operations.

For both buyers and sellers, preparation, diligence, and clear deal terms are non-negotiable. The right approach ensures smoother transactions and maximizes value.

Deal Sourcing: Finding Acquisition Targets

On-Market vs Off-Market Deal Sourcing: Timeline, Competition & Benefits Comparison

Navigating the lower-middle market (LMM) comes with its own set of challenges, and finding acquisition opportunities requires a mix of modern tools and experienced broker insights. Building a strong acquisition pipeline is critical for success. In this market, savvy buyers focus on a "blended pipeline" approach - balancing on-market listings for efficiency and cultivating off-market relationships for better terms. This strategy not only expands opportunities but also reduces the risk of deal fatigue when negotiations fall apart.

On-Market vs. Off-Market Deal Sourcing

On-market deals, typically listed by brokers or platforms, offer one key advantage: speed. Sellers in these cases are prepared, with financials packaged and data rooms ready, which can shorten the timeline to closing - often to about 6–9 months. However, competition is intense. A single well-prepared listing in the LMM can attract five or more serious buyers within a week, driving up valuations and sparking bidding wars.

"On-market deals exist to compress time. A decent broker has packaged the story, prepped the seller, and put guardrails around process." – BizCrunch

Off-market sourcing, on the other hand, takes a more direct route by reaching out to owners who haven’t formally listed their businesses for sale. While this approach requires patience - closures often take 12–18 months - the benefits can be substantial. Without the influence of brokers, off-market sellers are often more open to flexible deal terms. Plus, buyers get a clear view of the business without the polished presentation that typically comes with formal listings.

"Off-market is different. You're doing the work the sell-side didn't do... In exchange, you often get better entry multiples and friendlier structures." – BizCrunch

The most effective buyers dedicate time each week to off-market outreach, nurturing long-term relationships while maintaining a disciplined review of new broker listings - referred to as "Lane 2". This consistent effort ensures a steady deal flow and avoids the common mistake of halting prospecting once a letter of intent (LOI) is signed. Keeping at least five active conversations during due diligence provides valuable backup options if a deal falls through.

Using Technology for Deal Sourcing

Technology has revolutionized the way buyers identify acquisition targets. Today, 72% of dealmakers rely on advanced data platforms to source and screen potential deals. These tools go beyond traditional referral networks, using AI to analyze thousands of businesses and uncover opportunities that human analysts might overlook. They evaluate not just financial metrics like EBITDA but also qualitative factors, such as customer concentration, recurring revenue, and scalability.

One innovative tool gaining traction is Google Maps API integration for off-market outreach. This technology helps buyers locate businesses by industry, size, and location, then enriches the data with contact details to launch targeted campaigns. It’s a powerful way to discover opportunities that don’t appear in conventional databases. Deal import hubs and email-forwarding systems also centralize leads from various sources, eliminating the chaos of juggling multiple spreadsheets.

CRM and project management tools have become indispensable for tracking outreach efforts, managing tasks, and monitoring closing timelines. These systems ensure no opportunity is overlooked and provide a clear picture of where each prospect stands. Marketing automation adds another layer of efficiency, flagging high-priority leads based on engagement metrics and helping buyers focus their efforts.

While technology streamlines the search for targets, brokers remain essential for their market expertise.

Working with Brokers and Advisors

Despite the rise of digital solutions, brokers and advisors are still critical for accessing exclusive opportunities in the LMM. Specializing in deals with enterprise values between $5 million and $100 million, these intermediaries offer industry-specific knowledge, proprietary deal flow, and hands-on guidance throughout the acquisition process.

"Lower middle market M&A firms focus on companies with enterprise values between $5 million and $100 million. They're the go-to advisors for deals that are too small for the big investment banks but way too complex for your average business broker." – Jeff Barrington, Managing Director, Windsor Drake

Not all brokers are created equal. Some, known as "Volume Listers", focus on posting deals and leave buyers to handle the process. Others, labeled "Micromanagers", push for higher valuations and charge success fees of 5–7%. The best fit for many buyers tends to be the "Pragmatic Middle" brokers, who strike a balance between building strong relationships and managing realistic negotiations. Establishing clear valuation expectations early with high-fee brokers can prevent frustration during late-stage talks.

Buy-side advisors offer more than just introductions to deals. They assist with screening targets, conducting market research, initiating outreach, and building relationships with sellers. Given that many LMM businesses lack detailed financial reporting, advisors play a crucial role in assembling financials and evaluating management teams. They also connect buyers with private credit markets, which are becoming increasingly important as traditional bank lending tightens. When choosing an advisor, it’s essential to verify their experience through league tables and client references. Professional directories like M&A Source can help ensure they meet industry standards.

sbb-itb-a3ef7c1

Valuation and Financial Analysis

Determining the value of Lower Middle Market (LMM) businesses isn’t just about crunching numbers. It’s about blending financial metrics with adjustments for owner-related expenses, industry-specific dynamics, and unique risks. This approach helps avoid overpaying and ensures solid returns. Here's a closer look at the valuation methods and risk adjustments that play a crucial role in structuring profitable LMM deals.

Valuation Methods and Multiples

One of the most common approaches in the LMM space is the precedent transaction method, which evaluates recent deal prices for comparable businesses. This method often relies on EBITDA multiples, which vary significantly by industry. For instance, as of July 2025, Legal Services commanded a 21.34x multiple, while Advertising & Marketing lagged at 5.46x. Other industries fell in between: Software at 10.59x, Healthcare Facilities at 12.73x, and Construction & Engineering at 9.43x.

"EBITDA multiples will depend on the size of the subject company, its profitability, its growth prospects, and the industry in which it works." – Dan Gray, Equidam

For businesses operating across multiple sectors, valuation often requires a blended multiple. This is calculated based on the revenue mix from each industry. For example, a company earning 60% of its revenue from IT Services (9.68x) and 40% from Manufacturing (3.07x) would use a weighted multiple reflecting this distribution.

Other methods come into play depending on the business model:

- Discounted Cash Flow (DCF): Ideal for companies with steady, recurring revenue streams.

- Net Asset Value (NAV): Commonly used for asset-heavy businesses, it establishes a baseline value by subtracting liabilities from asset values.

Financial Normalization and Risk Assessment

To get an accurate picture of a company's earnings, it’s essential to normalize financials. This involves adjusting income statements to account for items like above-market owner salaries, personal travel expenses, and one-time legal fees.

"A common oversight is underestimating the value of brand recognition and intellectual property. Often, people focus on tangible assets like equipment and real estate, while intangible assets such as patents, trademarks, and customer relationships can be equally or more valuable." – Gary Hemming, Commercial Lending Director, ABC Finance Limited

For businesses with fluctuating earnings, buyers often use a three-year average to smooth out anomalies or a weighted average that gives more weight to recent growth. However, a sudden spike in EBITDA - especially in the year a business goes to market - can be a warning sign. Buyers need to dig deeper to understand if the increase stems from sustainable improvements, like launching high-margin services, or temporary cost-cutting measures unlikely to last under new ownership.

"Always red flags when you see EBITDA double the year they decide to sell. I'd take an average of the last three years after adjustments and go from there." – Dave Gilbert, CEO, Proven

Risk assessment is another critical piece of the puzzle. Factors like customer concentration, vendor dependencies, and owner involvement can significantly impact a business's value. For example, if a company relies heavily on the owner’s personal relationships to drive revenue, it may face a "marketability discount", as transitioning those relationships to a new owner can be challenging. To mitigate these risks, buyers often structure deals with features like earnouts or forgivable seller notes tied to post-close performance.

Industry-Specific Valuation Factors

Each industry has its own set of factors that influence valuation:

- Manufacturing: Focuses on equipment condition, inventory turnover, and the market value of physical assets.

- Healthcare: Emphasizes regulatory compliance and stable payer contracts.

- IT and Software: Prioritizes recurring revenue, customer retention, and scalability.

In 2025, the average business sold for 2.61x annual earnings and 0.69x annual revenue. However, these averages hide significant differences across industries. Online & Technology businesses, for example, achieved higher multiples - 3.25x earnings and 1.12x revenue - while Food & Restaurants lagged with 2.33x earnings and 0.41x revenue.

"The role of a valuation expert is to turn these qualitative factors that contribute to a company's value into quantitative ones. We put forth an argument that explains why they are high-value assets and should be included in the overall valuation price." – Chris Walton, Founder, Eton Venture Services

Next, we’ll explore the due diligence processes that refine these valuation assessments even further.

Due Diligence: Evaluating Target Businesses

After identifying a target and agreeing on a preliminary valuation, the next step is due diligence. This is where buyers dig deep to confirm what they’re purchasing and uncover any hidden issues. It’s also the stage where 30–40% of M&A deals fall apart due to undisclosed problems. In the Lower-Middle-Market, this process typically takes 30 to 90 days. The objective is clear: verify that the business operates as claimed and identify potential risks.

Financial and Operational Due Diligence

A thorough Quality of Earnings (QoE) analysis is essential. This includes reviewing normalized EBITDA, assessing revenue stability, analyzing customer concentration, and examining multi-year Net Working Capital (NWC) trends. These steps help gauge the business’s cash requirements after acquisition.

Operational scalability is another critical factor. Evaluate the roles of key personnel and determine whether the business can run smoothly without the current owner. If the owner plays a central role - acting as the main salesperson, technical expert, or relationship manager - you may need to allocate funds for replacements or plan for a longer transition period. It’s crucial to address these operational dependencies before moving forward. Also, review IT systems, vendor contracts, and any dependencies that could hinder growth. For example, relying on a single supplier poses a measurable risk.

"Everything that you might associate with a successful transaction - including the valuation - is derived from good due diligence." – DealRoom

Legal and Compliance Checks

Once financial and operational aspects are confirmed, shift focus to legal and compliance reviews to identify non-financial risks.

Legal due diligence often uncovers risks that don’t show up in financial statements. Start by confirming the target company’s good standing, proper formation, and clear ownership documentation. Pay close attention to material contracts for clauses related to change-of-control, termination penalties, or consent requirements. For instance, a landlord refusing to transfer a lease or a key customer exercising a right to exit after an ownership change could derail a deal after closing.

Intellectual property (IP) requires special scrutiny. Verify that trademarks, patents, and copyrights are properly registered, transferable, and free of infringement claims. A notable example is Hewlett-Packard’s acquisition of Mercury Interactive in 2006, where legal due diligence uncovered significant stock option backdating issues. This allowed HP to negotiate protections into the deal structure. In Lower-Middle-Market deals, where Reps and Warranties Insurance (RWI) is used in fewer than one-third of transactions, buyers often rely on escrow holdbacks - typically 12.5% of the deal value - to cover undisclosed liabilities.

Regulatory compliance is another area that can’t be ignored. Confirm that all licenses, permits, and certifications are current and transferable. In stock transactions, buyers inherit all existing liabilities, including tax or environmental exposures. While asset deals generally limit liability, some states impose "successor liability" for unpaid taxes. Requesting tax clearance certificates where applicable can help mitigate this risk.

Managing the flow of information effectively is another critical piece of the puzzle, and this is where Virtual Data Rooms come into play.

Using Virtual Data Rooms for Due Diligence

A well-organized Virtual Data Room (VDR) can streamline the due diligence process and minimize the risk of information leaks. Sellers who prepare their data rooms 3–6 months before going to market can address potential red flags early, often closing deals 2–3 times faster than those who don’t. A standardized folder structure - for example, Corporate, Financial, IP, HR, Material Contracts, and Technology - makes it easier for buyers to navigate and find key information. Sellers can also use tiered disclosure, starting with high-level summaries and only sharing sensitive data after an LOI is signed.

To protect sensitive information, encryption and dynamic watermarking are essential. Audit logs can track document access, allowing sellers to monitor activity and intervene if necessary. For deals involving earnouts, which are included in more than one-third of transactions, maintaining organized digital records is crucial for post-closing reporting and performance verification.

Deal Structure and Financing Options

Once due diligence is complete, it's time to finalize the deal structure and secure financing. In the Lower-Middle-Market, where closing payments generally stay under $50 million, these decisions are critical. They influence tax implications, risk exposure, and whether the buyer can close successfully. The two main deal structures - asset purchases and stock purchases - offer distinct benefits and drawbacks, making it essential to choose wisely before committing to a Letter of Intent. These structural decisions are closely tied to diligence findings and have a direct impact on post-deal integration.

Asset vs. Stock Purchases

In an asset purchase, the buyer cherry-picks specific assets like inventory, equipment, and goodwill, leaving the legal entity with the seller. This approach is common in Lower-Middle-Market transactions. Asset purchases help limit liability to identified risks and provide a tax basis step-up, which allows for greater depreciation. However, they often involve more administrative hurdles, such as re-titling assets, obtaining new licenses, and securing third-party approvals for contract assignments. These steps can add complexity and extend the timeline.

In contrast, a stock purchase involves acquiring the entire legal entity, essentially stepping into the seller's shoes. This method simplifies continuity - licenses, permits, and most contracts transfer automatically unless a "change of control" clause applies. Employees also remain with the company without needing to be rehired. The downside? Buyers inherit all liabilities, both known and hidden, including tax exposures, environmental claims, and litigation risks. Additionally, the target company retains its historical tax basis, which limits future depreciation opportunities. Sellers often favor stock sales because they benefit from capital gains tax rates.

The choice between these two structures must be clearly outlined in the Letter of Intent, as it shapes negotiations, tax strategies, and risk-sharing. For stock deals, buyers should carefully review "change of control" clauses during due diligence to avoid surprises with contracts. Even in asset deals, buyers must ensure proper notice and withholding to steer clear of successor liability for unpaid bulk sales taxes. With the structure determined, the next step is exploring financing options.

Financing Solutions for Acquisitions

Once the target's value is clear, buyers need to figure out how to finance the deal. In the Lower-Middle-Market, it's rare for transactions to be funded entirely with cash. Most deals combine buyer equity (10–25%), senior debt, and seller financing (5–20%). For smaller transactions under $5 million, SBA 7(a) loans are a popular option. These loans can cover up to 90% of the purchase price, requiring down payments as low as 10%. They usually carry interest rates around 6% with repayment terms of up to 10 years, making them accessible to first-time buyers. However, the approval process can take 2 to 4 months, so engaging lenders early in the due diligence phase is crucial. Working with a loan intermediary can further boost approval chances to 90–95%.

Seller financing is another common tool, used in over half of all business sales. Here, the seller accepts a promissory note for part of the purchase price, repaid over 3–8 years with interest rates ranging from 5% to 8%. If an SBA loan is part of the financing mix, the seller note may need to be on "full standby", meaning no payments are made until the SBA loan is fully repaid.

For larger deals, typically above $10 million to $25 million, mezzanine financing and private credit options come into play. These lenders offer 4–5x EBITDA leverage but charge higher interest rates and may require equity kickers. A recent shift toward private credit has been fueled by a regional banking crisis, with 78% of multi-strategy asset managers now favoring these options. Another approach is seller rollover equity, where the seller retains a minority stake (usually 10–20%) in the business. This reduces the buyer's upfront cash requirement while allowing the seller to share in future growth.

"Seller financing is extremely common; more than half of all business sales involve at least some seller financing." – Michele Schechter, Director, Financial Poise

Buyers should also confirm whether their lender will accept financial statements prepared by the company or if a Quality of Earnings report is required. This is especially important for transactions over $5 million, as most lenders demand such reports. Securing an exclusive Letter of Intent ensures the seller won't entertain competing offers while the buyer invests in financing and due diligence.

Purchase Price Adjustments and Contingencies

Even after agreeing on a purchase price, the final amount paid at closing often changes due to purchase price adjustments (PPAs). These adjustments account for fluctuations in working capital, inventory, or cash balances between signing and closing. PPAs are included in 92% of Lower-Middle-Market deals. If net working capital falls short at closing, the purchase price is adjusted dollar-for-dollar. To safeguard against the seller being unable to cover downward adjustments, nearly half of LMM deals include a PPA escrow, typically around 1.23% of the deal value.

Earnouts are another common contingency, used in over one-third of LMM deals. These arrangements defer part of the purchase price and tie it to the business's future performance. They are especially helpful when buyers and sellers have differing projections. Smaller deals (under $25 million) often feature larger earnouts as a percentage of the closing price compared to bigger transactions. To avoid disputes, earnouts should rely on straightforward metrics like revenue instead of complicated earnings-based formulas.

"An earnout based on revenue is much easier to negotiate and administer than an earnout based on earnings." – Morgan & Westfield

To protect sellers in earnout agreements, "No Actions Detrimental to the Earnout" clauses are included in 75% of smaller LMM deals. Additionally, post-closing information rights - negotiated in over 90% of LMM deals - help verify earnout and PPA calculations. These rights typically specify accounting standards, the level of reporting detail, and the seller's right to audit financial data.

Another key tool for managing risk is the general indemnification escrow, which holds about 12.5% of the transaction value in LMM deals (compared to 10% in the broader market). Since Reps and Warranties Insurance (RWI) is used in less than a third of LMM deals, buyers often rely on escrows and extended survival periods for seller representations. In fact, 96% of LMM deals without RWI extend these periods beyond 15 months. Increasingly, buyers are using multiple escrows (e.g., separate pools for tax, litigation, and PPAs) to better allocate risks.

"LMM sellers are putting a larger percentage of their transaction value at risk compared to the overall deal market." – Kip Wallen, Senior Director, SRS Acquiom

Understanding these mechanisms and contingencies is critical for both parties. Buyers need protection against unexpected post-closing issues, while sellers must ensure their proceeds are safeguarded and calculations are transparent. With the right terms in place, these tools can align interests and pave the way for a smoother transaction.

Post-Close Integration and Execution

Once a deal is finalized, the real work begins. The success of any transaction hinges on what happens after the ink dries. While careful valuation and due diligence lay the groundwork, the post-close integration phase is where the deal either thrives or falters. In fact, integration missteps are responsible for 83% of M&A failures. For businesses in the Lower-Middle-Market, where resources are often limited, a well-structured integration plan can boost deal value by 6% to 12%. Importantly, integration planning shouldn't wait until after closing - it needs to start during due diligence.

Integration Planning and Execution

One of the first steps to a smooth integration is establishing an Integration Management Office (IMO), led by a Chief Integration Officer. This team, which typically includes leaders like the CFO, COO, HR head, and CTO, oversees the entire process, ensuring alignment with the deal's goals. The IMO translates the broader deal objectives into an actionable integration plan, focusing on areas like cost efficiencies, revenue growth, or market expansion.

Preparation is key. Before Day One, each department should have a clear understanding of its roles and responsibilities through functional workstream charters. Detailed operational plans are essential to avoid any disruptions during the transition.

Cultural compatibility is another critical factor. Conducting a cultural assessment early on can help identify potential challenges in decision-making or communication styles. A well-known example is Disney's acquisition of Pixar. By allowing Pixar to retain its creative autonomy and leadership structure, Disney preserved Pixar's innovative spirit, leading to a string of successful films.

"Integration doesn't start when the legal documents are signed but instead begins with learning about the company and comprehensively analyzing how the business will fit into yours." – Nicole Kiriakopoulos, Director, PCE Companies

For Lower-Middle-Market deals, it’s crucial to confirm that your existing infrastructure can support the acquired company’s operations. Focus on a few critical decisions - like whether to integrate sales teams or align R&D efforts - that can deliver immediate cost savings or revenue growth. For example, Dell’s acquisition of EMC in 2016 involved a strategic decision to keep their sales teams separate initially, which led to multibillion-dollar revenue synergies in the first year.

Talent retention is another priority. Losing key employees with critical client relationships or specialized knowledge can erode the deal’s value. Identify these individuals early and use incentives like stay bonuses or clear career advancement opportunities to keep them engaged.

"Tough people decisions only get tougher with time... The sooner you select the new leaders, the quicker you can fight the flight of talent and customers." – Bain & Company

Monitoring Performance Post-Close

Once integration is underway, tracking progress is essential to ensure the deal delivers on its promises. Define success metrics during due diligence, covering areas like financial performance, operational efficiency, customer satisfaction, and employee engagement. Establish baseline measurements for each key performance indicator before closing.

Regular communication and accountability are critical. Weekly IMO meetings can help track milestones, address risks, and maintain momentum. Tools like a RACI matrix can clarify responsibilities and prevent bottlenecks. Some companies even hold weekly CEO-led “war room” meetings to keep everyone aligned on priorities.

Set realistic goals for capturing synergies. Aim to achieve around 30% of projected synergies within the first 90 days, with full integration occurring over a 4–24 month period. For deals involving earnouts - used in about 33% of transactions - rigorous financial monitoring is crucial. Most earnout agreements require formal post-closing reporting, so negotiating strong information rights is essential.

A dedicated synergy program can help track cost-saving and revenue-generating initiatives, ensuring they are integrated into the broader plan.

Common Post-Close Challenges and Solutions

Underestimating the integration effort is a frequent mistake in Lower-Middle-Market deals. Treating integration as a minor task rather than a strategic initiative can lead to delays and the loss of key personnel. To avoid this, establish a dedicated IMO early and implement a clear governance structure.

Cultural and communication gaps are another common issue, often resulting in disengaged employees or lost customers. Prepare Day One materials like employee FAQs, customer updates, and supplier communications to maintain engagement. Conducting a formal culture scan can also help address potential conflicts early on.

Scalability is another area where problems can arise. Assuming that existing systems and processes can handle the added workload without additional investment can strain operations. During due diligence, test whether your current platform can support the new business to identify potential scalability issues in advance.

IT and system compatibility is another critical consideration. Mismatched software platforms, such as incompatible ERP or CRM systems, can cause significant disruptions if not addressed early. Companies that successfully manage technology integration extract value 88% of the time, compared to just 42% for those that don’t.

For Lower-Middle-Market businesses, losing key knowledge can be particularly damaging. Often, critical information resides with just a few individuals, making their retention vital to maintaining smooth operations and client relationships. Identify these key personnel early and implement strategies to keep them onboard.

Timing is everything. A drawn-out integration process can sap energy and distract from core operations, while overly aggressive timelines may lead to resistance from employees. Prioritize a handful of cross-functional decisions that will drive the most value instead of trying to tackle everything at once.

"Paralysis during an integration can rapidly deplete value. Financial markets often expect early signs of value capture." – EY-Parthenon

With earnouts present in over one-third of deals and median indemnification escrows at 12.5% of transaction value, both buyers and sellers have a lot riding on successful integration. By addressing challenges head-on, maintaining open communication, and focusing on key decisions, companies can maximize the value of their transactions.

Conclusion: Key Takeaways for Lower-Middle-Market M&A

The lower-middle-market (LMM) M&A space is a dynamic segment, representing over 40% of all M&A transactions in recent years. Achieving success here demands early preparation, clear expectations, and disciplined execution at every stage of the process.

For sellers, preparation is everything. Long before planning an exit, engage legal, accounting, and M&A advisors to clean up financial statements, adopt GAAP-based accounting, and address any operational issues that might impact valuation. While the typical sale process spans 6–12 months, the groundwork for maximizing value often requires years of effort. Protect your interests post-close by negotiating strong information rights and operational covenants, such as a "No Actions Detrimental to the Earnout" clause.

For buyers, due diligence is non-negotiable. A Quality of Earnings analysis is essential to confirm EBITDA sustainability and uncover any one-time expenses or discretionary costs. With 83% of M&A failures tied to integration issues, integration planning must begin during due diligence - not after the deal closes. Setting up an Integration Management Office and identifying key personnel early can help preserve client relationships and ensure operational stability.

For advisors, your role is to bring all the pieces together. Coordinating accountants, attorneys, and lenders effectively is crucial for protecting client interests. With M&A advisory fees ranging from 5% to 12% of transaction value and median indemnification escrows at 12.5%, there’s a lot at stake. Use data-driven negotiation tactics and stay on top of market trends, like longer survival periods for representations and larger escrows, to secure the best terms for your clients.

At its core, success in LMM M&A boils down to a few fundamentals: start preparing early, conduct thorough due diligence, structure deals thoughtfully, and integrate effectively post-close. Companies that approach M&A as a repeatable, strategic process - rather than a one-off event - are far better positioned to avoid common pitfalls and unlock greater value from their transactions.

FAQs

What are the main challenges lower-middle-market companies face in M&A transactions?

Lower-middle-market companies often encounter specific hurdles during M&A transactions, largely due to their size and limited resources. One of the biggest challenges is determining valuation. Smaller companies often deal with fluctuating performance or insufficient data, making it tough to arrive at accurate assessments.

Due diligence is another tricky area. With fewer resources at their disposal, these companies may struggle to identify and address potential risks or issues effectively. On top of that, deal structuring can be particularly intricate. Elements like earnouts, purchase price adjustments, and indemnification provisions require careful planning to ensure everything aligns with the parties' goals.

Adding to the complexity, many lower-middle-market transactions involve first-time sellers or a smaller number of equity holders. This dynamic can make negotiations more challenging and complicate the process of integrating operations after the deal closes. To navigate these obstacles, companies need to focus on thorough preparation, strategic negotiation, and seeking guidance from experienced professionals.

How does technology improve deal sourcing in the lower-middle market?

Technology has transformed deal sourcing in the lower-middle market, making it quicker, more efficient, and highly precise. With the help of digital platforms and advanced tools, buyers, sellers, and advisors can pinpoint acquisition opportunities based on specific factors like industry, revenue, or financial performance. These tools rely on algorithms and data analytics to simplify the search process, cutting down on both time and effort.

Beyond efficiency, technology also improves the quality of deal sourcing. It offers deeper insights, broader access to the market, and entry to exclusive databases. This creates a more transparent and accurate way to assess potential deals - an advantage that's especially important in the resource-limited lower-middle market. By using these tools, businesses can extend their reach and pursue the opportunities that align with their goals with greater confidence.

What are the best strategies for successful post-merger integration in M&A deals?

To make the post-merger integration process as seamless as possible, start planning as early as the due diligence phase. Assemble a dedicated integration team with a strong leader - like a Chief Integration Officer - to guide the effort and keep everything on track. One key area to address is cultural alignment between the two organizations. Clear and transparent communication is essential to building trust and minimizing any potential disruptions.

Another priority should be identifying and acting on synergies quickly to unlock value. This might involve streamlining operations, aligning objectives, and tackling potential conflicts proactively. Regular updates and open collaboration across teams will go a long way in ensuring the transition is both smooth and effective.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)