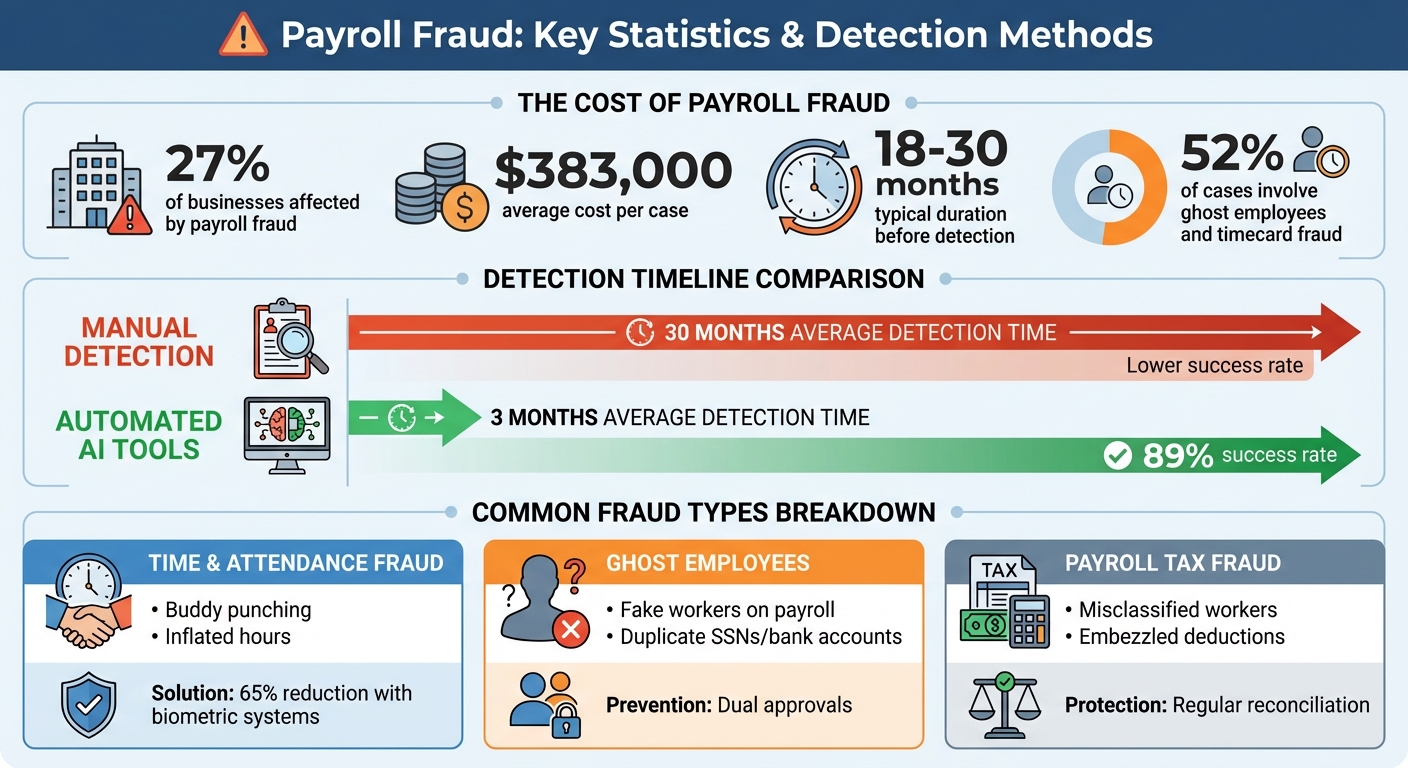

Payroll fraud affects 27% of businesses and can cost companies $383,000 per case on average. These schemes often go unnoticed for 18 to 30 months, causing financial losses, legal issues, and reputational damage. Small and mid-sized businesses are at higher risk due to weaker internal controls. Common types include ghost employees, inflated hours, and payroll tax fraud.

Key Takeaways:

- Time and Attendance Fraud: Employees claim hours they didn’t work (e.g., buddy punching). Solutions: Biometric systems and automated timekeeping.

- Ghost Employees: Fake workers are added to payroll. Prevention: Dual approvals for new hires and payroll audits.

- Payroll Tax Fraud: Misclassifying employees or embezzling deductions. Protection: Regular reconciliation of payroll and tax records.

How to Detect Payroll Fraud:

- Look for red flags like duplicate Social Security numbers, shared bank accounts, or sudden pay rate changes.

- Monitor employee behavior, such as avoiding vacations or living beyond their means.

- Use automated tools to identify anomalies in payroll data within 3 months, compared to the typical 30 months for manual detection.

Prevention Strategies:

- Separate payroll tasks among staff to reduce risk.

- Regularly reconcile payroll data with bank and tax records.

- Train employees to spot phishing attempts and encourage anonymous reporting of suspicious activities.

For business buyers and lenders, payroll fraud can distort financial health and derail deals. AI tools can quickly analyze payroll data, flagging risks like misclassified workers or inflated expenses. Clean payroll records are essential for securing financing and maintaining trust during acquisitions.

Payroll Fraud Statistics and Detection Timeline Comparison

Payroll Fraud: Key Steps for Prevention and Identification in 2023

Common Types of Payroll Fraud

Payroll fraud can take on various forms, with ghost employees and timecard fraud making up a staggering 52% of cases. Knowing how these schemes operate can help you identify and address them before they cause significant financial harm to your business.

Let’s dive into some of the most common types of payroll fraud, along with real-world examples and tips for spotting them.

Time and Attendance Fraud

This type of fraud happens when employees are paid for hours they didn’t actually work. A classic example is buddy punching, where one employee clocks in or out for another. Other methods include inflating hours in small increments or convincing payroll staff to override timesheets.

For instance, one hospital employee falsely claimed 400 extra hours, raking in over $25,000 in unwarranted pay. In another case, a postal worker fabricated jury duty claims and walked away with nearly $40,000.

How can businesses combat this? Switching from paper timesheets to biometric systems - like fingerprint or facial recognition - can make a huge difference. Studies show that integrated time and attendance systems can slash fraud-related losses by as much as 65%.

Ghost Employees and Phantom Contractors

Ghost employees are fake workers added to your payroll. These "employees" often have made-up Social Security numbers and bank accounts, with payments funneled to someone inside the company. Sometimes, terminated employees are left on the payroll, and their paychecks are redirected.

Consider the 2023 case in Chicago, where Alisha Richardson, a nursing home employee, was indicted for stealing over $100,000. She created ghost employees, logged fake hours for them, and cashed the fraudulent paychecks herself. Similarly, phantom contractors involve creating bogus contractor records or misclassifying employees as independent contractors to dodge taxes and insurance costs.

Large companies with high turnover or those lacking automated payroll audits are especially vulnerable. To minimize risk, implement dual approvals for new hires, terminations, and pay rate changes. Payroll software that flags duplicate Social Security numbers, addresses, or bank accounts can also be a game-changer.

Payroll Tax and Withholding Fraud

This type of fraud occurs when tax deductions are taken from employee paychecks but never sent to tax authorities. One variation, called embezzling withholding, involves a manager diverting deductions like Roth IRA contributions into their own account. Another common tactic is misclassifying employees as independent contractors to avoid paying unemployment and payroll taxes.

The consequences of payroll tax fraud are severe. Businesses can face hefty IRS fines, Department of Labor penalties, and even criminal charges. To protect your company, reconcile payroll registers with tax filings and bank statements regularly. Catching discrepancies early can save you from major legal and financial headaches.

Red Flags and Detection Clues for Payroll Fraud

Spotting payroll fraud early can save your business a fortune. On average, payroll fraud schemes last between 18 and 30 months, with losses hitting around $383,000 per case. But there’s good news: automated alerts can uncover fraud in as little as three months, boasting an 89% success rate. That’s a stark contrast to the 30 months it often takes for accidental discovery.

Knowing what to watch for can make all the difference. Here are some critical warning signs that demand immediate attention.

System and Data Anomalies

Your payroll system holds plenty of clues - if you know where to look. Duplicate entries, such as matching bank accounts, Social Security numbers, addresses, or phone numbers, are major red flags. Payments issued to former employees or individuals missing from active personnel records should also raise eyebrows.

Frequent, unauthorized changes to hours worked or pay rates are another clear indicator of trouble. Watch out for payroll entries with "round numbers", like exactly 10 or 20 hours of overtime - real work hours rarely align so perfectly.

Be especially cautious with direct deposit changes. Fraudsters often send urgent emails pretending to be employees, pushing for last-minute updates to bank account details. Always verify such requests by contacting the employee directly using the phone number in your HR records.

Employee Behavior Warning Signs

Sometimes, the most telling signs come from employee behavior. For instance, employees who never take vacation and those who suddenly adopt a more extravagant lifestyle - like purchasing luxury items - deserve closer scrutiny. Similarly, supervisors who insist on approving their own timecards or tightly control all payroll tasks to avoid oversight should be carefully monitored.

Financial Ratios and Metrics That Signal Fraud

Numbers often tell the story before fraud gets out of hand. Keep an eye on budget variances, excessive overtime, payments exceeding your active headcount, and commissions that don’t match up with actual sales figures. These discrepancies often point to fraudulent activity.

| Metric | Red Flag Indicator | Potential Fraud Type |

|---|---|---|

| Budget vs. Actual | Significant unexplained variance | Falsified wages or ghost employees |

| Overtime vs. Revenue | High overtime during low revenue | Timesheet padding |

| Payments vs. Headcount | More payments than active staff | Ghost employees |

| Commission vs. Sales | Commission % higher than policy | Commission inflation |

Establishing baseline metrics and investigating significant deviations is essential. Small businesses, in particular, are nearly twice as likely to experience payroll fraud compared to larger organizations. Monitoring these metrics is a critical step in safeguarding your company’s finances. These detection methods set the stage for the preventive measures covered in the next section.

sbb-itb-a3ef7c1

How to Prevent and Detect Payroll Fraud

Businesses that establish proactive measures tend to experience far fewer losses due to fraud. Considering that payroll fraud schemes typically last 18 to 24 months and result in average losses of $383,000 per case, taking preventative steps early is essential.

Setting Up Internal Controls

Start by dividing payroll responsibilities. Assign different employees to handle payroll preparation, approve changes like new hires or pay adjustments, and verify the final transactions. This separation ensures no single person has unchecked control over the payroll process, making it harder for fraud to occur.

Limit access to payroll systems based on roles and update passwords immediately when payroll staff leave. Require formal managerial approval for any changes to payroll records, such as salary updates, terminations, or bank account modifications. Always verify direct deposit changes by calling the employee using the phone number on file in your HR system. This extra step can help block payroll diversion phishing scams.

Regular reconciliations are key to spotting discrepancies. Compare payroll registers with bank statements, general ledger entries, and tax documents (like W-2s) each month. Check that the number of active employees matches the number of paychecks issued. Randomly audit timesheets, commission calculations, and expense reimbursements, ideally by someone outside the payroll department. A highly effective measure is requiring payroll staff to take consecutive days off. As Accounting Today explains:

"A potential red flag of fraud 'is an employee who hoards her work duties and never takes PTO,' indicating 'an unwillingness to leave for fear the fraud will be discovered by someone covering for her'".

Fraud often comes to light when another employee temporarily takes over and notices irregularities.

| Control Category | Specific Action | Fraud Type Prevented |

|---|---|---|

| Segregation | Separate payroll preparation from approval | Falsified wages, Ghost employees |

| Verification | Confirm direct deposit changes by phone | Payroll diversion (Phishing) |

| Reconciliation | Monthly bank reconciliation | Embezzlement, Unauthorized checks |

| Audit | Compare badge-in data to timesheets | Timesheet fraud, Padding hours |

| Access | Use Multi-Factor Authentication (MFA) | External hacking, Data breaches |

While internal controls are foundational, technology can bolster fraud prevention even further.

Using Technology and Automation

Technology shifts fraud detection from reactive to proactive. AI-powered tools can automatically flag unusual activities, such as unexpected overtime spikes, unauthorized bonuses, or employee logins at odd hours. These systems often detect fraud within three months in 89% of cases, compared to 30 months when discovered accidentally.

Electronic timekeeping systems integrated with payroll software eliminate manual errors and prevent "buddy punching." Biometric verification, like fingerprint scans or ID cards, ensures that only the right employee clocks in. Modern payroll platforms also maintain detailed audit trails, which are invaluable for investigating unauthorized changes.

Strengthen data security with Multi-Factor Authentication (MFA), Single Sign-On (SSO), and Role-Based Access Control (RBAC). Automated reconciliation tools continuously compare payroll accounts with bank statements, helping identify unclaimed checks, timing discrepancies, or unfamiliar transactions. When choosing payroll software, prioritize certifications like ISO/IEC 27001, SOC 2/SOC 3, and GDPR/CCPA compliance.

Of course, even the best technology can’t replace the vigilance and awareness of a well-trained workforce.

Employee Training and Reporting Channels

Your employees are often the first line of defense. Train them to spot common fraud tactics like phishing, W-2 scams, or payroll diversion - where scammers impersonate employees to redirect direct deposits. Stress the importance of basic security practices, such as never sharing payroll or timekeeping login credentials.

Encourage a workplace culture where employees feel comfortable reporting suspicious activity without fear of retaliation. Offer multiple ways to report concerns, such as speaking with a trusted manager, using an anonymous hotline, or contacting external authorities like the State Attorney General's office or FBI. Tips are the most frequent way fraud is detected, accounting for 43% of cases. If fraud is suspected, advise employees to report it discreetly to avoid tipping off the perpetrator, who might destroy evidence.

Cross-train employees to handle payroll tasks to ensure coverage during vacations or absences. This not only maintains business continuity but also creates opportunities to uncover fraud when someone new steps in. Small businesses, which are twice as likely to experience payroll fraud compared to larger organizations, especially benefit from these measures.

Taking these steps protects payroll integrity and can also enhance your business’s credibility with investors and lenders during acquisitions.

Payroll Fraud Detection in Business Acquisitions and Financing

When buying or selling a Main Street or Lower-Middle-Market business, payroll fraud can throw a wrench into the entire transaction. Hidden schemes can distort financial performance, scare off lenders, and force buyers to either overpay or rethink valuations. These fraudulent activities often span years, meaning the financial records presented during due diligence may not be entirely reliable. Such discrepancies erode trust and directly affect both valuation and financing terms.

How Payroll Fraud Impacts Valuation and Due Diligence

Payroll fraud can artificially inflate EBITDA and skew working capital calculations. For example, misclassifying W-2 employees as 1099 contractors reduces payroll taxes and benefits, which falsely boosts profitability. Similarly, ghost employees or fake overtime claims siphon cash over time, distorting historical cash flow analysis. Buyers relying on these inflated figures risk overpaying for a business, only to discover the true cost structure after the deal is closed.

During due diligence, it's critical to reconcile payroll registers with tax documents to spot inconsistencies. Investigating large variances between budgeted and actual payroll costs by department can uncover issues like inflated hours or unauthorized pay rate changes. Tools like IRS Form SS-8 or the Employer's Supplemental Tax Guide can help confirm whether workers are correctly classified as employees or contractors.

AI Tools for Spotting Payroll Fraud in Transactions

Today’s AI and machine learning tools can analyze hundreds of payroll records in seconds, flagging anomalies that might escape human auditors. These tools can identify duplicate Social Security numbers, shared direct deposit accounts, and suspicious patterns like "buddy punching" or round-number overtime entries (e.g., exactly 10 hours every week). Impressively, AI-driven analysis uncovers fraud within three months in 89% of cases, compared to an average of 30 months when discovered accidentally.

Platforms like Clearly Acquired integrate AI-powered financial analysis and risk screening directly into the deal evaluation process. These tools allow buyers to compare payroll data against industry benchmarks, identify worker classification risks, and flag potential red flags before committing capital. This tech-driven approach not only boosts transparency but also provides buyers with greater confidence - especially important considering the median loss per payroll fraud incident is $62,000, with some cases exceeding $383,000.

Lender Requirements for Payroll Verification

Advanced fraud detection tools aren’t just for buyers - they also help satisfy lender requirements for verified payroll data. Clean payroll records are essential for securing financing, whether through SBA 7(a), SBA 504, or conventional loans.

Lenders require payroll registers to align with the general ledger and payroll tax returns to confirm gross and net pay amounts. They also compare total W-2 wages with internal records and carefully examine worker classifications (W-2 versus 1099) to ensure compliance with payroll tax and insurance obligations.

Additionally, lenders assess internal controls, such as segregated payroll duties and detailed audit logs, to confirm the accuracy of records. If misclassification or tax evasion is uncovered during underwriting, it can lead to loan denial or require significant holdbacks to cover potential liabilities. To avoid these issues, businesses should reconcile check registers with payroll records monthly, use electronic timekeeping systems that create unalterable digital audit trails, and maintain thorough personnel files, including background checks and identification documents.

Conclusion

Payroll fraud impacts a staggering 27% of businesses and costs an average of $383,000 per case. Even more concerning, these schemes often go undetected for 18 to 30 months. However, modern tools and effective internal controls can significantly reduce both the risk of fraud and the time it takes to uncover it.

This highlights the importance of implementing specific strategies tailored to the needs of business owners, buyers, and lenders.

For business owners, taking proactive steps like segregating payroll duties and using integrated time and attendance systems can cut fraud risk by 65%. Additionally, requiring payroll staff to take mandatory vacations can help uncover irregularities that might otherwise stay hidden.

For buyers conducting due diligence, it's critical to examine payroll registers for ghost employees, misclassified contractors, and unauthorized account links. Reconciliation of payroll data with tax filings and ledgers can also reveal discrepancies.

For lenders, ensuring payroll registers align with tax filings and verifying worker classifications are essential steps to mitigate risk.

In addition to these traditional measures, advanced technology now plays a crucial role in fraud detection. AI-driven tools can identify anomalies in as little as three months, boasting an 89% success rate - far faster than the average of 30 months for accidental discovery. Tools like Clearly Acquired leverage AI-powered financial analysis to detect duplicate direct deposits, unusual pay changes, and risky classifications. These capabilities provide buyers and lenders with the transparency they need to make informed decisions confidently.

FAQs

What steps can small businesses take to prevent payroll fraud effectively?

Payroll fraud - like falsified wages, ghost employees, or unauthorized pay-rate changes - poses a serious threat to small businesses. Shockingly, it can go unnoticed for 18–24 months, causing average losses of $2,800 every month. Tackling this issue demands robust internal controls and vigilant oversight.

Here are some effective strategies to reduce payroll fraud risks:

- Separate responsibilities: Ensure the person handling time data isn’t the same one approving or processing payments.

- Require dual approvals: Make it mandatory for two individuals to approve changes to employee records, pay rates, or banking details.

- Reconcile payroll records regularly: Compare payroll data with bank statements and tax filings to catch discrepancies early.

- Leverage automated payroll systems: Use systems that log changes, limit access, and provide detailed audit trails.

- Watch for red flags: Keep an eye out for unusual patterns, like unexpected overtime spikes, duplicate employee IDs, or payments to unfamiliar accounts.

- Perform surprise audits: Conduct unannounced reviews and encourage transparency with a whistleblower policy for reporting suspicious activity.

By combining strong processes, smart technology, and periodic independent checks, small businesses can greatly reduce the chances of payroll fraud and its damaging effects.

What are the key warning signs of payroll fraud to watch for?

Payroll fraud can often be identified early if you know what to watch for. Some common red flags include unexplained salary increases, sudden spikes in overtime that don’t match production needs, or employees logging excessive hours without justification. Keep an eye out for ghost employees - these are nonexistent or former staff members who somehow remain on the payroll. Other warning signs might involve unauthorized changes to pay rates or direct-deposit details, duplicate or missing employee records, and payroll runs happening outside normal schedules or by unapproved personnel.

You might also notice frequent last-minute payroll adjustments, excessive use of ad-hoc checks, or tax inconsistencies like mismatched W-2 or 1099 forms. When these patterns surface - especially in combination - it’s wise to conduct a detailed audit and tighten your payroll controls to prevent further issues.

How does AI improve payroll fraud detection compared to traditional methods?

AI-powered tools are transforming how payroll fraud is detected, leaving behind the inefficiencies of traditional manual methods. Instead of relying on periodic reconciliations or occasional reviews, AI works around the clock, analyzing payroll transactions, time entries, and account changes. With machine learning, it spots patterns and flags anomalies like unexpected salary increases, duplicate direct deposit accounts, or unauthorized hires - often in real time. This shift slashes detection times from months to mere days or even minutes.

Beyond anomaly detection, AI streamlines routine tasks such as monitoring payroll batch sizes, tracking changes to bank accounts, and verifying employee counts. With real-time alerts and predictive risk scoring, finance teams can zero in on the most critical issues before they snowball into significant losses. By combining constant monitoring, advanced pattern recognition, and automated notifications, AI significantly improves both the speed and precision of payroll fraud detection.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)