Accurately valuing a small business with less than $2M in revenue requires a clear understanding of financial metrics, valuation methods, and risk factors. Here's a quick breakdown:

- Start with Financials: Gather three years of tax returns, profit & loss statements, and balance sheets. Normalize these to reflect true earning potential by removing one-time or non-essential expenses.

-

Use the Right Valuation Methods:

- Income-Based: Focus on cash flow using Discounted Cash Flow (DCF) or Capitalization of Earnings.

- Market-Based: Compare with similar businesses using Seller's Discretionary Earnings (SDE) multiples (typically 2x–4x for businesses under $2M in revenue).

- Asset-Based: Calculate the value of tangible assets minus liabilities, often as a baseline.

- Calculate SDE: Add back owner compensation, personal expenses, and non-recurring costs to net profit. Use this to apply an SDE multiple for valuation.

- Adjust for Intangible Factors: Consider elements like customer concentration, reliance on the owner, or recurring revenue, which can shift valuation by 5–20%.

- Avoid Common Errors: Use multiple methods, back up financial adjustments with documentation, and avoid unrealistic growth projections.

For most small businesses, combining these approaches provides a realistic valuation that aligns with buyer expectations and lender requirements.

Step 1: Prepare Your Financial Data

Collect Required Financial Documents

Start by organizing your business acquisition checklist of financial documents - this is the foundation for an accurate valuation. Most valuation professionals and lenders will ask for at least the last three years of tax returns and financial statements. Why? Because they want to assess consistent performance over time, not just a single standout year.

Make sure to gather profit and loss statements (P&L), balance sheets, and cash flow statements for the past three years. You’ll also need your federal and state tax returns for the same period. Danielle Hunt from EBIT Community highlights the importance of this:

"SBA lenders base their calculations on tax returns, not the adjusted financials sellers present".

In addition to these, collect supporting documents like W-2s, general ledgers, and payroll reports. These help validate claims about owner compensation and discretionary expenses. Monthly P&Ls can also reveal seasonal trends, while lease agreements and customer contracts provide insights into key dependencies. One technical tip: prioritize accrual-based statements over cash-basis ones. Accrual accounting gives a clearer picture of your business’s health by including committed amounts.

Normalize Your Financial Statements

Once you’ve gathered all your documents, it’s time to adjust the numbers to reflect the business’s actual earning potential. Raw financial statements often don’t tell the full story - they may overstate or understate the business’s profitability. This is where normalization, or "recasting", comes in. It’s a process that removes non-essential expenses and one-time costs, giving a clearer view of the business’s true earning power.

Start by identifying costs that won’t carry over to a new owner. For example, excess owner salary, personal expenses like insurance or vehicle costs, charitable donations, and one-time fees can all be added back to earnings. Here’s a quick example: if you pay yourself $150,000 annually but a market-rate manager would only cost $75,000, the $75,000 difference is an add-back. Similarly, a family vacation costing $8,000 or a one-time legal settlement of $15,000 would also qualify as non-recurring expenses.

Every adjustment you make should be backed up with solid documentation - receipts, invoices, or payroll records. Without proper evidence, these add-backs could be rejected during due diligence, which might hurt your deal. Thomas Smale, CEO of FE International, stresses this point:

"Normalization (or 'recasting') is crucial to presenting an accurate earnings base for valuation".

To build trust and streamline the review process, prepare a clear normalization schedule that outlines all adjustments. However, keep in mind that some costs, like deferred maintenance or ongoing marketing expenses, can’t be added back since they’re essential to keeping the business running at its current level.

These adjusted financials will serve as the solid groundwork for accurate valuation calculations in the next steps.

sbb-itb-a3ef7c1

How To Value A Small Business In 14 Minutes Or Less (SBA)

Step 2: Select Your Valuation Method

Once you've organized your financials, the next step is to determine how to value your business. The right method depends on how your business operates - its profitability, the weight of its assets, or the predictability of its cash flow. Using a combination of valuation methods, rather than relying on just one, often provides a more accurate range of values for your business.

Let’s break down the three main approaches to valuation so you can match the method to your business's unique profile.

Income-Based Valuation

This method zeroes in on your business's ability to generate future earnings. It’s widely used for small businesses with steady cash flow. The two main techniques here are Discounted Cash Flow (DCF) and Capitalization of Earnings.

- Discounted Cash Flow (DCF): This approach works best when your future cash flows are predictable. You estimate your cash flow for the next five years and calculate its present value using a discount rate. For small businesses, a reasonable discount rate is the Prime interest rate plus 2.5%, which was about 10% in early 2023. To value cash flows beyond year five, apply a conservative terminal growth rate of 3%.

- Capitalization of Earnings: This method is ideal for businesses with consistent cash flow. Divide your sustainable annual cash flow by the capitalization rate (cap rate), which typically ranges from 20% to 25%. For example, if your business generates $200,000 in annual cash flow and you use a 20% cap rate, your valuation would be $1,000,000 ($200,000 ÷ 0.20).

As Tiffany Verbeck from Nav explains:

"A discounted cash flow model takes [the time value of money] into account, which is why it can be also helpful if you're trying to compare different investment opportunities".

Market-Based Valuation

This approach values your business by comparing it to similar companies that have recently sold. It relies on the "principle of substitution", essentially asking, "What would someone pay for a business like mine?". It’s particularly effective in industries with a high volume of comparable sales, such as accounting firms, franchises, or insurance agencies.

The main tool here is valuation multiples, which are often based on Seller's Discretionary Earnings (SDE) for businesses with under $2M in revenue. Typical SDE multiples range from 2x to 4.5x, depending on the industry. For example:

| Industry | SDE Multiple Range |

|---|---|

| Restaurants | 1.5 – 2.5 |

| Retail Stores | 1.3 – 2.5 |

| Cleaning Services | 2.0 – 3.0 |

| Professional Services | 2.0 – 3.5 |

| Online Businesses | 2.5 – 4.0 |

| Construction/Trades | 2.0 – 3.5 |

In some cases, industries use revenue multiples instead, especially those with high growth potential or recurring revenue models. For instance, accounting practices often sell for 1.0x to 1.5x revenue, while insurance agencies range from 1.5x to 2.5x revenue.

The tricky part with this method is finding accurate data on comparable sales. Adjustments are usually needed for differences in size, location, customer base, and risk. For example, if a single customer accounts for more than 10%-15% of your revenue, your valuation multiple may be lower due to increased risk.

Asset-Based Valuation

This method calculates the net worth of your tangible assets after subtracting liabilities. It’s most useful for asset-heavy businesses, like manufacturers or equipment rental companies, or for businesses that are not profitable.

There are two ways to calculate this:

- Book Value: Simply use the numbers from your balance sheet.

- Adjusted Net Asset Value: Adjust the book value to reflect current market conditions. For example, equipment listed at $50,000 on your books might only sell for $35,000 in today’s market, or accounts receivable valued at $30,000 might drop to $25,000 after factoring in uncollectible debts.

Paul Henriquez from The Value Builder System explains:

"The most basic way to value a business is to figure out what the hard assets are worth and subtract any debt the business owners have on the business... This valuation method often renders the lowest value for the company because it assumes a business does not have any goodwill".

Because of this, asset-based valuation often serves as a "floor price" - the minimum your business should be worth. If your income-based or market-based valuations are lower than your asset value, it might signal operational issues, and liquidation could be a better option.

As Scot Cockroft, President of Sigma Mergers, puts it:

"The asset approach is only considered if the company is more valuable if liquidated for its assets than it would be if it continued to operate for cash flow or profit".

For most small, profitable businesses with under $2M in revenue, income-based and market-based methods will be your primary tools. Asset-based valuation is typically used as a sanity check or to establish a baseline value. By combining these methods, you’ll get a clearer picture of what your business is truly worth.

Step 3: Calculate Seller's Discretionary Earnings (SDE)

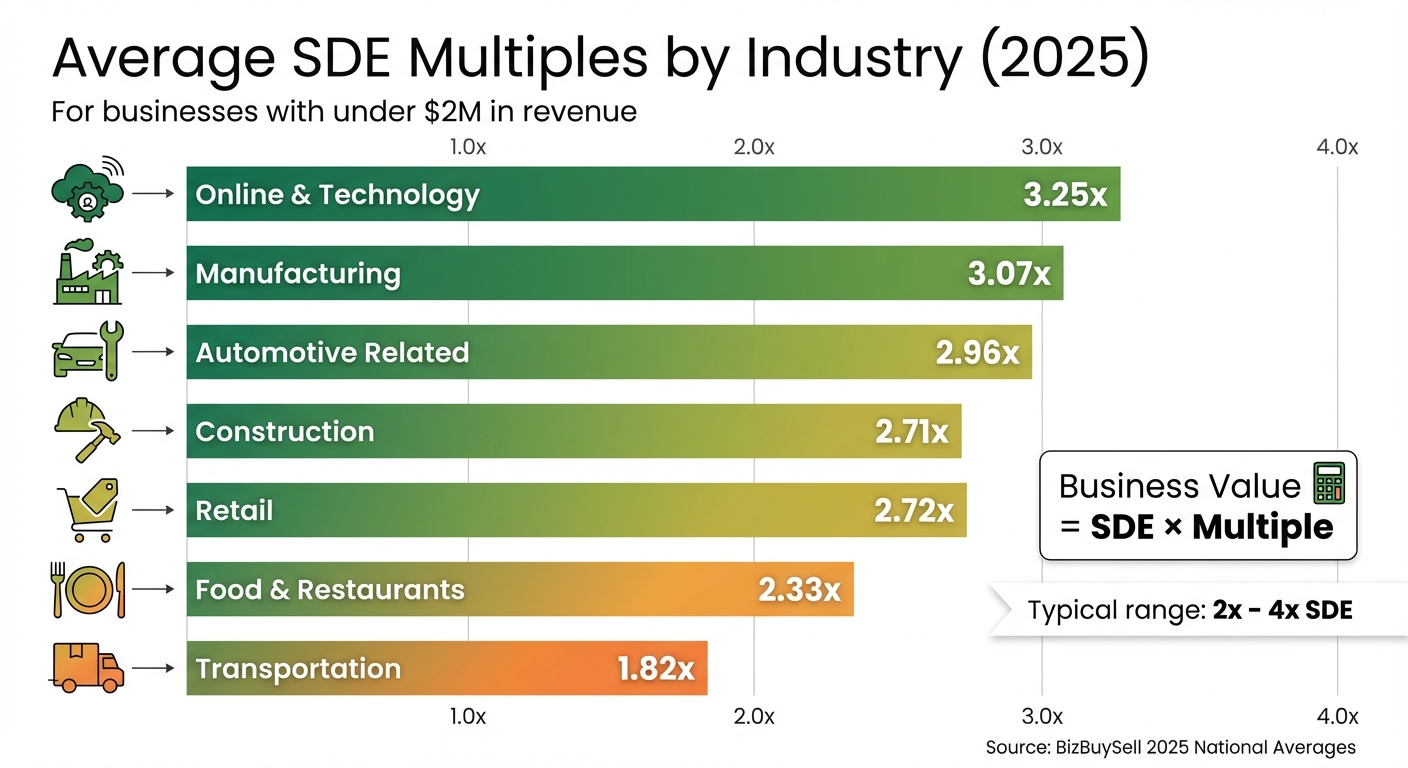

SDE Multiples by Industry for Small Business Valuation

For businesses earning less than $2 million in revenue, Seller's Discretionary Earnings (SDE) is a key financial metric. It reflects the total financial benefit a single, full-time owner can expect to receive annually from the business. Unlike net profit, which only shows the remaining amount after all expenses, SDE paints a clearer picture of the business's earning potential by factoring in the owner's salary, personal perks, and other expenses that likely won’t transfer to a new owner.

Understanding Seller's Discretionary Earnings

Once your financials are normalized, SDE provides a sharper view of the owner's actual benefits. It’s the go-to metric for smaller, owner-operated businesses generating less than $2 million in revenue. Why? Because these businesses typically assume the new owner will step into the current owner’s role, eliminating the need to hire additional management. In 2025, the average small business sold for 2.61 times its annual SDE, underscoring the importance of this calculation in determining valuation.

Jordan Kelliher, Founder of Kelliher Acquisitions, explains this well:

"SDE represents the total financial benefit a single, full-time owner-operator can expect to receive from the business in a year".

The main distinction between SDE and metrics like EBITDA lies in SDE including the owner's compensation as part of the overall benefit to the buyer. For larger companies with dedicated management teams, EBITDA is often more relevant. But for smaller, owner-operated businesses, SDE offers a more realistic snapshot of what a buyer can expect to take home.

Identify and Calculate Add-Backs

Once your financials are normalized, the next step is to adjust earnings to reflect the true benefits to the owner. Every add-back should be well-documented with supporting evidence. Start your SDE calculation with net profit from tax returns, as these are the only figures lenders like banks and the SBA will accept.

The formula for SDE looks like this:

SDE = Net Profit + Owner's Salary + Non-Essential Expenses + Non-Cash Expenses (Depreciation/Amortization) + One-Time Expenses - One-Time Income Adjustments.

Common add-backs include:

- The owner’s salary and benefits (e.g., health insurance, 401(k) contributions)

- Personal expenses run through the business (e.g., auto lease, cell phone, travel)

- Non-cash charges like depreciation

- One-time expenses, such as lawsuit settlements or major equipment repairs

If family members are employed at above-market rates, the excess portion of their salaries can also be added back. For instance, if you claim $12,000 annually for a personal vehicle, you’ll need receipts and usage logs to verify it. Without proper documentation on your tax return, lenders will exclude that expense from your SDE.

Additionally, subtract any non-recurring gains, as they don’t represent consistent earnings. For example, if you sold equipment last year and recorded a $15,000 gain, that amount should be removed from your SDE calculation.

Your normalization schedule plays a crucial role here, as it will be closely scrutinized during Quality of Earnings audits.

Apply SDE Multiples to Calculate Value

After determining your SDE, the valuation process becomes straightforward:

Business Value = SDE × Multiple. For businesses earning under $1 million, multiples generally range from 2x to 4x. The specific multiple depends on factors like your industry, business size, risk profile, and how much the business relies on you personally.

Here are some average SDE multiples by industry for 2025:

| Industry | Average SDE Multiple |

|---|---|

| Online & Technology | 3.25x |

| Manufacturing | 3.07x |

| Automotive Related | 2.96x |

| Construction | 2.71x |

| Retail | 2.72x |

| Food & Restaurants | 2.33x |

| Transportation | 1.82x |

(Source: BizBuySell 2025 National Averages [4])

For example, a cleaning service with $150,000 in SDE could be valued between $375,000 and $450,000, applying a multiple of 2.5x to 3.0x. However, if a single customer represents more than 10–15% of your revenue, you might need to use the lower end of that range to account for concentration risk.

To ensure your valuation is realistic, conduct a "lender test." Most SBA lenders require a Debt Service Coverage Ratio (DSCR) of 1.25x to 1.5x. This means your business must generate $1.25 to $1.50 in cash flow for every $1 of debt service. If your asking price requires financing that your SDE can’t support, buyers may struggle to secure approval, forcing you to adjust your valuation.

It’s also a good idea to use a three-year average of SDE to demonstrate consistency and growth trends. If your business is growing, give more weight to the most recent year, as it better reflects current performance. For instance, a business with $120,000 in SDE three years ago, $135,000 two years ago, and $150,000 last year tells a stronger story than one with flat or declining earnings, often justifying a higher multiple.

Next, this valuation can be adjusted further to account for intangible assets and specific business risks.

Step 4: Account for Intangible Assets and Risk Factors

Once you've calculated your SDE and applied a starting multiple, it's time to refine your valuation by factoring in intangible assets and potential risks. These adjustments can shift your final value by 5%–20% depending on the specifics of your business. While the SDE represents the financial baseline, the multiple reflects the quality and sustainability of those earnings.

Now, let's look at how intangible assets can add value and how risks can impact your final valuation.

Evaluate Intangible Assets

Intangible assets may not show up on a balance sheet, but they can have a big impact on your business's value. Think about proprietary technology, trademarks, patents, customer lists, or even strong digital assets like a well-maintained website or email list. These are the elements that create goodwill - essentially the difference between your company’s market value and the fair market value of its physical assets.

For example, a business with robust systems and processes that can run smoothly without constant owner involvement is far more appealing to buyers. If you've built a highly engaged email list, created a database with detailed customer purchase histories, or have a website ranking for competitive search terms, these assets can reduce future customer acquisition costs - making your business more attractive to buyers.

Paul Henriquez from Value Builder offers this perspective:

"Small companies are deeply discounted when compared with their large, publicly traded counterparts, so measuring a company's value against a Fortune 500 giant will often lead to disappointment".

Instead of comparing your business to corporate giants, focus on what makes your small business stand out. Document and formalize your intangible assets, like registering trademarks or patents, and keep detailed records of customer relationships and digital assets. This preparation will help you showcase their value during due diligence.

Adjust for Business Risks

Once you've identified the intangibles that enhance value, it's equally important to adjust for risks that could lower your valuation. Key risks for small businesses include customer concentration, owner dependency, and revenue quality.

Customer concentration is a red flag. If one customer accounts for more than 10%–15% of your revenue, your valuation multiple will likely take a hit. SBA lenders specifically look for a diverse customer base to minimize risk.

Owner dependency is another critical factor. As BizBuySell puts it:

"A business managed largely by employees is much more valuable than one whose owner needs to work 60 hours a week. The more 'passive' the income stream, the higher the multiple".

If your business relies heavily on your daily involvement or personal relationships, buyers will discount its value. The SBA often limits seller involvement to 12 months post-sale, so if key operations or relationships can't be transitioned to a new owner or team, your multiple will decrease.

Revenue quality also plays a big role. Businesses with recurring revenue - like subscriptions or long-term contracts - are far more appealing than those relying on one-off sales or project-based income. Predictable income streams reduce uncertainty for buyers and can justify higher multiples. On the flip side, if your revenue is inconsistent or fluctuates significantly, expect a lower valuation.

To ensure accuracy, validate your valuation using multiple methods and cross-check the results. This approach minimizes the risk of over-reliance on any single factor and provides a solid range to work with during negotiations. By accounting for both intangible assets and risks, you can present a valuation that reflects the true performance and potential of your business.

Step 5: Avoid Common Valuation Errors

Even with a solid understanding of SDE (Seller’s Discretionary Earnings) and intangible assets, mistakes can throw off your valuation. These errors can lead to unrealistic expectations, derail negotiations, or even cause deals to fall apart during due diligence.

Common Valuation Mistakes

Relying on a single valuation method or using inappropriate comparables is a frequent misstep. Nicholas Fecci, Manager at CBIZ, highlights this issue:

"A common mistake is assuming companies within the same industry are automatically comparable".

Public companies often benefit from economies of scale, strong brand recognition, and easier access to capital. These advantages can justify higher valuation multiples, but they don’t always apply to smaller businesses.

Another common error is assuming that a valuation remains valid indefinitely. Market conditions, regulatory changes, and shifting sales trends can all impact a company’s value over time.

Overestimating growth potential without credible evidence is another pitfall. Rachel Chong, Director at BDC, explains:

"Entrepreneurs may feel that the valuator doesn't believe in them if they have unrealistic expectations about the value of their company or its future growth".

Promising dramatic revenue growth without historical data or proven traction can damage your credibility with potential buyers or lenders. Avoiding these errors is key to ensuring an accurate and realistic valuation.

How to Prevent Valuation Errors

To sidestep these mistakes, adopt a structured approach to reviewing your valuation methods. Start by cross-checking your calculations with multiple approaches. Use at least two or three methods - such as SDE multiples, market comparables, and asset-based valuation - and check if the results align within a reasonable range. If there’s a big discrepancy, don’t just average the numbers. Instead, dig deeper to determine which method best fits your business.

Set clear parameters for your valuation from the outset. Specify the valuation date and standard to avoid confusion. Stick to the "known or knowable" rule - your valuation should only consider information available as of the chosen date.

Conduct a thorough audit of both tangible and intangible assets, and make sure every liability is documented.

Back up growth projections with solid evidence, such as historical data, signed contracts, or other clear indicators of traction.

Finally, normalize your financial statements with care. Adjust for any non-market-rate expenses or one-time events, ensuring that all add-backs are well-documented and defensible. Since SBA lenders base their calculations on tax returns, every adjustment must be backed by supporting documents like W-2s, invoices, or general ledgers. Only include add-backs that can be verified as truly discretionary.

Following these steps helps refine your valuation and sets realistic expectations for any potential deal.

Conclusion

This guide provides a clear, step-by-step approach to help you accurately assess a business's value. For companies generating under $2 million in revenue, the process becomes much more manageable when you rely on verified financial records, established valuation methods, and a careful eye for detail. Start with accurate historical financial data and calculate your SDE as explained earlier.

Using a mix of valuation methods and weighing the results appropriately can help you land on a well-rounded figure. Keep in mind that intangible factors - like customer concentration, reliance on the owner, or recurring revenue - can influence the valuation by as much as 5% to 20% in either direction.

Having a solid valuation in hand offers both clarity and leverage, helping you avoid costly mistakes. For transactions exceeding $350,000, it’s wise to hire a certified appraiser, especially since most SBA lenders require third-party valuations. Spending a few thousand dollars on professional expertise can significantly improve your negotiating power.

FAQs

Why is it important to normalize financial statements when valuing a business?

Normalizing financial statements plays a key role in business valuation. It involves adjusting financial data to remove non-recurring, owner-specific, or discretionary expenses. The goal? To present a clearer, more consistent picture of the business's earning potential.

This process ensures the financials accurately reflect the business's true performance, making it easier to compare results across different time periods or with similar businesses. For buyers, sellers, and investors, this clarity is critical when making well-informed decisions.

How do intangible assets affect the value of a small business?

Intangible assets play a crucial role in shaping the value of a small business. These assets - such as goodwill, customer relationships, brand reputation, intellectual property, and proprietary processes - may not show up on a balance sheet, but they can have a major influence on the business's future earnings and overall appeal in the market.

Take, for example, a well-established brand or a deeply loyal customer base. These factors can often justify higher valuation multiples, particularly when forecasting future cash flows. Intangible assets also carry significant weight in market-based valuations, where comparable sales often highlight the importance of reputation and customer loyalty. Properly evaluating these elements is especially vital in industries where strong relationships, intellectual property, or brand recognition are key drivers of revenue growth.

Why should you use multiple methods to value a business with under $2M in revenue?

Using several valuation methods is crucial for businesses generating less than $2 million in revenue because each method sheds light on different aspects of the business. For instance, asset-based valuation zeroes in on tangible assets, market-based valuation benchmarks your business against similar ones in the market, and income-based methods, such as cash flow analysis, assess profitability and potential future earnings.

Blending these methods offers a clearer and more well-rounded understanding of the business's value. It takes into account both tangible elements, like physical assets, and intangible factors, such as goodwill or customer concentration. This broader perspective is particularly important for small businesses, where unique traits can heavily influence their overall worth.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)