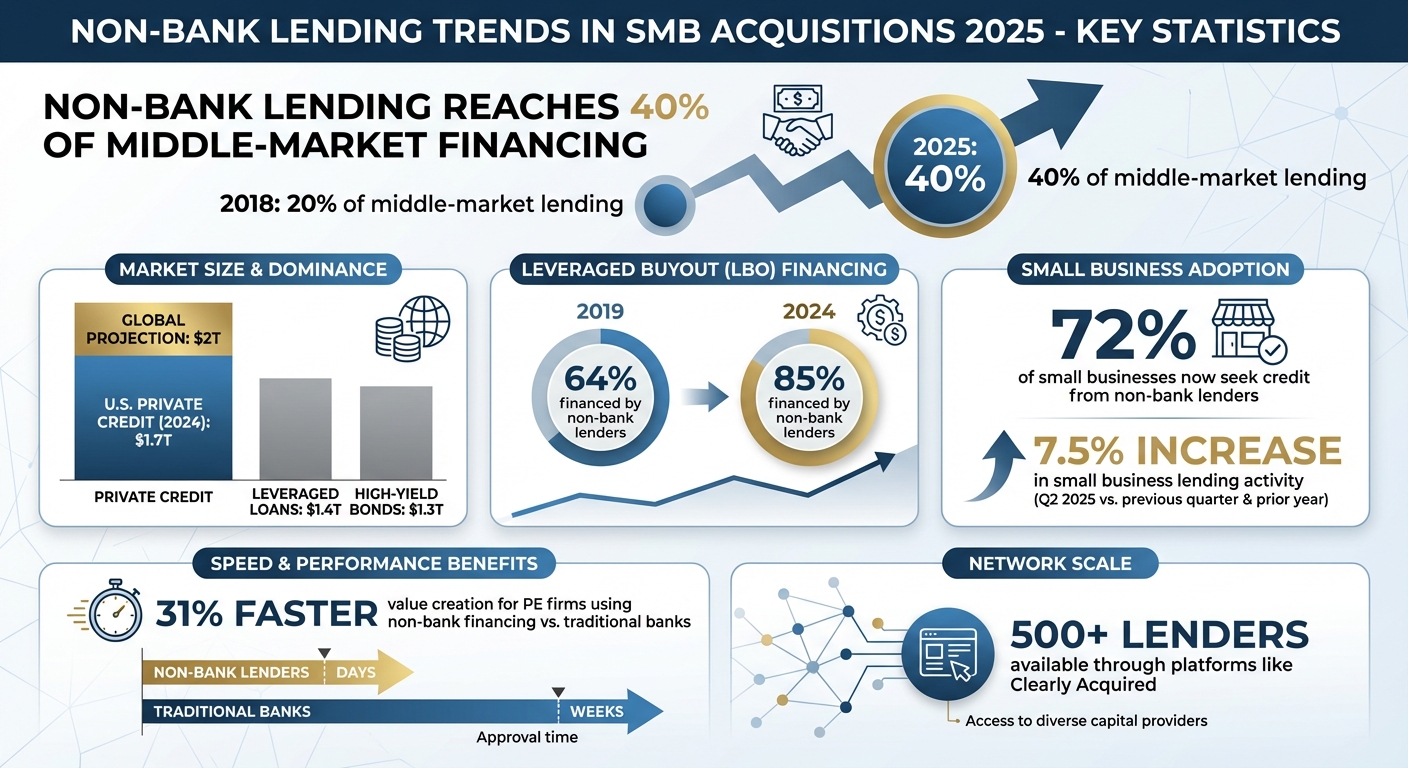

Non-bank lenders now dominate SMB acquisition financing. By 2025, they control 40% of middle-market lending, up from just 20% in 2018. Why? Faster approvals, flexible loan terms, and AI-driven underwriting have made them the go-to choice for 72% of small businesses seeking credit. Meanwhile, traditional banks face stricter regulations and slower processes, driving borrowers toward private credit and fintech platforms.

Key highlights:

- $1.7 trillion in U.S. private credit (2024), projected to grow to $2 trillion globally.

- 85% of U.S. leveraged buyouts (2024) financed by non-bank lenders.

- Loan options like covenant-lite and revenue-based financing offer fewer restrictions and tailored terms.

- AI tools enable faster decisions, cutting underwriting timelines from weeks to days.

However, risks are rising. Over-leverage and regulatory scrutiny could slow the sector’s growth. Borrowers must weigh the higher costs of non-bank loans against their speed and flexibility while staying cautious of default risks. Platforms like Clearly Acquired are helping streamline the process, connecting buyers with over 500 lenders and AI-powered tools.

The shift is reshaping SMB acquisitions, offering faster closings and expanded access to funding but requiring careful navigation of emerging risks and regulations.

Non-Bank Lending Growth in SMB Acquisitions 2018-2025

Non-Bank Lending Market Growth for SMB Acquisitions

Market Size and Growth Numbers

The non-bank lending market has grown significantly by 2025. U.S. private credit reached approximately $1.7 trillion by early 2024, with projections pushing it toward $2 trillion globally. Non-bank lenders now account for 40% of middle-market lending, doubling their share from 20% in 2018. The shift is evident: 85% of U.S. leveraged buyouts in 2024 were financed by non-bank lenders, a sharp rise from 64% in 2019.

Small business lending has also seen a boost, with activity rising 7.5% in Q2 2025 compared to both the previous quarter and the same time last year [3]. This growth stems from tighter bank regulations, interruptions in SBA funding that blocked $170 million in daily financing, and a growing need for quicker, more adaptable funding options [3]. As a result, SMB buyers are increasingly turning away from traditional banks and embracing non-bank alternatives [3]. These trends highlight the growing reliance on non-bank lenders for small business acquisitions.

Why SMB Buyers Choose Non-Bank Lenders

In 2025, speed and adaptability are essential for SMB buyers. Traditional banks often take weeks to process loans, while non-bank lenders can approve financing in just days. This speed gives SMB buyers a competitive edge in a tight market. Additionally, non-bank lenders provide covenant-lite loan structures and tailored terms that banks, bound by stricter regulations, cannot offer.

A prime example of this is KKR's 2024 deal, which secured $1.25 billion in private credit to support operational strategies that would have been impossible under traditional bank constraints. Private equity firms leveraging non-bank financing are achieving value creation 31% faster than those relying on traditional banks, thanks to the reduced covenants that allow for more aggressive growth strategies.

"SMBs prioritize speed, flexible structures, and digital access, with private credit enabling deals impossible under bank constraints." - eCapital CEO

This growing demand for non-bank options is reshaping industries and regions, as explored below.

Industries and Regions Using Non-Bank Loans

The need for faster and more flexible financing has led a variety of industries to embrace non-bank lenders. Service-based industries are leading the way in non-bank acquisition financing, while manufacturing continues to face challenges [3]. This trend spans sectors like construction, property management, technology, and customer engagement platforms. A notable example is Bridgepoint's December 2025 €500 million funding round for Brevo (formerly Sendinblue), a CRM platform aiming for €1 billion in annual revenue by 2030. The investment focuses on North American expansion and bolt-on acquisitions, with Brevo projected to exceed €200 million in ARR in 2025.

Geographically, non-bank lending for SMB acquisitions is thriving in areas where traditional banks have scaled back the most. Recent deals include site development firms in North Carolina, property management portfolios in New Mexico managing 1,030 units, highway paving companies in Pennsylvania with $48 million in revenue, and custom homebuilders in Colorado. Platforms like Clearly Acquired now connect buyers with networks of over 500 lenders, including private debt providers, trusts, and specialty finance firms, to align specific deal types with the right funding sources.

New Products and Technology in Non-Bank Lending

New Loan Structures for SMB Acquisitions

Non-bank lenders have introduced loan options like covenant-lite loans and floating-rate structures that offer more flexibility compared to traditional banks. These structures reduce operational restrictions, empowering buyers to take on ambitious growth plans. Another option, hybrid mezzanine financing, combines elements of debt and equity, bridging funding gaps for deals that require more than senior debt but avoid full equity dilution.

Revenue-based loans are also gaining popularity, especially among subscription-driven small businesses in industries like e-commerce and digital health. These loans adjust monthly repayments based on a percentage of revenue, offering a more adaptable approach to cash flow management. With 72% of small businesses now seeking credit from non-bank lenders, these options address financial challenges that traditional banking terms often fail to accommodate [3]. For instance, in Home Depot's $18.25 billion acquisition of SRS Distribution in June 2024, non-bank lenders played a key role by providing layered financing to support the transaction's scale and speed.

AI and Automated Underwriting

Beyond new loan structures, non-bank lenders are leveraging advanced technology to simplify and accelerate the acquisition process. By using AI-driven tools, lenders can analyze alternative data sources - such as real-time bank transactions, payment processing records, and recurring revenue metrics - cutting underwriting timelines from weeks to just days. This approach uncovers financial trends that traditional credit scores might overlook, making it easier for small business buyers with strong operations but limited credit histories to access funding.

Clearly Acquired is a prime example of this shift. Their proprietary AI tools streamline financial analysis, valuation screening, and lender matching across SBA, non-bank, and private credit options. These systems enable instant credit decisions and personalized loan solutions, making the process faster and more accessible.

Faster Funding Timelines

These technological advancements have significantly shortened funding timelines. Digital platforms now enable non-bank lenders to process and approve deals in just days, compared to the weeks required by traditional banks with manual reviews. This speed is essential in competitive acquisition markets, where delays can jeopardize deals. Buyers are increasingly turning to non-bank lenders for their ability to provide quick, reliable funding.

AI-powered data rooms further enhance efficiency by automating tasks like document management, eligibility verification, and underwriting. These tools allow buyers to organize financial documents and connect with advisors before formal underwriting even begins. The combination of innovative loan products and streamlined processing reflects a broader shift in SMB acquisition financing, emphasizing speed and adaptability.

How SMB Buyers Are Choosing Lenders in 2025

Who Is Using Non-Bank Lenders

Three key groups are driving the shift toward non-bank lenders: first-time buyers, micro-PE firms, and serial acquirers. First-time buyers have increasingly turned to these lenders out of necessity, especially after SBA freezes pushed 72% of small businesses to seek credit from non-bank sources [3]. Meanwhile, micro-PE firms and serial acquirers are drawn to covenant-lite loans and customized terms that support aggressive growth strategies. In fact, non-bank lenders financed 85% of U.S. leveraged buyouts in 2024, a sharp rise from 64% in 2019. This financing model allows buyers to hit their value creation milestones 31% faster than traditional bank loans. Other groups, like search funds, family offices, and operator-led investors, are also turning to non-bank lenders for tailored solutions that align with their acquisition goals. Across the board, these buyers prioritize the speed and flexibility that non-bank lenders are uniquely positioned to provide.

What Borrowers Want Most

In 2025, speed is the number one priority for SMB buyers. In competitive acquisition markets, where even minor delays can derail deals, borrowers favor online and fintech lenders that offer faster approval processes. Flexibility is the next big demand. Buyers are looking for covenant-lite loan structures, floating-rate options, and minimal paperwork requirements. Platforms like Clearly Acquired are stepping up to meet these needs by connecting buyers to over 500 lenders - including banks, trusts, and private debt partners. Using AI-powered tools, these platforms match deals with the best capital sources. Features like secure data rooms and automated underwriting streamline the process, helping buyers organize their documentation and even prequalify before engaging with lenders. This approach can shave weeks off the timeline, leading to faster approvals and better execution outcomes.

Borrower Experience and Results

Borrowers are overwhelmingly satisfied with non-bank lenders, thanks to higher approval rates and greater accessibility compared to traditional banks. By early 2024, private credit in the U.S. had grown to $1.7 trillion, surpassing both leveraged loans ($1.4 trillion) and high-yield bonds ($1.3 trillion). Non-bank lenders are expected to capture 40% of the middle-market lending share by the end of 2025, reflecting the trust borrowers place in these financing options.

The results speak for themselves. For example, in KKR's $8.2 billion acquisition, non-bank lenders provided $2.65 billion in unitranche debt, enabling a fast close with flexible terms that traditional banks couldn't match. Additionally, small business lending saw a 7.5% increase in Q2 2025 compared to both the previous quarter and the same period the year before [3]. These trends highlight the growing momentum of non-bank lending and its ability to meet borrower demand effectively.

sbb-itb-a3ef7c1

Regulations and What's Next for Non-Bank Lending

2025 Regulations Affecting Non-Bank Lenders

Non-bank lenders, known for introducing new products and leveraging AI, are now navigating a landscape of tighter regulations and heightened risks. As their market share grows, 2025 introduces stricter regulatory oversight. Key among these changes is the amendment to the Truth in Lending Act (TILA), which now mandates clearer APR disclosures for small and medium-sized business (SMB) loans to eliminate hidden fees. The Consumer Financial Protection Bureau (CFPB) is enforcing these rules with penalties of up to $5,000 per violation.

Additionally, the Financial Stability Oversight Council (FSOC) has started monitoring large private credit funds - those managing over $100 billion in assets - with stress tests akin to those applied to banks. This comes in response to the rising volume of private credit.

For SMB acquirers, these changes aim to bring more transparency to loan terms, especially in covenant-lite structures. However, compliance requirements may increase deal timelines by 10-15%. The CFPB is also pushing for uniform licensing across states to combat predatory practices, proposing a standardized APR cap of 36% for non-bank SMB loans in high-risk acquisitions [3]. These reforms follow the 2025 government shutdown, which froze SBA loan programs and halted $170 million in daily funding, forcing 72% of SMBs to turn to non-bank lenders [3]. While these regulations focus on transparency, lenders must also brace for emerging risks.

Risks Facing Non-Bank Lenders

The rapid growth of non-bank lending brings a host of challenges, particularly for SMB buyers. Default rates are expected to climb to 5-7% in 2025, driven by over-leverage. The IMF has cautioned that the interconnected nature of non-bank lending could lead to a 15-20% pullback if defaults rise sharply [3]. Middle-market buyouts funded by non-banks are currently operating at 4.1x leverage, leaving them especially vulnerable to interest rate swings and economic downturns [3]. In 2024 alone, the CFPB and FSOC initiated over 30 enforcement actions against non-banks for misleading APR disclosures and opaque underwriting practices.

Over-leverage remains a primary concern. Marius Silvasan of eCapital highlights that while non-bank financing helps private equity firms achieve goals 31% faster, borrowers face a higher risk of covenant breaches during economic downturns. This underscores the importance of SMB buyers diversifying their financing sources instead of relying exclusively on non-bank debt. Taken together, these regulatory and market pressures are setting the stage for significant changes in the industry.

What's Coming in the Next 3-5 Years

Over the next three to five years, the non-bank lending sector is poised for substantial shifts fueled by advancements in AI, embedded finance, and private credit growth. By 2027, the CFPB will require the use of explainable AI algorithms for SMB loan underwriting. Early pilots in 2025 have already demonstrated the potential of AI, cutting approval times by 50%. These new regulations will also standardize the use of alternative data, enabling non-banks to expand private credit to an estimated $2.5 trillion, though they will face annual audits to ensure compliance.

Embedded finance is another game-changer, integrating lending directly into acquisition platforms. This will allow SMB buyers to access capital seamlessly during the deal-sourcing process, making financing faster and more competitive. Meanwhile, private credit is projected to account for 40% of middle-market lending by the close of 2025. For SMB acquirers, these developments promise quicker approvals, more options, and increasingly advanced tools. However, staying informed about regulatory updates and maintaining disciplined leverage strategies will be critical to avoiding the risks of over-borrowing.

Non-SBA Deal Financing. Conventional Small Business Purchase Financing.

Key Takeaways for SMB Buyers and Sellers

The small business acquisition market has seen a major shift, with non-bank lenders now taking the lead. About 70% of small businesses seeking funding are bypassing traditional banks and going straight to non-bank lenders [3]. The numbers tell the story: U.S. private credit has hit $1.7 trillion, and by 2025, non-bank lenders are projected to hold a 40% share of middle-market lending. For buyers, this trend brings faster approvals, more adaptable loan options - like covenant-lite and unitranche loans - and the ability to close deals quickly, even in cases where traditional banks might decline due to factors like add-backs, concentration risks, or unconventional industries [3].

Sellers are also reaping the benefits. With more buyers able to secure financing, the pool of qualified acquirers grows, often leading to higher valuations or more competitive bidding. Financing structures such as seller notes, earnouts, revenue-based financing, and mezzanine debt are increasingly common, helping deals move forward that might have otherwise stalled under traditional bank-dependent financing [3].

While non-bank lenders tend to charge higher rates and fees, they offer unmatched speed, tailored solutions, and greater leverage [3]. For buyers, the critical question is whether the extra cost is worth the added flexibility.

Looking ahead, advancements like AI-driven underwriting, embedded finance, and explainable algorithms are expected to speed up approvals and further broaden access to capital through 2027 and beyond. Regulatory oversight is also evolving, with new disclosure rules aimed at increasing transparency without limiting access. These shifts are paving the way for platforms that streamline deal-making.

Platforms like Clearly Acquired are capitalizing on these trends by matching acquisitions with the best-fit lenders - whether SBA, bank, non-bank, or private credit. Using a network of over 500 lenders, AI-powered analysis, and integrated deal management tools, buyers can model capital structures in advance, improve their chances of closing deals, and secure terms that align with their cash flow and growth strategies. For sellers, coordinated debt and equity structuring ensures that qualified buyers can close deals efficiently, reducing risks and maximizing proceeds.

FAQs

What benefits do non-bank lenders offer for SMB acquisitions?

Non-bank lenders offer speedier approvals, adaptable financing choices, and personalized solutions designed specifically for small and medium-sized businesses (SMBs). Unlike traditional banks, they tend to be more nimble, allowing businesses to secure funding quickly and with fewer hurdles.

For SMB acquisitions, this translates to easier access to capital, stronger deal reliability, and financing arrangements that match the unique objectives of both buyers and sellers.

How does AI improve the speed and flexibility of non-bank lending?

AI is transforming non-bank lending by speeding up underwriting, automating deal assessments, and quickly verifying borrower details. This means loans can be evaluated and approved much faster, streamlining the entire process and cutting down on delays.

On top of that, AI-powered tools enable lenders to fine-tune their offerings to match the unique needs of borrowers. By providing financing options customized to align with specific business objectives, lenders help borrowers secure the right financial setup with greater ease and confidence.

What are the risks of using non-bank lenders for SMB acquisitions?

Non-bank lenders often provide quicker approvals and more adaptable options compared to traditional banks. However, there are a few risks to keep in mind. These lenders may charge higher interest rates, and their operations might have limited regulatory oversight, which can sometimes result in less transparent terms. This lack of clarity could lead to unexpected fees or conditions that aren't in your favor. To avoid surprises, it's crucial to carefully examine loan agreements and confirm that the terms align with your financial objectives before signing on the dotted line.

%20in%20a%20%2420M%20Sale..png)

%20vs.%20Conventional%20Loans%20for%20business%20acquisition.png)

.png)

.png)

.png)

.png)