Choosing the right business broker can make or break your deal. Whether you're selling a small café or a multi-location company, the decision between a local broker and a national broker depends on your business size, buyer type, and transaction complexity. Here's a quick breakdown:

Key Takeaways:

- Local Brokers: Best for businesses under $5 million, offering hands-on service, deep local market knowledge, and personal connections. Ideal for small, community-focused businesses.

- National Brokers: Suited for businesses over $5 million or multi-location operations. They provide broader networks, advanced digital tools, and access to private equity and strategic buyers.

Quick Overview:

- Local Brokers: Focus on regional buyers, rely on personal engagement, and are cost-effective for smaller deals.

- National Brokers: Leverage global platforms, specialize in larger transactions, and handle deals virtually with advanced technology.

The right broker depends on your business's value, industry, and goals. Let’s dive deeper into their differences and when to choose each.

National vs. Local Broker - Selling Your Business With A National Broker

sbb-itb-a3ef7c1

What Are Local Business Brokers?

Local business brokers, often called "Main Street" brokers, specialize in selling independently owned businesses typically valued under $5 million. These professionals focus on local establishments such as restaurants, salons, auto repair shops, and retail stores. Operating within a specific geographic area, they rely on their deep knowledge of the local market and strong relationships with nearby buyers, sellers, and transaction specialists to get deals done.

Ronald V. Chernak, President of The Rock Bridge Group, highlights their hands-on approach:

"At The Rock Bridge Group, we believe it is important for us to be at every meeting between buyer and seller and to participate in virtually every phone call when a transaction is being negotiated."

This approach involves attending site visits, being present during negotiations, and maintaining close ties with local law firms, accountants, and lenders throughout the process.

Local brokers typically earn a commission ranging from 10% to 15% of the final sale price. Their marketing efforts are concentrated within a limited physical radius, targeting individual entrepreneurs and local competitors as potential buyers. Additionally, in 17 U.S. states, brokers are required to hold a real estate license to operate.

Main Features of Local Business Brokers

Local brokers bring a personal touch and regional expertise to the table. They use a market-based approach to valuation, analyzing actual sale prices of similar businesses in the area. As BizBuySell explains:

"An experienced local business broker is closest to the market and understands how much buyers are willing to pay for a business such as yours."

Confidentiality is another key advantage. For small local businesses, news of a potential sale can disrupt employees or customers. Local brokers address this by using blind profiles to protect the seller's identity until buyers are thoroughly vetted. They also have an intimate understanding of the local market, including competitor locations and how a sale might impact the area.

Their established networks with local attorneys, CPAs, and lenders ensure smoother closings. Many local brokers also hold certifications like the Certified Business Intermediary (CBI) designation from the International Business Brokers Association. This certification requires 68 hours of coursework and adherence to strict ethical standards.

These qualities make local brokers particularly well-suited for businesses that need a hands-on, personalized approach.

When to Use Local Brokers

Local brokers are an excellent choice for businesses valued under $5 million, especially when the buyer pool consists of individual entrepreneurs or regional competitors. They are particularly helpful for businesses requiring frequent site visits or a broker’s physical presence - like a restaurant with a unique kitchen setup.

Confidentiality is another area where local brokers excel. In tight-knit communities, they can carefully screen potential buyers before revealing sensitive details about the business. Additionally, their expertise is invaluable in states with specific legal requirements - such as California's bulk sale statutes, which may necessitate in-state escrow agents or attorneys.

To ensure you’re working with a credible broker, it’s wise to check references from other business owners. For businesses in niche industries like restaurants or specialty retail, it’s essential to find brokers with a proven track record in that specific sector. As Ronald V. Chernak advises:

"If you are considering the sale of your business, you need to be prudent in your choice of firms; make sure that you have 'boots on the ground' readily available to assist you in the complex task of achieving a successful sale."

Next, we’ll dive into how national brokers differ in their approach and scope.

What Are National Business Brokers?

National business brokers are firms or franchises that operate on a larger scale, spanning multiple states or even nationwide. They typically focus on "mid-market" transactions, which fill the gap between smaller main-street business sales and large corporate mergers and acquisitions (M&A). Unlike local brokers, these firms often operate as franchises or boutique independent firms with a broader reach.

Specializing in deals for businesses valued above $5 million, national brokers bring together extensive administrative teams and industry professionals, such as escrow agents and attorneys, to manage complex transactions. Jacob Orosz, President of Morgan & Westfield, highlights their expertise:

"Intermediaries who broker nationally are experienced with diverse deal types. This increases their knowledge base, resourcefulness, and pattern recognition capabilities."

These brokers rely heavily on advanced technology, using tools like digital document management systems, proprietary sales methods, and virtual offices to handle transactions across time zones. Their reach extends beyond local networks, tapping into global buyer pools through industry portals and strategic connections. Unlike local brokers, who often focus on current sales and profit margins, national brokers use sophisticated valuation models that consider long-term growth potential and strategic value. These differences in approach and resources set national brokers apart, offering distinct advantages.

Main Features of National Business Brokers

National brokers bring a standardized approach and access to substantial resources. They employ large sales teams and streamlined due diligence processes to handle the extensive paperwork involved in high-value transactions. Their technology infrastructure includes cloud-based management systems and digital signature tools, making the entire process more efficient.

Many of these firms have specialized teams dedicated to specific industries, enabling them to expertly manage niche sectors like e-commerce or specialized manufacturing. They also access extensive business databases, uncovering off-market opportunities - about 75% of businesses for sale are not publicly listed.

Their fee structures typically include a success fee ranging from 2% to 18%, along with a retainer fee of $15,000 to $30,000. For larger transactions, the percentage often decreases, and an upfront deposit may be required to cover marketing and valuation costs.

National brokers also stand out for their expansive buyer networks, which include strategic buyers, private equity firms, and industry consolidators. The BizBuySell Team explains:

"M&A advisors... handle larger, more complex transactions, typically with companies valued above $5 million. These deals often involve multiple locations and complex ownership structures."

Understanding these features helps clarify when a national broker is the right fit for your business.

When to Use National Brokers

If your business is valued at over $5 million or operates across multiple locations, a national broker is likely the best choice. They are particularly useful for businesses that don’t depend on local foot traffic, such as e-commerce companies or those with a global customer base.

For transactions requiring strategic planning - like identifying acquisition targets or evaluating intellectual property - a national broker’s expertise is essential. Their advanced valuation models factor in future growth potential and strategic assets, which local brokers might overlook.

When selecting a national broker, check their credentials. Look for designations like Merger & Acquisition Master Intermediary (M&AMI) or membership in the M&A Source. It’s also a good idea to assess their technology capabilities to ensure they use modern tools that can speed up the sales process.

National brokers are particularly skilled at creating competitive bidding scenarios. As the International Business Brokers Association (IBBA) notes:

"The best way for a business owner to truly feel comfortable that he got the best deal is to have several financially viable parties bidding for his business, which is much more likely using the resources of a professional business broker."

For businesses requiring complex legal or tax planning across multiple states - or those targeting strategic buyers instead of individual entrepreneurs - national brokers provide the expertise and infrastructure needed to maximize value and ensure a successful sale.

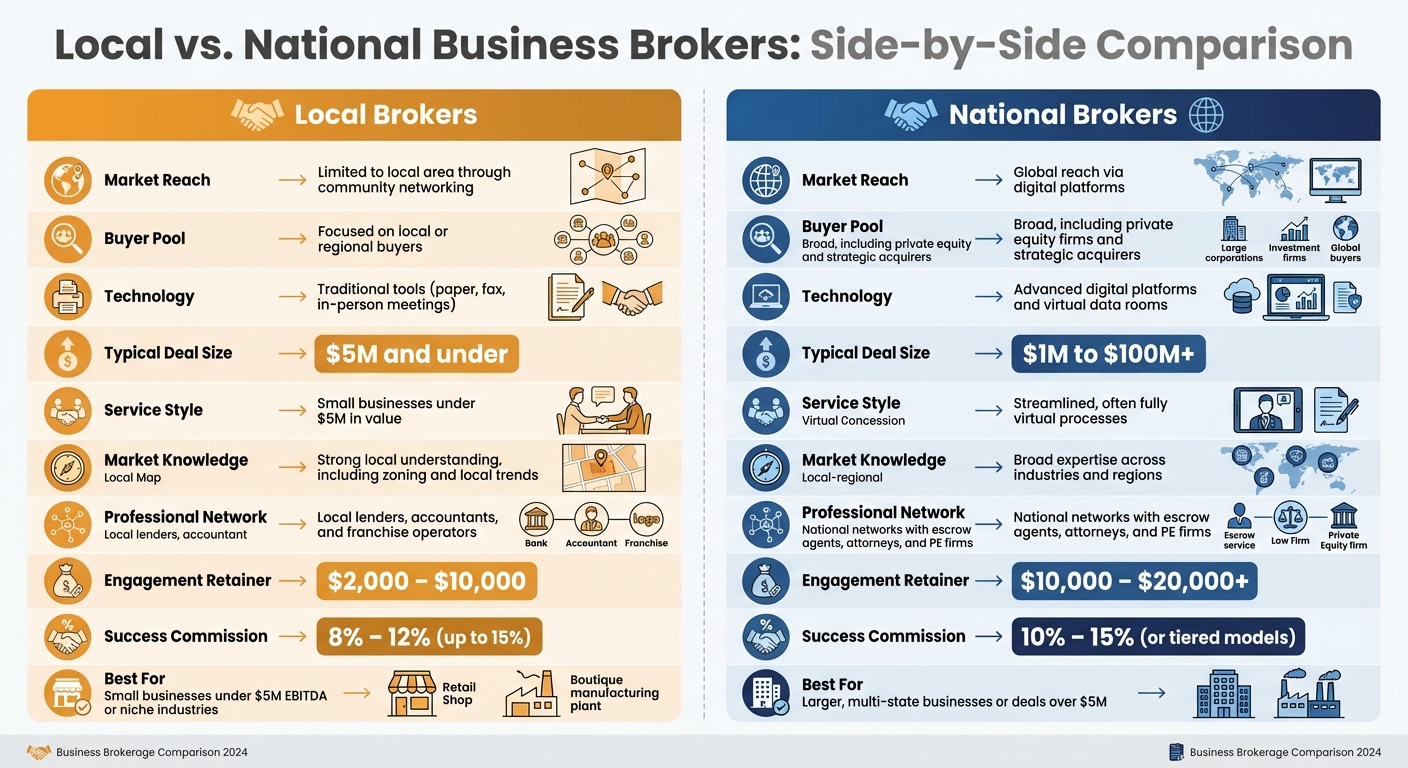

Local vs. National Business Brokers: Side-by-Side Comparison

Local vs National Business Brokers Comparison Chart

Main Comparison Factors

When comparing local and national business brokers, the differences in their operations, approaches, and pricing structures become clear. Local brokers often rely on their close connections within a specific geographic area, while national brokers tap into digital marketing and global platforms to reach a much broader audience. Jacob Orosz, President of Morgan & Westfield, highlights this shift:

"Networking now occurs globally online, increasing sales potential."

Local brokers tend to work with regional investor groups and rely on traditional methods like in-person meetings, paper documents, or even fax. On the other hand, national brokers leverage advanced digital tools and virtual buyer databases, including connections with private equity firms and strategic acquirers, to streamline the process and expand their reach.

The difference in service style is also notable. Local brokers take a hands-on approach, attending meetings in person and using their knowledge of local zoning laws, neighborhood growth trends, and community incentives to add value. National brokers, however, focus on digital efficiency, often completing transactions entirely online. While they excel in managing the process, they rely more on business owners to provide industry-specific insights.

Pricing structures vary as well. Local brokers typically charge retainers ranging from $2,000 to $10,000, with commissions between 8% and 12%. National brokers, in contrast, require higher retainers - $10,000 to $20,000 or more - and often use tiered commission structures. For instance, Morgan & Westfield might charge $80,000 to $120,000 for a $1 million transaction, depending on the service package.

Comparison Table: Local vs. National Brokers

Here’s a side-by-side look at how local and national brokers stack up:

| Factor | Local Business Brokers | National Business Brokers |

|---|---|---|

| Market Reach | Limited to a local area through community networking | Global reach via digital platforms |

| Buyer Pool | Focused on local or regional buyers | Broad, including private equity firms and strategic acquirers |

| Technology | Relies on traditional tools (paper, fax, in-person meetings) | Uses advanced digital platforms and virtual data rooms |

| Typical Deal Size | Small businesses under $5M in value | Transactions ranging from $1M to $100M+ |

| Service Style | Personal, in-person engagement | Streamlined, often fully virtual processes |

| Market Knowledge | Strong local understanding, including zoning and local trends | Broad expertise across industries and regions |

| Professional Network | Local lenders, accountants, and franchise operators | National networks with escrow agents, attorneys, and PE firms |

| Engagement Retainer | $2,000 – $10,000 | $10,000 – $20,000+ |

| Success Commission | 8% – 12% (up to 15% in some cases) | 10% – 15% or tiered commission models (e.g., Lehman Formula) |

| Best For | Small businesses under $5M EBITDA or niche industries | Larger, multi-state businesses or deals over $5M |

Pros and Cons of Local and National Brokers

Pros and Cons Table

Here’s a breakdown of the key strengths and weaknesses of local and national business brokers. The table below highlights their differences to help you make an informed choice.

| Broker Type | Advantages | Disadvantages |

|---|---|---|

| Local Business Brokers | • Strong local expertise: Deep understanding of regional market trends, buyer behaviors, and property comparisons • Personalized service: Fewer clients mean tailored attention and flexible fee arrangements • Face-to-face connections: Builds trust through in-person meetings |

• Smaller buyer pool: Limited reach outside the local area • Fewer resources: Lack of advanced tools and platforms • Risk of conflicts: Representing similar businesses may create competition • Traditional methods: May rely on slower, outdated processes |

| National Business Brokers | • Wider market access: Extensive networks, including private equity and institutional buyers • Streamlined systems: Advanced CRM tools and digital platforms for smoother transactions • Industry expertise: Specialists in niche markets • Cutting-edge technology: Tools like virtual data rooms and digital signatures speed up deals |

• Higher costs: Standardized fees often reflect national marketing and operational expenses • Less personalized: Handling multiple deals can reduce individual focus • Limited local insight: Centralized teams may overlook regional specifics • Reduced face-to-face interaction: Heavier reliance on digital communication |

Local brokers are ideal for smaller, community-based businesses, where regional knowledge and personal relationships are critical. On the other hand, national brokers are better suited for businesses with an EBITDA exceeding $1 million, as their broader networks and specialized tools cater to larger-scale transactions.

For instance, AQUILA points out:

"A broker at a national firm must work on more deals to make the same amount of money. More clients in the market and deals in the works at one time result in less attention on your deal".

These differences in fee structures, market reach, and technological capabilities are essential to consider. Local brokers often shine with their flexible pricing and hands-on service, while national brokers justify their higher fees with expansive networks and efficient digital processes that can speed up transactions.

How to Choose Between Local and National Brokers

Factors to Consider

When deciding between local and national brokers, it's important to weigh several factors to ensure the best fit for your business needs.

Business size and deal value should guide your choice. Local brokers typically specialize in main street businesses valued below $2 million, often catering to individual or family buyers within the community. On the other hand, if your business generates over $1 million in EBITDA or operates across multiple locations, national brokers are better equipped to connect you with private equity firms and strategic buyers.

Industry expertise often matters more than geography. A broker's experience in your specific industry - whether it’s restaurants, manufacturing, or professional services - can make a significant difference. For common local businesses, such as retail shops or service providers, a local broker with a proven track record in that niche might be the best choice. However, if your business operates in a specialized or technical field, a national broker with deep industry knowledge can better handle the complexities and meet buyer expectations.

Geographic and regulatory knowledge is another key consideration. Local brokers often have a strong understanding of regional economic trends and buyer demographics, which can be particularly helpful for businesses with a community-focused customer base. Additionally, they bring expertise in state-specific legal and regulatory requirements, ensuring a smoother transaction process.

Technology and efficiency can vary widely between the two. National brokers often rely on advanced digital tools like electronic signatures and virtual data rooms to streamline transactions and improve efficiency.

These factors form the foundation for tailoring your decision to your specific needs as a buyer or seller.

Recommendations for Buyers and Sellers

Here’s how buyers and sellers can apply these considerations to choose the right broker.

For sellers:

- Businesses valued under $2 million: Look for local brokers with a history of successfully selling similar businesses in your area. During interviews, ask about their marketing strategies, how they screen buyers, and how they plan to maintain confidentiality within your community.

-

Businesses with over $1 million EBITDA or niche markets: National brokers are better suited for these transactions, offering access to institutional buyers and advanced marketing tools to help you secure the best sale price. As Drew Ferner, a business advisor, explains:

Keep in mind that national brokers often have standardized fee structures that reflect their broader reach and use of advanced technology."A national broker can access a wider pool of potential buyers, including private equity firms, which are often looking for businesses with an EBITDA over $1 million".

For buyers, focus on the broker's experience in your target industry rather than their location. Interview multiple brokers to assess their deal flow, buyer representation strategies, and connections to financing resources. If you’re looking at businesses valued under $100,000, consider whether the typical 10% commission is worth it or if you might be better off conducting your search independently.

For complex transactions, a hybrid approach might work best. Engage a national broker for their market reach while partnering with a local attorney and CPA to handle state-specific legal and tax matters. This strategy combines the best of both worlds: broad access to buyers and localized expertise for regulatory compliance.

Ultimately, the right broker will align with your transaction goals and provide the expertise needed to achieve them effectively.

Conclusion

Finding the right broker depends on your business's size, the type of buyers you're targeting, and the complexity of your deal.

If you're looking for personalized service and a deep understanding of your local market, a regional broker might be the way to go. On the other hand, national brokers are better suited for businesses generating over $1 million in EBITDA or those in specialized industries, thanks to their broader marketing reach and access to institutional buyers.

Given the challenges of a low-turnover market, experience is key. Whether you choose a local broker with strong community ties or a national firm equipped with advanced tools, always check their credentials and reach out to past clients for references.

More than proximity, industry expertise is what truly matters. A broker who understands your specific business - whether it's e-commerce, manufacturing, or professional services - will handle the complexities of your deal far better than someone who simply operates nearby. For particularly intricate transactions, consider a combination of a national broker's expansive reach and the specialized insights of local experts.

Ultimately, your broker's expertise and clear communication play a vital role. The best broker will align with your goals, provide transparency throughout the process, and dedicate the attention your deal deserves. With the right partner, you'll have a trusted advisor to guide you through this critical financial decision.

FAQs

What should I keep in mind when deciding between a local and national business broker?

When choosing between a local or national business broker, it’s important to weigh factors like market expertise, business size, and service approach. Local brokers usually have a deep understanding of the regional market, including buyer trends and the local economy. They’re also likely to provide more personalized service and have strong connections with nearby professionals, which can help simplify the process.

National brokers, on the other hand, bring a larger network and greater resources to the table. This makes them a solid choice for larger or more complex deals that require visibility across multiple states. That said, their services often come with higher fees, and you might experience less direct involvement in your transaction.

The best choice depends on your business’s size, industry, location, and how much hands-on support you’re looking for.

How do local business brokers protect confidentiality during a sale?

Local business brokers take a proactive role in maintaining confidentiality throughout the sales process. They oversee meetings and negotiations closely, ensuring that sensitive information is shared only with serious, qualified buyers. By engaging directly with potential buyers, they can gauge their trustworthiness and discretion, reducing the chances of any information leaks.

To add another layer of protection, brokers often require buyers to sign non-disclosure agreements (NDAs) and carefully control how and when information is shared - offering details gradually as needed. Their deep understanding of the local market and personal networks also play a crucial role in safeguarding privacy while navigating the complexities of the sale. This personalized, privacy-focused approach makes them an ideal choice for sellers who value discretion.

What are the benefits of using advanced technology in national business brokerage?

Advanced technology is transforming the way national business brokerage operates, offering some game-changing advantages. For starters, it speeds up and sharpens the accuracy of business valuations. By tapping into massive datasets - like historical sales, industry trends, and financial performance - brokers can deliver market assessments that are both timely and precise. The result? Fair valuations that save significant time and effort.

Technology also breaks down geographical barriers, helping brokers connect buyers and sellers from coast to coast. Digital platforms, virtual tours, and online transaction tools make it easier than ever to showcase opportunities and manage deals remotely. This expanded reach means more chances to close successful transactions.

On top of that, AI-powered tools and automation are making the entire process more efficient. From vetting buyers to managing negotiations and transactions, these tools streamline complex tasks. The outcome is a smoother, more transparent process that keeps deals competitive and simplifies the challenges of national business transactions.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)