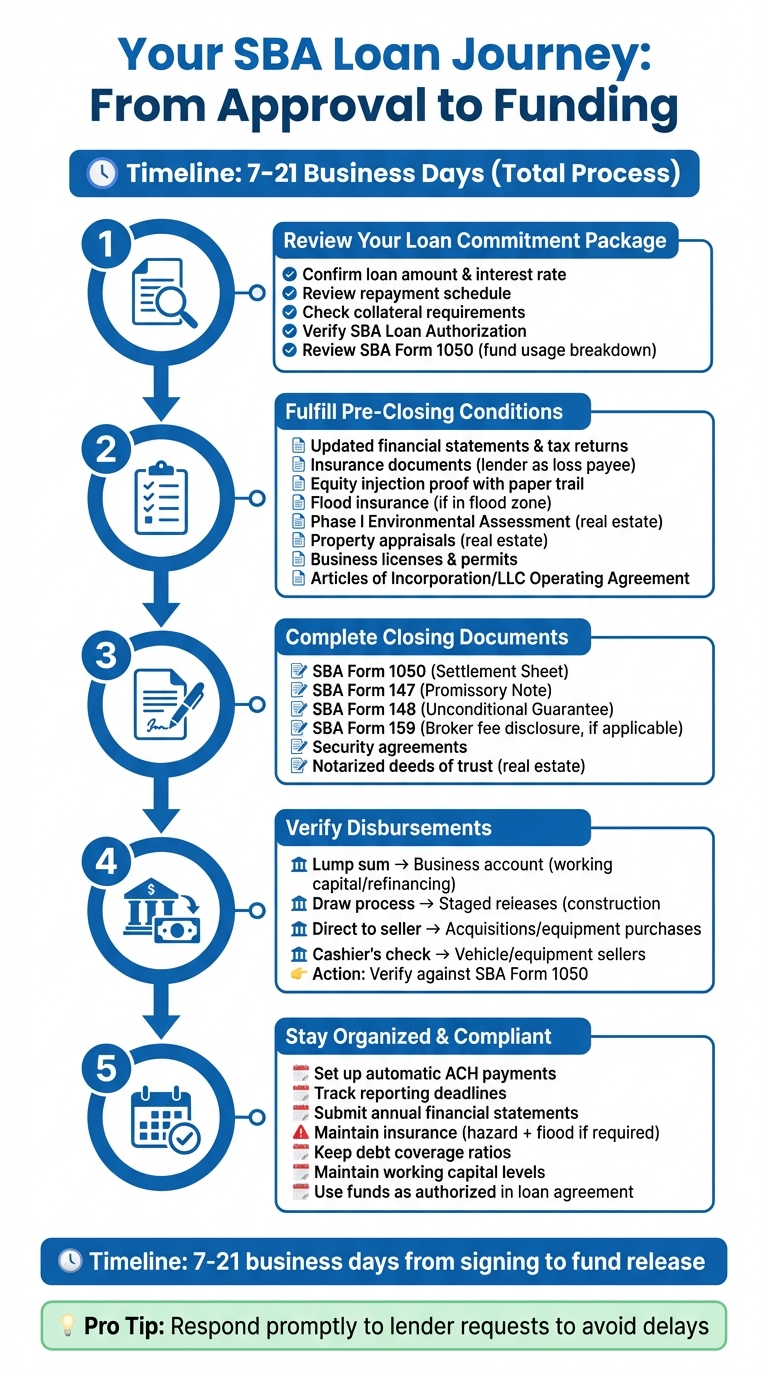

Once your SBA loan is approved, you’re not done yet. Before accessing funds, you’ll need to complete several steps, including signing documents, meeting pre-closing requirements, and verifying disbursements. Here’s a quick breakdown of what happens next:

- Review Your Loan Commitment Package: Confirm loan terms, repayment schedule, and collateral requirements.

- Fulfill Pre-Closing Conditions: Submit updated financials, insurance documents, and equity injection proof.

- Complete Closing Documents: Sign required forms like SBA Form 1050 (Settlement Sheet) and SBA Form 147 (Promissory Note).

- Verify Disbursements: Ensure funds are released as agreed, whether as a lump sum or in stages.

- Stay Organized and Compliant: Set up automatic payments, track reporting deadlines, and adhere to loan terms.

The process typically takes 7–21 business days after signing the final documents. Responding promptly to lender requests and staying on top of requirements will help avoid delays. Once funds are disbursed, focus on using them as outlined in your loan agreement while maintaining compliance to protect your business credit.

SBA Loan Post-Approval Process Timeline and Steps

🏦 SBA Loans - What Happens After Approval?

sbb-itb-a3ef7c1

What Your SBA Loan Approval Means

When your SBA loan approval comes through, it includes a detailed loan commitment package. This package lays out all the key terms of your financing, such as the approved loan amount, interest rate, repayment plan, and any required collateral.

Types of Approvals

The type of approval you receive depends on your lender. If your lender is part of the Preferred Lender Program (PLP), they can approve your loan without waiting for a full review by SBA headquarters. This can significantly speed up the process. On the other hand, non-preferred lenders must submit your application to the SBA for final authorization, which might add some time but doesn't change the final decision. Understanding the type of approval you’ve received can help you better anticipate your closing timeline. Once you know, carefully review your loan commitment package to confirm the terms.

Reviewing Your Loan Commitment Package

Take a close look at your loan commitment package to ensure everything matches what was agreed upon during underwriting. Start by confirming the loan amount and interest rate. Then, check the repayment schedule to understand how often and for how long you’ll need to make payments.

The package will also include the SBA Loan Authorization, which is a separate document detailing the government guarantee, repayment terms, and any additional requirements. Pay attention to SBA Form 1050, which breaks down how your loan funds will be used - whether for working capital, refinancing debt, or buying equipment. If there are prepayment penalties, ask your lender how these might impact your ability to refinance or pay off your loan early. Additionally, check for any annual maintenance requirements, like submitting periodic financial statements, that you’ll need to meet. Once you've reviewed all these details, focus on completing the pre-closing requirements.

Pre-Closing Conditions You Need to Fulfill

To keep your loan process on track, it’s crucial to meet all pre-closing conditions. Start by documenting your equity injection to prove your capital investment. If insurance is required, make sure your policies name the lender or SBA as the loss payee. For properties in flood zones, you’ll also need to secure flood insurance.

For real estate transactions, you’ll need to provide a Phase I Environmental Site Assessment and property appraisals. Double-check your business licenses, permits, and organizational documents - like Articles of Incorporation or LLC Operating Agreements - for accuracy and updates. Finally, submit updated financial statements and tax returns to confirm that your financial situation hasn’t changed since your application. Meeting these conditions ensures a smooth closing process and timely access to your funds.

Satisfying Pre-Funding Requirements

Once you've reviewed your commitment letter, the next step is submitting all the necessary documents to meet the pre-funding conditions. This phase involves gathering multiple documents, coordinating third-party reports, and verifying financial details - tasks that must be completed before closing. Key priorities include understanding specific document requirements, verifying your equity injection, and managing third-party reports.

Required Documents Checklist

You'll need to provide updated personal and business financial statements, IRS Form 4506-C, along with licenses, permits, and organizational documents to confirm there have been no changes to your business structure. These documents - like your Articles of Incorporation or LLC Operating Agreement - must be up-to-date and accurate to avoid delays in the process.

At this stage, completing SBA-specific forms is also essential. These include:

- SBA Form 147: The promissory note.

- SBA Form 148: The Unconditional Guarantee.

- SBA Form 1050: The Settlement Sheet, which certifies how the loan proceeds will be used.

Additionally, your lender will require proof of hazard insurance for all collateral, with the lender listed as the loss payee. If the property tied to your loan is in a designated flood zone, you'll also need to secure flood insurance.

Once your documents are in order, you'll need to clearly demonstrate your personal capital contribution.

Documenting Your Equity Injection

Your equity injection must be well-documented to satisfy lender requirements. This means providing a clear paper trail - such as bank statements and wire transfer confirmations - that shows the source of your funds. Lenders will also verify that your financial position remains stable and that the funds for the equity injection are still available.

The down payment will be collected at closing, and you'll work with your banker to decide whether to deliver it via cashier's check or wire transfer.

"The down payment on your loan will be collected at the time of closing. You will work with your banker to determine the best way to provide your down payment." – Jada Larson, Commercial Banker, NBC

At the closing, you'll sign SBA Form 1050 to confirm that the funds will be used as authorized. Additional documents, like invoices or wire confirmations, may also be required at this stage.

Managing Collateral and Third-Party Reports

For loans secured by real estate, you'll need to coordinate third-party reports. These typically include a property appraisal, title work, flood determination, and a Phase I Environmental Site Assessment. Your lender is responsible for submitting the appraisal and environmental report to the SBA as part of the closing.

"It is important to note that these items [property valuation, title work, flood determination, and an environmental search] are at the expense of the borrower." – Jada Larson, Commercial Banker, NBC

Since these costs are your responsibility, it's a good idea to budget for them early. For loans secured by equipment or vehicles, you’ll need to arrange insurance coverage, listing the lender as the mortgagee or loss payee on your policy. To avoid last-minute issues, work with your insurance agent ahead of time to ensure all requirements are met - proof of coverage is mandatory before signing your loan documents.

If your loan involves real estate, ask your lender about the option to escrow for taxes and insurance. This allows you to spread large annual payments into manageable monthly installments. Completing these steps is essential for the release of funds and finalizing the loan closing process.

Closing Your Loan and Receiving Funds

Once you've met all pre-funding requirements, the next step is to close your loan and receive the funds. This stage involves working with various parties, signing important legal documents, and understanding when and how the funds will be disbursed. Typically, it takes 7 to 21 business days from signing the closing documents to the release of funds.

Who's Involved in the Closing

The closing process brings together several key players. Your lender's closing team will handle final checks, such as reviewing title reports and verifying collateral. If real estate is part of the loan, a title company or escrow agent will oversee the escrow account and ensure proper distribution of funds.

If a broker helped secure your loan, they’ll participate in the fee disclosure process, which is documented on SBA Form 159. Additionally, your insurance agent will confirm that all required coverage is active and lists the lender as the loss payee. For SBA 504 loans, a Certified Development Company (CDC) ensures the transaction complies with program rules.

"SBA loans take longer to close than traditional loans because there's more red tape. Since they're partially backed by the government, lenders have to check every box (collateral, permits, compliance paperwork, etc.) before the funds are released." – Rosie Douglas, Freelance Copywriter, Lendio

Once these steps are complete, you'll move on to signing your closing documents.

Signing Your Closing Documents

At closing, you'll sign several key documents, including SBA Form 1050 (Settlement Sheet), SBA Form 147 (Promissory Note), and SBA Form 148 (Unconditional Guarantee).

Other documents might include security agreements, which outline the lender's rights to your collateral. If the loan involves real estate, you'll also sign notarized deeds of trust or file liens as necessary. Many lenders now offer digital signing options to speed up the process, though some documents may still require notarization.

Once everything is signed, the final step is the release of funds.

How Loan Funds Are Disbursed

After signing, the disbursement process begins. How the funds are released depends on the loan’s purpose. For working capital or debt refinancing, funds are usually deposited as a lump sum into your business account. For construction projects or phased equipment purchases, lenders typically use a draw process, releasing funds in stages as the project progresses.

If the loan is for acquisitions or equipment purchases, the funds may go directly to the seller. For vehicle or equipment purchases, lenders often issue a cashier’s check to the seller.

"The typical timeline for fund disbursement is generally within 7–21 business days after the loan closing documents are signed." – Rosie Douglas, Freelance Copywriter, Lendio

To avoid delays, double-check all wire instructions and invoices before closing. If funds are being sent to third parties, provide accurate payment details to your lender as early as possible. Any last-minute requests for documentation should be addressed immediately, as delays in paperwork are the most common reason for holdups during closing.

What to Do After Receiving Your Funds

After the excitement of closing, it’s time to focus on using your loan responsibly and staying compliant with its terms. The first 7 to 21 business days are especially important for setting up processes that will help you stay on track throughout the life of the loan. During this time, verifying disbursements, organizing payments, and meeting compliance requirements should be your top priorities.

Verifying Disbursements and Setting Up Payments

Start by reviewing your SBA Form 1050 (Settlement Sheet) to confirm that the funds you received match the approved loan amount. If you received a lump sum deposit, check your business bank account for the wire transfer or direct deposit. For third-party payments - such as funds sent directly to equipment vendors or business sellers - ask your lender for wire confirmation numbers to ensure the payments went to the correct recipients.

If your loan is tied to real estate or construction projects, verify with your title company that funds have been deposited into escrow and that they’ll be released in stages based on specific project milestones. Compare every disbursed amount to the invoices or purchase agreements you submitted during closing to catch any errors early.

To avoid missing payments, set up automatic ACH payments from your business account. Check your loan agreement to see if you’ll start with interest-only payments or full principal and interest (P&I) payments right away. Also, look for any prepayment penalties if you’re considering paying off the loan early.

Once you’ve confirmed your funds and automated your payments, you can turn your attention to running your business in alignment with the loan’s terms.

Transitioning Business Operations

Use the loan funds exactly as outlined in your loan authorization - whether you’re buying equipment, managing cash flow, or expanding your business. Keep detailed records like invoices, receipts, and wire confirmations to show proper use of funds. These records will be essential for SBA reporting and any future audits.

Make sure your insurance policies are updated, including hazard insurance and, if required, flood insurance, with your lender listed as the loss payee. If you’ve purchased a business, work with the seller to transfer licenses, permits, and vendor accounts. Review your Loan Commitment Letter for any ongoing requirements, such as maintaining specific permits or submitting updated financial statements. Once all funds are disbursed and payments begin, your loan enters regular servicing status, meaning you’ll need to meet ongoing SBA compliance standards.

With your operations adjusted, focus on staying compliant with loan covenants.

Staying Compliant with Loan Covenants

Compliance is an ongoing responsibility. You’ll need to provide annual financial statements, including profit and loss statements and balance sheets, and ensure that your property taxes and insurance remain current. Many lenders also require you to maintain specific debt coverage ratios or working capital levels, so keep a close eye on your finances to avoid violating these terms.

Keep track of reporting deadlines and payment schedules. If cash flow issues arise, contact your lender immediately to discuss options rather than risking a missed payment. Falling out of compliance can result in your loan moving from regular servicing to liquidation status, which could lead to charge-offs or settlement negotiations. Staying organized, proactive, and communicative will help you maintain good standing and protect your business credit.

Conclusion

Getting your loan approved is a big milestone, but the journey doesn’t end there. The final steps - reviewing your Loan Commitment Package, meeting pre-closing requirements, signing documents, and verifying disbursements - demand close attention. Once the loan closes, the first few weeks are crucial for setting up automatic payments, confirming that funds are used as planned, and ensuring all insurance and collateral documentation is in order.

Staying organized is essential for ongoing compliance. Keep all key loan documents in a secure place, and establish a system to monitor deadlines for financial reporting, payment schedules, and any covenant requirements. This helps ensure nothing important gets overlooked.

If cash flow becomes an issue, reach out to your lender right away. Open communication is critical if any payment challenges arise. Working closely with your banker can help you explore options like refinancing, extending your loan, or securing additional funds to support future growth.

FAQs

What should I do if my SBA loan funds are delayed?

If your SBA loan disbursement is taking longer than expected, the first step is to reach out to your lender to figure out what’s causing the delay. Double-check that you’ve submitted all the necessary documents and fulfilled any required conditions. If something is missing, provide the information as quickly as possible.

To keep things moving, it’s helpful to create a checklist of tasks and required documents. Regularly follow up with your lender to stay informed about the status of your loan. Staying organized and maintaining clear communication can make the process smoother and help you receive your funds sooner.

What steps should I take to stay compliant with my SBA loan terms after receiving funds?

To comply with the terms of your SBA loan, it's essential to stay on top of a few key responsibilities. First, make sure your financial records are accurate and kept up to date. Also, maintain any required insurance policies and carefully manage any collateral tied to the loan. If your lender or the SBA requests additional information or documentation, respond quickly to keep everything running smoothly.

You’ll also need to handle any post-loan servicing tasks - like adjustments or compromises - according to SBA guidelines. Staying organized and proactive not only helps you meet your obligations but also fosters a strong, positive relationship with both your lender and the SBA.

What should I watch out for after my SBA loan is approved?

After your SBA loan gets the green light, you’ll need to stay on top of a few key responsibilities to avoid unnecessary delays or complications. One common hiccup? Missing or incomplete paperwork. Lenders require all forms - like certifications, appraisals, and insurance certificates - to be submitted correctly and on time. Even one missing document can hold up your funds or lead to compliance reviews.

Another area to watch out for is post-closing obligations. This includes keeping your financial statements and tax filings current and staying compliant with any certifications tied to your loan. Skipping these steps can result in serious consequences, such as penalties or even default actions.

Lastly, misusing loan funds or neglecting collateral and insurance requirements can land you in hot water. Be sure to use the loan exactly as approved, and maintain the necessary insurance and collateral throughout the loan term. Staying organized and proactive will help you sidestep these issues and keep your loan - and your business - on the right track.

%20%20Process%2C%20Valuation%20%26%20Legal%20Checklist.png)

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)