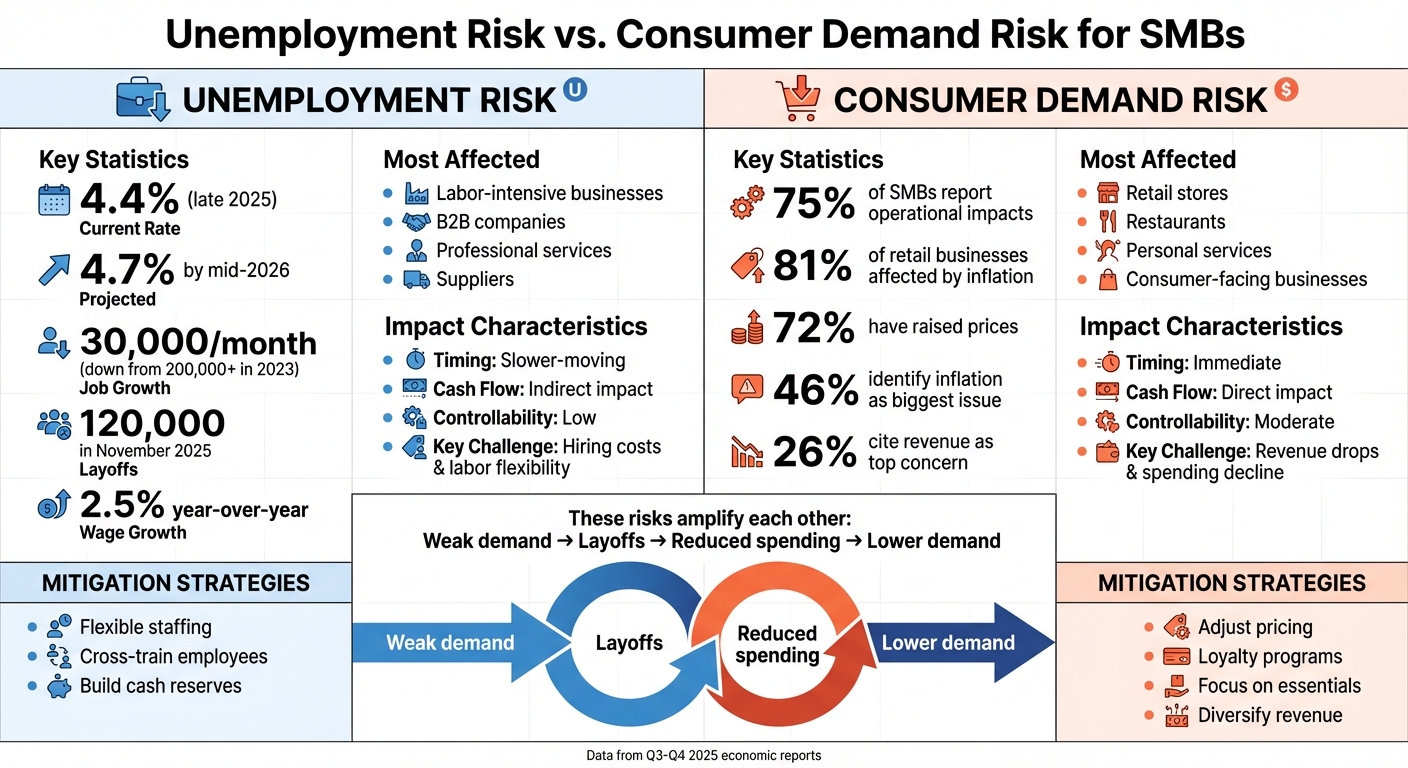

SMBs face two major risks in today’s economy: unemployment and shifting consumer demand. Both significantly impact hiring, revenue, and overall business health. Here’s what you need to know:

- Unemployment Risk: Rising from 4.3% to 4.4% in late 2025, unemployment is expected to hit 4.7% by mid-2026. This increases hiring costs, reduces labor flexibility, and slows wage growth. Layoffs are ramping up, with 120,000 workers cut in November 2025 alone.

- Consumer Demand Risk: Inflation is eroding spending power, with 75% of SMBs reporting operational impacts. Declining discretionary spending hits revenue hard, especially for retail and service businesses.

Key Takeaways:

- Monitor Indicators: Track unemployment trends, consumer confidence, and spending data to anticipate challenges.

- Business-Specific Risks: Labor-intensive businesses feel hiring pressures, while consumer-facing companies struggle with demand drops.

- Actionable Strategies: Build flexible workforces, diversify revenue streams, and adjust pricing to match spending habits.

Understanding these risks and acting early can help SMBs navigate economic uncertainty and maintain stability.

Unemployment Risk: What SMBs Need to Know

How Unemployment Affects SMBs

Unemployment creates a tricky balancing act for small and medium-sized businesses (SMBs). On one hand, low unemployment makes it tough to hire and pushes wages higher. On the other, high unemployment shrinks consumer spending, cutting into revenue. Right now, the U.S. finds itself in a challenging middle ground: the unemployment rate hit 4.4% in late 2025, the highest in four years, and is expected to climb to 4.7% by mid-2026. Job growth has slowed significantly, dropping from over 200,000 new jobs per month in 2023 to just 30,000 per month by mid-2025.

For SMBs, this slowdown stings. Layoffs have reduced labor flexibility, and wage growth for small business employees has slowed to 2.5% year-over-year, making it harder to attract workers despite hiring freezes. Economists describe this as a "low hire, low fire" dynamic: businesses are avoiding layoffs because rehiring is costly, but they’re also reluctant to bring on new employees. Many SMBs are stuck with lean teams that can’t expand to meet demand but also fear the expense of rehiring later.

Adding to the pressure, recent changes in immigration policy have tightened the labor pool in key sectors like construction, logistics, and agriculture. These challenges are structural and won't resolve quickly, even if the broader economy improves.

Labor Market Indicators to Track

To stay ahead of labor market shifts, keep an eye on these five indicators:

- Official unemployment rate - currently at 4.4% and climbing.

- Initial unemployment claims - these show whether layoffs are ramping up; claims recently hit their lowest level in three years.

- Job growth rates by industry - in September 2025, nonfarm payrolls increased by just 119,000.

- JOLTS hiring rate - stuck at 3.2%, signaling a slow pace of business recruitment.

- Quit rates - falling quit rates suggest workers are hesitant to leave their jobs.

Layoff announcements reached 1.1 million in 2025, a figure surpassed only during the 2020 pandemic and the Great Recession. These announcements often precede actual layoffs by months, offering SMBs a valuable early warning. Young workers and Black workers have been hit hardest, as these groups tend to feel economic downturns earlier in the cycle.

By monitoring these indicators, SMBs can better anticipate labor market trends and prepare for potential challenges.

Common Problems for SMBs

Unemployment risk doesn’t just affect hiring - it creates ripple effects that touch nearly every aspect of business. Revenue becomes more volatile, rehiring and training costs spike, and productivity takes a hit as overworked teams struggle to keep up with demand.

When job insecurity rises, consumer spending often drops, amplifying revenue pressures. Economist Mark Zandi notes that many Americans are already financially stretched, and if they cut back spending due to job concerns, it could "become fodder for a recession". For SMBs, this means even employed workers who tighten their wallets can create demand problems, compounding the challenges of a soft labor market.

Different industries feel these pressures in unique ways. In the retail sector, for example, 81% of small businesses report significant inflation impacts, and 72% have raised prices. By comparison, for professional services, those numbers are 67% and 56%, respectively. Mid-sized SMBs with 20–99 employees are particularly vulnerable, with 45% citing the cost of goods and services as a major growth challenge, compared to just 29% of the smallest businesses.

The timeline for these risks stretches into 2026, with the first half of the year likely seeing the most intense challenges. Layoffs announced in late 2025 will start to take effect, and consumer spending could weaken further. SMBs will need to navigate these hurdles carefully to stay afloat.

Consumer Demand Risk: Drivers and Effects

What Consumer Demand Risk Means

Consumer demand risk refers to the unpredictability small and medium-sized businesses (SMBs) face when customer spending habits change unexpectedly. Unlike unemployment risk, which impacts hiring and retention, demand risk strikes directly at revenue. Fewer customers, smaller purchases, or waning interest in certain products can all cause a noticeable hit to the bottom line. Economic concerns, inflation, and job insecurity often prompt consumers to cut back on spending, leaving SMBs grappling with revenue declines. In fact, 26% of small businesses rank revenue as their second-biggest concern, just behind inflation.

The problem is compounded by the speed at which these shifts can occur. A retail store that stocked up for the holiday season might suddenly face unsold inventory if customer spending slows. Similarly, service-based businesses like salons or restaurants, which rely on discretionary spending, can see bookings plummet. Adding to the strain, 75% of SMBs report raising prices due to inflation, even as consumer confidence continues to drop.

Demand Indicators to Monitor

Staying ahead of demand fluctuations requires paying close attention to consumer behavior. Many savvy SMB owners rely on consumer confidence indices, such as the University of Michigan Consumer Sentiment Index, to gauge whether customers feel financially secure or uncertain. A dip in confidence often signals a looming decline in spending. Retail sales data offers a clearer picture of what people are buying, while credit card spending trends provide near real-time clues about shifting purchasing habits.

Local trends are equally important. Observing foot traffic at your store, analyzing search trends for your products or services, and keeping an eye on local economic developments - like a factory closing - can reveal changes in demand that broader national data might overlook.

How Demand Changes Affect Businesses

When demand drops, the financial strain on SMBs is immediate. Cash flow tightens, making it harder to cover fixed costs. Inventory management becomes a balancing act - too much stock ties up capital, while too little leads to missed sales opportunities. Competition grows fiercer, often pushing businesses to lower prices and sacrifice margins just to attract customers.

The impact varies by industry. Service businesses that depend heavily on discretionary spending often feel the pinch the hardest, with sharp declines in appointments and bookings. What’s more, cautious spending habits are becoming a long-term trend rather than a short-term reaction, forcing businesses to compete for a shrinking pool of customers. SMBs that don’t adapt - whether through better inventory strategies, flexible pricing, or diversifying their customer base - risk losing ground to competitors who respond more quickly to these challenges.

Next, we’ll explore how these demand-related challenges compare to those brought about by unemployment trends.

How to survive the 2025 business crisis (before it's too late)

sbb-itb-a3ef7c1

Unemployment vs. Consumer Demand: Direct Comparison

Unemployment vs Consumer Demand Risk Comparison for Small Businesses

Which Risk Matters More by Business Type

The impact of risk depends heavily on the type of business. For retail stores, restaurants, and personal service businesses, the main challenge often revolves around consumer demand. When people tighten their budgets, discretionary spending is the first to take a hit, which can cause revenue to drop long before unemployment numbers rise. In Q3 2025, for instance, 46% of small businesses identified inflation as their biggest issue, while 26% pointed to revenue pressures - underscoring how demand concerns dominate for consumer-facing small and medium-sized businesses (SMBs).

For B2B companies, suppliers, and professional service firms, the story is different. Their primary concern hinges on the health of their clients. Take a packaging supplier, for example: its success depends not on national unemployment rates but on whether its retail clients continue placing orders. If those clients face weak demand and start cutting jobs, unpaid invoices and canceled orders can quickly follow. Similarly, professional service firms like accounting or consulting businesses often feel the pinch in tight labor markets, where finding and keeping skilled employees becomes a significant hurdle. The table below highlights these differences.

Side-by-Side Risk Comparison

| Factor | Unemployment Risk | Consumer Demand Risk |

|---|---|---|

| Timing | Slower-moving; layoffs follow demand declines | Immediate; sales can drop quickly in uncertainty |

| Cash Flow Impact | Indirect, through reduced spending and wage pressure | Direct, as revenue and cash flow take a direct hit |

| Controllability | Low; job losses are outside business control | Moderate; pricing, promotions, or product mix can help |

| Mitigation Options | Build cash reserves, diversify clients, flexible staffing | Adjust pricing, launch loyalty programs, focus on essentials |

How These Risks Affect Each Other

Unemployment and weak consumer demand often amplify each other. When demand softens, businesses respond by cutting costs - layoffs and reduced hours are common measures. These job losses, in turn, further reduce spending power, creating a downward spiral. For instance, in November 2025, small businesses cut 120,000 jobs, and wage growth slowed to 4.4% annually. Lower income growth means less spending, which further pressures SMB revenues.

This cycle can create ripple effects across local economies. Imagine a struggling mall: if anchor stores see declining foot traffic, they may shorten hours or close entirely, leading to layoffs among retail and food-service workers. As these workers spend less, the downward cycle deepens. To break this chain, SMBs need to focus on value-driven or essential products, nurture strong customer relationships, and maintain cash reserves to weather revenue drops and tighter credit conditions.

How to Manage Both Risks

Assess Your Business's Risk Exposure

Start by mapping out your revenue streams. Think about whether your customers are buying essentials like groceries or auto repairs, or if they’re spending on non-essentials like jewelry or luxury services. Businesses offering essential goods and services tend to hold up better when demand dips, while those relying on discretionary spending often feel the pinch first as budgets tighten.

Next, examine how labor-intensive your operations are by looking at your payroll expense ratios. Businesses with higher payroll costs may be more vulnerable to wage increases or shifts in unemployment trends. Don’t forget to evaluate your customer base. If too much of your revenue comes from a single client or segment, you could face trouble if that customer struggles financially.

Once you’ve identified your risks, you can start implementing targeted strategies to tackle them effectively.

Specific Tactics for Each Risk

To address unemployment risk, focus on building a flexible workforce without compromising quality. Cross-train employees so they can handle multiple roles, reducing reliance on specific positions. Combine full-time staff with part-time and contract workers to give yourself room to adjust as needed. In a tight labor market, retaining top talent becomes even more important. Invest in your team by offering skill development opportunities and clear paths for advancement.

For consumer demand risk, adapt your offerings and pricing to meet current spending habits. Introducing tiered products or services can help retain cost-conscious customers while protecting your margins. Subscriptions or memberships can create consistent, predictable income, shielding you from sudden demand fluctuations. With 81% of retail businesses reporting inflation-related impacts and 72% raising prices, dynamic pricing strategies can help you maintain profitability. Additionally, focusing on niche or hyper-local services can give you an edge during uncertain economic times.

Finally, use risk insights to inform your financial and acquisition decisions.

Using Risk Data in Financing and Acquisitions

Incorporating risk data into your financing and acquisition strategies can make a big difference, especially in uncertain times. If you’re considering buying, selling, or financing a business, a thorough risk assessment is a must. For acquisitions, look at the target’s revenue stability, customer retention, and employee tenure - these factors are critical given the challenges posed by small business job losses and fluctuating consumer demand. Aim for businesses with diverse revenue streams and a strong track record during downturns.

Platforms like Clearly Acquired offer tools to streamline this process. Their AI-powered data rooms can help you evaluate potential acquisitions, while access to detailed business and comparable data allows you to assess unemployment and demand risks more thoroughly. For financing, connecting with over 500 lenders provides options tailored to your needs. Whether it’s SBA 7(a) loans with longer terms, flexible lines of credit for navigating demand shifts, or equipment financing to conserve working capital, the right financial structure can help you stay agile. In uncertain times, flexibility in financing is crucial.

Conclusion

Small and medium-sized businesses (SMBs) face two major challenges: rising unemployment, which influences hiring and labor costs, and shifting consumer demand, which directly affects revenue. These challenges are deeply connected - how you respond to one can either ease or worsen the impact of the other.

Recent economic data underscores the weight of these risks. Key indicators, like local unemployment rates or retail sales trends, shed light on the pressures SMBs are navigating. This highlights the need for proactive strategies to manage these uncertainties.

To tackle these challenges, consider two approaches: flexible staffing and diversified revenue streams. Cross-training employees and making thoughtful hiring decisions can help you build a more adaptable workforce. At the same time, adjusting your products or services to align with changing consumer preferences can safeguard your revenue.

Data should guide your decision-making, especially when it comes to financing or acquisitions. Tools like Clearly Acquired’s AI-powered data rooms, a database of 100,000 verified listings, and partnerships with over 500 lenders for SBA loans and other financing solutions can provide the resources you need. These tools enable SMBs to secure growth capital, identify acquisitions with stable revenue, and make smarter choices in uncertain times.

The most resilient businesses prepare for a range of scenarios and remain agile as conditions shift. By understanding how these risks interact, monitoring the right economic indicators, and using effective tools, SMBs can navigate economic uncertainty and emerge stronger.

FAQs

What strategies can SMBs use to address the challenges of rising unemployment on hiring?

Small and medium-sized businesses (SMBs) can tackle the challenges of rising unemployment by exploring new revenue streams, boosting efficiency in operations, and considering flexible hiring options, like part-time or contract roles. These strategies can help businesses stay nimble and ease financial pressures during uncertain periods.

On top of that, using data-driven tools and seeking advice from experts can highlight ways to cut costs and make smarter decisions. By staying prepared and open to change, SMBs can strengthen their resilience and keep a competitive position, even during tough economic times.

How can small businesses adjust to shifts in consumer demand?

Small businesses can keep up with shifting consumer demands by leveraging data-driven insights to monitor market trends and spot fresh opportunities. Offering a broader range of products or services can address changing customer preferences, while tailored marketing efforts can boost engagement and foster loyalty. Staying nimble in day-to-day operations is equally important, enabling quick adjustments to meet new demands. These approaches help small businesses stay competitive and adaptable in fast-moving markets.

How do unemployment trends and shifts in consumer demand impact small and mid-sized businesses?

Unemployment and consumer demand are tightly linked, creating a cycle that can heavily influence small and medium-sized businesses (SMBs). When unemployment increases, fewer people have extra money to spend. This drop in spending often leads to lower sales for businesses, making it tougher to maintain steady cash flow and keep operations running smoothly.

On the other hand, when consumer demand dips, businesses may respond by cutting jobs to save money, which in turn pushes unemployment even higher. This back-and-forth highlights why SMBs need to stay ahead of the curve with smart risk management strategies to handle these challenges.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)