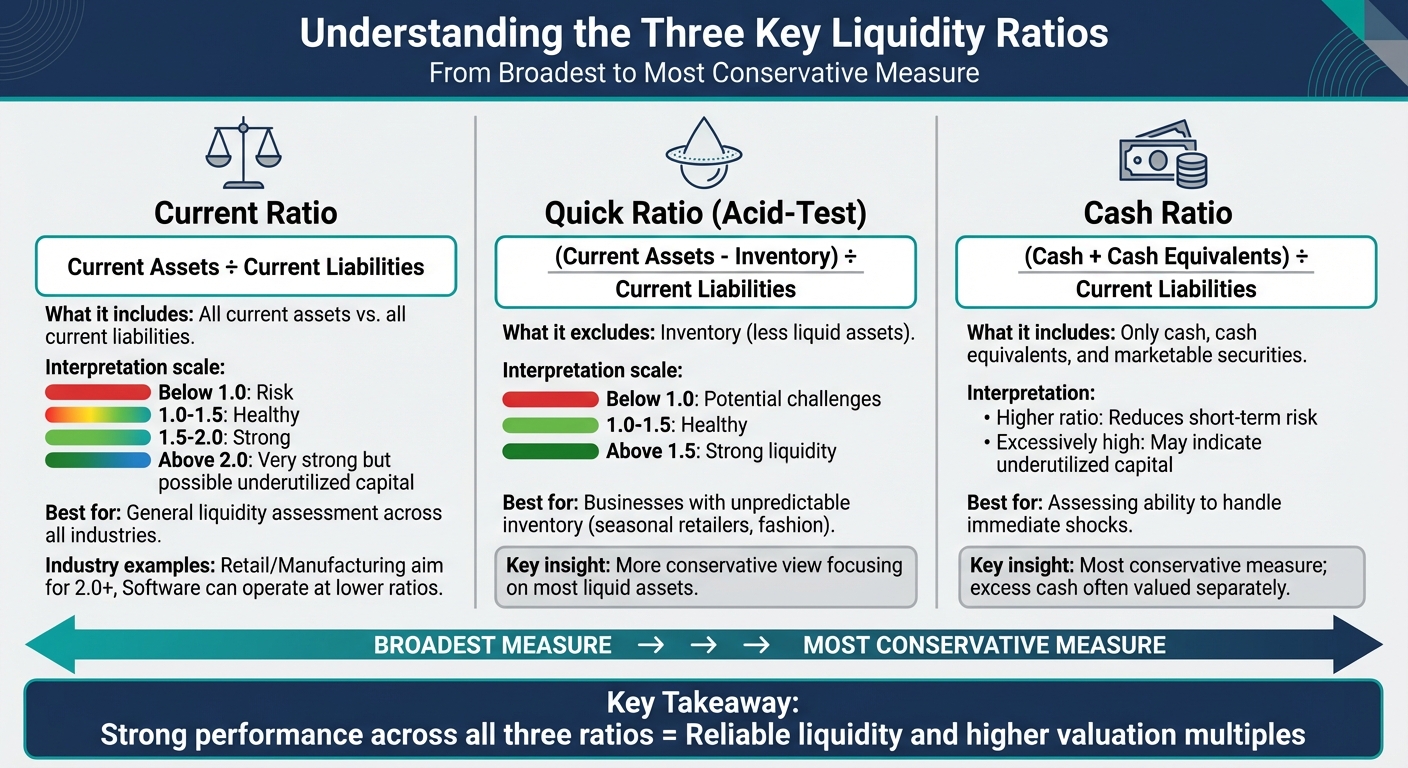

When evaluating a business, liquidity ratios are key to understanding its ability to pay short-term debts. These metrics - current ratio, quick ratio, and cash ratio - reveal how well a company manages its financial obligations and directly influence its valuation. Here's what you need to know:

- Current Ratio: Measures all current assets vs. liabilities. A ratio above 1.0 is healthy; below 1.0 signals risk. Ideal range: 1.5–2.0, depending on the industry.

- Quick Ratio: Excludes inventory, focusing on liquid assets. A ratio above 1.0 suggests financial stability.

- Cash Ratio: The most conservative, using only cash and equivalents. High ratios reduce risk but can indicate underutilized funds.

Strong liquidity reduces perceived risk, boosts valuation multiples, and improves financing terms. However, excessive liquidity can lower returns and flag inefficient capital use. For buyers, these ratios help assess risks, adjust valuations, and structure deals effectively. Tools like Clearly Acquired simplify this analysis by benchmarking against industry norms and connecting liquidity insights to financing options.

Liquidity Ratios explained [current, quick, and cash ratios]

Main Liquidity Ratios and How to Read Them

Three Key Liquidity Ratios Explained: Current, Quick, and Cash Ratios

When assessing a business for acquisition or financing, three key liquidity ratios offer progressively stricter measures of a company's ability to meet short-term obligations. Here’s a breakdown of these ratios, their calculations, and what they reveal.

Current Ratio

The current ratio is calculated by dividing total current assets by total current liabilities. A ratio below 1.0 suggests the company may not have enough current assets to cover its short-term debts, signaling potential liquidity issues. Ratios between 1.0 and 1.5 are generally seen as healthy, while a ratio above 2.0 indicates strong liquidity but could also suggest underutilized capital.

Context is critical. For example, industries like software, which operate with minimal working capital, can function effectively with lower ratios. In contrast, inventory-heavy sectors such as retail or manufacturing often aim for ratios at or above 2.0 to account for longer cash conversion cycles. A stable, high current ratio can signal lower short-term liquidity risks, potentially leading to a lower discount rate in valuation models. On the flip side, a low or volatile ratio might lead analysts to increase the discount rate, adopt conservative cash-flow projections, or negotiate for additional working capital at closing. Lenders also pay close attention to this metric; a ratio under 1.0 can trigger stricter loan terms or covenants, while ratios at or above industry norms can help secure better financing conditions, including SBA loans.

Quick Ratio (Acid-Test Ratio)

The quick ratio, also known as the acid-test ratio, refines the current ratio by excluding inventory. It’s calculated by subtracting inventory from current assets and dividing the result by current liabilities. This offers a more conservative view of liquidity, especially for businesses with large or unpredictable inventories, such as seasonal wholesalers or fashion retailers, where inventory may lose value or be slow to sell.

A quick ratio below 1.0 indicates potential challenges in covering short-term obligations with only the most liquid assets. Ratios between 1.0 and 1.5 are typically considered healthy. Strategic buyers might tolerate a lower quick ratio if the target can integrate into a larger, more liquid operation. However, financial buyers and SBA lenders often scrutinize low quick ratios, requiring additional guarantees, equity, or higher interest rates to offset liquidity risks. A strong quick ratio, particularly when exceeding industry norms, can support higher leverage, reduced escrow requirements, and more favorable valuation multiples. This metric becomes especially crucial in distressed deals or for service and SaaS businesses, where liquidity depends more on cash and receivables than on inventory.

Cash Ratio

The cash ratio takes the most conservative approach by focusing solely on the most liquid assets - cash, cash equivalents, and marketable securities - divided by current liabilities. This ratio is useful for answering critical questions like: "Can the company cover next year’s obligations with its available cash?" or "Does it have enough liquidity to handle short-term shocks post-closing without additional funding?".

While a higher cash ratio reduces short-term risk, an excessively high ratio might indicate the business is holding more cash than necessary, potentially neglecting opportunities to invest in growth, reduce debt, or return value to owners. In such cases, valuation professionals often separate "excess cash" from operating value, valuing the core business based on normalized working capital and adding surplus cash separately. Buyers may also use surplus cash at closing to fund part of the purchase price, pay down debt, or distribute funds to sellers, reshaping the equity structure without increasing operating risk. Lenders, while appreciating strong liquidity, focus on sustainable post-deal cash ratios rather than pre-closing figures, especially if surplus cash is expected to be extracted.

Putting It All Together

The current, quick, and cash ratios form a spectrum of liquidity tests, ranging from the broadest (current ratio) to the most conservative (cash ratio). A business with consistently strong performance across all three ratios demonstrates reliable liquidity and the capacity to meet obligations under even the strictest conditions. However, discrepancies - like a high current ratio paired with much lower quick or cash ratios - may indicate liquidity tied up in less-liquid assets like inventory. In such cases, a deeper dive into inventory turnover, receivables aging, and cash flow timing is essential to assess the business's true ability to meet short-term obligations. These liquidity metrics are integral to risk evaluations and valuation adjustments during acquisition or financing discussions.

Research Findings: How Liquidity Ratios Impact Business Value

Evidence of Positive Effects

In the U.S., studies and practical experience consistently reveal that maintaining adequate liquidity - typically with current ratios between 1.2 and 2.0 - leads to lower short-term default risks, fewer liquidity crises, and more stable cash flows. These factors collectively contribute to higher equity valuations and better debt terms. Research shows that strong liquidity reduces the chances of financial distress, enhances credit scores, and lowers borrowing costs, which in turn boosts discounted cash flow (DCF) values and valuation multiples.

Take, for example, a business with $1.2 million in current assets and $1.0 million in current liabilities, resulting in a current ratio of 1.2. This ratio suggests the company can meet its financial obligations, making it an attractive candidate for many banks and SBA lenders. Such businesses often secure lower interest rates and more favorable loan covenants, which enhance net margins and increase free cash flow - key components in DCF valuations. Valuation experts emphasize that stronger liquidity lowers perceived risk, which justifies reduced discount rates and higher capitalization multiples for privately held companies.

Lenders and investors heavily rely on liquidity ratios for credit scoring and risk assessment. Many even tie pricing tiers to specific minimum thresholds for current and quick ratios. By improving risk perception, businesses benefit from lower discount rates and, consequently, higher enterprise values.

However, while maintaining sufficient liquidity is beneficial, having too much liquidity can have the opposite effect.

Risks of Too Much Liquidity

Excessive liquidity - ratios far above industry norms - can indicate underutilized capital, which negatively impacts return on assets (ROA) and return on equity (ROE). Large cash reserves or marketable securities often suggest that management isn't reinvesting in growth opportunities, paying down high-cost debt, or returning value to shareholders. This can dampen growth expectations and reduce valuation multiples.

For instance, liquidity ratios significantly exceeding standard benchmarks (e.g., a current ratio above 4.0 when the industry norm is 1.5–2.0) may signal inefficient use of working capital. Red flags include growing cash balances without corresponding investments in growth, or minimal use of short-term debt even when borrowing rates are favorable. These patterns may suggest an overly cautious approach, missed opportunities, or an inefficient capital structure. For potential buyers, such signals often raise concerns about stagnant revenue, low reinvestment rates, or overly risk-averse management. This can lead to downward adjustments in projected cash flows or valuation multiples. In small business transactions, buyers often discount valuations when they detect excessive working capital not essential for operations, or they negotiate to exclude surplus cash from the deal, reducing the purchase price.

Industry and Size Factors

The relationship between liquidity ratios and valuation also depends on industry norms and company size. Different industries maintain varying liquidity benchmarks: capital-intensive sectors like wholesale, distribution, and manufacturing often require higher current ratios to manage inventory and receivables, while software, digital services, and professional services can operate effectively with lower ratios. For instance, a current ratio of 1.3 might be sufficient for a SaaS business with recurring revenue but inadequate for a seasonal retailer preparing for peak inventory demands. Valuations reflect these nuances through adjustments to discount rates, cash-flow forecasts, and working-capital assumptions.

Smaller businesses are particularly sensitive to liquidity shocks, which can significantly impact their valuations and financing options. With limited cash reserves, small businesses are more vulnerable to revenue disruptions, delayed payments, or unexpected expenses. As a result, lenders and buyers often require higher returns, stricter loan covenants, and sometimes even personal guarantees. Conversely, lower-middle-market businesses with diversified customer bases and established banking relationships may operate with leaner liquidity because they have better access to revolving credit and capital markets. Regardless of size, aligning liquidity ratios with industry norms and the company’s risk profile improves valuations by reducing perceived financial risk and ensuring operational stability.

sbb-itb-a3ef7c1

How Liquidity Ratios Affect Business Valuation

Risk Perception and Cost of Capital

Liquidity ratios play a critical role in shaping how buyers and lenders assess a business's short-term default risk. This evaluation directly impacts the discount rate or required return used in valuation models. For instance, when liquidity ratios dip below 1.0, buyers and lenders often tack on an additional 1–3% risk premium to account for potential liquidity challenges.

Take an acquisition candidate with a current ratio of 0.8 and limited cash reserves - such a business is likely to be valued at lower EBITDA multiples. On the other hand, a company with a current ratio between 1.5 and 2.0 tends to command higher multiples because its stronger liquidity reduces perceived risk. However, buyers don’t just stop at the numbers; they dig deeper, examining the quality and consistency of liquidity. Factors like seasonal dips below 1.0, reliance on slow-paying receivables, or an inventory-heavy balance sheet can raise concerns, even if the current ratio seems adequate on the surface. These red flags often result in more conservative offers, such as larger holdbacks, earnouts tied to cash flow, or specific working-capital targets that must be met at closing. This adjustment reflects how liquidity can influence perceptions of operational stability and growth potential.

Operating Stability and Growth Capacity

Strong liquidity - characterized by a current ratio slightly above 1.0 and a healthy quick ratio - helps businesses stay on top of payments, minimize revenue disruptions, and fund growth internally. This financial stability often translates into higher valuation multiples. For smaller companies, especially in the Main Street and lower-middle-market segments, robust liquidity can serve as a buffer against unexpected challenges like delayed payments from a key customer, supply chain hiccups, or even minor economic downturns. This resilience helps avoid covenant breaches or the need for distressed asset sales.

Buyers tend to model higher growth rates for businesses with strong liquidity, which can justify higher EBITDA or seller's discretionary earnings (SDE) multiples. This is particularly true in fragmented local markets, where additional working capital can quickly lead to increased market share. Additionally, liquidity enhances a company's ability to qualify for and manage growth-focused debt, such as equipment loans or credit lines. This capability allows buyers to execute expansion plans post-acquisition, adding what some might call an "option value" for growth. As a result, businesses with stable liquidity often achieve higher valuations compared to those constantly operating on the edge of a cash shortage.

Effect on Financing and Deal Structure

Lenders also rely heavily on liquidity ratios to evaluate a company's ability to repay debt, which in turn affects financing terms. A business with a current ratio comfortably above 1.0 and a reasonable quick ratio is more likely to qualify for higher leverage, often approaching the upper limits of SBA 7(a) eligibility. This is because lenders anticipate fewer cash flow issues that could disrupt debt repayment. Strong liquidity often leads to better loan terms, including lower interest rates, extended amortization periods, and more flexible structures. On the flip side, weak liquidity can result in stricter loan conditions, such as lower loan-to-value ratios, higher equity requirements, tighter debt service coverage ratios, and stronger collateral demands.

For buyers, weak liquidity can complicate deal structures. They may need to inject more equity, rely on seller financing, or include earnouts to maintain working capital. Lenders might cap term debt at a lower multiple of cash flow, pushing buyers to negotiate larger seller notes or performance-based earnouts, shifting more risk to the seller. In contrast, businesses with solid liquidity profiles can support higher levels of senior or SBA-backed leverage, allowing for a larger upfront cash component and reducing the need for seller financing. Weak or unstable liquidity often brings additional constraints, like stricter financial covenants, borrowing base requirements, or cash sweep provisions, along with more stringent personal guarantees in loan agreements.

Platforms like Clearly Acquired simplify liquidity analysis by standardizing financial data and automatically calculating key ratios like current, quick, and cash ratios. These tools also benchmark liquidity metrics against similar deals in the Main Street and lower-middle-market segments. With integrated loan brokerage capabilities, buyers can assess how a target's liquidity profile impacts financing options, including SBA 7(a), SBA 504, and conventional loans. By providing insights into expected leverage, interest rates, and covenants, Clearly Acquired helps buyers align realistic valuations with financing capabilities. Its combination of verified deal flow, advisory services, and AI-driven tools enables users to model post-close working capital needs and design deal terms that align liquidity realities with broader financial strategies.

Using Liquidity Ratios in SMB Acquisitions

This section delves into how liquidity ratios can be applied effectively when evaluating small and medium-sized business (SMB) acquisitions.

Screening Businesses Using Liquidity Metrics

Liquidity ratios are a vital tool for assessing a business's ability to meet short-term obligations. By analyzing these metrics early on, buyers can identify potential risks and avoid spending resources on deals that may not be viable. Ratios are calculated from financial statements and help filter out high-risk opportunities before deeper due diligence begins. Generally, a ratio below 1.0 signals potential liquidity issues.

Certain warning signs should not be overlooked. For instance, a quick ratio below 0.75 or a steady decline in liquidity over several quarters can indicate trouble. Take a manufacturing business with a quick ratio of 0.88 - it might raise concerns about slow inventory turnover and potential cash flow problems, especially during economic downturns.

Industry-specific benchmarks are equally important. For example:

- Retail businesses often require a current ratio between 1.5 and 2.5 to account for inventory needs.

- Service businesses with fewer assets can function with ratios between 1.0 and 1.5.

- Manufacturing businesses typically need ratios above 2.0 due to longer cash conversion cycles.

Ignoring these industry norms can lead to overestimating a business's value or underestimating its working capital requirements. Once a business passes this initial screening, its valuation should be adjusted to reflect any liquidity challenges.

Adjusting Valuation for Liquidity Risk

After screening, a business's valuation must account for its liquidity performance. One common method is the working capital adjustment, where the actual net working capital is compared to a target - often set at 10–15% of revenue. If the target is unmet, the purchase price is reduced dollar-for-dollar. For example, if a $5 million retail business has a $200,000 working capital shortfall and a current ratio of 0.9 (below the desired 1.5), the price would be adjusted downward by $200,000 to offset the risk.

Buyers can address liquidity risks using methods like:

- Holdbacks: Retaining 10–20% of the purchase price until liquidity improves.

- Earnouts: Linking additional payments to post-closing liquidity improvements.

- Seller notes: Making payments contingent on stable cash flow.

For example, in a restaurant acquisition, a cash ratio of 0.4 might justify a 15% holdback. This amount would be released after six months if the ratio improves to 0.8 or higher. Similarly, a manufacturing business with a quick ratio of 0.7 (compared to an industry average of 1.2) might face a valuation reduction of 12%, reflecting the anticipated cost of securing additional financing. On a broader scale, low liquidity often results in reduced EBITDA multiples, typically by 0.5–1.0×, as it signals financial distress.

How Clearly Acquired Simplifies Liquidity Analysis

Clearly Acquired streamlines the process of analyzing liquidity with its AI-powered data rooms. These tools automatically calculate key ratios - current, quick, and cash - from uploaded financial statements and compare them to industry benchmarks. Risks, such as ratios falling below 1.0, are flagged instantly, and valuation adjustments are simulated using working capital benchmarks.

The platform also integrates liquidity insights with SBA loan eligibility, helping buyers understand how a target's liquidity profile might impact financing options like SBA 7(a), SBA 504, and conventional loans. With access to data on over 200 million off-market businesses, Clearly Acquired enables buyers to evaluate liquidity ratios across a broad range of acquisition targets.

Additionally, expert advisory support helps users interpret financial data and understand its implications for valuation. By consolidating verified deal flow from over 100 marketplaces and brokerages, Clearly Acquired turns a once tedious and manual process into a streamlined, data-driven workflow. This allows buyers to model post-close working capital needs and tailor deal terms to reflect liquidity realities effectively.

Conclusion

The Need for Balanced Liquidity

Maintaining a current ratio between 1.5 and 2.5 suggests a company has enough liquidity to meet its obligations without tying up excess funds. Falling below a ratio of 1.0 can significantly impact valuations, often reducing them by 20–30% due to increased financial risk. On the other hand, quick ratios above 1.0 can lead to acquisition multiples that are 10–20% higher. Strong liquidity also reduces the cost of capital by 1–2%, which can boost valuations by 15–25%. That said, the "ideal" ratio depends on the industry. For instance, retail businesses often need ratios between 1.5 and 2.5 to handle inventory demands, while service companies can operate effectively with ratios from 1.0 to 1.5. Integrating this balanced liquidity into transaction analysis is crucial for accurate decision-making.

Including Liquidity Analysis in Transactions

Liquidity metrics are just one piece of the puzzle. They should be reviewed alongside profitability ratios, debt levels, and qualitative factors like management strength and industry dynamics. A quick ratio above 1.0 provides a solid starting point for screening potential targets. When liquidity falls short, valuation models often apply discounts of 10–15%. Stress-testing liquidity under adverse scenarios can improve accuracy, while adjusting for seasonal trends and structuring earnouts tied to liquidity improvements helps mitigate risk. Sellers aiming to enhance their position can focus on optimizing receivables and reducing debt before going to market.

How Clearly Acquired Supports Better Valuations

Clearly Acquired simplifies the process of liquidity analysis by leveraging AI-powered data rooms. These tools automatically calculate critical ratios, flag risks that fall below industry standards, and benchmark metrics against a database of over 200 million off-market businesses. Additionally, the platform connects liquidity insights with financing options, including SBA 7(a), SBA 504, and traditional loans, through a network of more than 500 lenders. By transforming manual analysis into a data-driven workflow, Clearly Acquired helps streamline decision-making and accelerates every stage of the transaction process.

FAQs

How do liquidity ratios influence a company's attractiveness in acquisitions?

Liquidity ratios are crucial when evaluating a company's financial well-being, especially during acquisitions. These ratios help determine if a business has enough short-term assets to meet its liabilities, offering insight into its ability to handle financial obligations without undue pressure.

For potential buyers, healthy liquidity ratios suggest reduced insolvency risks and highlight the company’s financial stability, making it a more attractive investment. On the other hand, poor liquidity ratios can signal potential cash flow challenges or a need for extra capital to maintain smooth operations.

What are the risks of having excessive liquidity in a business?

Excess liquidity often leads to underutilized capital, where funds that could otherwise fuel growth or be directed toward higher-return projects end up sitting idle. This not only stifles potential opportunities but can also chip away at profitability over time.

On top of that, having too much liquidity can create pressure to spend quickly, increasing the likelihood of hasty or poorly thought-out investments. These scenarios can send a negative signal to potential investors or buyers, suggesting that resources aren’t being managed effectively to promote growth or build value, ultimately impacting the company’s overall valuation.

How does Clearly Acquired assist in analyzing a business's liquidity ratios?

Clearly Acquired makes it easier to evaluate a business's liquidity ratios with its AI-driven tools and access to verified financial data. With features like secure data rooms and deal management hubs, users can seamlessly examine critical metrics such as cash flow, current assets, and liabilities.

These detailed financial insights empower buyers and investors to assess a company's liquidity position, leading to more informed acquisition choices and improved deal results.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)