Energy storage is reshaping how we manage energy demand and renewable integration. In 2026, mergers and acquisitions (M&A) are focusing on late-stage, revenue-ready projects instead of speculative growth. Key drivers include surging electricity needs from AI and data centers, grid modernization, and policy incentives like the Inflation Reduction Act. Here's what you need to know:

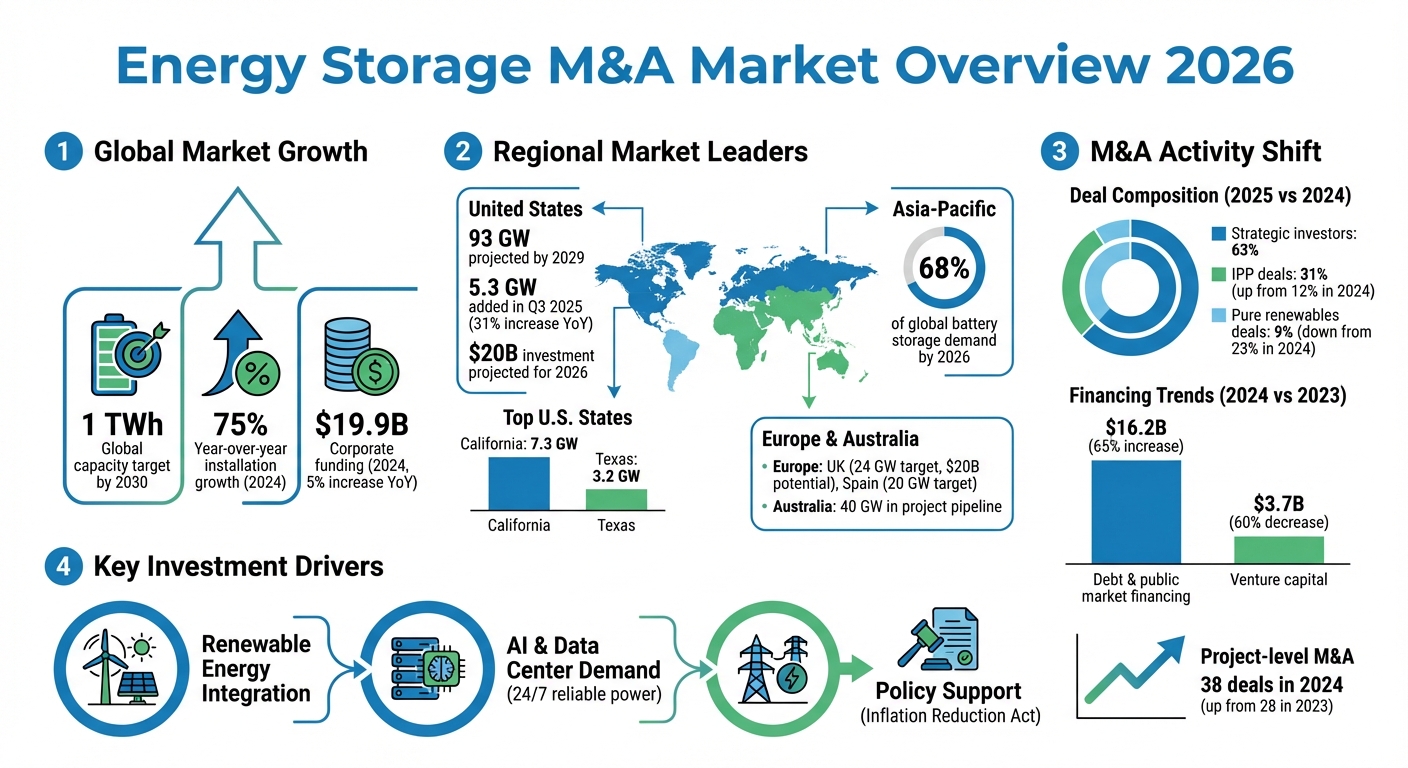

- Market Growth: Global energy storage installations are set to surpass 1 TWh by 2030. The U.S. leads with nearly 93 GW projected by 2029, while Asia-Pacific is expected to account for 68% of global battery storage demand by 2026.

- Shift in M&A Focus: Buyers now prioritize assets with stable revenues, confirmed interconnection, and diversified income streams. U.S. investment in battery storage is projected to reach $20 billion in 2026.

- Key Players: Strategic acquirers (e.g., Engie, Hitachi Energy), private equity firms (e.g., KKR, Blackstone), and "patient capital" investors are driving deals.

- Technology Trends: Long-duration energy storage (e.g., iron-air batteries) and AI-powered optimization tools are attracting significant investment.

The market is maturing, with disciplined dealmaking replacing rapid growth strategies. Investors are targeting quality over quantity, favoring assets that align with grid reliability and energy demands.

Energy Storage Market Growth and M&A Trends 2026

Energy Storage Market Growth and Opportunities

Market Size and Regional Data

The global energy storage market is experiencing rapid momentum. Installations worldwide surged by over 75% year-over-year in 2024, and the industry is on track to surpass 1 terawatt-hour (TWh) of capacity before 2030. Corporate funding also saw a boost, reaching $19.9 billion in 2024 - a 5% increase from the previous year.

The Asia-Pacific region is emerging as a dominant force, projected to account for 68% of global battery storage demand by 2026. Meanwhile, the United States continues to lead in development, with nearly 93 GW of new storage installations expected by 2029, according to Wood Mackenzie. Domestically, California holds the top spot with 7.3 GW of installed capacity, followed by Texas at 3.2 GW. In Q3 2025 alone, the U.S. utility-scale segment added 5.3 GW, marking a 31% increase compared to the same quarter in 2024.

Europe is also making strides. The United Kingdom aims to hit 24 GW of storage capacity by 2030, which could attract up to $20 billion in investments. Spain is equally ambitious, targeting 20 GW by 2030 - more than double its 2023 capacity of 8.3 GW. Australia, on the other hand, has 40 GW worth of storage projects in its pipeline.

However, the U.S. market faces challenges in the near term. Federal tariffs and new domestic sourcing requirements are expected to lead to a "modest contraction" between 2026 and 2027 before growth picks up again. Even so, state-level initiatives in places like California and Massachusetts continue to fuel deployment through targeted incentives and rebate programs. These regional dynamics offer a glimpse into the larger forces shaping the energy storage market.

What's Driving Demand

Energy storage demand is being fueled by three key factors: renewable energy integration, the growing power needs of AI and data centers, and grid modernization. First, as solar and wind power become more prevalent, energy storage is essential for managing their variability and ensuring grid flexibility. Second, AI and data centers are driving unprecedented electricity demand, requiring a consistent and reliable 24/7 power supply. Third, grid modernization efforts are encouraging utilities to adopt battery energy storage systems to balance supply and demand in real time.

Policy support plays a critical role in this growth. The Inflation Reduction Act (IRA) continues to provide federal incentives, while state programs like California's Net Billing Tariff and Massachusetts' SMART 3.0 offer additional momentum despite federal uncertainties. Corporate commitments to decarbonization are also accelerating adoption, as businesses increasingly prioritize energy storage to meet their net-zero goals.

sbb-itb-a3ef7c1

Jonathan Marren: Beyond Lithium and Rise of Long-Duration Energy Storage

M&A Activity in Early 2026

The energy storage mergers and acquisitions (M&A) market in early 2026 has taken a sharp turn from the frenzied deal-making pace of 2021–2022. Instead of chasing growth at any cost, buyers are now applying a "quality filter", prioritizing assets that are ready for execution and secured to the grid, rather than speculative development projects. While investment in battery energy storage is projected to remain steady at $20 billion in 2026, the focus of these deals has shifted. Buyers are now targeting assets with clear risk profiles and aiming to optimize their portfolios.

"Capital is paying for delivery, for assets that are grid-secured, credibly contracted (or close to it), and structurally positioned for a system that increasingly values flexibility." - Sebastian Montoya, Author, Teaser Energy Europe

The composition of buyers has also evolved. Strategic investors now account for 63% of total deal value in the broader power and utilities space heading into 2026. This marks a departure from the private equity-driven activity of earlier years. Independent power producers (IPPs) have seen their deal activity increase significantly, climbing to 31% in 2025 from just 12% in 2024, while deals focused solely on renewables dropped from 23% to 9%. This trend reflects a growing emphasis on operational flexibility and grid reliability over pure renewable generation, signaling a shift in how deals are structured and executed.

Who's Buying

Three key groups are driving consolidation in the energy storage space: strategic acquirers, private equity and infrastructure investors, and a category known as "patient capital" investors. Strategic acquirers, including major energy players like Engie and Hitachi Energy, are integrating battery storage into their operations to meet net-zero targets and boost grid flexibility. Meanwhile, private equity and infrastructure firms like KKR, EQT Infrastructure, and Blackstone are drawn to battery energy storage system (BESS) assets for their long-term value and role in stabilizing the grid.

The resurgence of patient capital in early 2026 has been especially striking. These investors are favoring late-stage projects with attractive valuations over rapid scaling. Their strategies often include mitigating merchant risk by diversifying investments across multiple Independent System Operators (ISOs) such as MISO, NYISO, and ISO-NE, which helps hedge against regional policy changes. Additionally, developers are leveraging M&A to recycle capital, selling completed assets to fund new projects as interconnection costs continue to rise.

"Discipline has replaced velocity, 'patient capital' is back, and diversification – across geography, technology, and revenue streams – is essential." - Ascend Analytics

These evolving buyer profiles have set the stage for major transactions and a more selective approach to consolidation.

Major Deals and Consolidation Patterns

Several headline transactions from January 2026 illustrate the market's current priorities. Elements Green acquired the 148.8 MW Bolney Green BESS project in the United Kingdom from Envirotech Energy Solutions, expanding its grid-scale storage portfolio. At the same time, Spring Creek, advised by CleanCap, invested in a German development portfolio from MEC Energy, which includes over 500 MWp of solar PV and 2.5 GW of BESS capacity. These deals underscore a trend toward hybridization, with investors increasingly favoring co-located solar-plus-storage assets as reliable, repeatable revenue generators.

Another noteworthy transaction involved Milvio Energy, which completed a forward sale of a co-located project in Lower Saxony, Germany. This project combines 80.4 MWp of solar PV with 70.2 MW of BESS, reflecting strong demand for hybrid developments that deliver both energy and flexibility services. Beyond project-level deals, supply chain M&A is also gaining momentum. For instance, in January 2026, Altris and Draslovka formed a strategic partnership in the Czech Republic to produce sodium-ion cathode materials at the Kolin facility, supporting efforts to localize Europe's battery supply chain.

"2026 seems not to be shaping up as a return to speed-dating auctions. It signals a market returning to selective, well-documented deals." - Sebastian Montoya, Author, Teaser Energy Europe

The consolidation patterns reveal a maturing market, where valuation gaps are bridged with milestone-based and contingent pricing. In the U.S., about 12% of existing storage systems required capacity additions (augmentation) in 2025, creating a fresh segment for M&A activity. On top of that, the One Big Beautiful Bill Act (OBBB) has extended federal incentives for energy storage through 2032, providing long-term regulatory stability for dealmakers in the U.S.. These factors are shaping a more disciplined and execution-oriented M&A market in 2026.

Technologies Attracting Investment

The energy storage M&A landscape in 2026 is being shaped by two key areas: advancements in hardware that extend storage capacity and software platforms that optimize energy operations in real-time, particularly in unpredictable power markets.

Battery Storage and Long-Duration Systems

Long-duration energy storage (LDES) technologies are gaining traction as power grids demand more flexibility beyond the typical 2–4-hour lithium-ion discharge window. New advancements in battery chemistry - like iron-air batteries, metal-hydrogen systems, and molten silicon thermal storage - are drawing attention from both venture capitalists and strategic buyers who are on the hunt for next-generation solutions. For instance, Form Energy secured $405 million in 2024 to further its iron-air battery technology, while EnerVenue Holdings raised $308 million to develop nickel-hydrogen storage systems.

"Energy storage projects have become increasingly valuable. The demand is partly driven by data centers and AI, which require reliable, 24/7 power". - Raj Prabhu, CEO, Mercom Capital Group

In 2024, corporate funding for energy storage companies reached $19.9 billion, reflecting a 5% increase from 2023. Much of this funding targeted upstream sectors like materials, components, and battery recycling. Battery recycling, in particular, continues to draw venture capital as companies focus on securing critical material supplies and meeting sustainability goals. These technological advancements not only improve the financial viability of energy storage projects but also provide strategic investors with more reliable, long-term revenue streams.

AI and Optimization Tools

While hardware innovations focus on extending storage capacity, software tools are transforming how energy storage systems operate. AI-powered optimization platforms have become pivotal in energy storage M&A, especially for managing market risks in volatile regions like ERCOT and CAISO. These tools enable real-time co-optimization (RTC+B), allowing energy storage systems to dynamically balance supply and demand, maximizing revenue even in unpredictable pricing conditions. They also enhance project valuations by delivering actionable market intelligence that supports financing and strategic decision-making.

Corporate funding for smart grid companies, which includes AI and optimization tools, reached $1.4 billion in the first half of 2025. Venture capital in this space hit $1.7 billion across 56 deals in 2024, reflecting a 13% year-over-year increase. In December 2025, Ascend Analytics expanded its capabilities by integrating the Ascend Energy Exchange (AEX) platform into its PowerVAL tool. This move streamlines energy asset transactions by connecting qualified buyers and sellers through data-driven insights. The trend highlights how investors are increasingly turning to optimization software to secure stable returns through precise bidding and efficient operations, perfectly aligning with the deal-focused environment shaping 2026.

Valuation and Financing Methods

The value of energy storage assets in 2026 will largely depend on asset maturity and location. Operational assets are fetching higher multiples, while geography plays a crucial role. For instance, projects in CAISO maintain strong valuations due to robust resource adequacy payments and merchant revenue potential. In contrast, ERCOT has seen a drop in development fees, driven by oversupply and market saturation. Additionally, confirmed interconnection and deliverability are now more valuable than ever, as FERC Order 2023 has increased the costs of holding interconnection rights. These regional dynamics are reshaping how valuations are approached across the industry.

Valuation Multiples

Valuation multiples have shifted to reflect a more disciplined market, focusing on asset maturity and revenue stability. The era of rapid growth has given way to a more measured approach to dealmaking. Asset maturity plays a key role in valuation: development-stage projects are priced based on capacity milestones, while operational assets often secure higher up-front payments. Diversified revenue streams also influence multiples, with companies managing merchant risks across multiple ISOs and revenue types - such as tolling agreements versus merchant pricing - achieving stronger valuations.

The growing demand from data centers and AI infrastructure has further elevated project values. These buyers prioritize reliable, round-the-clock power, making energy storage a critical part of renewable energy portfolios. Projects with confirmed deliverability and diversified revenue streams, particularly those outside of CAISO and ERCOT, are commanding premium valuations.

Financing Structures

As asset valuations stabilize, financing methods have evolved alongside them. The financing landscape for energy storage has matured significantly. In 2024, debt and public market financing reached $16.2 billion across 32 deals, marking a 65% jump from $9.8 billion in 2023. Meanwhile, venture capital funding dropped sharply - falling 60% to $3.7 billion - highlighting the growing bankability of storage technologies. Total corporate funding for energy storage companies climbed to $19.9 billion across 116 deals in 2024, reflecting a modest 5% increase from the previous year.

This shift also aligns with the growing trend of capital recycling in energy storage. Deal structures are becoming more flexible, enabling easier entry into regional markets. Two primary approaches dominate: platform acquisitions (buying the developer or company) and project-level M&A (acquiring specific battery energy storage system assets). Project-level transactions grew to 38 in 2024, up from 28 in 2023, while company acquisitions rose from 15 to 25. Developers increasingly favor M&A to recycle capital, using the proceeds to fund new development pipelines rather than holding onto assets long-term. For buyers unfamiliar with certain regional markets, development services agreements with local partners have become a popular strategy, helping them find, fund, and acquire the right business efficiently while mitigating execution risks.

Key Takeaways

The energy storage M&A market is undergoing significant changes, shaped by recent trends and advancements. These shifts highlight the growing opportunities for investors and developers who stay aligned with regional and technological developments.

In 2026, the energy storage sector presents a promising landscape. Q3 2025 alone saw a record-breaking 5.3 GW of capacity installed in the U.S., with projections pointing to nearly 93 GW by 2029. This rapid growth is being driven by increased demand from data centers and the need for dependable, 24/7 power to support AI infrastructure. As a result, energy storage has become a cornerstone of modern energy strategies.

"Discipline has replaced velocity, 'patient capital' is back, and diversification – across geography, technology, and revenue streams – is essential." - Ascend Analytics

Geographic diversification has become a key focus for managing risk. Investments are shifting away from traditional markets like CAISO and ERCOT to regions such as MISO, NYISO, ISO-NE, and certain WECC states. These areas benefit from supportive policies and growing capacity demands. Developers who achieve late-stage project milestones and secure deliverability are seeing higher valuations, especially in markets with limited project availability. This trend reflects a maturing market, as evidenced by recent funding and acquisition patterns.

For entrepreneurs and business owners, the strategy moving forward involves recycling capital. This means selling late-stage or operational assets to long-term investors and reinvesting the proceeds into new development pipelines. Meanwhile, investors should prioritize high-quality, late-stage projects with confirmed interconnection agreements and diversified revenue streams. Conducting detailed due diligence on battery technology origins and supplier countries is also essential to navigate tariff risks and comply with regulations concerning Foreign Entities of Concern.

The market has clearly evolved past speculative growth. Buyers now have the leverage to structure deals that minimize early-stage development risks, often linking purchase prices to specific capacity milestones. This environment benefits sellers who can present verified performance data and clear deliverability plans. At the same time, it rewards strategic buyers who are ready to act swiftly on assets that align with their portfolio goals.

FAQs

What’s driving the growing interest in acquiring late-stage, revenue-generating energy storage projects?

The rising focus on well-established, revenue-generating energy storage projects is closely tied to the growing need for dependable grid performance as renewable energy sources like wind and solar continue to expand. These advanced projects offer a track record of reliable performance and steady cash flow, which makes them a safer and more appealing choice for investors.

On top of that, consistent policies and positive market trends are driving the consolidation of mature assets. Prioritizing projects that are already generating revenue allows companies to provide immediate returns while enhancing grid reliability. This approach also aligns with broader efforts to improve infrastructure and speed up the shift toward cleaner energy solutions.

How are advancements in long-duration energy storage shaping investment trends?

Advances in long-duration energy storage (LDES) are reshaping investment patterns by enhancing how renewable energy systems perform and expand. These technologies make it possible to store excess renewable energy for longer periods, tackling key issues like grid stability and energy security. Unsurprisingly, this has sparked growing interest from investors.

In 2023, mergers and acquisitions in the energy storage sector reached an all-time high, with deals totaling about $24.1 billion. This surge highlights the increasing demand for storage solutions capable of supporting the shift toward net-zero targets. While funding levels have seen some ups and downs, the sector is showing signs of maturity, with a strong emphasis on long-term projects and diversified investments aimed at building the clean energy infrastructure of tomorrow.

How does geographic diversification help manage risks in the energy storage M&A market?

Geographic diversification plays a crucial role in managing risks within the energy storage M&A market. By allocating investments across various regions, companies can avoid over-reliance on a single market. This strategy helps mitigate localized risks, such as regulatory shifts, economic challenges, or supply chain issues. The result? Greater stability in returns and a safeguard against potential setbacks in any one area.

Recent data highlights notable differences in deal activity and funding levels across regions. These variations stem from factors like policy support, grid infrastructure, and market maturity. By diversifying geographically, investors can tap into opportunities in emerging markets with promising conditions while steering clear of over-saturated or uncertain regions. This balanced approach not only builds resilience but also aligns with the market's emphasis on steady, long-term growth.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)