Not following Regulation D rules when raising money for your business can lead to serious problems. These include fines, losing investor trust, and even being barred from raising funds in the future. Regulation D simplifies fundraising by letting companies sell securities without full SEC registration, but there are strict rules to follow, such as filing Form D within 15 days of the first sale. Here's what you need to know:

-

Key Rules:

- Rule 504: Raise up to $10M in 12 months; no general advertising.

- Rule 506(b): Unlimited fundraising; no public promotion; up to 35 non-accredited investors allowed.

- Rule 506(c): Unlimited fundraising with public advertising, but only accredited investors can buy.

-

Penalties for Non-Compliance:

- Civil fines (up to $195,000 in recent cases).

- "Bad actor" disqualification, preventing future use of Regulation D exemptions.

- Investor rescission demands (returning funds with interest).

- Possible criminal charges for intentional fraud.

- Why It Matters: Non-compliance damages your reputation, makes future fundraising harder, and may lead to legal battles.

To stay compliant, file Form D on time, verify investors properly, and follow both federal and state laws. Use reliable tools or advisors to manage the process efficiently.

SEC and State Compliance Part 2: Improper Structures in Syndications and Funds

sbb-itb-a3ef7c1

Key Rules Under Regulation D

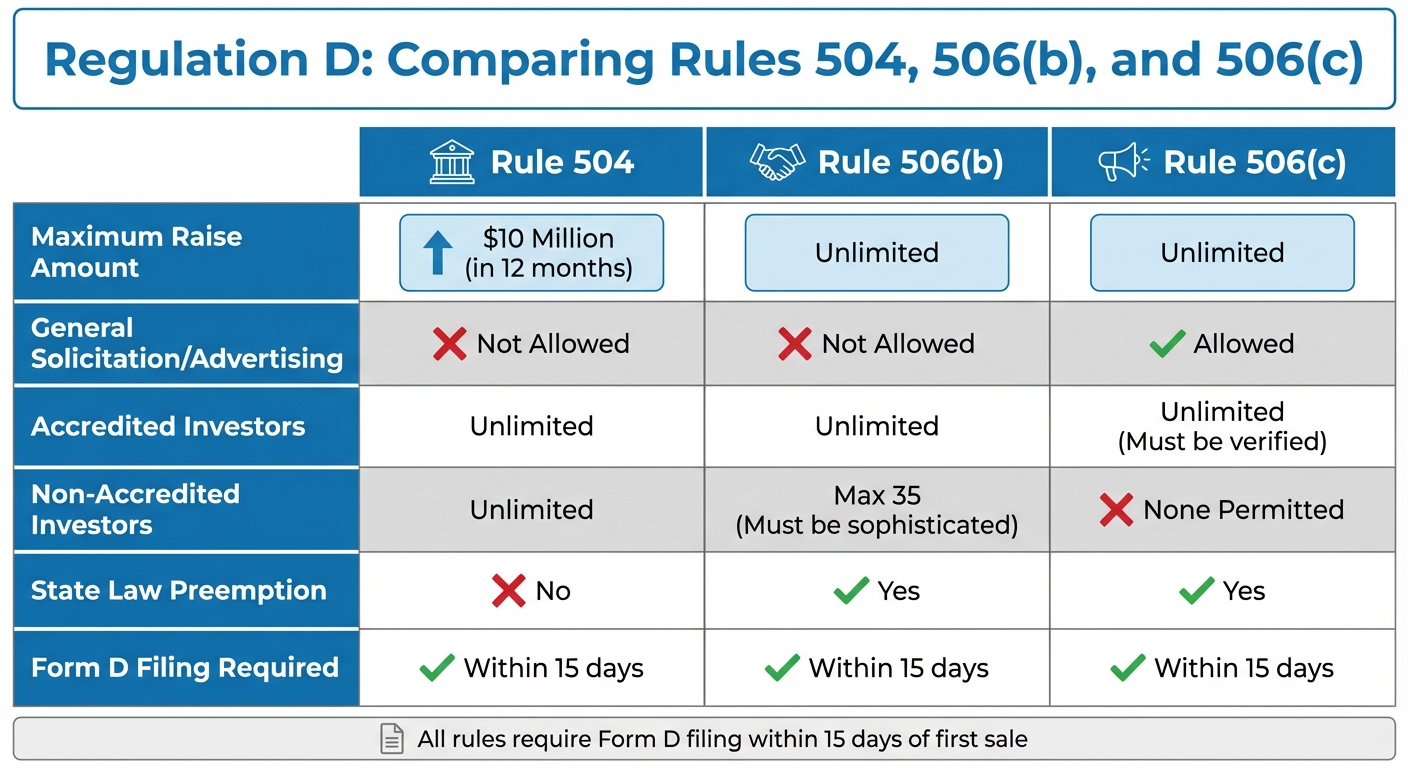

Regulation D Rules Comparison: 504, 506(b), and 506(c)

Regulation D provides three main exemptions tailored to different fundraising needs. Choosing the right rule for your business is critical to staying compliant and raising capital effectively. Here's a breakdown of the key rules and what they entail.

Rule 504: Offerings Up to $10 Million

Rule 504 is aimed at smaller capital raises, allowing companies to raise up to $10,000,000 within a 12-month period. This limit was raised from $5 million in March 2021, offering more opportunities for small businesses to secure funding without going through full SEC registration.

However, not all companies qualify. Rule 504 excludes "blank check" companies (those lacking a defined business plan), investment companies, and companies already reporting under the Exchange Act. Unlike Rule 506, Rule 504 does not override state securities laws. This means you'll need to meet registration or exemption requirements in every state where securities are sold.

General solicitation is not allowed under Rule 504. Additionally, a Form D must be filed within 15 days of the first sale. While federal law doesn’t mandate specific disclosures for investors, antifraud rules still apply. Staying compliant with these rules is essential to avoid penalties and maintain your fundraising capabilities.

Rule 506(b): Private Placements Without General Solicitation

Rule 506(b) is one of the most widely used exemptions, offering unlimited fundraising potential without a cap on the amount raised. The catch? You cannot advertise or use general solicitation. Instead, you must rely on existing relationships with potential investors.

You can sell to an unlimited number of accredited investors and up to 35 non-accredited investors, provided they are "sophisticated". For non-accredited investors, you’ll need to provide detailed disclosures, including audited financial statements.

One major advantage of Rule 506(b) is that it preempts state securities laws, simplifying compliance across multiple jurisdictions. As with Rule 504, a Form D filing is required.

Rule 506(c): Offerings With General Solicitation

Rule 506(c) allows for general solicitation, meaning you can promote your offering through public platforms like social media or websites. However, every purchaser must be an accredited investor, and you are required to take "reasonable steps" to verify their status. This verification often involves reviewing documents like W-2s, tax returns, or brokerage statements.

| Feature | Rule 504 | Rule 506(b) | Rule 506(c) |

|---|---|---|---|

| Maximum Raise | $10 Million | Unlimited | Unlimited |

| Solicitation Allowed | No | No | Yes |

| Accredited Investors | Unlimited | Unlimited | Unlimited (Must be verified) |

| Non-Accredited Investors | Unlimited | Max 35 (Must be sophisticated) | None Permitted |

| State Law Preemption | No | Yes | Yes |

Like Rule 506(b), Rule 506(c) offerings bypass state registration requirements and require a Form D filing within 15 days of the first sale. Many issuers use third-party services to ensure compliance with the stringent verification standards, reducing the risk of penalties or enforcement actions.

Penalties for Non-Compliance

Failing to comply with Regulation D can lead to serious consequences. The SEC has emphasized that adherence to these rules is not optional.

Civil Penalties and SEC Actions

In December 2024, the SEC took action against several entities for failing to file Form D on time. These issuers collectively failed to report nearly $300 million in unregistered securities offerings, highlighting the SEC's commitment to enforcement.

"Failing to file Form Ds on a timely basis... hinders the SEC's ability to assess the scope of the Reg D market, which is vital to the SEC's understanding of whether the regulation appropriately balances the need for investor protection with the facilitation of capital formation." - U.S. Securities and Exchange Commission

The consequences include civil fines, cease-and-desist orders, and even rescission, which requires issuers to repay investors with interest. If the funds have already been used for business operations, this repayment can be incredibly difficult.

Additionally, non-compliance can lead to bad actor disqualification, which prevents future fundraising under Regulation D. If you or any "covered persons" (such as directors, officers, or 20% owners) are deemed bad actors, your company loses access to exemptions under Rule 506(b), Rule 506(c), and Rule 504. Under Rule 507, the SEC can even seek a court order permanently barring you from using Regulation D exemptions.

Next, let’s look at how violations can escalate beyond civil penalties.

Criminal Charges for Serious Violations

When violations involve intentional fraud or misleading statements to investors, the stakes rise significantly. In such cases, companies and their leadership may face criminal prosecution in addition to civil penalties.

"Companies and their leadership could face civil or criminal action brought by the federal or state government, depending on the nature of the violation... This could include financial penalties or even incarceration, depending upon the type and severity of the offense." - SEC.gov

Criminal convictions can also lead to bad actor disqualification, permanently damaging a company’s ability to raise capital. The key difference lies in intent: accidental errors typically result in civil penalties, but deliberate deception can lead to criminal charges and even jail time.

State Securities Law Penalties

Federal penalties are only part of the picture. State securities laws, often referred to as Blue Sky Laws, can add another layer of complexity and penalties on top of SEC actions.

While Rule 506 offerings preempt state registration requirements, issuers are still required to file state notice filings. Failing to file Form D on time can invalidate reliance on Regulation D, leaving issuers exposed to state registration requirements.

"An issuer that fails to file a Form D leaves itself exposed to the regulatory position that it did not rely on Reg D... which does not preempt blue sky registration or qualification of securities." - Bryan Cave Leighton Paisner LLP

For Rule 504 offerings, state laws are not preempted at all. Issuers must comply with registration or exemption requirements in every state where securities are offered or sold. State regulators can impose their own fines, issue cease-and-desist orders, and even require full registration if their rules are not followed. This dual enforcement system makes non-compliance both financially and operationally burdensome.

Long-Term Effects of Non-Compliance

Non-compliance doesn’t just lead to immediate penalties - it can severely impact your ability to raise funds in the future and damage your credibility with investors.

Bad Actor Disqualifications

Being labeled a bad actor can block your company from using exemptions like Rule 504, Rule 506(b), and Rule 506(c). These disqualifications often have a long reach, with look-back periods of 5 years for court injunctions and 10 years for regulatory orders.

The restrictions don’t stop with the company itself. They extend to covered persons, which include individuals who own at least 20% of the company’s voting equity, as well as directors, officers, general partners, and even paid solicitors involved in the offering.

To avoid these pitfalls, it’s critical to conduct thorough background checks on all covered persons. If an issue arises, you can request a waiver from the SEC by proving "good cause" for why the exemption should still apply - but there’s no guarantee the SEC will approve it.

Once these disqualifications are in place, they create long-term reputational damage, making it harder to gain trust within the investor community.

Damage to Reputation and Investor Confidence

A history of compliance issues can cast a long shadow over your fundraising efforts. Sophisticated investors often require formal assurances, such as representations, warranties, and legal opinion letters, to confirm your compliance with securities laws.

The SEC has explicitly warned investors to view the absence of a Form D filing as a major red flag for potential fraud. Even if you correct the non-compliance, the damage is often public knowledge, uncovered during due diligence. This can make securing future investments an uphill battle.

For private fund advisers, the consequences extend further. Any SEC settlements must be disclosed as disciplinary events on Form ADV, a public document that potential investors review closely.

For example, in December 2024, the SEC resolved enforcement actions against a private fund adviser and two pre-IPO companies for failing to file Form D on time. These entities faced civil penalties totaling $195,000 and received cease-and-desist orders. The SEC noted that their non-compliance deprived the market of critical information about nearly $300 million in unregistered offerings. These kinds of public records can significantly impact investor confidence and trust.

How to Maintain Regulation D Compliance

Staying compliant with Regulation D involves careful planning and thorough record-keeping. Missteps can lead to penalties and erode investor trust, so it’s essential to follow the right procedures throughout your capital-raising efforts. Here’s a breakdown of the key steps to keep your compliance on track.

Filing and Record-Keeping Requirements

The 15-day rule is a strict requirement. You must file Form D electronically with the SEC within 15 calendar days of the first sale of securities in your offering. The "first sale" generally refers to when the initial subscription agreement is signed or when funds are received. While there’s no fee for filing or amending Form D, missing this deadline could result in serious civil penalties.

Beyond federal filings, you’ll need to comply with state-level securities laws, often referred to as Blue Sky laws, in every state where securities are offered or sold. For Rule 506 offerings, this typically includes submitting a notice filing that references your federal Form D. Keep detailed records of your verification processes, and ensure you disclose any bad actor events to investors in writing before completing a sale.

Verifying Accredited Investor Status

If you’re conducting a Rule 506(c) offering and using general solicitation, you must take "reasonable steps to verify" that each purchaser is an accredited investor. This isn’t optional - the SEC enforces this rule strictly. For instance, in 2022, the SEC penalized PIC Renegade Properties, LLC, for failing to verify the status of 15 entity investors. The company sold securities to at least four non-accredited individuals, leading to $400,000 in civil penalties.

The SEC outlines several acceptable methods for verifying accredited investor status:

- Income verification: Review IRS forms like W-2s, 1099s, Schedule K-1s, or Form 1040s for the last two years and obtain a written statement confirming the current year’s income.

- Net worth verification: Examine bank or brokerage statements, tax assessments, or appraisal reports from the last three months, and use a consumer report to confirm liabilities.

- Third-party confirmation: Obtain written verification from a registered broker-dealer, SEC-registered investment adviser, licensed attorney, or CPA who has verified the investor’s status within the past three months.

It’s important to note that verification for one offering doesn’t carry over to future ones. Each Rule 506(c) offering requires its own verification process.

Using Advisory Services and Compliance Tools

Managing Regulation D compliance can be complex, but third-party tools and advisory services can simplify the process. These tools can automate tasks like investor verification, filings, and due diligence, reducing the chance of errors while meeting SEC standards. They can also integrate into your onboarding workflows, offering real-time verification, secure document management, and detailed audit trails to support your compliance efforts.

For example, platforms like Clearly Acquired handle everything from financial analysis and investor verification to timely Form D filings and compliance with federal and state securities laws. Advisory services can also help with due diligence, ensuring that key individuals - such as directors, officers, or major stakeholders - don’t have disqualifying criminal or regulatory records. These checks typically cover a five- to ten-year period. By outsourcing these responsibilities to licensed professionals, you can focus on running your business while staying compliant.

Conclusion

Regulation D offers companies a way to raise capital without undergoing the full SEC registration process, but failing to comply with its requirements carries serious consequences. Penalties can include civil fines of up to $195,000 and rescission obligations, which might force a company to return investor funds. These outcomes can cause both financial strain and lasting reputational harm.

The repercussions don’t stop there. Non-compliance can lead to bad actor disqualifications, making it harder - or even impossible - to secure future funding. Many experienced investors insist on a proven track record of securities law compliance before committing their capital. Additionally, if your company has plans to go public, any unregistered securities sales from the prior three years must be disclosed during the IPO registration process. Past violations can complicate this process, resulting in costly legal fixes.

The good news? A well-thought-out compliance strategy can help you avoid these risks. This starts with timely Form D filings, thorough accredited investor verification, and precise record-keeping practices. For businesses managing complex capital raises, services like Clearly Acquired can assist with investor verification, Form D submissions, and state notice coordination. By relying on experts who understand both federal and state securities regulations, you can focus on growing your business while ensuring your compliance record remains spotless. A strong filing and documentation system is your best safeguard.

FAQs

What are the main differences between Rule 504, Rule 506(b), and Rule 506(c) under Regulation D?

Rule 504 lets businesses raise up to $10 million in a 12-month period. However, it comes with restrictions: general solicitation isn't allowed, and the securities issued must be restricted.

Rule 506(b), on the other hand, allows for unlimited fundraising but limits participation to 35 non-accredited investors. Like Rule 504, it prohibits general solicitation.

Rule 506(c) also permits unlimited fundraising, but there’s a key difference: all investors must be verified accredited investors, and general solicitation is allowed.

These differences are crucial for businesses considering capital raising under Regulation D.

What steps can businesses take to avoid being classified as 'bad actors' under Regulation D?

To stay compliant with Regulation D and avoid being labeled as "bad actors", businesses need to follow the bad actor disqualification provisions carefully. This means steering clear of activities like specific criminal convictions, regulatory orders, or violations of SEC rules. On top of that, it's crucial to file Form D correctly, meet all investor-related requirements, and ensure transparency in all offerings.

By addressing these key areas upfront, companies can lower the chances of facing penalties and protect their eligibility under Regulation D.

What are the long-term consequences of failing to comply with Regulation D?

Failing to follow Regulation D can lead to major consequences for your business. These range from legal action and fines to sanctions imposed by the SEC. In more severe cases, companies might even face restrictions on future securities offerings, which could seriously impact their ability to raise funds.

But it’s not just about the financial and legal penalties. Non-compliance can also tarnish your company’s reputation, making it tougher to gain the trust of investors and potential partners. Sticking to Regulation D isn’t just about avoiding trouble - it’s about safeguarding your business and maintaining strong relationships with your stakeholders.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)